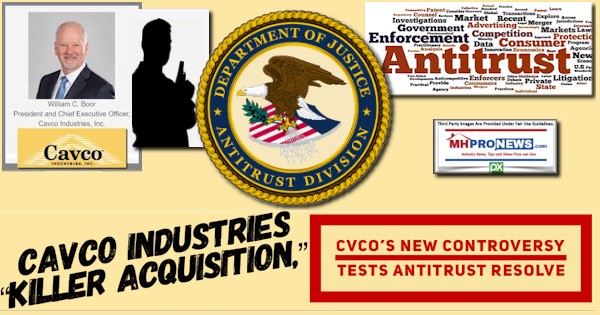

The following is the recent official statement from Cavco Industries (NASDAQ:CVCO) regarding their ongoing Securities and Exchange Commission (SEC) woes. It will be followed by additional information from left-of-center CNBC, plus further related information and analysis.

The following is per Cavco and the SEC website.

“Since 2018, the Company has been cooperating with an investigation by the enforcement staff of the SEC’s Los Angeles Regional Office regarding securities trading in personal and Company accounts directed by the Company’s former Chief Executive Officer, Joseph Stegmayer. The Audit Committee of the Board of Directors conducted an internal investigation led by independent legal counsel and other advisers and, following the completion of its work in early 2019, the Audit Committee shared the results of its work with the Company’s auditors, listing exchange and with the SEC staff. We have also made documents and personnel available to the SEC staff and we intend to continue cooperating with its investigation.

As previously disclosed in September 2020, the SEC staff issued a Wells Notice to Dan Urness, the Company’s Chief Financial Officer and Principal Financial Officer and Principal Accounting Officer at the time, in connection with its investigation, noting that it intends to recommend an enforcement action against him. Rather than have this be a distraction to the Company, Mr. Urness has gone on leave to focus on his response to the Wells Notice. Also, as previously disclosed in November 2020, the SEC staff issued a Wells Notice to the Company stating that they intend to recommend an enforcement action against the Company in connection with the SEC’s investigation. We have been exploring the possibility of a settlement with the SEC staff in connection with the matter but, at this time, we are unable to assess the probability of that outcome or reasonably estimate the amount of a potential loss, if any.”

CNBC says the following about Wells Notices.

“What is a Wells notice?

It’s a letter, usually from the SEC, that says a publicly traded company and/or person from the same firm—has been investigated and that there is probable legal action planned for violating federal security laws.

Those violations can include insider trading and/or misleading investors.

Individual investors/traders can also receive a Wells notice.

Before the Wells notice is sent, the SEC has conducted an investigation by subpoenaing witness and documents. By doing so, the company or person is made aware that an investigation is ongoing and that a Wells notice could be coming.

The time between the SEC investigation and the sending of the Wells notice can be from 5 months to a year, according to analysts.

…

What happens after a Wells notice is sent?

Once a person or company receives a Wells notice, they have the opportunity to ‘contest’ it. They can make what’s called a Wells submission—where a prospective defendant can speak directly to the SEC prior to the start of regulatory proceedings and make their case as to why they shouldn’t be prosecuted.

While it seems that a submission should be an automatic response to a Wells notice, they are not always done.

The reason is that a Wells submission is not confidential and anything that is stated in the submission can be used against the company at the hearing. And a Wells submission is discoverable—that means it can be subpoenaed and made public to be used in later civil litigation by private citizens.

…

What is the history of a Wells notice?

The name “Wells notice” is derived from the Wells Committee which proposed in 1972, the process of sending out notifications on investigations. This SEC committee was named after John A. Wells, a corporate lawyer, who was the committee head.”

##

Additional Information, more MHProNews Analysis and Commentary

Against that backdrop, notice that Cavco (CVCO) has tried to negotiate with the SEC. They are not, per their own reports, ‘contesting’ it in the strict sense.

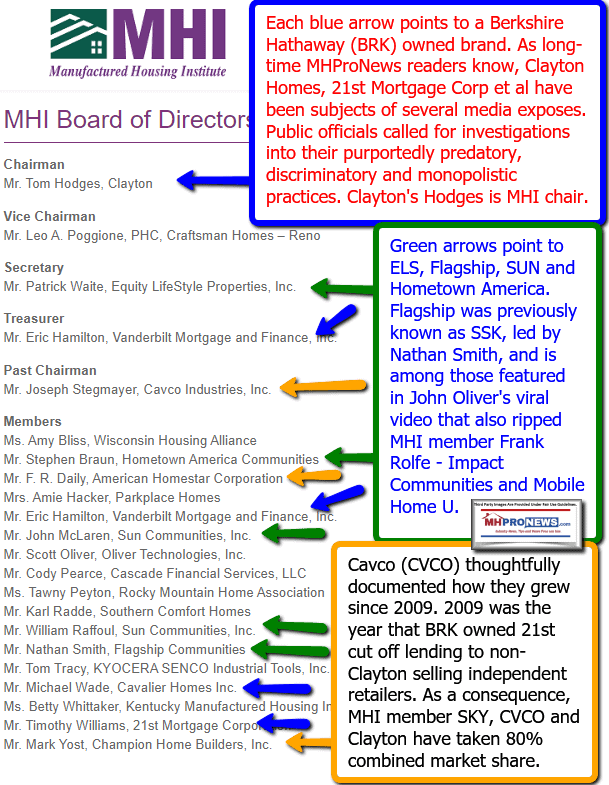

When pondering the so-called ‘ethics’ of the Manufactured Housing Institute (MHI), Cavco, or other firms such as Clayton Homes and their affiliated lenders, ponder the reports about Cavco, and the larger MHI brands.

When pondering why manufactured housing is struggling during a time when far more expensive conventional housing is soaring, ponder the problems connected with some of the larger brands that are members of MHI.

No trade publisher serving manufactured housing has provided more coverage on this and other Cavco related topics than MHProNews.

To learn more, see the linked reports, above, following, and further below the bylines and notices.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.