F.R. Jayar Daily has served as the Chief Operations Officer (COO) of American Homestar Corporation for years. The testimony he’s given to Congress referenced in the headline has certain common points to others from Manufactured Housing Institute (MHI) corporate leaders that have previously included Kevin Clayton and Thomas “Tom” Hodges, J.D., both with Berkshire Hathaway owned Clayton Homes. Daily’s comments will follow the following news item from Construction News Today, the leading part of today’s headline. Daily’s comments, which include seem to include some factually problematic statements, are largely okay. But they and the Construction News Today item beg the question, whose side is the Manufactured Housing Institute (MHI) on? This fact-packed report, analysis and commentary will ask that question. That will be followed by today’s MHVille (manufactured housing industry connected) stock market updates.

Starting with Construction News Today, which will be followed by Daily’s comments on behalf of MHI.

‘MHI Does Not Represent Entire Industry’ Manufactured Housing Assoc Slams Manufactured Housing Institute on Energy Rule

Manufactured Housing Association for Regulatory Reform (MHARR) Decries MHI “Lifeline” on Court-Rejected DOE MH Energy Rule for New Manufactured Homes

On 3.2.2022 a Manufactured Housing Institute email said: “MHI states that the [Department of Energy (DOE)} proposed rule raises a wide range of legal, policy, environmental, and implementation questions citing a recent court injunction blocking the [Biden] Administration from using the use of “Social Cost of Carbon” estimates in federal rulemaking.” But that same MHI email provided DOE “a lifeline” said the Manufactured Housing Association for Regulatory Reform (MHARR) by offering to rewrite DOE’s apparently failed proposal. Per MHI, “MHI and the industry again reiterated its commitment to supporting energy efficiency conservation efforts and other reasonable environmental protection initiatives.”

The Texas Manufactured Housing Association’s (TMHA) VP Rob Ripperda said, “The factory-built model only works when you can source your materials [for manufactured homes] at scale. If a standard product is no longer allowed because of a regulatory change and the mandated substitute isn’t available at the necessary quantities, you’ve got the makings of a slowdown.”

MHARR Files Comments Clarifying MHI’S Presumptive Statement Regarding Proposed DOE Energy Standards

In relevant part, “Appendix I” to MHI’s comments states that “MHI and the industry…” developed an “alternative manufactured housing energy standard” as set forth in the Appendix, “to provide a concrete example showing how a judicious increase in energy requirements can result in substantially improved energy efficiency and greater affordability.” (Emphasis added).

MHARR’s supplemental comments strongly object to any characterization of the MHI proposal as an “industry” initiative. First, MHI does not represent the entire manufactured housing “industry.” Any characterization of the MHI “alternative” standards proposal as an “industry” proposal, therefore, is false and misleading. Second, as MHARR’s initial comments in the Draft EIS rulemaking and in the preceding DOE manufactured housing energy standards rulemaking show, mainstream, modern HUD Code manufactured homes are already energy efficient, with average monthly energy costs below those of site-built homes for all tracked energy types. There is no basis, rationale, or need, accordingly, for an “increase” in manufactured housing energy requirements — “judicious” or otherwise – and no representative of any part of the industry should state, suggest, or imply otherwise, particularly when DOE’s energy proposal fails to meet the statutory criteria of both the Energy Independence and Security Act of 2007 or the Manufactured Housing Improvement Act of 2000.

MHARR acted immediately to disavow and correct this presumptuous misstatement insofar as it represents yet another in a string of strategic errors (including, but not limited to, one-sided procedural and substantive “compromises”) that have enabled DOE regulators to sidestep full compliance with EISA, the 2000 reform law and other applicable law, while repeatedly proposing draconian and destructive standards that would undermine manufactured housing as the preeminent source of non-subsidized, affordable homeownership for lower and moderate-income American families.

Particularly in light of the recent decision in Louisiana v. Biden [Case#2:21-CV-01074-W.D.La.Feb.11.2022], imposing a nationwide injunction against the DOE rule and others which rely in part on federal estimates of the “Social Cost of Carbon,” now is not the time to throw an undeserved “lifeline” to DOE regulators.

MHARR will continue to carefully monitor ongoing activity with respect to both the DOE manufactured housing energy rule and the related pending Social Cost of Carbon litigation, and will provide further updates as warranted. These matters will also be addressed in detail at the upcoming MHARR Board of Directors meeting.

cc: Other Interested HUD Code Manufactured Housing Industry Members and Consumer Groups ##

Attached MHARR comments dated 3.4.2022.

U.S. Department of Energy

Office of Energy Efficiency and Renewable Energy Building Technologies Program 1000 Independence Avenue, S.W.

Washington, D.C. 20585

Re: Draft Environmental Impact Statement for Proposed Energy

Conservation Standards for Manufactured Housing (DOE/EIS 0550)

Dear Sir or Madam:

The Manufactured Housing Association for Regulatory Reform (MHARR) filled comments in this docket on February 25, 2022 opposing the Draft Environmental Impact Statement (EIS) published by the U.S. Department of Energy (DOE) on January 14, 2022. MHARR also filed comments on October 25, 2021 and November 22, 2021 opposing the proposed manufactured housing energy standards published by DOE on August 26, 2021 and modified on October 26, 2021.

On February 28, 2022, another manufactured housing industry group, the Manufactured Housing Institute (MHI), filed comments in the present docket. Among other things, those comments include and incorporate a document captioned “Appendix I – Industry’s Proposal for Energy Efficiency Standards for Manufactured Housing.” In part, that document states: “MHI and the industry’s goal in developing this alternative manufactured housing energy standard was to provide a concrete example showing how a judicious increase in energy requirements can result in substantially improved energy efficiency and greater affordability.”

We are writing to ensure that the administrative record is abundantly clear that:

- MHI does not represent the entire manufactured housing industry;

- MHARR was not consulted with respect to the aforesaid misnamed “industry” proposal;

- MHARR does not support or endorse the aforesaid misnamed “industry” proposal and would not support its adoption or consideration; and

- MHARR, as set forth in its previously-filed comments, would not accept or support any proposed manufactured housing “energy conservation” rule that is developed outside of the Manufactured Housing Consensus Committee process prescribed by the Manufactured Housing Improvement Act of 2000.

We ask that this communication be included in the administrative record of the aforesaid proceeding in order to prevent any misrepresentation or misunderstanding regarding alleged “industry” support for the aforesaid MHI “Appendix 1” document.

Sincerely,

Mark Weiss

President & CEO

MHARR’s repeatedly called on independents to join them in efforts to fight for manufactured housing rights. ##

Mark Weiss, J.D.

Manufactured Housing Association for Regulatory Reform-MHARR

+1 202-783-4087

###

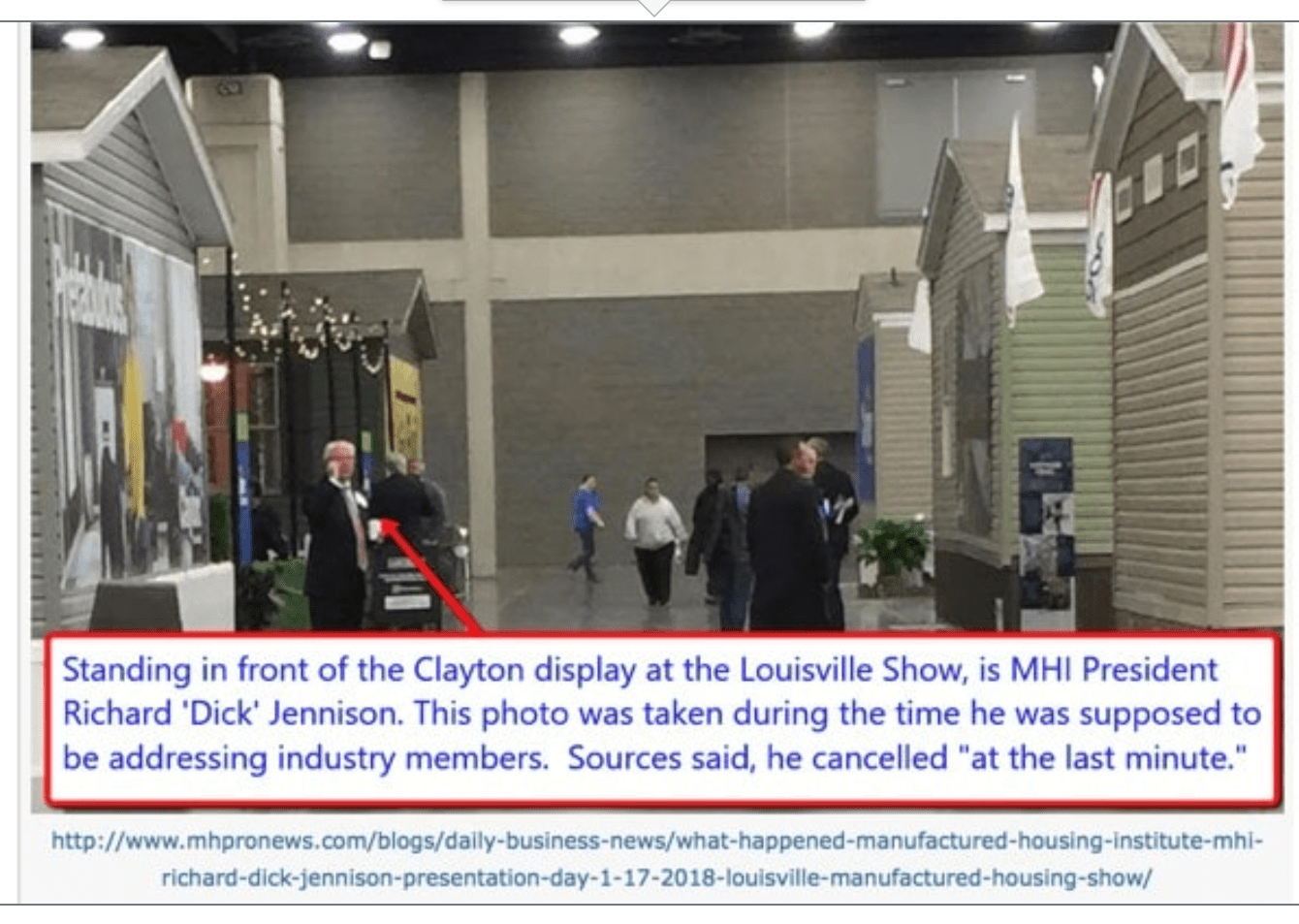

The above media release on Construction News Today was posed for reaction via social media on the morning of 3.15.2022 to MHI and MHI’s new hire, Josh Adams.

MHI’s Ides of March?

Meanwhile…

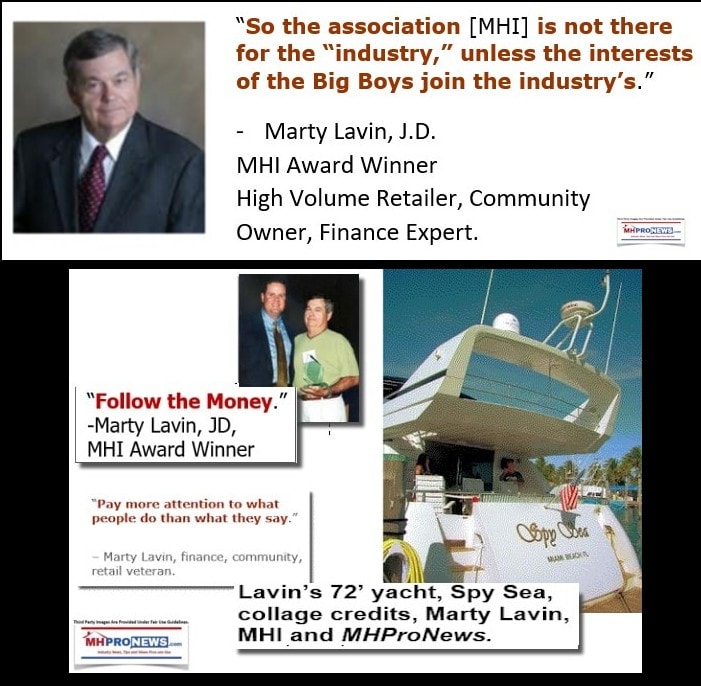

…pivoting toward Jayar Daily’s comments on behalf of the Manufactured Housing Institute (MHI). As noted, MHI appears to draft up these remarks and then has a corporate member deliver them on behalf of the trade organization. Daily’s firm is one of the top ten producers of HUD Code manufactured homes. Certainly, they should have an interest in industry growth. As a disclosure, as this writer was until starting about 2015, perhaps Daily sincerely bought into what MHI was preaching?!

Let’s preview what MHI’s statement does. In no particular order of importance.

- It provides some industry data, at least one of which is arguably incorrect. MHProNews has previously made the point that saying that manufactured housing saved 10-35% is odd at best, given that Census Bureau data has consistently shown that per square foot, manufactured homes are about half the cost of conventional housing. Why downplay one of the industry’s best claims to fame? Namely, saving homebuyers big money?

MHI provides insights on:

- the seemingly ever-pending DOE energy standards, which were addressed in the press release above and are further detailed in fact-packed deeper dive, linked here.

- The Manufactured Housing Improvement Act (MHIA) and the fact that it has not yet been fully implemented. MHI clearly is referring to “enhanced preemption” when it mentions federal preemption.

- Obtaining more chattel and other manufactured home lending. MHI speaks to the issue of the Duty to Serve (DTS), FHA Title I, and FHA Title II. But precisely what has MHI accomplished on any of these topics, beyond ‘talking’ about them?

The DOE rule revelations are an apt example of what MHI has arguably been doing for much of the 21st century. MHI talks a reasonably good talk. It is the follow through that is problematic. In the case of the DOE energy rule, MHI oddly – but perhaps thankfully – has ‘come clean’ to the extent that they are now admitting that they want to see DOE implement a new energy rule. They want it badly enough where they have openly told their own members that they are working for its implementation, a point that MHARR and MHProNews have alleged for some time. MHI wants it badly enough where they are pressing for it AFTER the Louisiana v. Biden decision (which MHARR has reportedly and apparently helped those state attorneys general advance in court by giving them evidence involving manufactured housing). After the Louisiana v. Biden ruling, MHI has offered “a lifeline” to DOE, as MHARR framed the MHI effort.

Even the TMHA, an MHI affiliate, has advised their members that the DOE rule could establish “the makings of a slowdown.”

MHI can’t have it both ways. They are either working for sustainable, robust, and ethical industry growth or they aren’t. Talk – mere words – can be cheap.

Why would ANY manufactured housing independent want a slowdown? Yet using TMHA VP Ripperda’s logic aptly makes clear that the standards could lead to a slowdown. Fewer sales due to higher costs and more regulatory hoops to jump = a slowdown. On what basis does MHI justify that move?

But what a careful reading of the MHI-provided testimony underscores is that the DOE rule is not a one-off.

A coalition of nonprofits – which does NOT include MHI – has seemingly successfully pressed the FHFA into denying the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac proposed plan for 2022-2014 which included ZERO manufactured home chattel loans. Berkshire Hathaway (BRK) owned 21st Mortgage Corporation CEO Tim Williams said in 2020 that he was ‘happy’ that the GSE pilot was dead.

MHI can’t have it both ways. They are either working for sustainable, robust, and ethical industry growth or they aren’t. Talk – mere words – can be cheap.

To the issue of the enhanced preemption, Ayden Mayor Pro-Tem Ivory Mewborn offered MHI a tailor made opportunity to walk their talk. MHI CEO Lesli Gooch called Mewborn, saying that their goal and his were in alignment. Mewborn wanted to know, will MHI deploy its legal resources to make preemption a reality in Ayden? Gooch deliberately ducked that question. Per Mewborn to MHProNews just days ago, there has been no further follow up or responses from Gooch or anyone at MHI.

So much for Gooch’s pitch for social and economic justice for blacks and other minorities by providing access to more affordable manufactured homes?

On issue after issue, the evidence makes the case that MHI is talking a pleasing sound game. But when it comes down to putting legal or other support into actually doing what they claim, they have consistently ducked that – or worked for the opposite of what they ought to be doing.

MHARR offered in 2019 to engage in legal efforts to advance enhanced preemption. MHI affiliates – perhaps under duress from MHI and/or their corporate masters – declined MHARR’s offer.

MHI can’t have it both ways. They are either working for sustainable, robust, and ethical industry growth or they aren’t. Talk – mere words – can be cheap.

With that background, here are Daily’s comments, seemingly drafted mostly by and certainly provided on behalf of MHI. See for yourself all of the interesting things MHI said some 6 years ago and ask yourself. What has MHI actually done since then to advance this or that issue? Keep in mind that MHARR – by providing useful involvement with a state AG – used a legal process to advance the interests of manufactured housing industry independents.

For emphasis, the value of these comments provided by Daily for MHI are due in part precisely to the fact that these are 6 years old. Why? Because these give an MHI provided measuring rod to see how MHI has done to advance their own stated agenda. Lots of happy talk, some of it well said. But what has happened since then?

Written Testimony

By

F.R. Jayar Daily

Chief Operations Officer, American Homestar Corporation

Director, Board of Directors of the Manufactured Housing Institute

Chairman, National Modular Housing Council

Immediate Past Chairman, the Manufactured Housing Division of the

Manufactured Housing Institute

Before the

Subcommittee on Housing and Insurance

House Financial Services Committee

U.S. House of Representatives

Hearing On

FUTURE OF HOUSING IN AMERICA: GOVERNMENT REGULATIONS AND

THE HIGH COST OF HOUSING

March 22, 2016

Washington, DC

1655 Fort Myer Dr., Suite 104, Arlington, VA 22209 Tel: 703.558.0400 Fax: 703.558.0401 http://www.manufacturedhousing.org info@mfghome.org

Thank you, Chairman Luetkemeyer, Ranking Member Cleaver and members of the Subcommittee for the opportunity to testify this afternoon about the future of housing in America and the impact of government regulations on the high cost of housing. My name is Jayar (Francis) Daily and I am the Chief Operations Officer of American Homestar Corporation, a producer of manufactured and modular housing. I am appearing before you today on behalf of the Manufactured Housing Institute (MHI), where I serve on the Board of Directors, serve as Chairman of the National Modular Housing Council, and am the immediate past chairman of the Manufactured Housing Division.

American Homestar Corporation is headquartered in Houston, Texas, and was founded 45 years ago. Our company designs and produces factory built housing and is the nation’s fourth largest vertically integrated company in the industry. Our homes are marketed under the brand names of Oak Creek and Platinum Homes. We also build modular housing and various types of commercial structures. American Homestar Corporation also offers financing and insurance for our customers. Our manufacturing facilities are located in Texas and Alabama and we employ 750 people.

MHI is the only national trade organization representing all segments of the factory-built housing industry. MHI members include home builders, lenders, home retailers, community owners and managers, suppliers and others affiliated with the industry. MHI’s membership includes 50 affiliated state organizations. In 2015, the industry produced over 70,000 homes, approximately 9% of new single family home starts.

A robust manufactured housing market is critical to increasing the availability of affordable housing, which is, in so many parts of the country, in short supply. Manufactured home owners generally have low and moderate incomes, and commonly live in rural areas. My testimony is focused on three critical barriers to the development of manufactured housing: 1) a housing finance system that does not adequately meet the market’s needs; 2) a regulatory structure that, while solicitous of industry feedback, ultimately passes along costly and burdensome regulations; and 3) an authorizing statute that after over 40 years is in need of critical revisions.

Manufactured Housing is a Critical Source of Affordable Housing for Millions of Americans

Manufactured housing provides quality, affordable housing for more than 22 million very low-, low- and moderate-income Americans. The median annual income of manufactured homeowners is slightly more than $26,000 per year, nearly 50 percent less than that of all homeowners.[1] Manufactured housing represents 7.3% of all occupied housing units, and 10.3% of all occupied single-family detached housing[2].

Manufactured homes serve many housing needs in a wide range of communities—from rural areas where housing alternatives (rental or purchase) are few and construction labor is scarce and/or costly, to higher-cost metropolitan areas as in-fill applications. Manufactured housing is more prevalent in rural areas. About two-thirds of all occupied manufactured homes in the U.S. are located outside of metropolitan statistical areas (MSAs), and 14 percent of homes in non-MSA counties are manufactured homes.[3]

One of the many salient features of manufactured housing is the quality of the homes and the value to consumers achieved through technological advancements and cost savings associated with the factory-built process. Based on U.S. Census data, the cost of manufactured homes are 10 to 35 percent less than the cost of comparable site-built homes. The affordability of manufactured homes has long made these homes the preferred housing choice for many families, including first-time homebuyers, retirees and families in rural areas.

Unlike site-built homes, manufactured homes are built almost entirely in a controlled manufacturing environment in accordance with federal building codes administered by the Department of Housing and Urban Development (commonly referred to as the “HUD Code”). Homes are transported to the home-sites where they are installed in compliance with federal and state laws.

The HUD Code is the only federal residential building code. It regulates home design and construction, installation, durability, resistance to natural hazards, fire safety, electrical systems, energy efficiency, and other aspects of the home. Homes are inspected by a HUD approved third party during the construction process and the industry adheres to HUD’s robust quality assurance program, which offers greater controls than other forms of housing in the home building industry. Federal, state or local authorities inspect each home installation.

The quality, reliability and durability of manufactured homes has improved substantially since the enactment of the Manufactured Housing Improvement Act of 2000, which considerably strengthened HUD’s oversight of construction and safety standards, set a national standard for installation, and required a Dispute Resolution program in every state to address disputes between consumers and manufacturers and installers. As a result, the quality of manufactured homes is much higher than it was 20 or 30 years ago.

The industry faces three strong headwinds that keeps it from achieving its full potential in addressing the affordable housing needs of the nation. The first is a housing finance regulatory system that does not adequately account for the unique way manufactured housing is financed. Because current Home Ownership and Equity Protection Act (HOEPA) regulations do not have sufficient flexibility on rates, points, and fees for small loan sizes, the pace of lending for manufactured homes has declined. With respect to the Federal Housing Administration (FHA), because of outdated rules, FHA’s Title I mortgage insurance program for chattel loans is of minimal utility. In addition, because there is not a secondary market for chattel lending, financing costs are higher for chattel loans than for mortgages on site-built homes. As a result, borrowers seeking to finance an affordable manufactured home have fewer options than borrowers who seek to finance site-built real estate.

The second challenge facing manufactured housing is a regulatory structure that lacks clarity, has the potential to overlap, and does not adequately incorporate industry feedback into regulations and guidelines. Regulatory uncertainty and barriers present compliance risks and costs that are ultimately passed on to the consumers. For example, often HUD does not properly take into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing. HUD also does not take a comprehensive view on all the regulations impacting manufactured housing so that the myriad patchwork of regulations do not have unintended cost consequences. Further, because HUD does not use its preemption authority for construction standards the way it should, states and localities are able to set guidelines in contrast to HUD Code, and in some cases localities are able to “zone” out manufactured housing communities.

Third, the legislation that established the manufactured housing construction safety standards (HUD Code), was enacted in 1974 and has become antiquated. Enacted at a time when manufactured housing was in its infancy, and transitioning from a “travel trailer” industry to one that provides permanent single family residential housing, this legislation needs to be updated so that the industry can continue to drive innovations in manufacturing.

The Challenge of Financing Manufactured Housing

MHI is eager to work with the Subcommittee to reduce the regulatory burdens harming consumers seeking to achieve the American Dream of homeownership by purchasing a manufactured home. The manufactured housing industry is fully committed to protecting consumers throughout the home buying process. MHI recognizes the importance of responsible lending and improving the consumer experience. Unfortunately, current regulations and the housing finance system harms consumers of manufactured housing by inadvertently limiting financing for this affordable homeownership option.

Reducing Regulatory Burdens to Financing for Manufactured Homes

Recent federal regulations have jeopardized access to manufactured housing financing.

The rules have penalized home buyers that cannot access traditional mortgage financing needed for single-family home ownership or live in rural areas where affordable rental or site-built housing is scarce or non-existent. Additionally, many at-risk families have seen the equity they have diligently built up in their manufactured homes wiped out because lenders are not providing the financing needed for resale due to these regulations.

There are two slight revisions to Consumer Financial Protection Bureau (CFPB) regulations that can spur lending without harming the consumer protections contained in the Dodd-Frank Act.

- High-Cost Mortgage Definition. The HOEPA provisions of the Dodd-Frank Act that established parameters for which mortgage loans are classified as “high cost” included more flexible annual percentage rate (APR) and points and fees provisions for small loans. This was in recognition of the simple mathematical fact that fixed costs on smaller loans translate into higher percentages of the total loan amount. Unfortunately, in practice, this flexibility has not been sufficient to address market realities. The 2014 Home Mortgage Disclosure Act (HMDA) data offers empirical evidence of the negative real world impact from the current HOEPA small loan thresholds, confirming conclusively that manufactured home lenders are not making loans with the “high-cost” HOEPA designation. The HMDA data shows that lenders made such loans before the rules went into effect, and they did not make them after. Manufactured home loans of all size categories went down by double digits, and the lower the dollar amount size the more pronounced the year-over-year decline. In comparison, overall mortgage loan data (for all homes) shows a 2013 to 2014 year-over-year increase in the number of mortgage loans. A simple adjustment to these thresholds is necessary to enable lenders to fully meet the demand for affordable financing for manufactured homes.

- Loan Originator Definition. The definition of loan originator established by the Dodd-Frank Act is based on traditional mortgage market roles that do not reflect the distinct features of the manufactured housing market. While they are only in the business of selling homes and do not originate loans, manufactured home retailers and sellers currently run the risk of being considered mortgage loan originators. Manufactured housing retailers and sellers should be excluded from the definition of a loan originator, so long as they are only receiving compensation for the sale of the home and not engaged in financing the loans. This simple change will not result in individuals receiving kickbacks for referrals, because they are barred from receiving compensation related to the loan.

These are modest modifications, but they are much needed to alleviate the challenges facing working families seeking quality affordable housing and families currently living in manufactured housing. The proposed statutory changes would more accurately take into account the price pressures unique to manufactured home lending while still maintaining significant consumer protection from predatory lending practices. The terms typically associated with manufactured home loans—namely fixed interest rates, full amortization, and the absence of alternative features (such as balloon payments, negative amortization, etc.)—allow lenders to satisfy the requirements of what the Dodd-Frank Act would consider conservative and prudent underwriting standards. In addition, existing regulatory requirements and statutory guidelines outlined in the Dodd-Frank Act provide significant consumer protections and disclosures while prohibiting many predatory loan features. These proposed revisions ensure that substantial protections are available to consumers while ensuring financing remains available for manufactured housing.

MHI commends the House Financial Services Committee for recognizing that consumers are being harmed by current regulations that limit the availability of financing for manufactured homes. In particular, MHI appreciates the Committee’s leadership in swiftly and successfully moving H.R. 650, the Preserving Access to Manufactured Housing Act, through the legislative process in the House of Representatives with bipartisan support. MHI hopes the Committee will continue to work toward its enactment in the 114th Congress.

Improving FHA’s Programs for Manufactured Housing Finance

- FHA Title I Program. The FHA Title I program provides an affordable financing option for personal property manufactured homes. However, due to a number of outdated program rules, FHA only endorsed $24 million in Fiscal Year 2014. This is woefully inadequate given that manufactured homes comprise seven percent of total occupied housing units in the United States. In many areas of the country, particularly rural areas, manufactured housing is the only form of quality affordable housing available. Improvements to the FHA Title I program would help ensure families in these communities have access to financing for manufactured homes through the Title I program.

The following are administrative changes HUD should implement to make the Title I program more effective:

- Origination Fees. The low dollar principal amounts of new personal property manufactured home loans means that the existing cap of two percent of the loan amount on the fees a lender can charge is not high enough to cover the cost of underwriting these loans, particularly with increased compliance costs related to new requirements under the Dodd-Frank Act. We believe this helps to explain the lack of utilization of the Title I program. Other laws, including Qualified Mortgage (QM) and HOEPA, have provisions that take into account the impact of lower balance personal property loans. FHA already permits a minimum underwriting fee of $2,500, for example, for a reverse mortgage (HECM) loan. The FHA Title I manufactured home loan program should also adopt a reasonable minimum permissible origination fee. MHI recommends that HUD amend its current underwriting loan fee cap of two percent of the loan amount to also allow a flat dollar amount of $2,000 for all loans.

- There are a limited number of eligible appraisers (80-85 in the entire country) who are qualified to perform Title I manufactured home appraisals. In many rural areas, where the majority of manufactured homes are located, there are literally no Title I qualified manufactured home appraisers who are available to perform an appraisal. Current appraisal requirements in the Title I program have resulted in fewer qualified appraisers and limited competition in the marketplace. HUD should amend the current requirement that requires all appraisers to be certified by a single private company (NADA) to also allow inspectors trained by qualified firms to do the on-site inspection, provided the work is ultimately reviewed and approved by NADA certified individuals. This would inject more competition into the provision of these appraisal services, while maintaining overall quality standards through the NADA certification process.

- Underwriting Standards. The detailed loan underwriting standards in the Title I program need to be updated to better align with the FHA Title II loans program. In particular, Title I underwriting standards regarding DTI ratios, treatment of Chapter 7 bankruptcy and other derogatory credit items, treatment of medical collections, and treatment of total unpaid collections should be changed to match those requirements in the Title II program.

- FHA Title II Program. The FHA Title II program is commonly used for “real estate” manufactured home loans, where the mortgage covers the land and the home. MHI recommends HUD update its installation requirements to conform to the HUD Minimum Installation Standards that were established in 2009, rather than utilizing the requirements in the outdated 1994 handbook. This would align installation requirements with more recently adopted standards that were implemented under the comprehensive 2000 regulatory legislation.

Establishing a Secondary Market for Chattel Loans

The 2008 Housing and Economic Recovery Act (“HERA”)4 singled out manufactured housing as one of only three Underserved Markets. This reflected frustration with the declining volume of Enterprise manufactured housing loan purchases at the time and with the virtual exclusion of chattel loans from the types of loans they would purchase. FHFA is in the process of reviewing comments it received as part of the proposed Duty to Serve rule. Since chattel loans constitute almost 70 percent of the manufactured housing market and are the most underserved segment of that market, MHI believes the final Duty to Serve rule cannot fulfill its statutory responsibilities without a significant requirement to purchase chattel loans.

Over the past eight years, the Enterprises have done little to support manufactured housing. Outside of some pre-financial crisis efforts to create a secondary market for chattel loans, the Enterprises have made no effort to purchase chattel loans despite significant improvements in the housing market and chattel lending underwriting guidelines and sound industry risk management practices. Additionally, even when measured against conventional mortgages, the Enterprises have purchased little in the way of conventional manufactured home loans. In fact, according to a 2014 GAO report, only 7 percent of conventional manufactured home mortgages were sold to the Enterprises

4 The Housing and Economic Recovery Act of 2008, Pub.L. 110‐289, Div. A, Title I, §§ 1128(c)(1), 1129(a), July 30, 2008, 122 Stat. 2701, 2703, added 12 U.S.C.A. § 4565 (Duty to serve underserved markets and other

To put a finer point on why a secondary market is necessary to support manufactured housing, the Consumer Financial Protection Bureau, in its September 2014 paper on manufactured housing, stated that chattel loans are approximately 50 to 500 basis points more expensive than real property loans[4]. In large part this disparity is due to the additional risks the lender takes on: a lack of a significant secondary market for chattel loans which may account for 100 to 150 basis points, concomitant interest rate risk, which combined may account for an additional 150 to 200 basis points, higher servicing costs and very limited risk sharing with lenders by either the private or government sectors, which may account for an additional 150 basis points.

A strong secondary market for chattel loans has the potential to not only ease financing costs for consumers but also expand consumer choice as more lenders enter the market. A strong secondary market will also provide refinancing opportunities to manufactured homeowners as market conditions warrant.

The Challenge of a Complex Regulatory Structure

As the only federally-regulated national building code, the HUD Code regulates manufactured home design and construction, installation requirements for strength and durability, resistance to natural hazards, fire safety, electrical systems, energy efficiency, and all other aspects of the home. Homes are inspected every step of the way and our industry adheres to a robust quality assurance program which offers far greater controls than anyone else in the home building industry. As a result, the industry has achieved economies of scale that have brought high quality affordable homes to millions of working American families and retirees.

While the HUD Code has brought standardization to the industry, in order for manufactured housing to achieve its full potential in addressing the affordable housing needs of the nation, the administration of the HUD Code should be improved to better account for cost impacts and industry practices. We believe improvements in this area fall into three categories: 1.) improving the way HUD develops and implements regulatory changes to the HUD Code, including properly taking into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing; 2.) enforcing its federal preemption authority for construction standards and aggressively weighing-in on local construction standards used to “zone” out manufactured housing; and 3.) taking a comprehensive view on all the regulations impacting manufactured housing so that the myriad patchwork of regulations do not have unintended cost consequences.

1.) MHI recommends improving the way HUD develops and implements regulatory changes to the HUD Code, including properly taking into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing.

The ability to utilize new technologies and materials, and to maintain the integrity of the uniform single building code is dependent on a construction code that is current. Recognizing this, in 2000 Congress passed the Manufactured Housing and Improvement Act (MHIA), which expanded HUD’s mission with regard to manufactured housing and improved the process for establishing, revising, enforcing, and updating the HUD Code. The law created the Manufactured Housing Consensus Committee (MHCC), an advisory committee comprised of industry, consumer and other stakeholders to recommend revisions and interpretations of the HUD Code.

While HUD has recently made strides in reducing backlog of MHCC recommendations, updates to the code continue to be hindered by the cumbersome rulemaking constraints of the Administrative Procedures Act, lengthy internal reviews, and low staffing levels/prioritization of the manufactured housing program at HUD. MHI recommends that HUD utilize the interim final rule process to more expeditiously implement MHCC recommendations. The process would allow HUD to publish the MHCC recommendations as interim final rules that could take effect immediately upon publication in the Federal Register. The public would still have an opportunity to comment, but in the meantime, an updated standard could be utilized.

MHI is increasingly concerned about HUD’s use of “Guidance Memorandum” to enforce and interpret the HUD Code, without seeking input from stakeholders. While there might be legitimate circumstances that necessitate the use of “Guidance Memorandum,” this is being used more and more frequently. HUD should follow its statutory mandate and seek approval from the MHCC prior to issuing guidance changing manufactured housing regulations. In the rare cases a guidance must be utilized, necessary input must be solicited from stakeholders to ensure housing affordability is maintained.

While an updated and current code is essential, MHI does not believe this should diminish efforts to ensure the benefits to consumers outweigh the additional costs resulting from new regulations. To maintain housing affordability, it is absolutely imperative that HUD conduct adequate cost-benefit analyses of all potential new regulations. As it stands, HUD does not undertake the appropriate cost analysis, testing and research required to update the HUD Code. This results in changes to the code that push up costs without a clear justification that the new regulations will lead to improvements to the code that are in the best interest of consumers.

A recent example of the negative impact of not conducting a cost-benefit analysis is with respect to the “On-site Completion” Rule. This final rule, which was published on September 8, 2015, establishes extensive new requirements for the on-site completion of construction of manufactured homes. In its final rule, HUD failed to assess the costs associated with the expanded requirements for homes that are substantially complete when they leave the factory. Because of this significant oversight, the Rule was “determined to not be a significant regulatory action under Section 3(f) of Executive Order 12866, Regulatory Planning and Review,” and therefore was not reviewed by the Office of Management and Budget.

MHI strongly believes the “On-site Completion” Rule adds significant planning, review, reporting, and paperwork burdens. According to a survey of manufacturers, retailers, and third parties, MHI estimates that the new Rule could impact as many as ten to fifteen percent of all new homes. The cost impact could be as much as $7 to $10.5 million. This cost does not include one-time design reviews for each site-construction labeled home, nor does it include increased costs to track inspections and keep records.

- MHI Recommends HUD Enforce its Federal Preemption Authority for Construction Standards and Aggressively Weigh-in on Local Construction Standards Used to “Zone” Out Manufactured Housing.

MHI has been working to address zoning and land use issues impacting the placement of manufactured homes in communities across America. These policies take affordable homeownership out of reach for those consumers who would choose a manufactured home. HUD has proactively pursued individual cases where local jurisdictions have sought to legislate construction and safety standards that are not identical to the HUD standards, or which exclude HUD- compliant manufactured homes on that basis. However, we believe that HUD can play a greater role in this effort, and in fact, has a Congressional mandate to do so.

The Manufactured Housing Improvement Act of 2000 (MHIA) significantly strengthened the preemptive language originally contained in the National Manufactured Housing Construction and Safety Standards Act of 1974 (MHCSS). MHI believes HUD has jurisdictional authority to move beyond a case-by-case analysis and affirmatively state a policy opposing local regulatory schemes that are in conflict with HUD’s mission and with its requirements under MHCSS Act and MHIA.

- MHI Recommends HUD Take a Comprehensive View of All the Regulations Impacting Manufactured Housing

While manufactured housing is insulated from disparate local requirements for building construction, it is still subject to zoning, land use, environmental, and permitting regulations as well as regulations of federal agencies, including the Department of Energy, Occupational Safety and Health Administration, Department of Transportation and the Environmental Protection Agency. Although these state, local and federal regulations serve legitimate purposes, they can present excessive burdens when they are applied—particularly when considering their cumulative effect— slowing down construction and driving up cost. We recommend that HUD, when establishing its own regulations for manufactured housing, take a close look at these crosscutting federal requirements to determine whether they might be simplified and made more flexible while still meeting the policy objectives Congress and the Federal Agencies initially sought by instituting them. HUD, in its role as the administrator of the Manufactured Housing Programs, has a statutory responsibility to protect the affordability of manufactured homes, as well as the safety, durability and quality.

In particular, MHI believes that HUD needs to maintain full authority for the enforcement of energy efficiency standards for manufactured housing. In 2007, Congress enacted legislation, the Energy Independence and Security Act (EISA), which contained a provision requiring the Department of Energy (DOE) to implement energy efficiency standards for manufactured housing. This had the result of creating dual administrative enforcement and regulatory authority over manufactured homes.

Last year, DOE’s Appliance Standard Rulemaking Advisory Committee (ASRAC) conducted negotiated rulemaking and developed a consensus recommendation for affordable, updated energy efficiency standards. DOE plans to publish a proposed rule based on the ASRAC recommendations in the very near future. While DOE has the expertise to develop energy efficiency standards, HUD should administer the standards through its existing regulatory framework. This will ensure that manufactured homes have updated energy efficiency standards, preserve affordability and minimize duplicative compliance and enforcement regulations. This is one of the key reasons why MHI supports H.R. 3135, which would preserve HUD’s exclusive jurisdiction over all manufactured housing construction standards.

The Challenge of Outdated Manufactured Housing Construction and Safety Standards

The Manufactured Housing Construction and Safety Standards Act of 1974 (MHCSS Act) provides the statutory basis for federal construction and safety standards, which apply to all manufactured homes nationwide. The law, last amended in 2000, needs a number of updates to ensure it is effectively preserving this affordable home ownership option. For example, the manufactured housing industry operates under an outdated law that in some instances treats homes like automobiles – by requiring, for example, a steel chassis and subjecting the industry to federal lemon laws. Adhering to these outdated standards incurs costs on both the construction side and the risk management side.

Thus, changes to the 1974 Act would enhance affordability by allowing more design options under the HUD Code and moving the regulations away from non-applicable automotive laws. Changes would eliminate the need for the industry to build on a steel chassis, which would give manufacturers and homebuyers more affordable housing options, while not impacting the safety and soundness warranties that are administered at the state level.

Amend the Definition of “Manufactured Home” (42. U.S.C. 5406).

The current definition of a manufactured home is outdated, as it was developed when the manufactured housing industry was in its infancy, and was transitioning from a “travel trailer” industry to an industry that provides permanent single family residential housing. The definition contains size, length and width requirements that are more appropriate for vehicles traveling down a highway. More importantly, the definition specifies that a manufactured home be built on a permanent chassis.

This outdated definition has constrained the ability for homes to be designed and permanently sited utilizing traditional methods of foundation design and construction comparable to site-built and modular housing. It adds unnecessary costs to homebuyers and can make it difficult, if not impossible, for manufactured homes to be aesthetically compatible with other forms of single family housing. It is also a barrier to more favorable zoning.

Updating the definition of a manufactured home would eliminate confusion between all types of recreational vehicles which are designed for recreational, temporary use, and are not designed for permanent residential use.

Eliminate Current Requirements for Notification and Correction of Defects (42 U.S.C 5414).

The MHCSS Act sets forth a complex system of notification and repair of manufactured homes for non-compliances, defects, and serious defects or imminent safety standards for the entire life of the home. The system is based on federal and state laws that address warranty issues more common to automobiles and other consumer products. Residential housing is not covered by the Magnusson-Moss Warranty Act, which is the federal “lemon law.”

Manufactured homebuilding is very competitive, and manufacturers take consumer satisfaction very seriously. The HUD Code provides for a robust quality control system and stringent compliance and enforcement requirements that are sufficient to protect consumers from serious safety hazards.

Replace the Notification and Correction of Defects Provisions with an Extended Warranty Requirement (42 U.S.C. 5414).

Under current law and regulation, a one-year warranty for all defects is required. In lieu of the burdensome, lifetime requirements of “Subpart I –Notification and Correction,” Congress should consider requiring an extended warranty for major structural, plumbing, electrical and mechanical systems in the home. The Subpart I regulations authorized under 42 U.S.C. 5414 were never intended to resolve complaints concerning defects and workmanship. Nor is it practical or cost effective to divert the attention of the code enforcement system to workmanship issues. Home defects and consumer complaints are more appropriately handled through a longterm warranty program that complements market realities of total quality assurance and consumer satisfaction.

Other Proposed Changes to the MHCSS Act

Other changes to the MHCSS Act that should be considered include: establish a formula for setting label fees based on production levels; authorize HUD to circumvent requirements under the Administrative Procedures Act (APA) for non-controversial updates and changes to the HUD Code that have been recommended by the MHCC; direct HUD to update its 1997 directives on zoning and preemption to reflect changes made to the MHCCS Act in 2000, in order to prevent local communities from discriminating against the siting of manufactured homes through the establishment of construction and safety standards and requirements which exceed those in the HUD Code.

Conclusion

Manufactured homes are the most affordable homeownership option in the market today and MHI appreciates the opportunity to offer our ideas to the Subcommittee about how to improve access to credit for families buying these homes, to streamline regulations and remove regulatory barriers to affordability, and to update outdated construction standards that impact cost and innovation.

MHI believes that manufactured housing can help address America’s affordable and workforce housing challenges into the future. MHI stands ready to work with the Subcommittee to develop appropriate legislative language and identify specific regulatory changes, to implement these recommendations to alleviate the challenges facing working families, seniors, and young professionals seeking quality affordable homeownership opportunities.

[1] See CFPB, ‘‘Manufactured-housing consumer finance in the United States,’’ at 17 (Sept. 2014) [hereinafter ‘‘CFPB White Paper’’], available at http://files.consumerfinance.gov/f/201409 cfpb report manufacturedhousing.pdf.

[2] 2014 American Community Survey

[3] U.S. Census Bureau American Community Survey (ACS), 2008-2012, available at http://www.census.gov/acs/www/data_documentation/data_main/.

[4] CFPB, “Manufactured Housing Consumer Finance in the United States September 2014, p.6

###

Additional Information, More MHProNews Analysis and Commentary in Brief

That MHI testimony before Congress is about 5200 words, per MS Word’s count. In their blizzard of statements, what has MHI actually accomplished from that list?

How about giving MHI partial credit for getting half of the Preserving Access to Manufactured Housing Act during the Trump years?

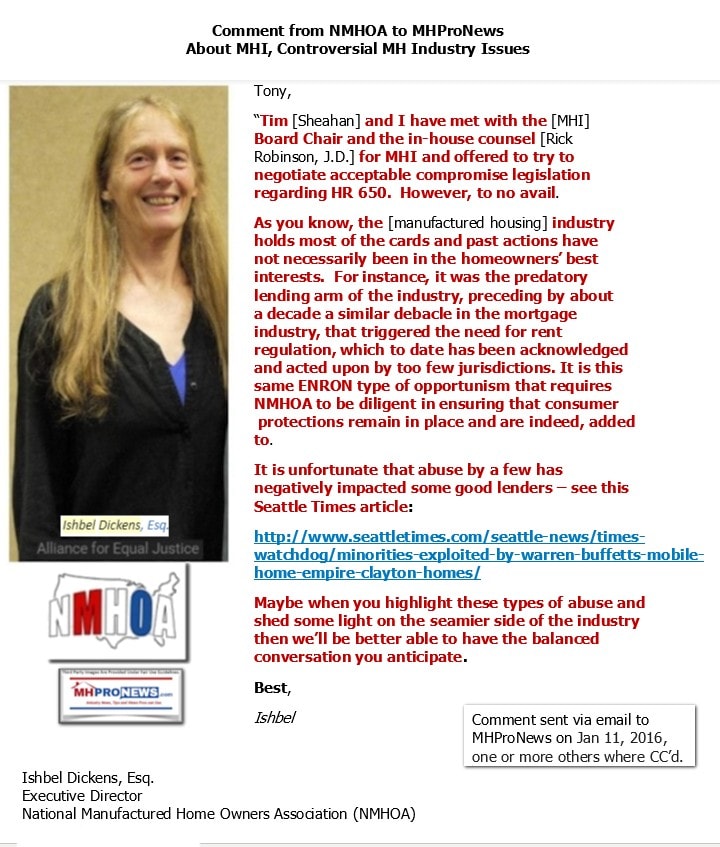

That may seem to be fair, but when closely examined, MHI was offered that deal by negotiation years before by National Manufactured Home Owners Association (NMHOA) Ishbel Dickens, J.D. That’s an insight you may only find only on MHProNews/MHLivingNews

In fairness to Daily, he may or may not have been aware of the MHI schtick. As was noted above, this writer – for MHProNews/MHLivingNews bought the MHI schtick for some years. That was until tips from inside and outside of MHI, combined with observations, research, questions to MHI leader and listening to and/or reading their responses began to reveal that they have on several occasions seemingly deliberately mislead their readers and members. The Dicken’s episode with respect to Preserving Access is just one more example.

It is former MHI chairman Nathan Smith who said that MHI had to be honest with itself and admit that it has previously failed to be pro-active. Smith made an important point. It sounded sincere. But what happened to that promise? It occurred well before Smith’s comments above.

There are some things that only become clear with the passage of time. Who said? That’s the apparent takeaway from one Warren Buffett about the rearview mirror being clearer than the windshield.

What does the rearview mirror tell us about MHI? That they have for most of the 21st century failed to do what they claim they are working to accomplish. Yet, MHI made these statements under oath.

When examining the evidence, Samuel “Sam” Strommen for Knudson Law concluded that MHI is part of a scheme to undermine manufactured housing independents and by extension, consumers. He’s accused with pages of evidence MHI and some of their dominating brands with criminal (felony) antitrust violations.

The 2022 elections are ahead. The public is seemingly awakening to the state of play in American politics. There is a growing number of public officials and others pressing the antitrust and other corporate-government collusion concerns.

The Construction Times Today report and analysis was published on March 15th, a.k.a. “the Ides of March. About the “Ides of March,” Quick and Dirty Tips explains that “The phrase telling us to be wary comes from Shakespeare’s play “Julius Caesar,” in which a soothsayer emerges from a crowd to warn the Roman dictator with the now-famous words: “Beware the ides of March.””

Tick-tock, tick tock. MHI can’t have it both ways. They are either working for sustainable, robust, and ethical industry growth or they aren’t. Talk – mere words – can be cheap. They can be costly, especially to those who may some day face criminal or other legal processes.

Stay tuned to MHProNews as your authentic source of “Intelligence for your MHLife.” ©

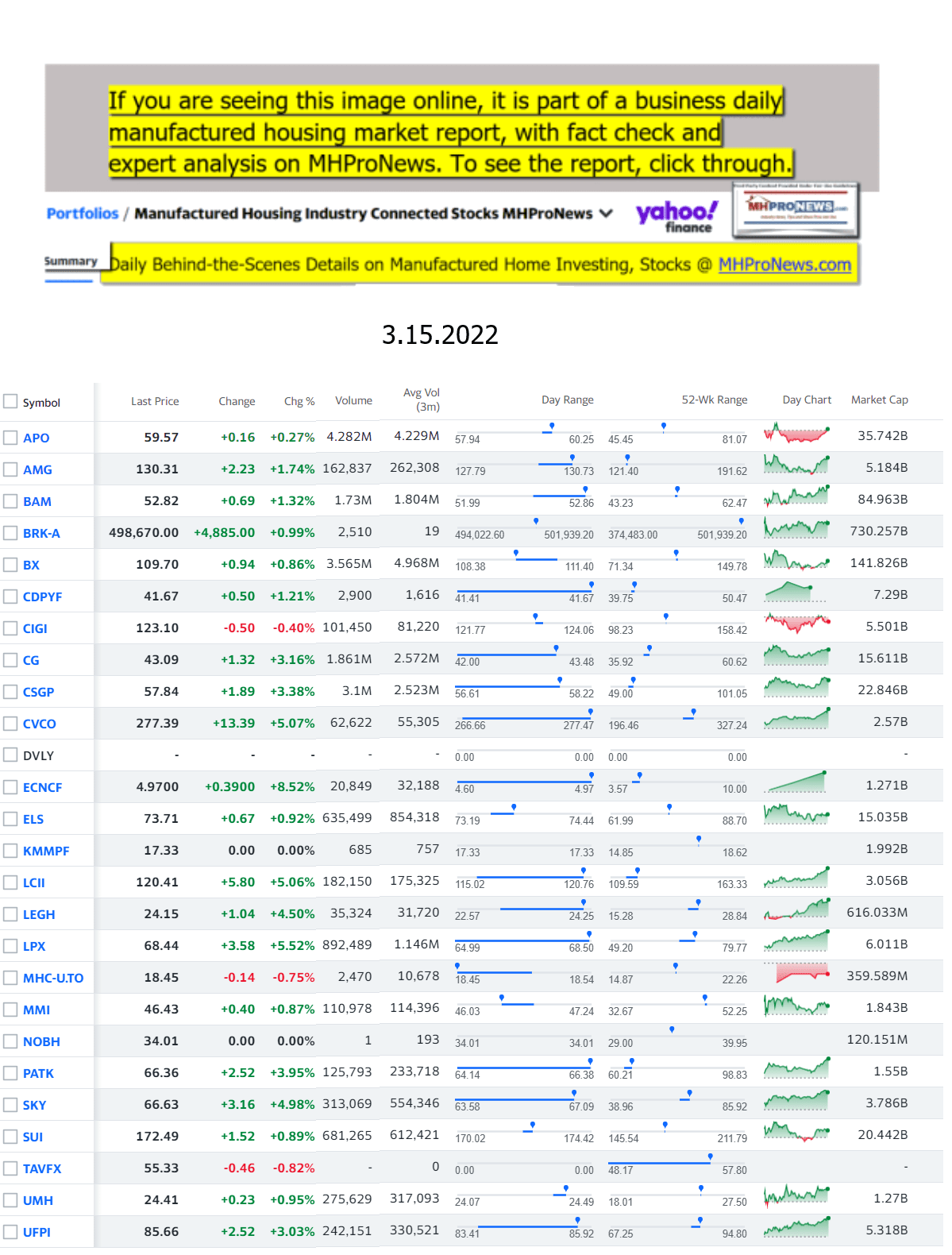

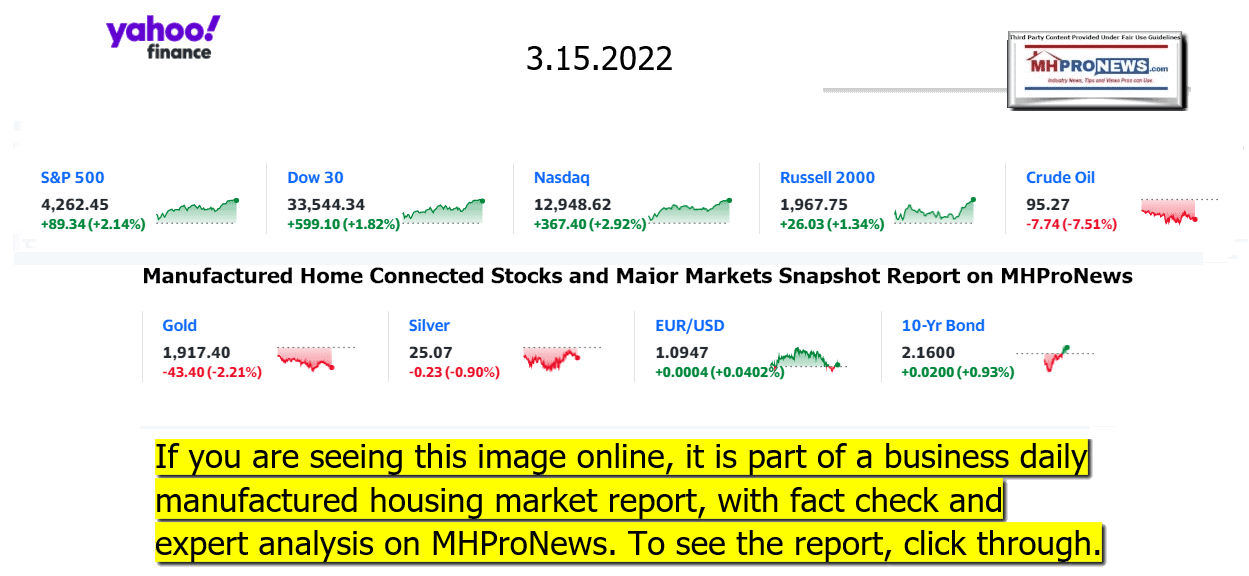

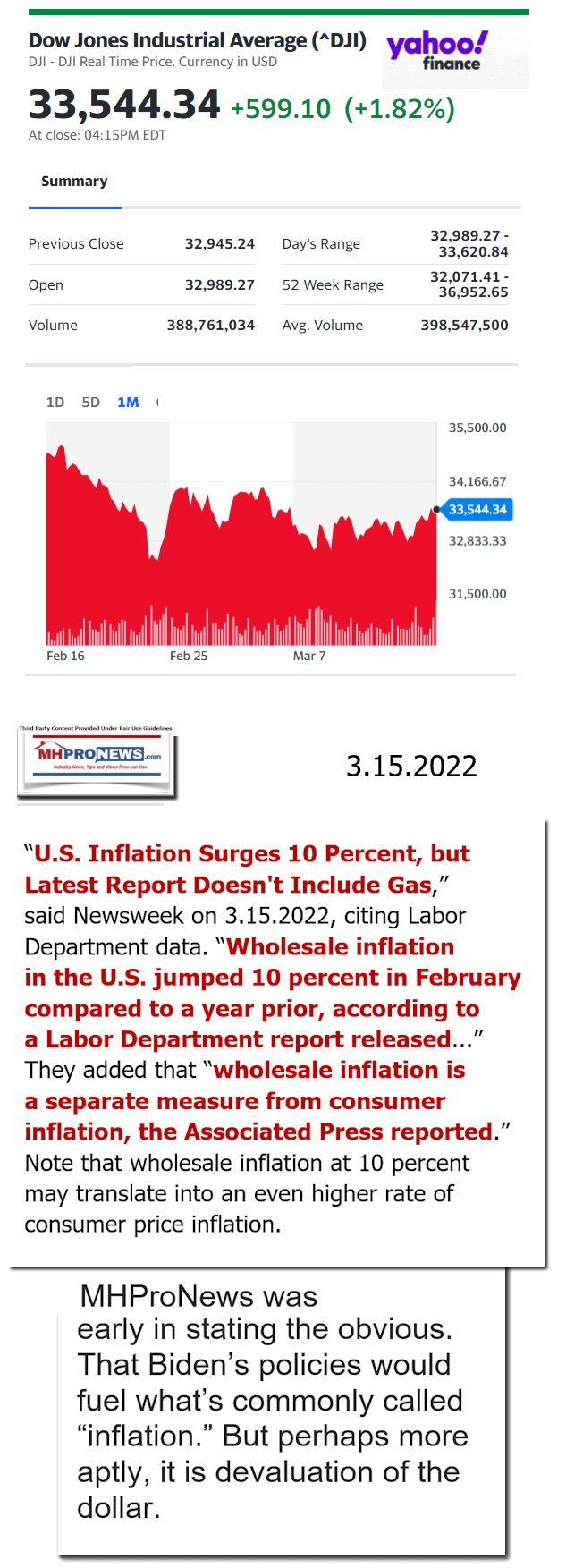

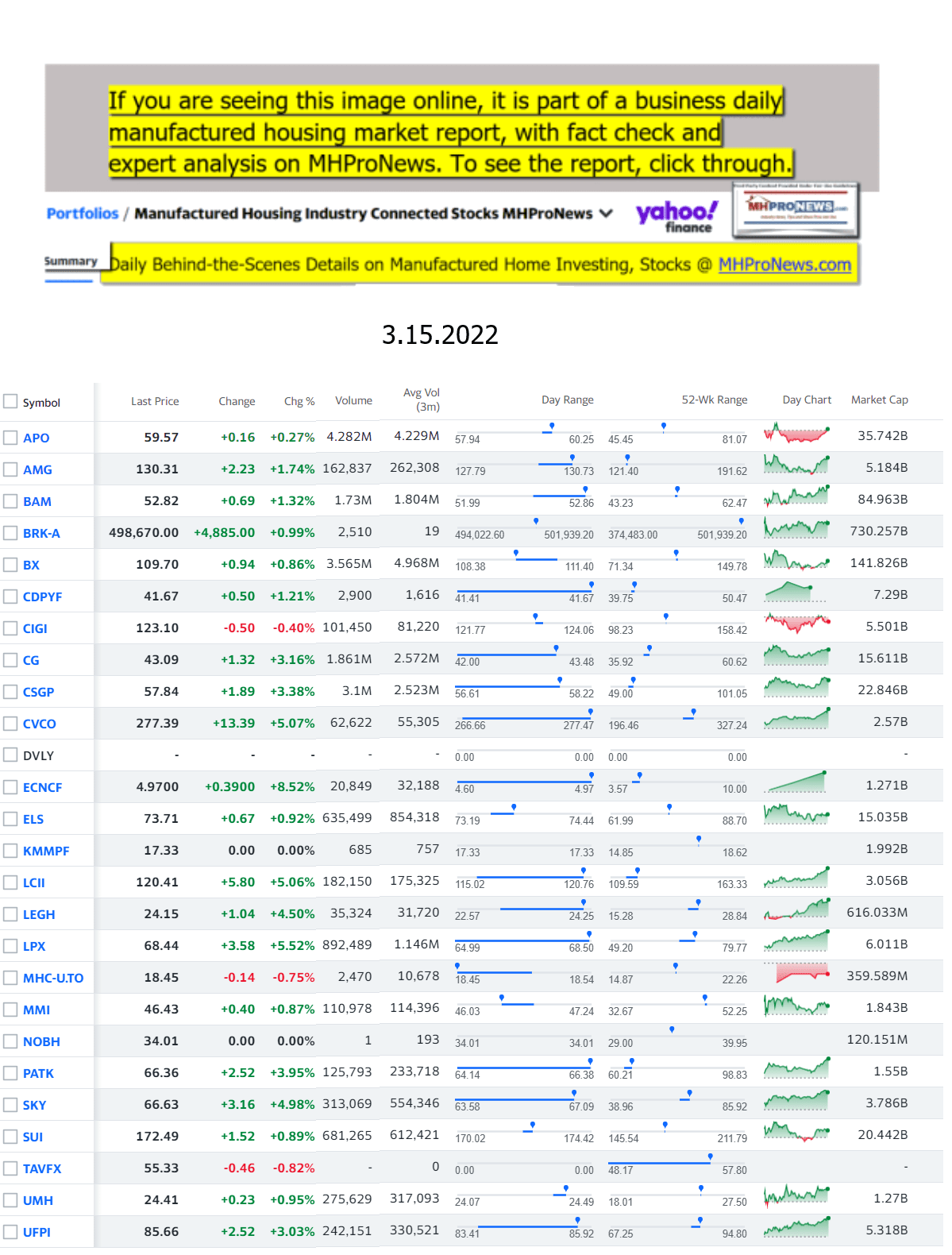

Next up is our daily business news recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left leaning CNN and Right-leaning (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – from the evening of 3.15.2022

- Gas prices fall — a little

- Holtsville, N.Y. Alexis Nicolas of Islandia, New York, fuels up her car at the BP gas station on the Long Island Expressway North Service Road in Holtsville, New York, on February 23, 2022.

- Prices remain historically high, but after a month of surging prices drivers get some modest relief

- Oil: Prices dropped 30% in a week. What gives?

- Closed: Russia is not an option for investors. These emerging markets are

- Loss: Veteran Fox war photojournalist killed while reporting in Ukraine

- Disinfo: Why Ukraine war misinformation is so hard to police

- Protest: Russian TV journalist who blasted Ukraine war on-air turns up in court

- Watch: Employee who crashed a live Russian broadcast in protest is no longer missing

- Foreign debt: Russia could default within days

- Energy: Why are gas prices soaring when America barely uses Russian oil?

- Watch: Vodka company CEO on rebranding: ‘Good must overcome evil’

- India: Russia may have found a buyer for its cheap oil

- Nuclear fears: Why potassium iodide pills are in high demand

- LATEST HEADLINES

- Semiconductors manufactured by the Intel company are displayed during the 'Paris Games Week' on November 02, 2017 in Paris, France.

- Intel will invest nearly $90 billion in Europe’s chipmaking industry

- Women still earn less than men. 6 leaders explain how to fix that

- Why does the gender wage gap still exist?

- Sarah Bloom Raskin withdraws herself from consideration to the Federal Reserve Board

- Key inflation measure hits double digits for February

- When will people get fed up with high prices?

- Britain’s cost of living crisis is pushing millions to the brink

- Starbucks is planning to phase out its iconic cups

- Elizabeth Holmes’ No. 2 and ex-boyfriend is about to have his day in court

- AMC buys surprise stake in a precious metals mine

- US economy flashes a recession warning sign

- Ford will start shipping Explorers without all the parts — and add them later

- Gravity could solve renewable energy’s biggest problem

- COVID IN CHINA

- Hong Kong domestic workers lose their homes in lockdowns

- Cathay will fly 2% of its capacity under COVID restrictions

- China’s new lockdowns are another threat to the economy

- Foxconn halts Shenzhen operations for COVID

- Zero-Omicron policy risks a big hit to the supply chains

- OPPOSING PUTIN

- FILE – In this file pool photo taken on Tuesday, Dec. 3, 2019, Vladimir Potanin, the billionaire owner of a nickel giant, right, gestures while speaking to Russian President Vladimir Putin in Sochi, Russia. During Friday’s call with officials and environmental experts, Putin lashed out at Vladimir Potanin, whose Norilsk Nickel company owns the power plant, saying that it was his company’s responsibility to check the fuel tanks’ condition.

- Russia’s richest businessman: Don’t take us back to 1917

- Oligarch says Putin’s bankers need to be blocked

- Commentator on state TV criticizes Putin’s invasion

- How Russians reacted to protester on state TV

- Journalist talks about Putin’s ‘propaganda bubble’

Headlines from right-of-center Newsmax – evening of 3.15.2022

- Oil Drops 27% From Recent High

- A Russian oil production site. (Getty)

- Russian Invasion of Ukraine

- EU Hits Russia With More Sanctions: From Trade to Truffles

- Russia: Sanctions Against Biden, 12 Others

- War in Ukraine Is Center Stage at Hungary’s Election Rallies

- Zelenskyy Appeals for Canada’s Help in Emotional Speech

- Trump: Sanctions on Biden May Reveal Conflict of Interest

- Fox News Cameraman Killed While Reporting in Ukraine

- Zelenskyy Urges Russian Troops to Surrender

- New US Sanctions Target More Putin Power Brokers

- Russia May Have Only 14 Days

- China Says It’s ‘Impartial’ on Ukraine

- Russia Arrests TV Protester

- 3 EU Nation Leaders to Visit Kyiv as Ukraine Refugees Top 3M

- How Plausible Is Chinese Military Aid for Russia?

- UN: Russian TV Protester Should Not Face Reprisals

- More Russian Invasion of Ukraine

- Newsmax TV

- Grothman: Human Rights Bill Expanded to Meet Biden Agenda | video

- Rosendale: Maybe Hunter Biden Would Have Gotten Keystone Built | video

- Fleischmann: Biden, Not Putin, Behind High Gas Prices | video

- Holt: Russia’s Failures Could Mean More ‘Desperation’ | video

- Gordon Chang: Xi Using Ukraine Crisis ‘to Go After Taiwan’ | video

- Graham: Putin Playing Biden ‘Worked Like a Charm’ | video

- Johnson: Biden Weakness Emboldens Enemies | video

- Bryan Leib: Diplomacy With Iran ‘Destined to Fail’ | video

- Blackburn: ‘Our Laws Are Clear, 9 Justices, That’s It’ | video

- More Newsmax TV

- Newsfront

- US Will Run Out of Key COVID Treatments Without More Funds: WH

- The U.S. government will run out of supplies of COVID-19 treatments known as monoclonal antibodies as soon as late May and will have to scale back plans to get more unless Congress provides more funding, the White House said on Tuesday.Raising the alarm about depleted…… [Full Story]

- Oil Drops 27% From Recent High

- Oil, which recently hit record highs, took a steep dip and saw some [Full Story]

- Trump: Russia Sanctions on Biden May Reveal Conflict of Interest

- Russia’s sanctioning of President Joe Biden may reveal a “bad [Full Story]

- ICE Arrests, Deportations Drop Drastically Under Biden’s ‘Open Border’ Policies

- Immigration and Customs Enforcement recorded significantly fewer [Full Story] | Platinum Article

- Poll: 81% of Americans Say Higher Gas Prices a ‘Serious Problem’

- A new poll out Tuesday by Rasmussen Reports found that 81% of [Full Story]

- ‘Bidenflation’ Caused Soaring Gas Prices, as Unions Betrayed Workers

- Prices at the gas pump have been setting record highs nearly every [Full Story] | Platinum Article

- Senate Approves Bill to Make Daylight Saving Time Permanent

- The U.S. Senate voted unanimously Tuesday to make Daylight Saving [Full Story]

- Cotton: US ‘Could Be Doing More to Help’ Ukraine

- Tom Cotton, R-Ark., told Fox News on Tuesday that the United [Full Story]

- Pfizer to Seek Authorization for Second COVID Booster Shot

- Pfizer Inc and its German partner BioNTech SE will seek emergency use [Full Story]

- Blue States Double Down on COVID Restrictions Even as Rest of Country Eases Mandates

- Border Patrol Nabs 123 Haitian Migrants in Florida Keys

- S. Customs and Border Protection announced Tuesday that it had [Full Story]

- Cargo Ship Runs Aground Off Maryland, a Year After Sister Ship Blocked Suez

- The Ever Forward container ship is currently grounded in the [Full Story]

- New Postal Stamp Honors Ukraine Soldiers Who Told Off Russian Warship

- A new postage stamp honoring 13 Ukrainian soldiers reportedly [Full Story]

- Democrats Preparing for Potentially Disastrous Midterms

- Democrats are getting ready for the 2022 midterm elections [Full Story]

- Russia Claims It Has Ordered Sanctions Against Biden, 12 Others

- Russia is claiming it has imposed sanctions against President Joe [Full Story]

- Lawyers for Jussie Smollett Demand His Release

- Attorneys representing actor Jussie Smollett are calling for his [Full Story]

- Saudis Consider Accepting Yuan Instead of Dollars for Chinese Oil Sales: Report

- In a move that would lessen the U.S. dollar’s dominance of the global [Full Story]

- ‘Inventing Anna’ Sorokin to Be Deported to Germany

- Anna “Delvey” Sorokin, the fake heiress who was jailed after she [Full Story]

- Prosecutors Admit Mistake in Bannon Probe

- Federal prosecutors investigating former White House adviser Steve [Full Story]

- Report: ‘Involuntary Celibates’ Emerge as Growing Terrorism Threat

- The U.S. Secret Service has released a study detailing the growing [Full Story]

- NY Times: Document Reveals Plan to Occupy Government Buildings on Jan. 6

- A document found in the possession of Enrique Tarrio, former head of [Full Story]

- Poll: Americans Hopeful as COVID Restrictions End

- A new poll finds that most Americans are feeling more confident [Full Story]

- Red State Lawmakers Seek to Prevent People From Going to Other States for Abortions

- A Missouri state representative introduced legislation that would [Full Story]

- Zelenskyy Urges Russian Troops to Surrender, Predicts Ukraine Victory

- A defiant Ukrainian President Volodymyr Zelenskyy early Tuesday gave [Full Story]

- NATO’s Estonia Calls for Immediate Establishment of No-Fly Zone

- Estonia’s parliament is calling for other United Nations member [Full Story]

- Eiffel Tower Grows Six Meters After New Antenna Attached

- The Eiffel Tower grew 6 meters (19.69 ft) on Tuesday after a new [Full Story]

- Man Wanted in Stabbing at New York’s MoMA Arrested in Philly

- Police early Tuesday arrested a man at a Philadelphia bus terminal [Full Story]

- Japanese, US Marines Practice Airborne Assaults in Sign of Deepening Cooperation

- In a sign of deepening military cooperation between Japan and the [Full Story]

- Investors See Risks Spiking, Fear Market-Wide Liquidity Crunch

- Wild swings in asset prices following Russia’s invasion of Ukraine [Full Story]

- Ukraine War May Lead to Rethinking of US Defense of Europe

- Russian President Vladimir Putin’s war in Ukraine and his push to [Full Story]

- Ohio Governor Signs Bill Ending Conceal Carry Permit Mandate

- Republican Gov. Mike DeWine signed into law Monday a measure that [Full Story]

- More Newsfront

- Finance

- Amazon to Build Affordable Housing Near Transit Stops

- Amazon said Tuesday it will spend more than $120 million to build affordable-housing units close to transit stations near Seattle and Washington, D.C, the latest example of a tech company trying to address the affordable housing crisis…. [Full Story]

- A Russian Bond Default Would Isolate Russia Further

- Biden’s Fed Nominee Bloom Raskin Withdraws

- George Mentz: Why Big Tech May Outperform During Higher Inflation, Interest Rates and Even War

- SEC Investigates Big Four Accounting Firms for Conflicts

- More Finance

- Health

- Pfizer to Seek Authorization for Second COVID Booster Shot

- Pfizer Inc and its German partner BioNTech SE will seek emergency use authorization for a second booster shot of their COVID-19 vaccine for people aged 65 and older, the Washington Post reported on Tuesday. The submission to the U.S. Food and Drug Administration, anticipated…… [Full Story]

- Even a Little Light in Your Bedroom Could Harm Health

- Omicron Subvariant Makes up 23.1% of COVID Variants in US: CDC

- Most Americans Can’t Distinguish Cognitive Impairment from Normal Aging: Poll

- Crossed Eyes in Children Linked to Increased Risk for Mental Illness

MHProNews has pioneered in our profession several reporting elements that keep our regular and attentive readers as arguably the best informed in the manufactured housing industry. Among the items shared after ‘every business day’ (when markets are open) is our left-right headline recap summary. At a glance in two to three minutes, key ‘market moving’ news items are covered from left-of-center CNN Business and right-of-center Newsmax. “We Provide, You Decide.” © Additionally, MHProNews provides expert commentary and analysis on the issues that others can’t or won’t cover that help explain why manufactured housing has been underperforming during the Berkshire era while an affordable housing crisis and hundreds of thousands of homeless in America rages on. These are “Industry News, Tips, and Views Pros Can Use” © features and others made and kept us the runaway #1 in manufactured housing trade publisher for a dozen years and counting.

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

-

-

In cases such as Apollo, Berkshire Hathaway, Blackstone or others, manufactured housing may only be part of their corporate interests. Note: depending on your browser or device, many images in this report can be clicked to expand. Click the image and follow the prompts. To return to this page, use your back key, escape or follow the prompts.

https://www.manufacturedhomepronews.com/steve-lawler-deer-valley-corporation-dvc-otcmkts-dvly-announces-merger-plus-manufactured-home-investing-stock-updates/

https://www.manufacturedhomepronews.com/nobility-homes-financial-position-very-strong-sales-strong-but-challenges-including-lending-and-others-examined-plus-manufactured-housing-stocks-update/ - 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments. MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing and have completed over a dozen years of serving the industry as the runaway most-read trade media.

- 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

Sample Kudos over the years…

It is now 12+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.