MHProNews contacted the CFPB to get additional information regarding manufactured home lending in their recent report, which is linked further below among the Sunday weekly headlines in review. Among the topics and technical concerns raised by their new research is this. Manufactured Home lending data previously referenced by the Manufactured Housing Institute (MHI) as well as the Manufactured Housing Association for Regulatory Reform (MHARR), and thus also by this publication too, appears to have been contradicted by the new CFPB report.

That will be examined further below.

Beyond that seemingly contradicted manufactured home lending data, other information was provided “on background” by the CFPB. In news reporting, the meaning is as follows. “On background,” Global OUP says is sometimes phrase: “not for attribution,” means the reporter may quote the source directly but may not attribute the statements to the source by name. The reporter may describe the source by her position.” The gender reference is generic from Global, not from MHProNews.

That “on background” source was an official spokesperson for the CFPB. That part of the CFPB statement to MHProNews about their will be examined in an upcoming special report.

Per the new CFPB report, “This report uses new information collected under the Home Mortgage Disclosure Act to explore the differences between mortgage loans for site-built homes, mortgage loans for manufactured homes (referred to as “MH mortgages”), and chattel loans for manufactured homes.”

It continues as follows.

“Comparison of these three financing types finds that borrowers with chattel loans face higher denial rates when applying for financing than manufactured housing mortgage and site-built borrowers. When they do get a loan, these borrowers pay higher interest rates than their MH mortgage and site-built counterparts and are also less likely to refinance. Analysis shows that Black, Hispanic, and American Indian and Alaska Native borrowers are more likely to get chattel loans than their non-Hispanic white counterparts, even when controlling for land ownership. Additionally, the market for MH lending—and chattel in particular—is more concentrated among relatively few lenders than the market for mortgages on site-built homes. This research also compares HMDA data with results from commonly used manufactured housing datasets to illustrate how HMDA fits into the MH research space.”

The above report by the CFPB on manufactured home lending practices is causing a stir in several mainstream and specialized media outlets. Some of that is explored in our initial report in our Daily Business News for the week, which is linked further below in our weekly reports in review. While it may be too soon to tell how this CFPB report may play out, it is reminiscent of the pushback and flak manufactured housing in general encountered following the years of Clayton, 21st and VMF backed – and MHI led – Preserving Access to Manufactured Housing Act (Preserving Access) bill. Preserving Access, along with other Clayton Homes and their related lending drama followed the Seattle Times series of reports on that ‘black eye’ topic.

For attribution from the CFPB were these data-points to MHProNews, which clarifies the question about just how much chattel lending is occurring in the manufactured home industry.

At first glance, HMDA estimates of chattel properties appear significantly lower than those from other datasets. However, underlying differences between these datasets can help explain the disparities. MHS data, for example, are based on shipments of new manufactured homes and include cash sales, while HMDA data contain both new and used housing and do not capture cash transactions. While we can’t compare the datasets directly, it seems likely that both provide reasonable estimates for the populations that they are measuring, especially in light of evidence that new homes appear far more likely than used homes to be financed with chattel loans. [Footnote: See Figure 22 in the Appendix.] HMDA results appear more similar to results from THOR [the Texas Homeownership Records data], even without accounting for the fact that THOR data undercounts loans secured by real property. [Footnote: About 89 percent of HMDA chattel loans in Texas had a lien recorded in THOR, compared to only 47 percent of MH mortgages.]

| Data Source | Population | % Chattel National | % Chattel Texas | % Land Ownership |

| HMDA, 2019 |

|

42% | 66% | 64% |

| AHS, 2019 |

|

— | — | 73% |

| MHS, 2019 |

|

76% | — | — |

| THOR, 2019 |

|

— | 78% [1] | — |

| UNC/Freddie Mac’s MH Survey and Report on Loan Shopping Experiences |

|

— | 73% | 61%

(TX only) |

Please let me know if you have any other questions.

Tia

Tia Elbaum

CFPB Spokesperson

##

While the graphic and full research document statement from the CFPB were useful, nevertheless, it still did not completely clarify why there was different data from different federal sources?

That inquiry was posed to the CFPB as a follow up question.

That MHProNews follow up drew the following from CFPB “on background.”

“The underlying populations for MHS and HMDA differ in a couple important respects. First, HMDA has new and used homes, while MHS only tracks new homes. Second, HMDA only includes financed transactions, while MHS includes both cash sales and financed sales.

o When we merge the Texas and HMDA data, we found new homes are more likely to be chattel loans than used home purchases (Figure 22), at least for Texas. That supports the theory that HMDA has a lower chattel rate, at least in part, because it includes used homes, which are less likely to get chattel loans.

o We don’t have data showing whether cash sales are more likely to be chattel loans. If that were the case, it could also help explain the differences between MHS and HMDA.”

What that means in part is that new manufactured home sales are predominately financed with chattel loans, also known as “personal property” financing or “home only” loans. That was known. But per the CFPB, it now appears that there may have been a disconnect between the actual percentage of such loans as the financial fuel for the sale of manufactured homes that has been provided by MHI, and thus MHARR and MHProNews too. It could be that the number of chattel loans nationally is somewhat lower than was previously thought. That difference is made up, per the CFPB and the MHS data, by cash sales.

Another Previously Hidden CFPB Revelation Obtained…

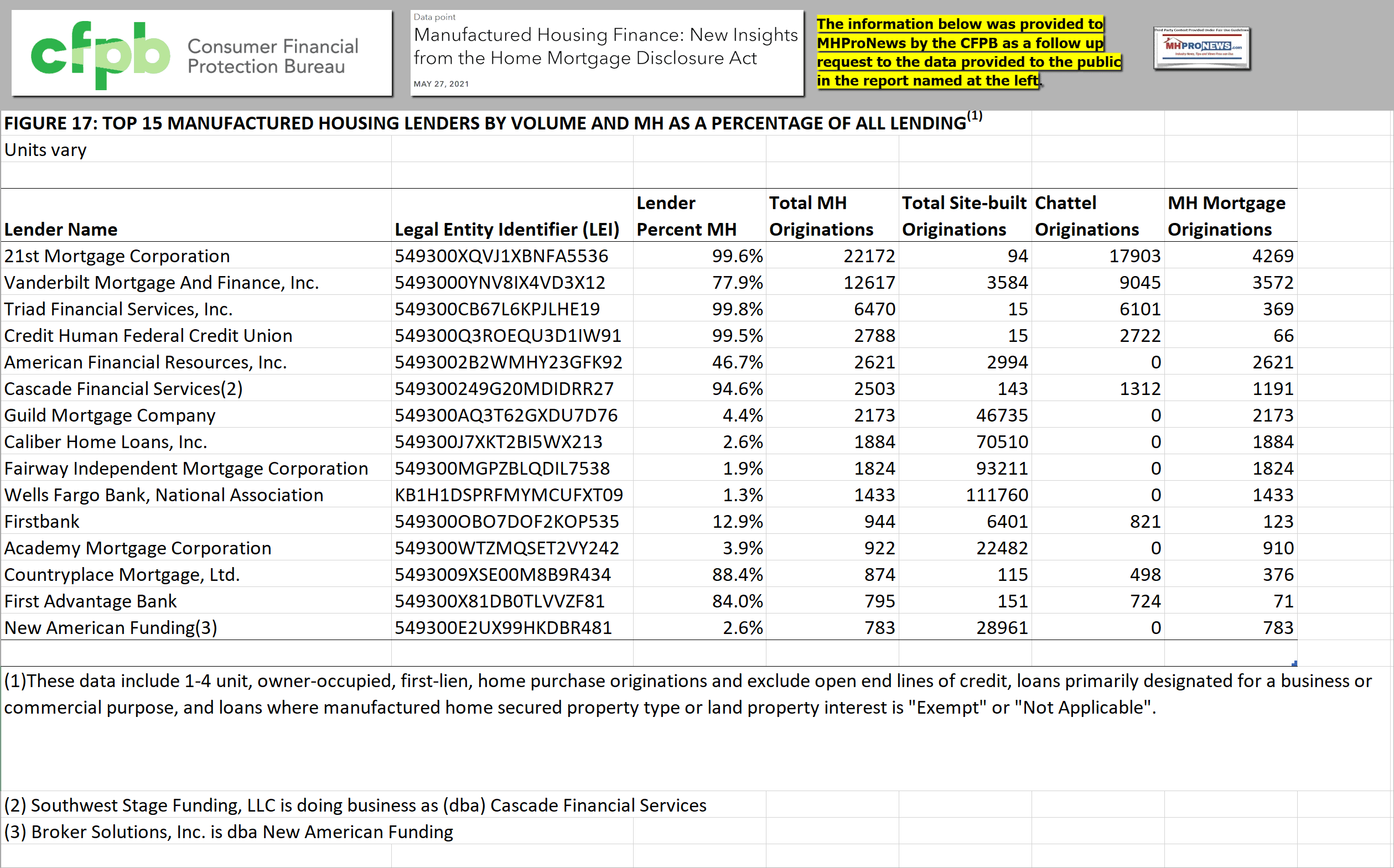

No less important is this data that the CFPB provided exclusively to MHProNews. This is the top 15 lenders in manufactured housing, per the CFPB HMDA data set.

Let’s do some math, and then unpack what the data above means.

Per the CFPB, 21st and VMF loans total some 26,848. All manufactured home loans from all 15 of the top manufactured home lenders total some 39,126. That yields 68.619332413% of all manufactured home chattel loans which are financed by Berkshire Hathaway (BRK) owned 21st & VMF.

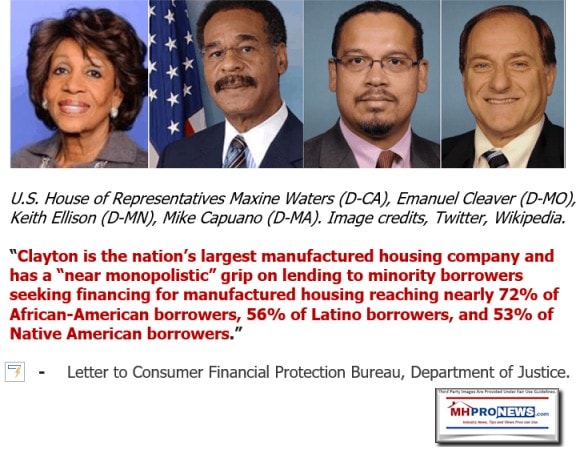

That said, recall this from Democratic lawmakers in the wake of the Seattle Times expose a few years go.

Thus, the grip of the Berkshire brands on manufactured housing, per CFPB, continues to tighten.

So, what happened to those DOJ and CFPB requests for inquiries? More on that in an upcoming special on MHProNews.

Don’t miss today’s postscript, which is related to the CFPB and manufactured home related controversies.

With no further adieu, here are the headlines for the week that was 5.30.2021 6.6.2021

What is New and Recent from Washington, D.C. from MHARR

What is New and the Latest on MHLivingNews

June National Homeownership Month, Historic – “2 Million Houses a Year” – NHC Spotlights Walter Reuther Plan Could Lift Conventional Housing, Manufactured Homes, and Build Wealth for Millions of Americans

What is the Walmart Effect, Undocumented Workers, and How That Influences Affordable Housing Seekers and Manufactured Homeowners?

What is New on the Masthead

Manufactured Housing Production Improves in 2 of 3 Categories, Official April 2021 Data, Trends, MHARR, Manufactured Home Pro News Analysis

June is National Homeownership Month – NAR, NAHB, P.E.P. and Manufactured Housing Institute – Factual, Evidence-Based, Curious, Eye-Opening Comparisons

What is New on the Daily Business News on MHProNews

Saturday 6.5.2021

Bill Boor, Cavco Industries (CVCO) Leadership Updates Reveal Progress, Problems, and Contradicts Manufactured Housing Institute, plus Manufactured Home Investing, Stock Updates

Friday 6.4.2021

Michigan Manufactured Housing Association Upstages Manufactured Housing Institute – plus Manufactured Home Stocks – Updates, Analysis

Thursday 6.3.2021

Flagship Employee – “Worst Company…Ever!” Co-Founder Nathan Smith Flagship Communities – “Aggressive Consolidations” – Examining Manufactured Housing Institute Claims Vs. Flagship Communities REIT-TSX:MHC.U– Analysis, plus Manufactured Home Stock Updates

Wednesday 6.2.2021

New Manufactured Housing Periodic Feature – 4 Shorts News Briefs, New Construction Data, plus Manufactured Home Investing, Stock Updates

Tuesday 6.1.2021

Clayton Homes’ “Racist” Lending – Credit Unions, ABA React – MHI Mute on Manufactured Home Loan Exposé – Greater Risks to “Black, Indigenous, and Hispanic families, as well as rural and lower-income families of all races and ethnicities” – CFPB’s Uejio

Monday 5.31.2021

Legacy – Manufactured Home Industry Pro Joseph “Joe” Ellis Obituary – Ike and Jack – Memorial Day Facts, Fiction, and Reflections

Sunday 5.30.2021

Actionable? Manufactured Housing Institute Paradoxically Surprising, Written Admission Involving HUD Secretary Marcia Fudge, Senators Scott and Sinema – plus Sunday Manufactured Home Weekly Headlines Review

Postscript

The CFPB landing page begins the introduction to their new report with the following overview.

“Manufactured housing is the largest source of unsubsidized affordable housing in the United States…” Those first 14 words are a periodic source of pride for numbers in our manufactured home profession. But that CFPB intro is immediately followed by these words – “but financing a manufactured home can be costly, especially for borrowers who do not own the underlying land. Whether the homeowner owns the underlying land plays a key role in whether the manufactured home is titled as personal (chattel) property or real property, a distinction which in turn affects many aspects of the home financing and can have major implications for the homeowner in terms of cost and security of tenure.”

Said differently, beginning with the first paragraph, the good news for millions about manufactured homes and their inherently affordable path to homeownership is immediately sullied by federal tax dollars at work.

When individuals wonder why our industry is suffering as it does, keep in mind that time after time the good news about manufactured housing is being buried by often accurate, but nevertheless largely negative remarks. Those statements – such as the one from the CFPB above – often lack the nuance and detail needed for the casual reader to get an authentic picture about our industry. Where good guys exist, they are effectively downplayed because it is bad actors that are routinely in the spotlight. Where purported predatory or black hat firms or organizations exist, they often get spotlighted in ways that make the entire profession – once more, to the casual reader – look bad.

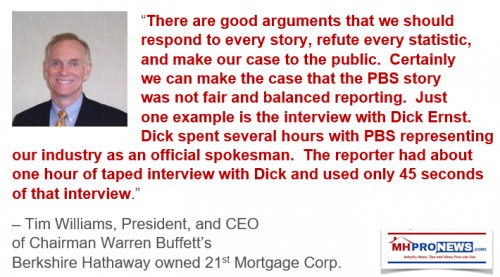

MHI and their leaders are aware of this. How do we know? Because then MHI Board Chairman Tim Williams, President and CEO of Berkshire Hathaway owned 21st, said so in official remarks on the record to MHProNews.

Time will tell if a year with mostly virtual meetings will have weakened some of the social glue that has kept manufactured home independents in the fold with MHI and their affiliates.

What seems increasingly certain is that our industry has what law enforcement sometimes refers to as the “usual suspects” when something goes wrong publicly.

There is always more to come. Watch for a special report planned this week on MHProNews, where we pull back the veil on items that most others ignore and what our industry’s powers that be hope you will miss.

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.