The bank filed the suit in 2012, claiming he was a recess appointee when he issued five lending-related regulations, as bloomberg tells MHProNews, making the rulings invalid even though he ratified them the next year after his Senate confirmation. “Plaintiffs raise three arguments to dispute the effectiveness of Director Cordray’s ratification,” Huvelle wrote in her ruling Tuesday, “none of which is persuasive.”

The bank’s attorney, Greg Jacob, said the decision will be appealed. “Judge Huvelle’s holding that Director Cordray could ratify literally thousands of invalid actions, including invalid rulemakings, by publishing three perfunctory sentences with no accompanying process at all cannot be right, and we are confident we will prevail on appeal,” Jacob said. The bank contends Cordray operates as a “mini-president of consumer finance” without being accountable to congress or the president.

Meanwhile, mortgage services company PHH Corp. had also raised the constitutionality of the CFPB’s authority, saying the agency director’s role violates the separation of powers principle. That case will next be heard in the U. S. Court of Appeals in Washington, D. C. ##

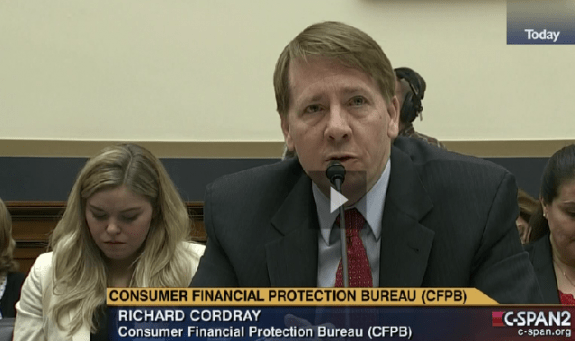

(Photo credit:cspan 2-CFPB Director Richard Cordray)