Bankers are nervous over the UK’s Brexit, says CNBC, and they’re jittery of the fallout of that event. Oil slides, reportedly over the strong dollar, but talk of a potential Clinton administration taxing fossil fuels even more is likely part of the mix. Gold is losing its luster with their big fans. Bloomberg says Carlyle should invest more of that “dry powder” they have, see a report upcoming on the Daily Business News about CG.

Daily Business News Market Tracker (Yahoo, CNBC):

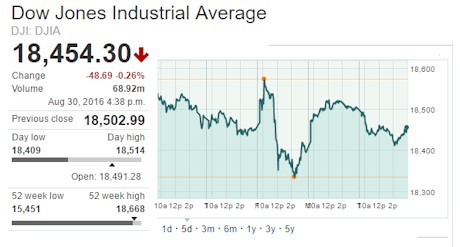

DJIA closed at 18454.30, after a fall of -48.69 points, or -0.26%.

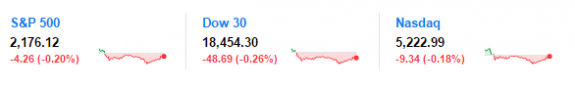

NASDAQ had a slide too, closing at 5222.99, losing -9.34 points, or -0.18%.

S&P 500 finished the day 2176.12, giving back -4.26 points.

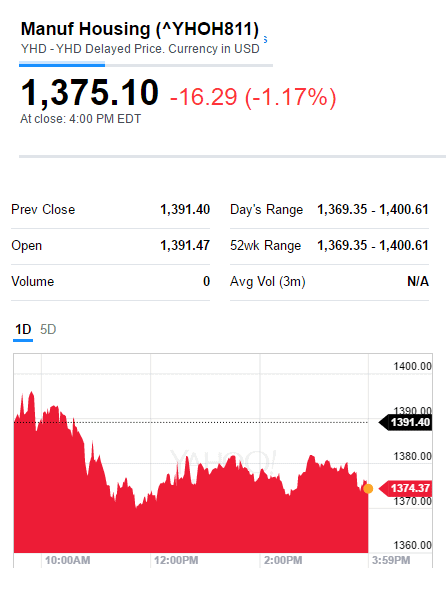

The Yahoo! Finance Manufactured Housing Composite Value (MHCV) gave back -4.71 percentage points, and finally settled at $1,391.40.

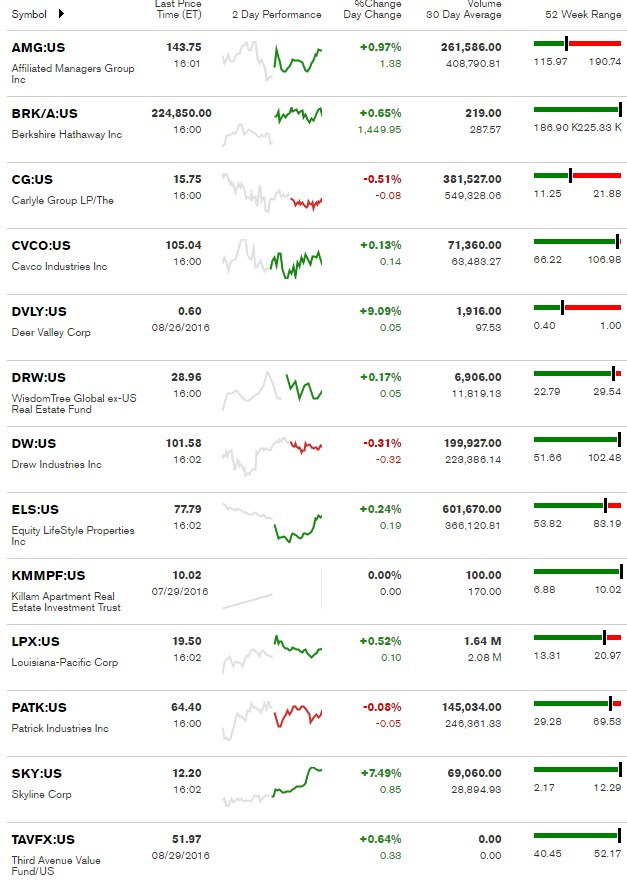

The MH-related tracked stocks biggest loser was Third Ave (TAVFX), and the biggest gainer was Patrick (PATK) with a 1.90 percent climb to close at $64.45. Cavco was featured in a weekend report, linked here, and closed up.

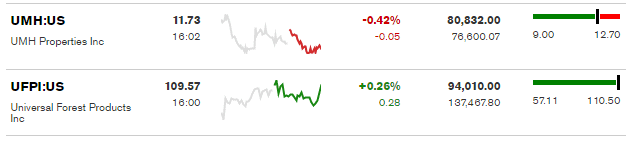

*Note: the chart below includes stocks not included in the MHCV

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown.)

(Editor’s Note: Matthew Silver is taking some much needed and well-earned time off, and L. A. “Tony” Kovach will be helping fill the Daily Business News role in the interim).

MH Industry Market Report by L. A. “Tony” Kovach, to the Daily Business News for MHProNews.