“Blackstone Group LP has made its first bet on manufactured housing by buying a portfolio of communities sold by Tricon Capital Group Inc., according to people with knowledge of the matter,” said Bloomberg earlier today.

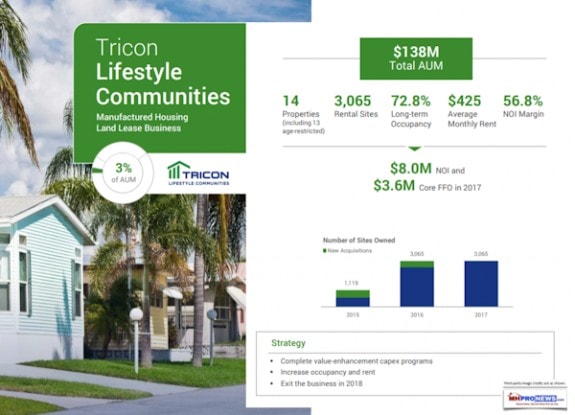

As the Daily Business News on MHProNews reported earlier this month, Tricon sold their portfolio to an undisclosed buyer. Bloomberg says that buyer is The Blackstone Group (BX).

Sale of $172 Million Manufactured Home Community Portfolio Completed

“…a principal investor and asset manager focused on the residential real estate industry, has completed the previously-announced sale of its 14-park manufactured housing investment vertical known as Tricon Lifestyle Communities (“TLC”) to an institutional asset manager for a gross transaction value of approximately $172 million.”

“A Blackstone representative declined to comment and a Tricon representative didn’t respond to requests for comment,” said Bloomberg.

“Manufactured housing communities are comprised of prefabricated homes often located near common facilities such as pools and recreation halls. This area of real estate is in favor with investors, in part because of the rising costs of homebuilding. The average price of a new manufactured home in the U.S. was $73,400, according to U.S. Census Bureau data that was last updated in February,” was Bloomberg’s better-than-average mainstream media description of the industry.

“Blackstone isn’t the first institutional investor to dive into manufactured housing,” their report correctly noted. “Singapore’s sovereign wealth fund GIC Pte. in 2016 was part of a group that acquired a majority stake in YES! Communities.”

“Centerbridge Partners LP was an early investor in Carefree Communities Inc., which was acquired by Sun Communities Inc. in 2016. Apollo Global Management LLC owns a majority stake in Gold River, California-based Inspire Communities and Carlyle Group LP has also been active in the sector,” wrote Bloomberg’s Gillian Tan.

“Evercore ISI analysts said in a note this month that they expect manufactured housing fundamentals to remain strong,” said Tan, “with projected core same-store net operating income growth of 4 percent to 4.5 percent annually over the next three years, substantially above the 2.5 percent average growth the firm expects from U.S. real estate investment trusts.”

“Equity LifeStyle Properties Inc. and Sun Communities, two REITs with sizable exposure to manufactured housing, have both outperformed the Bloomberg U.S. REITs Index over the past 12 months,” per Tan’s report.

About Blackstone

“Our investments are designed to preserve and grow our limited partners’ capital, provide financial security for millions of retirees, sovereign wealth funds, and other institutional and individual investors, and contribute to overall economic growth,” per the “Who We Are” on their corporate website.

“Blackstone is one of the world’s leading investment firms. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. The firm was founded in 1985 by Stephen A. Schwarzman, our Chairman and Chief Executive Officer, and Peter G. Peterson, who retired as Senior Chairman in 2008,” per the company.

“Thirty years later, we are a firm of nearly 2,300 employees in 25 offices worldwide. Our portfolio companies employ more than 460,000 people across the globe,” which also touts that “At Blackstone, we apply our capabilities as a leading global investment firm to deliver solutions, unlock value and propel growth. The capital we deploy on behalf of our investors fuels the development of businesses and communities. The investments we make are the wellsprings of future opportunity. Through this work, we seek to ensure a secure retirement for millions.”

Blackstone has been added to our Daily Business News evening closing ticker for manufactured home industry connected tracked stocks.

For those not yet familiar with the appeal to the manufactured home industry, or the communities sector, the related reports further below will prove insightful. “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Third-party images and content are provided under fair use guidelines.) See Related Reports, linked further below.

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Related Reports:

“Why Advocates Need to Rethink Manufactured Home Quality,” Harvard, GSE, Genz, “High Satisfaction”