Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

· U.S. banks pass Fed’s stress tests for first time

· Trump, Amazon, ‘internet taxes’: The real story

· All U.S. banks pass Fed’s stress tests for the first time

· There’s no ‘kill switch’ for malware attack

· Responding to Trump’s intensifying war on media

· Venezuela’s currency collapse is getting worse

· Jaguar reveals its quickest car ever Trending

· GM CEO says the world needs more coders Trending

· 7 first-time homebuyer mistakes to avoid

· ABC settles suit over what it had called ‘pink slime’

· Buffett says single-payer health care makes sense

· China frees 3 who probed former Ivanka Trump factory

Selected headlines and bullets from Fox Business:

· Fed clears all 34 banks to release dividends, buybacks

· Wall Street surges as banks, tech stocks spark rebound

· Oil rises more than 1 percent on U.S. weekly production decline

· Senate aims to amend health care bill by Friday, vote after July 4 recess

· DHS announces new aviation security measures

· JPMorgan CEO Jamie Dimon wants to solve America’s youth crisis

· Google’s $2.7B EU fine: Why Main St. in America ‘gets it’

· Arcimoto, maker of three-wheeled electric car, seeks IPO boost

· Wealthy New Jersey couples accused of stealing millions from welfare programs

· Christie Brinkley vs. Gwyneth Paltrow: Beauty Empires

· ABC News settles $1.9B ‘pink slime’ lawsuit with Beef Products

· Trump vs. Bezos: A look into the longstanding rift over taxes

· Christie Brinkley: It’s an exciting time to be ‘sixty’ in business

· Houston Rockets land Chris Paul, setting him up for huge payday

· Eight public college presidents pay topping $1 million, study finds

· Mississippi utility will stop efforts to complete coal plant

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

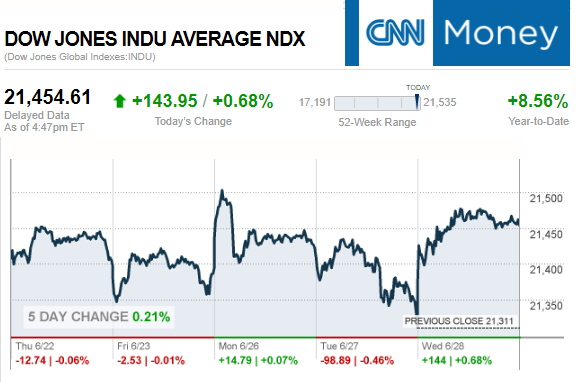

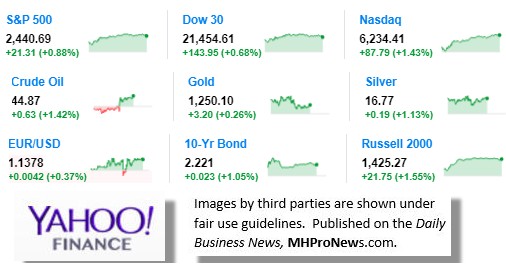

9 key market indicators, ‘at the closing bell…’

S&P 500 2,440.69 +21.31 (+0.88%)

Dow 30 21,454.61 +143.95 (+0.68%)

Nasdaq 6,234.41 +87.79 (+1.43%)

Crude Oil 44.87 +0.63 (+1.42%)

Gold 1,250.10 +3.20 (+0.26%)

Silver 16.77 +0.19 (+1.13%)

EUR/USD 1.1376 +0.0039 (+0.35%)

10-Yr Bond 2.221 +0.023 (+1.05%)

Russell 2000 1,425.27 +21.75 (+1.55%)

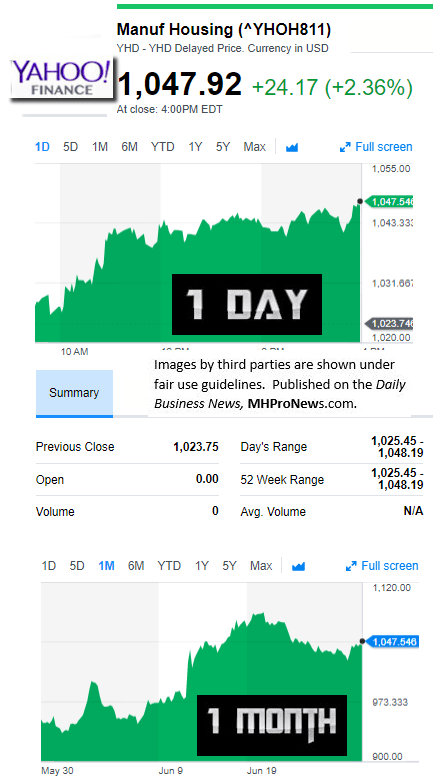

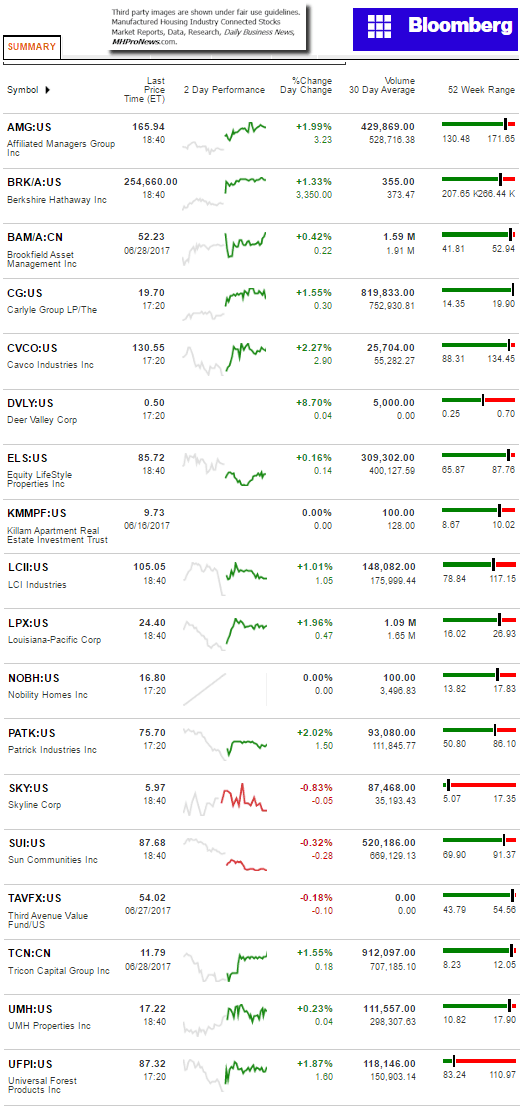

Manufactured Housing Composite Value 6.28.2017

Manufactured Housing Connected Stocks

Today’s Big Movers

Deer Valley and Cavco lead the gainers. Skyline Homes and Sun Communities lead the decliners.

See below our spotlight report for all the ‘scores and highlights.’

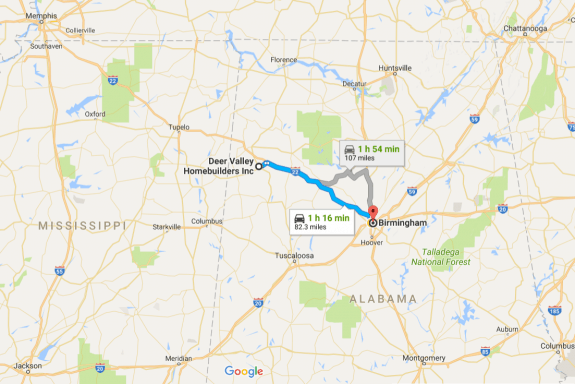

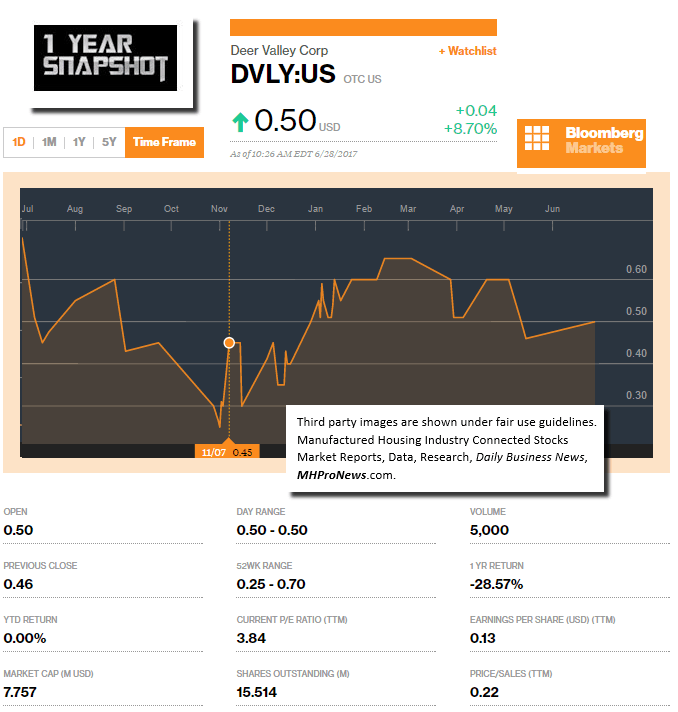

Today’s MH Market Spotlight Report – Deer Valley Homebuilders (DVLY)

Deer Valley is an over-the-counter stock that is traded only periodically, as those who follow the Daily Business News market report closely know.

So the major media reports only do a periodic report on the stock as well. What follows are some snippets of a previous write up from a longer report from investor-focused, Seeking Alpha.

- Trades at unjustifiably cheap valuation, even assuming no fundamental improvement.

- However, improvement is likely given manufactured housing tailwinds, stock deregistration, and recent performance.

- There is certainly risk: thinly traded, manufactured housing stigma and decline, and uncertainty on governance in the LCV ownership era.

- Conclusion: Investors are more than adequately compensated to assume these risks.

Business Background

- Deer Valley (OTCPK:DVLY) designs and manufactures factory-built homes which are marketed in 14 states through a network of dealers in southeastern and south central US.

“In 2006, Cytation, a blank check representing a group of investors led by Charles Masters and including John Steven Lawler, bought Deer Valley and brought it public. Masters and Lawler were homebuilding industry veterans and managed the company well. Revenue dropped from 61mm in 2008 to 2009 and the company generated $6.3mm of operating losses between 2009-2010, however there was goodwill impairments of $9.3mm in those years, so they actually, remarkably, maintained underlying profitability through a once-in-a-century-severity housing crisis. Some tough moves had to be made. They had to idle their Sulligent facility, one of their two plants, in 2008. Around the same time, access to financing for dealers in the manufactured home industry almost completely dried up and Deer Valley’s response was to create a financing subsidiary, DVFC, and offer short-term (24 month) inventory-secured financing to dealers until conditions improved. The company recently sold the Sulligent facility to the local municipality at a bargain price and DVFC-financed sales have declined from 36% of sales in 2013 to 22% in 2014 as lenders have come back to the space, which has unlocked cash from working capital…

Masters retired at the end of 2014 around the same time that Peerless Systems, another nanocap stock that was previously public, acquired 80% of the company from another hedge fund that was being liquidated…

In early 2015, LCV a hedge fund managed by Anthony J. Bonidy and Lodovico de Visconti acquired Peerless through a tender offer…”

The Thesis

“There’s two reasons to like Deer Valley:

- It trades at a ridiculously cheap valuation assuming the financials remain unchanged forever

- There is potential for dramatic performance improvement due to industry tailwinds in the manufactured housing industry off what could be a long-term bottom, and that would be compounded by operating leverage at Deer Valley given their manufacturing plant is currently operating at 53% of capacity.”

Valuation

- There’s really no reason for Deer Valley to trade as cheaply as it does…

- If I had the money, I’d buy the entire company even if I knew I wouldn’t get any more or less than that 10-year record in the 10 years to come.”

While that SA commentary is from last year, what our sources at Deer Valley tell MHProNews is that their firm continues to gain in the marketplace, much as Grasso’s commentary above suggested.

In particular, a sizable operation is now selling DVLY’s homes, which is a development that has buoyed their overall sales.

Sources also tell the Daily Business News that when MHLivingNews or MHProNews do a report on Deer Valley, they see an noticeable increase in interest. Time will tell if that pattern holds, following this report.

By way of disclosure, MHProNews has no ties to this or any other industry connected stocks, which leaves us free to comment and report.

While not publicly traded, nearby Sunshine Homes has reported a much better than industry average surge for two years running. In our editorial analysis, MHProNews observes that the residential side of HUD Code manufactured housing and modular homes are well poised for growth. The paucity of existing home inventory available, and the rising demand from millennials and boomers are among the reasons for that trend.

Absent the unexpected, these and other factors bode well for DVLY’s growth. Should HUD’s program management be shifted, and the facts on manufactured housing continue to spread in the mainstream media, the future looks bright for this company and others like it.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.