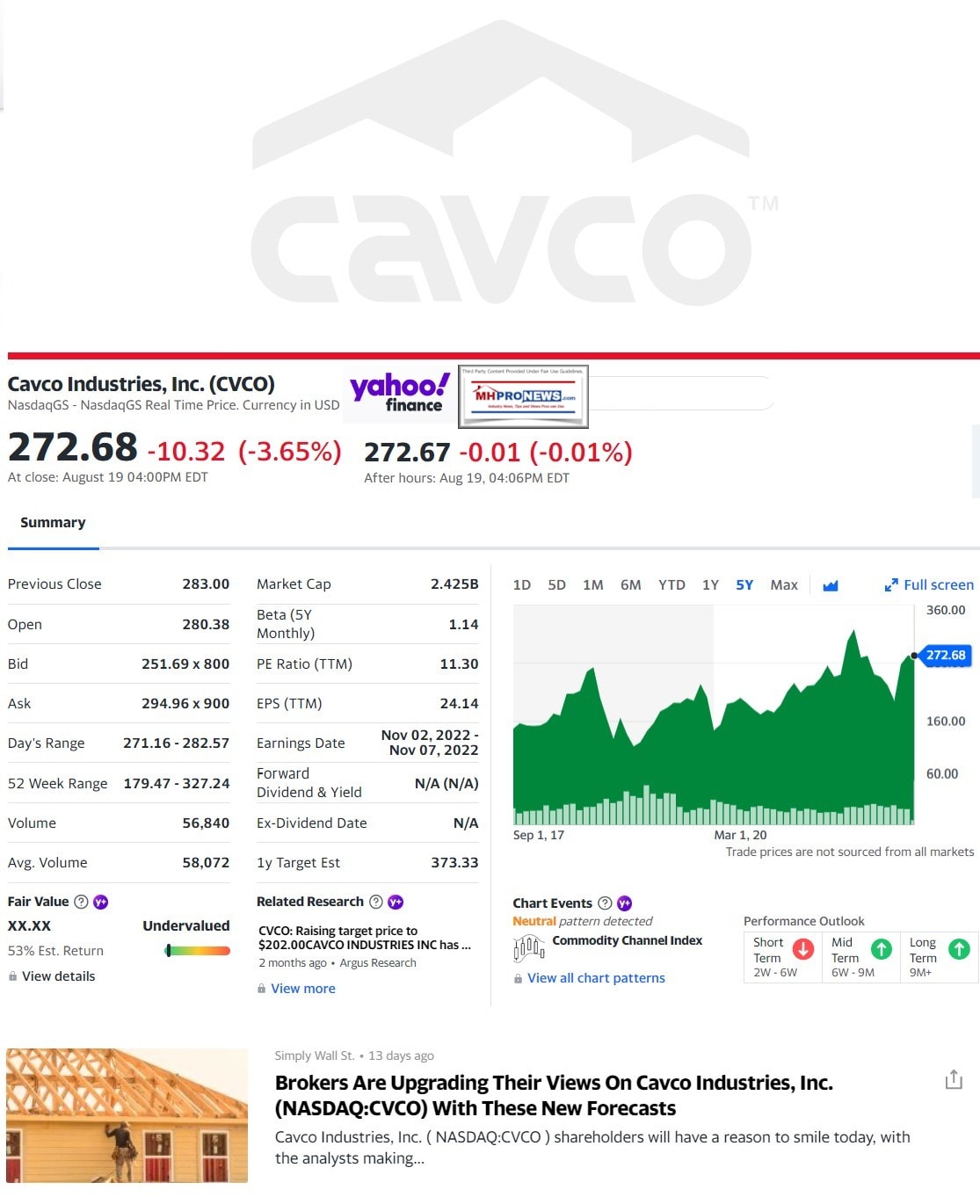

Cavco Industries (CVCO) has reported another strong quarter that includes some new ‘record’ results. As has been the custom at MHProNews for years, this report will provide the transcript of Cavco’s most recent quarterlies as well as some additional insights, information, and analysis. In this instance, Seeking Alpha has published the most recent Cavco Industries Q1 2023 Earnings Call transcript at this link here. The transcript below should be considered in the light of the legal probe on behalf of shareholders, industry information made available by MHProNews that was produced by third-party sources and previous Cavco provided snapshots linked below. With these various items blended together, a unique set of insights can emerge for the industry professional, investor, objective-information seeking researchers, public officials, advocates, and others.

The highlighting in the Cavco transcript is by MHProNews without changing any of the underlying text. Where an apparent or actual transcription error appears in below, a limited amount of editing was done that will be shown in the text below as provided by MHProNews. Those edits of the transcript aim to clarify the meaning of someone’s statements where the word(s) used would obscure the original statement. To clarify that, this is not so much a fisking of Seeking Alpha’s transcript, any more than it is when we do it with a transcript obtained from the Motley Fool. Often, such transcripts are machine generated. The goal of MHProNews is routinely that accurate, factual information be provided to readers. Based on facts and apparent evidence, better understanding and thus better decisions can be made. Additional information, more analysis and industry-expert editorial commentary will follow their quarterly results discussion. All of this is in keeping with well-established fair use guidelines for trade news or other media.

Cavco Industries, Inc. (CVCO) CEO Bill Boor on Q1 2023 Results Earnings Call Transcript

Aug. 05, 2022 6:01 PM ETCavco Industries, Inc. (CVCO)1 Comment

Cavco Industries, Inc. (NASDAQ:CVCO) Q1 2023 Earnings Conference Call August 5, 2022 1:00 PM ET

Company Participants

Mark Fusler – Director, Financial Reporting and IR

Bill Boor – President and CEO

Allison Aden – EVP and CFO

Paul Bigbee – CAO

Conference Call Participants

Daniel Moore – CJS Securities

Greg Palm – Craig-Hallum

Jay McCanless – Wedbush

Operator

Good day, and thank you for standing by. Welcome to the First Quarter Fiscal Year 2023 Cavco Industries, Inc. Earnings Call Webcast. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please be advised that today’s conference is being recorded.

I would now like to hand the conference over to Mark Fusler, Director of Financial Reporting and Investor Relations. Please go ahead.

Mark Fusler

Good day and thank you for joining us for Cavco Industries first quarter fiscal year 2023 earnings conference call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Allison Aden, Executive Vice President and Chief Financial Officer; and Paul Bigbee, Chief Accounting Officer.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions.

All forward-looking statements involve risks and uncertainties, which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco.

I encourage you to review Cavco’s filings with the Securities and Exchange Commission including without limitation, the company’s most recent Forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements. This conference call also contains time-sensitive information that is accurate only as of the date of this live broadcast, today, August 5th, 2022.

Cavco undertakes no obligation to revise or update any forward-looking statement, whether written or oral, to reflect events or circumstances after the date of this conference call, except as required by law.

Now I’d like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

Bill Boor

Welcome everyone and thank you for joining us today to review our results for the first quarter of 2023. Cavco is happy to report another very strong quarter with record revenue and net income. Net income was up 121% year-over-year and 12% compared to the fourth quarter.

For many quarters, we’ve been asked about our ability to exceed pre-pandemic levels of productivity. And this quarter, we reached over 85% capacity utilization. More tangibly, we shipped a record 5,346 homes this quarter, 44.5% more than a year ago. I really want to congratulate our manufacturing organization, which has set and exceeded aggressive production targets. We pride ourselves on operating excellence, and it’s great to see it showing up so clearly in our results.

We’re very well-positioned for and confident in the demand drivers for our products despite the affordability impact of high prices and increasing rates. While near-term market dynamics are shifting, some of those dynamics actually play in favor of manufactured housing.

Affordability is extremely stretched for our prospective buyers, but this doesn’t eliminate the fundamental need for more housing units, particularly at low price ranges.

Certainly, some would-be buyers are getting priced out of ownership in the near-term, however, they still need homes. Community operators, who continue to have aggressive growth plans, are providing a solution with single-family manufactured housing rental homes.

Also, first-time buyers are increasingly turning to manufactured housing as an alternative to site-built homes, given the rapid escalation in starter home costs. Manufactured housing is an option those buyers might not have considered in the past, however, now they are, and they’re finding attractive, energy-efficient, and high-quality homes that meet their needs.

Looking at total housing market indicators, risk missing the point that the needs are far greater where we provide solutions. For example, recent listing data showed that while overall new listings are up about 20%, which indicates a shift to a buyer’s market, listings for homes below $250,000 continued to decline 10% to 20% in June.

I recognize that while you’re interested in these bigger picture dynamics, you’re probably particularly interested in what’s going on right now. In the near-term, order rates are down and production is running faster than the pace of setting new homes in the field. As a result, our backlog ended the quarter at 25 to 27 weeks compared to four weeks last quarter.

Keep in mind that 25-plus week backlogs are pretty healthy. The backlog dropped approximately 10% from $1.1 billion to $1 billion. That drop was comprised of approximately 15% fewer units and 5% higher average selling prices.

Prospective buyers are feeling the effects of economic uncertainty and inflation. They see the previously anticipated rate increases have already occurred and delivery times are shortening. So, the urgency we’ve seen from a buyer to quickly get an order in has abated to some degree.

While retail traffic is still strong, reflecting the underlying need, buyers have become more patient, resulting in lower deposit ratios. Retail inventories are up compared to recent periods due to a combination of difficulties getting home set and accelerated deliveries as production rates have improved. We’re anticipating a near-term reset of retail inventories, which means orders may drop below true buyer demand for what I expect to be a short timeframe.

Just to reiterate, prices and interest rates are high, so the monthly payment impact is clearly a downward pressure on near-term demand. This is offset by lack of supply of lower-priced homes, market share gains for manufactured housing at price point site builders simply can’t hit anymore, and aggressive community growth plans, which are less sensitive to the recent rate changes.

To provide a project update, our new Glendale, Arizona factory is nearing completion. The plant looks great, and we’ve been recruiting and training people at our nearby Goodyear factory. So, we’re ready for a successful startup. The new plant at Hamlet, North Carolina, is also coming along very well. We expect a smooth transition as the previous owner wraps up their production, and we complete plant modifications to begin ours.

The goal from the beginning for both VBC, who is the previous owner of Hamlet and Cavco, has been to minimize any break in employment for the people at Hamlet. And we’re confident that we’re on track to do that.

Both projects will be state-of-the-art facilities and equally important, I’m very excited that they will both have model work systems and cultures. Great work has been done to ready these operations for start-up and both plants will begin production in the coming months.

With that, I’ll turn it over to Allison to discuss the quarterly results in more detail

Allison Aden

Thank you, Bill. Net revenue for the period was $588.3 million, 78.1% compared to $330.4 million during the past fiscal year’s first quarter. The Commodore Homes acquisition contributed $100.8 million of this year-over-year increase. Sequentially, from the fourth quarter of fiscal 2022, revenues increased 16.4%, primarily driven by an increase in units shipped, resulting from higher factory utilization.

Within the factory-built housing segment, net revenue increased 83.4% to $572.6 million from $312.3 million in the prior year first quarter. This increase was driven by both the addition of Commodore operations and a 26.9% increase in average revenue per home sold. The increase in average revenue per home sold was due to product pricing increases.

As Bill mentioned, factory utilization exceeded 85% during the quarter, which is a record level during the last 10-year period. Utilization has benefited from product simplification, sustained increased production headcount and other process efficiencies.

Financial services segment net revenue decreased 13.2% to $15.7 million from $18.1 million. This year-over-year decrease was due to unrealized losses on marketable equity securities versus gains in the prior period, decreased loan sales volume and lower service. These declines partially offset by a higher number of insurance policies in force.

Consolidated gross profit in the first fiscal quarter as a percentage of net revenue was 24.6%, up from 22.4% in the same period last year. The increase is mainly the result of the factory-built housing segment, which climbed to 24.4% in Q1 of 2023 from 21.2% in Q1 of 2022.

This increase was driven by pricing, partially offset by increased material cost per module. Q1 2023 factory built gross margins of 24.4% was 10 basis points lower than the Q4 2022 level of 24.5%, driven by higher material costs per module.

As discussed previously, the acquired Commodore was price protected and therefore, now yielding lower gross margins. As a result, this downwardly impacted the Q1 consolidated gross margin. We expect this impact to continue for the next couple of quarters as we work off the remaining backlog.

Gross margin as a percentage of revenues in — financial services declined 32.6% in Q1 of 2023 from 42.7% in Q1 of 2022 by unrealized losses on marketable — securities and the financial impact of greater weather-related events on our insurance business.

Selling, general, and administrative expense in the first quarter of fiscal 2023 was $66.1 million or 11.2% of net revenue compared to $40.8 million or 12.4% of net revenue during the same quarter last year.

The SG&A [technical difficulty] increase is due to the addition [technical difficulty] greater incentive wages on improved earnings and cost of third-party consultants assisting with the energy tax credit project.

Net other income this quarter was $900,000 compared to $2.5 million of income in the prior year quarter. This decrease is primarily driven by unrealized losses on marketable securities compared to gains in the prior period, partially offset by interest income earned on higher commercial balances.

Pre-tax profit was up 123.4% this quarter to $79.3 million, [technical difficulty]. The effective tax rate was 24.7% for the first fiscal quarter of 2023 compared to 23.8% in the same period last year.

Net income attributable to Cavco shareholders was up 120.7% to $59.6 million compared to net income of $27 million in the same quarter of the prior year. Net income attributable to Cavco common stockholders per diluted share in the quarter was $6.63 per share to $2.92 per share in Q1 of fiscal 2022.

Before we discuss the balance sheet, I would like to take a minute to highlight that this quarter, we executed nearly $39 million of stock repurchases, completing $100 million originally authorized in October of 2020.

In May, the Board authorized an additional $100 million for future share repurchases. It is important to note that we’ve continued to successfully execute against our capital allocation strategy.

As Bill mentioned, in addition to share repurchases, we’ve also deployed capital purchase of a manufacturing facility in Hamlet, North Carolina, and we’re also nearing the completion of the development of our Glendale, Arizona Park model facility, which should begin operations in the next few months.

Now, I’ll turn it over to Paul to discuss the balance sheet.

Paul Bigbee

Thanks Allison. I will be covering balance sheet from July 2nd, 2022 compared to [technical difficulty] 2022. The cash balance was $238.1 million, down — million from $244.2 million at the end of the prior fiscal year. The decrease is primarily related to cash used for repurchases of common stock and purchase property, plant and equipment [technical difficulty] in our new manufacturing plant in North Carolina, partially offset by net cash provided by operating activities.

Investments decreased from unrealized losses on equity securities held at the end of the period. Inventories increased due to higher levels of stock inventory at our retail locations as well as higher inventory purchases in preparation for increased [technical difficulty]

Prepaid and other assets decreased from lower income tax receivables and lower assets related to the loan repurchase option on delinquent loans — sold in Ginnie Mae. While we are not able to repurchase these loans, accounting guidance requires us to record an asset and liability for the potential of a repurchase. This was lower than the April 2nd, 2022 amount due to a reduction of loans in forbearance.

Accrued expenses and other current liability balances increased due to a higher volume [technical difficulty] warranty accruals and set-up accruals on higher sales, partially offset by lower customer deposits. Lastly, stockholders’ equity was approximately $851.6 million July 2nd, 2022, up $21.1 million from $800.5 million as of April 2nd, 2022.

With that, I’ll turn it back to Bill.

Bill Boor

Thank you, Paul. Before we turn it over to questions, I’d like to touch on the update provided in our earnings release regarding the SEC matter. I’m happy to report that we’ve reached an agreement in principal with the SEC to settle the litigation. Yesterday, a step was taken in that process when the SEC and Cavco informed the court that we’ve reached this agreement. And it’s pending final sign-off by the commission.

At this point, I’m unable to provide more details except that this settlement terms are not material to the financial results or position of the company. We will provide more details when that final approval is complete, which we anticipate will be within 60 days. This has been a long process, and we all look forward to the resolution and putting this behind us.

With that, Carmen, let’s turn it over for questions.

Question-and-Answer Session

Operator

Thank you. [Operator Instructions] Our first question comes from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Thank you. Good afternoon. Good morning to you Bill and Allison. Thanks for taking our questions. Start by saying congrats. That’s been a long road. I’m sure you’ll miss all of those SEC-related questions, but happy to have that put behind you or close to it at least.

Just start with the remarkable growth rate in shipments. I pencil out organic growth in the number of homes sold in the mid-teens, maybe high teens, excluding Commodore, is that the right ballpark, Allison?

Allison Aden

Yes, that is.

Daniel Moore

Okay. And then maybe, Bill, just to elaborate on the order rates moderating. To what degree have they moderated? If you had to sort of quote a current book-to-bill, what would that look like? And what’s your best guess of what annualized current demand kind of on a run rate basis, looks like for MH?

Bill Boor

Yes. Tough question has been important to get the tone of this rate. I mean, they really get a good feel for it because there’s certainly a transition but it’s far from dire, I guess, this is what I would say. You can see the industry shipments have been very robust. I think the numbers are still in the $125,000 rate for HUD shipments on a seasonally adjusted basis.

So, shipments are strong. There are still some constraints in retail and placing homes. And that’s kind of caused a continuation of the inventory back up at retail. So — and it’s hard to give you a great feel for the numbers. I would say that orders are certainly off the highs that we’ve been experiencing, but they’re probably more on a par with kind of pre-pandemic levels with appropriate seasonality.

So, we feel pretty good about it. The one thing I mentioned in my comments that I think is an important point to get as people are trying to gauge the health of the market. I view that the strong retail traffic is still a positive, even if we’re going through a little bit of an adjustment with the retail inventories.

So, you asked a specific question. I’m not sure I was able to give you a very specific answer, Dan, but happy to continue if you could follow up and asking what I’m leaving out.

Daniel Moore

No, that’s great. That’s helpful. But maybe pulling on the same string. The community builder market, an opportunity set is massive relative to the current size of the overall MH market. So, are they may be waiting for backlogs to come down a little bit more? I mean, gauging true demand is very difficult. So, what is it that sort of gets them off their hands and maybe accelerates that part of your demand profile a little bit more?

Bill Boor

Yes. That’s — I mean, communities are a real source of strength right now. I haven’t seen any sitting on the hands with regard to the communities, they’re still looking to get more homes. We’ve talked to this in the past, if you — just a little bit of the history because I think it’s important.

Before the pandemic for a number of years, communities, while they’re maybe about 30% of the market, they were providing most of the growth. And for the last bit — after a short pause at the beginning of the pandemic for the last bit, both retail and communities were going very strong, couldn’t get enough houses.

The communities still have very aggressive growth plans. They’ve got capital behind them. They’re not as sensitive in their purchasing to the interest rate changes that we’ve seen. And tried to make this point in my comments as well, they’re really a solution to what is going on for the buyer, right?

As mortgage rates and the monthly cost of buying have really gone up and made it very difficult for some people to purchase. The communities are very heavily into the rental business and so they’re buying manufactured homes, placing them in the communities for rent.

And that’s a solution for that family that can’t purchase but still needs a home. So, I really expect communities to be a source of strength for the business going forward, and they’re not showing any signs of slowing down that I see.

Daniel Moore

Perfect. Maybe one or two more on the margin front, and then I’ll jump out, but still very healthy gross margins in the quarter despite the drag from lower profitability in financial services as well as Commodore.

Allison, can you maybe just quantify those a little bit? How much of a drag was the lower financial services profitability as well as the lingering impact of price protection at the Commodore backlog? Thanks.

Allison Aden

Sure Dan. Just take a step back here and talk about the key elements that really drove the margin outcome. So, the last several weeks, what we see are lower commodity prices for lumber products and that will work its way through our material cost to — margins in the quarter.

And specifically your question on Commodore, what we saw this quarter is an impact was pretty similar to what we saw last, which is a little north of 200 basis points. And it is an important point to note that we’re working through these backlog homes that were previously price protected.

And that we expect Commodore pricing and margins to come into line with the less of our system. And that will produce a positive uplift in future quarters. So, something [technical difficulty] the labor pricing will come through. One element it’s difficult to predict is what the commodity — will do. And then also there could be in the future a partial offset to higher labor costs and other material pricing. Those are the main elements.

Daniel Moore

Perfect. I will jump back if I have any follow-ups. Thank you very much.

Operator

Next question comes from the line of Greg Palm with Craig-Hallum. Please proceed.

Greg Palm

Awesome. Thanks and congrats on the results here. I — starting maybe as a piggyback off the last question, Allison, you’ve — I think, used that same language for a couple of quarters now in terms of the impact from Commodore lasting a few more quarters. Can you get a little bit more specific in terms of will it get less of an impact this current quarter? When will it completely be run off at, at least in your opinion at this point?

Allison Aden

Sure, sure. Consistent with our comments last quarter is we expected the range as a drag this quarter, they’ll probably be more — quarter at this level. And then we’ll see during the next two to three quarters an uplift, [technical difficulty] price-protected backlog gradually then turn into revenue and uplift.

We’re still very happy with the outcome of our Commodore acquisition. This is a known issue. It’s a temporary issue and the deal is very rewarding. We’ve already — through our integration efforts and the unit production is exactly what we would have expected. So, all-in-all, the production is in line with what we expected and the profitability will be too long-term.

Greg Palm

Okay, fair enough. What about ASPs? I think what I heard was ASP increase due to pricing. Was any of it mix related? Or was it almost entirely just pricing? And then I guess the next question is, is sustaining this level in wake of recent commodity input cost deflation at least for several items, any thoughts there?

Bill Boor

Yes, I can jump in on that. It’s really all price. The mix has not shifted that significantly. We looked at that, and it’s been pretty stable recently. In fact, when we compare mix to this time last year — this quarter last year, it was almost identical. So, you can pretty much attribute the ASP change to pricing.

And I think your other question was given the — some of the larger commodities, in particular, I assume lumber and OSB coming off their highs recently, do we expect that we could hold the price, is that right, Greg? .

Greg Palm

Yes. Yes, just the sustainability of that going forward.

Bill Boor

Yes. Being consistent in our view, the industry backlogs on average are pretty good. And so I do think there’s still the ability to maintain margins. And if the — if we have spots where backlog start to drop rapidly, then I guess you could see some price competition. But so far, we’ve seen very little of that.

Greg Palm

Yes. Okay. Understood. And I guess just kind of last one for more of a big picture standpoint, I wanted to dig into this channel comment a little bit more in terms of strength that community, a little bit more moderation at retail. I mean, do you view the community strength as something that’s just more cyclical and that there’s pent-up demand because that channel shut off for so long during and post-COVID?

Do you think that there’s something more structural or secular [MHProNews editor, likely: cyclical] going on there? And if that’s the case, how do you sort of view your own capacity footprint in light of that, knowing that at least in the community channel, there’s obviously certain states and areas where there’s outsized exposure there?

Bill Boor

Yes, I don’t know. I mean — I think it’s not temporary. I think they’ve got — I talked to particularly the larger REITs, they’ve got very aggressive long-term growth plans, and they’re not — they don’t — aren’t tempering those based on anything. It’s going on right now in the market that I can see. Those discussions are kind of pretty much up to-date.

So, again, I think there is source of strength. I think they’re a little bit countercyclical to interest rates because — for the reasons that I talked earlier. So, we think that they’re going to be pretty solid. We’ve got exposure across the country to communities. When I think about our whole system geographically and our customer relationships, I feel like we’re pretty balanced right along the lines of the industry.

Historically, they’ve represented about 30%. And I think we get our share of that. In some areas, Florida, we have a little extra exposure to communities and Florida is an area that’s for us is very strong right now. So, it’s kind of the point I was trying to make that in these kind of shifting times with interest rates and everything, there are some aspects to the MH dynamics that buffer the demand exposure to those kind of drivers. And I think communities are a real source of strength.

Greg Palm

Yes, understood. All right. I’ll back in the queue. Good luck going forward. Thanks for taking the questions.

Bill Boor

Thanks Greg. Thank you.

Operator

Thank you. [Operator Instructions] Our next question comes from Jay McCanless with Wedbush. Please go ahead.

Jay McCanless

Hey, thanks for taking my questions and congrats on getting almost to the finish line at the SEC issue, glad to see it’s going to be in the rearview mirror soon. The first question I had was on the stock — the new stock repurchase plan. Is there an expiration date on that?

Allison Aden

Does not have an expiration date on it, Jay?

Jay McCanless

Okay. And then also had some questions about price, but you’ve answered most of those. I guess my question is, once you get to these price protected contracts, what type of step-up in a percentage or dollar basis, do you think you were going to see on the average price?

Bill Boor

I’m trying to figure out how to mentioned that for you. I mean, we’ve kind of talked about the drag that we’re seeing on our consolidated gross margins. But it sounds like you’re asking a different question.

Jay McCanless

Well, just if these are price protected, I guess, what’s the differential right now between the legacy Cavco and the price protected contracts that you’re selling from Commodore, maybe that’s the way to ask it?

Bill Boor

Yes. So, how much on a percentage basis is the pricing lower on that backlog?

Jay McCanless

Yes. Mark or Allison, you have — you and I, we’ve kind of tended to look at it in a margin sense since the products are even different, right?

Allison Aden

Yes, I mean I think it’s important to kind of think about the context of it, right? So I think that it’s not one particular range of prices, but the pricing that’s coming from the different models that they’re pricing and also at a different rate in the various facilities.

I think important to just note that tracking to the uplift in the margin would represent a gradual movement to the overarching pricing, which tends to be just a little bit under the total company ASP simply because of some of the mix of the modules that they’re actually bringing in market.

Bill Boor

Jay, I might not be hitting the mark on this. I’m just thinking about your question. I mean if we’ve got a couple of percent drag on our consolidated margins, and the gross margins are in the range that they’re in, right, then you could kind of do the algebra to figure out how much of a drag it is on our average selling price on a weighted average basis.

But again, given that they’re 25% of our production now, the discounted price is pretty significant in that backlog at this point, and that’s what we’re struggling to get through.

Jay McCanless

Got it. And did you — and I apologize, I think you said two more quarters, Allison, until that potentially could happen?

Allison Aden

Yes. I think next quarter, we’ll look about the same range of the impact that we saw this quarter and then the next two quarters would basically be a ramp-up towards something that’s more akin to the consolidated for the base business.

Jay McCanless

And then I guess with lumber having come down and now, I’m trying to — it seems like it’s trying to stabilize, maybe go up slightly. Is that giving you the ability to not take that next price increase? Or is everything else besides lumber moving up enough to where you have to keep still trying to push price where you can?

Allison Aden

I think — go ahead, Bill. I’m sorry.

Bill Boor

I was going to say, certainly, it’s a good point that every other input, including labor has continued to have some significant inflation. So, it’s important that we kind of stay ahead of that.

Jay McCanless

Okay, great. Thanks again for taking my questions.

Bill Boor

Thanks Jay.

Operator

[Operator Instructions] It comes from the line of Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Yes. Just from a production standpoint. You produced comfortably over 5,000 units this quarter, citing the efficiency gains that you’ve made plus Commodore. You just look thinking about supply chain, labor, et cetera, is that a number that’s sustainable for you in the near-term? Are you seeing any incremental challenges that might make that a little bit more difficult as we think about modeling the next couple of quarters?

Bill Boor

Yes. Look, I think there’s probably generally good news in that front. Staffing, we work pretty hard to get our staffing up. I’m not saying that we’re where we want to be in all of our plants. We still got some numbers to get, but we’ve made a lot of headway, which has really enabled the volume increase as we reported.

And now I still think there’s more benefit to be had. Because once you get the numbers right, you’ve got to do a good job of keeping them, keeping those individuals and then they develop skills as a team that provides more benefits in manufacturing.

So, I feel like we’ve still got progress to take in that regard. And this will be the first time I’ve said this, and I hope I’m not jinxing ourselves. Supply generally feels better, right? It’s not that we don’t have issues. You’re putting together house, one thing that’s not available to you can stop everything, but there’s certainly a feel that the supply issues are better than they have been.

Now, logistics is still a concern. I talked about the difficulties getting homes set in the field. That continues to be an issue logistics or as much of that is the setup crews, but both are a factor. But generally, the materials needed to build the house, we’re feeling slightly better on.

Daniel Moore

That’s great. Great to hear. And no one-week shutdowns or anything like that in the quarter that we should be — upcoming quarters that we should be aware of?

Bill Boor

Not that I can foresee.

Daniel Moore

Perfect. Thanks again.

Bill Boor

Thanks Dan.

Operator

Thank you. And I’m not showing any further questions in the queue. I will pass it back to management for any final comments.

Bill Boor

Okay. Thank you. The increasing need for affordable housing has certainly been exacerbated by supply limitations in the rates. But as I said earlier, rising homebuyer costs [MHProNews, likely] don’t to raise the serious need for our homes. There are opportunities in markets like this as the basic need to provide affordable solutions grows, our product and market opportunities.

After watching our leaders anticipate and proactively adjust to various challenges over the last few years, I’m very confident in our ability to stay on top of the market dynamics and to adjust as needed. So, we look forward to look forward to keeping you updated and we thank you for your interest in Cavco.

Operator

With that, ladies and gentlemen, we thank you for participating in today’s conference. You may now disconnect. ##

Additional Information with more MHProNews Analysis and Commentary in Brief

Bill Boor is quite correct to say that there is a “serious need for our [manufactured] homes.” He is correct in saying that “rates” and other housing “supply limitations” provides “opportunities in markets like this as the basic need to provide affordable solutions grows, our product and market opportunities.”

To push that point, recall that Boor previously said that there is an opportunity to ‘catch up’ with conventional building.

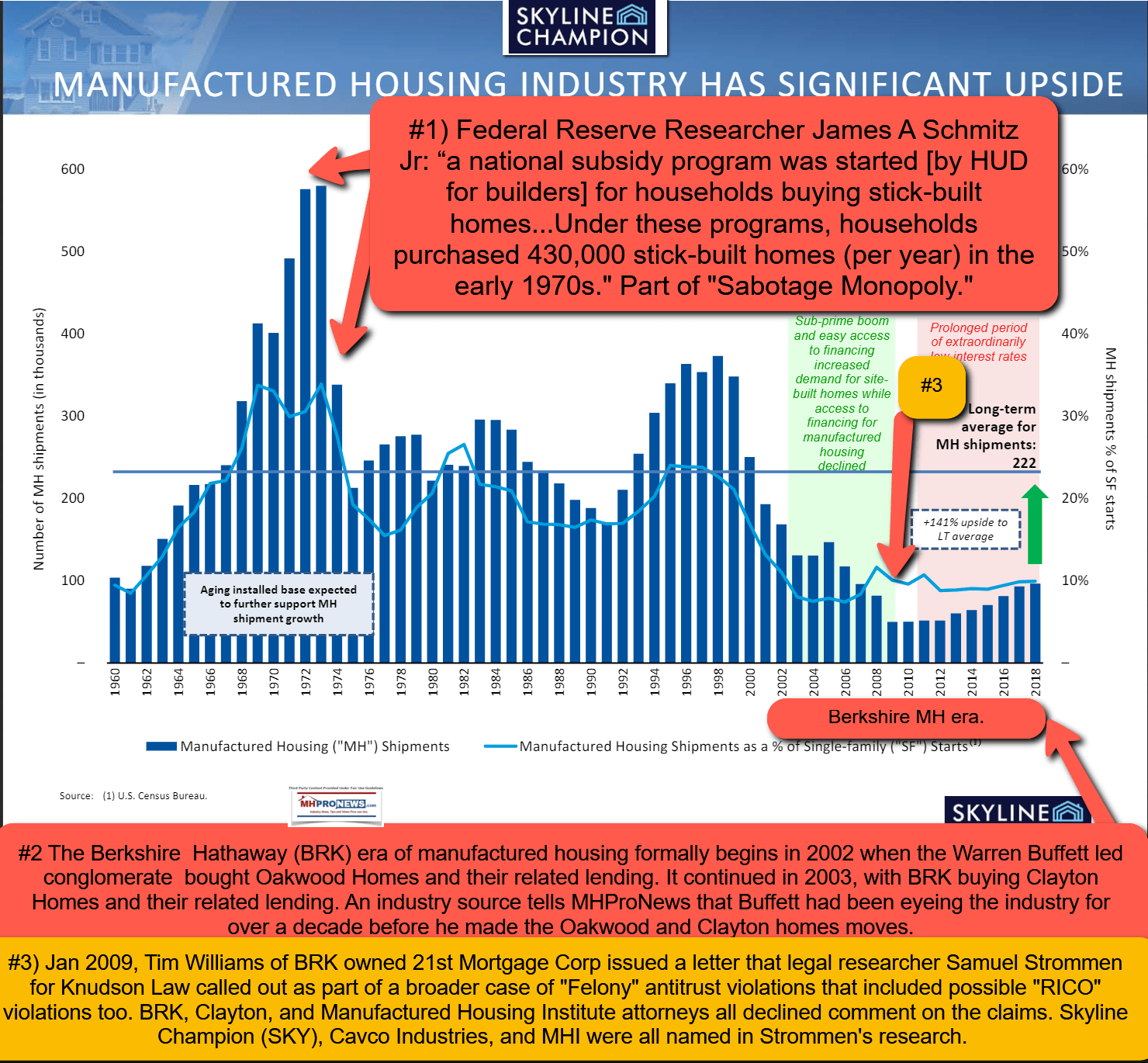

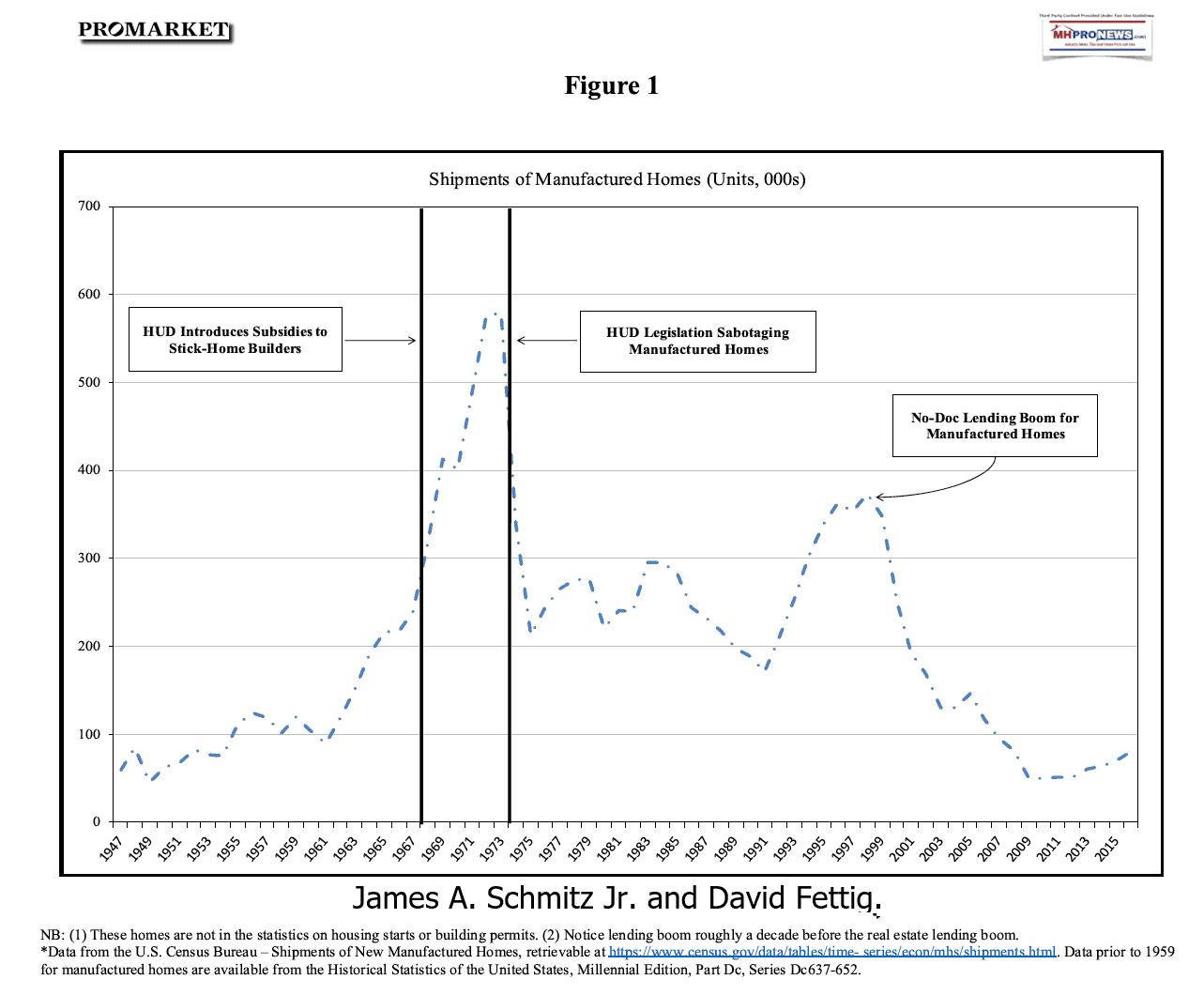

But that opportunity has existed to catch up or surpass conventional building for essentially all of the 21st century. Who said? Former Harvard Joint Center for Housing Studies fellow Eric Belsky. Somehow, MHI stopped using that statement below by Belsky after the dawn of the Berkshire Hathaway era in manufactured housing.

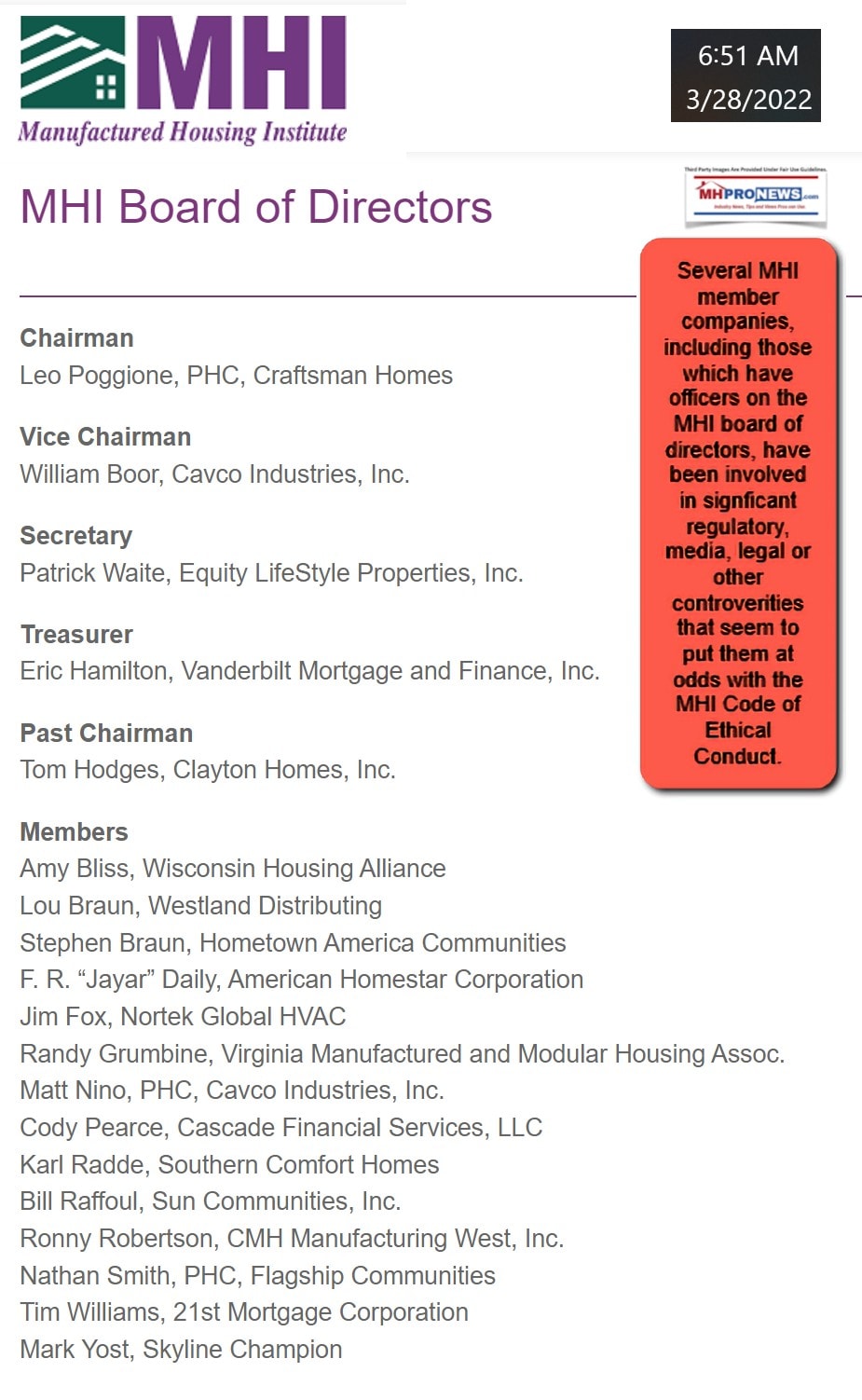

Rather than organizing a protest over the apparent prima facie and other alleged machinations involving Berkshire Hathaway (BRK) owned 21st Mortgage Corporation or the Manufactured Housing Institute (MHI)’s failures to address zoning/placement and access to more competitive consumer financing, Stegmayer and later Boor have played along.

The fact that new shareholder probes are underway and other nuanced statements above by Cavco’s leaders raises questions that are not being asked often enough – if at all – by those who say that have concerns about the lack of affordable housing in the U.S. See the remarks by PBS’s Bill Moyers and other relevant insights from the Sunday weekly recap below.

Underperformance is an apparent strategy. To tie in some of the points raised in yesterday’s analysis, various corporations – including Cavco – are deploying capital for stock buybacks and acquisitions instead of using it to drive more production through organic growth.

The Urban Institute facts and analysis are useful in seeing the bigger picture of what is possible in manufactured housing. Boor was right to say that the industry could catch up to conventional building. But the fact that such is not occurring is an apparent indictment of current management’s leadership.

Recalling Gordon Gekko’s (see postscript segment) comments, who is getting the shaft in this process? Shareholders. But they are not alone. Taxpayers, the affordable housing seeking public are too.

One can’t overlook – or shouldn’t overlook – the stealthy harms caused by monopolistic forces that work in an oligopoly style in manufactured housing. Note that in the third-party legal analysis referenced in that pull quote below specifically mentions Cavco Industries, one of the “Big 3” in manufactured housing and one of the dominating brands at the Manufactured Housing Institute (MHI).

At this time, Cavco essentially has two people sitting on the MHI “executive committee,” because Leo Poggione’s business has a large Cavco financial stake in it. So the MHI chairman (Poggione) and the MHI Vice-Chair, Cavco’s Bill Boor, are obviously in a position to represent Cavco’s interest at MHI. Cavco is in a position to influence the association. Restated, if MHI is failing to do something, Cavco’s leadership arguably has some measure of accountability in such a failure.

See the reports linked above to learn more. In summary, Cavco is advancing, but not nearly as much as they could be. Manufactured housing has advanced, but not nearly as much as they could be. Who says? MHI for one, but then they fail to do what is obviously needed. Nevertheless, Cavco and other MHI member producers stick with them, which speaks volumes.

The Manufactured Housing White Paper and the most recent and prior Q&A’s with former MHI VP turned MHARR founding president and now senior advisor, Danny Ghorbani are essential reading for those who want a thoughtful evidence-based analysis.

The third-party generated MH White Paper and Ghorbani‘s remarks often happens to align with concerns raised by the legal research provided by Samuel Strommen with Knudson Law to MHProNews/MHLivingNews. Independent of any known industry personality or organization, Strommen called for “felony” antitrust and possible RICO action in manufactured housing. Strommen thoughtfully provided over 120 footnotes to bolster his thesis.

Based on management’s statement above, it seems that Cavco might be getting off with some fine in the SEC issue. If so, then essentially it is Cavco’s customers who are paying for Cavco’s wrongdoing under their various management team’s leadership in recent years. That might beg the question. How is a settlement going to be anything other than a green light signal for more consolidation-focused machinations? For those that don’t know or need a refresher on what the SEC’s evidence and claims are, the report that includes the full pleadings by the SEC against Cavco below also happens to often align with the concerns raised by MHARR, Strommen, Lavin and other critics of MHI. ICYMI, or need a reminder, it is worth the time for reading it. What the SEC laid out sounds a bit like a spy story, but the espionage and machinations involved are by corporate officials of Cavco. Given the role, past and present, played by executives of the firm at the Manufactured Housing Institute (MHI), public officials, shareholders plaintiffs attorneys, affordable housing advocates, plus industry professionals seeking to better understand the profession they are in are well served by leaning into the SEC’s claims. As is customary here, an expert MHProNews analysis is also provided that connects key dots to save others time and effort. As usual, “We Provide, You Decide”© is the mantra ever at work.

If the current administration doesn’t do it, one should wonder. Will the next Congress and administration make a serious probe into manufactured housing happen? Time will tell.

But as the public increasingly ‘wakes up’ to what is occurring in America in business and its interplay with politics, the subset of troubling action/inaction patterns in MHVille may hit the radars of those who will react to growing public ire over the lack of affordable housing options.

And those options could be so much more robust, if only MHI and its larger brands – including, but not limited to Cavco – pressed for enforcement of the enhanced preemption clause of the Manufactured Housing Improvement Act of 2000 (MHIA) and Duty to Serve (DTS) provisions of the Housing and Economic Recovery Act of 2008. The potentially valuable and useful federal laws are there waiting to be used. The argument can therefore be made Cavco management’s failure to publicly press for those laws to be enforced through robust legal action harms the firm’s shareholders, the public, taxpayers and others. These various facts and pieces of evidence are part of the puzzling at first pattern of action/inaction that keeps manufactured housing preforming at historically low levels. While the latest manufactured housing production data is linked here, the insights from the report below are still relevant. ##

Programming Notices: a new series of third-party generated research into the manufactured housing market will be rolled out by MHProNews/MHLivingNews in the days ahead. Insights from other sources will be provided here too. Stay tuned for the most up-to-date looks at the facts, evidence, and by-the-curtain revelations that are found no place else online in MHVille. That is part of what has made and kept us as the runaway #1 resource in manufactured housing for well over a decade. Who says? Ironically, our competitors do.

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.