Part I – Cavco Industries Inc (CVCO) Reports 21.7% Decline in Net Revenue

| Three Months Ended | |||||||||||||||||||||||

| ($ in thousands, except revenue per home sold) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Net revenue | |||||||||||||||||||||||

| Factory-built housing | $ | 434,066 | $ | 559,602 | $ | (125,536) | (22.4) | % | |||||||||||||||

| Financial services | 17,964 | 17,790 | 174 | 1.0 | % | ||||||||||||||||||

| $ | 452,030 | $ | 577,392 | $ | (125,362) | (21.7) | % | ||||||||||||||||

| Factory-built modules sold | 6,912 | 8,863 | (1,951) | (22.0) | % | ||||||||||||||||||

| Factory-built homes sold (consisting of one or more modules) | 4,248 | 5,111 | (863) | (16.9) | % | ||||||||||||||||||

| Net factory-built housing revenue per home sold | $ | 102,181 | $ | 109,490 | $ | (7,309) | (6.7) | % | |||||||||||||||

| Six Months Ended | |||||||||||||||||||||||

| ($ in thousands, except revenue per home sold) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Net revenue | |||||||||||||||||||||||

| Factory-built housing | $ | 891,175 | $ | 1,132,199 | $ | (241,024) | (21.3) | % | |||||||||||||||

| Financial services | 36,730 | 33,531 | 3,199 | 9.5 | % | ||||||||||||||||||

| $ | 927,905 | $ | 1,165,730 | $ | (237,825) | (20.4) | % | ||||||||||||||||

| Factory-built modules sold | 14,318 | 18,105 | (3,787) | (20.9) | % | ||||||||||||||||||

| Factory-built homes sold (consisting of one or more modules) | 8,830 | 10,457 | (1,627) | (15.6) | % | ||||||||||||||||||

| Net factory-built housing revenue per home sold | $ | 100,926 | $ | 108,272 | $ | (7,346) | (6.8) | % | |||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| ($ in thousands) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Factory-built housing | $ | 100,507 | $ | 149,665 | $ | (49,158) | (32.8) | % | |||||||||||||||

| Financial services | 6,450 | 7,934 | (1,484) | (18.7) | % | ||||||||||||||||||

| $ | 106,957 | $ | 157,599 | $ | (50,642) | (32.1) | % | ||||||||||||||||

| Gross profit as % of Net revenue | |||||||||||||||||||||||

| Consolidated | 23.7 | % | 27.3 | % | N/A | (3.6) | % | ||||||||||||||||

| Factory-built housing | 23.2 | % | 26.7 | % | N/A | (3.5) | % | ||||||||||||||||

| Financial services | 35.9 | % | 44.6 | % | N/A | (8.7) | % | ||||||||||||||||

| Selling, general and administrative expenses | |||||||||||||||||||||||

| Factory-built housing | $ | 56,455 | $ | 61,640 | $ | (5,185) | (8.4) | % | |||||||||||||||

| Financial services | 5,051 | 5,254 | (203) | (3.9) | % | ||||||||||||||||||

| $ | 61,506 | $ | 66,894 | $ | (5,388) | (8.1) | % | ||||||||||||||||

| Income from operations | |||||||||||||||||||||||

| Factory-built housing | $ | 44,052 | $ | 88,025 | $ | (43,973) | (50.0) | % | |||||||||||||||

| Financial services | 1,399 | 2,680 | (1,281) | (47.8) | % | ||||||||||||||||||

| $ | 45,451 | $ | 90,705 | $ | (45,254) | (49.9) | % | ||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||

| ($ in thousands) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Factory-built housing | $ | 213,875 | $ | 289,251 | $ | (75,376) | (26.1) | % | |||||||||||||||

| Financial services | 10,961 | 13,072 | (2,111) | (16.1) | % | ||||||||||||||||||

| $ | 224,836 | $ | 302,323 | $ | (77,487) | (25.6) | % | ||||||||||||||||

| Gross profit as % of Net revenue | |||||||||||||||||||||||

| Consolidated | 24.2 | % | 25.9 | % | N/A | (1.7) | % | ||||||||||||||||

| Factory-built housing | 24.0 | % | 25.5 | % | N/A | (1.5) | % | ||||||||||||||||

| Financial services | 29.8 | % | 39.0 | % | N/A | (9.2) | % | ||||||||||||||||

| Selling, general and administrative expenses | |||||||||||||||||||||||

| Factory-built housing | $ | 112,476 | $ | 122,563 | $ | (10,087) | (8.2) | % | |||||||||||||||

| Financial services | 10,710 | 10,467 | 243 | 2.3 | % | ||||||||||||||||||

| $ | 123,186 | $ | 133,030 | $ | (9,844) | (7.4) | % | ||||||||||||||||

| Income from operations | |||||||||||||||||||||||

| Factory-built housing | $ | 101,399 | $ | 166,688 | $ | (65,289) | (39.2) | % | |||||||||||||||

| Financial services | 251 | 2,605 | (2,354) | (90.4) | % | ||||||||||||||||||

| $ | 101,650 | $ | 169,293 | $ | (67,643) | (40.0) | % | ||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| ($ in thousands, except per share amounts) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Net income attributable to Cavco common stockholders | $ | 41,539 | $ | 74,116 | $ | (32,577) | (44.0) | % | |||||||||||||||

| Diluted net income per share | $ | 4.76 | $ | 8.25 | $ | (3.49) | (42.3) | % | |||||||||||||||

| Six Months Ended | |||||||||||||||||||||||

| ($ in thousands, except per share amounts) | September 30, 2023 |

October 1, 2022 |

Change | ||||||||||||||||||||

| Net income attributable to Cavco common stockholders | $ | 87,896 | $ | 133,718 | $ | (45,822) | (34.3) | % | |||||||||||||||

| Diluted net income per share | $ | 10.05 | $ | 14.88 | $ | (4.83) | (32.5) | % | |||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| ($ in millions) | September 30, 2023 |

October 1, 2022 |

September 30, 2023 |

October 1, 2022 |

||||||||||||||||||||||

| Net revenue | ||||||||||||||||||||||||||

| Unrealized (losses) recognized during the period on securities held in the financial services segment | $ | (0.3) | $ | — | $ | — | $ | (1.2) | ||||||||||||||||||

| Selling, general and administrative expenses | ||||||||||||||||||||||||||

|

Expenses incurred in engaging third-party consultants in relation to the non-recurring energy efficient home tax credits

|

— | (1.9) | — | (4.5) | ||||||||||||||||||||||

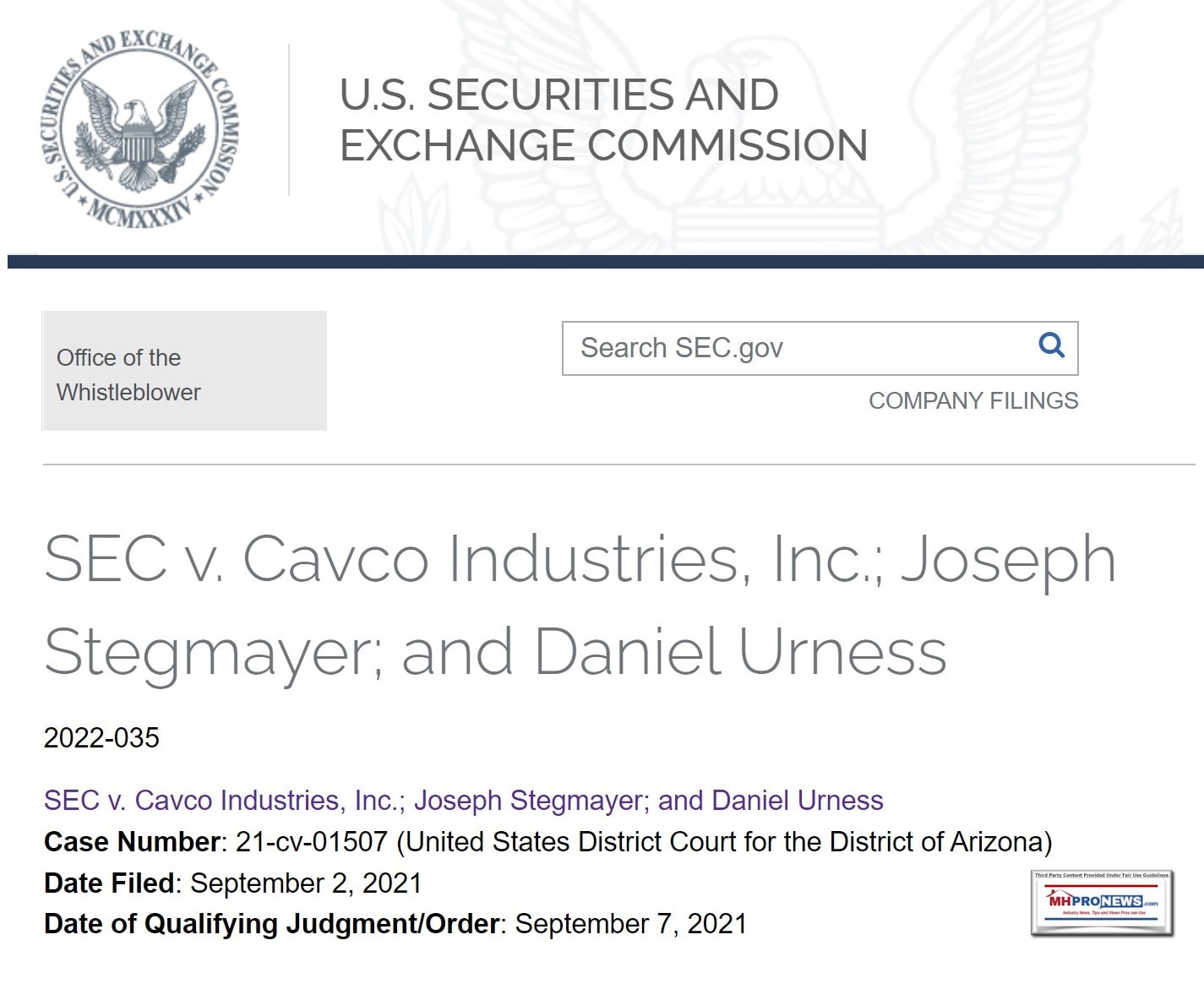

| Legal and other expense related to the Securities and Exchange Commission inquiry | (0.7) | (1.4) | (1.0) | (2.8) | ||||||||||||||||||||||

| Other income, net | ||||||||||||||||||||||||||

| Corporate unrealized gains (losses) recognized during the period on securities held | — | — | 0.1 | (1.1) | ||||||||||||||||||||||

(Dollars in thousands, except per share amounts)

| September 30, 2023 |

April 1, 2023 |

||||||||||

| ASSETS | (Unaudited) | ||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 377,264 | $ | 271,427 | |||||||

| Restricted cash, current | 17,180 | 11,728 | |||||||||

| Accounts receivable, net | 88,560 | 89,347 | |||||||||

| Short-term investments | 14,358 | 14,978 | |||||||||

| Current portion of consumer loans receivable, net | 10,503 | 17,019 | |||||||||

| Current portion of commercial loans receivable, net | 48,583 | 43,414 | |||||||||

| Current portion of commercial loans receivable from affiliates, net | 1,959 | 640 | |||||||||

| Inventories | 244,476 | 263,150 | |||||||||

| Prepaid expenses and other current assets | 72,560 | 92,876 | |||||||||

| Total current assets | 875,443 | 804,579 | |||||||||

| Restricted cash | 585 | 335 | |||||||||

| Investments | 20,507 | 18,639 | |||||||||

| Consumer loans receivable, net | 25,233 | 27,129 | |||||||||

| Commercial loans receivable, net | 40,998 | 53,890 | |||||||||

| Commercial loans receivable from affiliates, net | 2,928 | 4,033 | |||||||||

| Property, plant and equipment, net | 223,664 | 228,278 | |||||||||

| Goodwill | 116,015 | 114,547 | |||||||||

| Other intangibles, net | 29,005 | 29,790 | |||||||||

| Operating lease right-of-use assets | 34,413 | 26,755 | |||||||||

| Total assets | $ | 1,368,791 | $ | 1,307,975 | |||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | 41,095 | $ | 30,730 | |||||||

| Accrued expenses and other current liabilities | 264,380 | 262,661 | |||||||||

| Total current liabilities | 305,475 | 293,391 | |||||||||

| Operating lease liabilities | 30,529 | 21,678 | |||||||||

| Other liabilities | 7,792 | 7,820 | |||||||||

| Deferred income taxes | 5,740 | 7,581 | |||||||||

| Redeemable noncontrolling interest | — | 1,219 | |||||||||

| Stockholders’ equity | |||||||||||

| Preferred stock, $0.01 par value; 1,000,000 shares authorized; No shares issued or outstanding | — | — | |||||||||

|

Common stock, $0.01 par value; 40,000,000 shares authorized; Issued 9,356,421 and 9,337,125 shares, respectively

|

94 | 93 | |||||||||

|

Treasury stock, at cost; 844,742 and 671,801 shares, respectively

|

(211,646) | (164,452) | |||||||||

| Additional paid-in capital | 274,204 | 271,950 | |||||||||

| Retained earnings | 957,206 | 869,310 | |||||||||

| Accumulated other comprehensive loss | (603) | (615) | |||||||||

| Total stockholders’ equity | 1,019,255 | 976,286 | |||||||||

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity | $ | 1,368,791 | $ | 1,307,975 | |||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| September 30, 2023 |

October 1, 2022 |

September 30, 2023 |

October 1, 2022 |

||||||||||||||||||||

| Net revenue | $ | 452,030 | $ | 577,392 | $ | 927,905 | $ | 1,165,730 | |||||||||||||||

| Cost of sales | 345,073 | 419,793 | 703,069 | 863,407 | |||||||||||||||||||

| Gross profit | 106,957 | 157,599 | 224,836 | 302,323 | |||||||||||||||||||

| Selling, general and administrative expenses | 61,506 | 66,894 | 123,186 | 133,030 | |||||||||||||||||||

| Income from operations | 45,451 | 90,705 | 101,650 | 169,293 | |||||||||||||||||||

| Interest income | 5,812 | 1,851 | 10,430 | 3,165 | |||||||||||||||||||

| Interest expense | (257) | (233) | (523) | (394) | |||||||||||||||||||

| Other income, net | 655 | 488 | 781 | 57 | |||||||||||||||||||

| Income before income taxes | 51,661 | 92,811 | 112,338 | 172,121 | |||||||||||||||||||

| Income tax expense | (10,088) | (18,613) | (24,354) | (38,229) | |||||||||||||||||||

| Net income | 41,573 | 74,198 | 87,984 | 133,892 | |||||||||||||||||||

| Less: net income attributable to redeemable noncontrolling interest | 34 | 82 | 88 | 174 | |||||||||||||||||||

| Net income attributable to Cavco common stockholders | $ | 41,539 | $ | 74,116 | $ | 87,896 | $ | 133,718 | |||||||||||||||

| Net income per share attributable to Cavco common stockholders | |||||||||||||||||||||||

| Basic | $ | 4.80 | $ | 8.32 | $ | 10.15 | $ | 15.01 | |||||||||||||||

| Diluted | $ | 4.76 | $ | 8.25 | $ | 10.05 | $ | 14.88 | |||||||||||||||

| Weighted average shares outstanding | |||||||||||||||||||||||

| Basic | 8,656,537 | 8,903,703 | 8,663,430 | 8,910,933 | |||||||||||||||||||

| Diluted | 8,731,419 | 8,978,997 | 8,742,734 | 8,983,425 | |||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| September 30, 2023 |

October 1, 2022 |

September 30, 2023 |

October 1, 2022 |

||||||||||||||||||||

| Capital expenditures | $ | 4,287 | $ | 8,181 | $ | 8,470 | $ | 33,188 | |||||||||||||||

| Depreciation | $ | 4,275 | $ | 3,836 | $ | 8,449 | $ | 7,274 | |||||||||||||||

| Amortization of other intangibles | $ | 393 | $ | 502 | $ | 785 | $ | 1,010 | |||||||||||||||

Part II – Additional Information with More MHProNews Analysis and Commentary

From the SEC document linked here are the following remarks found in “Assessing Materiality: Focusing on the Reasonable Investor When Evaluating Errors.”

MHProNews hereby notes that failure for a firm to provide accurate information, and failure to correct information that may be “material” to a “reasonable” investor can be an important legal issue.

That noted, from that same SEC document: “Management is responsible for providing investors with GAAP-compliant financial statements, so whenever a material error is identified in previously-issued financial statements,[2] investors must be notified promptly and the error must be corrected. The determination of whether an error is material is an objective assessment focused on whether there is a substantial likelihood it is important to the reasonable investor.[3]

referred to colloquially as a reissuance restatement or a “Big R” restatement.” “such errors [both Big R and little r] should be transparently disclosed to investors.” “Since the concept of materiality is focused on the total mix of information from the perspective of a reasonable investor, those who assess the materiality of errors, including registrants, auditors, audit committees, and others, should do so through the lens of the reasonable investor.”

The last remark might be worth repeating for emphasis (with bold added by MHProNews) for better understanding the analysis that follows. “Since the concept of materiality is focused on the total mix of information from the perspective of a reasonable investor, those who assess the materiality of errors, including registrants, auditors, audit committees, and others, should do so through the lens of the reasonable investor.”

MHProNews asked Bing AI the following.

> “What is a fiduciary duty in law with respect to investing in publicly traded companies?”

- Exercise due care in how they manage a corporation’s affairs

- Handle their powers only for the collective benefit of the corporation and its stockholders

- Make decisions in good faith for shareholders in a reasonably prudent manner

- Not put other interests, causes, or entities above the interest of the company and its shareholders

- Choose the best option to serve the company and its stakeholders

- Exercise their business judgment in considering and reconciling the interests of various stakeholders, including shareholders, employees, customers, suppliers, the environment and communities, and the attendant risks and opportunities for the corporation.

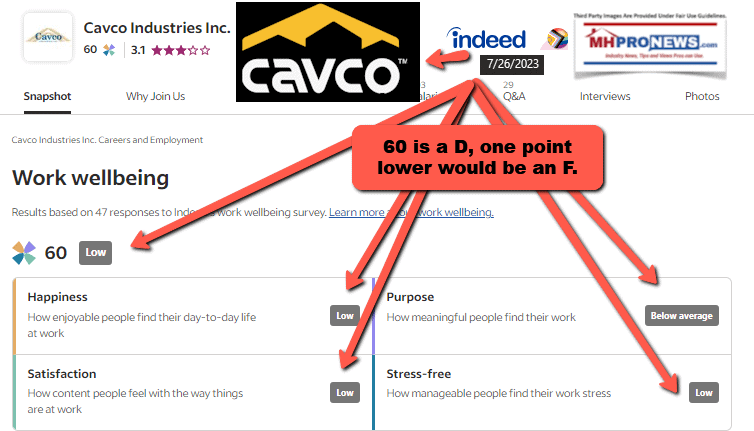

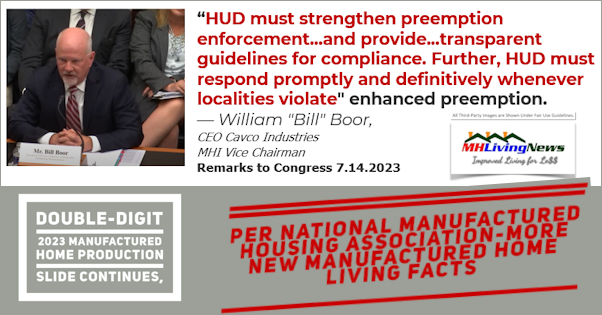

3) Boor ought to play an outsized role at MHI, given that he is their current chairman. Boor’s remarks on behalf of Cavco: “Prospective homeowners have gotten no relief from the impact of rising interest rates and the affordable housing crisis is intensifying” is arguably one more addition to the ‘indictment’ of the Arlington, VA based national trade association that he currently heads up as their corporate board leader.

4) Comparing Cavco’s quarterly results to that of the industry as a whole is a commonsense step for manufactured housing stakeholders and corporate shareholders, among others evaluating the information that Cavco’s has provided. Cavco has reportedly dropped some 22 percent, which is broadly in line with the fall in production reported by MHARR, IBTS, and other sources (see the above and below reports for details).

5) That said, affordable manufactured housing has apparently broadly performed worse than conventional housing, based upon recent reporting. See that data in the report linked below. The fact that manufactured housing is underperforming far costlier conventional housing ought to be a reason for a range of individuals, public officials, and advocates to wonder, why is this the case? What helps explain the apparently poor performance of several manufactured housing industry firms during an affordable housing crisis?

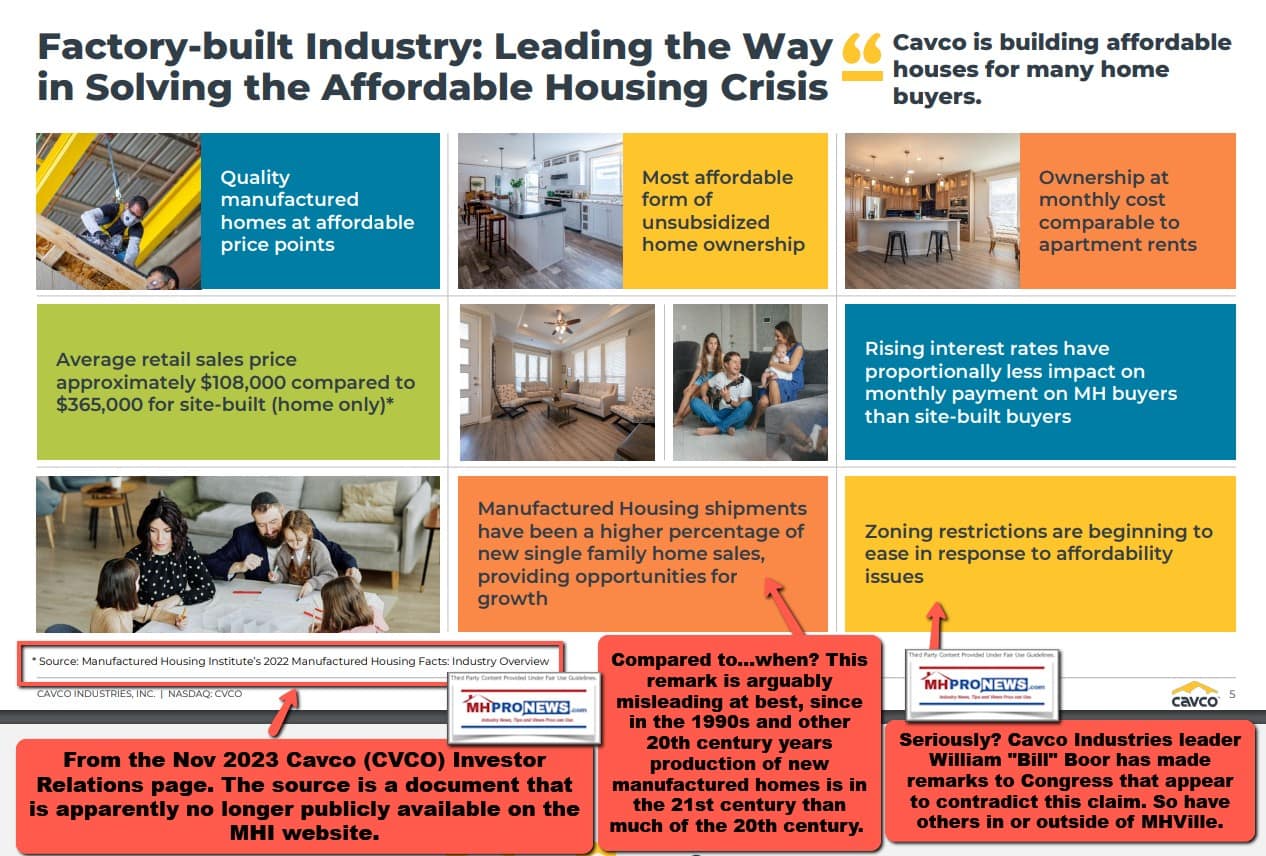

6) MHProNews will not do at this time a page-by-page “fisking” of Cavco’s latest investor pitch deck (investor presentation for November 2023). What we will do is focus this analysis to the following. The following page is from a previous Cavco Industries investor presentation. However, it is also page four of their current (November 2023) presentation (investor pitch deck).

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

that the industry ought to expect this current downturn because more expensive site-built housing is also in a downturn? MHI’s research and reasoning are arguably a classic example of PALTERING and the use of a RED HERRING logical fallacy. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

According to a search using Bing AI, the quotation above from the National Association of Home Builders CEO Jerry Howard is based upon remarks he made to Fox Business on the Varney and Company program on 11.22.2022. The precise quoted remark posted on their website says the following.

“Right now, in almost no market in this country, can a homebuilder build a house that is affordable for a first-time homebuyer,” National Association of Home Builders CEO Jerry Howard said on “Varney & Co.” Thursday. “We can’t do it. The costs that are on us make it impossible.” So, first, while Cavco’s quotation is close, it is NOT precise. Cavco’s version of NAHB CEO Howard’s remark omits the word “almost” Here is how Cavco posted it in their investor relations page 4 above. “…(in) no market in this country can a homebuilder build a house that is affordable for a first-time home buyer.” National Association of Home Builders CEO, Jerry Howard. Note that while Cavco cited the sources for 3 other remarks on that page (Pew, NPR, and Forbes), it failed to cite the source for NAHB CEO Howard’s remark. That said, the points that Cavco has made with that slide are important.

Next to “Why it matters” are these three remarks.

- Nationwide impact with approximately 6 million housing unit deficit

- Ownership helps prevent intergenerational poverty

- Shortage of affordable housing costs American economy $2T in lower wages and productivity

Once again, as with the Howard quote, those statements aren’t supported by the sources for those comments. That noted, there is support for those claims, as MHProNews previously noted in detail in the report linked below.

For those interested in ESG, those remarks are powerful. That said, Cavco’s Boor used ESG as a pivot point to make other remarks to Congress on July 14, 2023. Perhaps oddly, Cavco’s CEO Boor made distinctively different remarks to investors just a few weeks after his remarks to Congress.

7). Perhaps this next slide from Cavco’s 11.2023 investor presentation is where a question of materiality and the firm’s fiduciary duty to investors and stakeholders could come in to play (see preface and the introduction to Part II, above).

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

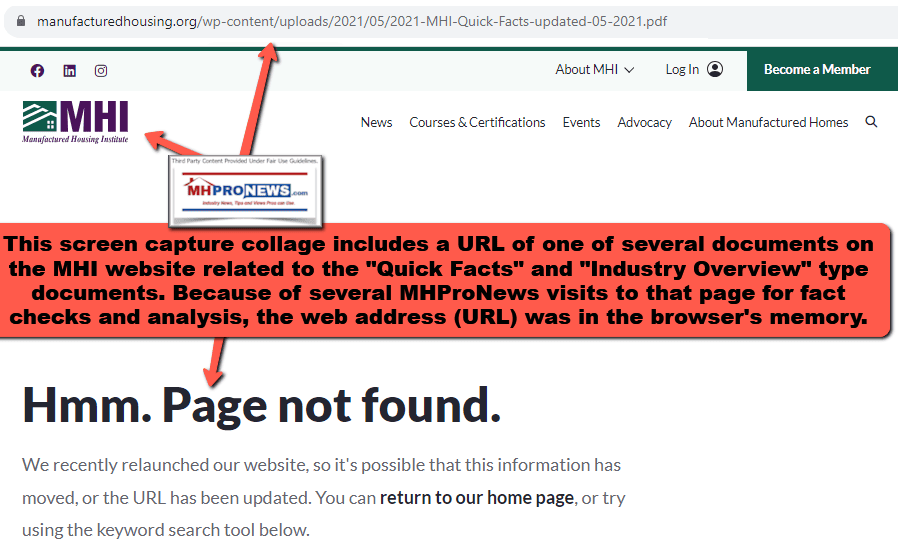

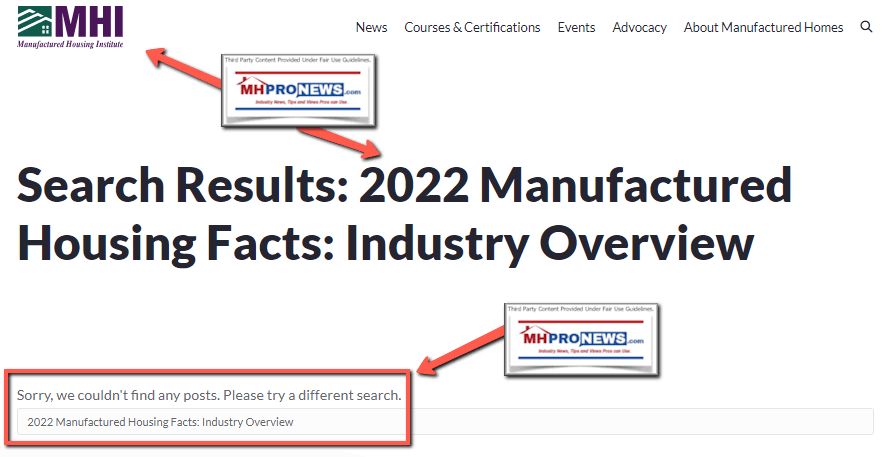

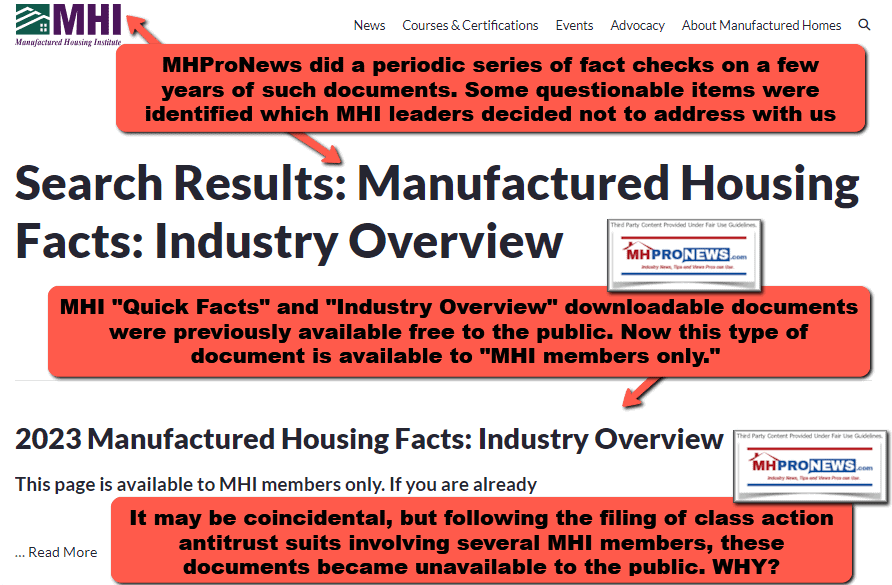

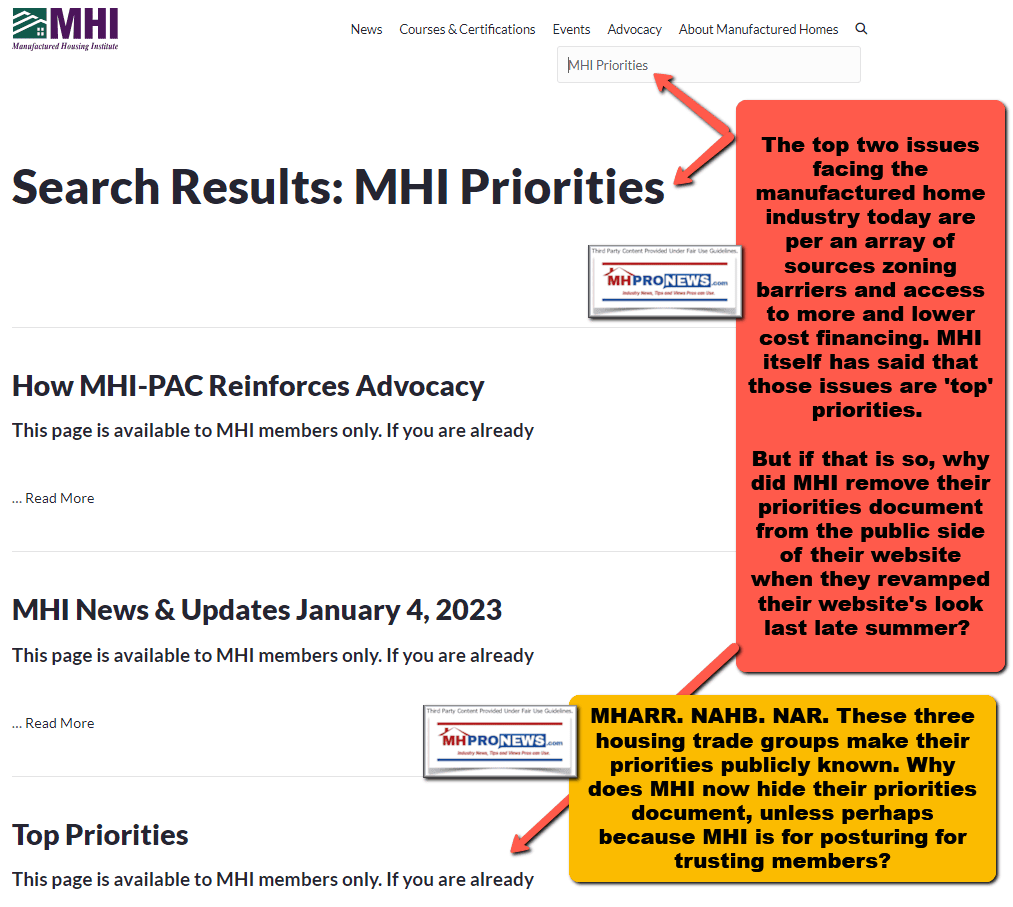

On the bottom left of page 5 (the MHProNews annotated screen capture above) is this statement. “* Source: Manufactured Housing Institute’s 2022 Manufactured Housing Facts: Industry Overview.” MHProNews has raised the topic several times that MHI’s recently revised website has made several changes beyond mere appearances. The case can be made that information previously made available by MHI to the public has been removed. What is interesting is that some of that removed information were the subjects of MHProNews fact checks. That reference from Cavco is to one of those removed (i.e.: now hidden, taken down, or perhaps members only) documents. This has occurred at about the same time as national class action lawsuits were filed against several prominent MHI members.

Keep in mind the information in linked in the opening paragraph of this article. In the recent past, Cavco has had years of legal woes.

For employees working for a firm that may have problematic business practices, the above and next reports are reminders that it can be beneficial to several for formal complaints, and/or news tips to media like ours that is willing to hold firms and organizations accountable for problematic actions/inactions. While the system may be problematic, it would be wrong to say that the system never works. It has worked in numbers of higher profile cases, such as the examples noted in the report and analysis linked below.

8) Cavco has made a big deal about encouraging the raising of concerns and complaints to management. Cavco, and perhaps several other MHI member firms, may have reason to hope and pray that their employees don’t blow the whistle on several aspects of their operations, especially in the light of the class action and other legal cases noted and linked from this report.

9) Back to the point raised in #7 above. Cavco cited an MHI document that was once publicly available, but now no longer is, according to the search of the MHI website shown below.

Note: to expand these images below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

It isn’t just that document, but others that were once publicly available that have since been removed. Another example recently detected is the one shown below. For the possible significance, see the deeper dive on MHI linked here. But keep in mind that Cavco is a prominent MHI member. That MHI “priorities” document that was removed included the issue of zoning barriers.

10) While MHI is ironically pitching potential and new members on the notion that they should sign up (see report linked above) to get access to a “members only” tool that details zoning barriers in the U.S., Cavco Industries is telling investor that “Zoning restrictions are beginning to ease in response to affordability issues.” Seriously? Where is the evidence for that remark? While there may be a very limited number of possible examples for that which Cavco could point to, the fact that their own CEO – Bill Boor – made remarks to Congress asking for help with HUD’s failure to press zoning issues ought to be a red flag for a disconnect between what Boor told Congress, and what Cavco told investors previously and in recent remarks that questionably claim that “Zoning restrictions are beginning to ease in response to affordability issues.”

11) Put simply, Cavco can’t have it both ways. They can’t tell Congress that zoning barriers are a serious problem (they are, as a notable example, see the report linked here), and then tell investors that zoning barriers are easing. Perhaps more revealing is the point that Cavco and MHI leaders have apparently had face-to-face meetings with HUD Secretary Marcia Fudge, yet there is no known evidence that the topic of “enhanced preemption” (see Boor’s remarks shown above about preemption enforcement) has been raised face to face with Fudge or senior HUD leadership. Yet Fudge said in video recorded remarks to Congress that these issues (zoning barriers) will “perpetually” persist until these legal questions are solved.

12) But those points are conveniently ignored in MHI’s recent or several prior messages to members and on the MHI website. Industry professionals, perhaps especially management, are often busy. They may not think that they have the time to spend checking up on the how ethical their national association (i.e.: MHI) and or MHI affiliated state associations happen to be. That said, state associations (dubbed by MHI as state affiliates) and MHI’s own previously asserted history items are also among the ones seemingly missing from their revised website. MHI boldly claims in their new home page that they are: “Expanding Attainable Homeownership” at a time when the industry is in a documented 11 months of year-over-year declining production. MHI leaders have made statements under oath which arguably have not been supported by the evidence.

13) To illustrate and give evidence in support of several of these points, the following inquiry was put to Bing AI.

> “Is there any known evidence that Manufactured Housing Institute corporate or staff leaders have discussed the lack of enforcement of the enhanced preemption issue under the Manufactured Housing Improvement Act of 2000 with HUD Secretary Marcia Fudge?”