Hensarling said that today 9.6.2018, marks the 10th anniversary of the housing finance takeover by the Federal Housing Finance Administration. (FHFA). He uses strong language, including “disastrous,” “uncompetitive,” and “monopoly.”

The FHFA and the GSEs have been periodically in the spotlight for years in MHVille, as the Manufactured Housing Institute (MHI) – most recently in their latest emailed ‘news,’ postures doing something.

An MHI member in the community sector of MHI told MHProNews yesterday that the MHI letter read much like their bland statements did 10 years ago.

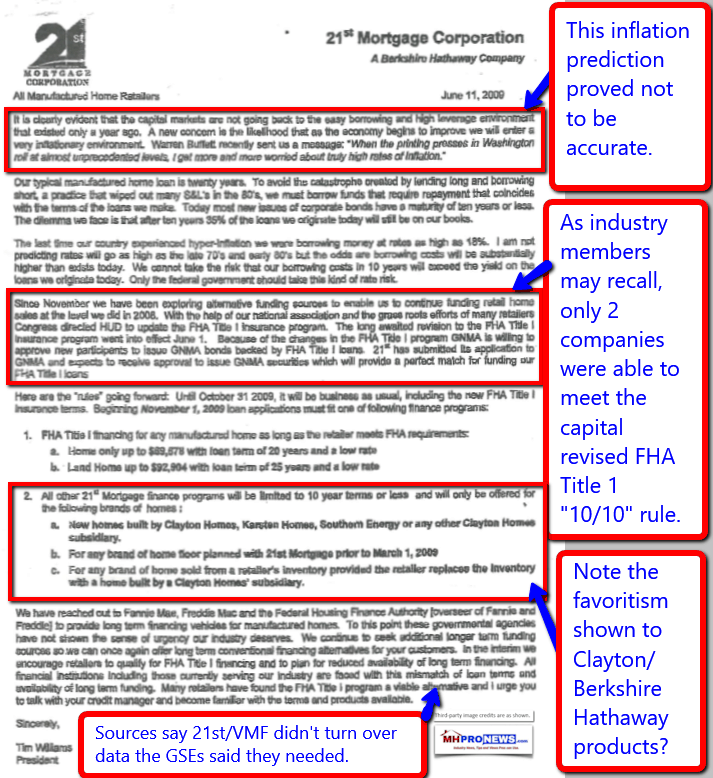

Indeed. 21st Mortgage President and CEO Tim Williams, in a letter shown below, encouraged near the end of the document customers to ask Congress to get the GSEs involved.

But doesn’t that beg the question? Because Congress had already spoken. That’s what HERA 2008 was supposed to fix, with the “Duty to Serve” (DTS) manufactured housing and underserved markets. The point of frustration by the Manufactured Housing Association for Regulatory Reform (MHARR) is precisely that laws on the books, like DTS, are not being applied.

The 21st letter with the reference to the GSEs is below.

GSEs Shocked

But what another MHI member told MHProNews just over a week ago is this. What 21st and the Berkshire Hathaway manufactured housing lenders accomplished about 9 years ago was to shock the GSEs into inaction.

Unlike more recently – when Clayton Homes’ Vanderbilt Mortgage and Finance (VMF) and 21st reportedly declined turning over data to the GSEs – circa 2008-2009, the Berkshire brand MH lenders DID turn over data to the GSEs. The reaction of the GSEs was one of “shock,” said our source, at “how high” the default rates were on Berkshire’s manufactured home loan portfolios.

In fairness, it should be noted that back then, some of those loans were purchased by Berkshire from other lenders, most if not all of whom had existed the MH lending business. Nevertheless, their portfolio of loans and the total performance is what it is.

So, the GSEs declined getting involved in manufactured housing lending at that time, after seeing the Berkshire brands lending performance.

More recently, because the GSEs didn’t get Berkshire data, this time, the GSEs did get involved, but only with a toe in the water. MHARR has pointed out what a sliver of the market the GSEs promised commitment represents.

“They [the GSEs] don’t want to loan on manufactured homes, period,” per our informed source. “That’s why they’ve created programs like MH Select [some years ago], that clearly failed [to gain traction in the market].”

Now, the GSEs are promoting lending that parallels MHI’s so-called new class of homes, that is backed by Clayton and the ‘big boys.’

That new program is also expected to have problems, and fail, our source with MHI and GSE connections said. The source said that once these new MH program fail, the GSEs will have deniability. “Look, we tried,” is what the MHProNews source said the GSEs will likely say when that happens.

Another source with ties to the GSEs and MHI has said similarly.

Barry Noffsinger, Credit Human, and GSE Reminders

Noffsinger has said in association meetings that he’s personally told representatives of Fannie Mae that MH Select was an insult to intelligent manufactured home shoppers. It was saying to them, ‘look, we don’t give the same terms for manufactured homes as we do for conventional housing.’

That’s an insightful statement by Noffsinger. Because doesn’t it apply equally to the new plans by the GSEs that only apply to MHI’s controversial new class of homes? Doesn’t it diminish the vast majority of “standard” manufactured homes, by implication?

Common Denominators

The common denominator in what Hensarling said, and these other incidents could be boiled down to the words “disastrous,” “monopoly,” and “uncompetitive.”

The full statement by the Financial Services Committee, followed by closing thoughts, are found below.

Chairman Hensarling Delivers Opening Statement, Unveils Bipartisan GSE Reform Bill

WASHINGTON – Financial Services Committee Chairman Jeb Hensarling (R-TX) delivered the following opening statement at today’s full committee hearing on the 10th anniversary of the federal government’s takeover of Fannie Mae and Freddie Mac, the failed government-sponsored housing enterprises (GSEs). During his remarks, Hensarling detailed his bipartisan plan to reform our broken housing finance system.

September 6th, 2008 is a day that will live on in economic infamy. For today marks a not-so-happy anniversary of one of the most frustrating and costly moments in recent financial history: namely, the 10 year anniversary of the federal takeover of the failed housing government sponsored enterprises, Fannie Mae and Freddie Mac (the GSEs).

The GSEs’ anti-competitive government charters and ever-increasing “affordable housing” mandates created a toxic mess of systemic risk. Their collapse directly led to the second worst financial crisis in our history, causing more than $190 billion of taxpayer bailouts and forcing them into a government-run conservatorship.

Embarrassingly, ten years later, the GSEs remain in conservatorship, very much alive and very much unreformed as they quietly return to their pre-crisis market dominance. That’s bad news for competition, innovation, and, most of all, taxpayers, since the Congressional Budget Office has said their $5.1 trillion of mortgage obligations are “effectively guaranteed by the federal government.”

Meanwhile, as several of our witnesses will testify, systemic risk is building yet again. The cost and risk of continuing to do nothing is rising and rising at an alarming rate. Reform, while critical, has proven elusive. For almost 20 years, I along with a handful of reformers like Congressman Ed Royce have labored in vein to replace the GSEs’ government-sanctioned monopoly with a new system based on competitive private capital, innovation, consumer choice, and market discipline.

We passed the PATH Act in the 113th Congress to do just that. I am reintroducing the PATH Act this week, and for no other reason it is the right thing to do and it will let me sleep better at night. Regrettably, its chances for passage remain slim. So as an alternative, I’ve decided to partner with Mr. Delaney on the other side of the aisle to propose a bipartisan compromise housing reform plan that preserves the government guarantee in the secondary mortgage market.

In the time I have remaining in Congress, this is the plan I will pursue.

Our discussion draft, which we will unveil later today, will repeal the GSEs’ charters, permanently ending their monopoly, and transition to a system that allows qualified mortgages backed by an approved private credit enhancer with regulated, diversified capital resources to access the explicit, full government securitization guarantee provided by Ginnie Mae. I believe the plan will preserve much of what is demanded in the current system: liquidity, the TBA market, and the 30-year pre-payable fixed mortgage. And it will do so while dispersing risk and leveling the playing field for all entrants into mortgage finance. Additional details on our proposal will be released later today.

While by no means perfect, we offer this proposal as a grand bargain on how to move past an increasingly dangerous status quo: codify an explicit government MBS guarantee into law, coupled with an accountable and effective affordability program in exchange for placing the taxpayer in a catastrophic loss position only diffusing the credit risk beyond two GSEs, and creating market competition.

If the political will to enact such reform stalls in this Congress or the next, the Administration can and should effectuate change. The President will appoint a new Federal Housing Finance Agency Director in January. The Director has broad, unilateral power as conservator of Fannie and Freddie to dramatically reduce their size, scope, and function. If Congress fails to act by early next year, I call upon the new Director to institute these reforms administratively. The grand bargain I have described does not necessarily represent my preferred policy or optimal policy, but I believe it represents an achievable policy and a good faith effort at bipartisan compromise. A decade without GSE reform has once again put homeowners, taxpayers, and the economy at risk. The time to act is now. With apologies to the rolling stones, “you can’t always get what you want, but if you try some time, you just might find, you get what you need” to avert the next housing crisis.

###

See related reports, linked further below. That’s “News through the lens of manufactured homes, and factory-built housing,” where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Third party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Related Reports:

“Waste, Fraud, and Abuse” – FHFA, GSE Federal Oversight Announcement