“As innovation and automation displace jobs and transform the marketplace, it will require a paradigm shift in policy to ensure that the economy remains stable, everyone benefits, and no one is left behind,” U.S. Representative Chris Lee (D-HI) wrote on r/futurology on Reddit.

With experts saying that most service jobs – like wait staff, cooks, cleaners and more – will be replaced as automation takes over. A growing number fear for the jobs of those who work in these industries, per the Associated Press (AP).

In Hawaii, where service jobs make a large portion of the economy, due to the tourism industry, the threat of automation is more critical. One proposed solution being proposed there is universal basic income (UBI) for residents, regardless of their employment status.

Both Sides of the Universal Income Coin

No one has yet to propose a plausible way of paying for the universal basic income concept. But to properly understand this issue – or any other – the voices of some of those promoting and opposing the concept deserves a fair hearing.

Representative Lee introduced a bill that proposed providing a basic income for Hawaiians. State lawmakers recently voted to explore the idea.

“Hawaii’s heavy reliance on a service-based economy makes it more susceptible to economic disruption and job loss than any other states, and work must begin now to address the rapid automation, innovation, and globalization that already is beginning to displace significant amounts of local jobs, resulting in worsening income equality,” the bill reads.

The full bill is available for download here.

Why Consider Universal Income?

“In the modern world, everybody should have the opportunity to work and to thrive. Most countries can afford to make sure that everybody has their basic needs covered,” Virgin Group founder Sir Richard Branson wrote in a recent blog post.

He went on to write, “One idea that could help make this a reality is a universal basic income. This concept should be further explored to see how it can work practically.”

The basic concept of universal basic income is that people would receive a set amount of money each month or year that is expected to cover basic needs like shelter, food and other essentials. This income would be given to everyone, regardless of whether they are employed or not.

It certainly sounds appealing to millions – as did the promise of free college, or free health care – in the last election cycle.

“Basic income is such a broad subject, it could encompass hundreds of different kinds of mechanisms to help families,” Lee told CBS. “You don’t have to enact the entire thing in one massive program; you can take bits and pieces that make sense.”

One example advanced by advocates as a form of universal basic income is Alaska’s oil dividend. Those payments range from $1,000 to $2,000 annually, per the Associated Press (AP).

Natalie Foster, co-chairwoman of the Economic Security Project, says that people don’t see it as a hand-out, but as an Alaskan right to oil royalties.

“If people in Alaska deserve an oil dividend, why don’t the people of Hawaii deserve a beach dividend?” asked Karl Widerquist, co-founder of the U.S. Basic Income Guarantee Network, an informal group promoting the idea of UBI.

“Pursuing hard work enough to make a decent living no longer applies in an economy in which automation and innovation have taken that away from so many people,” Lee told Business Insider.

Those For and Against a Universal Basic Income

As one would expect, there are arguments both for and against the idea of a universal basic income. What Hawaii is considering, is something that has been proposed by the likes of Elon Musk, and potential 2020 presidential candidate – Facebook’s Mark Zuckerberg.

However, just because the idea is proposed by influential names does not mean it is one that will work.

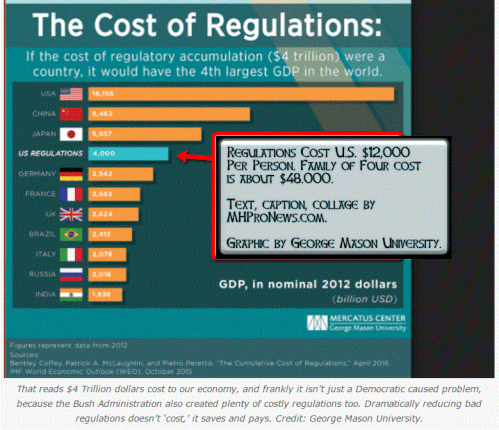

Many economists have pointed out the major issue with universal basic income – where is the money going to come from?

A study conducted by a team of economists at the left-leaning Roosevelt Institute claim that implementing a guaranteed income of $1,000 a month for all Americans would accelerate U.S. economic growth by 12.56 percent over the course of 8 years.

But they propose financing such a program by increasing federal debt.

They also looked at the possibility of financing it through an increased redistributed tax. They found that doing that would lead to a smaller growth, producing 2.63 percent of GDP growth over 8 years.

Their study says that doing it this way, would lead to a 1.39 percent decrease in federal debt, as well as a decrease in unemployment.

The study did not however, account for issues like whether it would make people less likely to seek jobs, or increase their freedom to take innovative risks.

Another often overlooked challenge is that historically, the wealthy flee high tax jurisdictions. Even as some claim to support higher taxes, they often move their money to a lower tax state – or a lower tax nation.

That’s why there’s an estimated 2 to 3 trillion U.S. dollars offshore today. High taxes, high regulations, pushed those companies out.

So how do Alaskan’s spend their oil dividend, which is the closest thing to a form of universal basic income in the U.S.?

“A study commissioned by the Economic Security Project found that 72 percent of Alaskans saved the money for essentials, emergencies, debt payments, retirement or education. Just 1 percent said that receiving the oil dividend had made them likely to work less,” per AP.

One thing that should be noted, is that the oil dividend of $1,000-2,000 annually, is far less than the $1,000 per month proposed in the Roosevelt Institute study.

“A lot of poor people move here anyway, because they don’t freeze,” said Tom Yamachika, president of the Tax Foundation of Hawaii. “This won’t help.”

With a steady stream of income that requires no work, will people be less likely to work? The hope may be that they will use the money to spend on extras, side projects, or retirement savings – which would boost the economy.

But will this be the reality if universal basic income were applied? And would such a program be sustainable long-term?

If people relied on that income, and neglected to work, rather than perusing work to fund additional aspirations, wouldn’t that defeat the purpose of a universal basic income?

In a situation where such a program relies on an increase in government taxes, as proposed by the Roosevelt Institute, what problems could occur long-term?

What it All Comes Down To…

…is the fact that universal basic income, while a fine sounding idea, is upon closer scrutiny likely to be unsustainable. As manufactured housing advocate, the Rev. Donald Tye said recently, there is no such thing as a free lunch. Someone always pays.

Millions aren’t asking, how is it just to take from someone who has earned money, and give it to someone who hasn’t? That’s a point Frederic Bastiat made two centuries ago.

Or as publisher L. A. ‘Tony’ Kovach has said, what ever you subsidize you tend to get more of that behavior. Rewarding the wrong behavior only leads to more of that behavior.

“Governments may like UBI because it is the sword that can cut through the messy Gordian knot of their welfare systems, which are generating generational poverty rather than helping anyone,” George Zarkadakis, an artificial intelligence (AI) engineer, wrote in a contribution to the Huffington Post.

“There are millions of people currently on benefits whose life is miserable. Extending the idea of welfare to all under the guise of UBI we are in danger of extending misery.”

Rather than creating yet another social program, funded by working Americans, the Trump Administration is working to boost the economy through proven economic means.

One of the ways the administration is hoping to do this is to reduce illegal immigration to make more jobs available to American’s. This would eventually lead to a demand for higher paid employees, boosting the minimum wage naturally.

President Trump has also been pushing Congress to pass a tax reform bill – and soon.

When most voters in the U.S. are in favor of less taxes, why would anyone want to be taxed more for a guaranteed income? President Trump’s tax plan would create opportunities for true economic freedom in the United States. ## (News, analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)