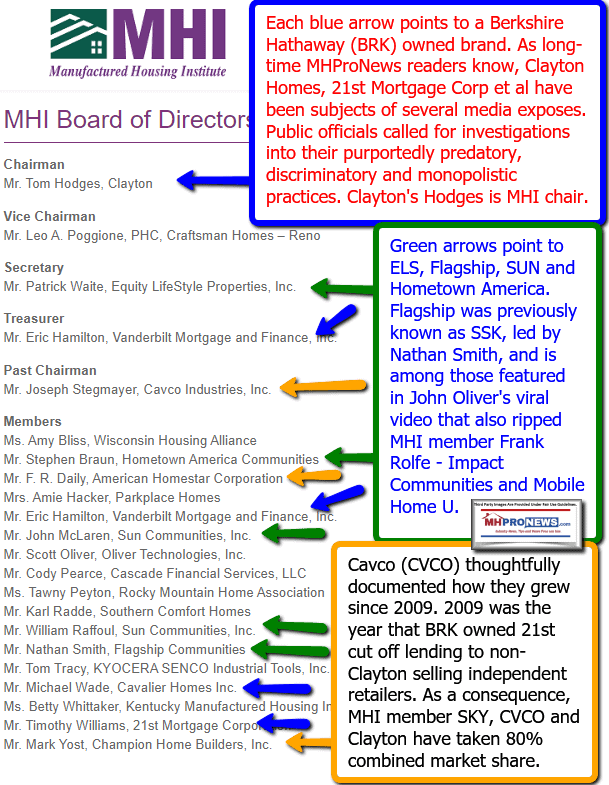

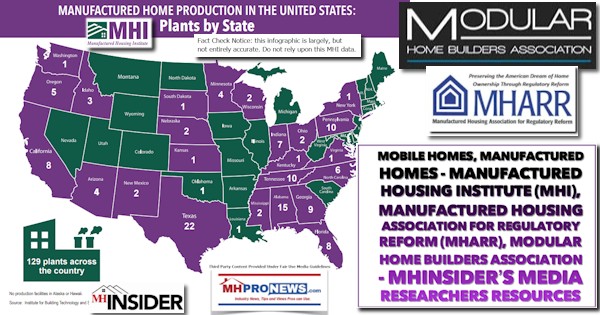

In what follows from Cavco Industries’ most recent quarterly and annual statements, there are one or more topics raised that appear to be in response to reports and analysis previously generated exclusively by MHProNews. One example is the issue of manufactured home retailer “pushback,” see that further below. But there is more that first needs to be woven in from the headline topics, before pivoting back to Cavco leadership’s formal remarks.

Before exploring the “desperate” “bullsh-t” insights/tips, it is worth mentioning that a publicly-traded firm is supposed to provide information that is deemed accurate and reliable at the time it was made. That legal notion is supposed to be protection for investors. More on that later.

Casinos in Las Vegas and elsewhere know that if someone has a good memory, patience, discipline, and sufficient capital – in an unrigged game – there are instances in specific ‘games of chance’ where a savvy player could consistently ‘beat the house.’

Hold that thought, because it as useful in what follows as an analogy when applied to understanding the insider game in manufactured housing.

Without meaning to offend anyone or any organization, a rational and evidence-based case can be made that manufactured housing operates at multiple levels in its various segments.

For example, there are those ‘white hat’ or ethical ‘players’ who ‘play’ the manufactured home game straight. Numbers of those white hats are so genuine that they have a hard time imagining that someone else ‘in the game’ is ‘rigging the system.’ The game riggers are shrewd, long-term thinkers. They literally study the psychology of specific people of interest to them. The system riggers also have what amounts to sociological research to understand group dynamics. So, be it an individual or a group, be it someone the game riggers have specific knowledge about or more generic sociological insights about, the system riggers have numerous and seemingly invisible advantages.

- As MHProNews has previously reported, while field reps are common, certain industry companies have field reps that are providing what is tantamount to research to their parent company offices. An insider source provided photographic evidence to MHProNews of what they described. Merely publishing the photo(s) could reveal the source of the tipster, so those have been held in house as that person at last check is still working for said brand.

- Beyond those generic field and other research mechanisms (there are more), the ‘big boy’ brands can if desired deploy other investigative tools that would shock numbers of white hats, but only if those white hats trustingly failed to realize has been occurring in manufactured housing for years.

An industry insider recently sent the following message to MHProNews. Words in brackets are edited in to clarify the meaning of a munch long thread. Keep in mind that some individuals use hyperbole to emphasize a point.

“Tony…these clowns are DESPERATE, as [due to COVID-19] they have lost ALL THEIR USUAL FORUMS where they wine, dine and BS their way to give phony and faux comfort zones to their audiences that toe their line.”

“…Therefore, at least for the time being [because of COVID-19] there are no in person shows, committees, boards, state [meetings], fundraisers, subcommittees, hearings, awards, lunches, dinners, PAC, H of F [=Hall of Fame]…etc., etc., etc. you name it…all the stuff that their staff and paid constants use to gland hand, bullsh-t and lie and collect “I owe yous” from the industry’s innocent, unsuspecting, trusting and hardworking members…”

As the ellipsis above reflects, the inside tipster said more, which may be deployed in an upcoming report.

But those excerpts are sufficient to elaborate on the analogies and points begun at the top. Casinos do not like card counters. Watch one of several movies about gambling where that point is theatrically demonstrated.

Also by analogy, in a rigged game, those who have rigged it – for whatever their rationales might be to do so – they normally do not want that rigged game to be exposed. Part of the ‘rigging’ of the manufactured housing ‘system’ are the in-person meetings. As MHProNews has previously reported, these meetings, gatherings, and numbers but not all trade associations have euphemistically been described as Buffett’s Buffet.

The “glad handing” and other “bullsh-t” that occurs as those events aim to take advantage of “the industry’s innocent, unsuspecting, trusting and hardworking members…”

Put that puzzle piece alongside the others noted herein and a picture begins to emerge of the different levels of the industry and its members.

Beyond question, manufactured housing’s ‘rigged system’ is not immediately self-evident. But once the puzzle pieces come into focus, following that ‘aha’ moment of discovery, it becomes difficult to understand the industry in any other way. The softball video interview of Kevin Clayton and the related transcript in the report below sheds light on how the game is played, with instructions on how to play the long game provided – per Kevin – by Warren Buffett.

- But that there are people who rig an industry for fun as well as deceptive profit, one need look no further than these next two pull-quotes from a mainstream media source. Type out that quote from Warren Buffett’s now longtime buddy Bill Gates and put it into a Google search. You will see for the original source and context of Gates’ remarks. Then step back and keep in mind that Gates, who once said he thought ill of Buffett for this reason now has been his close associate in business and what they call ‘philanthropy’ for well over a decade.

Notice. There are millions of individuals who are prone to jump to conclusions. That’s a sociological reality. Once more, those who rigged the system in manufactured housing know that numbers of trusting and good people are often unwilling to think ill of others, especially someone that comes off in person as a ‘good old boy.’ For those who play the game, this is part of their duplicitous entertainment value.

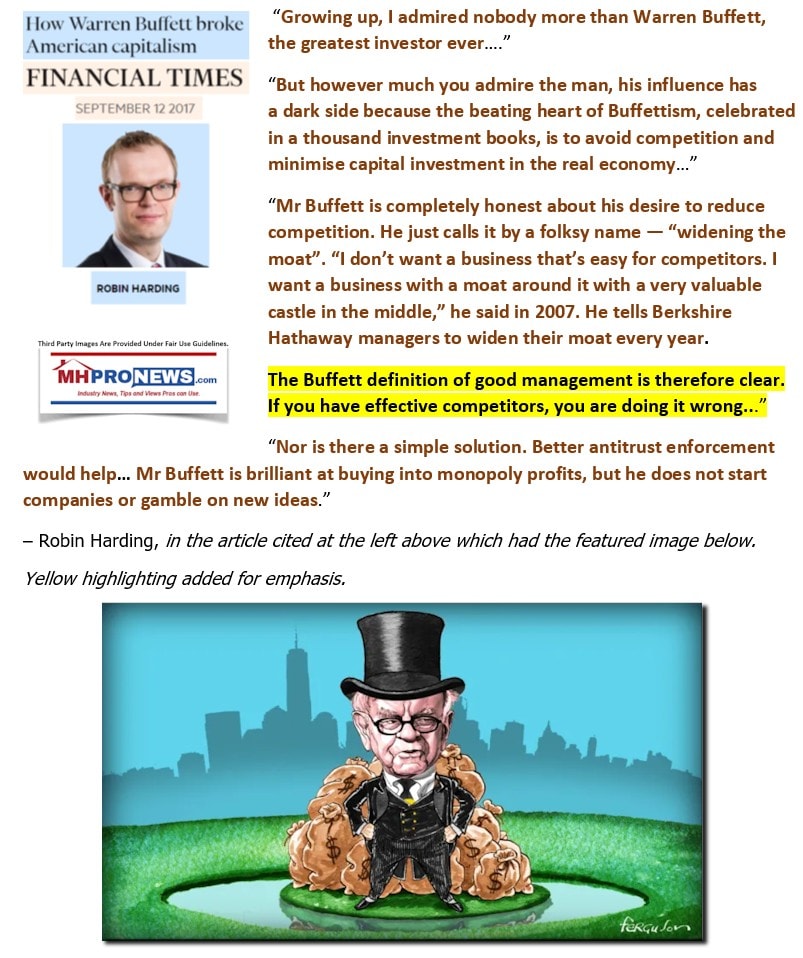

Several one-time fans of Warren Buffett have – upon more careful studying the man – arrived at an understanding of the ‘dark side’ of Buffettism, his “castle and moat” or other methods purportedly developed – and per Kevin Clayton in that video/report linked above and here – deployed by Berkshire Hathaway brands operating in manufactured housing. That noted, this is not to imply that something similar may be occurring and spreading over time to others in or beyond manufactured housing.

If you have read this before, as objectively as you can muster, take a fresh look at this extended quotation from a self-described fan of Warren Buffett.

- Those two quotes, from Gates and the Financial Times writer Robin Harding ought to be framed. They should then be hung on the wall of every manufactured housing professional’s office.

- Every potential or would be investor into manufactured housing also should frame those two quotes.

- Both professionals, investors, advocates, and others keen on affordable manufactured housing should then make a point of stopping and reading those two quotations from past or current Buffett fans daily. The following fun photos should also be borne in mind.

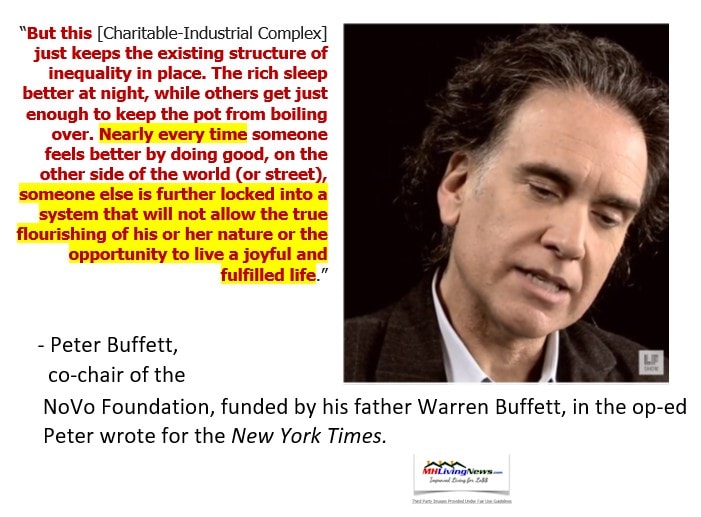

Gates and Buffett are among the two wealthiest on the planet. They are so wealthy that making more money per se is not necessarily important. Currently and for years, they are deploy capital via nonprofits. Those nonprofits are not “charities” or philanthropy in the normal sense. Who says so? Recipients of the “philanthropy” as well as the son of Warren Buffett.

Recapping the above:

- Gates and Robin Harding have said that the game is rigged by practitioners of Buffett’s “castle and moat” methodology. As Harding put it, if you have effective competition, in Buffett-world, ‘you are doing it wrong.’

- Kevin Clayton, not some Buffett hater or skeptic, has described how Buffett preaches the “castle and moat.”

- Buffett himself has periodically rolled out that phrase. It is not a secret.

- Peter Buffett, Warren Buffett’s own son, has agreed that their Buffett’s charity is “Philanthro-Feudalism.”

- The award-winning docu-drama, Poverty, Inc. video – which that pull quote is sourced from – makes it clear that Peter Buffett was not mistaken or exaggerating.

Statistically, by this time in the report, some have already lost the point that the above is all a lead-up to a report about Cavco Industries [CVCO]. But many others are glued and following this, trying to discern if this is some kookie idea or if it is all to be taken seriously. Don’t take my word for it. Consider how the pull quotes from Danny Glover, who has served on a Buffett board summed it up.

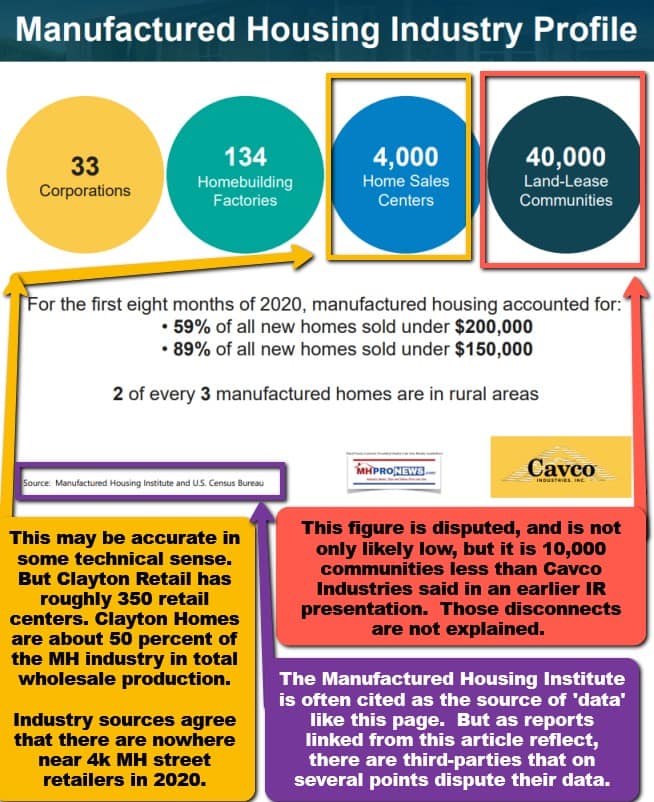

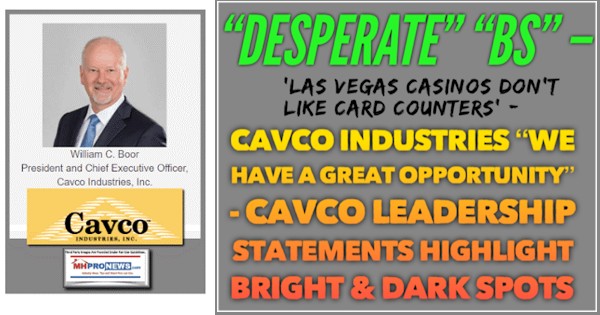

With that backdrop, here are two pull quotes from Cavco’s current president and CEO William C. Boor. Boor aptly says the industry is well-poised. The Cavco illustration above also makes that point, as will more data that follows below. MHProNews editorially and logically agrees. Boor also noted that “conversion” rates and other factors are improving.

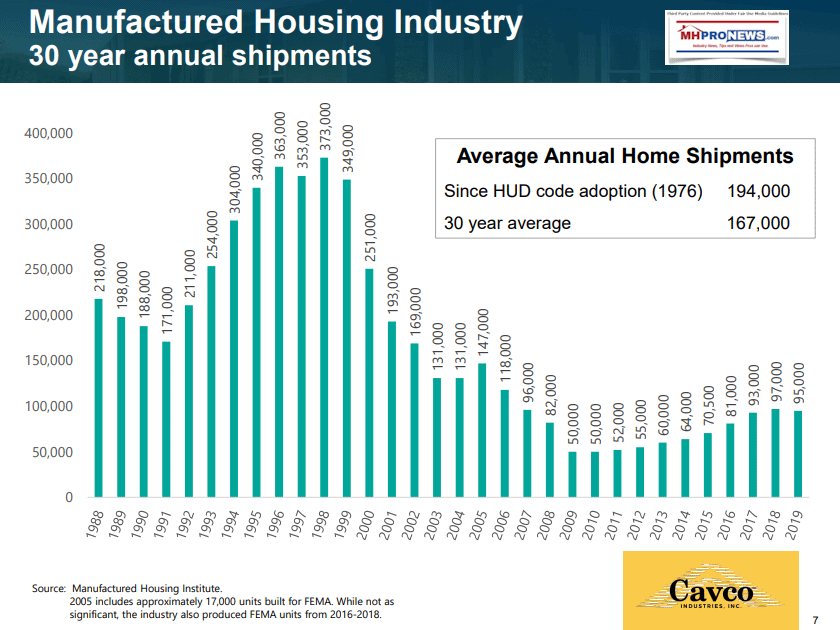

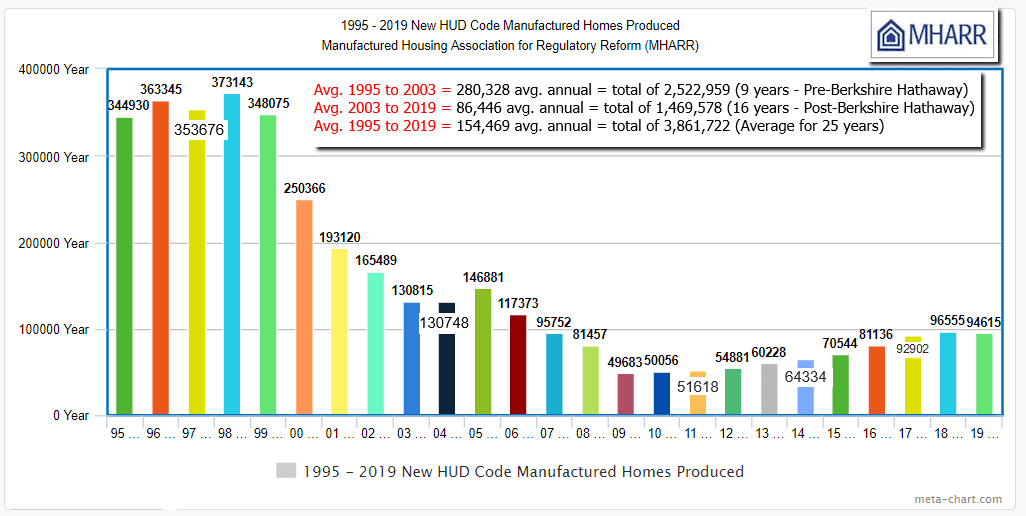

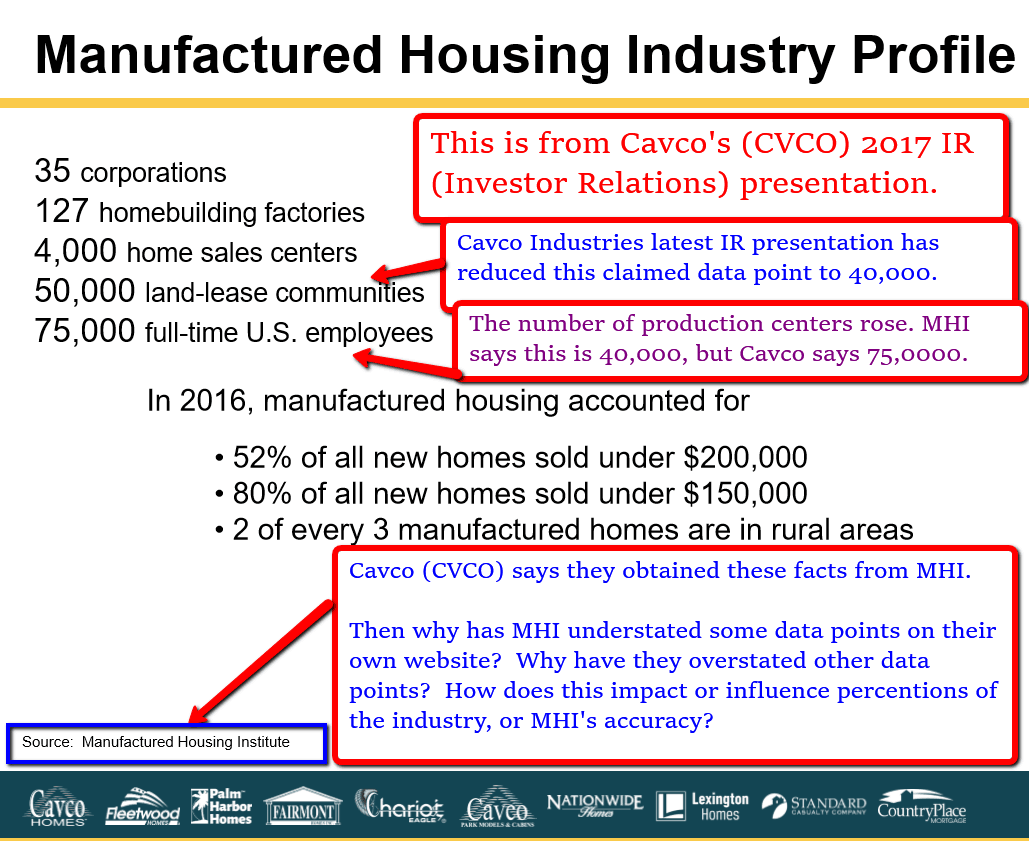

But those statements by Boor only serve to make the point that manufactured housing has been, and continues to, underperform. That underperformance predates COVID-19. Cavco undramatically says as much through this graphic from their IR presentation.

But it is MHProNews’ similar graphic that sets the above into a more precise and refined light.

Approaching Cavco’s Most Recent Quarterly Comments

For a variety of reasons, MHProNews has held the publication of this earnings call quarterly transcript that follows below until today.

Let’s note that in order to rig an industry successfully, someone must be willing to do so in broad daylight. The plan must include elements that are seemingly innocuous. In candor and humility, MHProNews had industry members that told this writer what was occurring over the course of several years, it all seemed to hard to believe. Besides, as someone who attended those “BS” meetings, let me assure you, they are good at accomplishing what they aim to do.

If you have doubted that the system is rigged, so have I. But some highly successful, as well as other industry insiders through patience and my own observations and research, finally brought me to the sad epiphany that “the system is rigged” and part of that was understanding the “moat” which none of those insiders happened to mention. Once the moat, and the above, are understood, several realities come into focus.

Note that among the information-gathering methods that would make trusting ‘white hat‘ independents blush are beyond troubling. Sufficient for now as but one example is to say that if someone on the system rigging side of the fence deemed it useful, the services of de facto if not actual gigolos or prostitutes are acceptable.

The above is not hyperbole.

Furthermore, this writer was informed by a federal agent about certain clues as to what is occurring in manufactured housing that would make for a good book or movie script. Only what is occurring in manufactured housing is real. The rigged system is not fiction, a conspiracy theory, or the ranting of a lunatic. The truly cunning and evil recognize that there are no limits. The more brazen the scheme, as long as the rules of human relationships are applied, can successfully be carried out in the open.

The rigged system is part of the entertainment value of making money for the billionaire class and their chosen allies.

People like the purported puppets in Arlington, VA are merely tools and window dressing. Millions of Americans watched daytime soap operas that where pure fantasy. But if money is no barrier, someone can create their own soap opera in the real world, complete with characters that are living their lives.

Meanwhile, the puppet masters deploy their game, tool, researchers, resources knowing that state and federal officials are unlikely to try to stop them. They also know that media is unlikely to report on it, because it is too fantastic to believe.

That’s power.

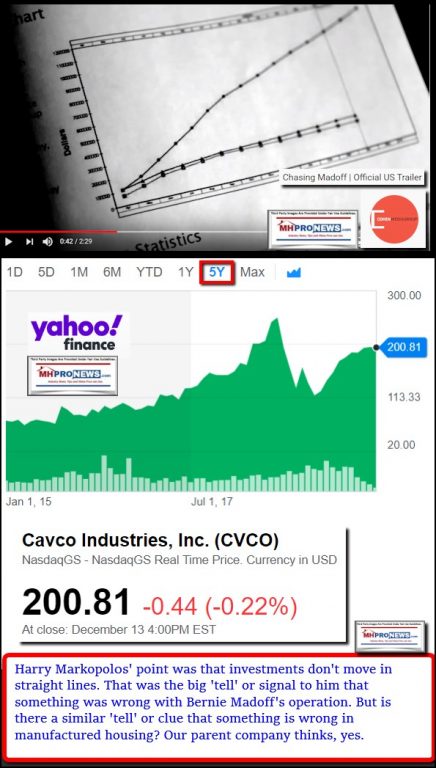

As a parallel illustration, Harry Markopolos’ example is useful.

Markopolos ‘discovered’ billionaire Bernie Madoff’s scheme. Set aside the point that Madoff had a Ponzi scheme. The Ponzi angle is interesting, but not always relevant detail to grasping how a big con game can operate in the open for years on end.

Markopolos spotted the “tell” of Madoff’s scheme. “The tell” is what made the high stakes, operating in the open con game, apparent to Markopolos. Not only did Madoff pull it off for years and make billions, but 21st century companies like Enron and WorldCom are mildly similar examples of how high-end con games can operate successfully for years. Some of it is political and media connections.

With that background, it is now time to pivot toward the Cavco transcript that follows. These added points are useful.

1) Certain investors and analysts monitor MHProNews. Some monitor this platform and our MHLivingNews sister site personally. Others hire that service or have a trusted team member do that for them. Let’s simply note that these educated, intelligent, successful people do not monitor MHProNews for its entertainment value. Rephrased, they follow MHProNews because reporting in recent years arguably holds together under closer examination.

2) There are none, zero, zippo trade media in MHVille that are as carefully-read as this one and our sister site, MHLivingNews. Some amusingly think we are – as a message recently to this writer accused us of being “batsh-t crazy.” The ironic timing of that phrase was apparently lost on the message sender.

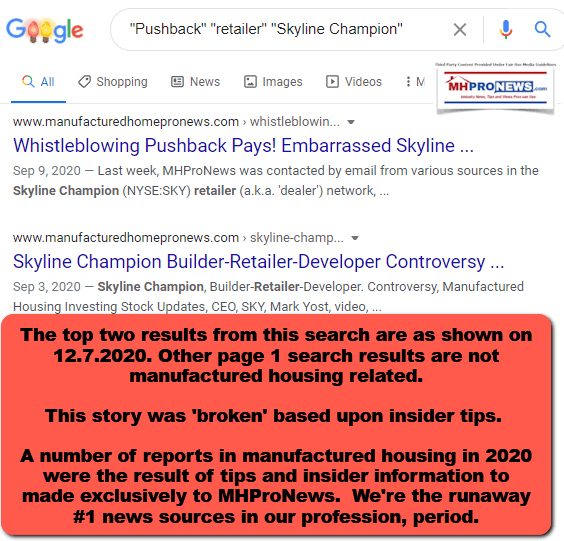

3) Examples of how Cavco, Skyline, Berkshire Hathaway brands – among others – who monitor MHProNews directly and/or through surrogates follows. It isn’t that this is earth-shattering evidence. But it makes the point clear that Barry Cole or others are not wrong when they say that most industry professionals read this publication.

- As a disclosure, MHProNews does not have the tools that Facebook has recently been revealed having deployed for years. When you or anyone else visits here, we do not ‘see you’ as an individual person. But there is generic data collected about every visitor on most modern websites that have Google Analytics, Webalizer, or other metric systems in place. That’s done without logging in. Based upon years of experience, it is a safe bet that reading by government officials will shoot up on MHProNews in the aftermath of this report.

On the one hand, this report is only one piece of the bigger puzzle of why manufactured housing is underperforming as an industry.

After discerning this report and others that are linked further below, certain state execs and MHI staffers may need Depends – or will run to the water closet – if they grasp the reality. Some at the SEC, HUD, and the FHFA are likely to be leaning in for various motivations (good and bad) when they read this.

And frankly, this report is just a teaser. This is a mild tip of the iceberg. The Titanic sank when it was entirely avoidable.

But for the keen of mind, this report is either an “aha moment,” or, more confirmation that in manufactured housing, the system is rigged. Some will say, ‘those guys are’ “batsh-t crazy.”

That is why the powers that be in MHVille love and hate this platform. It’s the only game in town like it, and they know it. Paraphrasing what an important player told MHProNews yesterday, he read us, others he knows do too, and there is little else in the industry’s publishing that they pay much attention to.

An example of how investors and analysists are among those who are following MHProNews is found below.

That is fairly easy to determine because no one else in mainstream or manufactured housing industry trade media made any similar report about the controversies involving the pushback from Skyline Champion independent retailers over purported violations of their dealer agreements.

Let’s make something clear. These points are not made out of ego or hubris. Rather, it is to illustrate what should be self-evident. Intelligent souls read MHProNews, even if they don’t like what they read, because what is found here makes sense upon careful scrutiny.

That bears emphasis.

- Our MHProNews reports, thesis about the industry’s underperformance and related analysis stand up to scrutiny.

That noted, a few added items to set the table about the timing of this Cavco report, some linked background items are warranted.

Other reports about controversies regarding Cavco have been reported by MHProNews, as the examples of reports linked above and below reflect.

Note too that per our report on 12.7.2020, Cavco is one of the companies that have reported challenges related to labor. See the report below as how it relates to some of Cavco comments that follow.

Linked In the transcript from Motley Fool, minor edits – missing punctuation (e.g.: adding a period, comma where it is grammatically correct) – and a couple of typos were corrected below. But otherwise, the transcript is as shown in their report linked here.

Cavco Industries Inc (CVCO) Q2 2021 Earnings Call Transcript,

Per Motley Fool Transcribers

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Ladies and gentlemen, thank you for standing by and welcome to the Second Quarter Fiscal Year 2021 Cavco Industries’ Earnings Call. [Operator Instructions]

I will now hand the conference over to your speaker Mark Fusler, Director of Financial Reporting and Investor Relations. Please go ahead.

Mark Fusler — Director of Financial Reporting and Investor Relations

Good day and thank you for joining us for Cavco Industries’ second quarter fiscal year 2021 earnings conference call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Paul Bigbee, Chief Accounting Officer and myself.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions.

All forward-looking statements involve risks and uncertainties, which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco. I encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation, the Company’s most recent Forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements.

Some factors that may affect the Company’s results include, but are not limited to the impact of local or national emergencies including the COVID-19 pandemic, and such impacts from state and federal regulatory action that restricts our ability to operate our business in the ordinary course and impacts on customer demand and the availability of financing for our products, our supply chain and the availability of raw materials for the manufacture of our products, the availability of labor and the health and safety of our workforce, our liquidity and access to the capital markets, the risk of litigation or regulatory action, potential reputational damage that Cavco may suffer as a result of matters under inquiry, adverse industry conditions, our involvement in vertically integrated lines of business including manufactured housing consumer finance, commercial finance and insurance, market forces and housing demand fluctuations, our business and operations being concentrated in certain geographic regions, loss of any of our executive officers, additional federal government shutdowns and the regulations affecting manufactured housing.

This conference call also contains time-sensitive information that is accurate as of the date of this live broadcast, Friday, October 30, 2020. Cavco undertakes no obligation to revise or update any forward-looking statement whether written or oral, to reflect events or circumstances after the date of this conference call, except as required by law.

Now, I’d like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

William C. Boor — President and Chief Executive Officer

Thanks, Mark. Welcome, everyone and thank you for joining us to review our results for the second quarter. The people of Cavco continue to adjust a constantly changing dynamics, with our clear objective of operating all of our businesses to the extent we can do so safely. It’s been humbling to be part of and to see the commitment and it hasn’t been easy in any regard.

I really want to begin today’s call by acknowledging our people, we need to keep driving forward to serve our customers. Our folks are making smart decisions in the light of the circumstances. I’m very proud of our performance. In late March, I don’t believe anybody could have foreseen where we are today. I expect everyone on the call has been watching demand indicators and understands that the general homebuilding industry is seeing extraordinary buyer activity. But we’ve been talking for a long time about the fundamental drivers such as years of under-building the household formations. Enabled by very low interest rates, the pent-up demand has been proven, despite the pandemic.

Looking at recent MH industry shipment data, could be misinterpreted as a demand indicator with the seasonally adjusted annual rate below last year’s shipments. However, the shipments reflect what the industry has been able to supply. We have a backlog that has grown $164 million since last quarter and stands at approximately 21 to 22 weeks based on our current production rates. We believe every producer is experiencing backlogs that are at on healthy levels. Backlog increases from a combination of very high order rates and continuing production challenges due to labor and supply issues.

To provide some perspective, even if we are producing at the same rate as last year, orders have been so strong that we would still have 19 to 20 week backlog. We know that we need to produce more. However, the growth in our backlog has been primarily the result of extraordinarily high order rates, this quarter home order rates were nearly 65% higher than a year ago.

Turning to the cost side, it’s been widely reported that lumber prices increased dramatically since hitting lows this past April, moving to extreme highs by the end of September. As an example, the Southern Yellow Pine indicator price rose approximately 180% in that period. While lumber prices have since come off those highs, the magnitude of these changes have resulted in the need to quickly adjust pricing on our homes.

Gross margins may continue to be squeezed in the near term as those price increases worked through the backlog, through our proactive approach in addressing pricing should allow us to maintain gross margins over time. Production labor challenges continued through the second quarter. Absenteeism has affected our productivity and while there has been some improvement, hiring still remains limited. To address these issues, our plants are making adjustments to hiring practices and wage rates, as well as implementing other programs to attract, retain and develop production employees.

In manufacturing, our focus continues to be taking action to increase productivity. In our retail operations, we continue to perform very well. What we’re seeing in our owned retail stores is a level of traffic that is following a typical seasonal pattern with some slowing going into the fall, the traffic remains strong and still higher than last year’s levels. Conversion rates, the percent of traffic opportunities converted into sales remained significantly higher than a year ago. In financial services, our lending has been relatively stable. Interest rates for mortgages and home-only loans are at historic lows, making financing much more affordable for most home buyers.

As previously discussed, the home-only lending environment has been increasingly competitive since early in the pandemic. We’re still pursuing a longer-term strategy of increasing our home-only originations. The pace of that strategy in the near-term is affected by our measured underwriting standards and an aggressive low rate competitive environment. Our insurance operation is doing a great job with what they control, new policy sales and renewals. During the quarter, we experienced an unusually high number of weather events, none of which were catastrophic, but cumulatively they represented a high claims cost. United States experienced a record number of named storm landfalls this year, 11. Four of those directly affected Texas. Normally were affected by name storm only about once every two years. I remind people that for comparison this quarter a year ago claims costs were very low due to unusually favorable weather.

Overall, we’ve generated a significant amount of cash from operations since the beginning of the fiscal year. Paul and Mark, are going to provide specifics in a few minutes. As we’ve said in the past, we’re continually evaluating capital priorities in light of our growing cash balance. When COVID hit, I think it was understandable that we adopted a wait and see approach regarding cash. Two quarters later, Cavco has demonstrated our ability to remain profitable and generate significant cash from operations, despite the disruption. There is no doubt that uncertainty remains high regarding interest rates, consumer demand, the general economy and other factors that impact the MH demand.

However, our Board of Directors has determined that it makes sense to authorize a new $100 million stock buyback program. In light of those uncertainties, we are not putting a specific timeline in place. However, this is an important tool we now have along with other opportunities to deploy capital, for us to manage our cash reserves at appropriate levels. It’s very important to make clear that our decision to put this buyback authorization in place does not change our view about investment in our businesses for organic growth or in acquisitions. We’re comfortable that the buyback does not impede other opportunities.

Again, it was a good quarter in light of the challenges of the day, with all of our operations team, flexible and focusing on the fundamentals. We know we have a lot of work ahead to meet the demand of buyers who are in need of quality, affordable manufactured homes. As noted in our recent 8-K, our CFO, Dan Urness has decided to go on leave to deal with the Wells Notice he received from the SEC. For those who have not heard from him previously, I want to introduce Paul Bigbee, our Chief Accounting Officer. Paul is doing an outstanding job stepping up. He and Mark Fusler will be reviewing the financial results.

With that, I’ll turn it over to Paul.

Paul Bigbee — Chief Accounting Officer

Thanks, Bill. Today, I’m going to cover the Company’s financial results and then turn it over to Mark to go through the balance sheet. So, I’ll start with consolidated net revenue. And for the second fiscal quarter of 2021, we were at $258 million, which was down 4% compared to $268.7 million during the prior year’s second fiscal quarter. So, if you look at the pieces, the first I’ll go through is the Factory-built housing segment, where net revenue decreased 4.6% to $241 million from $252.7 million in the prior year quarter. This reduction was primarily due to a 9% decline in units sold. Home production declined from primarily operational challenges presented by COVID-19. We had high production employee absenteeism, we were complying with health guidelines and also had supplier disruption and production down days. Unit sales, however were partially offset by 5.2% increase in average revenue per home sold, primarily from product pricing increases.

Also call out a few non-comparables. So, in the current quarter we had an additional month of net revenue from Destiny Homes acquisition compared to last year’s prior quarter, as a transaction occurred in August 2019 and the prior year quarter included revenue from Lexington Homes, which was closed in June 2020. In the financial services segment net revenue increased by 6.3% to $17 million from $16 million [Phonetic], mainly the result of 700,000 unrealized gains on equity investments in the insurance subsidiary’s portfolio compared to 200,000 in the prior year period.

In addition, there were higher home loan sales and more insurance policies in force compared to the prior year. These increases were partially offset by declines in interest income from the formally securitized loan portfolios that continue to amortize as expected. Consolidated gross profit in the second fiscal quarter as a percentage of net revenue was 20.8% down from 21.8% in the same period last year. Decline here was primarily the result of $3.3 million in higher weather-related claims compared to the same period in the prior year.

If you recall, we had two hurricanes, Hanna in July and Laura in August that made landfall on or near the Texas Coast. In the factory-built housing segment, margins were consistent between periods with lower sales and production inefficiencies caused by COVID-19 pandemic and increases in material costs were partially offset from decreases in labor cost, driven by declines in overtime hours, given the high absenteeism levels. Selling, general and administrative expenses in the fiscal 2021 second quarter as a percentage of net revenue was 13.7% compared to 13.4% during the same quarter last year. This increase was primarily due to additional compensation related costs and other corporate related expenses on a lower revenue base, offset by decreases in legal expenses.

Also wanted to call out in the second quarter of 2021 was favorably impacted as the Company received an $800,000 insurance recovery of prior legal expenses related to the SEC inquiry, resulting in a net benefit of $300,000 compared to last year’s quarter $800,000 cost. Other income, net this quarter was $1.7 million compared to $5.2 million in last year’s second quarter. This decline was primarily due to a $3.4 million gain that was recorded on the sale of idle land in the prior year quarter.

Effective income tax rate remained fairly stable, 23.2% for the second fiscal quarter compared to 23.4% in the same period last year. Net income came in at $15.1 million, down 27.8% compared to net income of $20.9 million in the same quarter of the prior year. Net income per diluted share this quarter was $1.62 versus $2.25 in the last year’s second quarter.

Now, I’ll turn it over to Mark to cover the balance sheet.

Mark Fusler — Director of Financial Reporting and Investor Relations

Thanks, Paul. I’ll be covering the changes in the September 26, 2020 balance sheet compared to the March 28, 2020. The cash balance was $312.2 million, up from $241.8 million six months earlier. The increase was primarily due to five areas. Net income offset by other non-cash items, changes in working capital, including higher customer deposits received as a result of higher order rates, deferral of certain payroll taxes under the CARES Act, collections on outstanding accounts receivable and consumer loans principal balances, and lower net commercial lending activity.

The current portion of consumer loans increased from a greater number of loans classified as held for sale, which are expected to be sold in the near term due to the timing of such sale. Prepaid and other assets was higher from the assets recorded in regards to the loan repurchase option for delinquent loans that have been sold to Ginnie Mae, while we are not obligated to repurchase these loans, accounting guidance requires us to record an asset and liability for the potential of a repurchase. Balance increased from the additional loans in forbearance.

Long-term consumer loans receivable decreased from principal collection on loans held for investment that were previously securitized. Accounts payable and accrued expenses and other current liabilities increased from greater payments received on consumer loans to be remitted to third parties, higher customer deposits, which have grown with factory backlogs as well as the delinquent loan repurchase option discussed above. Lastly, stockholders equity was approximately $641.2 million as of September 26, 2020, up approximately $33.6 million from March 28, 2020 balance.

And that completes the financial report.

William C. Boor — President and Chief Executive Officer

Thank you, Mark. Sydney, let’s turn it over for questions.

Questions and Answers:

Operator

[Operator Instructions] Our first question comes from Daniel Moore with CJS Securities. Your line is now open.

Daniel Moore — CJS Securities — Analyst

Good afternoon, gentlemen. Thank you for taking the questions. Maybe starting with just capacity utilization, you said 65%, I believe during the quarter, up to 75% — it’s up to 70% by the end. How quickly can you ramp that up to 75% and ultimately closer to 80%? And what kind of key challenges to doing so?

William C. Boor — President and Chief Executive Officer

Yeah, the speed I mean that’s what we’re all focused on, I can tell you that, the speed is partly going to be dependent on how things continue. I mean, just to give you a feel, kind of given plan, we might be going along pretty well with low absenteeism. And then if that area, sees an upsurge in, for example COVID cases, suddenly our absenteeism spikes and it hurts our utilization. So, as you guys know we’re not as COVID and we’re seeing kind of sort of a moving target on where those cases surge, that’s just one example. The other thing that we don’t control and it’s hard to have a crystal ball on its supply, which is really affecting us.

So, Dan, it’s hard to say how quickly if it, all that stuff suddenly smooth out, I think we would move up pretty quickly to 80%. We’ve been able to run that way consistently in the past, but it’s just kind of a battle with every plan, to try to get there right now. Those are the main factors, some of what affected our utilization, it contributed — people may not be thinking about, for example, we had days down for the Oregon fires. So we’ve had those kind of things happened as well, that have contributed to the utilization challenges that are non-COVID related.

Daniel Moore — CJS Securities — Analyst

Absolutely. In terms of the supply chain issues, do you see an end insight not this quarter obviously or this month. But is that a six-month — three-month phenomenon, six-month phenomenon? COVID obviously more difficult crystal ball, but just wondering if you see some of those of supply chain constraints working themselves out over a couple of quarters?

William C. Boor — President and Chief Executive Officer

Yeah, it certainly would help over a couple of quarters. In talking, we’ve had — it’s been almost across the Board, it’s hard to even zero in on one piece of the supply that we need. But we have had different suppliers tell us that they expect to be challenged well into the first calendar quarter. So, it’s going to take some time and hopefully early in the calendar year, we will be feeling a little bit better than we do right now. But that’s…

Daniel Moore — CJS Securities — Analyst

Okay.

William C. Boor — President and Chief Executive Officer

Still expect to have, Dan.

Daniel Moore — CJS Securities — Analyst

Is 70% capacity utilization, a decent base rate to utilize for this current quarter, at least for the time being?

William C. Boor — President and Chief Executive Officer

We’ve been bouncing right in that 65% to 70% rate the last two quarters, including the first one, it was so disruptive. So, and that’s kind of within the process last six months.

Daniel Moore — CJS Securities — Analyst

Okay. In terms of margins, gross margin lower by 100 bps, but you called out the insurance claims obviously. With input costs rising more significantly toward the back half of this past quarter, how do we think about gross margins in Q3 and Q4, maybe relative to Q2 as a baseline?

William C. Boor — President and Chief Executive Officer

Yeah. Well, people follow things like — lumber is one of the biggest contributor to our cost structure and people who followed just public indicator pricing on that know, that as I said, this thing is really shot up. I don’t know if I can say unprecedented but incredibly quickly from April through September, one thing I cited was — I think was Southern Yellow Pine up about 180%. They have come-off of their highs, those lumber prices. And equally important lumbers become more available. We are worried about running out, I think if we can talk about price running out was a concern as well.

So, there is an example where right now, a big contributor to our cost has started to come-off it’s very high peak, still high but pointed in a better direction for us. If that kind of a trend continues, I think we’re going to see a dynamic, we’ve seen in the past, right. We’re going to see margins compress, while prices — while costs are going up, before we can get prices through the backlog. And then potentially that can all reverse and we get a quarter where margins are bigger, because prices have taken hold and costs are down. So, that’s a typical pattern. I don’t know for sure the timing of how that will play out. But as I commented in my remarks, I think over a period of a few quarters, we feel like we’ll be able to manage the kind of solid typical margins.

Daniel Moore — CJS Securities — Analyst

That’s helpful. ASPs grew, was that mix or largely pass through of rising raw material costs or both? And what do you expect for ASPs year-over-year kind of over the next quarter or two?

William C. Boor — President and Chief Executive Officer

Yeah, I mean we really are pushing price increases to a point that it’s been very difficult for dealers and customers. I think we’re all very sensitive to that, but it’s been a really volatile cost market. It’s more about price increases than it is about mix shifts in this quarter. So, we expect to be able to — for the short term, I think it’s fair to say, we should be able to hold that price increase. But we haven’t — it hasn’t been driven as much by mix shifts.

Daniel Moore — CJS Securities — Analyst

Said in another way, you didn’t — probably didn’t get the full benefit of that in this past quarter given the timing, is that fair?

William C. Boor — President and Chief Executive Officer

That’s fair. I mean, we still have a backlog, now this price increase you may have heard this from other folks you talk to, this price increase has been, as I said, particularly hard for dealers and customers, because it was so rapid, they were successive. And where we typically, as an industry protect existing orders particularly retail sale orders, or there is a home buyer on the other end, that even got kind of loosen price increases. So, we have to wait for some of it to get through the backlog — other parts of the price increase to hold pretty quickly. It’s a bit of a negotiation at the grassroots. But I don’t think, all of it has gotten through in the numbers that you’re seeing now.

Daniel Moore — CJS Securities — Analyst

Got it. And one or two more, I’ll jump out. Financial services, are you seeing weather events that drove claims in fiscal Q2 continue into Q3 so far?

William C. Boor — President and Chief Executive Officer

Yeah, really have no idea. I mean, we are through kind of the quarters that are typically the toughest from a claims cost perspective. So we’re entering quarters that are generally tend to be milder. But it was, as I said, it was pretty unprecedented for the number of storms that hit the US and we got our share of them. Now as I said, none of them, from a claims perspective, being sensitive about it, none of them or what we call catastrophic that would just settle — they were just several, so the costs added up [Phonetic].

Daniel Moore — CJS Securities — Analyst

Perfect. Lastly, the D&O insurance, amortization of $2.1 million, I think it’s scheduled to burn-off after this past quarter. Do you expect that full amount to come off the P&L are there any offsets that would prevent that from kind of flowing to the bottom line?

William C. Boor — President and Chief Executive Officer

No, after a lot of quarters of telling you which quarter it was going to end the amortization should be over.

Daniel Moore — CJS Securities — Analyst

Perfect. I’ll jump back with any follow-ups. Thank you for the color.

William C. Boor — President and Chief Executive Officer

Thanks, Dan.

Operator

Thank you. And the next question comes from Greg Palm with Craig-Hallum. Your line is open.

Greg Palm — Craig-Hallum — Analyst

Yeah. Hey, everyone. Thanks for taking the questions here. I mean, maybe to start off, can you just comment a little bit on the cadence of orders throughout the quarter? What you’ve seen thus far in October, and anything that was sort of outsized performance from a geography standpoint or even a specific channel?

William C. Boor — President and Chief Executive Officer

Yeah, I probably hesitate a little bit on this quarter, because where this month — because we’re not commenting on it. But the orders were high consistently, I mean, they really have been, it hasn’t been — when we look at year-over-year order rates, it hasn’t been jumping around, it’s been consistently higher than last year. Geographically, we’ve commented in the past and might be a question people are thinking about, there we’ve commented in the past about community business and where the community is — really very quickly when the pandemic hit, put their orders on hold.

We’ve seen that come back generally, geographically, I guess, to give you more color in the Southwest, we’ve seen it come back a little stronger. They both have taken orders that were on hold-off of hold and want delivery of them, and they’ve resumed picking up orders. So that’s been pretty encouraging. But handling backlogs like this, it’s just adding to the challenge I guess, ahead of us.

And then in Florida, I guess, I’d comment that the community side really probably hasn’t been quite as strong as I just commented about the Southwest. In Florida, it seems to be particularly at the larger community operators, it seems to be a little bit more of a wait and see, as far as what the — probably, what the snowbird season looks like, and whether they need to really be stocking homes at this point. So, those are some geographic differences, I guess. But generally, when we talk about the strength of the MH orders, it’s across our geographies, we don’t have an area that really has lag there.

Greg Palm — Craig-Hallum — Analyst

And what gives you confidence that this is not some sort of short-term pent-up demand versus something that’s got legs to it. I don’t know if you can comment, maybe what are the biggest reasons you think you’re seeing the strength whether it’s financing related, whether it’s this migration trend from urban or rural, what’s — what are your general thoughts there?

William C. Boor — President and Chief Executive Officer

Yeah, you’re asking for speculation, I’ll give you a little bit of personal speculation, but I’ll leave with that way. I believe we’ve been talking a long time about — if you just look at supply and demand of homes over really the last decade, it’s been lacking, the supply has been lacking household formations and I believe in that. And I think that in particular is lacked at the lower ends in the more affordable segments, because as, even the traditional home builders have been stretched to the supply of the market, they’ve moved to higher price homes.

So, we’ve been talking about a pent-up demand that we really believe in and it’s much more than just a near-term cyclical event. And I believe that’s what we’re seeing and I believe it’s obviously very much — I mean we can’t never forget how much that’s facilitated by the low interest rates that we’re seeing. If interest rates hadn’t been incredibly low through this period, I think we would have a very different scenario. The pent — the demand is there, it’s got to be met at some point and it seems to be coming out right now with the low interest rates despite the pandemic.

I’ve been a little bit more, I guess hesitant on kind of predicting or pointing at trends, driven by the pandemic, doesn’t mean I’m right. But I think what we’re seeing is way too big to really think that those are significant drivers of what we’re seeing. I think it’s more of a complete — it’s a demand that’s been built up for years. So, that gives me, I mean, given my view about that, that gives me some confidence this is something that is going to persist, it probably will have some micro cycles as we go forward, because of economy and interest rates. But we’ve got a great opportunity here, I think as an industry to catch-up with building.

Greg Palm — Craig-Hallum — Analyst

Yeah, makes sense. I mean, if that’s the general thought process and in light of all of these labor challenges that we’ve been talking about, I mean, does that change, how you might be thinking about investments in your own manufacturing facilities? I mean anything you’re looking at non-labor base to maybe try to increase production rates?

William C. Boor — President and Chief Executive Officer

Yeah, I mean we’re looking, we’re always looking at just general market opportunities. People have asked about greenfielding in the past, when were having labor challenges like we are — I think there is a little bit of putting first things first as far as trying to get our capacity utilization up. But, we’re looking at all of those kinds of things. And I also spoken in the past, I think there are entirely new market opportunities that will have factory-built housing outside of our traditional markets that we’re looking at. And we would love to be able to break through with some investment. So, we’re trying to get the opportunity to invest behind these demand drivers that I spoke about.

Greg Palm — Craig-Hallum — Analyst

Okay. Last one, on the buyback, obviously phenomenal free cash flow generation. So, cash continues to build, but anything specific that drove the decision to up the authorization, I mean, pretty meaningfully here from $10 million all the way up to $100 million? I mean, did you buy back any stock under the previous program?

William C. Boor — President and Chief Executive Officer

Previous program, which is in place for a long time, I’m looking at more of it as 2008. It was not utilized and can’t really comment too much about. But as far as the decision we made here to put $100 million into the buyback program, as I said, it gives us another tool to try to manage our cash balance. I know the investors have been pointing out for quite a while appropriately and we have one more tool to start managing at appropriate levels. So, that’s about it. We talked quite a lot about it, we’ve — I’ve been asked in past calls and have — uncomfortable situation believe me, we’re thinking about it, and now we finally have something tangible that we hopefully will be able to go out and execute against.

Greg Palm — Craig-Hallum — Analyst

Okay, great. I’ll leave it there. Best of luck going forward.

William C. Boor — President and Chief Executive Officer

Thanks.

Operator

Thank you. And our next question comes from the line of Jay McCanless with Wedbush. Your line is now open.

Jay McCanless — Wedbush — Analyst

Hey, everyone. Thanks for taking my questions. I guess the first one, could you talk about what you’re seeing for chattel rates right now? And are you seeing anything from a lending perspective, whether it’s taking a lower down payment, little bit of widening on credit terms anything that concerns you there?

William C. Boor — President and Chief Executive Officer

Yeah, I don’t know that I mean — whether things get too aggressive, I guess is in the eye of beholder and I’m not sure I have strong enough view to say that I have concerns about what we’re seeing out there. As far as rates we’re seeing historic low rates for not only traditional mortgages, manufactured housing mortgages, but also home-only loans. Home-only is not typically correlated to mortgage rates. I think I’m in the right zone to say, it’s typically run in the 7.5% to 8%.

And what we’re seeing right now is more in the mid-5%, so it came down pretty aggressively since the pandemic and it’s been interesting to see how lenders have moved in trying to lower those rates and be more aggressive. Whether that’s overheated or not, I don’t know that I have a strong view about that. Obviously there is a big demand and that kind of interest rate is helping bring that demand forward and creating some of the backlog challenges we have.

Jay McCanless — Wedbush — Analyst

Yeah. I’d say so. From the dealer perspective have you all sorted to have any type of cancellations? Or — I know you said there was some pushbacks to the most recent price increase? But are you all starting to lose some orders, because it’s just such a long back or long delivery time at this point?

William C. Boor — President and Chief Executive Officer

I think the dynamic about loosen orders every — essentially every manufacturer has a huge backlog right now. So, there probably is some shuffling. Anecdotally we’ve talked to folks and understood that customer gets frustrated with the length of the backlog and maybe either doesn’t buy or [Indecipherable] and says I’m going somewhere else. And they probably are going to get a similar backlog. So, I think in my mind is kind of probably just a shuffling of the chairs. I don’t think net, we’re losing anything because we’re not standing out as the ones with the high backlog.

So I don’t think we’re really losing anything. And as far as pushback, I guess, I wouldn’t necessarily characterize it as pushback, it’s just very hard on a dealer when manufacturers are increasing one after another increase. The manufacturers would make an increase thinking we got it — get us where we need to be. And cost kept going up and they turned around, so jeez we need to do another one. That’s really hard on a distributor dealer. And so what takes place after that is a lot of working together, sitting down and looking actually at specific deals. And deciding which ones, the wholesaler agrees we should price protect. So, there is a lot of work going on, really at the ground floor to try to work through it with the dealers but it’s been a difficult dynamic for sure.

I don’t think we’ve net lost anything, because I think that dynamic, I think, I’m safe to say that dynamics going on with all manufacturers. And no one is really sitting there with an empty backlog ready to jump in. So, I can get your house a lot quicker.

Jay McCanless — Wedbush — Analyst

Got it. And then the last one I had and apologize for putting words in your mouth, Bill. But I think you said when it comes to the homes that you all are taking orders for now people are maybe going a little more upscale a little bit bigger footprint, more options inside the home. If I heard that correctly could that along with the price increases you’re talking about results in a meaningful step function higher? And where your average prices are at this point?

William C. Boor — President and Chief Executive Officer

Yeah, thanks giving me the chance to correct something if I came across that way, because I didn’t intend to say that. I’m trying to think what I said, I know at one point in the Q&A here, I talked about traditional site builders when they are kind of stretched for capacity they tend to go up and build more expensive homes, leaving the lower price levels. And it even more in deficit. As far as supply I’m wondering if that’s what you’re picking up on, but I didn’t mean to imply that, we were seeing a big move of customers going to higher-end right now or even from an options perspective going up, that’s been fairly stable from my perspective.

Jay McCanless — Wedbush — Analyst

Yeah. Thank you for clarifying that.

William C. Boor — President and Chief Executive Officer

In fact you asked, because I didn’t mean to leave a wrong impression there.

Jay McCanless — Wedbush — Analyst

No, it may have been my bad hearing. So, thank you guys for all that. The one other question I had, does it make sense to restart Lexington or think about keeping it open just to give you another shot at working through the backlog?

William C. Boor — President and Chief Executive Officer

Well, we’ll keep looking at that, but right now, that’s not something that we’re looking at. We’ve made a decision I still think it was probably the right decision just from where that plant was positioned in the market. And the specific struggles we are having, trying to identify the right product niche for it. So that’s not something that we’re actively looking at. But I get — definitely get the point when we look at these kind of backlogs. So, we’ll keep our eyes open on all those kind of choices.

Operator

Thank you. And our next question comes from DeForest Hinman with Walthausen & Company. Your line is open.

DeForest Hinman — Walthausen & Company — Analyst

Hi, thanks for taking the questions. Can you just give us a little bit more color as it relates to the response that the Company is taking on the labor side. You alluded to some things in the prepared remarks, but any additional color there would be helpful, in terms of how can we address the labor issues you had been facing?

William C. Boor — President and Chief Executive Officer

Yeah, I mean it’s certainly not a one-thing approach. One of the challenges we’re having is hiring. And we’ve done a lot to try to improve basically the recruiting effort. We’ve over the last year we’ve built up a bit more of a human resources, infrastructure in the Company, I think that’s paying dividends for us now because those folks are working very closely with our individual plans to improve their recruiting efforts. And sometimes it’s trial and error, so we definitely have — had some spots of success where we’ve seen plans take a different approach to recruiting and it’s paid-off. So, that’s under way.

There has been a considerable amount of work on wage rates and that’s not generally just as simple as saying, we’re going to increase the base wage, usually it’s plants thinking through how much will be in base wage and how much would be in incentive compensation, and what the drivers of the incentive comp are. But the net effect is, several of our plants are making significant moves on their wage rates. And I think that’s necessary and I think it’s smart moves in our system. And this is a philosophical thing, and we’re standing by it, because I really think it’s the way to operate.

In our system, the plants probably get plenty of input, people like me will come in, we’re talking at a minimum. I’m in conversation on operating reviews with the GMs every month, but our VPs are really the ones that are managing that system. But ultimately we believe that the local General Managers have the best perspective on what they need to do in these kinds of areas. But I can report that generally our plants are increasing wage rates and structuring it in good ways.

So, I think that will have an impact on retention. And over time, we’ve — we’ve tried to do things that also improved the workplace. All that stuff, I think all of that is smart, it’s generally mid-term type things, as far as the pay-off. But right now the need is urgent as we all understand. So, it’s just been heightened attention to those sorts of efforts, that I’m confident we’ll pay-off for us, but it’s been frustrating.

DeForest Hinman — Walthausen & Company — Analyst

Does it make sense to run over time as the facilities are trying to get the teammates or crews to work an extra day of the week? Are there other plants running five or six or seven days a week? Can you just give us color in terms of any of those initiatives or potential opportunities?

William C. Boor — President and Chief Executive Officer

That’s a really good question. And I can — typically our plants do run over time even in much slower backlog environments like this. They often they will run on Saturdays here and there not as a scheduled approach, but it’s not atypical at all for plants to run couple of Saturdays a month. And we continue to do that. But think about the dynamic when your absenteeism is high, the people that are showing up to work you kind of have to be a little bit careful about how hard you work that group, trying to make up for the production.

So, the folks in our plants really have a balancing act to do. They’re driving hard to get that extra house out, but if they drive too hard with the overtime in the Saturday work, we’re just going to compound our labor problems, by basically trying to people out. So, we actually saw our labor costs go down a little bit — our production worker cost go down a little bit, partly because we had days that we were not producing in the plant, partly because of absenteeism. That partly because we just can’t work, the folks who are showing up so hard, that we exacerbate our problem. So, it’s a real fine line. But we definitely do what you’re talking about as far as looking at opportunities to work overtime to get the incremental house up.

DeForest Hinman — Walthausen & Company — Analyst

Okay, that’s very helpful. I appreciate the color. Separate topic, the share repurchase authorization we have had the SEC inquiry. Are we restricted from making share repurchases, while that inquiry is outstanding and these Wells Notices are outstanding, are we allowed to purchase stock at this point?

William C. Boor — President and Chief Executive Officer

Yeah. It’s something that it’s material inside information question, right, obviously. And so they’re very well may be times when we have to under the black — blackout and keep ourselves out of the market. Having said that, so frankly, it could be a challenge at times, just as you’re alluding to. Having said that we have taken an approach of trying to be as transparent to the market with what we disclosed as possible around the SEC matter. So, there going to be times when the market knows as much as we know and those points in times taking a conservative approach to inside information, will hopefully be able to be in the market. So, it’ll be interesting to see how that plays out, but we didn’t — we wouldn’t have done the authorization, if we thought we were going to be precluded from doing it.

DeForest Hinman — Walthausen & Company — Analyst

Well, I was just, I know, I would just wanted the insight, because the Board meets at certain times. And in some instances, it could be an indication that the SEC inquiry maybe nearing a close, there is a blackout, and we’ve already taken the steps and put that in our tool kit and we’re prepared to use it appropriately.

William C. Boor — President and Chief Executive Officer

Yeah, I mean the Board gave management authorization. So, the Board’s not going to be directly managing when we’re able to purchase. So, we’ll be able to do that, obviously as we go forward. Yes, like I said, we’ll be — we’ll obviously be very cautious about it. But we wouldn’t have authorized or asked the Board to authorize if we didn’t think there’ll be opportunities.

DeForest Hinman — Walthausen & Company — Analyst

Okay. And then final question on the repurchase authorization. Can you just help us understand the philosophy around that? Is the goal to offset dilution? Is the goal to reduce the outstanding share count? Is the goal to be opportunistic from a pricing or valuation perspective? Or should we think about as a gradual run-off of this authorization over some period of time?

Mark Fusler — Director of Financial Reporting and Investor Relations

Well, the pace of execution is yet to be seen. The goal in my mind is pretty clearly balance sheet management. That’s the priority. We’ve got a cash balance that we needed another way to manage that cash balance and this is an added tool, as I said.

DeForest Hinman — Walthausen & Company — Analyst

Okay. Thank you.

William C. Boor — President and Chief Executive Officer

Yeah. Thanks a lot.

Operator

Thank you. [Operator Instructions] Our next question comes from Daniel Moore with CJS Securities. Your line is open.

Daniel Moore — CJS Securities — Analyst

Sorry about that, I was muted. I was going to ask, but I think you covered it Bill, to the extent that you could, but is there any level — high level of color you can provide on beyond the press release recently on whether or not we’re closer to putting the SEC investigation, as it relates to Cavco, at least to rest?

William C. Boor — President and Chief Executive Officer

Yeah, I appreciate the question. I mean, we had the 8-K, that just went out in September, I think it was late September, I can’t remember the date actually. And really there is not an update since then. And that’s the way this was going to go — it’s in that way for a while. These things will come — it’s in spurts, we’ll do our best to be transparent to the extent we can, extend it’s appropriate, but not much to update from that 8-K.

Daniel Moore — CJS Securities — Analyst

Okay. Thank you again.

William C. Boor — President and Chief Executive Officer

Thanks, Dan.

Operator

Thank you. And I’m not showing any further questions at this time, I’d like to turn the call back to your speakers.

William C. Boor — President and Chief Executive Officer

Okay. Well, just to wrap up, I mean, gives us saying that, these are strange times we’re operating in, but our team has continued to fall forward to meet the needs of our customers. And I’m very proud of the commitment being demonstrated every day by the folks who make up Cavco without a doubt.

A quarter ago we were relieved that we were seeing demand for our products and services. And when the pandemic first hit, it was a big question mark whether things would kind of go to zero. And last quarter when we talked to you, we were kind of our backlog was I think it was around seven weeks, it was kind of just healthy, maybe a little long, but we were relieved to be seeing the demand. And now in manufacturing and retail, we’re challenged to keep up with it — challenge to provide enough homes with orders that would exceed production under any circumstances. So, continues to change, we know we have to do. And with that, I really want to thank you for all your interest in Cavco, I hope each of you and your families will stand healthy and safe. And we’ll wrap up the call. Thanks.

Operator

[Operator Closing Remarks]

Duration: 48 minutes

Call participants:

Mark Fusler — Director of Financial Reporting and Investor Relations

William C. Boor — President and Chief Executive Officer

Paul Bigbee — Chief Accounting Officer

Daniel Moore — CJS Securities — Analyst

Greg Palm — Craig-Hallum — Analyst

Jay McCanless — Wedbush — Analyst

DeForest Hinman — Walthausen & Company — Analyst

##

CVCO earnings call for the period ending September 26, 2020.

Motley Fool Transcribers

(MFTranscribers)

Oct 30, 2020 at 7:31PM

Cavco Industries Inc (NASDAQ:CVCO)

Q2 2021 Earnings Call

Oct 30, 2020, 1:00 p.m. ET

###

Additional MHProNews Analysis, Information, and Closing Thoughts

At already over 10,000 words above, this is longer than many people’s attention spans. But that too is important. Once again, like or admire him or not, Warren Buffett has made some insightful statements. Among them is that he spends 5 hours daily reading. He also spends time on the phone to gather insights from others.

Buffett’s words are held in more rapt attention than those of white-hat performance guru, Matthew Kelly. Kelly has said that superficiality is the curse of the modern world.

Like or admire Buffett nemesis businessman-turned-President Donald J. Trump, the president’s statement below is also useful.

Manufactured housing is underperforming. The statement by Richard “Dick” Jennison, MHI’s prior president and CEO posted below blew me away as he was saying it.

That statement by Jennison in the brief video above was frankly part of my professional awakening. As a longtime industry professional, publisher, and history fan, Jennison’s statement made no sense logically. That – for the logical – begs the question, why did he say this? Given that the manufactured home industry was underperforming, that there was an affordable housing crisis, and that we have long before believed – based upon real-world experiences – that the industry could do better, Jennison’s words were shocking.

Frankly, it was not an immediate awakening. But I made it a point to ask his de-facto boss on the MHI board to have Jennison clean that statement up. At the time, some of those players were clients of our firm.

Jennison subsequently changed his tune completely. At the next Louisville Show, following the event the video above was taken from, Jennison then said on camera that the industry could be doing 500,000 new HUD Code manufactured home units a year. Also, as a result of a request from this writer to that MHI senior board member, Jennison publicly praised our publication by name.

For the 90% who believe in God, the ideals of free will, and notion of Divine Providence, my own prior naivete perhaps proved to be a blessing in disguise. Had the powers that be not trusted this writer to be a useful vehicle for communications, they would never have praised MHProNews.

Those who now quietly whisper this or that fall into the wisdom of the late President Abraham Lincoln.

Samuel Clemens was a writer, who frankly wrote some outrageous things. Clemens, a.k.a. Mark Twain, knew what he was talking about when he said this.

- The manufactured home industry is underperforming.

- That underperformance has lasted for over two decades.

- The initial causes of that underperformance were an understandable correction of a system that was ripe with fraud in the financing of homes.

- But that initial financial meltdown circa post-1998 into the early 21st century should have been followed by a renaissance. Said who? Outside experts such as then Harvard Joint Center for Housing Studies fellow Eric Belsky. Belsky said that manufactured housing should surpass conventional housing by 2010. That has obviously not happened. That begs examination.

- With over 2 decades of manufactured housing underperformance – the last roughly 15 years of which are not the result of fraud-repossessions and related upheaval – even some multi-decade professionals who experienced the relative ‘go go days’ in the 1980s and 1990s have often managed to explain away or rationalize (sometimes, even to themselves) the relatively low sales levels.

- But executives and researchers from outside of manufactured housing are often blown away by the value proposition when they see what MHARR calls “mainstream” HUD Code manufactured homes. After they are stunned by the value, they are then blown away by how few manufactured homes are being sold.

While it is not a perfect example of the bullet above, the statement of these two banking professionals illustrates that point.

What’s the bottom line?

There are several.

- There is a prima facie case that a rigged system exists.

- There are opportunities to grow the industry. But it won’t occur by doing more of the same.

- The status quo must be challenged on multiple levels.

With respect to Cavco, a few parting thoughts.

- MHProNews plans to unpack more from their recent public and published statements.

- Additional information is coming, stay tuned.

- There is room for discussion on to what degree Joe Stegmayer succeeded or failed to implement the Buffett “moat” and related thinking for his firm while he led it.

- Buffett followers – see the quotes above – know that the man says some things that are true on their face, but others that are arguably code-words. To grasp the realities of MHVille, arguably including, but not limited to Cavco, paltering, spin, posturing, must all be kept in mind. Manufactured housing is on some level a metaphorical Kabuki theatre. It is entertainment for billionaires, who profit from their games.

- Casinos do not like card counters. Is it any surprise that MHProNews is the media that the insiders love and hate?

- If you aren’t already on our industry-leading x2 weekly emailed headline news updates, click the link below to sign up.

Only those willing to challenge the status quo can hope to outperform. There are reasons why new blood and those already in MHVille who are willing to challenge the status quo are in a state of positive expectation. Because Boor is right on this, there are “great” opportunities. Ironically, Boor’s own words reveal both opportunities and avoidable obstacles.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Long-Time HUD Attorney’s Formal Statement on Manufactured Housing Enhanced Preemption

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)