The Consumer Financial Protection Bureau (CFPB) “is committed to ensuring that consumers have access to responsible credit in the manufactured housing market,” Director Richard Cordray said in an agency report. “Manufactured housing is a critical source of affordable housing for some consumers, particularly those who are older, live in a rural area, or have less income and wealth.” The report describes manufactured home (MH) owners in these terms: “These consumers may be more financially vulnerable and benefit from strong consumer protections. The Bureau is committed to ensuring that consumers have access to responsible credit in the manufactured housing market.” according to the CFPB’s recent report on manufactured home lending, linked here.

Mortgage lenders routinely consider an MH loan a specialty niche with currently lower demand than conventional housing, so they do not take on “chattel” or personal property loans which are not secured with real estate, leaving the national market to five major MH personal property lenders.

There is also a patchwork of smaller local or regional MH lenders, which local MH retailers may know, but are often not easy for consumers to find. CFPB regulations effectively gag sales people from pointing those lenders out to shoppers, for fear or violating CFPB rules which can result in large fines per incident or other sanctions.

Professional Perspectives on MH and Financing

“At Datacomp we have always believed that a robust and resilient resale market for Manufactured Homes is critical if we

“The CFPB report supports what CFED and other nonprofit organizations have said in recent years: Manufactured Home loan borrowers are vulnerable to expensive products and are often not well-served by the current financing market due to the lack of competition, lack of liquidity and the costs of the loans.” Ryan said in a response, published here.

A source close to the action in Washington DC meetings with regulators and elected officials told MHProNews off the record that: “I think this was probably done as a direct result for Cordray to have ammunition next time he is questioned on the Hill.” Others mirrored the comment, telling MHProNews that parts of the CFPB report looked like ‘pay back’ for Director Codray being grilled by Congressional representatives from both side of the political aisle in a hearing held on January 28, 2014 by the House Financial Services Committee’s Subcommittee.

Other allegations in the 55 page CFPB report include the statement that 68 percent of all manufactured-housing purchase loans in 2012 were “higher-priced,” typical of chattel (or personal property, “Home only”) loans, compared to three percent of site-built home loans. The report alleges that nearly the same percentage of MH owners were eligible for traditional mortgages, but chose the personal property route instead.

Commenting on the CFPB’s report, Lewis pointed out that “For a manufactured home to be titled as real estate property, the home generally must be set on a permanent foundation on land that is owned by the home’s owner. If a manufactured home is titled as personal property, it generally must be financed through a personal property loan, also known as a chattel loan.”

Chattel loans are quicker to obtain and have lower origination fees than a mortgage, but CFPB claims they have far fewer consumer protections. While manufactured homes account for six percent of all occupied housing; and one out of seven homes outside metropolitan areas is a manufactured home.

Ernst’s comments reflect key points made by the Government Accountability Office (GAO). The GAO report was issued in response to a request April 17, 2012 from the Chairman of the House Financial Services Committee, for a GAO analysis of HUD’s implementation of the Manufactured Housing Improvement Act of 2000 (MHIA 2000). The full download of the more favorable GAO report is available on MHLivingNews.com, linked here.

According to the GAO, HUD has fallen short of enforcing the MHIA 2000 by showing little effort to encourage Ginnie Mae to help securitize additional manufactured home loans, thereby reducing the availability of affordable manufactured housing.

The GAO also stressed the lack of a secondary market, which the Government Sponsored Enterprises (GSE) were required to do under provisions of HERA 2008’s Duty To Serve (DTS) manufactured housing and under-served markets.

Attorneys Sound Off

The law firm of Bradley Arant Boult Cummings LLP, was recently joined by William “Bill” W. Matchneer, JD. Matchneer – who worked at both the CFPB and previously directed the manufactured housing program for HUD – said with the firm’s associate, Jonathan R. Kolodziej, a statement shared with MHProNews:

“…this white paper should serve as a warning that the CFPB has taken an interest in the manufactured housing industry. The Bureau is continuing to monitor the impacts of the new mortgage rules on the manufactured housing market, which could signal that the Bureau may be open to making adjustments to the rules that would reduce burdens on creditors and lower the cost of credit for consumers.

However, they have also tipped their hand to at least one area of ongoing concern. Creditors originating chattel mortgages should pay particular attention to the amount, and types, of information that is being provided to borrowers and should ensure that they are fully informed of their financing options and the costs and benefits associated with each.”

“While at present apparently still unconvinced to lessen its regulations applicable to manufactured housing,” Wiliamson said, “CFPB has committed publicly to continue its study of the unique features of manufactured home financing. A positive prospect that has potential for creating more credit opportunities for the consumer markets served by manufactured…” homes could “…stimulate a more robust manufacturing housing market.“

Association Perspectives on the CFPB Report

The Manufactured Housing Association for Regulatory Reform (MHARR) stated in their commentary, that “CFPB White Paper, insofar as it signals no imminent steps based on the impact of its existing regulations on the manufactured housing market, appears to be designed to establish a policy base-line and public reference point for future CFPB action.”

The Manufactured Housing Institute (MHI) said in their initial formal response to the CFPB’s report that, “…is pleased the CFPB’s report underscores the valuable role manufactured homes play as a key form of affordable housing, particularly in rural and underserved communities. More importantly, the CFPB has finally acknowledged that the Dodd-Frank Act mortgage lending rules have had a disparate impact on manufactured housing compared to the larger site-built housing market. The report specifically states:

The Bureau has recognized that certain provisions of the Dodd-Frank Act the Bureau implemented through rules that took effect in January, 2014, may affect the market for smaller-size mortgages and, more specifically, the manufactured housing segment of the market, in ways that differ from the rules’ effect on other market segments. (1)

One of the Industry’s largest lenders goes on the record…

“As I read through the report I became frustrated over the inaccuracies and the bias against chattel lending throughout the report.

An example of the inaccuracy is the statement that 60% of chattel customers own their land and imply they are eligible for a conventional mortgage. This is simply a false statement and it is irresponsible of the CFPB to print such a misleading statistic.” Williams asserted.

“Even if it were true that 60% of the chattel customers own their land, the inference that they would qualify for a convention real estate mortgage is false.” Williams elaborated, adding “The truth is about 26% of our chattel loan borrowers report they own their land and this is probably an overstated response to the question. We know some people will report owning their land when in fact it is owned by a family member.

Williams went on to say, “I was glad to see the CFPB acknowledge some of their regulations have resulted in less credit being available to manufactured home owners. When a regulation has results that run contrary to your stated mission, you should change it. Hopefully the CFPB will consider what is best for the consumers and take advantage of their considerable authority to correct these damaging regulations.”

Looking back at a related GSE finding

A recent CNBC report stated what most manufactured home sales people – or other housing professionals – know about selling a home. Namely, that it’s “the down payment and monthly payments” that are key pieces of information home shoppers are seeking in order to make an informed purchasing decision.

Yet this kind of common-sense consumer desired information is precisely what CFPB regulations makes it difficult or even a violation of their policies for thousands of industry professionals to provide home shoppers.

How many consumers walk away in frustration when they’re not able to get information from a manufactured home community or retailer, when a Realtor ® isn’t similarly stopped by the CFPB from providing such commonly requested insights? How is that playing field level?

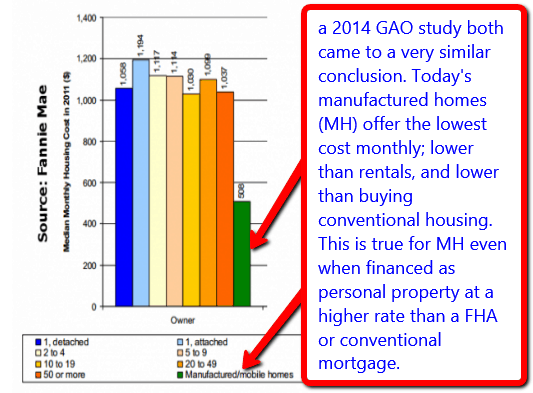

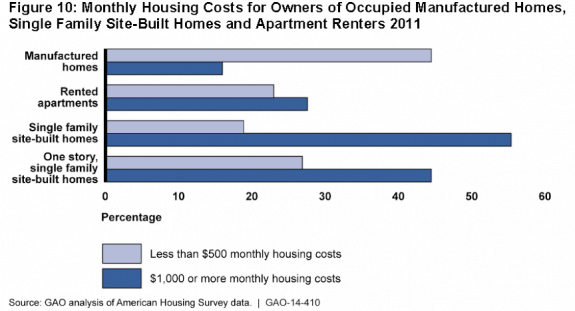

Quoting from Manufactured Home Living News, “The chart below from Fannie Mae demonstrates that manufactured homes are the lowest cost housing option, even when a higher interest rate is in place. A recently released GAO report demonstrated the same point.”

Information dramatically demonstrated by the chart above – that even with a higher rate, payments on MH can be half that of conventional housing – has attracted millions of consumers over the years to purchase a manufactured home in the first place. Because manufactured homes are more affordable – as CFPB, CFED and all of the professionals MHProNews contacted acknowledge – even when the rate is somewhat higher, the down payment and monthly payments often still remain more attractive than renting or other housing options.

Thousands came out in rain and cool weather last May to shop for a modern

manufactured home during the Eastern Ohio Home Show.

The causes of the rate disparity between site built and conventional housing are simple business math, as experts like Dick Ernst have routinely stated. The lack of a secondary market for MH loans, which the Duty to Serve (DTS) made law in the Housing and Economic Recovery Act (HERA 2008) required, was sidelined by the Federal Housing Finance Agency (FHFA) after they took the GSEs into receivership.

Ironically, the FHFA was also created by HERA 2008.

In an exclusive and official statement to MHProNews, Jason Boehlert – Senior Vice President of Government Affairs at MHI – said:

But CFED, CFPB and others, “fail to recognize the valuable role retailers and sales representatives have historically played in helping consumers identify financing alternatives.” Boehlert stated.

Congressman Walter Jones (NC3-R) told MHProNews some 3 years ago that it was never Congress’ intent to muzzle the free speech of MH sales people.

Matchneer and Kolodziej point to an apparent unfairness in the CFPB’s regulations, when they said, “…the new Loan Originator Compensation (“LO Comp”) rules in TILA may also be increasing the consumer’s cost of obtaining credit for a manufactured home. Unlike realtors, manufactured housing retailers are not exempt from the LO Comp rules.”

Indeed, every major MH lender MHProNews has spoken with stated they had to add staff – increasing costs – to handle more applications being ‘shot gunned’ to every MH finance company since CFPB regs went into effect mid-January 2014. Previously, an application was more likely to be submitted to only one or two lenders.

The reason for the new retail sales behavior? Because MH retailers fear they may be accused of ‘steering’ a customer by the CFPB.

Boehlert’s statement echoes that, “As the regulations are currently written—this is what MHI is attempting to fix in HR 1779/S 1828—the retailer cannot help the customer find a mortgage lender or inform the consumer of alternatives. The consumer needs the retailer’s help to become informed of the financing alternatives.”

OTR – Off the Record – but on Point?

In private comments, a not-for-profit leader said, “We absolutely believe more lenders need to get into this space..I I believe that the first step to this is getting a final Duty to Serve rule in place….Two things I see holding back the potential of this type of lending (personal property or chattel loans) are the lack of a secondary market – most local banks and other lenders will not hold in portfolio, of course – and mortgage insurance. These would also lower the costs. “

An association leader provided this OTR observation, “My suggestion is that we all advocate that since manufactured homes are considered under the CFPB guidelines as a mortgage, that lenders should NOT be able to state that the loan will not be made simply because it is a manufactured home and that they should NOT be able to charge higher rates simply because it is manufactured.”

As a result of remarks published on Industry Voices, as linked in this report, there may emerge a new dialogue between interested parties on how the MH industry can best advance the cause of reforming the reforms of Dodd-Frank and the SAFE Act in a fashion that is good for consumers and industry stakeholders alike.

The Current Reality

The consensus among industry professionals is that manufactured housing is being stifled because well meaning individuals in and out of the government are attempting to impose “solutions” to issues they don’t fully understand and that don’t match up with market place realities. For example, while most loans on MH today are personal property financing, about 30% of all new manufactured homes sold are paid by cash or with mortgages made by lenders who do FHA, VA, USDA or conventional loans. Some of those lenders are also MHI members. So the industry is already open to doing both kinds of lending.

As a result of the new CFPB regulations, key lenders in manufactured housing no longer offer loans on homes of less than $25,000. The costs to originate and service those low balance loans, and the risks created by CFPB regulations, make them unprofitable.

What this has done is penalize millions of manufactured home owners, most of whom likely do not yet know that the CFPB’s regulatory action has harmed their property’s value. So who is protecting the ‘vulnerable’ consumer the CFPB claims a mandate to safeguard from the unintended consequences of their regulations?

Errant public policies – ranging from zoning to finance – keep potentially millions more who would benefit from owning a greener, appealing and lower cost modern manufactured home from making that choice.

And therein lies are still more ironies; those who may favor ‘choice’ as a matter of principle, are limiting it in practice. Those who say that consumers need protection are keeping consumers from getting the information they need to make informed choices.

The industry continues to pursue HR 1779 and S. 1828 – The Preserving Access to Manufactured Housing Act – precisely to fix what so far the CFPB has not yet agreed to do under their rule making authority.

The consequences of CFPB regulations keeps more manufactured home loans from being made by lenders, community owners or private investors. Doesn’t this in turn cost the U.S. Treasury billions of dollars in housing subsidies that go toward rentals, which could instead be used to buy manufactured homes and create good jobs?

...I stepped up because this is a common sense issue. The government’s overreach and bad regulations here are hurting jobs and families. Something has to be done to stop that, and H.R. 1779 is just one way we can help maintain the quality of life for Americans across the country…”

- Stephen Fincher – Congressman and HR 1779 Sponsor.Cordray said it himself: “Manufactured housing is a critical source of affordable housing for some consumers, particularly those who are older, live in a rural area, or have less income and wealth.”

Why should Realtors ® be allowed to communicate information that MH Professionals are not? Why do policies allow non-MH lenders – or zoning officials – to discriminate against MH, when the result harms affordability in the housing market?

Modern manufactured homes can be used in municipal, suburban or rural settings. Photo

from CityScapes at the Mills of Carthage, courtesy of ManufacturedHomeLivingNews.com

With incomes down for the vast majority of Americans, manufactured housing could be the solution for the growing affordable housing crisis which exists in many U.S. markets. Will the CFPB and other public officials modify their course?

Or will a new Congress have to take this issue up again after the mid-term elections? Time will soon tell. What we know is that MH has been on a steady rebound since 2009, and many believe the industry could climb back to historic levels and beyond, given the right regulatory climate. ##