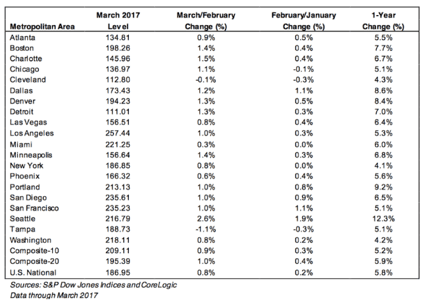

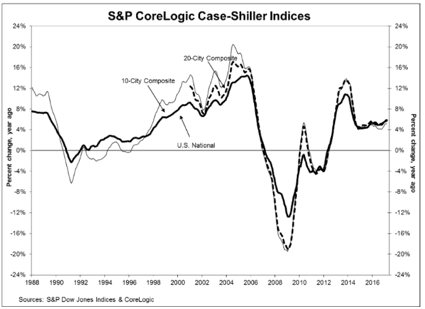

New numbers released from the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index this week, show a 5.8 percent annual gain in March, up from 5.7 percent in February.

The numbers represent a 33-month high.

According to Builder, Seattle, Portland, and Dallas reported the highest year-over-year gains among the 20 cities measured. Seattle led the way with a 12.3 percent year-over-year price increase, followed by Portland coming in at 9.2 percent, and Dallas finished with an 8.6 percent increase.

“Home prices continue rising with the S&P CoreLogic Case -Shiller National Index up 5.8 percent in the year ended March, the fastest pace in almost three years,” said David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

“While there is some regional variation, prices are rising across the U.S. Half of the 20 cities tracked by the S&P CoreLogic Case-Shiller indices rose more than 6 percent from March 2016 to March 2017. The smallest gain of 4.1 percent, in New York, was roughly double the rate of inflation.”

Prior to seasonal adjustments, the National Index posted a month-over-month gain of 0.8 percent in March, and after seasonal adjustment, the number showed a 0.3 percent month-over-month increase.

“Sales of both new and existing homes, housing starts and the National Association of Home Builders’ sentiment index are all trending higher. Over the last year, analysts suggested that one factor pushing prices higher was the unusually low inventory of homes for sale. People are staying in their homes longer rather than selling and trading up,” said Blitzer.

“If mortgage rates, currently near 4 percent, rise further, this could deter more people from selling and keep pressure on inventories and prices. While prices cannot rise indefinitely, there is no way to tell when rising prices and mortgage rates will force a slowdown in housing.”

The Impact… and the Opportunity

Blitzer’s comment regarding home prices and pressure on inventories presents an interesting scenario.

Numbers from the National Association of Realtors (NAR) last week showed existing homes stayed on the market for less time in April than in any month since 2011, but tight inventory drove a decline in existing home sales over March’s record pace.

“Demand from buyers is still far exceeding the available supply, leading to both the decline in existing home sales and the fact that homes are flying off the market,” said Lawrence Yun, NAR’s chief economist.

“Demand is easily outstripping supply in most of the country and it’s stymieing many prospective buyers from finding a home to purchase.”

Yun continued, focused on the root of the issue.

“Realtors continue to voice the frustration their clients are experiencing because of the insufficient number of homes for sale,” said Yun.

“Homes in the lower- and mid-market price range are hard to find in most markets, and when one is listed for sale, interest is immediate and multiple offers are nudging the eventual sales prices higher.”

The challenges referenced by Yun show a site built housing market that is, by all accounts, upside down. Demand for affordable housing is outstripping supply, keeping those who would otherwise be able to realize the dream of home ownership from doing so.

Customers quickly discover that when home shoppers give a good, careful look at today’s residential style manufactured and modular homes, many are saying ‘yes.’

With interest rates rising, and more cities considering or being urged to accept manufactured homes as infill, the manufactured home industry’s opportunities are rising.

As the Daily Business News has covered, the Manufactured Housing Association for Regulatory Reform has made similar points, and is calling for a full implementation of the law – notably the Manufactured Housing Improvement Act of 2000 (MHIA 2000) – as a key way to fuel more industry sales to meet the demands of an affordable home-hungry public. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by RC Williams to the Daily Business News for MHProNews.

(Copyright Notice: This and all content on MHProNews and MHLivingNews always have been and are Copyrighted, © 2017 by MHProNews.com a dba of LifeStyle Factory Homes, LLC – All Rights Reserved. No duplication is permitted without specific written permission. Headlines with link-backs are of course ok. A short-quoted clip, with proper attribution and link back to the specific article are also ok – but you must send a notice to iReport