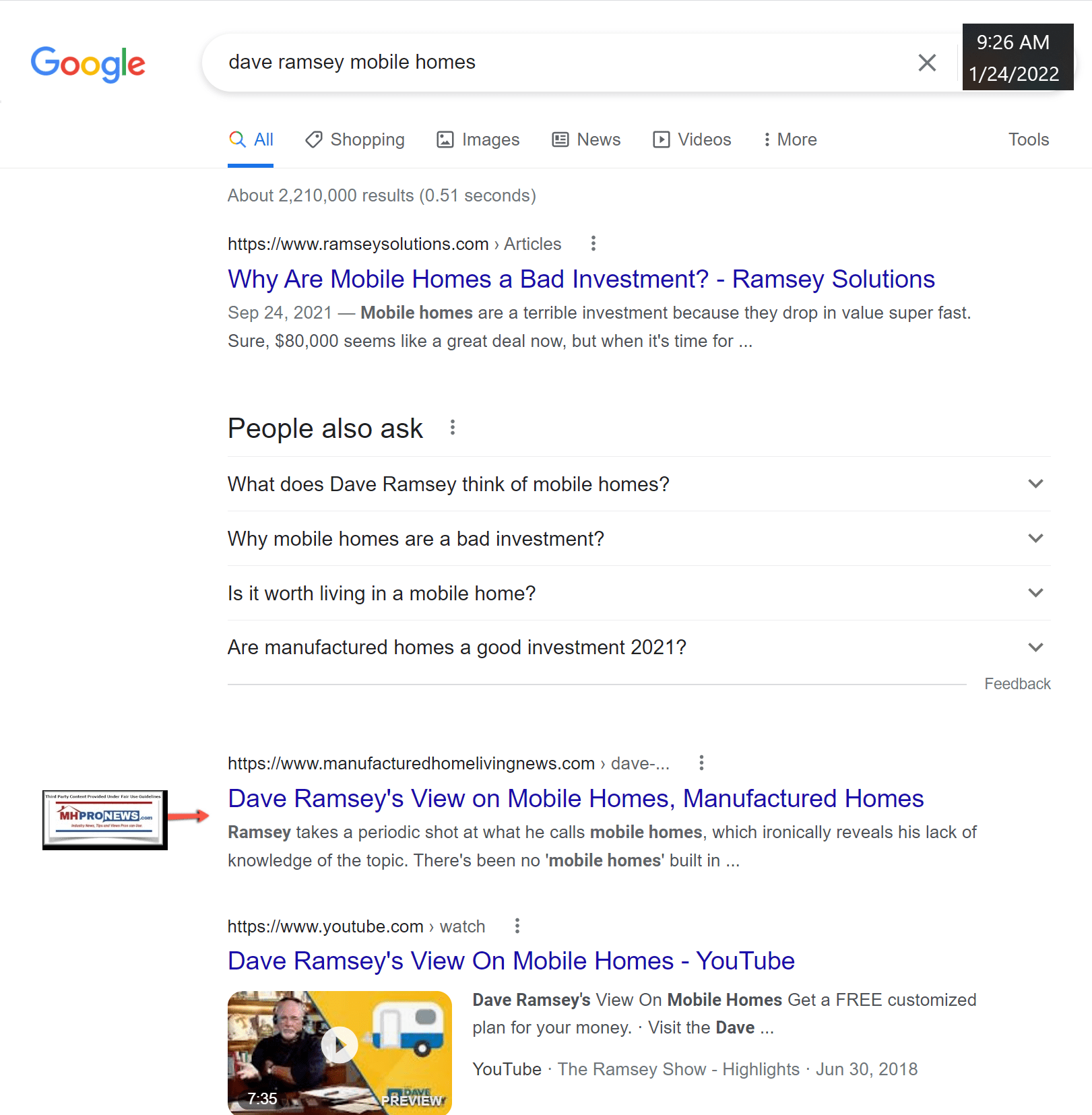

Dave Ramsey and Ramsey Solutions were contacted by MHProNews on 1.24.2022 to request corrections to another one of their arguably factually flawed reports. The request is as follows and precedes the text of their post that rips manufactured homes as a bad investment. As Ramsey framed it: “Why Are Mobile Homes a Bad Investment?” It is a topic that MHLivingNews and MHProNews have featured previously. It is one that the Manufactured Housing Institute (MHI) is not known to have dealt with in a public fashion. More on that aspect of this problematic issue will follow the outreach to Ramsey and the text of their post which sparked the emailed request for corrections.

The email to two different contacts at Ramsey said the following. It was sent on 1.24.2022 at 8:36 AM ET.

Subject: Ramsey Solutions, Media Outreach, Evidence-Based Request for Corrections

Public Relations @ Dave Ramsey/Ramsey Solutions,

The article linked below came to our attention earlier today.

https://www.ramseysolutions.com/real-estate/mobile-homes

By way of introduction, we publish the runaway largest and most read professional trade publication serving the manufactured home industry, MHProNews.com. We also publish a public facing site, MHLivingNews.com. These each get millions of visitors annually.

We recognize and respect that Ramsey has a reputation for financial advice that has benefited numerous individuals, households, and families. That said – and with all due respect – this specific advice by Ramsey is arguably flawed on several levels. It should therefore be corrected ASAP.

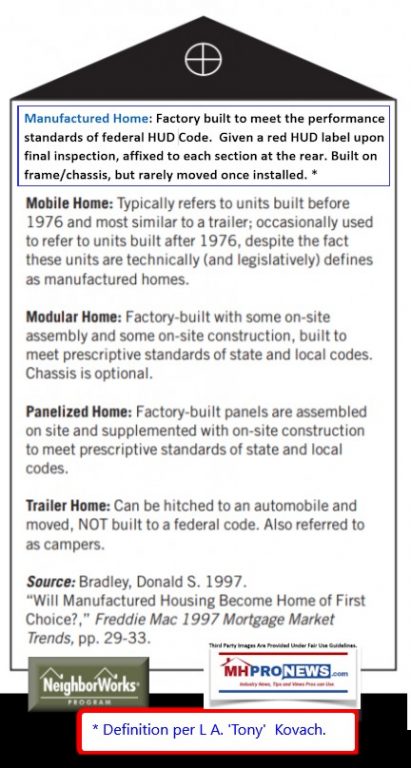

First, you have self-contradictory information. The paragraph that begins with “We want to be clear that we’re talking specifically about mobile or trailer homes here, not manufactured homes.” is contradicted by the second paragraph statement: “or buy a brand-new two-bedroom mobile home for roughly $80,000.” If it is a “brand new” factory built home on a permanent frame that bears the HUD seal, that is by definition a manufactured home, not a mobile home. The part of your article is close to correct – Technically, the government lumps any mobile home that was built after 1976 into the manufactured home category … – in as much as the HUD Code for manufactured housing went into effect on June 15, 1976. To put it differently, the terminology is not interchangeable. Each term has a specific meaning, legally and practically.

Next, recent and years of prior research debunks your claim that new manufactured homes drop in value ‘super-fast,’ like a car. FHFA, the Urban Institute, and most recently LendingTree have produced studies that reflect the opposite. Namely, that manufactured homes appreciate at similar rates and for similar reasons that conventional housing does.

There are a series of media releases among the links below that your operation are welcome to appropriately use and reference with the source credited. These each provide links to the supporting data and evidence.

For these reasons, we hereby request that you update this report by making the appropriate corrections.

Not every report below may be of interest, but they will reflect that we are willing to hold problematic behavior in our industry accountable. That noted, where the facts warrant, our publications will provide the evidence that allows consumers and others to make informed decisions. For instance, your article mentioned tornadoes. This is another common myth, that at least two of the reports linked below (one an EIN press release) will factually correct the record.

Note that tornadoes that occurred after that date appear to support those facts.

Third, your report is dated Sept 2021, but your pricing data is not the most recent even as of that date.

Fourth, and not to fisk every part of your Ramsey post, but the site fees on land lease communities are too low in some cases, even for the date in question.

Please have someone on your team that has no animus or agenda against manufactured housing correct your report. Or, you can use the media releases we have below with appropriate credits.

We are BCCing several state associations to document this request. Kindly confirm you have this message and please state your intentions with respect to this request for correction. Thank you.

Tony

See fwd:

=== some of the relevant links from the 1.20.2022 emailed news update are as shown below ===

As was noted in the email above, the request was related to this specific article on the Ramsey Solutions website, currently found at this link here. By providing this content under fair use, this documents the issues raised with respect to the content as of this date and time.

It should be made clear that showing their copy is in no way an endorsement of their apparently errant beliefs on this topic. See the linked reports for the facts and evidence that corrects the misstatements made below.

Why Are Mobile Homes a Bad Investment?

Ramsey Solutions | SEP 24, 2021

John and Debbie Miller are living in a $500,000 paid-off home in Albany, New York. It’s a great home, but John and Debbie are empty nesters now. They don’t need a big four-bedroom, three-bathroom house with a huge backyard, but they do need that $500,000 to put toward their retirement dreams.

The Millers have decided they’re going to downsize. They want to stay in Albany to be close to the grandkids, and they’re looking either to buy a modest two-bedroom home for $180,000 or buy a brand-new two-bedroom mobile home for roughly $80,000.

The Millers say they would be perfectly happy with either option, so they’re leaning toward buying the mobile home. After all, it would be smart to save the $100,000, right?

Wrong!

Mobile homes are a terrible investment because they drop in value super fast. Sure, $80,000 seems like a great deal now, but when it’s time for John and Debbie to move on, they’re going to see just how much money they threw away by “saving” on that mobile home.

We want to be clear that we’re talking specifically about mobile or trailer homes here, not manufactured homes. Technically, the government lumps any mobile home that was built after 1976 into the manufactured home category, but that term can cover a whole lot of different housing options.1 For the sake of this article, we’re talking about the mobile homes that look like they came in on a truck.

We’re also not saying that mobile homes aren’t nice. There are some really nice-looking trailer homes out there! But that doesn’t make them a good investment. Mobile homes go down in value as soon as you move in, the same way your car loses value the second you drive it off the lot. Investing in a mobile home is not investing in real estate. The land the mobile home sits on is real estate, but the home is considered personal property.

How Much Do Mobile Homes Cost?

According to the U.S. Census Bureau, the average price of a new manufactured home was $87,300 in September of 2020.2 Of course, the price varies with the size and look of the home:

| Type | Avg Cost | Avg Living Space | Bedrooms | Bathrooms |

| Single-Wide | $58,300 | 500–1,200 sq. ft. | 1–2 | 1–2 |

| Double-Wide | $107,800 | 1,000–2,200 sq. ft. | 2–3 | 2 |

Buyers should keep in mind that costs and size regulations vary by state because these homes will need to be transported. The price will also depend on personal customizations (like granite counter tops) and add-ons (like a front porch).

If you buy a trailer home, you’ll also need to either buy or rent land for it to sit on. The nationwide average cost of a mobile home lot is $380 a month, but those prices will reflect the real estate costs of your state and city. For example, the average lot rent in Indiana is $140, but in California it’s $707.3 For our friends John and Debbie Miller, they’re looking at roughly $400 a month in upstate New York.

The lot price also depends on amenities you may have access to, including things like electricity, trash pickup or even an on-site pool.

How Long Do Mobile Homes Last?

According to the Department of Housing and Urban Development (HUD), manufactured homes built today have a life expectancy of 30 to 55 years. That estimate is for manufactured homes that were built with HUD’s current building codes and construction standards that go for all manufactured homes since 1976.4

Of course, just like a car, a mobile home will hold up as well as it’s maintained. If you keep up general maintenance, choose your plot location wisely, and have it inspected every so often, you could outlast that 55-year mark.

Like standard stick-built homes, mobile homes are made out of wood and metal. But unlike standard homes, they’re not built on a permanent foundation with framing that’s built to last. People who live in mobile homes are most vulnerable to natural disasters, including hurricanes, tornadoes, flooding and fires. A recent study found that a tornado-related fatality is 15 to 20 times greater in a mobile home than in traditional housing.5

Needless to say, a mobile home isn’t something you’re going to pass down to your family for generations.

Should I Invest in a Mobile Home?

If you’re smart, you’re not going to look at a trailer home as an investment. From a financial standpoint, buying a mobile home is like buying a very large car that you sleep in. And we all know what happens to cars over time—they lose value.

Some like to argue that buying a mobile home is better than paying rent on an apartment or home. We would disagree. When you pay, say, $1,200 a month in rent, that’s all you’re losing. But when you buy a mobile home, you’re losing money every day on the ownership of that thing because it depreciates so quickly. It may look good from a tax perspective, but it’s bad news for your resale value.

Good Investing Alternatives to a Mobile Home

If you’re looking at investing in real estate, there are much better opportunities out there than mobile homes, and that’s because of one magical word: appreciation.

Despite the ups and downs of the real estate market, most properties increase in value over time. In fact, home values have been rising pretty much nonstop for nearly a decade now.6 Meanwhile, trailer homes are treated just like your car—losing value every year.

Another big key of real estate? Location! Buy a home in a part of town that’s on its way up. That way you buy at a lower price and can ride out any downturns in the market while your property value goes up.

If we were advising John and Debbie Miller, we would tell them to go for the $180,000 home over the $80,000 trailer home. After selling their $500,000 home, they could pay for the smaller home in cash and have $320,000 left over to play with. When they die, they can bless their kids or grandkids—either with a paid-for home, rental property or a property to sell. At that point, the home would likely be worth more than the $180,000 they paid for it!

Real estate is one of the biggest investments you’ll ever make. It can be a big money maker, but it’s really confusing (and risky) to navigate if you don’t have all the tools in your toolbox.

That’s why we recommend working with a real estate professional who’s the best in their field. Reach out to one of our trusted Endorsed Local Providers (ELPs) who can help you find what you’re looking for. Through our ELP program, you’ll get instant access to the right real estate professional for your family. ##

The article below provides some of the better-known information on site fees in various parts of the U.S., which Ramsey could reference if that team wants to be accurate on that specific topic.

Additional Information, more MHProNews Analysis and Commentary in Brief

In no particular order of importance are the following points worth pondering.

- Some aspects of the Ramsey business model are apparently revealed through that last paragraph in their arguably factually flawed post.

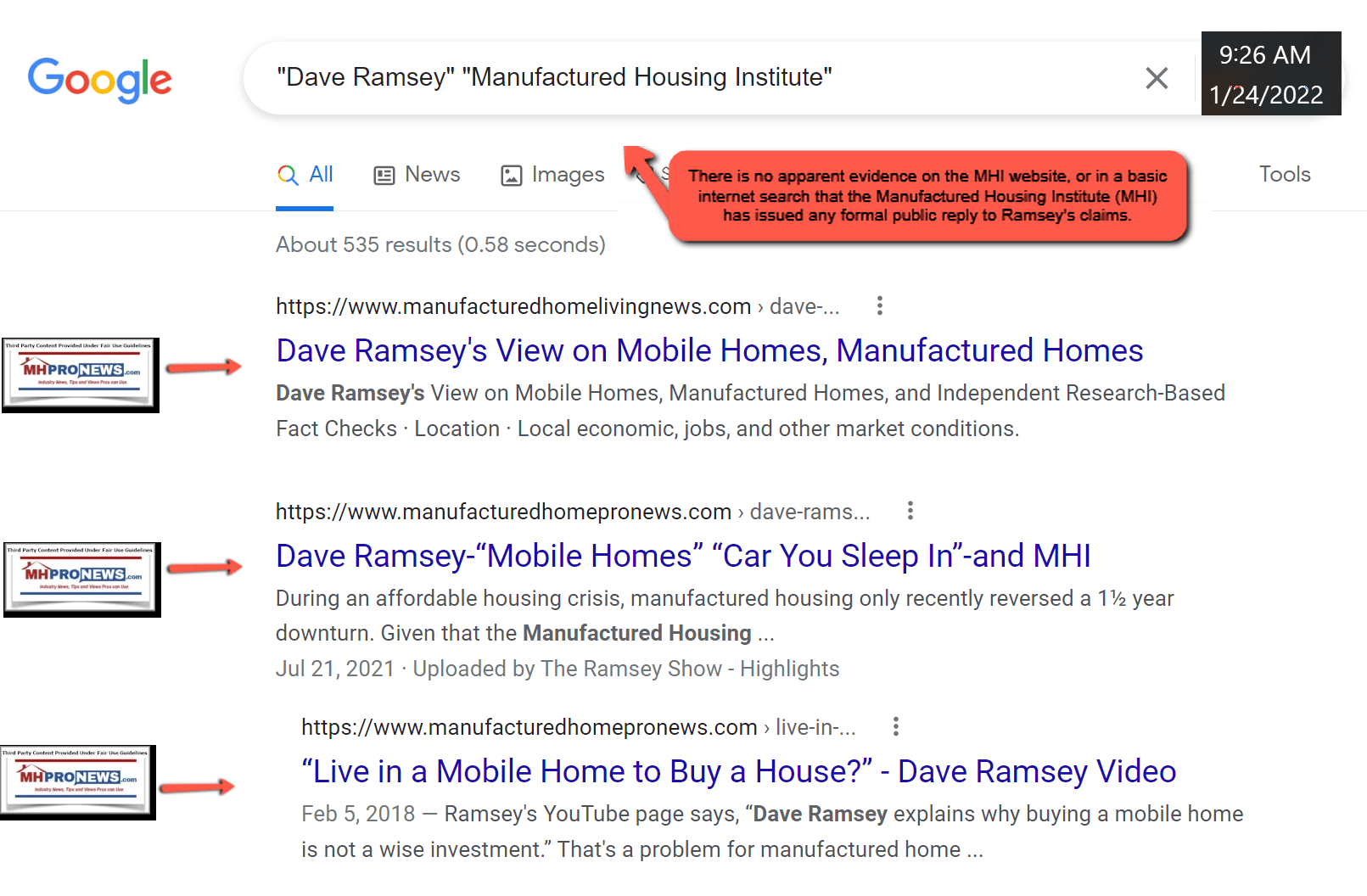

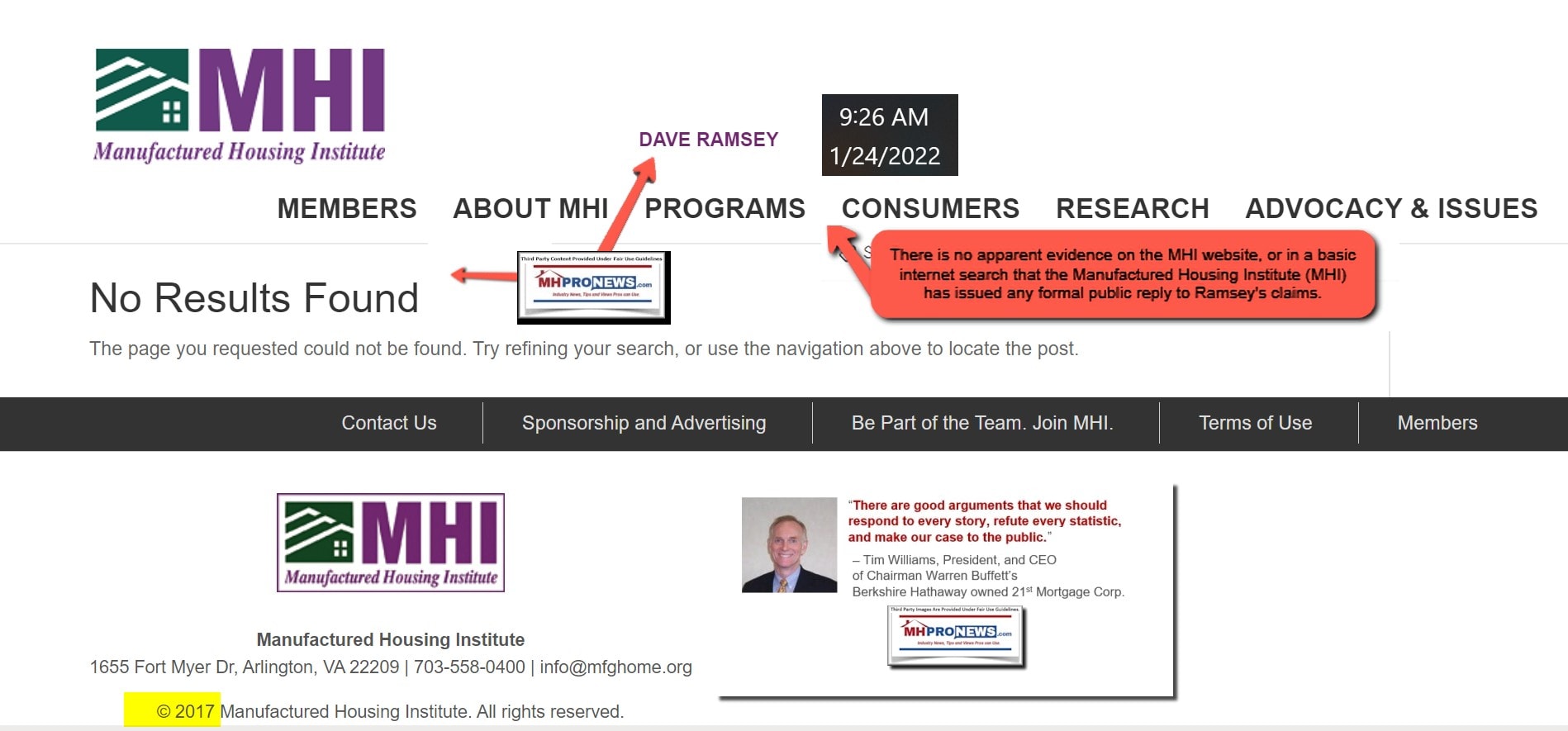

- In fairness to Ramsey, while they are obviously responsible for their own research and statements, there is no known outreach by the Manufactured Housing Institute (MHI) on behalf of the industry’s sellers and homeowners. See screen capture below.

- That MHI bears some measure of responsibility is exemplified by former MHI Chairman Tim Williams on-the-record comment shown below. When Williams said that it is logical to correct every factual inaccuracy, that’s quite correct – so long as that effort is made or performed by MHI.

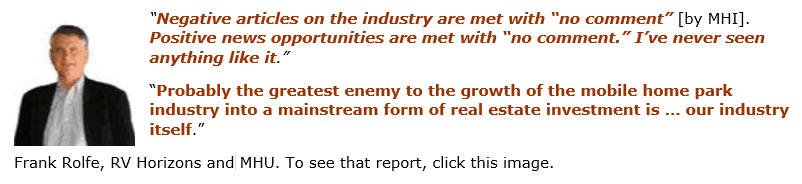

- As prominent and arguably notorious MHI member Frank Rolfe aptly said, MHI’s failure to properly address either good or bad news is stunning in a problematic fashion.

- It should be noted that controversy is not necessarily a bad thing, so long as the issue in question is properly debated or addressed. That noted, failure to address such a problematic claim by Ramsey or someone of that public stature is a serious issue for manufactured home sellers and homeowners.

There is more that has been and could be said. These are the reasons why MHProNews has launched the latest phase of accountability and reporting. See the linked reports above and below to learn more about those efforts.

Summary and Conclusion

Ramsey and MHI each bear responsibility for their respective missteps. Ramsey holds himself out as a person motivated by religious faith, which encourages humility as well as honesty. A legal source has told MHProNews that there is possible liability for both Ramsey and MHI in their respective failures. Time will tell if Ramsey Solutions et al will make the necessary changes to their statements. MHProNews plans to follow up once Ramsey has been given the opportunity to digest and address the points raised. Additional Ramsey related articles, and recent ones with respect to MHI and their dominating brands ‘leadership’ are shown further below. ##

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

nbsp;