There are those Manufactured Housing Professionals who are directly engaged in the sale of new homes that already realize they’re part of a broader housing market. There are also others, who quite frankly, don’t really fully appreciate that fact.

‘But it is what it is.’

Those who ‘dial into’ the reality of the HUD Code manufactured home industry should be seen through the prism of the larger housing market – including insights presented exclusively by LifeStyle Factory Homes, LLC – soon begin to see their potential in manufactured housing in an entirely different light.

That in turn, leads the ‘enlightened ones’ to higher profits.

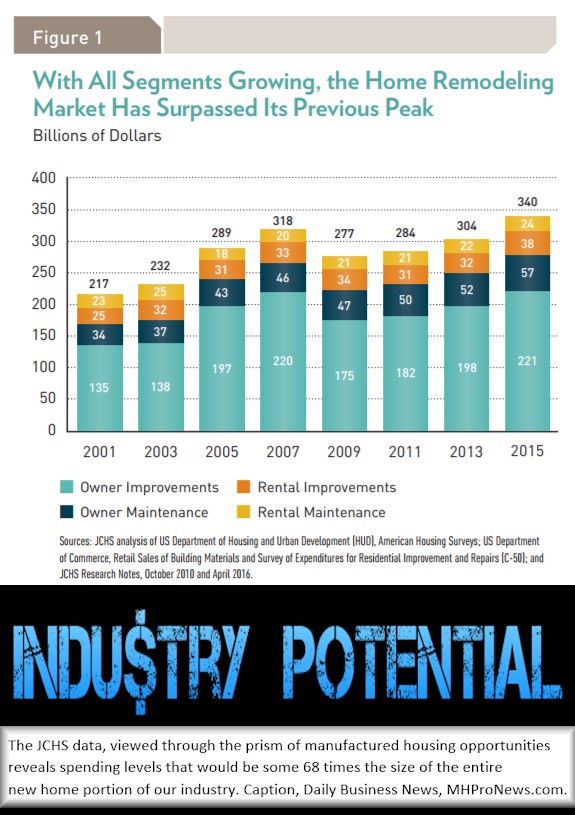

Harvard’s Graduate School of Design – the Harvard Kennedy School – commissioned a recent report in their prestigious “Joint Center for Housing Studies” (JCHS) of Harvard University series.

The JCHS report is entitled, Demographic Change and the Remodeling Outlook.

Among the highlights, “Home owners spent a record $361 billion on home improvement, maintenance, and repairs in 2016.”

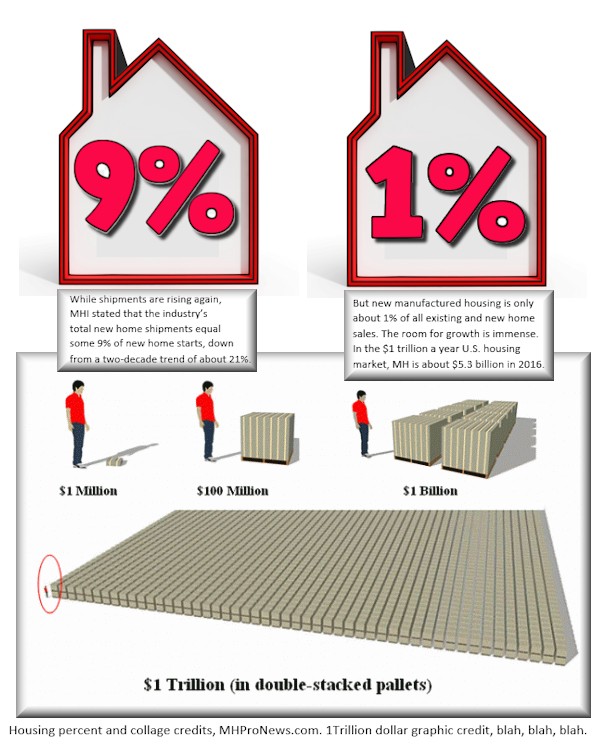

To put that into perspective, in 2016 saw about $5.3 billion in new HUD Code manufactured home sales. So, the remodeling, improvement and maintenance industry is about 68 times larger than the entire manufactured home industry.

To put that into perspective, in 2016 saw about $5.3 billion in new HUD Code manufactured home sales. So, the remodeling, improvement and maintenance industry is about 68 times larger than the entire manufactured home industry.

Publisher and industry consultant, L. A. “Tony” Kovach recently laid out the case editorially that many in manufactured housing are “cooked in a squat,” a Zig Ziglar line that means self-limiting in their thinking or behavior.

Per Harvard’s recent JCHS report, “Rising house prices and incomes, an aging housing stock, and a pickup in household growth are all contributing to today’s strong home improvement market.”

Why is that Market Improving?

In a parallel study, Nino Sitchinava, principal economist at Houzz told CNBC recently that their report revealed the following.

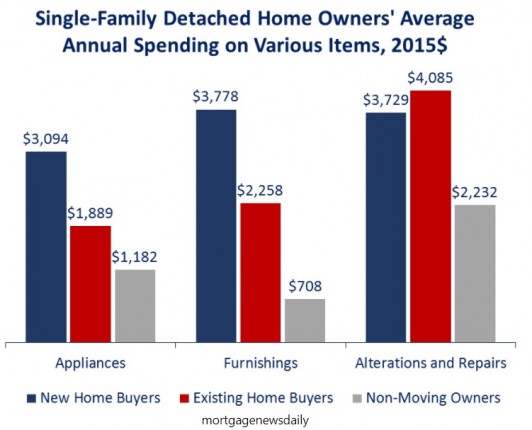

“The [Houzz] survey said that the 25-to-34-year-old age group spent an average $26,200 last year on the upgrades. That’s 7 percent more than they did the previous year. First-time homebuyers spent $33,800, representing 22 percent more. Overall spending across all age groups was consistent year over year, according to the survey of residential remodeling, building and decorating activity,” Sitchinava said.

But boomers spent even more.

Two of the Biggest Potential Markets for MH Pros

The old – and politically incorrect – witticism that ‘the newly wed and nearly dead’ were two key markets for factory-built housing industry professionals dates back to the mobile home and early pre-HUD Code manufactured home days.

That blunt observation still has a high degree of validity.

Millennials and boomers are driving a significant amount of home buying, new construction, existing house sales — and manufactured homes sales.

So, what the JCHS study and the Houzz report reflect are the mirror opposite of what would move more manufactured housing sales.

Because what many are paying to upgrade or renovate could make a huge down payment – or purchase outright – a new manufactured home.

What’s Missing?

What’s missing is the proper understanding of over 90% of the housing market, as the recent report linked here documented. In a word, its “education,” said James McGee and Chet Murphree of Deer Valley Homebuilders (DVLY).

Naysayers and skeptics point out that most manufactured home sales are rural. True, but must it be so?

Entry Level vs Residential Style Manufactured Homes, Why Dr. Ben Carson at HUD Should Enforce the Law from ManufacturedHome-ModularHomeNews on Vimeo.

While particularly dense, high-rise housing markets may not make a great candidate for new HUD Code homes per the multi-level regulations in place today, there are numerous urban and suburban neighborhoods where infill on vacant scattered lots could create significant business opportunities.

- How manufactured homes could meet urban needs,

- have a positive impact on neighborhoods,

- see their HUD Code homes appreciate,

- and those conventional houses of their neighbors rose in value too.

Neighborhoods were improved, thanks to manufactured housing. See that report, linked here.

Donald Tye, Jr. described something similar in his experiences in a Cincinnati metro area, where their family’s business sold dozens of factory-built homes in the early 1970s. Those homes were embraced, and became part of the neighborhood. Those too rose in value.

What Does It Mean?

For those industry professionals who understand the true potential provided by the Manufactured Housing Improvement Act of 2000 (MHIA 2000) with its “enhanced preemption” over local zoning, the opportunities are many times larger than the total size of the industry today.

That is one of the many reasons why Danny Ghorbani, engineer, senior advisor and predecessor to Mark Weiss, JD, president and CEO of MHARR have said that HUD Code home producers should be doing several hundred thousand homes annually. Not someday, today.

What’s missing?

Education.

Education of professionals who don’t yet ‘fully get it’ about the industry’s potential, plus the need to educate those outside of the manufactured home business. Those doing so are succeeding at a pace far faster than that of the industry at large.

Independent producer John Bostick of Sunshine Homes, and his daughter, Lindsey Bostick – both of whom own and live in their company’s factory-crafted homes – have made similar points. So too has Leigh Abrams (from high-flying LCI, the former Drew Industries), Sam Landy and a numerous other industry professionals that have been interviewed by MHProNews.

Remodeling is done because what those home buyers want something new and appealing, and they don’t see that they could have what they wanted for less with a manufactured home.

Rising star Frank Rolfe has said that the industry itself is – i.e., MHI – is harming its own growth. Can any serious, objective observer doubt that is true?

There are de facto forces within the industry that are part of the relatively slow growth the industry is experiencing. As more professionals wake up to that reality, they are seeing those voices that have been consistent in promoting the potential of the industry, and are consistent in supporting those efforts that are spurring the industry’s true growth potential.

A home seeker can order custom built manufactured home, as Sunshine Homes President John Bostick has said, in a matter of weeks, not months. They can buy those homes at a cost that’s a fraction of that of new home construction.

There are millions spending billions on housing that ought to be the customers of today’s manufactured homes. Note that the segment of the industry that Sunshine targets is the residential side, not the entry level side. That’s where the largest growth potential is. Stan Dye, Tom Fath and many others we’ve interviewed say the same thing.

The JCHS report is entitled, Demographic Change and the Remodeling Outlook, is linked here. ## (News, analysis.)

(Note: LifeStyle Factory Homes, LLC is the parent company of DBAs, MHLivingNews.com and MHProNews.com, among other enterprises.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)