Equity LifeStyle Properties (ELS) Chairman Sam Zell and Harvard’s Joint Center for Housing Studies (JCHS) Eric Belsky both agree that capital is crucial in real estate and housing.

So, it should be noted that the 2017 tax cut plan which included incentives to repatriate money has already produced billions of dollars flowing back into the U.S.

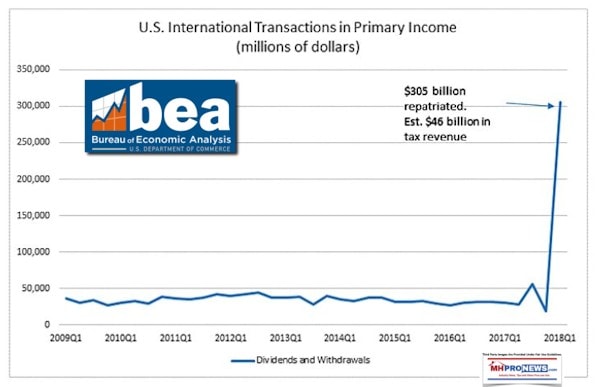

In fact, federal data reveals the tax cut’s repatriate provisions are already producing record results.

“Despite President Trump’s tit-for-tat trade barbs, America’s CEOs are not wasting anytime in taking advantage of his tax reform plan. Over $300 billion was repatriated to the U.S. in the first quarter, according to the Bureau of Economic Analysis (BEA) — the most on record,” said Fox Business on Tuesday.

BEA data, a subset of the U.S. Department of Commerce, confirms that report.

“U.S. firms that used to build their factories overseas in order to avoid U.S. taxes, they stopped in their tracks because of the tax bill, they are bringing all the money home,” said Kevin Hassett, chair of the president’s Council of Economic Advisers, during an interview on Varney & Co.

The BEA notes the main driver of the repatriation surge is that companies are no longer taxed on foreign earnings when returning the funds to the U.S. “We fixed that really, really stupid thing” said Hassett.

Some $305 Billion returned in Q1 of 2018, per the BEA data to MHProNews. By comparison just $38 billion was repatriated during the same period a year ago. Q1 repatriation yielded some $46 billion in revenue to the U.S. Treasury.

Before tax reform was enacted in December 2017, U.S. companies had an estimated $2.6 trillion parked in overseas accounts, as tracked by the United States Public Interest Research Group (USPIRG).

These facts confirm prior reports on the Daily Business News on the inflow of capital into the U.S.

The video with Warren Buffett is few a few years ago, where he tells CNN why repatriation was a bad idea. Buffett speaks for himself. The questions to industry professionals could be, why would the Oracle of Omaha argue for less capital coming into the U.S.? Was it to maintain his capital advantage in the marketplace, including the manufactured housing market?

Note the Oct 5, 2011 CNN video is in a similar timeframe to the interview with Kevin Clayton, and their discussion of strategic moats, and the advantages that gives their company. For videos by Buffett and Clayton, click the link below.

http://mhmarketingsalesmanagement.com/blogs/tonykovach/best-warren-buffett-kevin-clayton-clayton-homes-berkshire-hathaway-annual-meeting-competition-and-the-moat-video-collection/

Meanwhile, the more recent video interview with Andy Pudzer explains some of the many advantages that the president’s tax cut and repatriation plan impact capital investments.

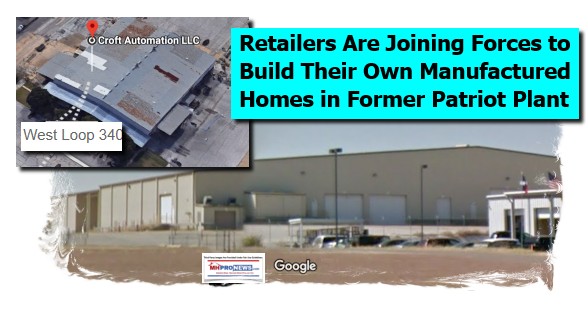

There has already been one new manufactured housing start up announced since the tax cut bill. Others are expanding too. But this need not be limited to production centers. What about new communities, more retailers, developers, or more capital for private lenders?

The BEA keeps the names of corporations and sums being repatriated by company confidential. But the latest data certainly appears to confirm that American CEOs are sticking to their pledges to bring more money earned overseas back to the U.S.

Those corporate pledges were given shortly after the tax plan was signed by President Trump in late December 2017. It is one of the factors that is keeping the U.S. economy moving ahead while others in the world are struggling.

The National Federation of Independent Business (NFIB) – which has some 325,000 members, including hundreds from the manufactured housing industry – recently voiced strong support for making the 2017 Tax Cuts plan permeant. See related reports, linked below. That’s “News Through the Lens of Manufactured Homes, and Factory-Built Housing.” © (News, analysis, and commentary.)

(Third party images are provided under fair use guidelines.)

Related Reports:

Citing Tax Reform, Billion$ in More U.S. Investments Coming, MH Industry Impact

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources