The National Association of Manufacturers (NAM), and the National Federation of Independent Business (NFIB) are among those supporting tax reform, as the Daily Business News on MHProNews has previously reported.

So, it with interest that many industry professionals are following the tug-of-war in the nation’s capital over tax policy and proposed tax reform.

Kudlow On the Air

Larry Kudlow sounded off on the topic on Sunday, in a radio interview with John Catsimatidis on AM 970 in New York, per reports by a slew of media outlets.

Ending the War on Business

“Donald Trump is, in fact, ending the war on business,” Kudlow said during the radio interview.

“Trump is ending the punishment of investment. That’s what this tax bill is really about: The return on capital will go up after tax,” the Hill reported, adding that Kudlow said. “The cost of capital will go down after tax. And that will lead directly into new business projects, and more hires, and better wages and productivity. It doesn’t get any better than this.”

It echoes a refrain that Kudow has been sharing for months, as this recent interview on CNBC reflects.

Left Leaning Media Revolt, While Kudlow Wrote The Book

Left of center outlet, NYMag says of the economist, author and commentator that “Kudlow is a fanatical adherent of supply-side economics.”

The Huffington Post has snarked, “Kudlow is best known for being wrong,” while Bloomberg has said, “Kudlow Is a Troubling Economics Adviser for Trump.”

But does history prove otherwise?

“During the first term of the Reagan administration (1981–1985), Kudlow was associate director for economics and planning in the Office of Management and Budget (OMB), a part of the Executive Office of the President,” says Wikipedia.

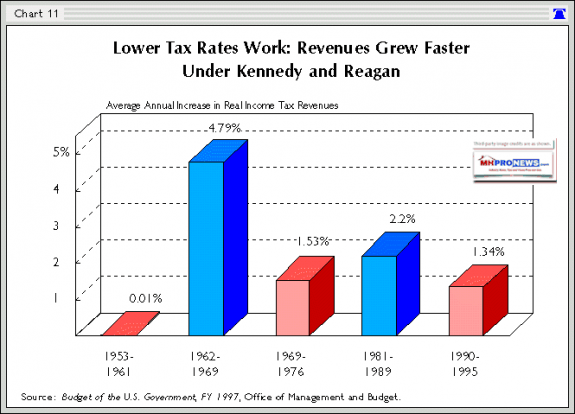

Kudlow has literally written the book on how Democratic President John F. Kennedy, as well as GOP President Ronald Reagan both cut tax rates. Each saw significant economic growth in their wake.

Furthermore, while revenues to the federal government initially dropped, over time, they rose in both cases.

Kudlow and business associations are far from alone in promoting tax reform.

Billionaire Steve Forbes has argued for tax reform and simplifying the code for years, see a recent report, linked here.

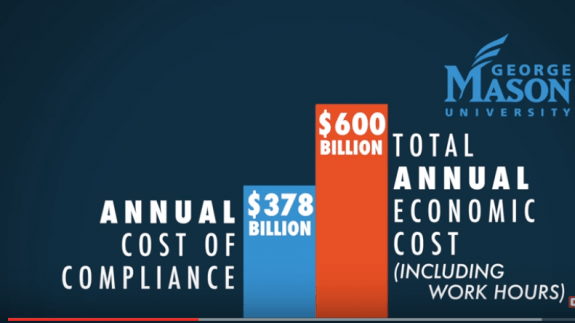

Forbes reminds his readers and listeners that properly done, tax reform is more than just money savings that frees capital to create more growth. Forbes argues for tax reform to avoid the time lost in tax compliance.

White House Press Room to MHProNews

The White House press room sent a reminder to MHProNews about President Donald J. Trump’s op-ed in a Wisconsin newspaper that focused on tax reform.

In that presidential op-ed in the Milwaukee Journal Sentinel, he said the country’s “self-destructive tax code costs Americans millions of jobs, trillions of dollars and billions of hours spent on compliance and paperwork.”

That’s a point that mirrors Forbes’ observation, noted above.

“To fix this, we have made the foundation of our job creation agenda fundamentally reforming our tax code for the first time in more than 30 years,” President Trump wrote in the op-ed.

“I want to work with Congress on a plan that is pro-growth, pro-jobs, pro-worker and pro-American.”

The president has that his tax plan would “dramatically reduce” the “income taxes for American workers and families.”

While the White House and House speaker Paul Ryan are quoted by the Hill as saying they expect some bi-partisan support. But given the partisan trench warfare in Washington, D.C., that’s not yet a given.

Those who support tax reform should let their senators and congressional representative know. The links below can help you contact your elected officials by phone or message.

“We Provide, You Decide.” © ## (News, analysis, commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)