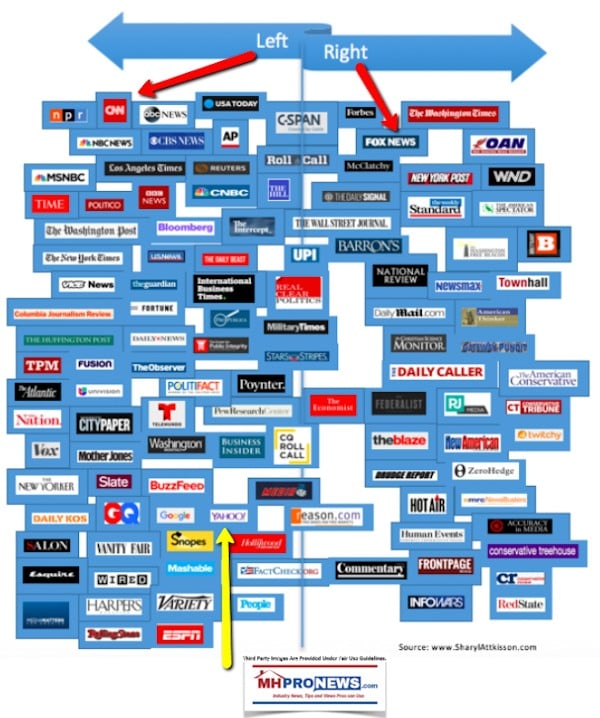

Every evening our headlines snapshots from two major media outlets on each side of the left-right news spectrum reflects topics that influence, reflect, or move investor sentiment. In moments, you can get insights-at-a-glance. This sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes, and factory-built housing.” ©.

We begin with left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Headlines from left-of-center CNN Business.

· Stocks snap one-week losing streak

· The Dow recovers some ground after markets were rocked by the intensifying trade crisis

· Goldman Sachs says the spat between the US and China will continue until after the 2020 election

· Trump’s trade war could could crush oil prices

· The case for why stocks could climb 20%

· OPINION Trump’s new tariffs will cause more pain for Americans

· This is what life on Mars could be like

· Calling out China over its currency is an empty threat

· 4 former Fed chiefs issue a stark warning: The US central bank must be independent

· Barneys, an icon in American retail, files for bankruptcy

· Garfield has a new owner: Nickelodeon

· Tencent wants to make Drake and Ariana Grande even bigger stars

· Her candle company empowers victims of human trafficking in Ohio

· OPINION China isn’t the economic manipulator in this trade war. Trump is

· Domino’s UK is stockpiling pizza ingredients in case of a disorderly Brexit

· China blinks first. Now US stocks are bouncing back

· SpaceX’s new business strategy: Rideshares for small satellites

· How NASA’s Apollo program kicked off Silicon Valley’s tech revolution

· SpaceX’s massive Starship prototype lifts off

· Is the future of space travel just for super rich people?

· Here’s what spacesuits of the future will look like

· HARD TIMES FOR BRICK AND MORTAR

· Barneys, an icon in American retail, files for bankruptcy

· Sears’ owner wants to get out of paying $43 million in severance to former employees

· Charming Charlie is closing all of its stores

· Topshop closes all US stores

· After bankruptcy, Sears is opening smaller stores

Headlines from right-of-center Fox Business.

· US STOCKS BOUNCE BACK FROM WORST DAY OF 2019

· U.S. and China are on the brink of currency war: Here’s how it all went down

· Trump says China can’t hurt American farmers: True or false?

· China targets US agriculture as farmers caught in trade war crosshairs

· Retirement savings: What you should do when the market plummets

· Jeff Bezos sells billions in Amazon stock, then attends NFL Hall of Fame with Lauren Sanchez

· AT&T employees bribed to hack the system: DOJ

· US and China edge closer to a currency war: Here’s what it means

· New minimum wage takes bite out of the Big Apple

· Trump suggests China’s ‘historic currency manipulation’ is a good sign for Americans, here’s why

· Trump rips Google over alleged anti-conservative bias

· Aretha Franklin’s sons squabble over handwritten will

· Barneys bankruptcy: Where is luxury shopping going?

· What Bezos, Zuckerberg, mega-rich lost as stocks spiraled

· Why a ‘dumb’ phone is the smart new trend

· Is bitcoin the new gold standard? Ron Paul says not yet

· Blue Apron’s latest results hard to digest as customer base shrinks

· Vince Carter’s career earnings: How NBA star’s pay compares entering record 22nd season

· Burger King’s new Impossible Whopper comes with fine print

· Celebs flocking to Google climate change conference in private jets

· First A.I.-powered bar in London

· Fundamentals don’t point to oil being this low: Energy analyst

· Why a ‘dumb’ phone is the smart new trend

· Marriott to take $126M charge after massive data breach

· Movers & Shakers: August 6, 2019

· Stories moving the markets and shaking up the world.

· Are ‘Dumb’ phones the hot new trend?

10 Market Indicators Yahoo Finance Closing Tickers on MHProNews…

Tonight’s Business/Market/Political Impact Spotlight –

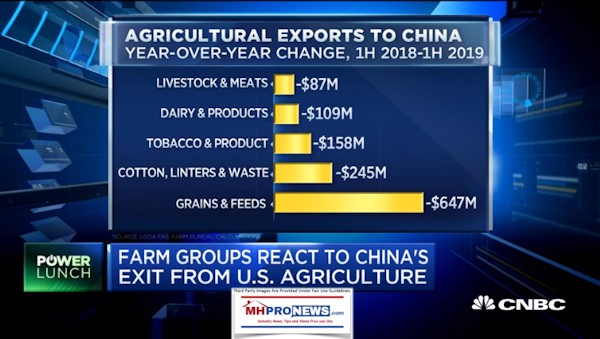

- Farmers are losing their fourth-largest customer as China officially stops buying U.S. agricultural products.

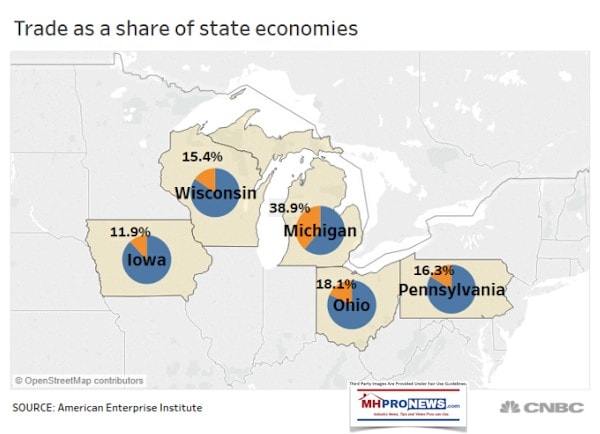

- The loss piles onto an already tough year for crops and commodity prices and could dent U.S. gross domestic product and sales at companies whose businesses are tied to farming in the Heartland.

- “It doesn’t look like trade is going to get any better, so I think we’re in for a very rough ride,” says former Iowa Lt. Gov. Patty Judge.

“Sales have already been lower this crop year because of the existing tariffs. If we went all the way to no China exports whatsoever, that would of course result in even larger market and price impacts,” said Pat Westhoff, director of the Food and Agricultural Policy Research Institute at the University of Missouri. “Cutting China completely out of the market would be a very big deal.”

China made up about $5.9 billion in U.S. farm product exports in 2018, citing the U.S. Census Bureau. It’s the world’s top buyer of soybeans and purchased roughly 60 percent of U.S. soybean exports last year. Westhoff estimated that soybean prices have already dropped 9% since the latest round in the trade war began last July.

On Tuesday, President Trump tweeted that farmers know that China “will not be able to hurt them,” since “their President has stood with them.”

“As they have learned in the last two years, our great American Farmers know that China will not be able to hurt them in that their President has stood with them and done what no other president would do – And I’ll do it again next year if necessary!”

Related Reports:

Chinese Communists Strike Back, Stocks Worst Day 2019, plus Manufactured Home Stock Updates

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP all supply manufactured housing.

· AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to an example of industry praise for our coverage, is found here and here. For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for Your Vote of Confidence.”

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

· Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.

Connect with us on LinkedIn here and here.