Stocks ended modestly higher after a soft jobs report, says MarketWatch. “The U.S. added 151,000 jobs in August, slowing sharply from earlier in the summer.”

The billion-plus monthly pageview news aggregator Drudge Report cited the following headlines and numbers; Biggest gains in bars, restaurants – ‘Army of Men’ Out of Work – 94,391,000 Not In Labor Force – and Gov’t Workers Outnumber Manufacturing Workers by 9,932,000.

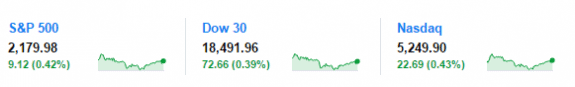

All 3 major U.S. stock market indexes closed higher, with the Manufactured Housing Composite Value (MHCV) outperforming them all, see the report below.

Dow – 18,491.96 / +72.66 +0.43%.

Nasdaq – 5,249.90 / +22.69 +0.42%.

S&P 500 2,179.98 / +9.12.

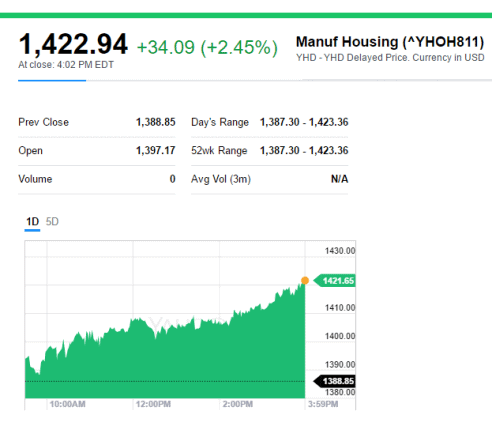

The Yahoo! Manufactured Housing Composite Value closed today at: 1,422.94 +34.09 (+2.45%).

Manufactured Housing Composite Value Ticker

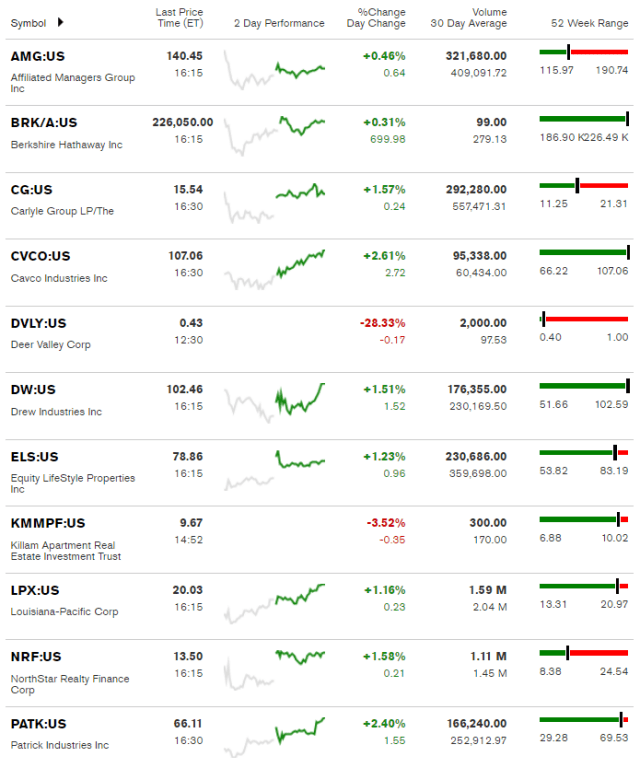

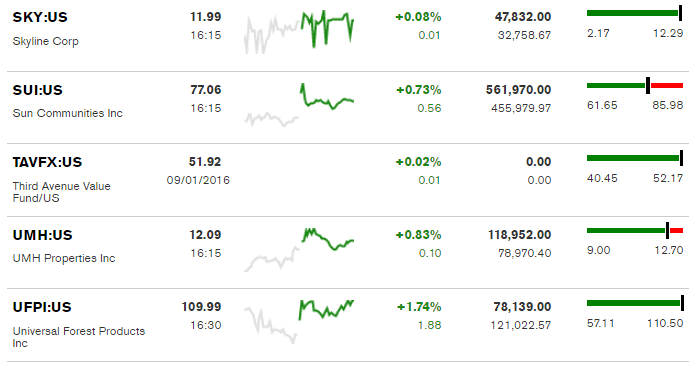

DVLY was the largest loser on the day, while Cavco was the biggest gainer. To see Joe Dyton’s head-to-head comparison of Sun Communities vs. apartment giant, MAA, please click here.

*Note: the chart below includes stocks not included in the MHCV

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown.)

(Editor’s Note: As the insightful report yesterday by Joe Dyton reflects, or this performance comparison of Sun Communities with Apartment giant, MAA – linked here demonstrates, MHProNews is welcoming periodic guest writers.

ICYMI, Matthew Silver is taking some much needed and well-earned time off, and L. A. “Tony” Kovach will be helping fill the Daily Business News role in the interim).

MH Industry Market Report by L. A. “Tony” Kovach, to the Daily Business News for MHProNews.