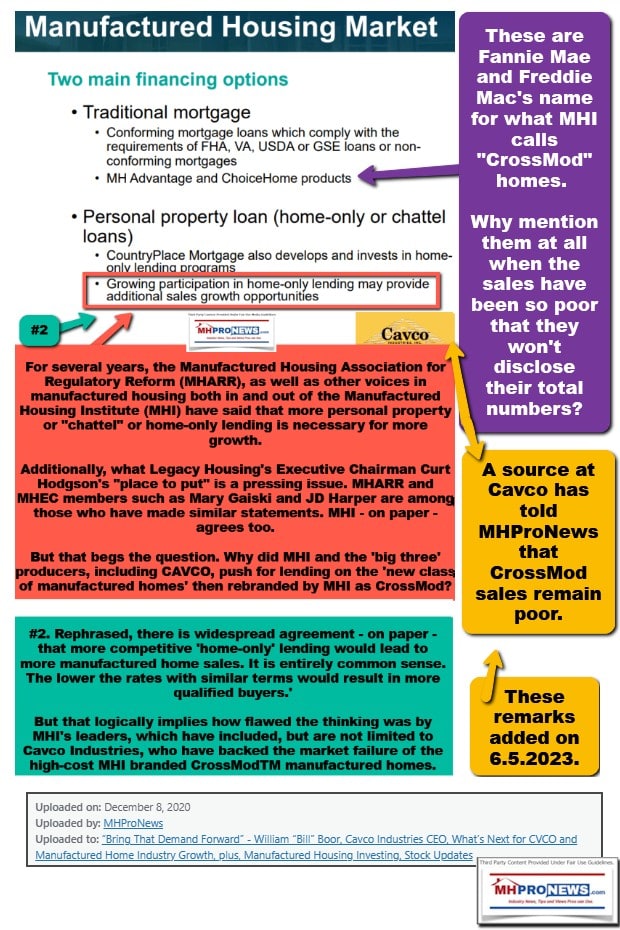

There is a mix of good news and troubling news that has emerged from Skyline Champion’s (SKY) earnings call and related ‘official’ corporate information. Several remarks in the following earnings call transcript for Skyline Champion’s most recent quarterly results ought to be a good reason to look more carefully at other statements and claims made by that firm and/or other organizations in manufactured housing. For instance. The Manufactured Housing Institute (MHI), where Skyline Champion holds a seat on their board of directors, is still pushing their arguably failed CrossModTM homes project. With CrossMods in mind, Skyline Champion made several references during their earnings call to the point that smaller homes with few options have been in vogue in 2023. That trend towards smaller and fewer optioned homes is so significant, that SKY noted that their average selling price (ASP) has been falling as a result of that and lower supplies costs. Despite that trend toward smaller and less costly homes that Skyline Champion admits, neither they nor MHI leaders, have yet to ‘kill’ the apparently market-failed CrossMods plan. Ironically, MHI’s new website notes in a post on their website dated 2.1.2023 that they’ve been promoting that ‘new class of manufactured home’ which they later rebranded as CrossMods since 2016.

From that MHI post are the following remarks.

Skipping ahead, that MHI post made the next claims about their ‘research.’

“Buyers also value the fact that manufactured homes are built in a streamlined indoor environment which means faster building times and less waste.”

“But when compiling the [research] results, we found that by adding some features and amenities to our homes it would create a new category of manufactured home that would appeal to an even larger group of potential homeowners. Features like pitched roofs, increased energy efficiency and garages or carports are things builders to our homes to give them widespread appeal not only to homebuyers but also to lenders and government officials.”

Those remarks and others like it were deemed odd by critics from the beginning. Sources inside MHI told MHProNews that at the MHI event where the ‘results’ of their ‘research’ was announced, several attendees walked out in apparent disgust and protest.

Manufactured Housing Institute “Walk Out,” “Cover Up,” and Shock at their Vegas Event

For well-informed manufactured home industry professionals, it was curious at best, or perhaps devious at worst, when MHI claimed several wonders about this supposed new class of manufactured homes. Despite their claims of “momentum,” when CrossMod® became a focus of much of MHI’s messaging, manufactured housing industry production began to decline. That is the opposite of what they claimed would be the result of this program. They said then and since that the manufactured home industry would grow. But the skeptics, which included the editorial stance of this publication, proved to be correct.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

That means that MHI’s geniuses and their well-paid consultants proved to be wrong.

Hold those thoughts as we return to MHI’s website pitch on 2.1.2023 for CrossMods.

These homes also bring another huge benefit to homebuyers – competitive financing. Both Fannie Mae and Freddie Mac have developed special financing programs available now to thousands of their lending partners. Manufactured homes can cost half as much per square foot as site-built homes they already hold a clear value advantage over all other forms of housing. And the financing available for the new class of manufactured homes makes them affordable for buyers of nearly every budget.”

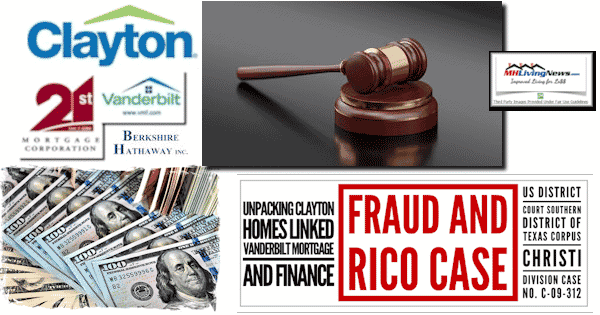

That is arguably an example of paltering at its finest. True, Fannie Mae and Freddie Mac developed special financing programs in conjunction with MHI. Those programs are available to Fannie and Freddie’s lending partners. But while there are thousands of such claimed partners, perhaps 100 (+/-) CrossMods total nationally have been built since 2016. The numbers are so low, that MHI routinely fails to mention them. Nor do Skyline Champion, Clayton Homes, or Cavco Industries reveal the total number of such CrossMods type homes they have built and sold at retail.

Said Bing AI on 11.28.2023: “I searched the web for information on the total number of CrossMod homes sold in the U.S. since the program was launched by the Manufactured Housing Institute, Clayton Homes, Skyline Champion, and Cavco Industries. Unfortunately, I could not find any reliable sources that provide this information.” As a follow up to that Q&A, MHProNews asked the following.

> “Who are the sources in the manufactured housing industry that have questioned the wisdom and effectiveness of the CrossMod program in the light of apparently poor results?”

So, when reading the information that follows below from Skyline Champion’s earnings call, noting that home prices and sizes are falling, one of several implications ought to be an absence of references to CrossMods. If their ‘research’ had been correct, wouldn’t they be singing the praises of CrossMods early and often?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Skyline Champion does spend considerable time bragging about their new captive finance program in this earnings call transcript. That captive lending program offers chattel or “home only” lending. Which ought to beg the question. Why didn’t MHI’s leaders push Fannie and Freddie to provide lower cost chattel lending programs for all manufactured homes? Why did MHI push for lending by Fannie and Freddie for an untested CrossMod®/”new class of manufactured homes “scheme, when MHI could and arguably should have been pressing for lower cost lending for all manufactured homes?

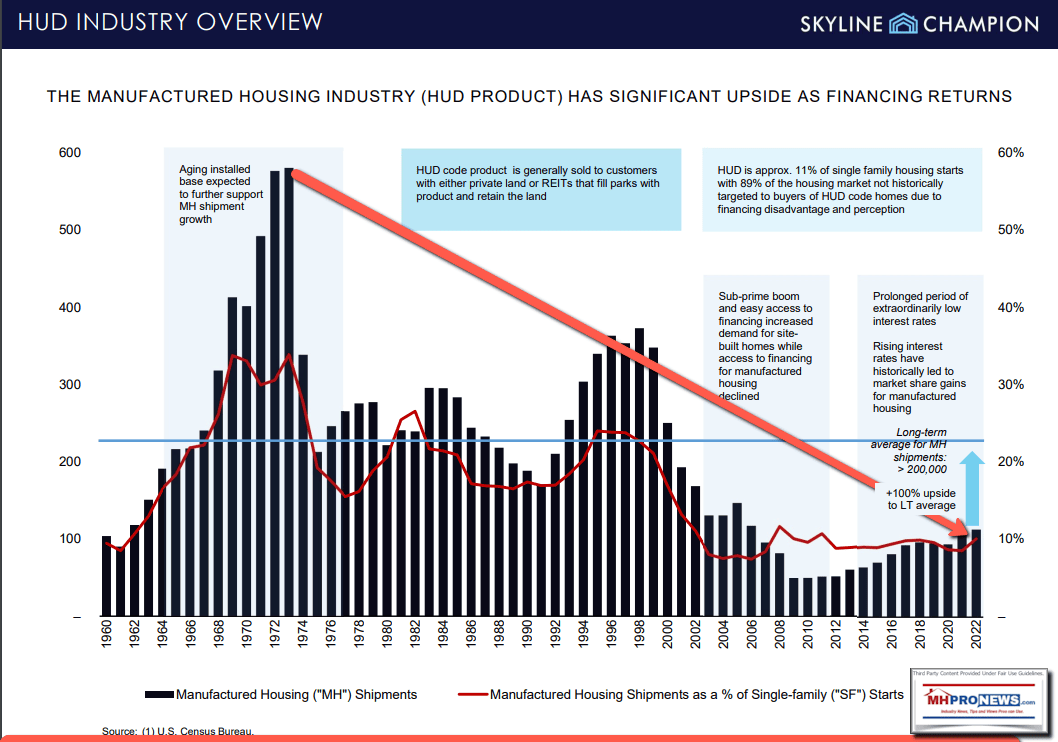

As one more curious – perhaps questionable – claim below is this one: “In addition, the need for affordable housing continues to grow each and every day, and we believe that the elevated cost of housing will drive more traditional site-built buyers to our homes.” While that sounds good, and those who want to see the manufactured housing industry grow back to what was true in the 20th century. But if that comment by Skyline Champion leadership still so were so in the 2020s, then why has manufactured housing sales and production declined more than conventional housing has?

Why hasn’t manufactured housing production risen as conventional housing has fallen?

What this editorial introduction reflects is that only when known facts are understood that questionable behavior and poor decisions made by several MHI-linked corporate and association staff leaders comes to light.

With that preface, Part I that follows has the transcript of the Skyline Champion earning’s call. Where [brackets] are shown, those edits are by MHProNews to correct what appeared to be errors. Highlighting in what follows was also added by MHProNews.

Part I

Skyline Champion Corporation (NYSE:SKY) Q2 2024 Earnings Call Transcript

November 6, 2023

Skyline Champion Corporation (NYSE:SKY) Q2 2024 Earnings Call Transcript November 1, 2023

Operator: Good morning, and welcome to Skyline Champion Corporation Second Quarter Fiscal 2024 Earnings Call. The company issued an earnings press release yesterday after the close. I would like to remind everyone that today’s press release and statements made during this call include forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission. Additionally, during today’s call, the company will discuss non-GAAP measures, which it believes can be useful in evaluating its performance.

A reconciliation of these measures can be found in the earnings release. I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost: Thank you for joining our earnings call and good morning, everyone. I am pleased to be joined on this call by Laurie Hough, EVP and CFO. Today, I will briefly talk about our second quarter highlights and then provide an update on activities so far in our third quarter and conclude with our thoughts on the balance of the year. We saw healthy demand from end consumers through our captive and independent retail channels. Community REIT channel saw continued as expected through the September quarter as our [REIT] partners worked through their backlog of existing new home inventory before placing new orders. This pause in the community ordering, combined with the absence of FEMA related sales that were in the second quarter of last year drove our year-over-year declines in both production and revenue.

Backlog as of September 30th was $258 million compared to $260 million at the end of the June quarter as sequential quarterly unit increases were offset by decreases in price. Average lead times of 8 weeks have normalized within our local range of 4 to 12 weeks and are consistent with lead times at the end of the first quarter. Order volume during the quarter increased again sequentially, and we are seeing the expected decrease in home prices as consumers shift to smaller homes or homes with fewer features and options given the current interest rate environment.

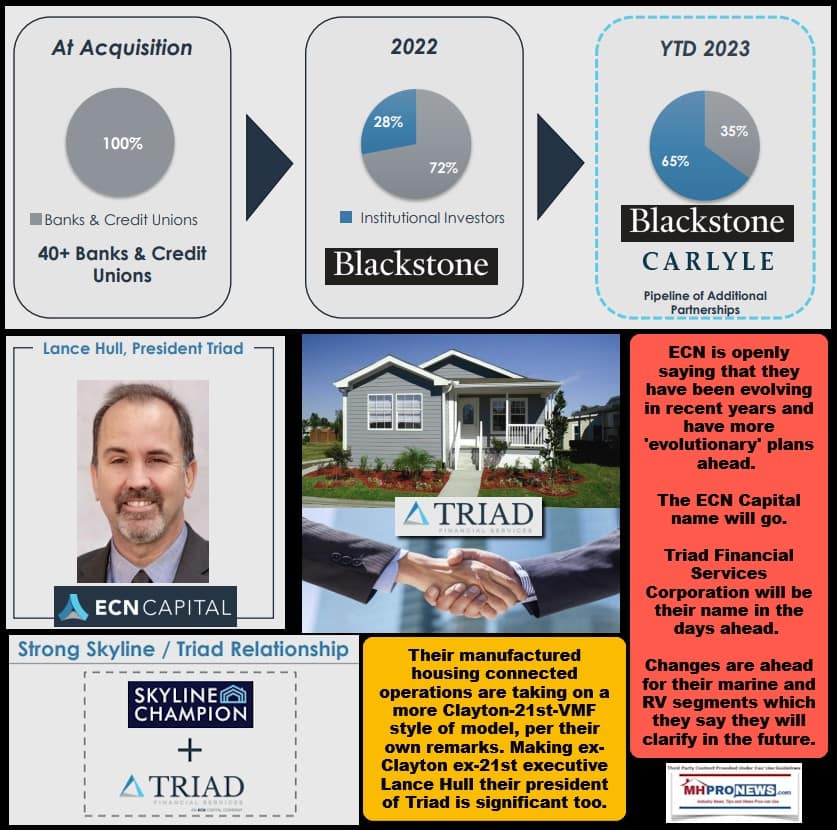

Shifting to some of our strategic actions we have taken recently, on September 26th, we closed our investment in ECN Capital and the establishment of our new captive finance company, Champion Financing.

We believe that the formation of a captive finance company will unlock home volume growth and bring value for our key stakeholders by providing broader and more attractive financing options and services to our customers. It will enable us to provide a comprehensive home buying solution while becoming more deeply connected with our channel partner customers and the end consumers who purchase our homes. The investment aligns with our longer term strategic view on offering digital configuration and selling to homebuyers. As we continue to ramp up Champion Financing, we believe the benefits will create a deeper connection with our dealers and end consumers. As we drive more volume to ECN, which will help to increase the diversity of capital sources that will accelerate a growth of the industry overall.

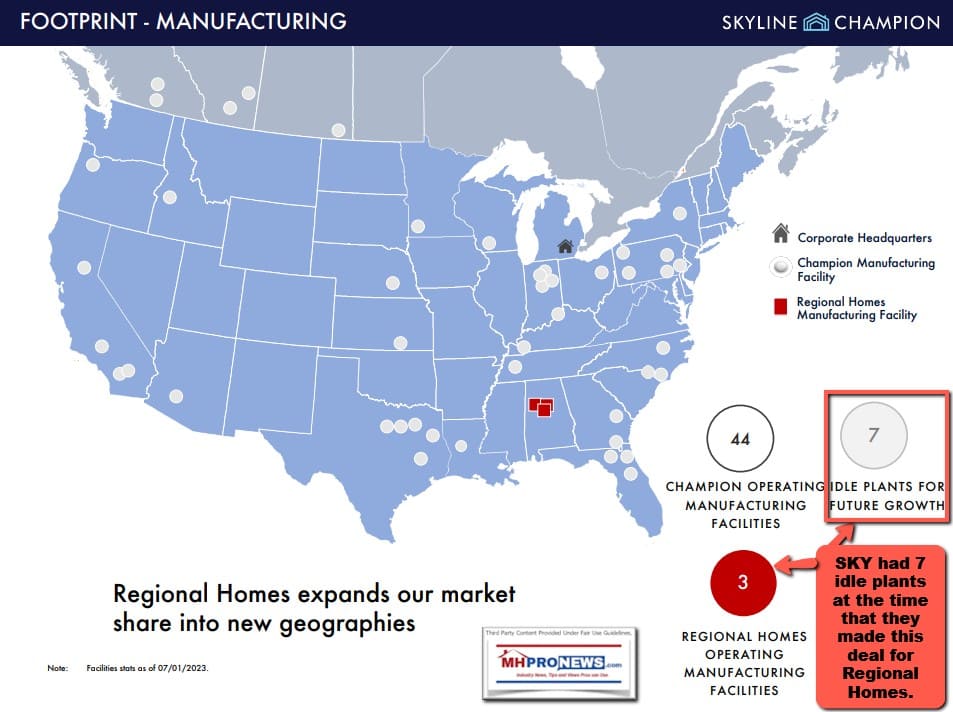

Additionally in October, we closed on the acquisition of Regional Homes, the fourth largest HUD manufacturer in the United States. The largest independent retailer and the company we have long admired. We are confident that the addition of Regional Homes to the Skyline Champion platform will allow us to accelerate profitable growth through the expansion of our retail and manufacturing distribution across the Southeastern United States. Regional Homes has a customer centric selling approach and is dedicated to providing an exceptional home buying experience to its customers, which directly aligns with Skyline Champions core value and our strategic initiative to enhance customer buying experience. In coordination with the closing of the acquisition, I am excited to welcome Heath Jenkins to the Skyline Champion Leadership Team as he will serve as president of our captive retail operations.

Heath brings years of industry retail experience and strong leadership capabilities, but most importantly exhibits an unwavering commitment with the customer first. Altogether, these investments represent an exciting opportunity as we strengthen our efforts to support the long term growth and solidify Skyline Champion’s market positioning as a leading provider of attainable housing solutions, for which the market is in tremendous need of today. Moving to the third quarter outlook. Tremendous Needs’ We continue to see stronger order rates from our retail and builder developer channels and while some REIT customers have returned to the market, as Tremendous Needs’ others are continuing to destock as we move into our normally seasonally slower period. We expect the third quarter revenue to be up mid to high single digits as a result.

We have seen orders strengthen five quarters in a row, by the growing need from consumer for affordable housing. We anticipate this need for housing to be longer in duration than we initially anticipated due to recent indications from the Federal Reserve. Additionally, this need is driving more regulatory tailwinds for our products that give us increase in confidence in the long term growth potential of our housing solution. With our long term strategic investments into retail, financing, digital, and automation, we are adding value and enhancing the buying experience with the end consumer and our channel partners. I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough: Thanks Mark and good morning, everyone. I’ll begin by reviewing our financial results for the second quarter followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectations. During the second quarter, net sales decreased 42% to $464 million compared to the same quarter last year, in which we recognized $118 million in FEMA unit sales. The decrease in net sales reflect a 15% year-over-year decline in average selling price per US home due to FEMA unit sales last year, which carry a higher ASP than our core product due to the complexity of sales. In addition, our core product ASP declined due to product mix and the decrease in material surcharges. During the quarter we sold 4842 homes in the US compared to 7274 homes in the prior year period.

US home volume was down year over year due to the absence of FEMA related sales and reduced production schedules to align with order rates. On a sequential basis, US factory built housing revenue was in line with the first quarter consistent with expectations that demand would remain relatively flat. An increase in the number of homes sold was partially offset by a decrease in the average selling price per home as core customers opt for smaller and less optioned homes, in an effort to maintain affordable monthly payments in the current interest rate environment. Capacity utilization decreased to 53% compared to 56% in the sequential first quarter of fiscal 2024. Capacity utilization is being adversely impacted by newly opened plants and a rightsizing of production rates at certain plants that serve end markets in which current order trends remain softer.

Canadian revenue decreased 25% to $29 million compared to the second quarter last year, primarily due to a 23% decline in the number of homes sold, driven by slowing demand. The average home selling price in Canada decreased to a $126,100 compared to a $129,400 in the prior year period, primarily due to the fluctuation in the translation of the Canadian Dollar to the US dollar for the year-over-year period. Consolidated gross profit decreased 58% to a $116 million in the second quarter and gross margins contracted by 890 basis points versus the prior year quarter. On a sequential basis, we saw gross margin declined 280 basis points.

Our US housing segment gross margins were 24.5% of segment net sales, down 950 basis points from the same quarter last year, primarily due to higher margin seen in unit sales in the prior year quarter as well as lower core product sales volume and a mix shift to homes with less features and options, allowing the homeowner to hit monthly payment price point given higher interest rates.

Gross margins were also negatively impacted by lower production rates as we are choosing to operate plants at lower run rates in order to be prepared to quickly ramp upon the return to normal order volume. SG&A in the second quarter decreased $19 million to $64 million primarily due to lower incentive compensation expense on reduced sales activity. Net income for the second quarter decreased 68% to $46 million or $0.79 per diluted share compared to net income of a $144 million or earnings of $2.51 per diluted share during the same period last year. The decrease in EPS was driven by the decline in sales and reduced operating leverage on lower volume. Diluted EPS for this quarter includes approximately $0.03 of transaction related costs incurred for the acquisition of Regional Homes.

The company’s effective tax rate for the quarter was 24.5% versus an effective tax rate of 25.0% for the year ago period. Adjusted EBITDA for the quarter was $59 million compared to $197 million in the prior year period. Adjusted EBITDA margin of 12.7% compared to 24.4% in the prior year period, reflects the return to more normal profitability levels. In the near term, we remain focused on maintaining efficient production lines as channel conditions improve and order activity returns to a more regular cadence. The structural improvements and investments made in our business have strengthened our operational capabilities, protecting profitability in periods of lower output. That said, we reiterate our expectation that the mix shift by customers looking to maintain affordable monthly payments in the current interest rate environment will continue for the remainder of fiscal 2024.

We expect margins to compress further in the sequential third and fourth quarters due to product mix shifts newly added production capacity continuing to ramp and the purchase accounting implications of the Regional Homes acquisition. As of September 30, 2023, we had $701 million of cash and cash equivalents and long term borrowings of $12 million with no maturities until 2029. We generated $54 million of operating cash flows for the quarter compared to $231 million for the prior year period. The decrease in operating cash flows is primarily due to lower net income and working capital impact of producing FEMA units in the prior year. During the quarter, we allocated $143 million of the capital for the strategic purchase of common and preferred shares of ECN Capital.

Subsequent to quarter end, we used $318 million of cash to purchase Regional Homes. In addition, we assumed $93 million of debt primarily related to inventory floor plan liabilities. We remain focused on executing on our operational initiatives and given our favorable liquidity position plan to utilize our cash to reinvest in the business and for opportunities that support strategic long term growth.

Since closing on the ECN investment, we have been working to develop the business plan for the strategic partnership with Triad financial services, including the roll out of Champion Financing branded floor plan programs for our retail and community channel partners as well as tailored retail loan programs for our retail network. We are targeting launching these programs in January 2024.

As a reminder, the partnership is an asset white structure, leveraging Triad’s existing origination and servicing infrastructure and ECM’s funding capabilities, which include relationships with community banks and leading institutional investors with no loan risk on the Skyline Champion balance sheet. We will be reporting the impact of the ECN common stock investment and the results of the captive financing partnership on a quarterly basis. We began the integration of Regional Homes upon closing of the transaction in mid-October. The teams have been meeting to share best practices and to begin to capture synergies. As a reminder, we anticipate synergy capture of $10 million to $15 million over the next two years, including manufacturing procurement synergies leveraging our national footprint and operational improvements from sharing of best practices across production and sales.

The regional balance sheet including retail finished goods inventory, will be revalued to its fair value and will negatively impact the company’s consolidated gross margin in the next several quarters as those homes are retail sold. In addition, SG&A will increase for the amortization of intangible assets generated from the acquisition. I will now turn the call back to Mark for some closing remarks.

Mark Yost: Thanks Laurie. As we manage through the rebalancing of our channels, we believe Skyline Champion is well positioned due to our affordable price points, strategic positioning, and our core initiatives. The long term outlook for demand is supported by the channel opportunities with community REITs, manufactured rent, and builder developer growth as well as helping our retail partners adapt changes in consumer demographics. In addition, the need for affordable housing continues to grow each and every day, and we believe that the elevated cost of housing will drive more traditional site-built buyers to our homes. Before we open the lines for Q&A, I want to take a moment to thank our people. The entire Skyline Champion team, as our consistently strong performance is a result of the amazing things they make happen each and every day. So with that, operator, you may now open the lines for Q&A.

Operator: Thank you. [Operator Instructions]. Our first question is coming comes from Greg Palm with Craig-Hallum Capital Group. Please proceed with your question.

Greg Palm: Yes. Good morning. Thanks for taking the questions. I wanted to start with gross margin. It sounds like in the quarter, the maybe the weaker than expected result, it was more of a function of some of these plant operating costs versus maybe increased competition or discounting. So I just wanted to make sure that was right? And then just sort of going forward is the thought process that you’re maybe keeping more employees on or keeping more shifts, in preparation for that returner of demand. Is that why one of the reasons why gross margin is going to maybe stay a little bit subdued here in the near term?

Laurie Hough: Yes, Greg, I think that you summed it up pretty well. We are definitely seeing in addition to the things that you mentioned, a product that product mix shift that we were anticipating but to a greater degree as well. So yeah.

Greg Palm: And just in terms of maybe quantifying a little bit more relative to this previous quarter, what kind of compression should we expect over the next quarter or two?

Laurie Hough: Yes. For the next few quarters, we’re definitely it’s going to be there’s a lot of moving parts. So we’re going to continue to see the product mix shift, with the consumer trying to reach a more affordable monthly payment with interest rates, where they are today as well as the ramping plans and then the impact of the Regional purchase accounting on gross margin. So we are expecting probably around 200 basis points.

Greg Palm: And the purchase accounting was kind of 40 to 60 basis points correct?

Laurie Hough: Yes, I did mention that last quarter, we are still working through all the numbers based on the closing balance sheet.

Greg Palm: Yep. Okay. And then I don’t know if you can maybe talk a little bit more about Champion Financing and what that looks like over the next one or two years, I know ECN, the partner here, they have publicly stated the expectation of that JV contributing $40 million of pretax income per partner in calendar 2025. I think maybe they said at least $40 million if I remember right. Is that something you want to bless as well? And if that’s the case, just kind of curious what that ramp might look like over the next couple of years?

Mark Yost: Yes, Greg. I think the ramp is out there. I think ECN mentioned 12 to 24 for their 50%. So I think that’s where you’re looking at that piece for that. The JVs obviously in a great position. We are very excited about that, especially given the banking conditions that we are seeing today. I think the fact that ECN has capital flow partners from Blackstone and Carlyle is tremendous in today’s market. We have already seen two or three banks regional and community banks start to exit out of the lending space for our customers and as there is further pressure and we anticipate some further pressure on regional and community banks, making sure our customers have access to liquidity is very important for our dealers and obviously our partners and builder developers as a matter of fact.

So I think having that partnership with ECN is vital and especially with the strong relationships they have with Blackstone and Carlyle, who committed an additional $1.3 billion worth of capital. So infusing liquidity into the market when community and regional banks. So that really is a strong leg forward to us. So as Laurie mentioned, we are getting things set up right now. We anticipate we will have the systems and other things ready to go by January time period and so we will really start to ramp it in the calendar year of 2024 and so I think everything’s on track for that and the teams are working very well together.

Greg Palm: Yes, makes sense. And just to be clear, I was talking calendar 2025. I think they mentioned 12 to 24 in calendar 2024. Is that right?

Mark Yost: Yeah, that’s correct.

Greg Palm: Okay. Makes sense. Okay. I will leave it there. Thanks.

Mark Yost: Thanks, Greg.

Operator: Thank you. Our next question coming from Daniel Moore with CJS Securities. Please proceed with your question.

Daniel Moore: Yes, thanks. Good morning, Mark. Good morning, Lori. First off, just wanted to clarify comments, Mark. I think you said fiscal Q3 revenue up mid-to-high single digit sequentially. Is that correct? And if so, is that organically or inclusive of [R]egional?

Mark Yost: That’s inclusive of [R]egional. Dan in that number. Yeah, we expect somewhere at least in that range mid to high single digits at least for the quarter. Sequentially.

Daniel Moore: Got it. And it sounds like some communities returning, some still destocking. Are there any discernible differences be it [R]egional or other that you can identify or is it more community versus community by community?

Mark Yost: It’s really more community by community. We have seen actually a handful of communities return. They have been starting to order and get back on a normal cadence. Others are still in that destocking process. So it’s I don’t want to say it’s fifty-fifty, Dan, but it’s definitely, there’s a split between the communities that are starting to move and others are still kind of in that pause mode.

Daniel Moore: Got it. And what can you say just in terms of longer term progress that the Genesis Solution is making, we focus on those top 100 builders, but even beyond that, in terms of sort of converting to your solution, I recognize it takes years, not quarters, but what’s the sort of momentum or cadence of those dialogues?

Mark Yost: The momentum is, it is phenomenal, actually. I think now that interest rates have stayed up a little bit in in their forecasted to stay up a little longer, according to the Fed. It’s really causing builders to take a look at what that outlook is. Right now, a majority of builders are buying down loans to really drive their volumes and I look at our quarter we had order growth of 20%sequentially and orders year-over-year grew by 250% and that’s with no buy downs, no real incentives to drive volumes. So I think the affordable price point is there and with their cost to cap it for small to [mid-tier] builders kind of ranging in that 14% range for development that’s a huge incentive for them to switch to our solutions to where we can save them 9 to 12 months of cost capital time. So it’s tremendous.

So I would say the momentum is definitely picking up, especially now that people are looking at the fact that buy downs can’t last forever and the Fed’s extending longer. I think that really is a motivation for builders look at an alternative because they can’t do it otherwise.

Daniel Moore: Got it. Helpful. And last for me, just circling back to the gross margin, I appreciate the color and commentary. You know, 200 bps, kind of back down to the 23% range, maybe a little conservative, we’ll see. Just talk, Laurie, about, when we get through the, purchase accounting and get to maybe back to 60% to 65% utilization, where you see margins leveling off even at this new, let’s say, if it’s a new norm for a longer period time in terms of lower price points, mix, etc., where you sort of see us leveling off over the next, you know, 4 to 8 quarters?

Laurie Hough: Yes, Dan, thanks for the question. We still think that our long term structural margin targets are in that mid 20%. So I do believe that we’re going to get back to the targets that we talked about, historically, it’s just going to be bumpy for the next few quarters.

Daniel Moore: Alright, very helpful. I’ll jump back with any follow ups. Thanks.

Operator: Thank you. Our next question comes from Phil Ng with Jefferies. Please go ahead. Please proceed with your question.

Phil Ng: Hey, Mark. You sound pretty excited about this direct to builder channel. Certainly, you have some excess capacity right now with a softer demand backdrop. What’s your ability to kind of pivot to serve that a little more fuller. Is there anything you got to do on the labor front or the facilities?

Mark Yost: Thanks for the question Phil. No, that part of the reason we’re running this quarter, we ran at 53% capacity utilization. Part of the reason we’re choosing to run at kind of less than optimal capacity utilization is really to make sure we have that available capacity to enter that channel. Right now is that pressure point and I think a lot of builders have been buying down rates doing that in view that it would be a short term, they just need to do it for a few quarters, to get through to keep their sales up. I think now that it’s more of a marathon, less than a sprint of rate buy downs, I think they’re starting to reconsider. So I think we’ve got this infrastructure in place to move into that channel very quickly, which is why I think the pipeline is shaping up the way it is for us.

Phil Ng: Okay. That’s helpful. And then how do you see this ECN integration rolling out and progressing call in the next 6 to 12 months. Any big mile marks you want to achieve, ahead of spring selling season. And then you called out how having this partnership now gives you better access liquidity, especially in a environment where credit’s a little tougher. Does it help on the rate side of things as well? Do your consumers get a more competitive rate now versus when you didn’t have this partnership, previously?

Mark Yost: Yeah, Phil. We haven’t done anything to drive rates in a different way. There are some benefits, I think, to our partners in terms of rate that we can look at, especially with our turnkey solutions that we’re offering, Phil. I think, if they’re buying from us, if they’re using our construction services, they’re using our floor plan and other things, I think overall, we can look at it from a DVD or a volume discount basis that will definitely help them in some ways. I really think the benefit for them is going to be a few fold; 1. It’s access to liquidity. 2.It is the, the speed that we’re going to deliver. So we’re working hand in hand with EC[N] in the Champion Financing program really to deliver great customer experience, faster turnaround times, better offerings in terms of what we can deliver to them and then I think the third piece is really just like I said, a suite of services to where they have one partner they can deal with for multiple needs and obviously competitive rates to the end consumer is really what it’s all about.

Phil Ng: Super. And just one last one for me. How do you kind of see your sales cadence kind of wrapping up on fourth quarter, you talked about 3Q. It’s just kind of a noisy year, so it would be helpful to kind of get your perspective on how the shape of the air wraps up? and do you expect pricing and mix to stabilize here, or there could be some further degradation in the back half?

Mark Yost: Yeah I think there is going to be a little bit of noise. Right? I mean, we are going to have some choppiness as we integrate Regional they have a different price point and other things that we’ll have to bring in here, but I would see revenue up sequentially and then continue to grow into spring, as the market ramps and some of the community customers continue to come back. I really think it’s positioned very well. ASPs are going to be a little bit noisy, to be honest, just because with the mix of retail versus manufacturing, you’re going to see kind of volatility in in rates just in terms of all a bit of noise, which is not really price deterioration or increases. It will be more mix oriented as Laurie mentioned earlier.

Phil Ng: And then Regional mix is down or up? Or I just want to make sure, you made some integrated Regional. Just want to make sure I flush that out.

Laurie Hough: Yeah. So Regional is seeing, the mix shift that we are seeing more broadly across all of the plants. So where last year they had higher prices, their prices are coming down as well just due to the mix shift in the monthly payment price point that the customer is driving. So we do expect ASPs to come down just generally sequentially from the second quarter to third quarter and probably stay in that range for the next few quarters, as we work through that leveling of mix.

Phil Ng: Okay thanks a lot.

Operator: Thank you. Our next question comes from Mike Dahl with RBC Capital Markets. Please proceed with your question.

Q – ChristopherKalata: Hi. It’s actually ChristopherKalataon for Mike. Just to follow-up on the Regional, discussion, now that the deal is closed, is there any more specifics you could provide on terms of expected unit contribution in next quarter and into 4Q, just given the additional color you have now?

Mark Yost: Chris, thank you for the question. We don’t break out Regional separately in terms of the guidance I think they are wrapped up in our overall statement of how we see the third quarter shaping up.

ChristopherKalata: Got it. Understood and then just maybe shifting towards the many changes in your core customer dynamics following the move up higher in rates. Have you seen a change and order trends, in the last month or two, how financing environment has shifted in response to the move higher, have spreads expanded ad any color you could provide on the health of the core and which consumer today, relative to a few weeks back and the financing changes?

Mark Yost: Yes. Thank you, Chris. I think I’m actually fairly confident in the consumer right now. You know, we have seen, like I said, one thing I look at very directly is the fact that our unit volumes and our order rates have picked up 20% sequentially and like I said earlier, I think 250% year over year, and that’s without incentives. So think that we’re seeing that drive to affordability. We are seeing customers look for a better alternative and we don’t really have to drive huge financial incentives to capture that customer base. So I think that outlook is shaping up very well for us in terms of that. Our customers right now are seeing probably, we’re seeing rates probably the best rates we’re seeing right now for channel are about 8.5%.

I would say the average is probably closer to 8% to 9%. If they’re poor credit, they are in the 10% to 11.5%. So, but it’s a great spread right now. In some cases, 50 basis points to 100 basis points we are seeing for channels, which is very competitive in the marketplace today. So it’s a great value for our consumers.

ChristopherKalata: That’s it. Thanks for taking the questions.

Operator: Thank you. We do have a follow-up question coming from the line of Greg Palm with Craig-Hallum Capital Group. Please proceed with your question.

Greg Palm: Yeah. Thanks for taking the follow-up. Can apart from the, excluding this purchase accounting, will Regional’s gross margins be accretive or are they kind of in line with kind of that mid-twenty’s gross margin. I forget whether you have talked about that before, but, maybe you can remind us?

Laurie Hough: Yes, Greg, they’re a little bit lower. So we’ve got to work on bringing in the synergy capture over the next couple of years to bring that up.

Greg Palm: Okay. Got it. So maybe that’s part of the mix shift as well. And then just thinking longer term, I know Laurie, you mentioned kind of getting back to mid-20s, but why wouldn’t it be higher, whether it’s in that kind of 26% to 27% range that that you were talking about previously or even somewhere in the higher 20s, just under more normal capacity utilization levels. You mentioned the synergy capture. It just feels like, but I just wanted to maybe flush that out a little bit more if I could?

Laurie Hough: Yes, Greg, the 26% to 27% is still certainly doable. At normal capacity levels and obviously as volumes increase, there’s some upside potential there too. So we see it in that range, 25 to 27, whatever.

Greg Palm: Okay. So it doesn’t sound like anything sort of changed in terms of getting back to that lever or long term versus what we were thinking last quarter?

Laurie Hough: Not from a long term perspective, no.

Greg Palm: Yeah. Okay. All right. Understood. Thanks for taking the follow ups.

Laurie Hough: Thanks.

Operator: Thank you. It appears we have no further questions at this so I’d like to pass the floor back over to Mr. Yost [for] any additional closing remarks.

Mark Yost: I would like to thank everyone for participating in today’s call. We appreciate the time and your continued interest. We look forward to updating you on our progress in our third quarter call. Thank you and have a great day.

Operator: Thank you. [Operator Closing Remarks]. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

This will be quite a different examination of Skyline Champion than was used with Cavco Industries in yesterday’s report, as detail-minded readers of both will detect.

In no particular order of importance, is the following. It may not seem related but consider what the Federal Housing Finance Agency (FHFA) said about the housing market in a new release on 11.28.2023.

U.S. House Prices Rise 5.5 Percent over the Last Year; Up 2.1 Percent from the Second Quarter

U.S. house prices rose 5.5 percent between the third quarter of 2022 and the third quarter of 2023, according to the Federal Housing Finance Agency (FHFA) House Price Index (FHFA HPI®). House prices were up 2.1 percent compared to the second quarter of 2023. FHFA’s seasonally adjusted monthly index for September was up 0.6 percent from August.

“U.S. house price growth continued to accelerate in the third quarter, appreciating more than in each of the previous four quarters,” said Dr. Anju Vajja, Principal Associate Director in FHFA’s Division of Research and Statistics. “House prices rose in the third quarter in all census divisions and are higher than one year ago, driven primarily by a low supply of homes for sale.”

Driven primarily by a low supply of homes for sale.

When someone who understands the manufactured housing industry examines the remarks from Skyline Champion above, several items issues could be raised beyond the financing and CrossMods topics noted in the preface. For instance.

Note how Genesis modulars are being ‘talked up’ by the folks at Skyline Champion? Perhaps this time it will be different. But this is not the first time that Genesis modulars were historically promoted by Champion.

Clearly, Champion was wrong – for whatever reasons – in their claims above.

More recently, Mark Yost said during a different earnings call: “We believe Skyline Champion can continue to outperform the broader housing industry due to our attractive price points, product offerings, enhanced production capabilities and future growth opportunities as more people become buyers of our homes.” Really? But in February of this year, Yost and other Skyline Champion brass sold MILLIONs of dollars’ worth of company stocks.

From the Skyline Champion (SKY) investor relations pitch deck for November 2023 are the following remarks. Note some similarities between SKY’s remarks and Cavco‘s?

HOMEOWNERSHIP

AFFORDABILITY

- Manufactured housing is the largest source of unsubsidized affordable housing in the U.S.1

- The average price per sq ft of factory-built homes is 50% less than that of site built 2

- Average cost of a new factory built HUD code home is $108,100 2 Average cost of site-built home is $365,904, excluding land2

- Price premium between the average new site-built home and manufactured home is ~$100k for similar features and amenities 2

The cited sources for the above are as follows.

1 Source: Consumer Finance Protection Bureau – Manufactured Housing Finance Report (May 2021)

2 Source: MHI 2022 Manufactured Housing Facts Industry Overview (August 2022)

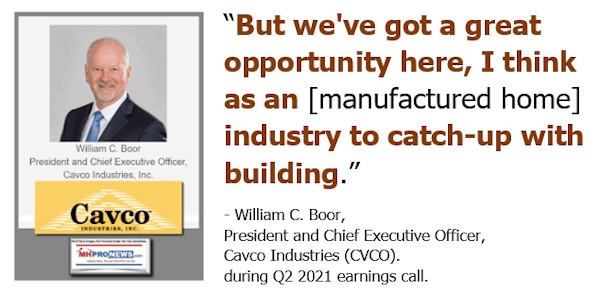

To be clear, MHProNews and MHLivingNews have editorially long ‘championed’ – pardon the pun – that philosophically, intellectually, and in terms of market potential, manufactured housing COULD catch and surpass conventional housing. The problem isn’t ‘is it possible?’ The correct answer should be, yes, of course it is possible for manufactured housing to “to outperform the broader housing industry due to our attractive price points, product offerings, enhanced production capabilities and future growth opportunities as more people become buyers of our homes.” The question is, why hasn’t Mark Yost or Cavco’s William “Bill” Boor taken the steps necessary to make their respective – and similar claims on that point move from potential to reality.

Note the similarity between Yost’s and Boor’s remarks to what Eric Belsky, per MHI, said about the manufactured housing industry’s potential over 2 decades ago.

But it isn’t only Belsky that reportedly made such observations.

Richard Genz, in a research paper for the Fannie Mae Foundation entitled “Why Advocates Need to Rethink Manufactured Housing,” listed pages of reasons why manufactured housing was doing remarkable well at that time, despite the fact that policy makers were turning a blind eye to what the manufactured housing market’s consumers were saying.

In a paper published in 2001, Genz said manufactured housing’s market share “Accounting for 30 percent of new homes nationwide…” “When the housing market speaks, advocates need to listen.” That is roughly 2 to 3 times the market share of manufactured housing then vs. what it has been in more recent years. Who says? Ironically, Skyline Champion.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Genz wrote: “When it comes to manufactured housing, the market is not just speaking, it is shouting. Yet the huge popularity of manufactured housing has

prompted only a shrug, and in some cases a cold shoulder, from those who promote housing opportunities…”

Genz chides not manufactured housing, but policy advocates, lenders, and public officials. “There is a palpable stigma attached to manufactured homes, dating

back to when workers towing trailers moved from city to city, chasing jobs and crowding into muddy, unsanitary trailer parks.” “However, these serious shortcomings are not inherent in the factory-built home itself. Rather, they are the product of laws, policy choices, and business practices that are selling millions of people short.”

“Housing advocates might find it surprising to walk through a couple of new homes at a dealer’s lot, keeping the monthly payment in mind and mentally comparing the local rental stock available for the same price. Interiors have good light. Insulation standards are solid. Floor plans have come a long way from the time when residents said that living in a mobile home was like living in a hallway,” stated Genz, who also cited insights from other third-party researchers.

Genz’s observations and references included the following – some 22 years ago.

- “Low- or moderate-income families living in a multifamily rental can achieve the privacy of a detached home much sooner with a manufactured home than with site-built alternatives.”

- “Consumer Reports says that “manufactured housing can last as long as site-built housing,” (“Manufactured Housing” 1998, 30)”

- “Marketing” “Fundamentally different marketing systems for manufactured housing and conventional housing affect how consumers think about the two kinds of shelter.” Doesn’t that still largely hold true two decades later?

- “…manufactured homes have been chosen by an average of 29 percent of new home buyers every year since 1980 (Manufactured Housing Institute 2001)” Note that MHI and corporate leaders are acting as if the 1980s and 1990s didn’t exist, when the market share of manufactured housing compared to single family conventional housing was almost 1 out of 3 (one new manufactured home for almost every 3 single family housing starts). While it was a notable exception, the following quote from Genz is noteworthy.

- “In North Carolina, manufactured housing accounted for fully 40 percent of new home starts during the 1990s (The Brookings Institution 2000).”

In several respects, these looks back into manufactured housing history and related research ought to be embarrassing for MHI and MHI linked corporate professionals. Perhaps that is why they don’t have these documents publicly available on their website?

Writing about financing options, Genz notes that the USDA Rural Development loan program said the following.

- “Despite its expertise in financing modest rural homes, the Rural Development Administration (RDA) has only a small role in financing manufactured housing. RDA’s nationwide manufactured housing loan originations in fiscal year 2000 amounted to just 487 loans (2.8 percent)…” While Genz called that contribution to the total manufactured home marketplace “a small role” that 487 loans in 2000 may well be some 5x (+/-) the total number of all CrossMods type homes sold in 7 years! Even by glancing at the history, often stunning insights may emerge.

- “Up to now, participation in the sector by Fannie Mae and Freddie Mac has been very small. In 1998, GSEs funded less than 15 percent of all loans on manufactured housing, compared with their 55 percent share of the home mortgage market overall (HUD 2000b).”

- “The challenge for housing advocates is to critically analyze the system and correct policies and practices that hurt low-income people.”

- “Citing the fact that a majority of buyers have held the same job for 5 to 10 years, a Freddie Mac economist notes that “except for lower incomes, the profile of manufactured home buyers seeking financing does not appear to differ greatly from site-built loan borrowers” (Bradley 1997, 4).”

Genz looked at abuses in the manufactured housing marketplace too. He wasn’t Pollyannish.

- As Consumer Reports puts it, “[S]hopping for a manufactured home can combine all of the headaches of buying an automobile with the complexities of any housing purchase” (“Manufactured Housing” 1998, 33). Buyers must figure the process out for themselves, since there is virtually no buyer education for manufactured home buyers like the hundreds of programs that have evolved for conventional home buyers over the past 10 years.” But in fairness, at that time, the internet was still fairly young. Genz also noted the following.

- “The balance of power in a mobile home park is with the landowner.”

- “Strict park rules can range from petty to draconian. In contrast to members of a conventional homeowners association, who set their own rules, homeowners in mobile home parks are powerless tenants when it comes to the land they occupy.”

But some of his insights pointed a finger at the mortgage giants and federal regulators.

- “As the regulator of GSEs, HUD is trying to stimulate secondary mortgage market funding for manufactured housing. Noting that 76 percent of manufactured housing loans were to low- and moderate-income borrowers in 1998 and that most homes are being placed on the home buyer’s land, HUD rejected the request by secondary market agencies to exclude this part of the market when calculating 2001–2003 affordability goals. The GSEs had argued that the manufactured housing market was “not available” to them, and that they were not “full participants” in it (HUD 2000b, 65090).”

- “Several other studies establish the simple fact that some manufactured homes increase in value, and some decline.” Since that time, the FHFA, Urban Institute, and LendingTree have said that manufactured housing is appreciating at about the same rate as conventional housing, and in several states, at a faster rate of increased value than conventional housing. Genz keenly observed the following.

- “This perception of manufactured housing [as a depreciating asset] contributes to a self-fulfilling prophecy about long-term value by discouraging maintenance, deterring legal conversion to real estate, and making long-term leases or permanent integration with the site uninteresting.” Genz concluded as follows.

- “Clearing up misperceptions about manufactured housing and addressing the problems of buyers, owners, and renters should be the first priority for advocates. On a separate front, it should be possible to incorporate the cost advantages of manufactured homes into nonprofit housing developments (Wallis 1991). If stereotypes can be overcome, the nonprofit development community could eventually help reinvent manufactured homes as quality, wealth-building, affordable housing.”

As with most anything human, Genz’s research had its pluses and minuses. For instance. Though the publication date says 2001, it fails to mention the Manufactured Housing Improvement Act of 2000 (MHIA), which was signed into law on 12.27.2000.

But granting the Genz research report’s shortcomings, it may nevertheless be as or more important in certain respects now than it was then. When Genz speaks about ‘advocates’ for manufactured housing, shouldn’t MHI be the prime advocate? From the new MHI website: “The Manufactured Housing Institute [MHI] is the only national trade organization representing all segments of the factory-built housing industry. We are your trusted partner, advocate and industry leader.” Oh, please. Seriously?

- How is it possible that a dozen years after Kevin Clayton said in a video interview that the manufactured housing industry (i.e.: meaning, MHI) was ready for an image and education campaign like the GoRVing campaigns for the Recreational Vehicle (RV) industry.

- How is it possible that some 17 years after MHI commissioned the Roper Report that manufactured housing is still not being nationally promoted?

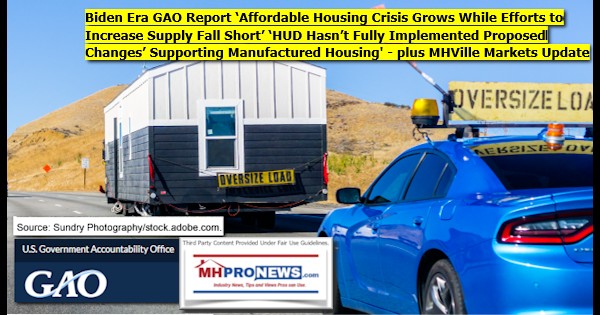

- How is it possible that over 20 years after Genz pointed his finger at Fannie Mae, Freddie Mac, and HUD for their failures in the manufactured housing financing market that FHA, and the Government Sponsored Enterprises (GSEs) of Fannie and Freddie are still foot dragging? It ought to be an embarrassment that the Government Accountability Office (GAO) recently tagged HUD/FHA for their failures in the manufactured home marketplace.

- If Skyline Champion’s Yost and Cavco Industries’ Boor aren’t aware of historic items like Genz and others, then the case can be made that they aren’t doing their jobs properly.

- If Yost and Boor are aware of these historic items, then they aren’t doing their jobs properly.

Why? Because the manufactured home industry is in several respects still suffering from the same constraints – in some cases, perhaps worse constraints – than it did when Genz published his research.

The nearly single-minded hunt for consolidation/M&A has arguably harmed investors, stakeholders, untold millions of renters, taxpayers and the economy at large. Who says? Ironically, Bill Boor’s IR pitch deck page posted below.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

that the industry ought to expect this current downturn because more expensive site-built housing is also in a downturn? MHI’s research and reasoning are arguably a classic example of PALTERING and the use of a RED HERRING logical fallacy. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Yost and Boor have sat or stood side-by-side in several meetings. They have both held board positions at the Manufactured Housing Institute (MHI).

Yost and Skyline Champion’s leadership have not hidden their focus on M&A (consolidation).

What has that focus brought Skyline Champion (SKY)? Production lines that are operating at under 60 percent utilization. Several idle plants.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

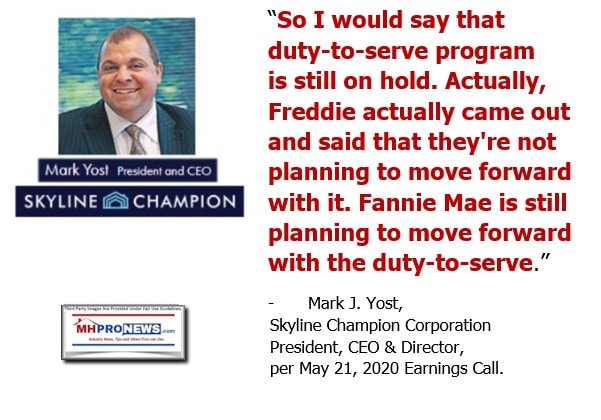

Yost’s reply to this inquiry about the Duty to Serve (DTS) a few years ago seems nonchalant.

It may be good for Yost’s brand that they have made a strategic deal with Triad Financial Services parent ECN Capital.

But the fact that they believe that it is good for Skyline Champion, and they noted that there are ripples in the banking/finance industry, could mean that they believe that another rough patch for manufactured home lending is ahead.

If so, in what sense did Skyline Champion (or for that matter, others on the MHI board of directors) live up their fiduciary duty to protect the interests of all MHI members?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

To tee up the issue, consider this Q&A with Bing AI.

> “Generally speaking, what is the fiduciary duty of nonprofit board members in a trade association? Are they supposed to represent only the interests of their own company’s brand, or are they supposed to represent the interests of all members of the trade organization?”