Frank Rolfe and Dave Reynolds have been involved in the Kurt Kelley, J.D., quarterly MHReview since the early days when the quarterly was still a monthly publication. Rolfe, for example, often appears with an article in their pages. Ads by one or more of Rolfe/Reynolds enterprises are not uncommon in MHReview (MHR). The manufactured home communities’ (MHC) segment of the industry is a routine subject for their publication, perhaps due in good measure to their sponsors and Kelley’s own business interests in that sector. In their Q4 2023 issue, the first article up is by Rolfe and is entitled: “Don’t Bring a Knife to a Gun Fight.” That may seem to be a bit melodramatic, but it is his title and not ours. As is our norm, every item mentioned in the headline will be covered in this report, analysis, and weekly recap.

Part I

In his MHR article, Rolfe runs through what he sees as troubles in the commercial real estate (CRE) sector: office buildings, retail centers, hotels, self-storage and industrial segments of CRE all get his thumbs down.

Apartments are okay, per Rolfe. In a total no surprise for those who know him, so too are “trailer parks” or “mobile home parks” – Rolfe’s deliberate (mis)use of those terms instead of land lease communities or manufactured home communities (MHCs).

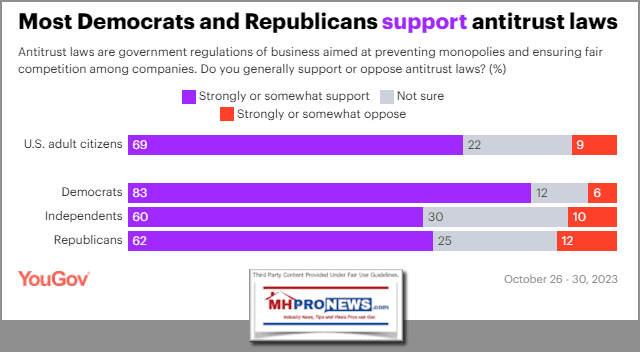

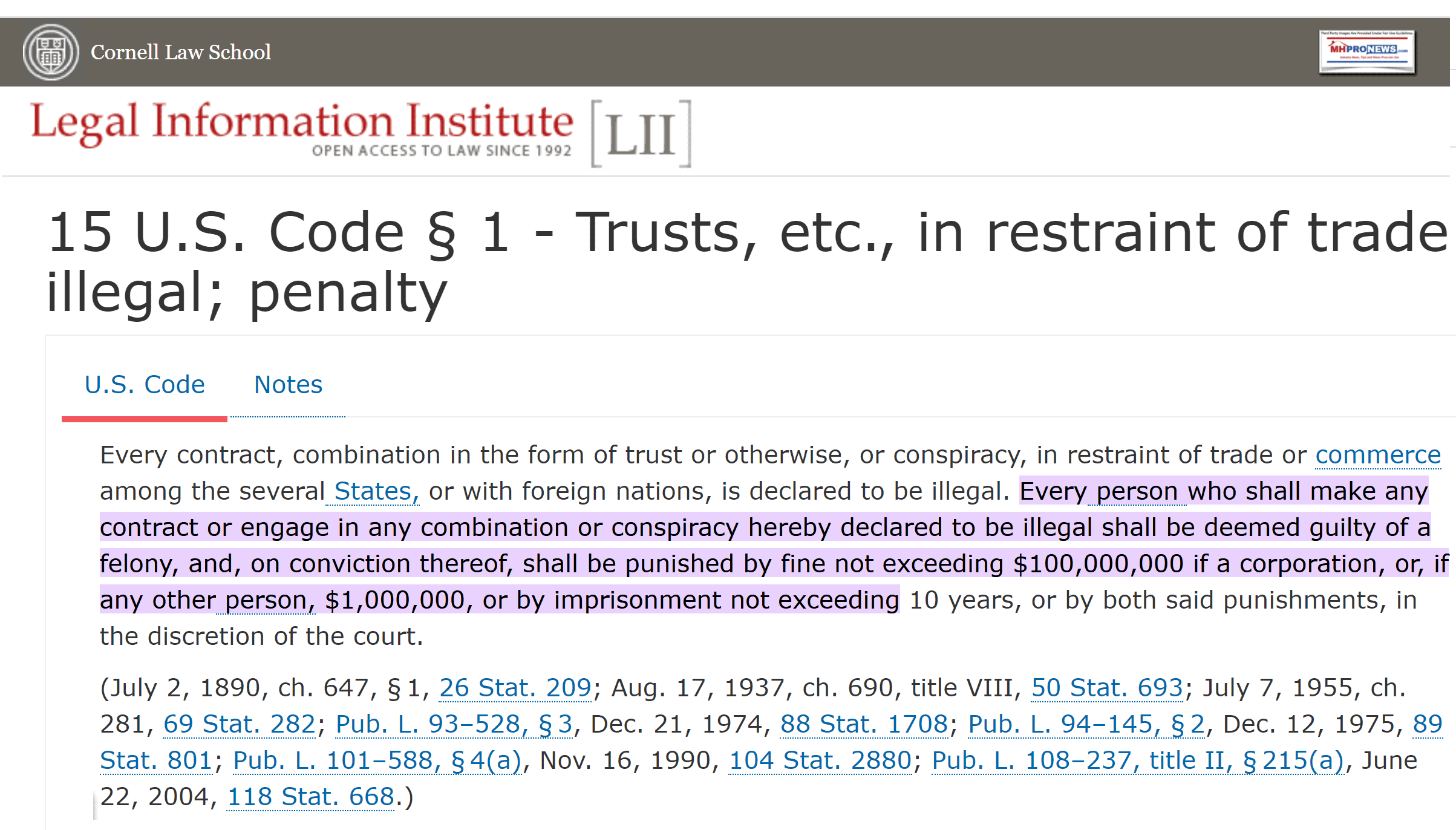

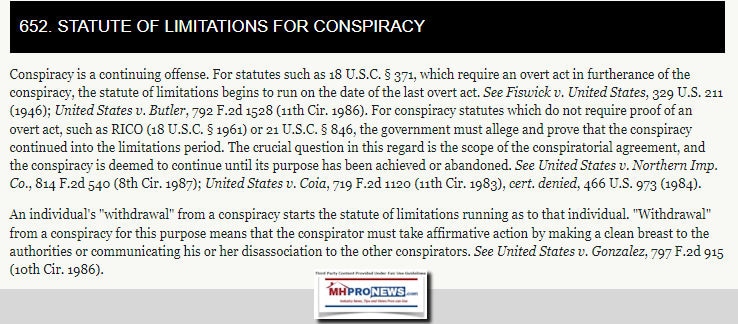

Also, in the new issue of MHReview is an article by “Dr. Cody J. Dees” which includes these opening thoughts: “By now, most everyone in the industry has seen or heard news coverage related to the class-action lawsuit, which was filed against Datacomp, and its customers. Skimming the suit, it appears to build a narrative that mobile home park owners are intentionally using ‘less than ethical’ means for establishing competitive rent pricing and must be held accountable.” Yes, “most everyone in the industry has seen or heard the news coverage,” perhaps not so much because of MHR, or MHInsider, et al., but rather due to the regular references found here on MHProNews and our MHLivingNews sister site. It is to some extent a backhanded compliment. But as the first link below reminds regular readers of MHProNews, there is what could be described as a ‘regional’ class action as well as national class action. That’s one of several details that Dees, a self-declared linguist, appears to have missed mentioning.

Dees linked Datacomp to a page that per a word search performed by MHProNews has no mention of the owner of Datacomp, MHVillage, and MHInsider. That would be Equity LifeStyle Properties (ELS). That noted, on 12.16.2023 that page linked by Dees from Datacomp oddly claims: “Accurate, Independent, Market-Based Mobile Home Appraisals.” Independent? Independent of whom? Certainly not independent of ELS, are they?

Dees also said: “As unfounded allegations like these are often thrown about without a requirement for supporting evidence, I would like to take the next few moments to engage a bit deeper with the specifics of the concept of “price fixing.” I feel that this may be a case were ‘knowledge is power’ and supporting our community with a deeper understanding will help us all fight back, or at least feel more secure in the face of such claims against our livelihood.” Dees is deliberately defending manufactured home operators/investors, who he indicates include himself.

Dees closing paragraph in that article said: “Wrapping things up, if you were concerned about the suit against Datacomp, I would encourage you to take heart, as a flock of attorneys have already taken the case. There is little evidence to support the claims against the mobile home industry, and once this lawsuit is settled, it will add a new chapter to the law history of the mobile home industry, affording us all greater protection from such claims in the future. Until the suit is over though, I would ask that each of you take the time to learn as much as you can about the types of legal terms and jargon that you may hear being flung about in relation to our livelihood. Learn the terms others use to condemn and use those same terms to protect yourself!”

Immediately following Dees article in MHR is an ad for a manufactured home attorney, err, “mobile home park” attorney. Of course.

Dees appears to be connected to a LinkedIn profile that doesn’t appear to mention his manufactured home communities investing. But that profile does indicate that he served the United States Air Force (USAF) in a “classified” capacity. He’s also been working for a “company” called the “

Jumping back to Rolfe’s article, which is followed by a full-page pitch for Rolfe’s and Reynolds’ “Mobile Home University” (MHU) Frank said the following.

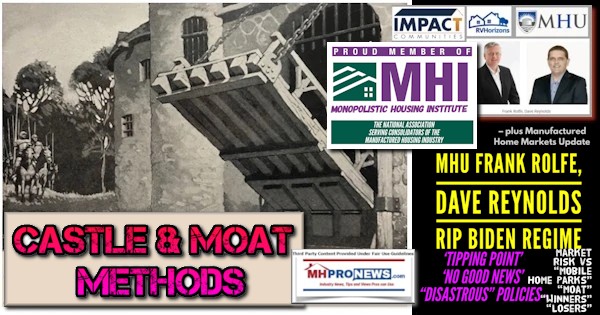

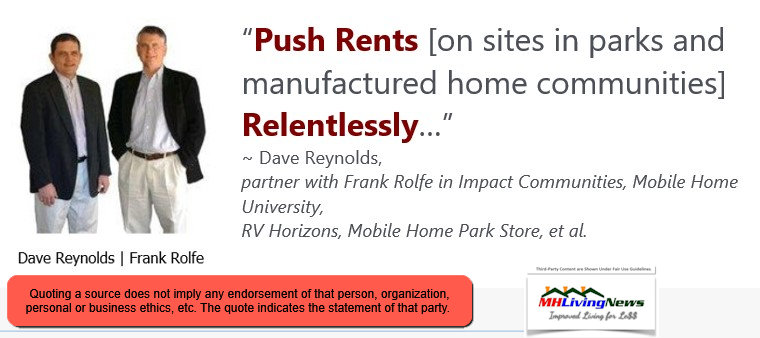

Last, but not least, on the list [of commercial real estate investments] is the lowly “trailer park” which turns out to be the strongest of all the sectors when it comes to surviving the modern cannon ball. Just like the apartment sector, mobile home parks are all about “necessity investing” as they are the Dollar General of housing. But more importantly the lot rents nationwide are insanely cheap (around $300 per month) and could double or triple and still be cheap – which is not an option that apartments share. Additionally – and unlike each and every sector shown above – you have not been able to build new mobile home parks since the 1970s. This cap on the supply maintains extremely favorable supply/demand metrics and creates another medieval reference which is what Warren Buffett calls the “moat”: the barrier to competition that protects your investment. And finally, mobile home parks are by definition “parking lots” and have very low capital needs.

Conclusion

The commercial real estate sector is a big mess. Only two niches will emerge untouched: 1) apartments and 2) mobile home parks. Of these two, I prefer the “trailer park” as it has some unique competitive advantages. But as long as I’m not in office, retail, lodging, self-storage or industrial I’m happy. The carnage coming up for the other niches will make the worst medieval battlefield look good. Who would have ever thought that this is how the commercial real estate industry would end up? I’m sure the knights on the battlefield when that first cannon went off were equally shocked.”

So, Dees – a self-proclaimed wordsmith who for whatever reasons is advocating that those in the manufactured home community sector: “if you were concerned about the suit against Datacomp, I would encourage you to take heart, as a flock of attorneys have already taken the case. There is little evidence to support the claims against the mobile home industry” when earlier in his own article Dees said that the “allegations” were “unfounded.” There is a significant difference, as a linguist or wordsmith should know, between “little evidence to support the claims” and “unfounded,” which by definition from Oxford Languages means: “having no foundation or basis in fact.”

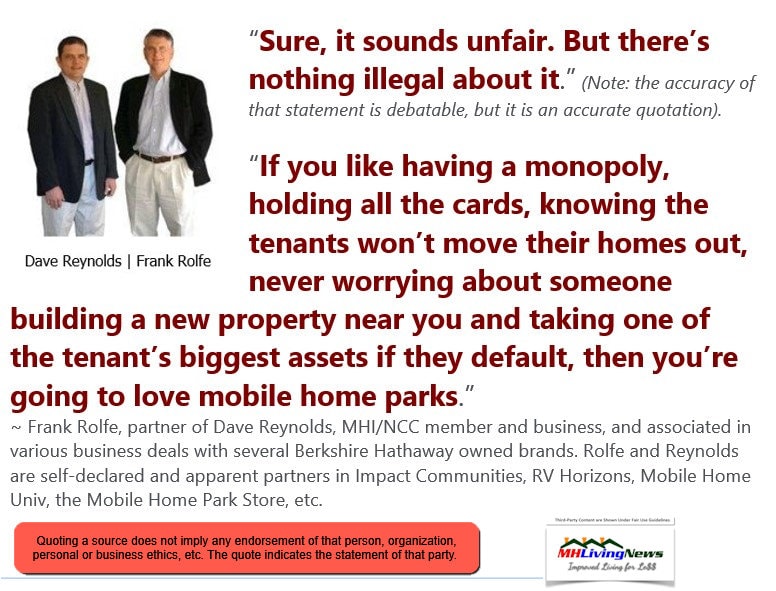

The business model of Rolfe and Reynolds has previously made the pitch for aggressive site fee hikes. Once again, in his latest MHR, Rolfe not too subtly hints at that by saying: “But more importantly the lot rents nationwide are insanely cheap (around $300 per month) and could double or triple and still be cheap.”

Among the articles for this MHProNews week in review is the published research from Marcus and Millichap Inc. (MMI). Look at what MMI said, and the analysis of it, as it relates in several ways to the seemingly wobbly – and as noted above, somewhat self-contradictory – arguments by Dees. The MMI report also sheds light on the notions from Rolfe cited herein above.

Rolfe’s latest reference to Buffett’s “moat” thinking is not his first such comment. MHProNews has spotlighted his remarks in reports like those that follow.

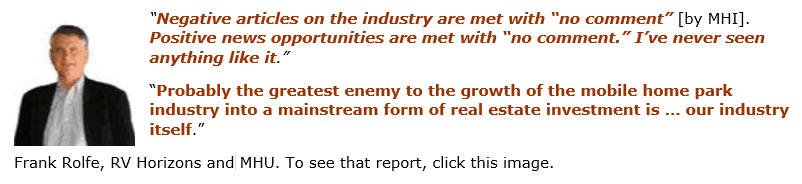

Not all that Rolfe has said is entirely self-serving, or at least, there are times that things that he has said things that can be demonstrably useful in painting a more complete picture of MHVille. Indeed, some of what Rolfe said arguably is harmful to him and his partner’s interests, whether he thought so at the time or not. Some examples follow.

Rolfe and Reynold’s (R&R) have also reportedly been sued by residents. Rolfe and Reynolds apparently responded with a countersuit. How often do you read about the landlords suiing the residents for something other than eviction, rules enforcement, or unpaid rentals/fees? Based on Rolfe’s own words cited above with respect to Nathan Smith (co-founder of what now is called Flagship Communities), did that mean that the duo put the MHC industry at risk?

Rolfe, Dees, or whomever can try to make the argument that the class action suit legal “allegations” were “unfounded.” Will there be a defense? Of course. MHProNews explored that weeks ago by presenting the views of an “industry insider.”

But as we have noted for years, the fact that these “moat” tactics have been deployed for some time now in MHVille with what may seem to some as little or no apparent consequences doesn’t mean that those impacts aren’t looming. Indeed, given the case of those already hit by the national class action suit, they are already here. In terms of Buffett -led Berkshire, even Barron’s indicated that his business practices are risking his ‘good guy’ image, see that in a headline report in the week that was, below.

Those points noted, look again at what Rolfe said about their local monopoly rationale with an added quote for more context. Seriously? R&R have been so apparently brazen that they have likely provided evidence that MHR’s author Dees has conveniently overlooked in his gee, whiz, don’t worry, learn the legal lingo, and keep on going as you did before these lawsuits were launched argument.

Part II

A researcher probing the manufactured home industry contacted MHProNews a few times in recent days. One subject of the digital conversation was the removable chassis topic and pending Congressional legislation.

MHProNews sent this as part of the reply on 12.16.2023. It should prove useful to others who want a quick overview into a subject covered in our week in review, below. Some items are edited out with the ellipsis … as shown.

Part III

https://www.manufacturedhomelivingnews.com/rigged-system-feudal-fascist-marxist-megacapitalist-socialist-corporate-shell-games-understand-why-working-middle-classes-struggle-american-dream-affordable-homeownership-fades-facts-analysis/

What’s New or Recent from Washington, D.C. from MHARR

What’s New or Recent from the Masthead on MHProNews

What’s New at the Daily Business News on MHProNews

Saturday 12.16.2023

Friday 12.15.2023

Thursday 12.14.2023

Wednesday 12.13.2023

Tuesday 12.12.2023

Monday 12.11.2023

Sunday 12.10.2023

Postscript

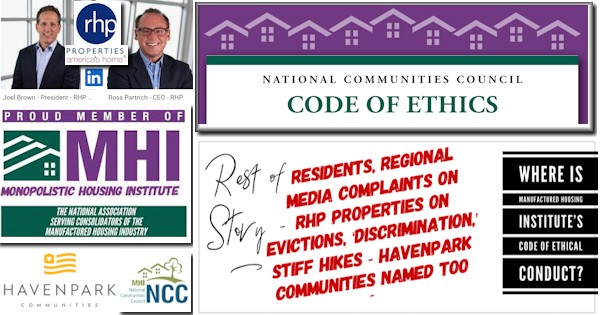

It is no secret that we don’t ‘cotton’ to the often-aggressive business practices that have been practiced by several MHI member brands. Those business practices appear to violate MHI’s so-called code of ethical conduct. Among the items that seemed to vanish from the publicly accessible side of MHI’s website since they gave their site a face-lift late last summer was that MHI Code of Ethical Conduct. That means that one of the few places online that someone can read all about that piece of posturing is linked below.

Per sources deemed reliable, among those who ‘read all about it’ here on MHProNews are those at RHP Properties and those in one or more of the Rolfe and Reynolds brands. If someone reads MHI’s code above, and looks carefully at the business practices advocated and used by R&R, there is an argument to be made that Rolfe and Reynolds have violated those ‘conduct’ rules several times. Who says? Among others members of the teams of firms who are, or previously were, MHI members. If you can imagine how unhappy thousands upon thousands of residents are living in some of the named communities in the report linked below, then it isn’t hard to picture the tough conditions that numbers of the employees in those firms describe? As the old saying from newspapers’ heydays used to go, ‘Extra! Extra! Read all about it!’ in the article linked below.

As MHProNews has taken pains to note, not every MHI member is a proverbial ‘black hat brand.’ That said, to some, MHI operates a bit like an irksome protection racket. Some who recall MHI during the Chris Stinebert era think that MHI merits four-letter word descriptions.

Rolfe’s MHR article did a snapshot the other segments of commercial real estate (CRE), as was noted in Part I above. For those who trust too much in what Rolfe has to say, consider the following snapshot offered by Bing AI, in response to the inquiry that follows.

> “How sound are the commercial real estate sectors of self-storage, industrial, office space, hotels, and retail?”