Part of Warren Buffett and Berkshire Hathaway’s “strategic moat” is arguably how access – or limiting of access – to capital impacts the manufactured housing industry.

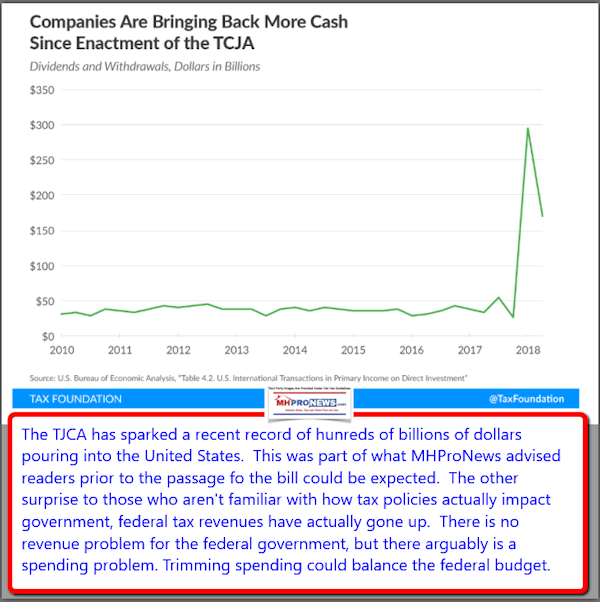

So, while some point to Buffett’s Berkshire benefit from the Tax Cuts and Jobs Act (TCJA), what is underreported in MHVille is the fact that hundreds of billions of dollars in capital is pouring back into the U.S.

The reason for that is the ‘repatriation’ provisions of the TCJA. For those who need it, and are willing to chase the capital, it’s out there in sums not seen in the U.S. in a long time. Who says?

The Tax Foundation, which tracks and reports on such items.

Erica York, in a media release for the Tax Foundation to the Daily Business News on MHProNews, noted the following facts and bullets:

Key Findings

- The Tax Cuts and Jobs Act (TCJA) changed the U.S. tax system from one where the worldwide income of U.S. corporations was taxed to one which only taxes income earned within the United States.

- These changes removed a major barrier to repatriation, or the process by which companies bring overseas earnings back to the United States. Going forward companies do not face the old tax barriers which discouraged repatriation.

- To transition to the new system, the TCJA imposed a one-time tax of 15.5 percent on liquid assets and 8 percent on illiquid assets, payable over eight years, regardless of whether companies repatriate old overseas earnings.

- Estimates of the amount of earnings built up overseas under the old system vary, but the headline amount is less important than knowing the composition: how much was reinvested overseas versus how much remained in liquid assets such as cash.

- Recent estimates show companies held about $1 trillion of overseas earnings in liquid assets. Most of this $1 trillion is invested in dollar-denominated bonds, such as U.S. Treasuries.

- Repatriation has significantly increased since enactment of the TCJA. More earnings have been repatriated in the first sixth months of 2018 than in 2015, 2016, and 2017 combined. However, it is unclear how much of this repatriation is comprised of current as well as past earnings.

- Repatriation, or the potential of an inflow of capital into the United States, is not the reason the TCJA is expected to boost investment and grow the economy. The lower corporate tax rate drives the long-run economic growth expected from the TCJA.

During the third quarter of 2018 witnessed the fifth highest U.S. corporate repatriations. That’s according to the Bureau of Economic Analysis (BEA) numbers. The first and second highest were in the first and second quarters of 2018, which paints the picture of the trend.

The total corporate repatriation in the first three months of 2018 hit over $571 billion dollars. Another $92.7 billion dollars reportedly came into the U.S. during the third quarter of 2018.

“The Credit Suisse report estimated that at the end of 2014, S&P 500 companies had $2.1 trillion of overseas earnings held abroad.[12] Excluding financial companies, it further estimated that 37 percent was held in cash ($690 billion), while the remaining $1.2 trillion was reinvested in assets.[13] Audit Analytics reported that the total amount of indefinitely reinvested earnings held overseas by Russell 1000 companies reached $2.6 trillion in 2016.[14],” wrote York.

“Thus, the measure of overseas earnings that could be repatriated should not include earnings that have been reinvested in overseas operations, and instead focus on earnings that are liquid,” said York. “More recently, an analysis by Federal Reserve economists reports that as of the end of 2017, U.S. multinational corporations had accumulated approximately $1 trillion in liquid assets held abroad, most of which was invested in U.S. fixed-income securities.[15] Most overseas earnings thus are not held in cash, but in dollar-denominated bonds, which can be more easily converted to cash should companies want to repatriate past earnings.”

There’s more reasons to see the TCJA as good for the potential future of manufactured housing, and U.S. factory home builders in general. Prior reports on this issue are shown in the related reports, found in below the byline and notices at the end of this report.

Now is arguably the time for the manufactured housing industry to break free of the capital grasp of Berkshire by the industry’s independents. Learn more about that from the linked text/image box below.

It’s Your Profession – Investment of Time, Talent, Treasure – So What’s Next?

A recent study reflected that pay gaps have largely been proven to be a matter of choices. Men, per that study, earn more because they put in more overtime. That’s a choice. Within the norms of morality and good laws, choices should be honored. says roughly 97% of our audience is domestic U.S.

Now is also the time to prepare for serious success in 2019 and 2020. That’s MH “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” “We Provide, You Decide.” ## (News , analysis, and commentary.)

NOTICE: You can join the scores who follow us on Twitter at this link. You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Billion Dollar Startup Modular Builder, Using Robotics, Could Soon Rival Clayton Homes’ Total Sales

MHC, Housing Giant Blackstone Group Lands $20 Billion, Plus Manufactured Housing Market Updates