Nobility Homes, Inc. (OTCQX:NOBH) announced sales and earnings for its third quarter ended August 6, 2022. Sales for the third quarter of 2022 were up 18% to $13.8 million as compared to $11.8 million recorded in the third quarter of 2021. Income from operations for the third quarter of 2022 was $2.2 million versus $1.2 million in the same period a year ago. Net income after taxes was $1.9 million as compared to $1.0 million for the same period last year. Diluted earnings per share for the third quarter of 2022 were $0.56 per share compared to $0.29 per share last year.

For the first nine months of fiscal 2022 sales were $35.3 million as compared to $35.6 million for the first nine months of 2021. Income from operations was $5.2 million versus $4.5 million last year. Net income after taxes was $4.5 million compared to $3.8 million last year. Diluted earnings per share were $1.30 per share compared to $1.06 per share last year.

Nobility’s financial position during the third quarter 2022 remains very strong with cash and cash equivalents, certificate of deposits and short term investments of $22.9 million and no outstanding debt. Working capital is $31.2 million and our ratio of current assets to current liabilities is 3.0:1. Stockholders’ equity is $45.2 million and the book value per share of common stock was $13.40.

Terry Trexler, President, stated, “The demand for affordable manufactured housing in Florida and the U.S. continues to be strong. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2021 through July 2022 were up approximately 22% from the same period last year. Although net sales increased during the three months ended August 6, 2022 as compared to the same period last year, we continued to experience the negative impact of limitations being placed on certain key production materials from suppliers, the delay or lack of key components from vendors as well as back orders, delayed shipments, price increases and labor shortages. These supply chain issues have caused delays in completion of the homes at the manufacturing facility and the set up process of retail homes in the field, resulting in decreased net sales due to our inability to timely deliver and setup homes to customers. We expect that these challenges will continue for the remainder of fiscal year 2022 and potentially beyond until the industry supply chain normalizes.

Maintaining our strong financial position is vital for future growth and success. Because of very challenging business conditions during economic recessions in our market area, management will continue to evaluate all expenses and react in a manner consistent with maintaining our strong financial position, while exploring opportunities to expand our distribution and manufacturing operations.

Our many years of experience in the Florida market, combined with home buyers’ increased need for more affordable housing, should serve the Company well in the coming years. Management remains convinced that our specific geographic market is one of the best long-term growth areas in the country.”

On June 5, 2022 the Company celebrated its 55th anniversary in business specializing in the design and production of quality, affordable manufactured homes. With multiple retail sales centers in Florida for over 31 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

MANAGEMENT WILL NOT HOLD A CONFERENCE CALL. IF YOU HAVE ANY QUESTIONS, PLEASE CALL TERRY OR TOM TREXLER @ 800-476-6624 EXT 121 OR TERRY@NOBILITYHOMES.COM OR TOM@NOBILITYHOMES.COM

Certain statements in this report are unaudited or forward-looking statements within the meaning of the federal securities laws. Although Nobility believes that the amounts and expectations reflected in such forward-looking statements are based on reasonable assumptions, there are risks and uncertainties that may cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the potential adverse impact on our business caused by the COVID-19 pandemic or other health pandemics, competitive pricing pressures at both the wholesale and retail levels, inflation, increasing material costs (including forest based products) or availability of materials due to potential supply chain interruptions (such as current inflation with forest products and supply issues with vinyl siding and PVC piping), changes in market demand, changes in interest rates, availability of financing for retail and wholesale purchasers, consumer confidence, adverse weather conditions that reduce sales at retail centers, the risk of manufacturing plant shutdowns due to storms or other factors, the impact of marketing and cost-management programs, reliance on the Florida economy, impact of labor shortage, impact of materials shortage, increasing labor cost, cyclical nature of the manufactured housing industry, impact of rising fuel costs, catastrophic events impacting insurance costs, availability of insurance coverage for various risks to Nobility, market demographics, management’s ability to attract and retain executive officers and key personnel, increased global tensions, market disruptions resulting from terrorist or other attack, any armed conflict involving the United States and the impact of inflation.

NOBILITY HOMES, INC.

Condensed Consolidated Balance Sheets

| August 6, | November 6, | |||||||

| 2022 | 2021 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 20,437,309 | $ | 36,126,059 | ||||

| Certificates of deposit | 1,946,429 | 2,093,015 | ||||||

| Short-term investments | 541,132 | 621,928 | ||||||

| Accounts receivable – trade | 775,596 | 680,228 | ||||||

| Note receivable | 23,905 | 32,825 | ||||||

| Mortgage notes receivable | 15,566 | 22,589 | ||||||

| Inventories | 20,385,622 | 10,394,288 | ||||||

| Pre-owned homes, net | 662,453 | 542,081 | ||||||

| Prepaid expenses and other current assets | 2,314,540 | 1,821,267 | ||||||

| Total current assets | 47,102,552 | 52,334,280 | ||||||

| Property, plant and equipment, net | 7,569,386 | 6,847,780 | ||||||

| Pre-owned homes, net | – | 755,394 | ||||||

| Note receivable, less current portion | 22,243 | 38,895 | ||||||

| Mortgage notes receivable, less current portion | 132,184 | 222,459 | ||||||

| Mobile home park note receivable | 201,464 | 72,731 | ||||||

| Other investments | 1,829,146 | 1,788,436 | ||||||

| Operating lease right of use assets | – | 1,597 | ||||||

| Cash surrender value of life insurance | 4,095,216 | 3,966,939 | ||||||

| Other assets | 156,287 | 156,287 | ||||||

| Total assets | $ | 61,108,478 | $ | 66,184,798 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 1,329,275 | $ | 939,964 | ||||

| Accrued compensation | 832,632 | 555,222 | ||||||

| Accrued expenses and other current liabilities | 1,571,351 | 1,513,967 | ||||||

| Income taxes payable | 156,918 | 89,083 | ||||||

| Operating lease obligation | – | 1,597 | ||||||

| Customer deposits | 11,984,065 | 13,671,092 | ||||||

| Total current liabilities | 15,874,241 | 16,770,925 | ||||||

| Deferred income taxes | 65,496 | 99,568 | ||||||

| Total liabilities | 15,939,737 | 16,870,493 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $.10 par value, 500,000 shares | ||||||||

| authorized; none issued and outstanding | – | – | ||||||

| Common stock, $.10 par value, 10,000,000 | ||||||||

| shares authorized; 5,364,907 shares issued; | ||||||||

| 3,370,912 and 3,532,100 shares outstanding, respectively | 536,491 | 536,491 | ||||||

| Additional paid in capital | 10,828,305 | 10,766,253 | ||||||

| Retained earnings | 60,708,402 | 59,742,759 | ||||||

| Less treasury stock at cost, 1,993,995 and | ||||||||

| 1,832,807 shares, respectively | (26,904,457 | ) | (21,731,198 | ) | ||||

| Total stockholders’ equity | 45,168,741 | 49,314,305 | ||||||

| Total liabilities and stockholders’ equity | $ | 61,108,478 | $ | 66,184,798 | ||||

NOBILITY HOMES, INC.

Condensed Consolidated Statements of Income

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| August 6, | July 31, | August 6, | July 31, | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net sales | $ | 13,846,698 | $ | 11,778,120 | $ | 35,300,014 | $ | 35,592,531 | ||||||||

| Cost of sales | (9,948,638 | ) | (9,265,376 | ) | (25,651,808 | ) | (26,969,655 | ) | ||||||||

| Gross profit | 3,898,060 | 2,512,744 | 9,648,206 | 8,622,876 | ||||||||||||

| Selling, general and administrative expenses | (1,653,200 | ) | (1,320,456 | ) | (4,448,349 | ) | (4,144,350 | ) | ||||||||

| Operating income | 2,244,860 | 1,192,288 | 5,199,857 | 4,478,526 | ||||||||||||

| Other income (loss): | ||||||||||||||||

| Interest income | 62,449 | 62,491 | 176,706 | 145,621 | ||||||||||||

| Undistributed earnings in joint venture – Majestic 21 | 15,488 | 20,202 | 40,710 | 45,959 | ||||||||||||

| Proceeds received under escrow arrangement | 52,140 | 75,156 | 285,639 | 121,024 | ||||||||||||

| (Decrease) increase in fair value of equity investment | (57,022 | ) | (449 | ) | (80,796 | ) | 203,310 | |||||||||

| Gain on disposal of property, plant and equipment | – | – | 88,936 | – | ||||||||||||

| Miscellaneous | 161,157 | 48,169 | 187,065 | 73,434 | ||||||||||||

| Total other income | 234,212 | 205,569 | 698,260 | 589,348 | ||||||||||||

| Income before provision for income taxes | 2,479,072 | 1,397,857 | 5,898,117 | 5,067,874 | ||||||||||||

| Income tax expense | (594,313 | ) | (347,111 | ) | (1,399,498 | ) | (1,226,425 | ) | ||||||||

| Net income | 1,884,759 | 1,050,746 | 4,498,619 | 3,841,449 | ||||||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||

| Basic | 3,370,912 | 3,599,133 | 3,460,074 | 3,621,084 | ||||||||||||

| Diluted | 3,376,771 | 3,613,187 | 3,469,769 | 3,630,216 | ||||||||||||

| Net income per share: | ||||||||||||||||

| Basic | $ | 0.56 | $ | 0.29 | $ | 1.30 | $ | 1.06 | ||||||||

| Diluted | $ | 0.56 | $ | 0.29 | $ | 1.30 | $ | 1.06 | ||||||||

SOURCE: Nobility Homes, Inc.

##

The above was via AccessWire and the Digital Journal, which cited AccessWire. The report has an original dateline September 16, 2022 from OCALA, FL, which is the base of operation of Nobility Homes.

Additional Information with More MHProNews Commentary in Brief

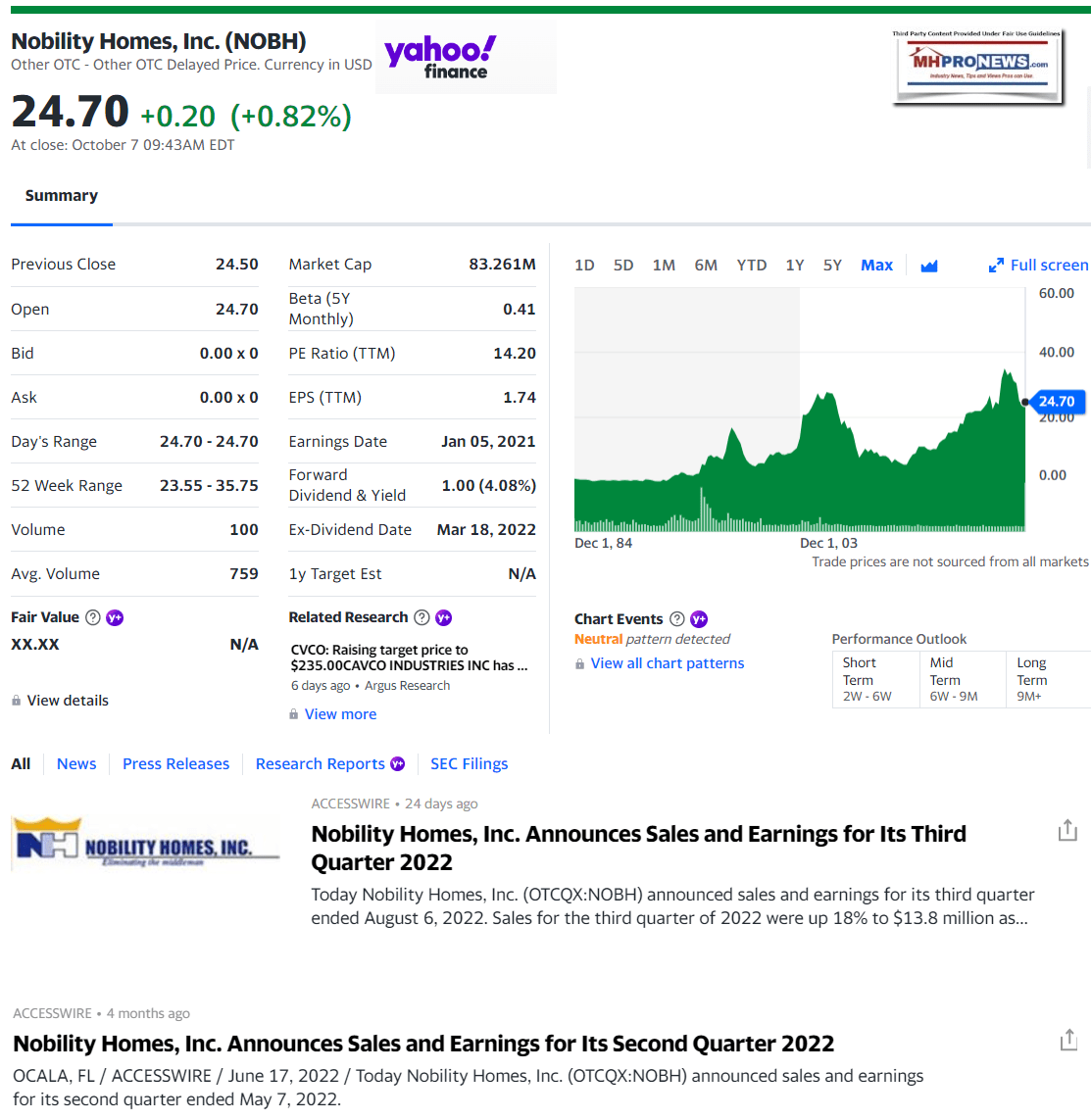

Friday’s market at the close reflected the following ‘maximum’ stock trend for manufactured housing independent and vertically integrated Nobility Homes, Inc. The graphic is per Yahoo Finance.

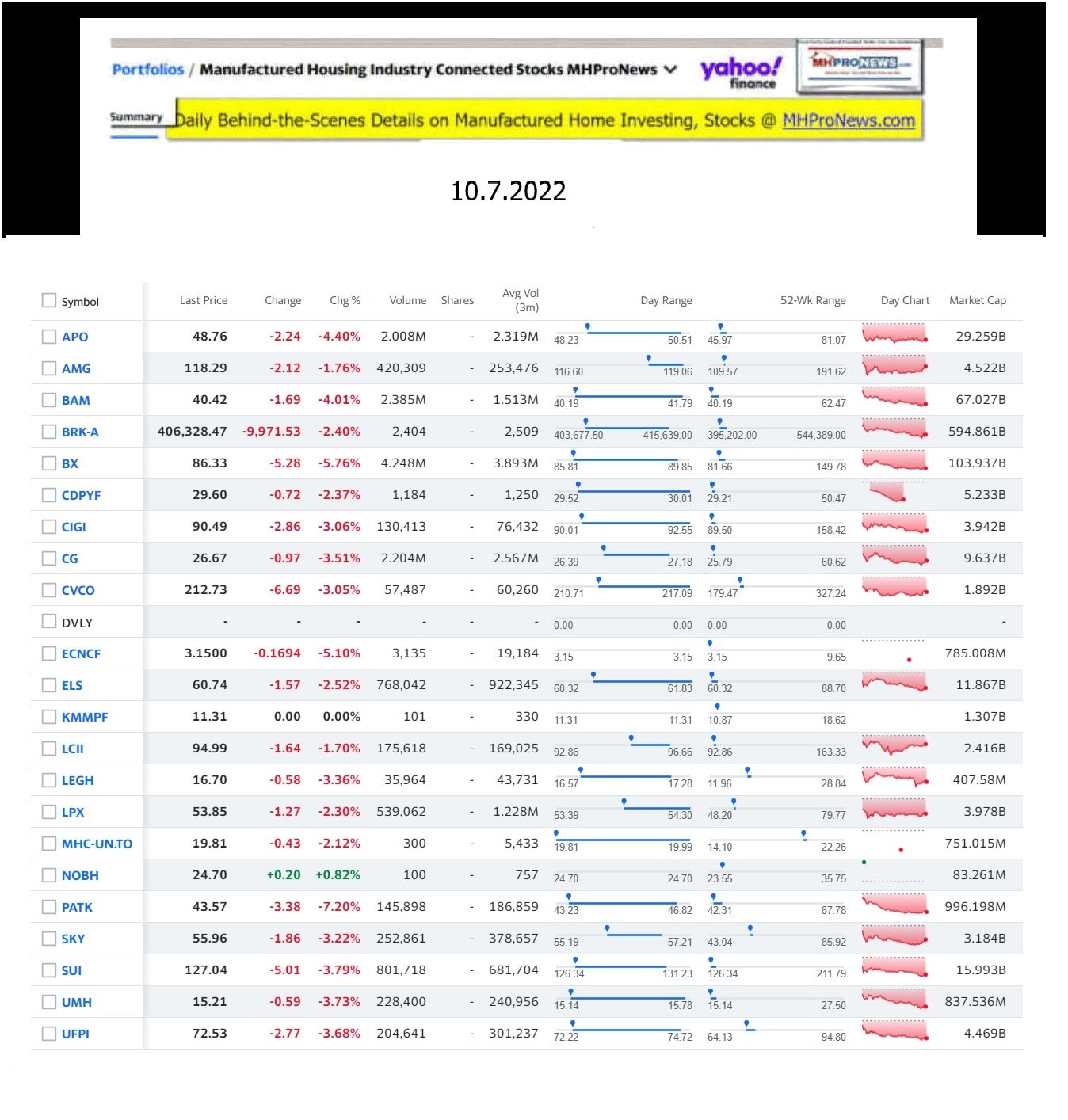

Note that on Friday, virtually all manufactured housing connected equities, with a notable exception of Nobility. “Life happens at the level of action, not words,” said Alfred Adler, as Tim Connor CSP noted recently. Nobility’s actions are apparent.

As conventional housing has largely been slowing, Nobility Homes has largely been advancing.

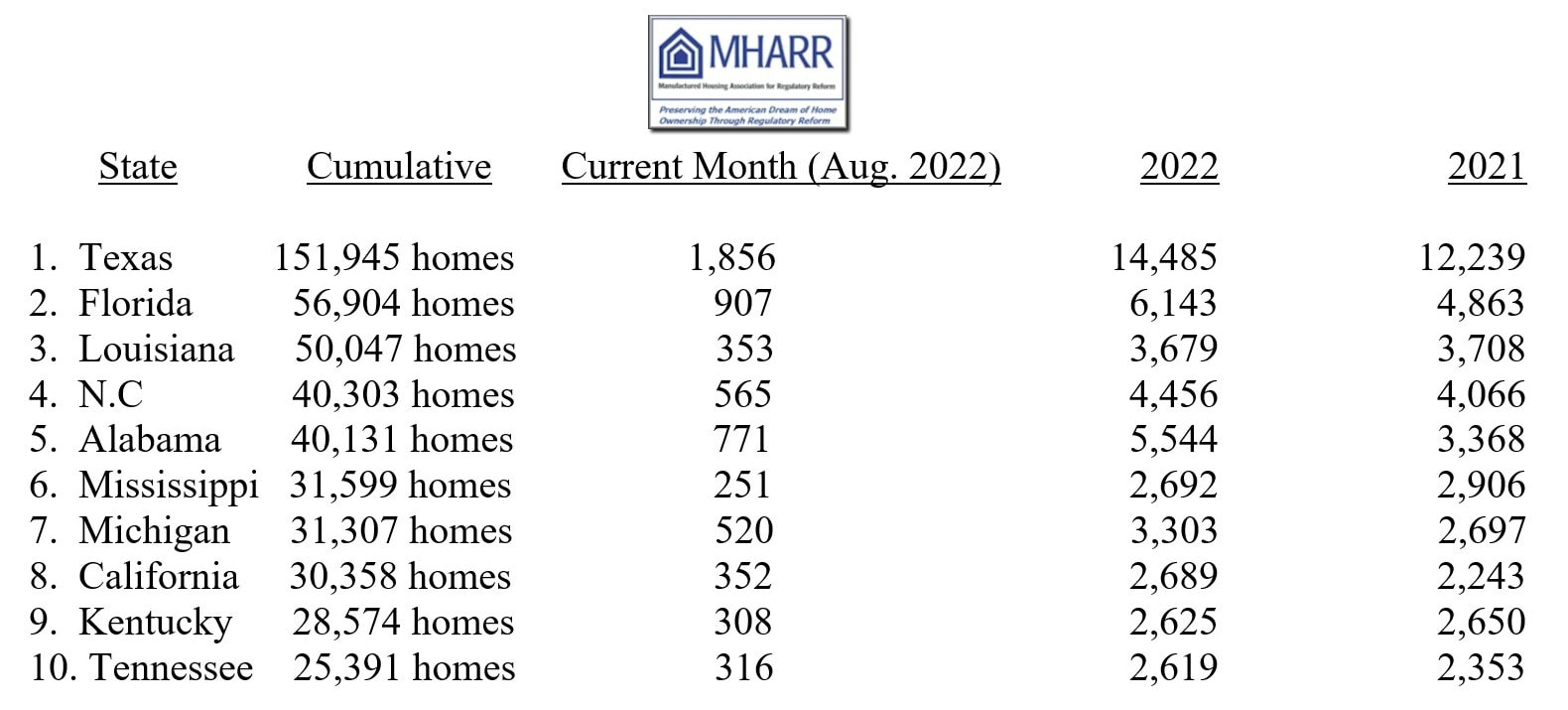

Disclosure. MHProNews as a matter of policy holds no position in any of the equities being reported on in our Daily Business News on MHProNews report. Nobility focused and other recent and/or related reports are as shown above and as follows. Florida is the #2 state in the U.S. for the shipment of HUD Code manufactured homes, per the monthly Manufactured Housing Association for Regulatory Reform (MHARR) most recent recap. ##

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.