Noteworthy headlines on MarketWatch – How energy stocks could power the Dow toward 24,000 in 2017. Dollar pulls back after recent rally, but remains near multiyear highs. As mortgage rates march higher, a few reasons not to panic. Oil breaks 4-day win streak as U.S. inventories rise.

Gold = 1,159.00 18.10 1.59

Oil = 53.85 -0.21 -0.39

At the closing bell…

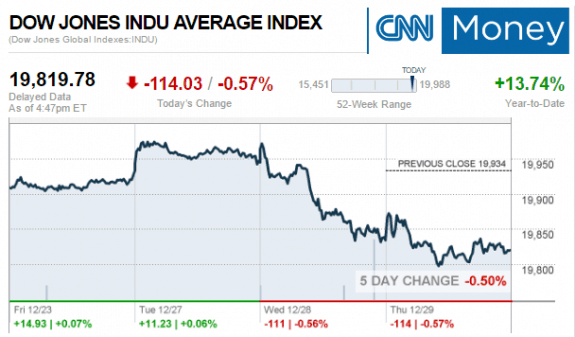

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P = 500 2,249.26 -0.66 (-0.03%)

Dow JIA = 19,819.78 -13.90 (-0.07%)

Nasdaq = 5,432.09 –6.47 (-0.12%)

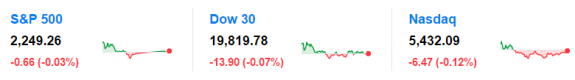

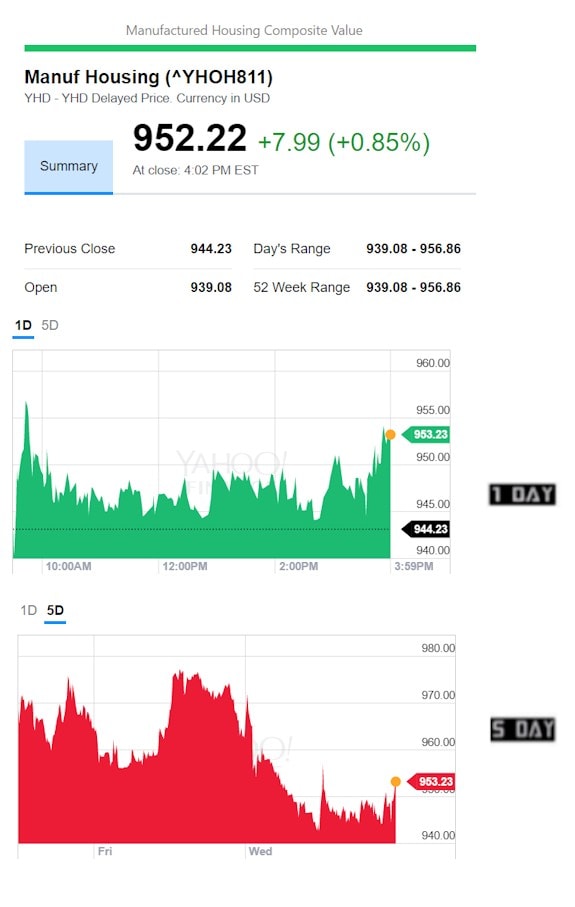

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Deer Valley Deer Valley Corp (DVLY) and UMH Properties (UMH). The top two sliders for the day were Drew Industries (DW) and Third Avenue Value Fund (TAVFX). Killam and Deer Valley held steady today, as the stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

A recent Sun report, linked here.

A recent AMG report, linked here.

A recent Tricon report, linked here.

Recent UFPI investor moves, linked here.

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.