A major apartment developer says that even as multifamily housing is hitting new highs, but that “an acute crisis” is coming in affordable housing. With the correct approaches, this could be good news for manufactured home professionals, working within their local market(s).

The Daily Business News begins with CNBC’s report below, and will conclude with some data that reflects why this could be useful for visionary manufactured housing professionals.

Olick’s Reality Checks

CNBC’s Diana Olick says that while luxury apartments are being overbuilt, lower-to-middle-income apartments Her bullet points, part of the video shown, include the following facts.

- The luxury market is largely overbuilt, while there is a shortage of affordable rental housing.

- Lower- and middle-income households are spending proportionally more on their rent, says apartment developer Toby Bozzuto.

- Nearly half of all renter households pay more than 30 percent of their income for housing.

- Scan the downtowns of the nation’s largest cities, and you are likely to see a staggering array of cranes.

- Most of them are helping to build luxury apartment buildings. In fact, multifamily construction is now at a 40-year high.

- Apartment completions in the 150 largest U.S. cities jumped to 395,775 units in 2017, beating 2016 production by a staggering 46 percent and more than doubling the long-term average, according to RealPage, an apartment management software and data company. Luxury, upscale buildings accounted for between 75 and 80 percent of the new supply in the current cycle.

- “It’s really tough to deliver product at those lower price points. The cost of land, the cost of building materials, the cost of labor. It’s really about the same regardless of what product you’re doing and it’s just tough to make a deal work financially if you’re going toward that middle-market price,” said Greg Willett, chief economist at RealPage.

- “In our portfolio, which represents 70,000 units mostly in the luxury space, we’re seeing that our renters are spending a relatively low amount of their income on rent despite rents being perceptively high,“ said Toby Bozzuto, president and CEO of The Bozzuto Group, a multifamily management and development company operating in the Northeast and Mid-Atlantic. “That being said, it is a tale of two cities. In the middle income and the lower income markets, people are spending proportionally more on their rent — so much so I believe there’s an acute crisis headed our way.”

- Despite rising incomes, nearly half (47 percent) of all renter households (21 million) pay more than 30 percent of their income for housing, including 11 million households paying more than 50 percent of their income for housing, according to a late 2017 report from Harvard’s Joint Center for Housing Studies.

- “While the market has responded to rental housing needs for higher-income households, there are alarming trends that suggest a growing inability to supply housing that is affordable for middle- and working-class renters, let alone those with very low incomes,” said Christopher Herbert, the center’s managing director.

- Rents on the high end flattened in the last year, and landlords are starting to offer concessions, like high-end amenity packages or a month’s free rent.

- “We’re getting a pretty competitive leasing environment in select locations at those really high-end price points, and we’ve already gotten to flat to slightly declining rents,” said Willett.

- That is not happening outside the luxury market, where rent increases are still strong due to low supply. Developers say they simply can’t afford to add anything but luxury.

- “The two-by-four doesn’t care whether it’s in a luxury building or in an affordable building. It costs the same,” said Bozzuto. “The differential of course, is the rent and there’s a huge disparity in high-end rent versus low-end rent. So the issue is for us to develop an economically viable, feasible project, it has to be, by its very nature, high end. The rents have to be high to support the cost.”

- The cost of that two-by-four, lumber, is now at a record high. Other products like steel and concrete are more expensive, but the real cost spikes are in land and labor. Skilled construction labor is not only expensive, it is extremely difficult to find.

- Investors, according to Bozzuto, are now moving away from new construction and instead rehabbing older rental stock. These so-called value-add projects just raise the rents on current tenants even more.

- There are some government programs that offer developers financial incentives to build lower-income housing, but they don’t meet the needs.

- “Those are finite and many, many of us are competing for those very finite resources,” said Bozzuto, adding that the luxury market is, “on the precipice of oversupply, but I think macroeconomic conditions are actually going to keep us this year from developing much further. Costs in particular, land costs, hard costs mostly driven by labor, will ultimately make it harder to build new buildings.”

What this Could Mean for MHVille

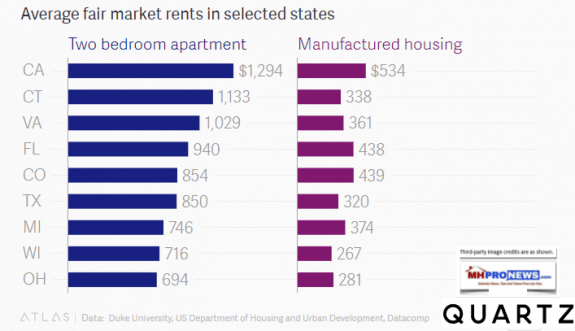

The chart above comparing rents to manufactured housing tells the opportunity tale at-a-glance. The issue is how do retailers and communities attract those would be renters or buyers in greater numbers? To begin finding those answers, readers should tune into the popular Monday Morning Sales Meeting series.

What’s Your Manufactured Housing Narrative? Monday Morning Sales Meeting

The episode above is a useful place to start. ## (News, analysis, and commentary.)

For Professional Services click here.

Thousands “Get It.” Sign Up Today! Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading them by the thousands. These are typically delivered twice weekly to your in box.

Follow us on Twitter:

ManufacturedHomes

@mhmsmcom

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.