If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Uber has gone 64 days without a CEO

- Study: Exxon misled public on climate change

- Trump playing ‘bad cop’ in NAFTA negotiations

- Giant Powerball drawing could set a record

- Ferrari unveils new 200 mph convertible

- Will Republicans kill the estate tax?

- Tourists are returning to Paris after attacks

- Don’t turn this annoying auto safety feature off

- S. companies still hoarding cash overseas

- Elon Musk unveils SpaceX’s chic new spacesuit

- Here are the charities that have dumped Mar-a-Lago

Selected headlines and bullets from Fox Business:

- Trump will be go down as one of the ‘greatest presidents’, says ex-sheriff Joe Arpaio

- Wall St lower on Trump’s threat of government shutdown

- Oil edges up on eighth weekly U.S. crude stock drawdown

- S. new home sales fall to seven-month low

- Trump’s NAFTA withdrawal would hurt US businesses, consumers

- Whole Foods shareholders approve sale to Amazon

- USS Fitzgerald heading to Huntington Ingalls for repairs

- NYC Mayor De Blasio considers taking down Christopher Columbus statue

- ‘Leftist media’ is to blame for inciting violence: Lara Trump

- The lottery’s hidden secret: Billions in unclaimed prizes

- American Express to pay $96M to consumers over discriminatory card terms

- Lowe’s giving workers longer shifts in battle with Home Depot

- How ESPN botched Robert Lee decision, according to media experts

- Edmunds: Labor Day’s best bets for car shoppers

- Muni bond Wednesday update: 10-year yield falls

- EPA taps Alabama business lobbyist to lead Southeast region

- Lowe’s and Stryker fall while Express and Wal-Mart rise

- Stocks that moved substantially or traded heavily on Wednesday: Lowe’s Cos., down $2.81 to $73.01

- How major US stock market indexes fared Wednesday

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,444.04 -8.47 (-0.35%)

Dow 30 21,812.09 -87.80 (-0.40%)

Nasdaq 6,278.41 -19.07 (-0.30%)

Crude Oil 48.36 +0.53 (+1.11%)

Gold 1,295.70 +4.70 (+0.36%)

Silver 17.09 +0.11 (+0.64%)

EUR/USD 1.1806 +0.0043 (+0.36%)

10-Yr Bond 2.171 -0.044 (-1.99%)

Russell 2000 1,369.74 -1.80 (-0.13%)

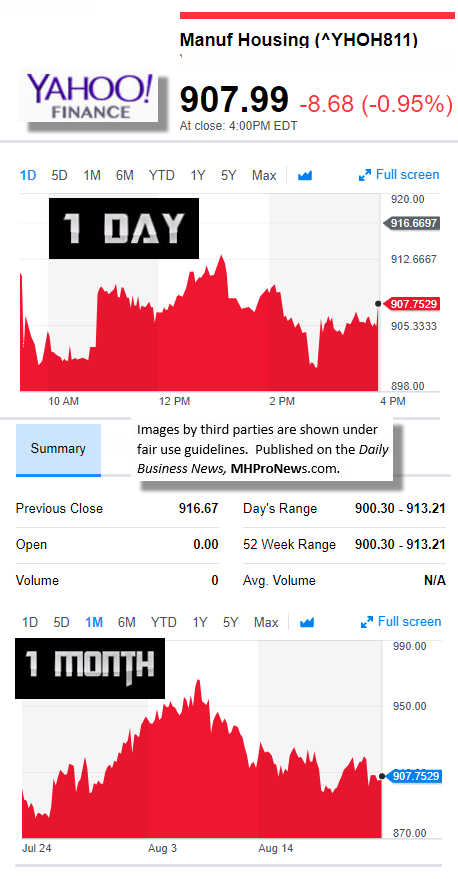

Manufactured Housing Composite Value

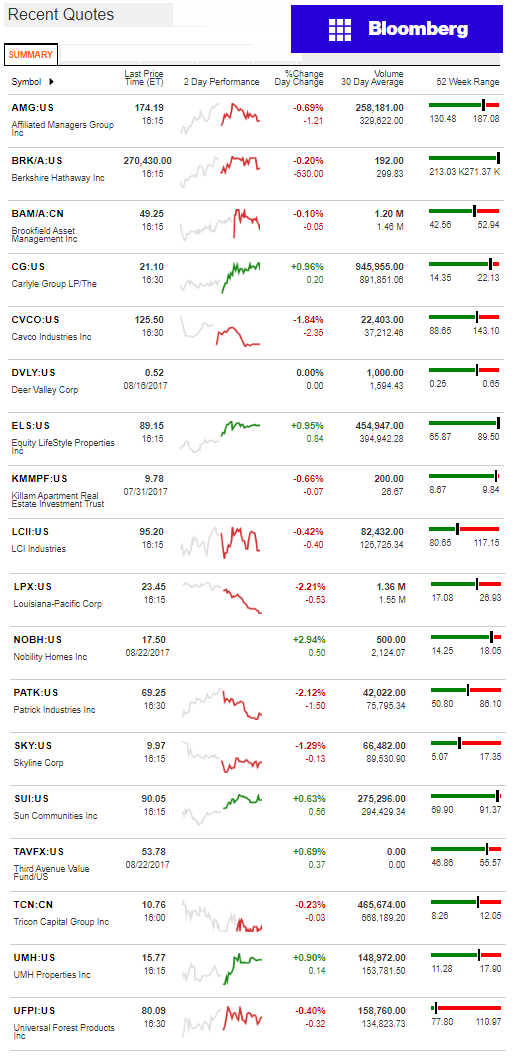

Today’s Big Movers

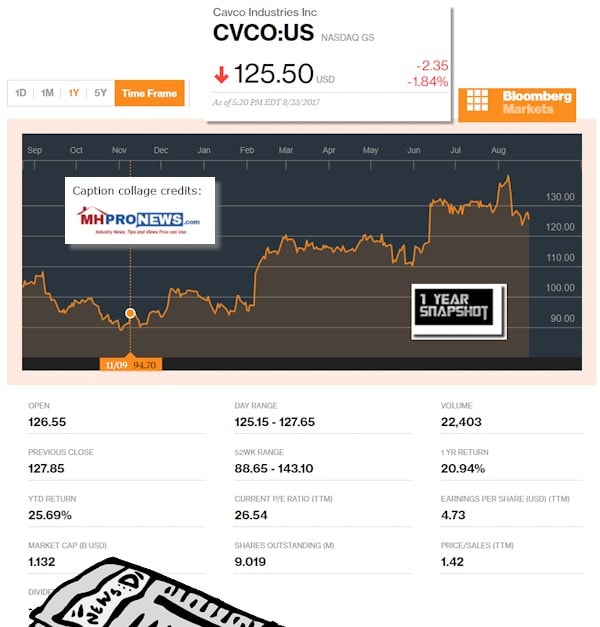

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

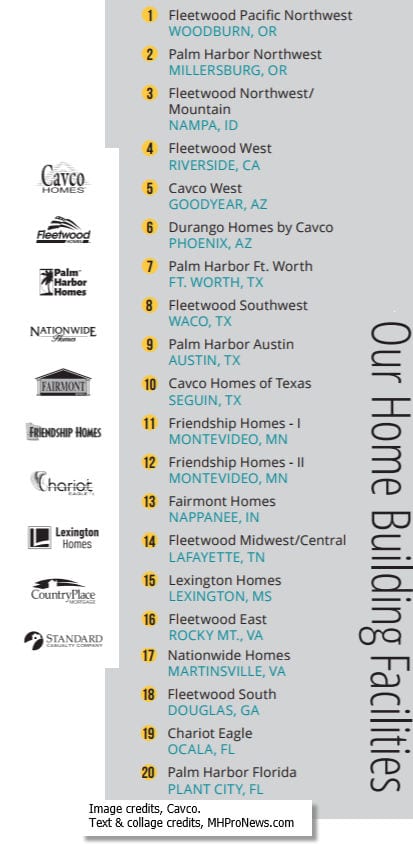

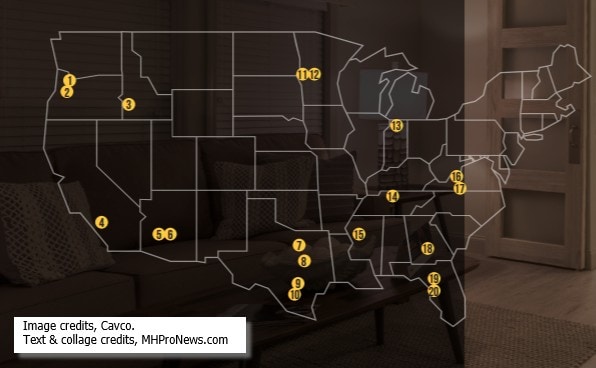

Cavco Industries Spotlight

Sources often describe Cavco Industries (CVCO) as a well-managed company, taking advantage of their growing economies of scale. They are reportedly the #2 producer in the industry, behind Clayton Homes.

At the same time, the opening paragraph by Chairman and CEO, Joe Stegmayer, reveals that they are growing at a slower sales pace than the industry at large.

Fiscal year 2017 was another solid year for Cavco Industries. We generated $774 million in net revenue this fiscal year, up 9% from fiscal year 2016 and marking the highest revenue earned in the Company’s history. Manufactured housing industry home shipments grew 15% nationally to 81,169 homes in 2016 from 70,519 homes in 2015. We sold 13,820 homes in fiscal year 2017 compared to 12,339 homes in fiscal year 2016, a 12% increase.”

Their 2017 annual report is available linked here, as a download.

Their most recent quarterly report, on Seeking Alpha, says in part:

For our financial report this quarter, net revenue for this first fiscal quarter of 2018 fiscal year was $207 million, up 12%, compared to $185 million during the same quarter last year. Breaking this increase down by business segment, factory-built housing net revenue increased $20.4 million, from a larger proportion of multi-section homes sold and higher home sales volume or higher home sales prices.

Financial services segment, net revenue increased $1.3 million for more insurance policies enforced in the current period compared to the prior year period. Consolidated gross profit in the first fiscal quarter as a percentage of net revenue was 20.3%, up from 18% in the same period last year. The improvement was mainly from stronger earnings in the financial services segment compared to last year’s first fiscal quarter results, which were significantly impacted by high insurance claims activity.

Selling, general and administrative expenses in the fiscal 2018 first quarter as a percentage of net revenue was 12.7% compared to 13.3% during the same quarter last year. The improvement, related to effective costs control efforts as we continue working to increase home production levels.

Net income for the first quarter of fiscal 2018 was $11.8 million compared to net income of $5.4 million reported in the same quarter of the prior year. Net income per diluted share was $1.28 versus $0.60 in last year’s first fiscal quarter.

Comparing the July 1, 2017 balance sheet to April 1, 2017, the balance sheet of Lexington Homes is included in the consolidated balance sheet this quarter.

Cash was approximately $130 million compared to $133 million 3-months earlier. The decrease was more loans held for sale at our finance subsidiary based on the timing of regular home sales as well as changes in other working capital accounts…”

From a press release on Seeking Alpha by Cavco, the following:

Financial highlights include the following:

Net revenue for the first quarter of fiscal year 2018 totaled $206.8 million, up 11.7% from $185.1 million for the comparable prior year period. The increase was primarily from improved home sales volume and a larger proportion of higher priced homes sold.

Income before income taxes was $15.7 million for the first quarter of fiscal 2018, an 86.9% increase from $8.4 million income before income taxes in the comparable quarter last year. The improvement was from increased home sales as well as stronger earnings in the financial services segment compared to last year’s first fiscal quarter, as the segment’s prior year results were significantly impacted by high insurance claims activity.

Income tax expense was $3.9 million with an effective tax rate of 24.9% for the first quarter of fiscal year 2018 compared to $3.0 million and an effective tax rate of 35.4% in the same quarter of the prior year. The current quarter contains a benefit of $1.4 million related to the Company’s required implementation of Accounting Standards Update No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvement to Employee Share-based Payment Accounting, which, among other items, requires the Company to record excess tax benefits on exercises of stock options as a reduction of income tax expense in the consolidated statement of comprehensive income, whereas they were previously recognized in equity.

Net income was $11.8 million for the first quarter of fiscal year 2018, compared to net income of $5.4 million in the same quarter of the prior year, a 118.5% increase.

Net income per share for the first quarter of fiscal 2018, based on basic and diluted weighted average shares outstanding, was $1.30 and $1.28, respectively, compared to net income per share of $0.61 and $0.60, respectively, for the comparable quarter last year.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)