If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News MH connected stock report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Selected headlines and bullets from CNN Money:

- Wall Street to Trump: No trade wars. And lay off Amazon

- Dow drops 459 points as Amazon tumbles, trade war fears rise

- Intel stock tumbles on report that Apple will make its own Mac chips

- Trump administration aims to lower drug prices for seniors

- Sinclair responds to criticism of media-bashing promos

- AT&T trial goes deep on carrier negotiations

- The 2018 tax cuts by state

- Tesla’s dumb, awful weekend

- New York OKs plan to skirt a controversial provision of the GOP tax law

- California takes on health care giant over high costs

- Amazon stock sinks following Trump’s attacks

- How office buildings are reducing their carbon footprint

- Sinclair tells stations to air media-bashing promos – and the criticism goes viral

- John Oliver calls Sinclair anchors ‘members of a brainwashed cult’

- Disney’s ESPN+ service launches April 12

- What’s behind ESPN’s high-stakes morning show?

- This is what a trade war looks like

- She was too short to play Goofy. Then she invented Spanx. Now she’s a billionaire

- US trade with China, explained

- Saks, Lord & Taylor breach: Data stolen on 5 million cards

- China pledged to invest $250B in the US. Now what?

Selected headlines and bullets from Fox Business:

- Panera Bread data breach exposes customer records

- Wall Street gets black eye as traders stampede out of tech

- Amazon sees biggest point drop ever on Trump criticism

- CBS said to plan all-stock bid for Viacom, below valuation

- China retaliation draws US meat and fruit industry plea

- March Madness upset results in free pizza for America today

- Thank Little Caesars and the UMBC men’s basketball team.

- Trump’s Amazon attacks aren’t personal: White House

- Tesla CEO Elon Musk takes over Model 3 production as stock slides

- California’s leftist lawmakers facing sanctuary backlash: Dobbs

- With direct listing, Spotify takes unorthodox approach to going public

- China trade war: US CEOs threatening national security?

- Walmart eyes Medicare Advantage in Humana talks

- What cybercriminals really want to steal from you

- Wasserman Schultz said to have waived Pakistan IT aide’s security check

- Amazon has little to do with why USPS is bleeding red ink

Today’s markets and stocks, at the closing bell…

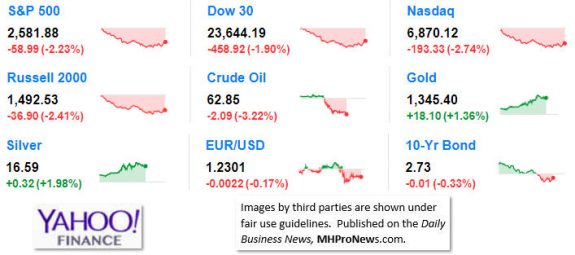

S&P 500 2,581.88 -58.99(-2.23%)

Dow 30 23,644.19 -458.92(-1.90%)

Nasdaq 6,870.12 -193.33(-2.74%)

Russell 2000 1,492.53 -36.90(-2.41%)

Crude Oil 63.11 +0.10(+0.16%)

Gold 1,341.80 -5.10(-0.38%)

Silver 16.54 -0.13(-0.79%)

EUR/USD 1.23 -0.0002(-0.02%)

10-Yr Bond 2.732 -0.009(-0.33%)

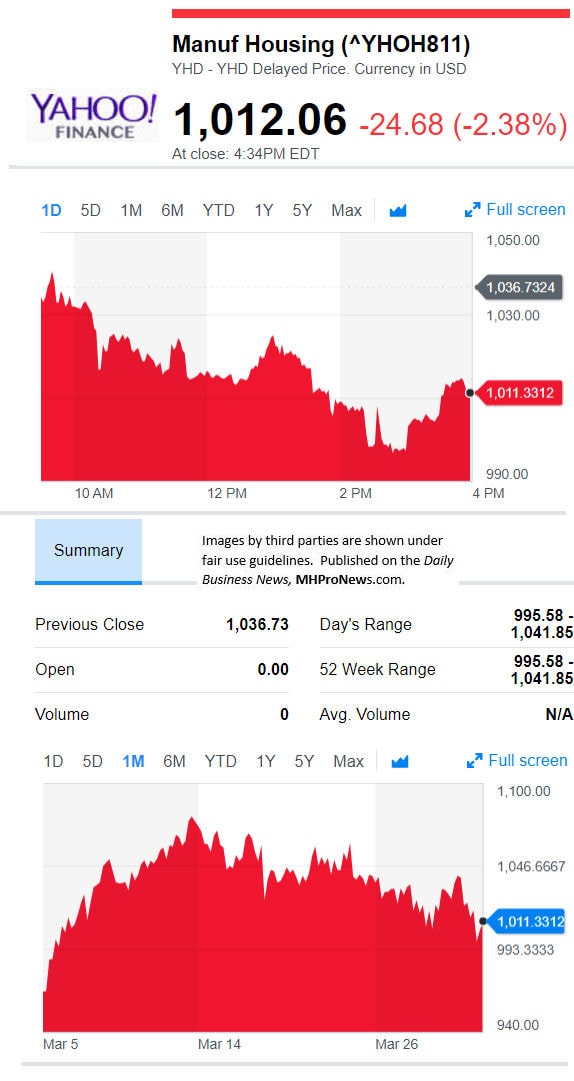

Manufactured Housing Composite Value

Today’s Big Movers

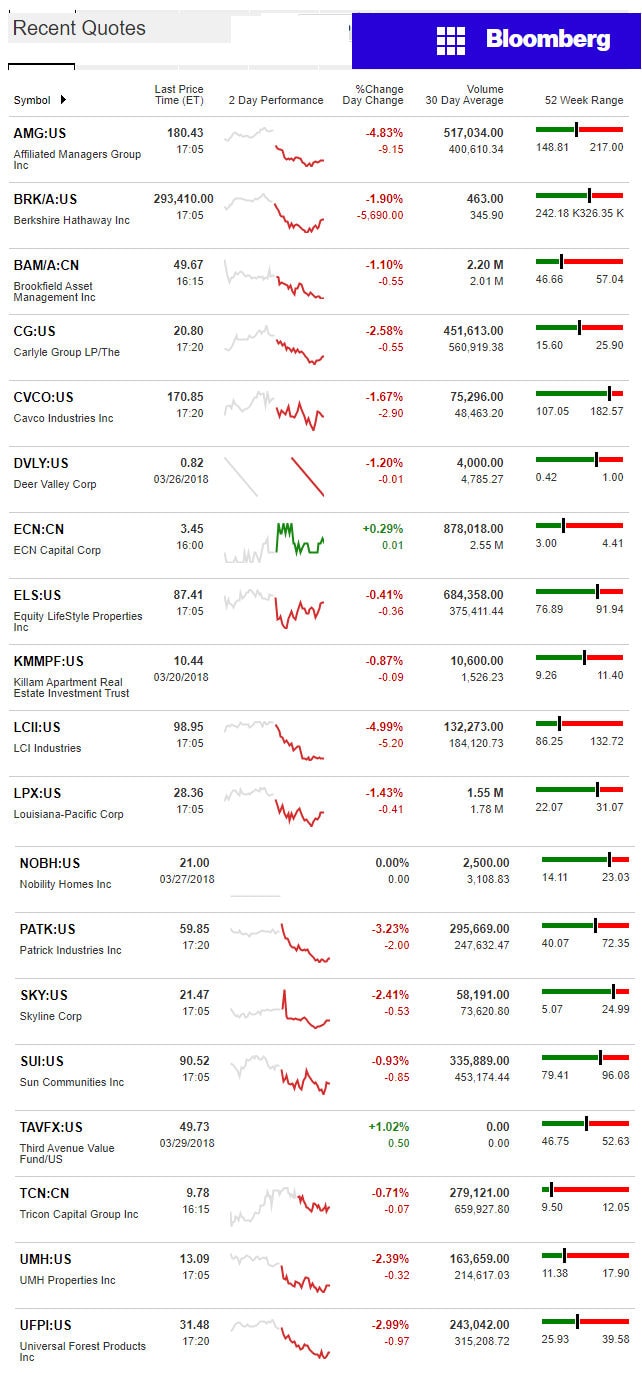

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

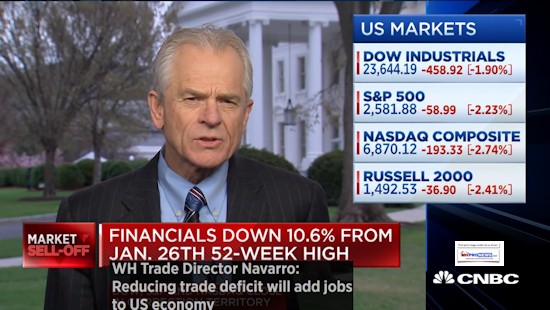

President Donald J. Trump’s trade advisor Peter Navarro says that hitting all points of the Trump agenda will witness ‘the market will go up’

Part of the reason for the market slide is the it on the tech sector. Amazon, Facebook and other tech giants are taking hits, and some like Apple’s Tim Cook and Facebook’s Mark Zuckerburg are trading shots of their own.

But Navarro is focused on the fundamentals, and with earnings reports just ahead, those fundamentals may – say some analysts – a rebound.

Per Navarro, per CNBC:

- The stock market is not reacting to the “unbelievable” strength Trump’s economic agenda, Peter Navarro says.

- If we hit all points of Trump’s agenda, the market will go up, he says.

- “Everybody needs to relax and kind of look the chess board here,” Navarro says.

In an interview with CNBC’s “Closing Bell,” Navarro said Trump’s “singular focus is on economic growth, rising wages and a strong manufacturing and defense industrial base.”

“If we hit all points … the market will go up.”

The Dow Jones industrial average fell another 459 points on Monday, after falling as much as 758.59 earlier during the day. The S&P 500 dropped 2.2 percent and re-entered correction territory. The Nasdaq composite dropped 2.7 percent.

A White House official who declined to be named told CNBC today: “We’re focused on long-term fundamentals. We’re not really reacting to market fluctuations.”

Navarro, director of the White House National Trade Council, however suggested investors may be overreacting.

“Everybody needs to relax and kind of look the chess board here. This economy is just strong,” he said.

If fact, he said if he if put on his old hat as a financial market analyst, “I’m thinking the smart money is certainly going to buy on the dips here because the economy is as strong as an ox.”

Bloomberg Closing Ticker for MHProNews

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)