Now, tailwinds are pushing the industry forward and the company, located in Guin, Alabama, has been steadily advancing. Although considered a nano-cap, it competes effectively from one location with Clayton Homes, Cavco Homes, and Nobility Homes.

With revenue up 14 percent in year-to-date 2015, and operating income nearly tripled, Grosso does not understand why the stock is so low priced. He says operating leverage is good, as DVLY is only using 53 percent of its manufacturing capacity, making it ripe for an upturn in production.

In 2006 a group of investors led by Charles Masters and John Steven Lawler bought Deer Valley and took it public. In response to the downturn, the company closed its Sulligent, Ala. facility, and because credit for dealers all but dried up, DVLY started its own financing subsidiary, offering 24 month inventory-secured financing to dealers. Financed sales have since fallen from 36 percent of sales in 2013 to 22 percent in 2014 as lenders have slowly returned, freeing up working capital for DVLY.

Towards the end of 2014, Peerless Systems acquired 80 percent of the company through its acquisition of a hedge fund that was being liquidated, and Peerless, in turn, was acquired by another hedge fund in early 2015. In Dec., 2015, DVLY announced a $4mm convertible venture loan bearing 5% interest to an affiliated company that is making a $14,000 fiberglass car in Italy at a facility for auto manufacturing not being used.

While Grosso says, “Shipments and inventory of manufactured houses are near historic lows,” in fact they have been rising since Aug. 2011, although they are not near the 300k that were selling in the late 1990s. In any case, he notes the weakness in the MH market is due to loose credit offered low-income people during the housing bubble that lured them away from MH to site-built homes and condos they could ultimately not afford. The Recession itself hurt people at the lower reaches of the income scale more than others, and older couples who might be interested in an MH are waiting for home prices to rise before they move.

Noting that MH get a bad rap for not appreciating, Grosso says he has lived in a multi-sectional home and does not understand why they do not appreciate in value. “I suspect that a traditional home would have a lot of problems after 50-60 years too if you didn’t put any major work into it,” he added. He thinks, giving the nature of homes being manufactured inside a facility with advancements in technology, MH will grow and DVLY’s profits and cash flow will rise around ten percent.

The stock has only traded on 25 days since late Aug., 2015, which amounts to less than $300 a day in volume, which would turn away investors and appeal mostly to small individual investors, which Grosso says he is one.

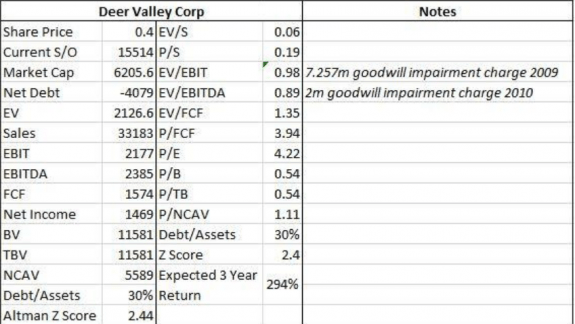

At the same time, he is a little concerned that Deer Valley has invested all of its cash in a venture capital investment in a foreign company, although Google Ventures and Kleiner Perkins are part of the funding. Nonetheless, he refutes the notion that MH is on a decline, realizing that housing is a cyclical market, and while Deer Valley is skating a little on thin ice with its foreign investment, its stock at $.40 to $.70 a share is definitely worth the risk.

In today’s trading, March 21, Deer Valley fell -0.08 points, -11.59%, to close at 0.61. ##

(Graphic credit: seekingalpha)