MHProNews has been tracking reports of a financial duel between publicly traded Sun Communities (SUI) and equity giant Blackstone (BX) for a portfolio of land-lease manufactured home communities for a deal reportedly worth north of half-a-billion dollars.

The first brief below is from left-of-center Bloomberg News. It will he followed by a subsequent report from another source that clarified several items in Bloomberg’s report. That will in turn be followed by a additional related information, MHProNews analysis and commentary.

—

By Gillian Tan

September 10, 2020, 12:47 PM EDT

- Potential sale of business could fetch at least $750 million

- Properties have been a bright spot in real estate market

Private equity firm TPG is exploring the sale of Strive Communities, an operator of mobile-home parks that could fetch $750 million or more, according to people with knowledge of the matter.

The firm, working with an adviser, is set to begin soliciting interest from potential suitors in coming weeks, said the people, who requested anonymity because the talks are private. It’s possible TPG will decide to keep the business, one of the people said.

A TPG spokesman declined to comment.

Bright Spot

The potential sale comes as investors increasingly bet on mobile home parks, making the properties a bright spot at a time when traditional corners of commercial real estate, such as office and retail, are facing pandemic-related headwinds.

TPG’s real estate arm owns Colorado-based Strive, which oversees more than 120 communities across 16 states including Texas, Illinois and Iowa.”

##

Note that TPG also reportedly has a stake in “Frank and Dave” led Impact Communities.

Four days after the report above, Bloomberg updated their report to say that the target figure would be around $550 million. MHProNews then noted that less than a week after Bloomberg’s first report, commercial real estate focused The Real Deal reported the following on September 15, 2020. Note that the terminology errors are in the original.

—

NY-based investment manager to buy about 40 trailer parks from Summit Communities

- TRD STAFF SEP 15, 2020 9:15 AM

Blackstone is turning its attention to one of the most recession-resistant sectors of real estate.

The giant asset manager is planning to buy about 40 mobile-home parks from Summit Communities for about $550 million, according to Bloomberg. Most of the properties are in Florida, the publication reported, citing confidential sources.

Blackstone will make the investment through Blackstone Real Estate Income Trust, also known as BREIT. Real estate investment trust Sun Communities also made an offer for the mobile-home communities.

Blackstone shelled out $200 million for seven mobile home parks largely in Florida and Arizona earlier this year, according to Bloomberg.

Large investment firms like Brookfield and Sam Zell’s Equity LifeStyle Properties have been eying mobile homes in recent years — won over by the sector’s high returns and limited supply.

There are just 6,250 mobile home parks in the U.S., according to a 2019 Cushman & Wakefield report. And despite their name, mobile homes are not that easy to move, and their occupants often cannot afford the upfront costs to relocate. That leaves them vulnerable to rent increases that boost profits for owners of trailer parks.

More than $800 million worth of such properties traded in the second quarter of this year, an increase of 23 percent from a previous year, according to JLL, Bloomberg reported. — Keith Larsen…”

##

Additional Details, MHProNews Analysis and Commentary

Facts without context, including historic trends, can often lose their full meaning. Some involved in our industry are understandably fascinated by the growing push into manufactured home communities, which are routinely outperforming other parts of the real estate market. See our recent report on that topic, linked below.

Big Surge in Manufactured Home Community Deals, Insider Details Others Missed

It isn’t just Blackstone that is eyeing and doing more deals in manufactured home communities. Northwestern Mutual, an insurance giant, just reported a record deal for their firm too.

Newer readers should know, and longer-term readers at MHProNews should keep in mind, that one of several firms that the Private Equity Stakeholders Project (PESP) spotlighted is Blackstone. MHAction, known to many in manufactured housing industry circles is among the left-of-center groups that brought attention to Blackstone, Frank Rolfe and his partner Dave Reynolds, and other firms that routinely have ties to Manufactured Housing Institute (MHI) members, or are members themselves.

TPG is one of the firms that Senator Elizabeth Warren engaged in her letters to ‘predatory’ firms that MHAction and their allies have spotlighted.

While these may bring excitement in some investment quarters, they ought to be considered warning signs for thousands of industry connected professionals, millions of others who are living in a land-lease, or for the estimated 111 million renters who may want to buy a manufactured home someday in order to get into affordable home ownership.

One bottom line for these various trends is ironically a point that Frank Rolfe raised a year ago, but then dismissed. Is the manufactured home land-lease community sector overheating?

A vicious cycle is occurring in which state and local lawmakers are responding to outcries from residents and are layering on rent-control and other regulations. While that may sound good, the experience in Delaware and other rent control states in manufactured housing demonstrates otherwise.

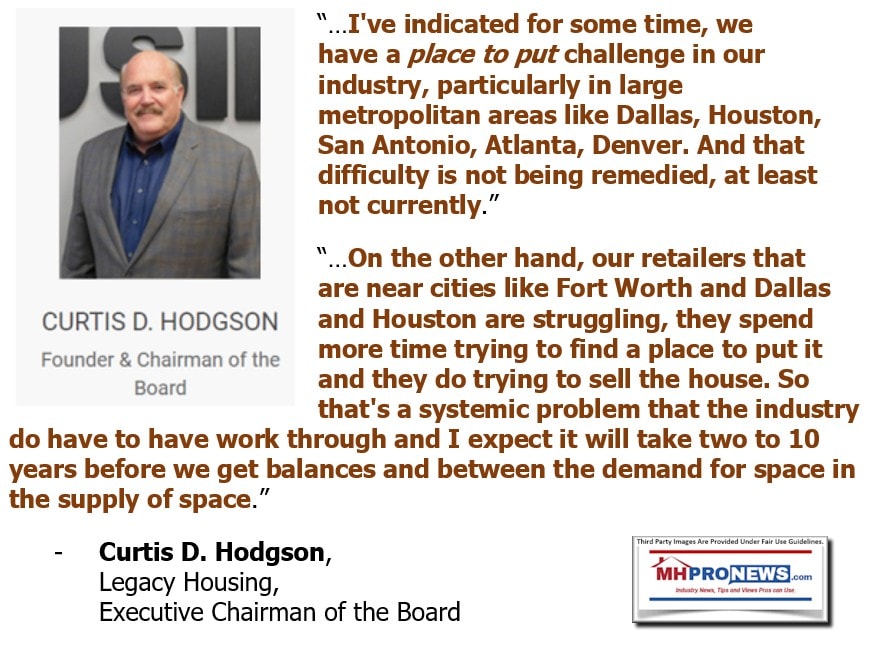

At the root of these issues are a paucity of new development and placement options. MHI member Legacy Housing has watched this trend and responded by developing their own homesites.

But not everyone has Legacy’s (LEGH) financial capability. With companies like MHI member Flagship Communities pushing for a looming IPO. An update by MHProNews on that Nathan Smith/Kurt Keeney IPO topic is pending.

From their respective perches, the Manufactured Housing Association for Regulatory Reform (MHARR), MHProNews and MHLivingNews have spotlighted these trends as warning signs for independents and consumers alike. It arguably makes laughable Tim Williams’ on-the-record claim yesterday to MHProNews that he cares about MHARR members and MHI members alike.

The reported deal by Blackstone – in the context being shared – sheds light on this report based on third-party information.

Logically, the rules of economics, marketing, and the trends point to this vexing reality. While some are benefiting from purported market manipulation, the majority are being penalized. Because affordability is being harmed by these trends, that will continue to hurt the image of manufactured housing and land-lease communities alike.

Modern feudalism and growing oligarchy are on full display.

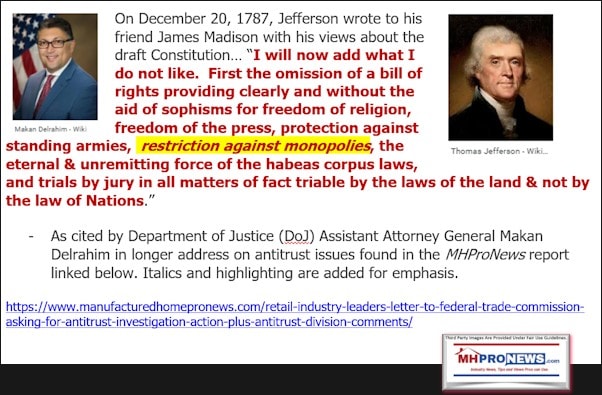

It will require vigorous antitrust action to blunt these trends, and perhaps, other legal moves by federal and state regulators.

See the related reports to learn more.

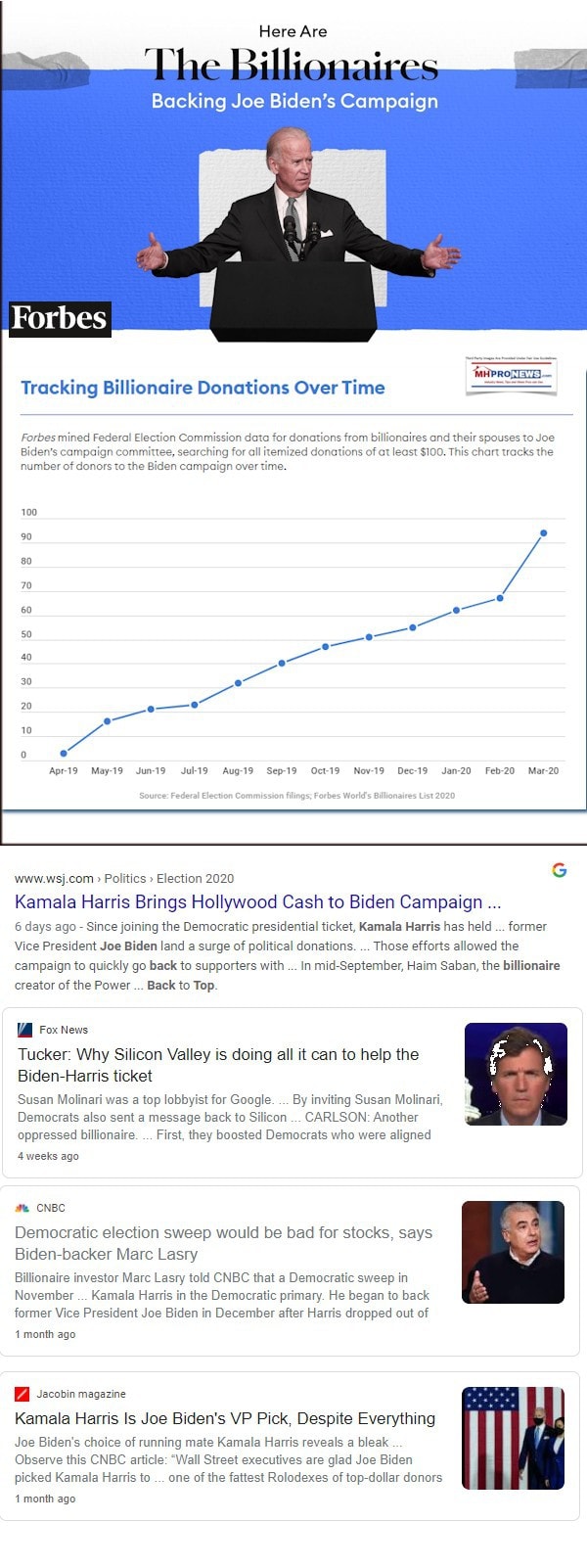

There is no president in the 21st century that has taken on the “establishment” of both the Republican and Democratic parties as has candidate-turned President Trump. The Republican Party today is quite different than it was just 5 years ago. The GOP has become increasingly a worker, middle class and retirees political party.

As political independents, MHProNews notes in contrast that the Democratic Party is getting the backing of Wall Street and most of the top billionaires.

That speaks volumes. To learn more about these various issues, see the related reports above and further below.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Alice Sparks, SSK Communities Partner, Dies Amidst Flagship Communities IPO Controversies

Manufactured Housing Lending 2020 Re-Examination – FEDs, Lenders, and Advocates

Nathan & Mary Lee Chance Smith, Leaders in ‘Anti-Trump Resistance,’ Manufactured Housing Impact?

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights