The Consumer Financial Protection Bureau (CFPB) is correct in saying that ‘manufactured homes are vital affordable housing,’ as is shown further below. Per the CFPB pleadings linked further below filed “Case 3:25-cv-00004” in the “United States District Court – Eastern District of Teneessee.” According to National Mortgage Professional’s version of this hot news item: “The consumer watchdog alleges that Vanderbilt violated the Truth in Lending Act (TILA) and Regulation Z by failing to make reasonable, good-faith determinations of borrowers’ ability to repay loans. According to Modex, the company originated just under $2 billion in 2023, and just over $2 billion in 2024. Vanderbilt is a lending unit of Clayton Homes, Inc., the largest manufactured home builder in the U.S., and a wholly owned subsidiary of Berkshire Hathaway, Inc. Vanderbilt originates mortgages for the purchase of manufactured homes that are built and sold by Vanderbilt-affiliated companies. Vanderbilt also does business as Silverton Mortgage.” The left-leaning New York Times, Association Press (AP), Yahoo Finance, Reuters, and Payments, among others in U.S. media.

Part I of this report will be the CFPB press release.

Part II will include, but is not limited to, most of the pleadings of the CFPG case vs. Vanderbilt Mortgage and Finance (VMF). Also included will be insights from the New York Times, NPR, Clayton Homes on behalf of VMF, and other sources that happens to dovetail with what MHProNews planned on (and will) address in greater detail further below. This is likely to be the most complete report with analysis and expert commentary anywhere, certainly in the manufactured home industry if history is a guide.

Part I

CFPB Sues Vanderbilt for Setting Borrowers Up to Fail in Manufactured Home Loans

Berkshire Hathaway-owned company pushes people into unaffordable loans to purchase Clayton Homes

WASHINGTON, D.C. – Today, the Consumer Financial Protection Bureau (CFPB) sued Vanderbilt Mortgage & Finance for setting families up to fail when they borrowed money to buy a manufactured home. The CFPB alleges that Vanderbilt’s business model ignored clear and obvious red flags that the borrowers could not afford the loans. As a result, many families found themselves struggling to make payments and meet basic life necessities. Vanderbilt charged many borrowers additional fees and penalties when their loans became delinquent, and some eventually lost their homes. The CFPB is seeking to stop Vanderbilt’s illegal practices and obtain relief for the harmed homeowners.

“Vanderbilt knowingly traps people in risky loans in order to close the deal on selling a manufactured home,” said CFPB Director Rohit Chopra. “The CFPB’s lawsuit seeks to not only protect homebuyers, but also honest lenders helping people to finance the purchase of an affordable home.”

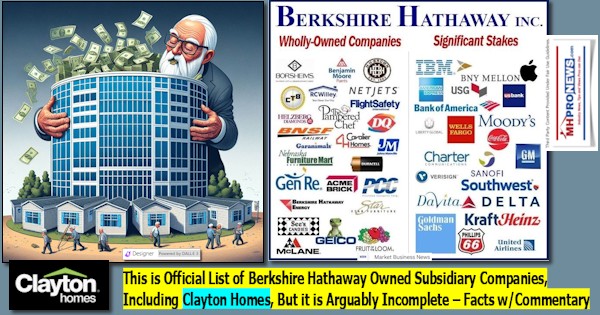

Vanderbilt Mortgage & Finance, Inc. is a nonbank financing company based in Maryville, Tennessee that originates loans for manufactured homes across the country. Vanderbilt is a unit of Clayton Homes, Inc., which is the largest manufactured home builder in the U.S. and a wholly owned subsidiary of Berkshire Hathaway, Inc., the multinational conglomerate based in Omaha, Nebraska.

Vanderbilt originates mortgages for the purchase of manufactured homes that are built and sold by Vanderbilt-affiliated companies. Manufactured homes, or mobile homes, are a vital source of affordable housing, particularly for millions of low-income Americans and for older Americans. For these homeowners, who predominately live in rural areas, manufactured homes can fill the gap left by the lack of affordable site-built homes. Although manufactured homes may be more affordable to purchase, CFPB research has shown that manufactured home loans often come coupled with higher interest rates and limited opportunity to refinance compared to traditional home mortgage loans.

In response to widespread problems in mortgage originations, including systemic failures to consider borrowers’ income when making loans, Congress in 2010 required that all residential mortgage lenders document and verify borrowers’ income before making a mortgage, and that mortgages only be made after the lender has made a good-faith and reasonable determination that the borrower can repay the loan. Those systemic failures contributed directly to the 2008 foreclosure crisis, which resulted in more than six million families losing their homes.

The CFPB alleges that Vanderbilt failed to make reasonable, good-faith determinations of borrowers’ ability to repay loans, as legally required. Specifically, the lawsuit alleges Vanderbilt:

- Manipulated lending standards when borrowers did not make sufficient income: In its underwriting process, Vanderbilt often disregarded evidence that borrowers did not have sufficient income or assets (other than the value of their home) to pay their mortgage and cover recurring obligations and basic living expenses, like food and health care. Sometimes, Vanderbilt originated loans for borrowers who were already struggling, making their financial situation worse. For example, Vanderbilt approved a loan for a family with 33 debts in collection and two young children. The borrowers fell behind only eight months after getting the mortgage.

- Fabricated unrealistic estimates of living expenses: Vanderbilt justified its determination that borrowers could pay the loans by using artificially low estimates of living expenses that made no adjustment for higher expenses in different geographic areas. Vanderbilt’s estimated living expenses were about half of the average of self-reported living expenses for other, similar, Vanderbilt loan applicants. These families were left with little or no buffer to cover unexpected expenses. For example, Vanderbilt left one family of five with only $57.78 in net income after Vanderbilt applied its estimate of living expenses. That family first missed a payment only a year after signing the mortgage.

- Made loans to borrowers it projected could not pay: In some cases, Vanderbilt violated its own policy and made loans to borrowers who, even under the company’s overly optimistic estimates, did not have enough income to cover the mortgage and basic living expenses. For example, Vanderbilt approved a mortgage for a single mother with two dependents after estimating she had insufficient income, and then sent her loan to collections when she missed a mortgage payment after only four months in the home.

The CFPB alleges that Vanderbilt violated the Truth in Lending Act and Regulation Z. When Vanderbilt originated loans to borrowers who lacked sufficient income (or assets beyond the home) to make the payments on the loan, Vanderbilt set those families up for failure.

Enforcement Action

Under the Consumer Financial Protection Act, the CFPB has the authority to take action against institutions violating consumer financial laws, including the authority to enforce the Truth in Lending Act and Regulation Z.

The CFPB’s lawsuit seeks to stop the company’s unlawful conduct, to provide redress for harmed consumers, and the imposition of a civil money penalty, which would be paid into the CFPB’s victims relief fund.

Read consumer complaints submitted against Vanderbilt.

The CFPB has resources for consumers about mortgages. Consumers can submit complaints about financial products and services by visiting the CFPB’s website or by calling (855) 411-CFPB (2372).

Employees who believe their company has violated federal consumer financial protection laws are encouraged to send information about what they know to whistleblower@cfpb.gov. To learn more about reporting potential industry misconduct, visit the CFPB’s website.

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. For more information, visit www.consumerfinance.gov.

Part II

1) Also per NMP are the following.

The CFPB lawsuit specifically alleges that Vanderbilt:

Manipulated lending standards when borrowers did not make sufficient income: In its underwriting process, Vanderbilt often disregarded evidence that borrowers did not have sufficient income or assets (other than the value of their home) to pay their mortgage and cover recurring obligations and basic living expenses, like food and health care. Sometimes, Vanderbilt originated loans for borrowers who were already struggling, making their financial situation worse. For example, Vanderbilt approved a loan for a family with 33 debts in collection and two young children. The borrowers fell behind only eight months after getting the mortgage.

Fabricated unrealistic estimates of living expenses: Vanderbilt justified its determination that borrowers could pay the loans by using artificially low estimates of living expenses that made no adjustment for higher expenses in different geographic areas. Vanderbilt’s estimated living expenses were about half of the average of self-reported living expenses for other, similar, Vanderbilt loan applicants. These families were left with little or no buffer to cover unexpected expenses. For example, Vanderbilt left one family of five with only $57.78 in net income after Vanderbilt applied its estimate of living expenses. That family first missed a payment only a year after signing the mortgage.

Made loans to borrowers it projected could not pay: In some cases, Vanderbilt violated its own policy and made loans to borrowers who, even under the company’s overly optimistic estimates, did not have enough income to cover the mortgage and basic living expenses. For example, Vanderbilt approved a mortgage for a single mother with two dependents after estimating she had insufficient income, and then sent her loan to collections when she missed a mortgage payment after only four months in the home.

2) From the CFPB suit linked here are the following remarks.

COMPLAINT

The Consumer Financial Protection Bureau (“Bureau” or “Plaintiff”) brings this

action against Defendant Vanderbilt Mortgage and Finance, Inc. (Vanderbilt) for

originating manufactured-home-purchase loans without making a reasonable, good faith determination that their borrowers would have a reasonable ability to repay those

loans.

The following is from that same CFPB complaint.

COMPLAINT

The Consumer Financial Protection Bureau (“Bureau” or “Plaintiff”) brings this action against Defendant Vanderbilt Mortgage and Finance, Inc. (Vanderbilt) for originating manufactured-home-purchase loans without making a reasonable, good faith determination that their borrowers would have a reasonable ability to repay those loans.

INTRODUCTION

- Manufactured homes, commonly known as mobile homes, are a vital source of affordable housing for millions of financially vulnerable, low-income

Americans, many of whom are located in rural areas of the United States and lack access to affordable site-built homes for themselves and their families.

- Vanderbilt is a manufactured-home-financing company that purports to provide access to affordable housing for this financially vulnerable population, but instead, it saddled borrowers in the greatest need with mortgages that they couldn’t reasonably afford to repay.

- Vanderbilt’s underwriting process ignored clear and obvious red flags that certain consumers would not be able to repay their loans according to their terms. Vanderbilt used implausible estimates of monthly expenses that meaningfully underestimated what consumers would need, after paying their monthly mortgage payments and other often significant monthly debt obligations, in order to keep food on the table and meet other living expenses.

- Additionally, for some of these same consumers who lacked sufficient monthly income to cover living expenses, Vanderbilt ignored that these consumers were currently struggling to satisfy their existing debt obligations, as demonstrated by one or more debts in collection on the consumers’ credit reports, and that they lacked assets to repay these debts.

- As a result, Vanderbilt originated loans where the company did not make a reasonable, good faith determination of the consumer’s ability to repay the loan, as the law requires. Predictably, many of these consumers experienced late fees and penalties when their loans became delinquent and had their homes repossessed when their delinquent loans went into default.

JURISDICTION AND VENUE

- This Court has subject matter jurisdiction because this action is “brought under Federal consumer financial law,” 12 U.S.C. § 5565(a)(1), presents a federal question, 28 U.S.C. § 1331, and is brought by an agency of the United States, 28 U.S.C. § 1345.

- Venue is proper in this district because the Defendant is located, resides, or does business here. 12 U.S.C. § 5564(f).

PARTIES

- The Bureau is an agency of the United States charged with regulating the offering and provision of consumer financial products and services under “Federal consumer financial laws,” 12 U.S.C. § 5491(a), including the Consumer Financial Protection Act of 2010, 12 U.S.C. § 5481 et seq. (CFPA); the Truth in Lending Act, 15

U.S.C. § 1601 et seq. (TILA); and TILA’s implementing Regulation Z, 12 C.F.R part 1026. See 12 U.S.C. § 5481(12), (14). The Bureau has independent litigating authority, including the authority to enforce the Federal consumer financial laws. 12 U.S.C. 5564(a), (b).

- Defendant, Vanderbilt, is a Tennessee corporation, with its principal place of business at 500 Alcoa Trail, Maryville, TN 37804. Defendant is a subsidiary of Clayton Homes, Inc., which is, in turn, a subsidiary of Berkshire Hathaway, Inc. Defendant is a “covered person” under the CFPA, 12 U.S.C. § 5481(6)(A), because it engages in offering or providing extensions of credit—specifically, mortgage loans—to consumers for personal, family, or household purposes, 12 U.S.C. § 5481(15)(A)(i).

- Defendant is also a “creditor” under TILA and Regulation Z, because Defendant regularly extends credit—specifically, mortgage loans—to consumers for personal, family, or household purposes, where the credit is subject to a finance charge or is payable by written agreement in more than four installments (not including a down payment), and where the obligation is initially payable to Defendant. 12 C.F.R. § 1026.2(12), (17), implementing 15 U.S.C. § 1602(g), (i).

FACTS

- Vanderbilt originates mortgage loans to consumers to finance the purchase of manufactured homes.

- Most loans that Vanderbilt finances are for manufactured homes sold and manufactured by affiliated companies that are owned by Vanderbilt’s parent, Clayton Homes, Inc.

- Before originating a mortgage loan, Vanderbilt purports to make a reasonable and good faith determination at or before consummation that the consumer has the ability to repay the loan according to its terms.

- In 2014, Vanderbilt developed a residual income model as part of its internal underwriting process. The model subtracts food, healthcare, gasoline, and utility expenses; monthly recurring debt obligations; and the mortgage payment from the applicant’s monthly income. Any positive amount left over after this calculation is considered the applicant’s net residual income and Vanderbilt evaluates it along with the applicant’s assets, debts, and credit profile to determine the consumer’s ability to repay the loan.

- The living expenses Vanderbilt uses in its residual income model are based on either the borrower’s self-reported numbers or, where the borrower self-reports $0 in living expenses or other nominal amounts below Vanderbilt’s estimate, Vanderbilt substitutes its own, proprietary living-expense estimate (Vanderbilt’s Living-Expense Estimate).

- Vanderbilt’s Living-Expense Estimate relies on living-expense figures based on family size that are unreasonable for a single borrower and increasingly unreasonable as borrower’s family size grows. When estimating an applicant’s living expense, Vanderbilt does not consider other borrower characteristics or geographical variations in living expenses.

- For example, Vanderbilt’s Living-Expense Estimate projects that a single parent with four dependents would incur monthly living expenses well below a reasonable estimate for a single parent’s costs to clothe, feed, transport, and care for themselves and four children every month no matter where they live in the United States.

- Vanderbilt’s Living-Expense Estimate is about half the average self reported living expenses of Vanderbilt’s own similarly situated loan applicants.

- Vanderbilt’s loan-underwriting policy permitted the company to rely on its implausible Living-Expense Estimates to approve loans to borrowers who did not have enough income to cover their families’ likely living expenses after paying their often significant debt obligations each month.

- In addition to relying on unrealistic Living-Expense Estimates for many of its borrowers, Vanderbilt ignored the fact that many of these same borrowers had factors that indicated they lacked an ability to repay their loans.

- Vanderbilt originated loans even where borrowers lacked assets (other than the value of the property securing the loan) that could be relied upon for repayment, given their lack of sufficient residual income. And Vanderbilt also disregarded evidence that borrowers had multiple debts in collection.

- For example, Vanderbilt approved a loan to co-applicants with 33 debts in collection, insufficient assets to pay those debts, and two young children. Vanderbilt assumed unreasonably low monthly living expenses for this family of four, which would have left them with a net residual income of $65.67 after paying their significant monthly debt obligations, including the Vanderbilt mortgage. The borrowers fell behind on their payment eight months after getting the mortgage.

- As another example, Vanderbilt approved a loan for a couple to purchase a home. The co-applicants had three dependent children and seven debts in collection. Vanderbilt assumed unreasonably low monthly living expenses for this family of five, which would have left them with $57.78 in net residual income. A year after the mortgage was issued, the borrowers missed a payment and eventually went into default.

- In some cases, Vanderbilt violated its own loan-underwriting policy and made loans to borrowers who had negative net residual income even under its own implausible Living-Expense Estimates.

- For example, Vanderbilt approved a mortgage for a single mother with two dependents and a residual income of -$0.50 based on Vanderbilt’s unreasonably low monthly living expense estimate for that family. The borrower had nine debts in collection and no additional assets. This borrower failed to make her mortgage payment four months after the mortgage was originated and eventually Vanderbilt sent the loan to collections.

- For these reasons, borrowers were put into loans where Vanderbilt failed to make a reasonable, good faith assessment at or before the time the loan was made that they could reasonably repay those loans according to their terms. Vanderbilt could not reasonably conclude that a consumer has a reasonable ability to repay their loan according to its terms where the borrower’s income and assets (other than the value of the property securing the loan) would be insufficient to make their mortgage payment, other recurring debt obligations, and necessary living expenses.

- Because of this, many of these borrowers became delinquent on their loans within a few years of consummation and incurred late fees and penalties. Many other borrowers filed for bankruptcy or eventually defaulted on their loans and lost their homes.

VIOLATIONS OF LAW

COUNT I: VIOLATION OF TILA AND REGULATION Z’s MINIMUM UNDERWRITING STANDARDS

- TILA and its implementing regulation, Regulation Z, set forth minimum underwriting standards for consumer-credit transactions secured by a dwelling. 15 U.S.C. § 1639c, 12 C.F.R. § 1026.43. Vanderbilt’s dwelling-secured mortgage loans must meet Regulation Z’s minimum underwriting standards.

- TILA provides that “In accordance with regulations prescribed by the Bureau, no creditor may make a residential mortgage loan unless the creditor makes a reasonable and good faith determination based on verified and documented information that, at the time the loan is consummated, the consumer has a reasonable ability to repay the loan, according to its terms, and all applicable taxes, insurance (including mortgage guarantee insurance), and assessments.” 15 U.S.C. § 1639c(a)(1). In turn, the Bureau’s Regulation Z provides that a creditor, such as Vanderbilt, “shall not make a loan that is a covered transaction unless the creditor makes a reasonable and good faith determination at or before consummation that the consumer will have a reasonable ability to repay the loan according to its terms.” 12 C.F.R. § 1026.43(c)(1).

- The commentary to Regulation Z also explains that “whether a particular ability-to-repay determination is reasonable and in good faith will depend not only on the underwriting standards adopted by the creditor, but on the facts and circumstances of an individual extension of credit and how a creditor’s underwriting standards were applied to those facts and circumstances.” 12 C.F.R. pt. 1026 supp. I, cmt. 43(c)(1)-1.i. Additionally, the fact that the “creditor disregarded evidence that the consumer may have insufficient residual income to cover other recurring obligations and expenses, taking into account the consumer’s assets other than the property securing the loan, after paying his or her monthly payments for the covered transaction, any simultaneous loans, mortgage-related obligations, and any current debt obligations” is “evidence that a creditor’s ability-to-repay determination was not reasonable or in good faith.” 12 C.F.R. pt. 1026 supp. I, cmt. 43(c)(1)-1.ii.B.5.

- As discussed in paragraphs 11 to 27 above, Vanderbilt made mortgage loans to borrowers without making a reasonable and good-faith determination that the borrowers could repay them according to their terms, in violation of TILA, 15 U.S.C. 1639c(a)(1), and Regulation Z, 12 C.F.R. § 1026.43(c).

COUNT II: VIOLATION OF CFPA’S PROHIBITION AGAINST

PROVIDING A FINANCIAL PRODUCT NOT IN CONFORMITY WITH

FEDERAL LAW

- Section 1036(a)(1)(A) of the CFPA prohibits covered persons from offering or providing to a consumer “any financial product or service not in conformity with Federal consumer financial law,” or from committing “any act or omission in violation of a Federal consumer financial law.” 12 U.S.C. § 5536(a)(1)(A).

- The CFPA defines “Federal consumer financial law” to include TILA and its implementing Regulation Z. 12 U.S.C. § 5481(14).

As a result, Vanderbilt’s violations of TILA and Regulation Z, as described in Count I, constitute violations of Section 1036(a)(1)(A) of the CFPA. 12 U.S.C. § 5536(a)(1)(A).

DEMAND FOR RELIEF

Plaintiff request that this Court:

- Permanently enjoin the Defendant from committing future violations of 15

U.S.C. § 1639c, 12 C.F.R. § 1026.43, or 12 U.S.C. § 5536(a)(1)(A);

- Grant additional injunctive relief as the Court may deem to be just and proper;

- Award damages and other monetary relief against the Defendant;

- Award restitution or disgorgement against the Defendant;

- Award civil money penalties against Defendant;

- Award costs against the Defendant; and

- Award additional relief as the Court may determine to be just and proper.

Respectfully submitted,

Eric Halperin

Enforcement Director

Alusheyi Wheeler

Litigation Deputy

Owen Martikan

Assistant Litigation Deputy

s/ Meghan Sherman Cater Meghan Sherman Cater

(NY Bar No. 4473120)

Telephone: 202-435-9165

Email: meghan.cater@cfpb.gov

John Thompson

(NM Bar No. 139788)

Telephone: 202-435-7270

email: john.thompson@cfpb.gov

Enforcement Attorneys

Consumer Financial Protection Bureau

1700 G Street, NW

Washington, DC 20552

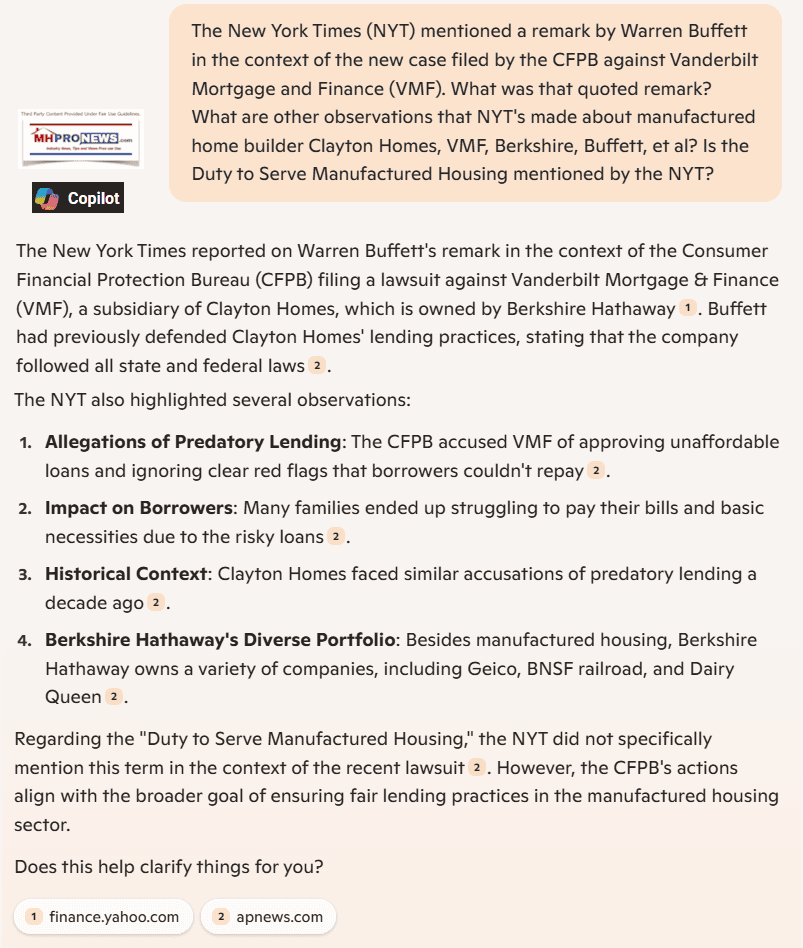

3) The left-leaning New York Times report on the CFPB vs. Vanderbilt matter included the following points, per left-leaning Copilot

4) NPR’s report on this legal action by the CFPB vs. Vanderbilt included the following observations.

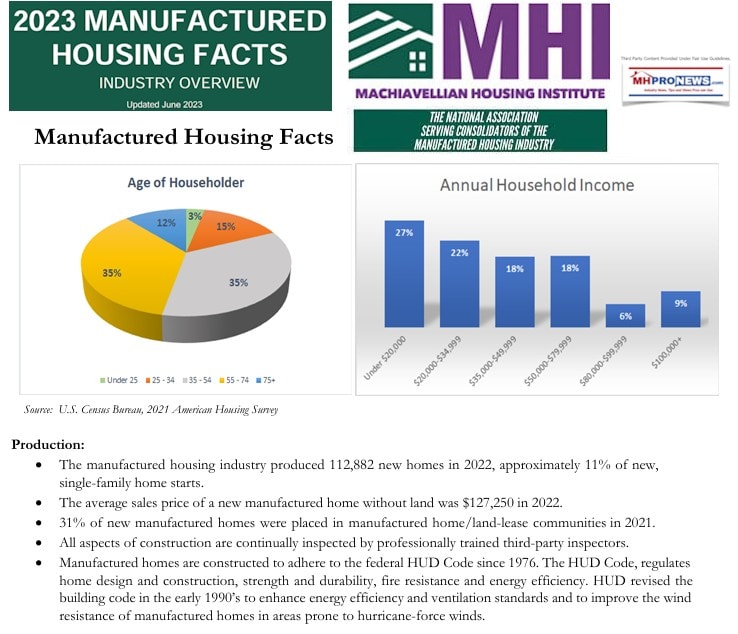

According to the Manufactured Housing Institute, a trade organization, the median household income in 2022 for buyers of manufactured homes was $35,000. Nearly 113,000 such homes were produced in that year, representing about 11% of all new home starts. The average sales price of a manufactured home was $127,250 without land.

A 2016 report by the Center for Public Integrity cited Clayton Homes for lending at interest rates of 15% or more while tacking on thousands of dollars in additional loan fees. It also said that former Clayton dealers reported that the company “encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.”

At a Berkshire Hathaway annual shareholder meeting in 2015, Buffett defended the lending practices of Clayton Homes, saying he had “no apologies whatsoever” for the way the company issued loans, according to Reuters.

The MHI document referenced by NPR indicated in one of its graphics that most manufactured home buyers made under $50,000.

Note that the MHI document referenced above, per a MS Word search, makes no mention of the Duty to Serve, FHA Title I, the Manufactured Housing Improvement Act of 2000, or of federal preemption, much less “enhanced preemption.”

5) Clayton Homes posted the following “News Release” on their website on 1.6.2025 in response to the CFPB suit. Note, quoting Clayton Homes should not be construed as an endorsement of their remarks nor of the firm and its business practices. Rather, this reflects the balance that ought to be the aim of any reasonably accurate report, particularly an in depth one.

Corporate News

Response to CFPB Lawsuit

January 6, 2025

For 50 years, Vanderbilt Mortgage has increased homeownership in the U.S. The CFPB’s lawsuit is unfounded and untrue, and is the latest example of politically motivated, regulatory overreach.

Vanderbilt Mortgage’s underwriting processes exceed the legal requirements for assessing a borrower’s ability to repay loans by considering both monthly debt-to-income ratio and residual income, while the law only requires the use of one or the other. Vanderbilt Mortgage goes further by taking the greater of the borrower’s actual reported expenses or an estimated living expense for the family size, similar to that used by the Federal VA loan program.

The CFPB examined tens of thousands of Vanderbilt Mortgage loans and identified less than 0.8 percent, over a six-year period, that allegedly should not have been made. Many of those loans have not been delinquent. Vanderbilt Mortgage follows the law, and the facts bear that out.

Despite regularly blessing Vanderbilt Mortgage’s underwriting practices in the past, the CFPB is now demanding compliance with an unknown and unknowable new “standard” not addressed in the law. Far from protecting American consumers, the CFPB’s lawsuit will deprive credit worthy borrowers of owning a home.

The lack of attainable housing is one of the greatest threats facing our country. Vanderbilt Mortgage remains committed to protecting the American public’s access to fair lending services while providing a path to homeownership for hardworking families.

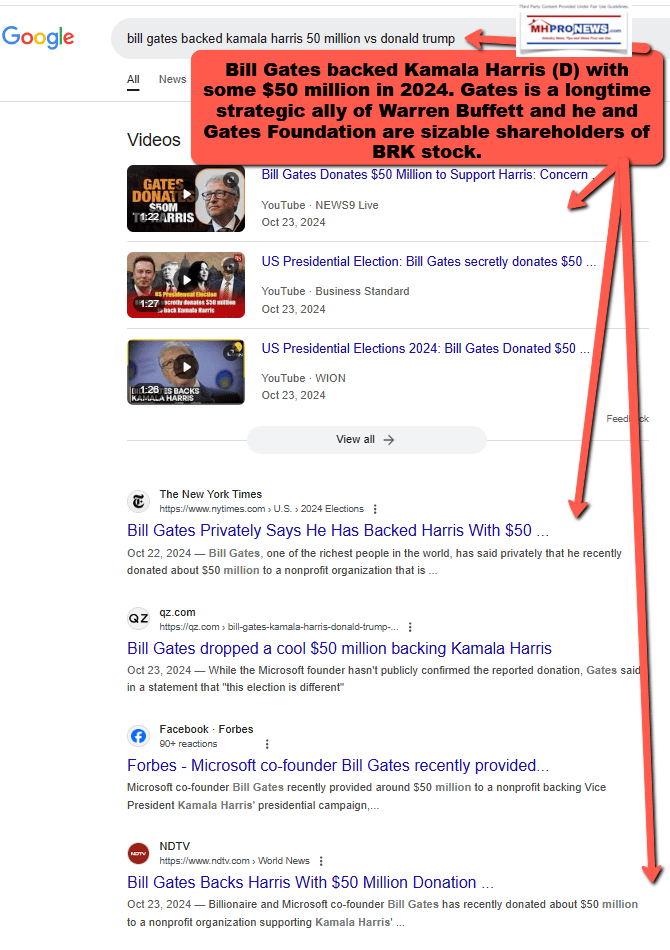

6) It is curious at best that Clayton would allege that the CFPB action is: “the latest example of politically motivated, regulatory overreach.” Say, what? Didn’t Joe Biden (D) and Kamala Harris (D) occupy the president’s and VP’s quarters in the last nearly 4 years? Before the 2024 election, which Buffett didn’t weigh in to endorse Kamala Harris (D), didn’t Warren Buffett consistently support Democratic presidential in the 21st century? To illustrate, consider this Q&A with Copilot.

7) MHProNews posed this follow up.

Didn’t Buffett and Clayton Homes both work with the Clinton Foundation as well? Isn’t Bill Clinton and Kevin Clayton both photographed together in a report on MHProNews about the problematic placement of Clayton Homes in response to a disaster in Haiti that went sideways and has been the source of ongoing controversy for Clayton and the Clinton Foundation?

The report on MHProNews highlights these issues, pointing out that the placement of Clayton Homes in Haiti did not go as planned and has led to criticism of both Clayton Homes and the Clinton Foundation 1 .

If you have any more questions or need further details, feel free to ask!

8) Numerous facts are missing from several of these reports, including the fact that Vanderbilt may not be as readily able to charge higher rates or behave in a predatory fashion if the Biden-Harris (D) regime FHFA had fully and properly enforced the Duty to Serve (DTS) Manufactured Housing.

a) Warren Buffett himself made a related remark about DTS in the context of a Berkshire Hathaway annual meeting.

b) While Buffett didn’t endorse anyone in 2024, his close ally Bill Gates reportedly backed Kamala Harris (D) to the tune of $50 million dollars. Gates is linked to Microsoft owned Bing, which is the parent company to AI powered Copilot.

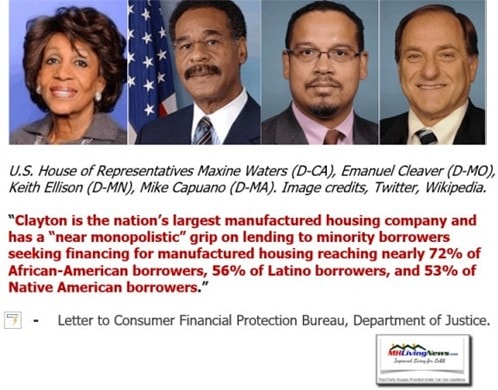

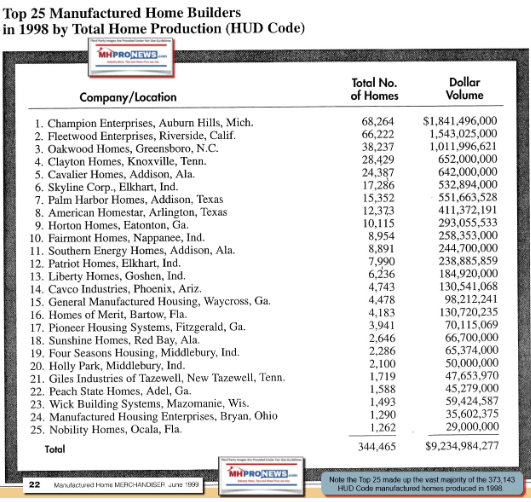

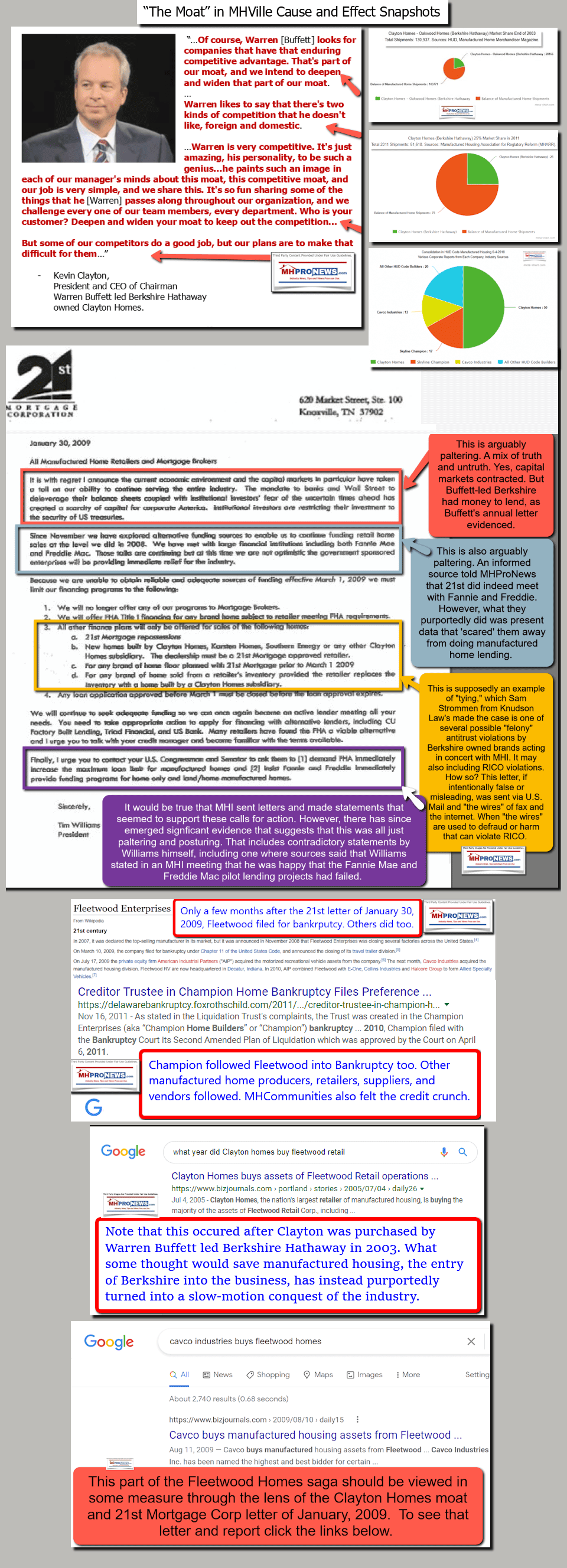

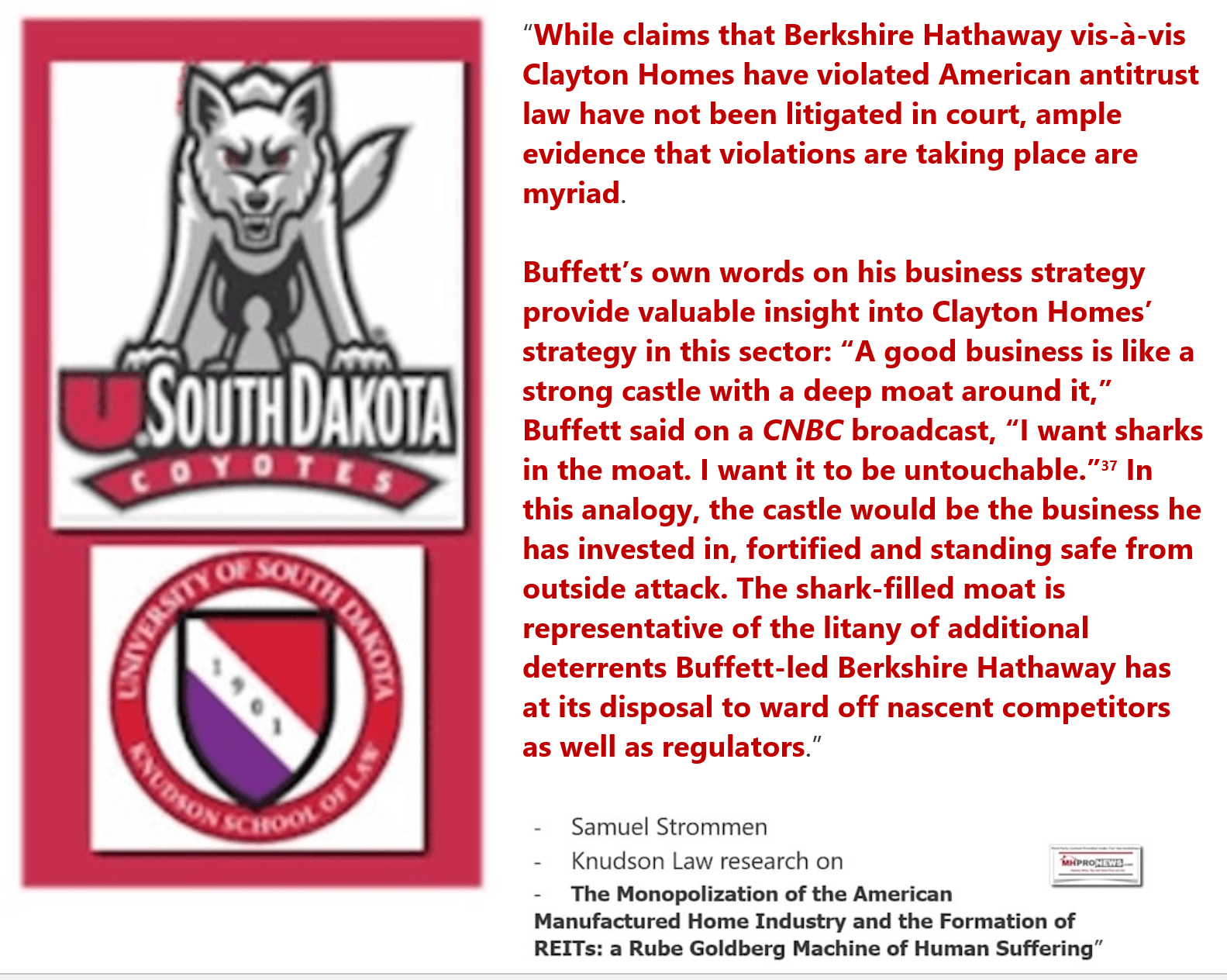

9) Not mentioned by Clayton Homes’ press release were most of the facts shown herein. Clayton, VMF and 21st have faced over a decade of allegations regarding their lending and apparent antitrust violating market manipulation that resulted in their moving from #4 in 1998 among manufactured home producers to them becoming the largest producer of manufactured homes in the 21st century.

10) So, once again, Clayton Homes’ and its captive lender Vanderbilt Mortgage and Finance (VMF) has made the news in a manner that manages to give manufactured housing a bad name. Will this CFPB suit hurt then? Highly unlikely that any result will cause Clayton or VMF serious harm, at least in terms of how they have operated for much of the 21st century.

There is no mention of this issue on the MHI website at this time (about 9:35 AM ET on 1.7.2025).

Is there any chance that MHI will take action under the Code of Ethical Conduct vs. VMF or Clayton? Highly unlikely.

11)

MHProNews plans to monitor this case and related developments and report accordingly.

—

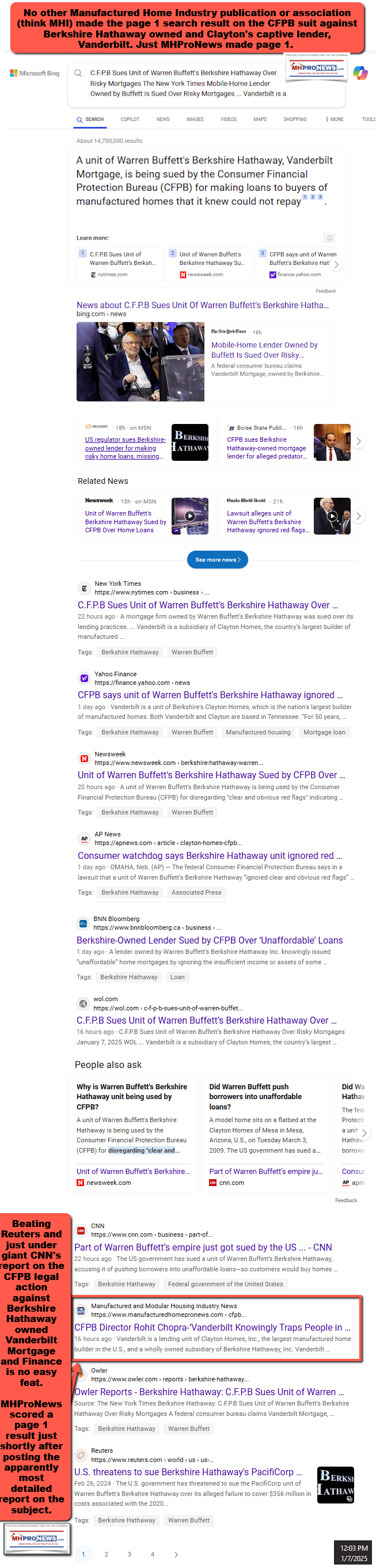

Update: 12:20 PM on 1.7.2025. About 2 hours after publishing the report above, MHProNews achieved the manufactured home industry’s ONLY page 1 result on this CFPB vs. Vanderbilt case.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’