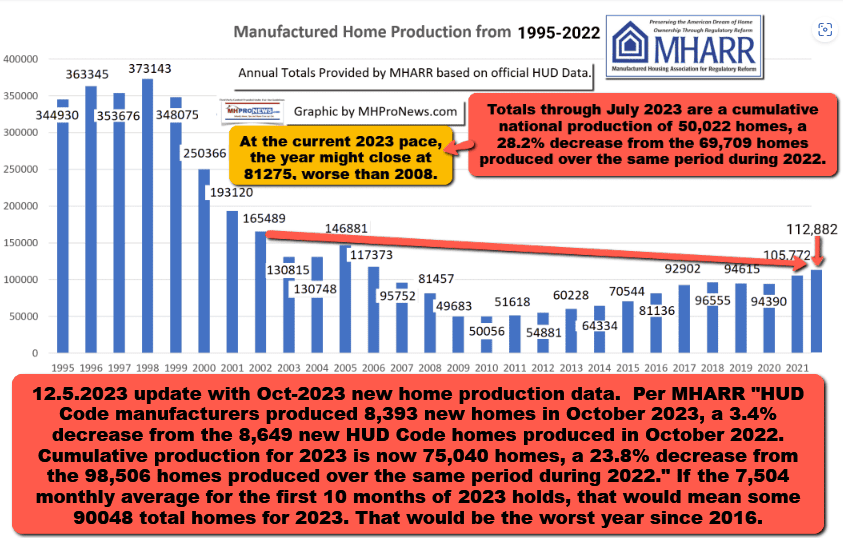

The previously steeper rate of decline in U.S. HUD Code manufactured housing production has slowed. But the decline in manufactured home production has continued, said the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR). That ongoing year of decline has somehow occurred despite the fact that a U.S. affordable housing crisis is raging. Some key Manufactured Housing Institute (MHI) members have said as much about the needs for manufactured housing and affordable homes. For example, recently MHI member Skyline Champion (SKY) said that there are “tremendous needs” while MHI member Cavco Industries stated that ‘the affordable housing crisis’ is “intensifying.” More facts and analysis will be explored in Part II of this report that can shed light on why manufactured housing is underperforming during an affordable housing crisis.

Part I

Manufactured Housing Production Decline Continues in October 2023

Washington, D.C., December 4, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in September 2023. Just-released statistics indicate that HUD Code manufacturers produced 8,393 new homes in October 2023, a 3.4% decrease from the 8,649 new HUD Code homes produced in October 2022. Cumulative production for 2023 is now 75,040 homes, a 23.8% decrease from the 98,506 homes produced over the same period during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The statistics for October 2023 produce one change from last month, moving Louisiana into 6th place, ahead of Georgia.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARRDG@AOL.COM

Website: www.manufacturedhousingassociation.org

Part II – Additional Information with More MHProNews Analysis and Commentary

“The phrase “Superficiality is the curse of age” is the opening line of the book CELEBRATION OF DISCIPLINE by Richard J Foster,” stated Journeys Chattanooga. “Superficiality is the curse of our age. The desperate need today is not for a greater number of intelligent people, or gifted people, but for deep people. —Richard J. Foster” quoted Renovare.org in a post by Nathan Forster entitled “The Cure for Distraction – Staying present through intentional slowing.” Nathan’s posted opened with the quote by Richard Foster on the curse of superficiality, and then said this: “My dad wrote this quote in 1978. Some 40 years later, it feels as relevant as ever.” Those thoughts are similar to the previously cited quotation by businessman, author, speaker, and consultant Matthew Kelley, posted below.

Nathan Foster’s post referenced above said: “If we were able to look at human history in its entirety, I wonder what would be the defining characteristics of our present era?” He asserts that the answer is found in part by his dad’s point on superficiality being “a curse.” Foster is candid in saying that staring at “boxes” and devices are common today, “I wonder if we would be the only ones living with extreme anxiety and stress for reasons other than basic survival? Would we be the ones busily scurrying about while spending all of our down time staring at boxes for entertainment and “human” interaction?” Then Nathan admits: “Yet, I love my distractions. Not only are they fun and interesting, they work so well to protect me from feeling anything unpleasant. Readily available entertainment and crowded schedules easily keep sadness and boredom at bay. Not to mention how the rush of productivity from checking a mess of things off my to-do list not only builds my sense of self, but gives me a profound feeling of worth and value. Never mind what God says about me. When I’m rushing around, not allowing myself rest, when I’m busy and efficient, the world says I’m important.”

“Distraction is the curse of our age. The desperate need today is not for a greater number of efficient people, or busy people, but for present people.””

An evidence-based case can be made that readers of MHProNews, this writer included, also have our “distractions.” That said, regular readers here are routinely less distracted than millions of others. That’s evident because our reports are longer, the depth of content greater, and the engagement by readers like you is roughly double what it is on huge mainstream news sites like CNN or Fox. If you are a regular and detail-mined reader here, you are apparently less distracted, more disciplined, and are searching for the truth that explains the traps and distractions that apparently the Manufactured Housing Institute (MHI – as but one possible example) doesn’t seem to want people to grasp.

We opened today’s column with the very brief preface that noted that two prominent vertically integrated MHI members who produce and retail manufactured homes each have said that the needs for manufactured housing, and more affordable housing in general, are tremendous. Quoting that preface: “MHI member Skyline Champion (SKY) said that there are “tremendous needs” while MHI member Cavco Industries stated that ‘the affordable housing crisis’ is “intensifying.”” Yet, the decline in production has lasted a year?

Recall that post-COVIID19 outbreak, a high-level manager in an MHI member brand told MHProNews months before the downturn began that a downturn was coming. Meaning, while the industry was overall still growing in sales and expanding its production, a leader shared the tip that a downturn was ahead. MHI came out with what might be called “Momentum 2.0” when they asserted once more that the industry had “momentum.” But the prior time that MHI said that manufactured housing had momentum, MHI corporate and staff leaders somehow managed to deploy a plan that caused a more modest downturn in the wake of the slow crawl up from the bottom that manufactured housing hit in 2009-2010.

Because others in manufactured housing have apparently not yet followed through with a similar factual outline of production levels in manufactured housing in the late 20th century and through the first two-plus decades of the 21st century, MHProNews will once again share the facts to set the stage for what follows, which will reveal how distractions and happy talk without proper attention to detail and accountability for those making their apparently faux promises can prove costly.

Understanding the past helps us better understand our present.

> “What was U.S. manufactured housing production by year from 1995 to 2022?”

After mentioning the Census Bureau, Bing AI said the following in an edited for length opening Q&A using the balanced or blue setting on 12.5.2023.

That link was also the top result on Bing’s regular search result on that date. Both linked to the article below.

Here is the follow up Q&A with Bing AI. The reply shown below has been put into a single column, but the reply provides the same text as Bing AI gave in response to the inquiry shown.

> “Can you provide that year by year listing from that report on Manufactured Home Pro News that you listed? Have others in manufactured housing trade media or bloggers reproduced that list of production by year from 1995 to 2022?”

Learn more:

Note that even though our articles are copyrighted, our press releases (see #5 above) are specifically meant to be reproduced. While MHLivingNews and scores of mainstream news websites that picked up our press release provided that ranking by year, oddly, would-be rivals in manufactured housing trade media who routinely regurgitate content from MHI and/or are MHI members have not provided that information. Why not?

The downturn that MHARR is reporting is NOT publicly available from MHI, it is “members only” information, as MHProNews has previously documented. Fortunately, MHARR has years of such month-by-month date on their website at this link here.

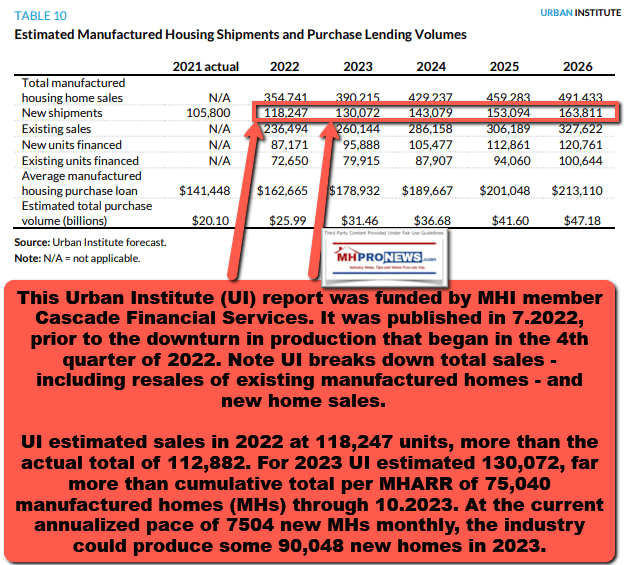

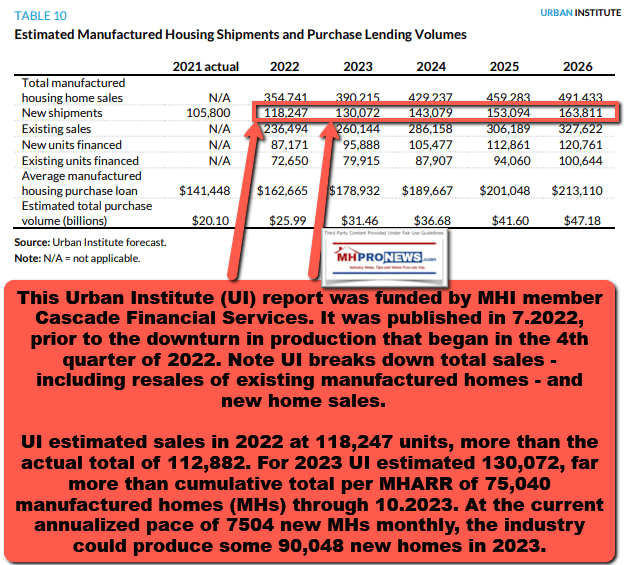

What an MHI Member Paid to Have the Urban Institute Report

“This report was funded by Cascade Financial Services. We are grateful to them and to all our funders, who make it possible for Urban to advance its mission.” So states the opening of the “Acknowledgements” by the Urban Institute of a report entitled The Role of Manufactured Housing in Increasing the Supply of Affordable Housing by Karan Kaul and Daniel Pang, published in July 2022. That research was previously referred to by MHLivingNews in the report linked here. That Cascade Financial Services funded Urban Institute research report is also available as a download at this link here. That report includes the following graphic.

So, that Urban Institute (UI) report was funded by MHI member Cascade Financial Services. The UI published that report in 7.2022, prior to the downturn in production that began in the 4th quarter of 2022.

Note UI breaks down total sales – including resales of existing manufactured homes – and new manufactured home sales.

- UI estimated sales in 2022 at 118,247 units, more than the actual total of 112,882.

- For 2023 UI estimated 130,072, far more than cumulative total per MHARR of 75,040 manufactured homes (MHs) through 10.2023. At the current annualized pace of 7504 new MHs monthly, the industry could produce some 90,048 new homes in 2023.

That same Cascade Financial Services funded Urban Institute research report also looked into this topical subheading: “Improved Access to Financing Can Boost Demand for Manufactured Housing.” Isn’t that a common theme from MHARR? In a word, yes. See their Washington Update of October 26, 2023 as an example.

On the same page 20 of the UI report funded by MHI member Cascade Financial Services cited above it says the following: “Increased annual shipments would also help purchase originations increase and aid further development of the manufactured home lending market. As origination volumes rise, traditional mortgage lenders might enter this market, increasing competition and offering better borrower terms.” Every word of that could well be true. But if shipments are not growing, if they are dropping instead, then the opposite could also be true. Lenders that might otherwise enter the market could decide against doing so. If sales and production fall enough, some lenders might decide there isn’t enough volume in manufactured housing to want to be in the manufactured home lending market. Don’t forget, manufactured housing lost a serious lender during a prior downturn.

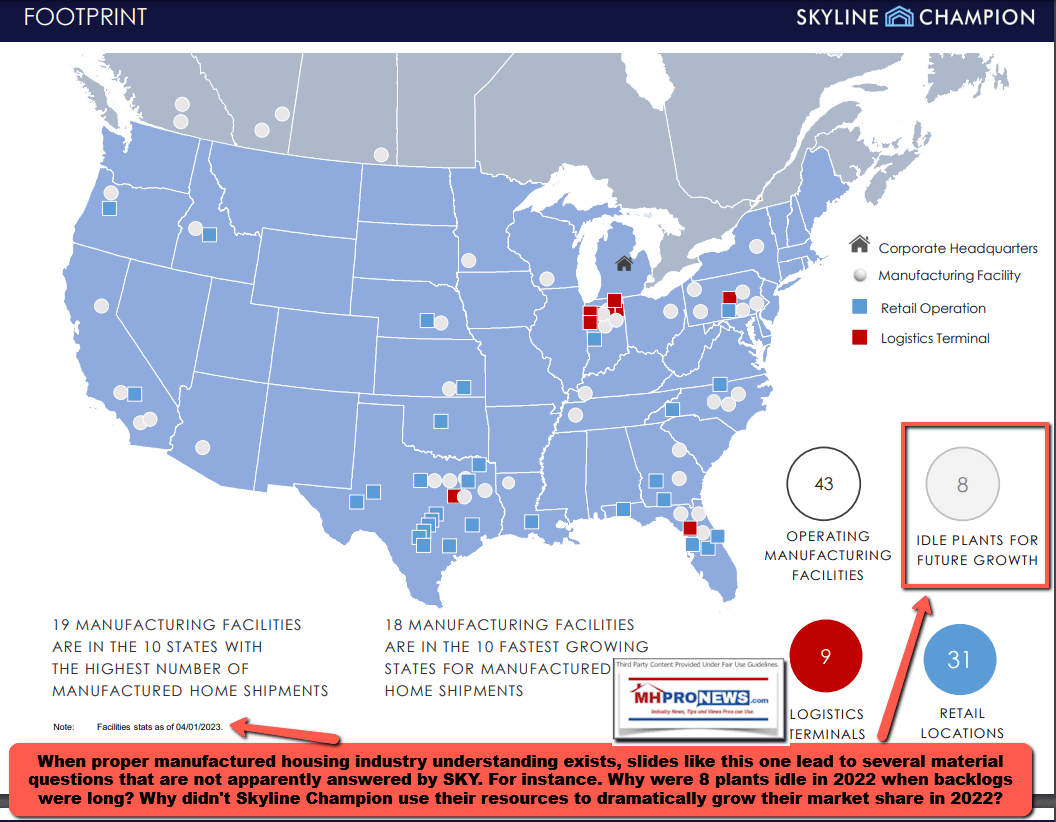

Indeed, the combination of repossessions, falling production and other factors caused several lenders to leave manufactured housing lending in the early 20th century. Which begs the question. Is teasing growth, but providing yo-yo ups and downs in the manufactured housing industry mere coincidence? When production was rising, why didn’t Skyline Champion – for example – ramp up one of their idled plants? Why did Skyline Champion wait until production as falling to begin to ramp up production at three of their previously idled plants?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

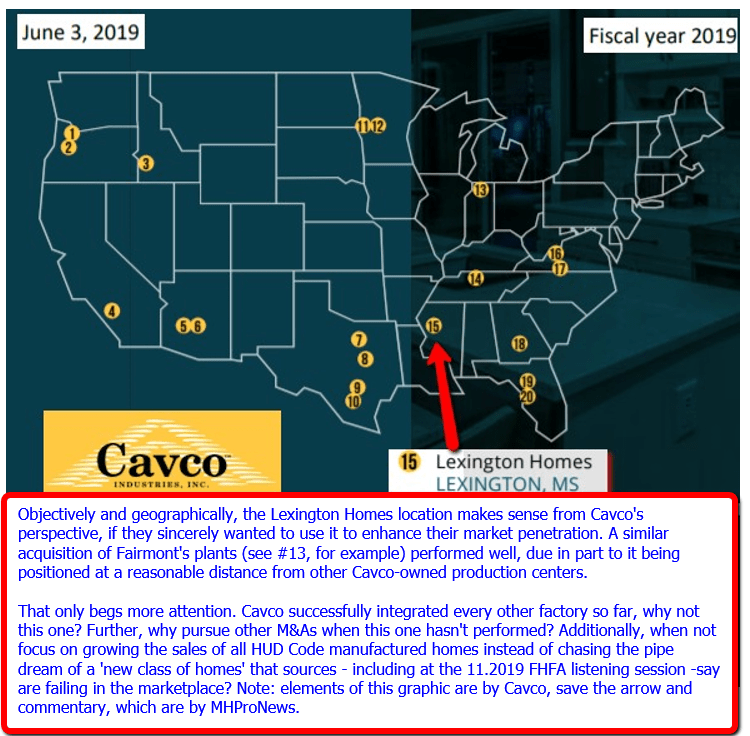

When it would be obvious that production demands would grow, why didn’t Cavco Industries restart production at their previously shuttered Lexington Homes Mississippi plant?

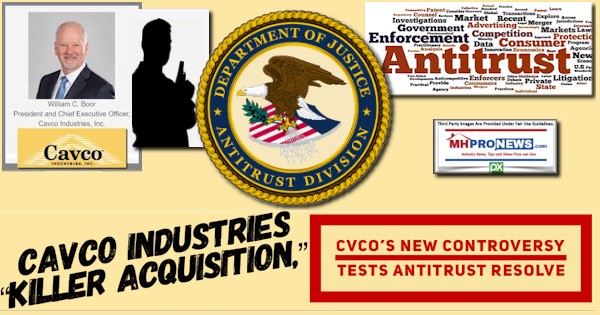

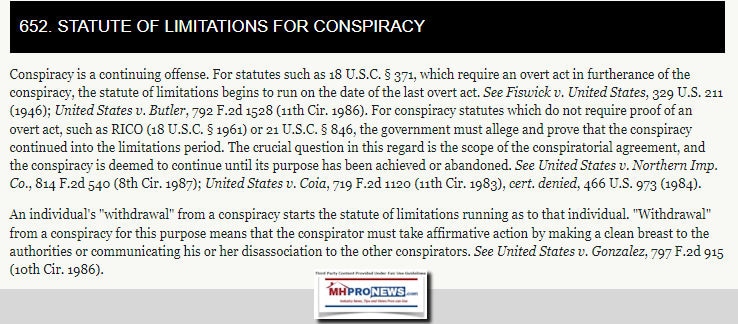

If the pattern of problematic, if not illegal behavior apparently involving Manufactured Housing Institute (MHI) members wasn’t clear enough for state and/or federal antitrust enforcement professionals, perhaps it could be so now. If a conspiracy is involved, then the statute of limitations has not yet started.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

If some shrugged off the notion of conspiracy involving several key MHI brands before, it can hardly be shrugged off now. After all, several sets of attorneys launched antitrust class action lawsuits claiming collusion – a conspiracy – that harmed residents of several MHI members brands and/or were members of MHI state affiliates.

As our report detailed yesterday (bold added for emphasis) a jury decision hit: “The National Association of Realtors and some residential brokerages, including units of Warren Buffett’s Berkshire Hathaway, were found liable for nearly $1.8 billion in damages after determining they conspired to keep commissions for home sales artificially high.”

The case for antitrust on the production and lending sides of manufactured housing ought to have gone up as a result of this potentially relevant and related evidence. It was almost a year ago that MHProNews produced the report linked below. Detail minded professionals, researchers, investigators, affordable housing advocates, and others should dig into these items with thoughtful focus, not distraction or a superficial skimming of the facts, evidence, and manufactured housing expert analysis.

Should it be grasped by public officials and/or sufficiently motivated, sincere, and well-heeled plaintiffs’ attorneys that affordable manufactured housing is the victim of years of what Minneapolis Federal Reserve researchers dubbed ‘sabotaging monopoly’ practices, then a massive legal battle could ensue. Given the suits referenced above, it is no longer purely hypothetical.

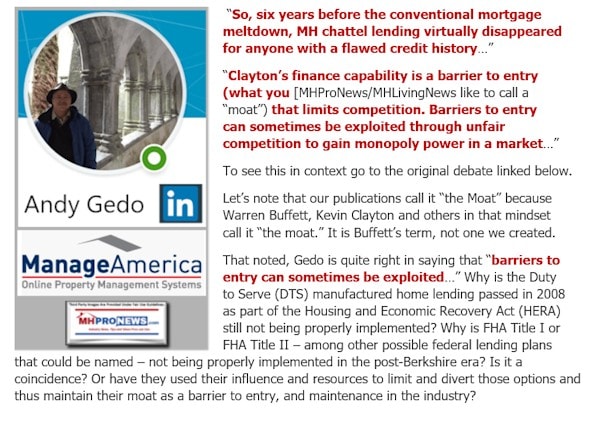

MHI member Cascade funded Urban Institute research has essentially confirmed or ‘vindicated’ another part of years of MHProNews/MHLivingNews concerns. Namely that underperformance is a barrier to entry, persistence, and exit in manufactured housing. Look again at that quote from page 20 of their report: “Increased annual shipments would also help purchase originations increase and aid further development of the manufactured home lending market. As origination volumes rise, traditional mortgage lenders might enter this market, increasing competition and offering better borrower terms.” The flip side of that truism is that is lower annual manufactured home shipments are a barrier to entry. With that in mind, go back to the prior references to Andy Gedo’s remarks in the online debate with this writer for MHProNews about antitrust issues in manufactured housing.

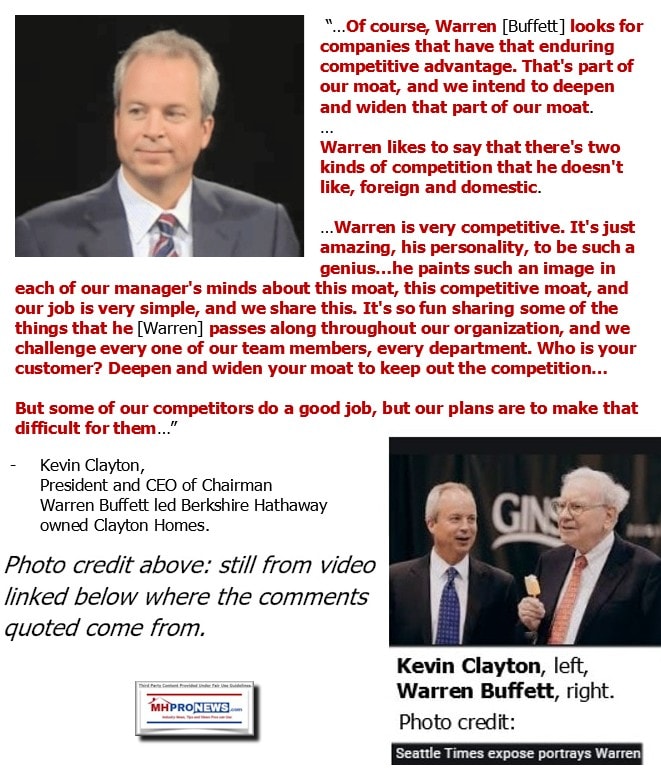

While not an outright confession, Kevin Clayton’s remarks cited below apparently demonstrate just what Gedo was talking about.

It ought to be kept in mind that monopolistic practices are hardly victimless crimes. Monopolies are often illegal for good reasons. Monopolistic harm, a big focus of antitrust and fair competition laws, can injure employees, the labor market, consumers, as well as actual or potential competitors. Or as the headline report below framed it, if employees in manufactured housing – as an example – wanted a 17 percent increase in pay, then they should be motivated to see antitrust laws enforced. That’s according to sources that span the left-center-right divides, as the report with analysis details.

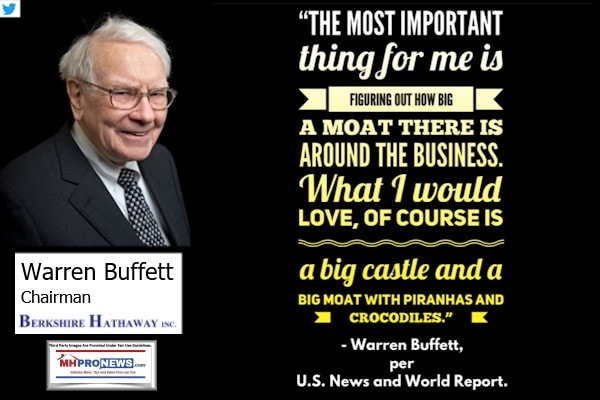

As MHARR has asserted for years, there is a need for robust investigations and litigation to tackle the core issues undermining manufactured housing. While it may seem counter-intuitive to undermine an industry from within, no less a figure than William “Bill” Gates III – a longtime ally with Buffett in investing and philanthro-feudalism, ‘finding weaknesses in markets and exploiting them’ is what Warren Buffett apparently has done in manufactured housing. While Buffett may not do so in every market he enters, the fact that he has done so in manufactured housing is sufficient reason for virtually all industry professionals and affordable housing advocates to lean in, take notice, and care about enough to act upon such insights. Keeping manufactured housing small is how market shares can be gobbled up at often discounted valuations.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

For those who may muse, ‘well, Charlie Munger – Buffett’s right-hand man and longtime vice-chairman at Berkshire Hathaway is dead. Buffett is even older, how much longer can Warren live?’ That kind of thought should not spawn comfort. It might inspire even more concern. How so? ICYMI, or need to better understand the issues evolving, Greg Abel – Buffett’s heir apparent at Berkshire – could be harsher than Buffett himself. Who said? While he used different words, Charlie Munger among others. Buffett – see the report linked above – has built Berkshire to last. That’s what castles and moats are about. In pondering the quote below, keep in mind that in Buffett’s choice of words to illustrate his message, piranhas and crocodiles are man-eaters.

For balance, it should be noted that not all MHI members are predatory and not all MHI members are looking to limit the industry in order to foster consolidation. Legacy Housing, for example, has bucked several trends. Compare Legacy to what Skyline Champion (SKY) or Cavco Industries (CVCO) has said.

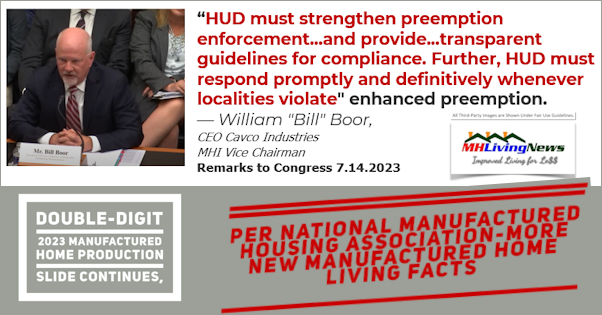

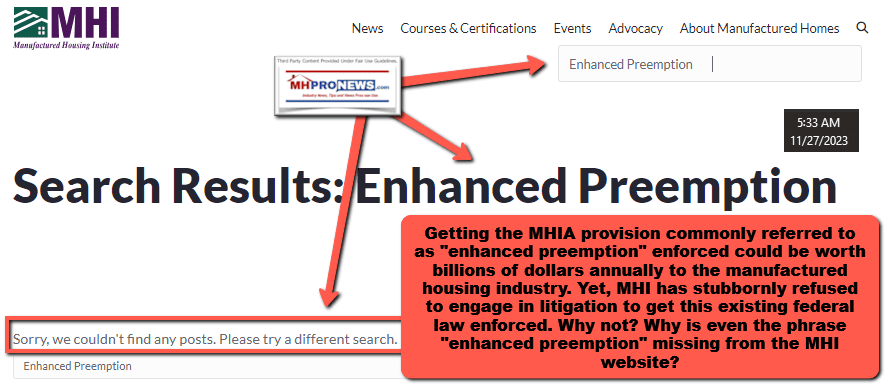

That noted, instead of MHI litigating issues such as the Duty to Serve, FHA Title I and the 10/10 rule, or zoning and placement barriers with respect to the “enhanced preemption” provision of the Manufactured Housing Improvement Act (MHIA) of 2000, MHI is ironically created a tool for MHI ‘members only’ to see where zoning problems exist. Pardon me? Don’t local retailers likely already know where they face zoning hurdles? Why not solve the problem, instead of talking endlessly about how the problem is stunting manufactured housing industry growth?

MHI and their leaders for years has carefully avoided using the term “enhanced preemption” on their own website, in their own op-eds, and their favored trade media have demonstrably followed suit. But they have used the phrase narrowly in talking about it, or in MHI emails (not as easily found by a search engine, unless it is published later on a website). The collage below can be expanded to a larger size, see the instructions under the image, or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note in startling contrast to MHI’s lack of using the words “enhanced preemption” on their website, how MHARR has used it numerous times on their website. MHLivingNews and MHProNews have used the terms hundreds of times collectively. Why? Because it is that important.

Cascade Financial may or may not have been aware of what MHI CEO Lesli Gooch, Ph.D., was going to say to the Federal Housing Finance Agency (FHFA) listening session last summer. But whatever the case may be, MHI’s own CEO handed Fannie Mae and Freddie Mac a gift-wrapped excuse NOT to do more lending in manufactured housing under arguably long-overdue proper enforcement of the Duty to Serve (DTS) Congressional “mandate.” Where was the outrage from pro-MHI trade media?

There are several questions and concerns about the underperformance of manufactured housing not only in the 21st century in general, but in the last few years more specifically. Was the fiasco of so-called long backlogs avoidable? Was too much inventory on street retailers (a.k.a. “dealers”) lots eventually leading to a downturn predictable? Why did several larger MHI member-communities which have been buying and setting hundreds of homes a year suddenly have problems doing what they’ve done numerous times before? MHI leaders and their attorneys were asked about such issues. They declined to respond.

Look again at what Cascade supported Urban Institute said in that graphic above. Reposting below for ease of reader reference, look carefully at the data and columns. Over 30,000 new units were expected to be purchased for cash. A signficant part of that is likely to be by manufactured home communities (MHCs) and for use as rentals. The actual numbers of new manufactured homes being sold at retail are that much lower than the data indicates. Just as private equity has been slammed for buying a significant percentage of single-family housing for rental purposes, something similar is occurring in manufactured housing too.

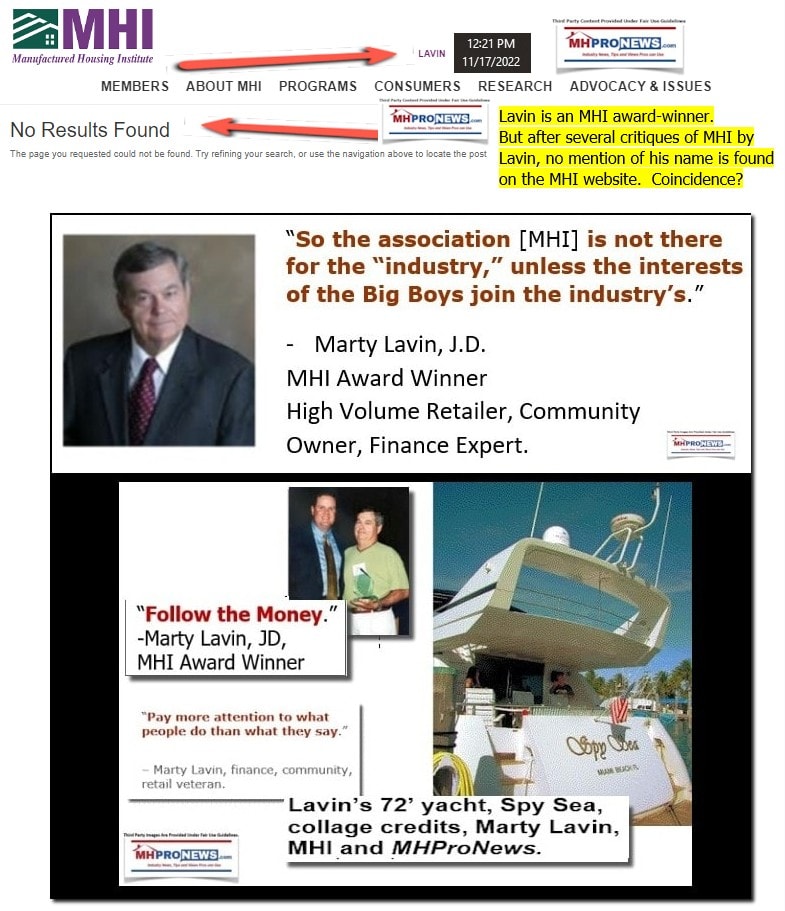

Wordplay in the form of posturing and paltering is apparently part of how the forces inside and beyond manufactured housing have limited the industry. MHI pretends to be the friend of all, but a closer look reveals that it is the friend of consolidators. Who said? Not in so many words, but perhaps by implication, Marty Lavin an MHI award winner. Once Lavin became a periodic MHI critic, is it a surprise that the MHI award winner’s name can’t be found on MHI’s website?

Former MHI VP Danny Ghorbani has been more direct. He flatly accused MHI of posturing for effect while doing nothing measurably productive.

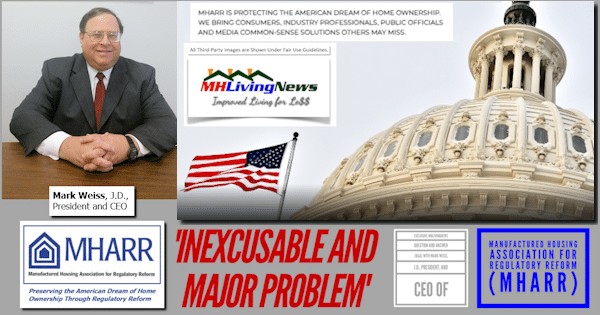

MHARR’s current president and CEO, Mark Weiss, J.D., has called what is occurring a shell game.

MHI leaders and their attorneys have been repeatedly invited to respond to our reports. They have repeatedly declined to do so. While silence is their Constitutionally protected 5th Amendment right, it also leaves the mounting allegations and evidence against them largely unchallenged.

MHI can’t have it both ways. They can’t claim that they are working to grow the industry, when the industry is demonstrably shrinking for the past year. They can’t claim that they are getting momentum, when that momentum is followed by downturns. The report below was mentioned above and was published months in advance of the latest downturn.

Not every MHI leader is a scoundrel. But that there are apparent scoundrels in the mix is rather easy to evidence, despite the ‘awards’ and ‘philanthropy’ that some hide behind.

MHProNews had multiple sources that said in advance of the latest downturn one is coming. At the time, who else would have dared said it? But perhaps as important, MHProNews has a source that has said that the industry may ‘never recover’ to its prior levels. Why not? See the report linked below.

Anything that has happened before can happen again. Thousands of manufactured housing industry firms were torpedoed from within. That is what years of research and reporting reveals. Outsiders looking in have helped document those issues. Until there is a serious shakeup at MHI and their consolidating focused brands, perhaps brought on by public officials probing-charging them with various offenses and/or crimes, or more class action lawsuits force change, the status quo is sadly likely to prevail. Instead of sales rising, as the Urban Institute forecasted, the manufactured home industry has declined. See the related reports to learn more. ##

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the morning of 12.4.2023

- Some traders appear to have anticipated October 7 Hamas attack, research finds

- Sheryl Sandberg on Hamas attack: Rape should never be used as an act of war

- Joan Donovan, a disinformation researcher, at the Shorenstein Center on Media, Politics and Public Policy, at Harvard University in Cambridge, Mass., Sept. 16, 2021.

- Former Harvard disinformation scholar says she was pushed out of her job after college faced pressure from Facebook

- Electric cars are having more problems, but not because they’re electric

- Sir Richard Branson attends “Branson” New York Premiere at HBO Screening Room on November 29, 2022 in New York City.

- Richard Branson sends Virgin Galactic shares plunging after he says he’s not putting any more money in

- Alaska Air to buy Hawaiian Airlines for $1.9 billion

- The U.S. Supreme Court building is seen in Washington, U.S., August 31, 2023.

- US Supreme Court scrutinizes controversial opioid crisis settlement that would give Sackler family immunity

- Gold bars and gold coins lie in a safe at the precious metal dealer Pro Aurum in Munich, Germany in March 2023.

- Gold has never been this expensive

- Representation of Bitcoin cryptocurrency is seen in this illustration photo taken in Krakow, Poland on April 19, 2022.

- Bitcoin hits highest level in 18 months as investors gear up for ETF approval

- Beyoncé’s ‘Renaissance’ tops the box office with $21 million opening

- Spotify to cut 17% of its staff

- New US rules on Chinese batteries could push up price of electric cars

- Shein and Reddit IPOs don’t herald a Wall Street boom. Here’s why

- The wealth of middle-class and lower-income Americans grew at a faster rate than high earners early in the pandemic

- It’s one of the hottest designer bags around, and it’s affordable. Here’s why

- Why are real estate commissions 6%? – and why that may be changing

- While Black Friday and Cyber Monday did well, Giving Tuesday lagged

- Here’s why some bond traders care so much about the US government’s budget deficit

- Clean energy stocks have fallen out of favor. They face more challenges ahead

- Hollywood box office sales slumped in November

- No shortage of Christmas trees this year, but don’t expect any red-tag deals

- Walmart is the latest advertiser to pull ads from Elon Musk’s X

- Target date funds: What are they and are they right for you?