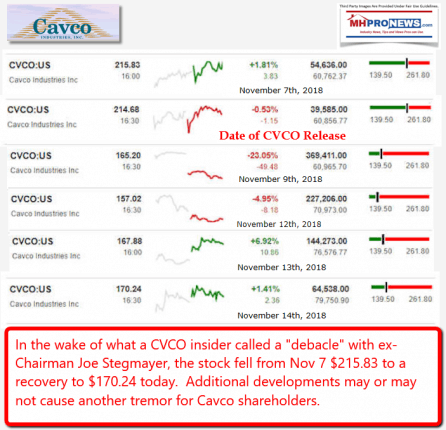

Cavco and the Securities and Exchange Commission (SEC) have both responded to inquiries from the Daily Business News on MHProNews. Before turning to their comments, the larger news item is the start of the headline above. At least two law firms are calling on Cavco Industries (CVCO) shareholders to contact them, as they advance investigations that aim to sue-for-damages for wrongdoings by the publicly trade manufactured and modular home company.

The “Debacle” at Cavco

As a follow up to last night’s report, linked below, an insider with Cavco has called the developments at the Phoenix, AZ based firm a “debacle.”

Other sources at Cavco with knowledge have declined specific comments, perhaps knowing that the matter has already harmed the value of any shares that they personally hold.

Manufactured Housing Institute on Cavco Industries, ex-Chairman Joe Stegmayer SEC “Debacle”

Our report last night report last night included the following:

“Shareholder Alert” from 2 Law Firms

Their news release opened with, “SHAREHOLDER ALERT: Investigation of Cavco Announced by Holzer & Holzer, LLC”

It continued as follows:

“Holzer & Holzer, LLC is investigating whether certain statements made by Cavco Industries, Inc. (“Cavco” or the “Company”) (NASDAQ: CVCO) complied with federal securities laws. On November 8, 2018, Cavco announced that an internal investigation had identified certain violations of the Company’s policy related to securities trading activities by former CEO, Joseph Stegmayer. The price of Cavco common stock fell significantly following this announcement.

If you purchased Cavco common stock and suffered a loss on that investment, you are encouraged to contact Corey D. Holzer, Esq. at cholzer@holzerlaw.com or Marshall P. Dees, Esq. at mdees@holzerlaw.com, or by toll-free telephone at (888) 508-6832 to discuss your legal rights.”

Another media release from a different law firm provided to MHProNews said the following.

“SHAREHOLDER ALERT: Kaskela Law LLC Announces Investigation of Cavco Industries, Inc. and Encourages Investors with Losses in Excess of $100,000 to Contact the Firm – CVCO”

What follows is the body of their media statement.

“Nov 14, 2018

Legal Newswire POWERED BY LAW.COM

RADNOR, Pa., — Kaskela Law LLC is investigating Cavco Industries, Inc. (NASDAQ: CVCO) (“Cavco” or the “Company”) on behalf of investors. The investigation seeks to determine whether Cavco and certain of its officers and/or directors made false and/or misleading statements to investors, and whether Cavco investors have been harmed as a result.

Cavco investors with financial losses in excess of $100,000 are encouraged to contact Kaskela Law LLC (D. Seamus Kaskela, Esq.) at (888) 715 – 1740, or via email at skaskela@kaskelalaw.com, to discuss this investigation and their legal rights and options. Additional information about this investigation may also be found at http://kaskelalaw.com/case/cavco-industries-inc/.

On November 8, 2018, Cavco disclosed that “on August 20, 2018, the Company received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of [a] Public Company. On October 1, 2018, the SEC sent a subpoena for documents and testimony to former Chairman, President and Chief Executive Officer, Joseph Stegmayer regarding similar issues. At this time, the Company believes that Mr. Stegmayer traded in certain publicly traded stock in his personal accounts as well as in accounts held by Cavco at a time when the Company had agreed to refrain from such trading. The Company intends to cooperate fully with the SEC’ s investigation. Effective November 8, 2018, Mr. Stegmayer stepped down as Chairman, President and Chief Executive Officer of the Company after an internal investigation, conducted by independent legal counsel to the Audit Committee of the Board of Directors, identified certain violations of Company policy related to securities trading activities conducted by Mr. Stegmayer. The internal investigation remains ongoing.”

Following this news, shares of the Company’s common stock declined $49.48 per share, or over 23%, to close on November 9, 2018 at $165.20 per share, on heavy trading volume.

Cavco investors with financial losses in excess of $100,000, and individuals with information relevant to this investigation, are encouraged to contact Kaskela Law LLC at (888) 715 – 1740 or via http://kaskelalaw.com/case/cavco-industries-inc/. Kaskela Law LLC exclusively represents investors in state and federal actions throughout the country. For additional information about Kaskela Law LLC please visit www.kaskelalaw.com. This notice may constitute attorney advertising in certain jurisdictions.

URL : http://www.kaskelalaw.com

Contact Information:

Kaskela Law LLC

Seamus Kaskela, Esq.

(484) 258 – 1585

(888) 715 – 1740

skaskela@kaskelalaw.com

The Kaskela website says the following about the firm’s specialty and services.

“Kaskela Law represents current and former shareholders of publicly traded corporations in securities fraud class actions, shareholder derivative actions, and merger & acquisition litigation. The firm exclusively litigates cases on behalf of investors on a contingency basis – advancing all costs and fees until the successful completion of a case.”

Cavco, SEC Responses to MHProNews Inquiries

What follows are the replies from media spokesmen for Cavco and the SEC.

They could be summed up as ‘polite, artful dodges,’ but we asked for an attorney to review those replies, which will follow further below, as they are insightful.

That outside attorney’s off-the-record responses are likely to be of wide interest to manufactured housing industry professionals, as well as to Cavco shareholders. As a disclosure, it should be noted that the principles of MHProNews hold no positions in that company.

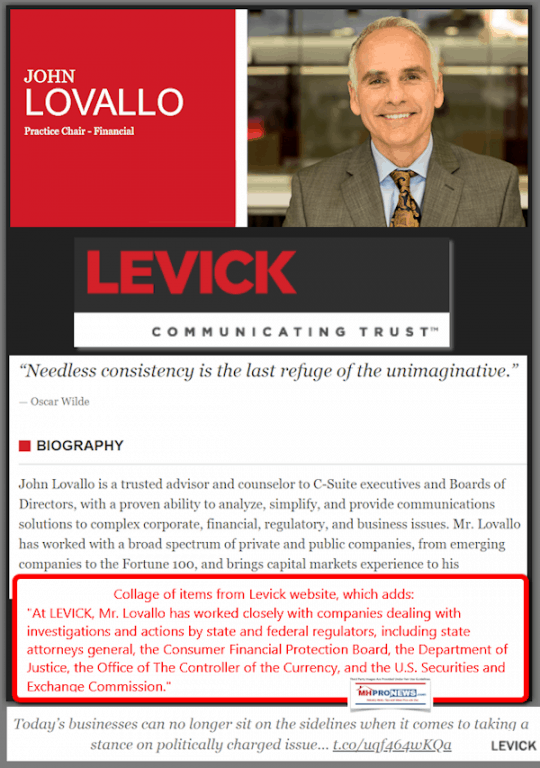

Note that John Lovallo was the Cavco designated contact for this matter involving ex-chairman, Joe Stegmayer.

Lovallo was asked about the threat of litigation being raised by the law firms above. As of this time, no reply has come to that inquiry.

However, Lovallo did reply to prior inquiries by MHProNews, as follows.

“First, the only public statement relating to the findings of the independent investigation and SEC subpoenas is included in the Company’s SEC filings and public disclosures.

The only additional public/on the record statement I can provide on the SEC matter is as follows:

“The Company is fully cooperating with the SEC’s investigation”

Related to your other comments our additional public/on the record statement is as follows:

“It is business as usual at the Company. Cavco continues to build quality, energy efficient homes for the modern-day home buyer, and team members are focused on providing customers and partners best in class service.

Cavco is a strong Company and is strategically positioned to continue to be an industry leader under Dan Urness’s leadership. And, as reported last week, the Company’s fiscal second quarter 2019 financial results were strong.

Mr. Urness and his team are focused on continuing to execute. The Board of Directors fully supports Cavco’s current strategy and is confident that Dan Urness is the right person to build on the Company’s success.”

You can attribute the above statements to John Lovallo spokesperson for Cavco Industries.”

A follow up questions that asked which stock(s) were involved brought a polite, prompt reference back to the previous statement.

Per Lavollo, “Here is the link to our public filing (10Q), which covers our public disclosure on the SEC matter – https://investor.cavco.com/public/phhweb/gallery/userupload/ir-doc-580/cvco_2018.9.29_10q_final.pdf

Please see page 25, paragraph 4, where it states:

“Legal Matters. On August 20, 2018, the Company received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of another public company. On October 1, 2018, the SEC sent a subpoena for documents and testimony to Joseph Stegmayer, the Company’s former Chairman, President and Chief Executive Officer, regarding similar issues. At this time, the Company believes that Mr. Stegmayer traded in certain publicly traded stock in his personal accounts as well as in accounts held by the Company at a time when the Company had agreed to refrain from such trading. The Company has initiated an independent investigation and intends to cooperate fully with the SEC’s investigation.”

This is our public disclosure related to the SEC matter.

John

John Lovallo

Practice Chair – Financial Communications”

About Lovallo, Levick and Cavco

Cavco Industries has their own media relations person. That normal press relations person at Cavco was also contacted, but allowed John Lovallo to make all of their formal replies in this Stegmayer/SEC matter.

Why is that significant?

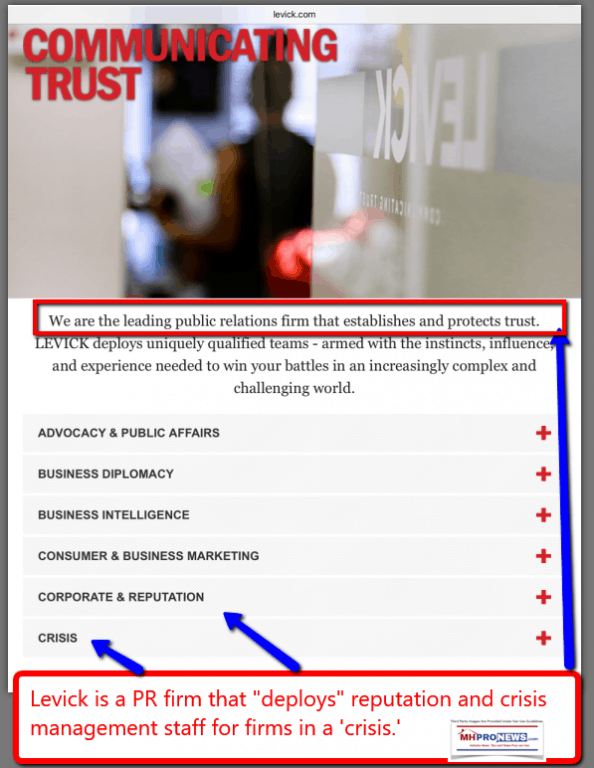

Because Lovallo works for Levick, which their site describes as follows.

“We are the leading public relations firm that establishes and protects trust. LEVICK deploys uniquely qualified teams – armed with the instincts, influence, and experience needed to win your battles in an increasingly complex and challenging world.”

As the screen capture below reflects, Levick is into “crisis management.”

Put differently, it’s arguably recognition by management at Cavco that they have a crisis, which they are trying to manage as best they can. That’s not implying something sinister. Rather, it’s perhaps an intelligent option to attempt to protect a firm and its shareholders.

But that in turn arguably underscores what our well-placed source told MHProNews, namely, that this is a “debacle” at Cavco.

Given Joe Stegmayer’s role as MHI Chairman, it’s a “debacle” that arguably reflects beyond Cavco.

Which brings us to the SEC.

Christopher Carofine, at the U.S. Securities and Exchange Commission, told MHProNews that the organization “Decline to comment.” That was in response to this inquiry.

“Cavco’s press release

says in part as follows:

“The Company also announced that it had received a subpoena from the Securities and Exchange Commission’s Division of Enforcement (“SEC”) requesting certain documents relating to, among other items, trading of the stock of another public company. Subsequent to sending the Company a subpoena, the SEC sent a subpoena for documents and testimony to Joseph Stegmayer, regarding similar issues. The Company has initiated an independent investigation and intends to cooperate fully with the SEC’s investigation. Please see Part II, Item 1, Legal Proceedings section of the Company’s quarterly report on Form 10-Q for the period ended September 29, 2018, filed with the Securities and Exchange Commission contemporaneously with the issuance of this press release, for additional information regarding this matter.”

Our question is this. Which company was the “trading of the stock of another public company” referring to, please?”

But the next direct ‘no comment’ could, depending on the answer to the issues raised herein, be a hidden story-behind-the-Cavco-trading-story.

MHProNews asked the SEC’s Carofine, “Are you investigating possibly AntiTrust issues? Involving Clayton Homes (Berkshire Hathaway), Cavco and Stegmayer, who is still the Manufactured Housing Institute chair?”

Carofine’s reply?

“Decline to comment.”

Outside Counsel OTR Feedback to Above

According to an outside attorney asked to review the puzzle pieces laid out above, “the key language to me — and potentially the key to solving the mystery — is the language “at a time when the company had agreed to refrain from such trading.” That would indicate that there was some previous issue with the SEC or other regulators — i.e., “agreed” with who? And why? Would the trading have been legal but for that agreement? Did the agreement grow out of a previous enforcement action? When? Probably the agreement was in writing. Where is it? Wouldn’t such an agreement be germane to investors? Was it disclosed? When? If not, why not?”

Another legal comment indicated that this may or may not connect to concerns by some in the industry that a masked antitrust issue may be at play.

It’s a concern that is denied by those asked at Cavco.

But Stegmayer, who is a former division president for Clayton Homes, per some industry sources, needed help to get his early acquisitions of other manufactured home firms at Cavco ‘done.’ “Their [Cavco’s] balance sheet didn’t support” their early acquisition, was an argument made by one such source, when MHProNews asked for evidence of their concern.

It should be noted that prior to receiving documents on 21st used in Smoking Gun 3 (see related reports, further below) and other MHProNews articles, those was just another unconfirmed claim. Obviously, those documents transformed a mere claim into a noteworthy purported path to consolidate manufactured housing. So, if there is specific evidence about Cavco and their acquisitions, it should be presented to investigators or MHProNews, which can be done off-the-record.

An attorney indicated that the pending CVCO shareholder suits, if they aren’t settled out of court, could reveal information on that antitrust, MHI, Clayton, or other subjects in discovery. Because these have possible antitrust and/or RICO implications, and could be a thorny issue for the Manufactured Housing Institute (MHI) too.

MHProNews will continue to monitor this issue and expects relevant updates from contacts with the various operations noted above. That’s this morning’s MH “Industry News, Tips, and Views Pros Can Use,” where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports: