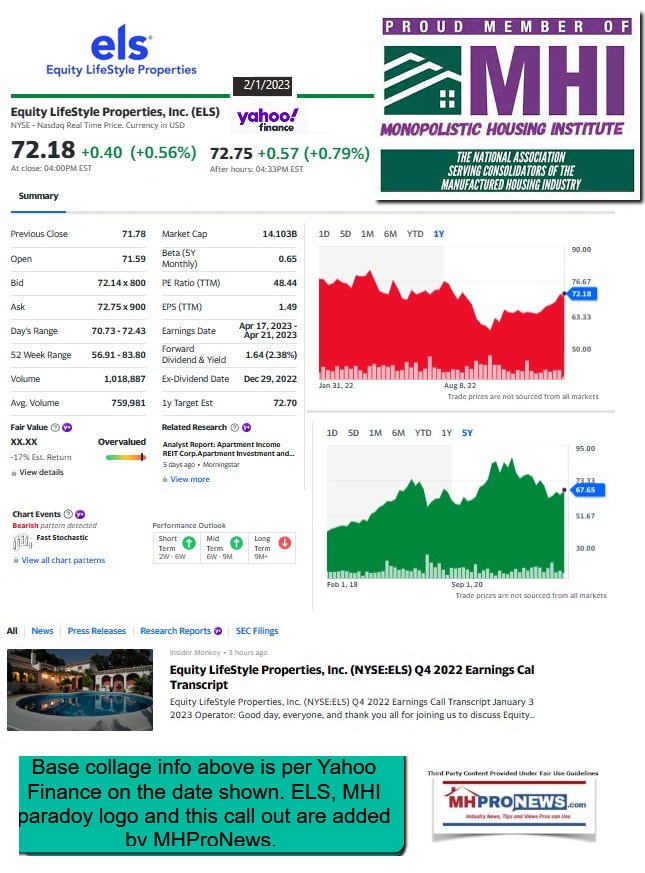

Included in Part I of today’s report are the January 30, 2023 Equity LifeStyle Properties (ELS) press release facts and figures plus their January 31, 2023 earnings call transcript. That transcript from Seeking Alpha (SA) has some edits made by MHProNews reflected with [bracketed] words. Those bracketed words represent corrections in apparent typos, as do some strikeouts that aim to correct an apparent typo in the SA transcript. That noted, the content is almost completely in line with what the respective sources (ELS, Seeking Alpha) published, with one additional caveat. MHProNews has added highlighting on several comments deemed to be noteworthy in our editorial and expert view of the manufactured home industry. That’s not to divert attention from other facts, statements or insights. For new readers who are researchers, investors, attorneys, or public officials seeking insights, our focus is obviously on the manufactured housing. Their remarks and information on recreational vehicles (RVs) sites, marina slips, and campgrounds remain. With those qualifiers disclosed, among the highlighted pull quotes below is from their press release, which includes a cautionary note for investors due to what they said was the possible: “impact of government intervention to stabilize site-built single-family housing and not manufactured housing…” (bold emphasis is added).

That remark, as well as others highlighted by MHProNews, are arguably significant on several levels. One, it seems to directly contradict recent Manufactured Housing Institute (MHI) and their surrogates’ talking points. MHI claimed that they have worked with the Biden Administration and Congress to get their priorities addressed. But the Manufactured Housing Association for Regulatory Reform (MHARR) says MHI is posturing without actually accomplishing their stated goals. See the linked reports to learn more.

ELS Remark Apparently Supports MHARR Claim

Put differently, what MHARR alleges with evidence in their White Paper has apparently been supported by ELS’ remark on the “impact of government intervention to stabilize site-built single-family housing and not manufactured housing.” This is significant to industry professionals, investors, affordable housing seekers, advocates, and others.

ELS’ Remark Demonstrates Example How Industry and National Politics Impact Manufactured Housing

With one eye on politics (manufactured home industry politics as well as national politics), several fascinating insights bubble up to the surface from that “impact of government intervention to stabilize site-built single-family housing and not manufactured housing” and other ELS remarks, such as on inflation, financing, and more.

As a brief but relevant aside, millions say that they ‘hate’ politics, which is understandable. After all, politics has been described as a dirty business. News headlines daily underscore how ugly and corrupt politics can be. That said, ignoring politics arguably isn’t the proper response to ‘hating’ politics. Why?

Because the reality is that those who avoid so-called political topics are doing so at their own peril. Who says?

- Nobel Prize winning author Thomas Mann once said: “Everything is politics.”

- Award-winning and left-leaning Paul Krugman of left-leaning New York Times fame was cited by JSTOR as remarking that ‘Everything Is Political.’

- Feminist and writer Carol Hanisch’s published an essay titled “The Personal is Political” (1970, cited by ThoughtCo, Psyche.co, and others), which is another way of saving that even personal matters have a political relevance. Hanisch reportedly said that she was not the first to say so.

- So, for approaching a century in the U.S. there are notable voices that have stressed the importance of understanding politics.

- As a quick aside as to sources, per JSTOR’s own site: “JSTOR is a digital library for the intellectually curious. ”JSTOR per left-leaning Wikipedia is: “JSTOR is a digital library founded in 1995 in New York City. Originally containing digitized back issues of academic journals, it now encompasses books and other primary sources as well as current issues of journals in the humanities and social sciences.”

- Back to Mann, Creative Associates cited his “Everything is Politics” statement and then noted that “thinking and working politically (TWP) is at the core of all we do in development.” They went on to say about TWP: “Our real-world experiences have taught us that TWP can be an effective tool for more than donors and implementing partners. TWP can serve as a way of working among local actors to guide strategic decision making and as a tool for empowerment.”

In business as well as in personal (individual) lives, the evidence makes clear that those who ignore politics do so at their own risk. Big businesspeople routinely are engaged in politics, which is the opposite of ignoring politics.

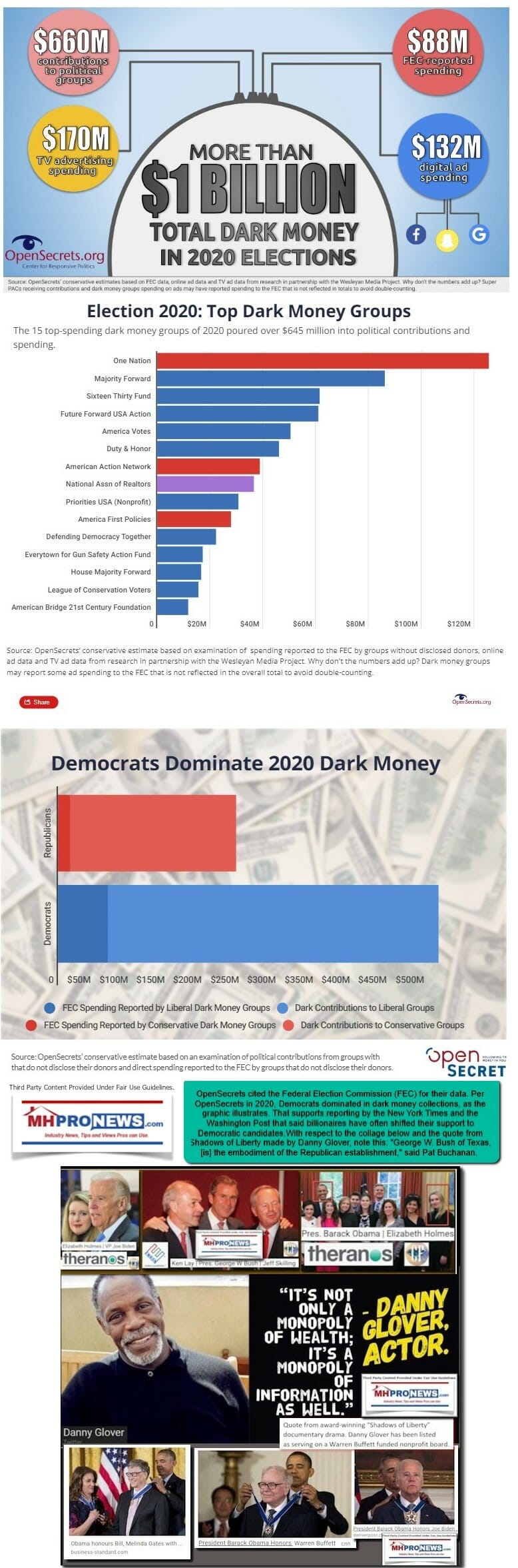

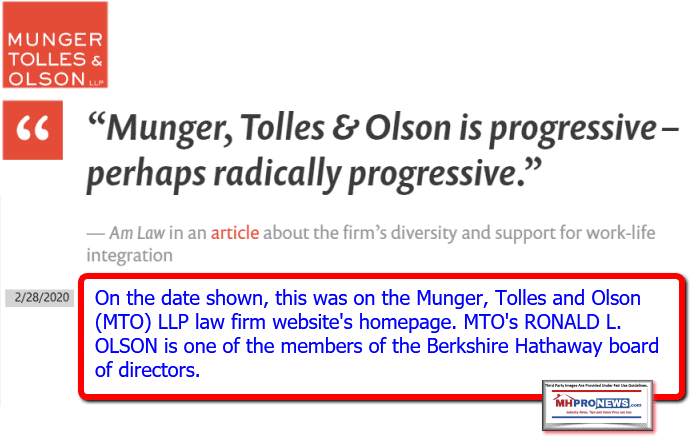

For example. Warren Buffett (Berkshire Hathaway or BRK) is a prime example of a corporate leader who is prominent in manufactured housing and other industries who is deftly involved in politics in a variety of ways. Buffett’s politics, and that of his partner Charles “Charlie” Munger, J.D., are demonstrably more left-leaning or pro-Democratic. That’s not to say that they don’t wield influence (think campaign donations, nonprofits, media, or other forms of influence) over political and bureaucratic (think regulatory) issues with so-called “Establishment Republicans,” they do.

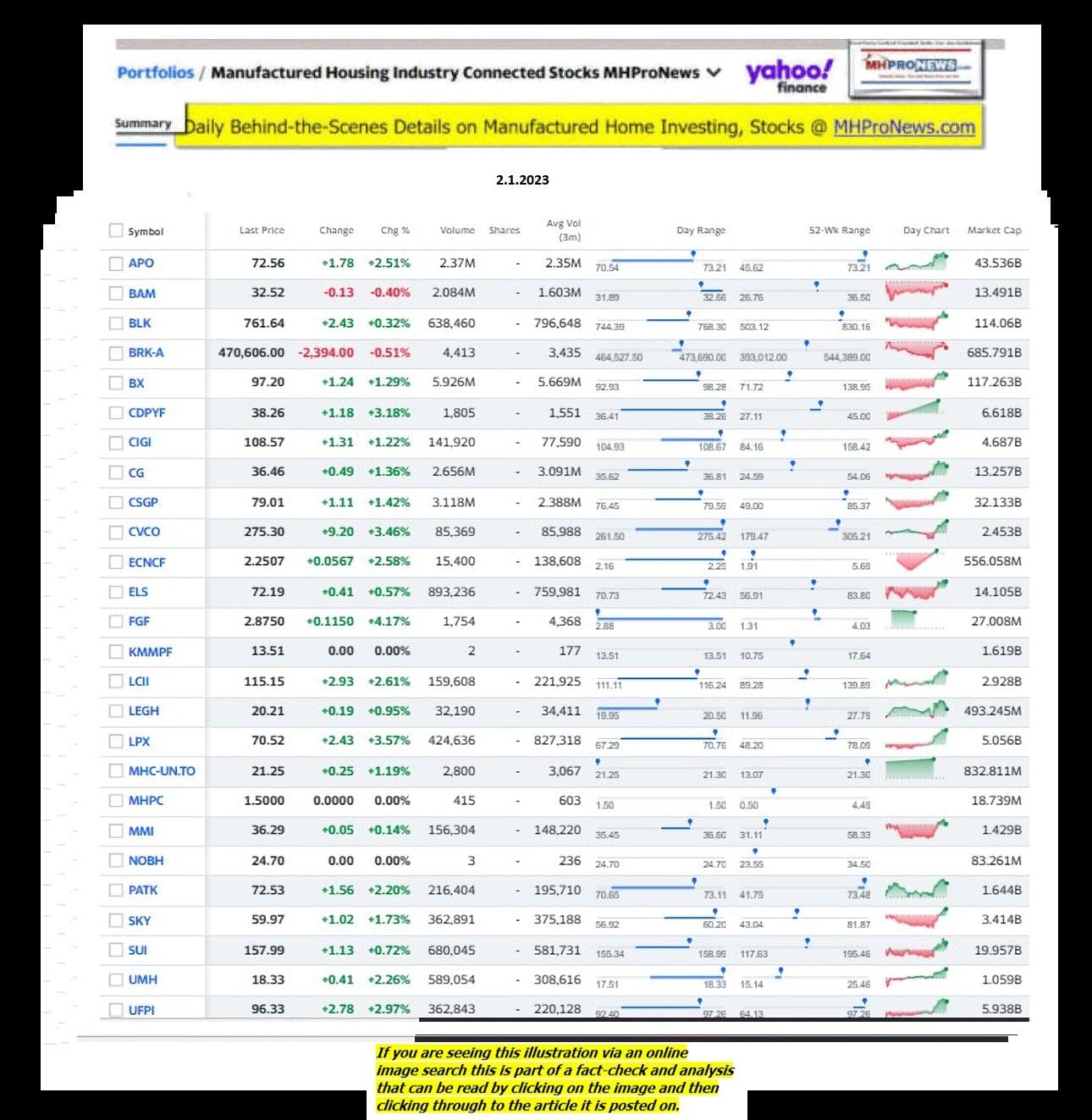

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic, or click and follow the prompts.

As another brief but relevant aside, Wikipedia says: “The Establishment is a term used to describe a dominant group or elite that controls a polity or an organization.” Wiktionary says an Establishment Republicans is “A moderate or liberal member of the US Republican Party.” But to the point of the first definition, an “establishment” candidate is one who is ‘controlled’ by an “organized society” or “as a political entity.”

It is apparent to those who pay close attention that larger companies are often keenly engaged in political and lobbying efforts through a variety of means that include using media, nonprofits, campaign contributions, the revolving door between government and private enterprise, and so on.

ELS and Industry Politics

For example, in manufactured housing and pivoting back to ELS specifically.

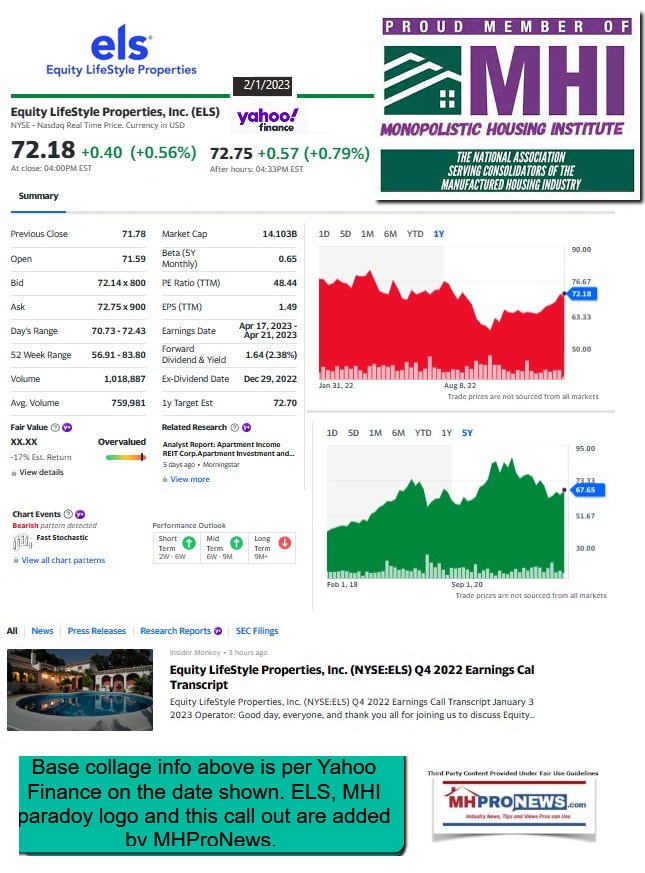

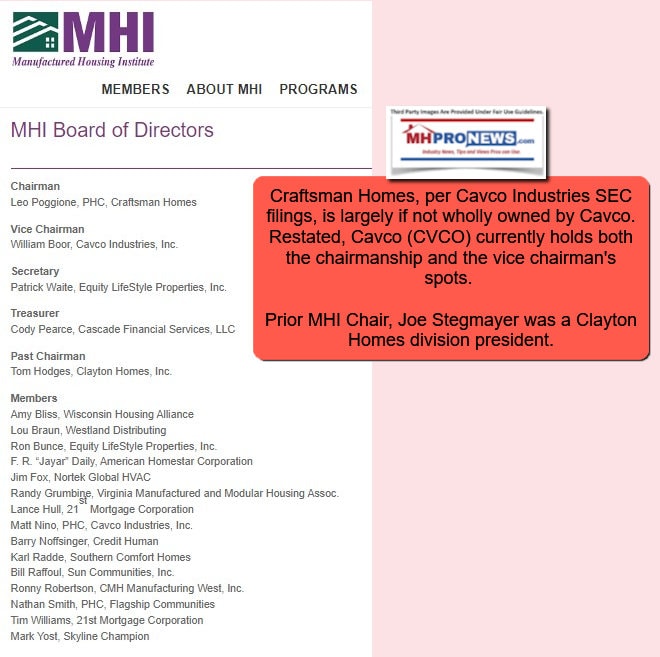

ELS is a prominent Manufactured Housing Institute (MHI) member. MHI has an ELS executive on the MHI “executive committee” (the so-called ‘elected’ powers behind the MHI board of directors). ELS President and CEO Marguerite Nader has also called MHI ‘their’ trade association. While Nader’s remark might be interpreted as a mere figure of speech, one should approach her comment as an apparent example of oligopoly style economic feudalism or oligopoly style corporatist (fascist) operating in the manufactured home market which other MHI members who are publicly traded firms have described the manufactured housing industry as “fragmented.” That term “fragmented” means there are (and certainly were more so in past years) literally thousands of more independently owned locations. Those independent locations are referred to as ‘mom and pop’ or family-owned businesses as distinct from corporate ownership. Examples of corporate ownership among manufactured home community (MHC) operators include publicly traded firms such as ELS, Sun Communities (SUI), UMH Properties (UMH), Flagship Communities (MHC–UN.TO), or those owned by RHP Properties, Impact Communities (Frank Rolfe, Dave Reynolds), Havenpark Communities, etc. the later three of which are ‘privately owned’ but they and others in that group still may have private equity from publicly traded entities involved.

MHI asserts they are nonpartisan. A close look at their MHI PAC would certainly reflect contributions to members of both major parties. But before and during the Trump Administration, some statements and/or actions could be understood as being more Democratic supporting, although they may have had corporate and/or staff leaders that said otherwise (e.g.: Tim Williams, 21st Mortgage Corp). So, politics is an issue that savvy professionals as well as investors are wise to keep an eye upon. MHARR asserts that opportunities were frittered away by MHI during the Trump Administration.

So, with one eye on politics, several fascinating insights bubble up to the surface from the ELS remarks. More on that in Part II that follows Part I, below.

Part I. Equity LifeStyle Properties (ELS) 4th Quarter 2022 Results, per their own data

Per their Nov 2022 Investor Presentation, which MHProNews plans to examine and unpack in a planned future report, ELS had 202 manufactured home communities with “74,500 sites” as of 10.31.2022. Per their other statements, no other manufactured home communities were apparently added in the 4th quarter (see their various remarks, below). While ELS certainly outshines some other manufactured home community operations in total sales, which they reported a ‘record year’ in 2022. The PDF for the ELS release that follows is linked here.

Part I a.

ELS REPORTS FOURTH QUARTER RESULTS

Continued Strong Performance;

Provides 2023 Guidance and Increases Annual Dividend

CHICAGO, IL – January 30, 2023 – Equity LifeStyle Properties, Inc. (NYSE: ELS) (referred to herein as “we,” “us,” and “our”) today announced results for the quarter and year ended December 31, 2022. All per share results are reported on a fully diluted basis unless otherwise noted.

Financial Results for the Quarter and Year Ended December 31, 2022

For the quarter ended December 31, 2022, total revenues increased $5.3 million, or 1.6%, to $340.6 million, compared to $335.3 million for the same period in 2021. For the quarter ended December 31, 2022, net income available for Common Stockholders increased $7.5 million, to $73.0 million, or $0.39 per Common Share, compared to $65.5 million, or $0.36 per Common Share, for the same period in 2021.

For the year ended December 31, 2022, total revenues increased $130.7 million, or 9.9%, to $1,447.1 million, compared to $1,316.4 million for the same period in 2021. For the year ended December 31, 2022, net income available for Common Stockholders increased $22.1 million, or $0.10 per Common Share, to $284.6

million, or $1.53 per Common Share, compared to $262.5 million, or $1.43 per Common Share, for the same period in 2021.

Non-GAAP Financial Measures and Portfolio Performance

For the quarter ended December 31, 2022, Funds from Operations (“FFO”) available for Common Stock and OP Unit holders increased $3.6 million, or $0.01 per Common Share, to $126.6 million, or $0.65 per Common Share, compared to $123.0 million, or $0.64 per Common Share, for the same period in 2021. For the year ended December 31, 2022, FFO available for Common Stock and OP Unit holders increased $38.0 million, or $0.16 per Common Share, to $523.6 million, or $2.68 per Common Share, compared to $485.6 million, or $2.52 per Common Share, for the same period in 2021.

For the quarter ended December 31, 2022, Normalized Funds from Operations (“Normalized FFO”) available for Common Stock and OP Unit holders increased $4.6 million, or $0.02 per Common Share, to $128.1 million, or $0.66 per Common Share, compared to $123.6 million, or $0.64 per Common Share, for the same period in 2021. For the year ended December 31, 2022, Normalized FFO available for Common Stock and OP Unit holders increased $42.7 million, or $0.19 per Common Share, to $531.6 million, or $2.72 per Common Share, compared to $489.0 million, or $2.53 per Common Share, for the same period in 2021.

For the quarter ended December 31, 2022, property operating revenues, excluding deferrals, increased $9.8 million to $306.4 million, compared to $296.6 million for the same period in 2021. For the year ended December 31, 2022, property operating revenues, excluding deferrals, increased $91.9 million to $1,277.5 million, compared to $1,185.6 million for the same period in 2021. For the quarter ended December 31, 2022, income from property operations, excluding deferrals and property management, increased $8.2 million to $180.6 million, compared to $172.4 million for the same period in 2021. For the year ended December 31, 2022, income from property operations, excluding deferrals and property management, increased $49.9 million to $731.9 million, compared to $682.0 million for the same period in 2021.

For the quarter ended December 31, 2022, Core property operating revenues, excluding deferrals, increased approximately 5.1% and Core income from property operations, excluding deferrals and property management, increased approximately 7.3%, compared to the same period in 2021. For the year ended December 31, 2022, Core property operating revenues, excluding deferrals, increased approximately 6.1% and Core income from property operations, excluding deferrals and property management, increased approximately 5.7%, compared to the same period in 2021.

Business Updates

Pages 1 and 2 of this Earnings Release and Supplemental Financial Information provide an update on operations and 2023 guidance.

Investment Activity

In November 2022, we acquired an 80% interest in a joint venture with RVC Outdoor Destinations for a total purchase price of $2.4 million. The joint venture owns one Recreational Vehicle (“RV”) property under construction located in Sandusky, Ohio.

In November 2022, we acquired a 50% interest in a joint venture with Kampgrounds of America for a total purchase price of $5.1 million. The joint venture owns and operates, through its wholly owned subsidiary, Bald Mountain RV, LLC, a 283-site RV community located in Hiawassee, Georgia.

In December 2022, we completed the acquisition of Whippoorwill, a 288-site RV community located in Marmora, New Jersey for a purchase price of $21.8 million.

2023 Dividends

Our Board of Directors has approved setting the annual dividend rate for 2023 at $1.79 per share of

Common Stock, an increase of 9.1%, or $0.15, over the current $1.64 per share of Common Stock for 2022. Our Board of Directors, in its sole discretion, will determine the amount of each quarterly dividend in advance of payment.

About Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment trust (“REIT”) with headquarters in Chicago. As of January 30, 2023, we own or have an interest in 448 properties in 35 states and British Columbia consisting of 170,965 sites.

For additional information, please contact our Investor Relations Department at (800) 247-5279 or at investor_relations@equitylifestyle.com.

Conference Call

A live audio webcast of our conference call discussing these results will take place tomorrow, Tuesday, January 31, 2023, at 10:00 a.m. Central Time. Please visit the Investor Relations section at www.equitylifestyleproperties.com for the link. A replay of the webcast will be available for two weeks at this site.

Forward-Looking Statements

In addition to historical information, this press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include without limitation, information regarding our expectations, goals or intentions regarding the future, and the expected effect of our acquisitions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, including, but not limited to:

- our ability to control costs and real estate market conditions, our ability to retain customers, the actual use of sites by customers and our success in acquiring new customers at our properties (including those that we may acquire);

- our ability to maintain historical or increase future rental rates and occupancy with respect to properties currently owned or that we may acquire;

- our ability to attract and retain customers entering, renewing and upgrading membership subscriptions;

- our assumptions about rental and home sales markets;

- our assumptions and guidance concerning Net Income, FFO and Normalized FFO per share data;

- our ability to manage counterparty risk;

- our ability to renew our insurance policies at existing rates and on consistent terms;

- home sales results could be impacted by the ability of potential homebuyers to sell their existing residences as well as by financial, credit and capital markets volatility;

- results from home sales and occupancy will continue to be impacted by local economic conditions, including an adequate supply of homes at reasonable costs, lack of affordable manufactured home financing and competition from alternative housing options including site-built single-family housing;

- impact of government intervention to stabilize site-built single-family housing and not manufactured housing;

- effective integration of recent acquisitions and our estimates regarding the future performance of recent acquisitions;

- the completion of future transactions in their entirety, if any, and timing and effective integration with respect thereto;

- unanticipated costs or unforeseen liabilities associated with recent acquisitions;

- the effect of Hurricane Ian on our business including, but not limited to the following: (i) the timing and cost of recovery, (ii) the impact of the condition of properties and homes on occupancy demand and related rent revenue and (iii) the timing and amount of insurance proceeds;

- our ability to obtain financing or refinance existing debt on favorable terms or at all;

- the effect of inflation and interest rates;

- the effect from any breach of our, or any of our vendors’ data management systems;

- the dilutive effects of issuing additional securities;

- the outcome of pending or future lawsuits or actions brought by or against us, including those disclosed in our filings with the Securities and Exchange Commission; and

- other risks indicated from time to time in our filings with the Securities and Exchange Commission.

Our guidance acknowledges the existence of volatile economic conditions, which may impact our current guidance assumptions. Factors impacting 2023 guidance include, but are not limited to the following: (i) the mix of site usage within the portfolio; (ii) yield management on our short-term resort and marina sites; (iii) scheduled or implemented rate increases on community, resort and marina sites; (iv) scheduled or implemented rate increases in annual payments under membership subscriptions; (v) occupancy changes; (vi) our ability to attract and retain membership customers; (vii) change in customer demand regarding travel and outdoor vacation destinations; (viii) our ability to manage expenses in an inflationary environment; (ix) our ability to integrate and operate recent acquisitions in accordance with our estimates; (x) our ability to execute expansion/development opportunities in the face of supply chain delays/shortages; (xi) completion of pending transactions in their entirety and on assumed schedule; (xii) our ability to attract and retain property employees, particularly seasonal employees; (xiii) ongoing legal matters and related fees; and (xiv) costs to restore property operations and potential revenue losses following storms or other unplanned events. In addition, these forward-looking statements, including our 2023 guidance are subject to risks related to the COVID-19 pandemic, many of which are unknown, including the duration of the pandemic, the extent of the adverse health impact on the general population and on our residents, customers and employees in particular, its impact on the employment rate and the economy, the extent and impact of governmental responses and the impact of operational changes we have implemented and may implement in response to the pandemic.

For further information on these and other factors that could impact us and the statements contained herein, refer to our filings with the Securities and Exchange Commission, including the “Risk Factors” section in our most recent Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q.

These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward looking statements whether as a result of such changes, new information, subsequent events or otherwise. ##

Supplemental Financial Information

Operations and Financial Update

- Net income available for Common Stockholders was $1.53 per fully diluted share, for the year ended December 31, 2022, 7.0% higher than the year ended December 31, 2021.

- Normalized FFO per Common Share on a fully diluted basis was $2.72 for the year ended December 31, 2022, 7.4% higher than the year ended December 31, 2021.

- Acquired four RV communities, one membership RV community, an 80% interest in two joint ventures with RV properties under development, a 50% interest in one joint venture with one RV community, and three land parcels with an aggregate value of approximately $150.9 million.

- Added 1,036 expansion sites during the year ended December 31, 2022.

- New home sales of 1,176 for the year ended December 31, 2022, which was the highest in company history.

- During the year ended December 31, 2022, we entered into a $200.0 million unsecured term loan agreement. The term of the loan is five years and bears interest at a rate of Secured Overnight Financing Rate (“SOFR”) plus approximately 1.30% to 1.80%, depending on leverage levels.

- During the year ended December 31, 2022, we closed on a secured refinancing transaction generating gross proceeds of $200.0 million. The loan is secured by one MH community, has a fixed interest rate of 3.36% per annum and matures in 11 years.

- During the year ended December 31, 2022, we entered into our current at-the-market (“ATM”) equity offering program with an aggregate offering price of up to $500.0 million. The full capacity remains available for issuance.

- Recognized $40.6 million of expenses for debris removal and cleanup costs related to Hurricane Ian and an offsetting insurance recovery revenue accrual of $40.6 million for the quarter and year ended December 31, 2022.

- Recorded a $5.4 million reduction to the carrying value of certain assets and offsetting insurance recovery revenue of $5.4 million as a result of Hurricane Ian for the year ended December 31, 2022.

Core Portfolio

- Core portfolio generated growth of 5.7% in income from property operations, excluding deferrals and property management, for the year ended December 31, 2022, compared to the year ended December 31, 2021.

- Core MH base rental income increased by 5.8% during the year ended December 31, 2022, compared to the year ended December 31, 2021. The increase is due to 5.4% growth from rate increases and 0.4% from occupancy gains.

- Maintained average Core MH occupancy at 95.1% for the years ended December 31, 2022 and 2021.

- Manufactured homeowners within our Core portfolio increased by 637 to 66,069 as of December 31, 2022, compared to 65,432 as of December 31, 2021.

- Core RV and marina base rental income for the year ended December 31, 2022 increased by 9.1%, compared to the year ended December 31, 2021.

- Combined Core Seasonal and Transient RV base rental income for the year ended December 31, 2022 increased by

9.5% or $11.1 million, compared to the year ended December 31, 2021.

- RV Annual occupancy within our Core RV and Thousand Trails portfolios increased by 570 during the year ended December 31, 2022, compared to the year ended December 31, 2021.

Non-Core Portfolio

- During the quarter ended December 31, 2022, operations at our Fort Myers Beach, Gulf Air, Pine Island, and Ramblers Rest properties were interrupted as a result of Hurricane Ian, therefore we designated them as Non-core properties. This change is reflected throughout the results represented in this release and in our Supplemental Financial Information package.

($ in millions, except per share) 2023

First Quarter Full Year

Net Income/share $0.42 to $0.48 $1.65 to $1.75

FFO/share $0.70 to $0.76 $2.79 to $2.89

Normalized FFO/share $0.70 to $0.76 $2.79 to $2.89

2022 Actual 2023 Growth Rates

Core Portfolio: First Quarter Full Year First Quarter Full Year

MH base rental income $154.4 $626.0 6.0% to 6.6% 6.0% to 7.0% RV and marina base rental income (3) $102.7 $393.4 5.8% to 6.4% 5.7% to 6.7%

Property operating revenues $310.2 $1,240.2 5.7% to 6.3% 5.7% to 6.7%

Property operating expenses $124.9 $526.4 7.5% to 8.1% 6.7% to 7.7%

Income from property operations, excluding deferrals $185.3 $713.8 4.4% to 5.0% 5.0% to 6.0%

and property management

Non Core Portfolio: 2023 Full Year

Income from property operations, excluding deferrals

and property management $17.7 to $21.7

Other Guidance Assumptions: 2023 Full Year

Property management and general administrative $114.4 to $120.4

Debt Assumptions:

Weighted average debt outstanding $3,300 to $3,500

Interest and related amortization $127.5 to $133.5

- First quarter and full year 2023 guidance ranges represent a range of possible outcomes and the midpoint reflects management’s estimate of the most likely outcome. Actual growth rates and per share amounts could vary materially from growth rates and per share amounts presented above if any of our assumptions, including occupancy and rate changes, our ability to integrate and operate recent acquisitions and costs to restore property operations and potential revenue losses following storms or other unplanned events, is incorrect. See Forward-Looking Statements in this release for additional factors impacting our 2023 guidance assumptions.

- Guidance assumptions do not include future capital events (financing transactions, acquisitions or dispositions) or the use of free cash flow.

- Core RV Annual revenue represents approximately 61.5% and 66.5% of first quarter 2023 and full year 2023 RV and marina base rental income, respectively. Core RV Annual revenue first quarter 2023 growth rate range is 2% to 8.8% and the full year 2023 growth rate range is 7.5% to 8.5%.

| Investor Information

Equity Research Coverage(1) |

||

| Bank of America Securities | Barclays | BMO Capital Markets |

| Jeffrey Spector/Joshua Dennerlein | Anthony Powell | John Kim |

| Citi Research | Colliers Securities | Evercore ISI |

| Nick Joseph | David Toti | Steve Sakwa/Samir Khanal |

| Green Street Advisors | RBC Capital Markets | Robert W. Baird & Company |

| John Pawlowski | Brad Heffern | Wes Golladay |

| Truist | UBS | Wolfe Research |

| Anthony Hau | Michael Goldsmith | Andrew Rosivach/Keegan Carl |

______________________

- Any opinions, estimates or forecasts regarding our performance made by these analysts or agencies do not represent our opinions, forecasts or predictions.

We do not, by reference to these firms, imply our endorsement of or concurrence with such information, conclusions or recommendations.

Financial Highlights

(In millions, except Common Shares and OP Units outstanding and per share data, unaudited)

As of and for the Quarter Ended

Dec 31, Sep 30, Jun 30, Mar 31, Dec 31,

2022 2022 2022 2022 2021

| Total revenues ………………………………………………………………………………………. | $ 340.6 | $ 381.0 | $ 365.3 | $ 360.2 | $ 335.3 |

| Net income …………………………………………………………………………………………… | $ 76.7 | $ 70.5 | $ 64.6 | $ 87.1 | $ 68.8 |

| Net income available for Common Stockholders ………………………………………. | $ 73.0 | $ 67.2 | $ 61.5 | $ 82.9 | $ 65.5 |

| Adjusted EBITDAre (1) …………………………………………………………………………..

|

$ 159.2 | $ 166.4 | $ 153.3 | $ 168.4 | $ 150.7 |

| FFO available for Common Stock and OP Unit holders (1)(2) ……………………….

|

$ 126.6 | $ 134.4 | $ 121.6 | $ 140.9 | $ 123.0 |

| Normalized FFO available for Common Stock and OP Unit holders (1)(2) …….. | $ 128.1 | $ 136.8 | $ 125.3 | $ 141.4 | $ 123.6 |

| Funds Available for Distribution (“FAD”) for Common Stock and OP Unit holders (1)(2) ……………………………………………………………………………………………

Common Shares and OP Units Outstanding (In thousands) and Per Share Data |

$ 106.9 | $ 115.4 | $ 103.6 | $ 125.1 | $ 102.3 |

| Common Shares and OP Units, end of the period ………………………………………

Weighted average Common Shares and OP Units outstanding – Fully Diluted Net income per Common Share – Fully Diluted (3) ……………………………………..

FFO per Common Share and OP Unit – Fully Diluted ……………………………….. Normalized FFO per Common Share and OP Unit – Fully Diluted ……………… Dividends per Common Share ………………………………………………………………… Balance Sheet Total assets …………………………………………………………………………………………… Total liabilities ……………………………………………………………………………………… Market Capitalization Total debt (4) ………………………………………………………………………………………….

Total market capitalization (5)…………………………………………………………………..

Ratios Total debt / total market capitalization …………………………………………………….. Total debt / Adjusted EBITDAre (6)………………………………………………………….

Interest coverage (7) ………………………………………………………………………………..

Fixed charges(8) ……………………………………………………………………………………..

|

195,386

195,281 $ 0.39 $ 0.65 $ 0.66 $ 0.4100 $ 5,493 $ 3,975 $ 3,416 $ 16,038 |

195,380

195,269 $ 0.36 $ 0.69 $ 0.70 $ 0.4100 $ 5,405 $ 3,886 $ 3,329 $ 15,607 |

195,373

195,227 $ 0.33 $ 0.62 $ 0.64 $ 0.4100 $ 5,400 $ 3,878 $ 3,298 $ 17,066 |

195,303

195,246 $ 0.45 $ 0.72 $ 0.72 $ 0.4100 $ 5,265 $ 3,734 $ 3,193 $ 18,130 |

194,946

193,412 $ 0.36 $ 0.64 $ 0.64 $ 0.3625 $ 5,308 $ 3,822 $ 3,303 $ 20,392 |

| 21.3 % 21.3 % 19.3 % 17.6 % 16.2 %

5.3 5.2 5.3 5.2 5.6 5.6 5.7 5.7 5.7 5.5 5.6 5.6 5.6 5.6 5.5 |

|||||

______________________

- See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for definitions of Adjusted EBITDAre, FFO, Normalized FFO and FAD and a reconciliation of Consolidated net income to Adjusted EBITDAre.

- See page 9 for a reconciliation of Net income available for Common Stockholders to Non-GAAP financial measures FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders.

- Net income per Common Share – Fully Diluted is calculated before Income allocated to non-controlling interest – Common OP Units.

- Excludes deferred financing costs of approximately $28.1 million as of December 31, 2022.

- See page 17 for the calculation of market capitalization as of December 31, 2022.

- Calculated using trailing twelve months Adjusted EBITDAre.

- Calculated by dividing trailing twelve months Adjusted EBITDAre by the interest expense incurred during the same period.

- See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for a definition of fixed charges. This ratio is calculated by dividing trailing twelve months Adjusted EBITDAre by the sum of fixed charges and preferred stock dividends, if any, during the same period.

Consolidated Balance Sheets

(In thousands, except share and per share data)

December 31, 2022 December 31, 2021

Assets

Investment in real estate:

| (unaudited) | |

| $

|

2,084,532

4,115,439 1,169,590 |

|

|

7,369,561

(2,258,540) |

|

|

5,111,021 22,347

45,356 81,404 50,441 181,950 |

| $ | 5,492,519 |

| $

|

2,693,167 496,817

198,000 175,148 197,743 11,739 122,318 80,102 |

| 3,975,034 | |

|

|

—

1,916 1,628,618 (204,248) 19,119 |

|

|

1,445,405 72,080 |

| 1,517,485 | |

| $ | 5,492,519 |

|

|

6,989,064

(2,103,774) |

|

|

4,885,290

123,398 39,955 70,312 47,349 141,567 |

| $ | 5,307,871 |

| $

|

2,627,783 297,436

349,000 172,285 176,439 9,293 118,696 70,768 |

| 3,821,700 | |

|

|

—

1,913 1,593,362 (183,689) 3,524 |

|

|

1,415,110 71,061 |

| 1,486,171 | |

| $ | 5,307,871 |

Land …………………………………………………………………………………………………………………..$ 2,019,787

Land improvements …………………………………………………………………………………………….. 3,912,062

Buildings and other depreciable property ……………………………………………………………….. 1,057,215

Accumulated depreciation ……………………………………………………………………………………. Net investment in real estate …………………………………………………………………………..

Cash and restricted cash ………………………………………………………………………………………………. Notes receivable, net …………………………………………………………………………………………………… Investment in unconsolidated joint ventures …………………………………………………………………… Deferred commission expense ……………………………………………………………………………………… Other assets, net …………………………………………………………………………………………………………. Total Assets …………………………………………………………………………………………………

Liabilities and Equity Liabilities:

Mortgage notes payable, net …………………………………………………………………………………. Term loan, net …………………………………………………………………………………………………….. Unsecured line of credit ………………………………………………………………………………………..

Accounts payable and other liabilities ……………………………………………………………………. Deferred membership revenue ……………………………………………………………………………….

Accrued interest payable ……………………………………………………………………………………….

Rents and other customer payments received in advance and security deposits ……………

Distributions payable …………………………………………………………………………………………… Total Liabilities …………………………………………………………………………………………..

Equity:

Preferred stock, $0.01 par value, 10,000,000 shares authorized as of December 31, 2022 and December 31, 2021; none issued and outstanding.

Common stock, $0.01 par value, 600,000,000 shares authorized as of December 31, 2022 and December 31, 2021; 186,120,298 and 185,640,379 shares issued and outstanding as of December 31, 2022 and December 31, 2021, respectively.

Paid-in capital ……………………………………………………………………………………………………..

Distributions in excess of accumulated earnings ………………………………………………………

Accumulated other comprehensive income …………………………………………………………….. Total Stockholders’ Equity ……………………………………………………………………………. Non-controlling interests – Common OP Units ………………………………………………………..

Total Equity ………………………………………………………………………………………………..

Total Liabilities and Equity …………………………………………………………………………

Consolidated Statements of Income

(In thousands, unaudited)

Quarters Ended December 31, Years Ended December 31,

Revenues:

| $

|

1,118,601 63,215

34,661 (21,703) 56,144 180,179 7,430 8,553 |

|

|

1,447,080

443,157 74,145 23,513 (3,196) 74,083 202,362 139,012 27,321 44,857 — 8,646 1,156 116,562 |

|

|

1,151,618

— |

|

|

295,462 3,363 |

| 298,825 | |

|

|

(14,198) (16) |

| $ | 284,611 |

| $

|

269,190

16,212 6,890 (3,475) 12,828 35,242 2,084 1,633 |

|

|

340,604

101,677 17,772 5,047 (450) 18,110 49,625 27,118 6,175 10,022 — 1,769 — 31,286 |

|

|

268,151 3,747 |

|

|

76,200 474 |

| 76,674 | |

|

|

(3,635)

(8) |

| $ | 73,031 |

Rental income ………………………………………………………………..$ 258,282 $ 1,032,575 Annual membership subscriptions ……………………………………. 15,203 58,251 Membership upgrade sales current period, gross ………………… 6,927 36,270

Membership upgrade sales upfront payments, deferred, net … (3,945) (25,079)

Other income …………………………………………………………………. 13,539 50,298

Gross revenues from home sales, brokered resales and

ancillary services (1) ………………………………………………………… 42,467 152,517 Interest income ………………………………………………………………. 1,702 7,016

Income from other investments, net ………………………………….. 1,159 4,555

Total revenues …………………………………………………………….. 335,334 1,316,403

Expenses:

Property operating and maintenance …………………………………. 98,283 398,983 Real estate taxes …………………………………………………………….. 18,517 72,671 Sales and marketing, gross ………………………………………………. 4,756 23,743

Membership sales commissions, deferred, net …………………… (670) (5,075)

Property management …………………………………………………….. 17,024 65,979 Depreciation and amortization …………………………………………. 50,317 188,444

Cost of home sales, brokered resales and ancillary services

(1) …………………………………………………………………………………. 35,081 120,623

Home selling expenses and ancillary operating expenses (1) …. 5,949 23,538

General and administrative (1) ………………………………………….. 8,983 39,576 Casualty-related charges/(recoveries), net (2) ……………………… — —

Other expenses (1) …………………………………………………………… 1,398 4,241 Early debt retirement ………………………………………………………. — 2,784

Interest and related amortization ………………………………………. 108,718

Total expenses …………………………………………………………….. 1,044,225 Gain/(loss) on sale of real estate and impairment, net (3) ……

Income before equity in income of unconsolidated joint

ventures ………………………………………………………………………… 67,745 272,119

Equity in income of unconsolidated joint ventures …………… 1,095 3,881

Consolidated net income …………………………………………………. 68,840 276,000

Income allocated to non-controlling interests – Common OP

Units …………………………………………………………………………….. (3,286) (13,522)

Redeemable perpetual preferred stock dividends ……………….. (8) (16)

Net income available for Common Stockholders …………….$ 65,546 $ 262,462

______________________

- Prior period amounts have been reclassified to conform to the current period presentation.

- Casualty-related charges/(recoveries), net includes debris removal and cleanup costs related to Hurricane Ian of $40.6 million and insurance recovery revenue of $40.6 million for the quarter and year ended December 31, 2022.

- Reflects a $1.7 million reduction to the carrying value of certain assets as a result of Hurricane Ian and insurance recovery revenue of $5.4 million for the quarter ended December 31, 2022. Reflects a $5.4 million reduction to the carrying value of certain assets and insurance recovery revenue of $5.4 million as a result of Hurricane Ian for the year ended December 31, 2022.

Non-GAAP Financial Measures

This document contains certain non-GAAP measures used by management that we believe are helpful to understand our business. We believe investors should review these non-GAAP measures along with GAAP net income and cash flows from operating activities, investing activities and financing activities, when evaluating an equity REIT’s operating performance. Our definitions and calculations of these non-GAAP financial and operating measures and other terms may differ from the definitions and methodologies used by other REITs and, accordingly, may not be comparable. These non-GAAP financial and operating measures do not represent cash generated from operating activities in accordance with GAAP, nor do they represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of our financial performance, or to cash flows from operating activities, determined in accordance with GAAP, as a measure of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to make cash distributions. For definitions and reconciliations of non-GAAP measures to our financial statements as prepared under GAAP, refer to both Reconciliation of Net Income to Non-GAAP Financial Measures on page 9 and Non-GAAP Financial Measures Definitions and Reconciliations on pages 19-21.

Selected Non-GAAP Financial Measures

(In millions, except per share data, unaudited)

Quarter Ended December 31, 2022

| $

|

174.8

5.8 (28.1) 6.9 (31.3) |

| $

|

128.1

(0.4) (1.1) |

| $ | 126.6 |

| $0.65

$0.66 |

|

| $

|

128.1

(21.2) |

| $ | 106.9 |

Income from property operations, excluding deferrals and property management – 2022 Core (1) …………………………….

Income from property operations, excluding deferrals and property management – Non-Core (1) ……………………………..

Property management and general and administrative ………………………………………………………………………………………..

Other income and expenses (excluding transaction/pursuit costs) …………………………………………………………………………

Interest and related amortization ………………………………………………………………………………………………………………………

Normalized FFO available for Common Stock and OP Unit holders (2)………………………………………………………..

Transaction/pursuit costs (3)……………………………………………………………………………………………………………………………..

Lease termination expenses (4)………………………………………………………………………………………………………………………….

FFO available for Common Stock and OP Unit holders (2) …………………………………………………………………………..

FFO per Common Share and OP Unit – Fully Diluted ………………………………………………………………………………………… Normalized FFO per Common Share and OP Unit – Fully Diluted ……………………………………………………………………….

Normalized FFO available for Common Stock and OP Unit holders (2)………………………………………………………..

Non-revenue producing improvements to real estate ………………………………………………………………………………………….

FAD for Common Stock and OP Unit holders (2)…………………………………………………………………………………………

| Weighted average Common Shares and OP Units – Fully Diluted ……………………………………………………………………….. | 195.3 |

______________________

- See pages 11-12 for details of the Core Income from Property Operations, excluding deferrals and property management. See page 13 for details of the Non-Core Income from Property Operations, excluding deferrals and property management.

- See page 9 for a reconciliation of Net income available for Common Stockholders to FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders.

- Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6.

- Represents non-operating expenses associated with the Westwinds ground leases that terminated on August 31, 2022. As such, the expenses are not comparable from period to period and have been added back to Normalized FFO.

Reconciliation of Net Income to Non-GAAP Financial Measures

(In thousands, except per share data, unaudited)

Quarters Ended December 31, Years Ended December 31,

| $

|

284,611 14,198

21,703 (3,196) 202,362 3,886 — |

|

|

523,564 1,156

3,807 3,119 |

|

|

531,646

(80,527) |

| $ | 451,119 |

| $

|

73,031 3,635

3,475 (450) 49,625 1,075 (3,747) |

|

|

126,644

— 423 1,046 |

|

|

128,113

(21,246) |

| $ | 106,867 |

Net income available for Common Stockholders ………………………$ 65,546 $ 262,462 Income allocated to non-controlling interests – Common OP Units .. 3,286 13,522 Membership upgrade sales upfront payments, deferred, net ………….. 3,945 25,079

Membership sales commissions, deferred, net …………………………….. (670) (5,075)

Depreciation and amortization …………………………………………………… 50,317 188,444 Depreciation on unconsolidated joint ventures …………………………….. 536 1,083 (Gain)/loss on sale of real estate and impairment, net (1) ……………….. — 59

FFO available for Common Stock and OP Unit holders 122,960 485,574

Early debt retirement ………………………………………………………………… — 2,784

Transaction/pursuit costs (2) ………………………………………………………. 598 598 Lease termination expenses (3) …………………………………………………… — —

Normalized FFO available for Common Stock and OP Unit holders …………………………………………………………………………………… 123,558 488,956 Non-revenue producing improvements to real estate ……………………. (21,247) (70,510)

FAD for Common Stock and OP Unit holders ………………………….$ 102,311 $ 418,446

| Net income available per Common Share – Basic …………………….. | $ | 0.39 | $ | 0.36 | $ | 1.53 | $ | 1.43 |

| Net income available per Common Share – Fully Diluted (4)………

|

$ | 0.39 | $ | 0.36 | $ | 1.53 | $ | 1.43 |

| FFO per Common Share and OP Unit – Basic …………………………. | $ | 0.65 | $ | 0.64 | $ | 2.68 | $ | 2.52 |

| FFO per Common Share and OP Unit – Fully Diluted ……………… | $ | 0.65 | $ | 0.64 | $ | 2.68 | $ | 2.52 |

| Normalized FFO per Common Share and OP Unit – Basic ……….

Normalized FFO per Common Share and OP Unit – Fully |

$ | 0.66 | $ | 0.64 | $ | 2.73 | $ | 2.54 |

| Diluted …………………………………………………………………………………… | $ | 0.66 | $ | 0.64 | $ | 2.72 | $ | 2.53 |

| Weighted average Common Shares outstanding – Basic ………………..

Weighted average Common Shares and OP Units outstanding – |

185,848 | 183,889 | 185,780 | 182,917 | ||||

| Basic ……………………………………………………………………………………….

Weighted average Common Shares and OP Units outstanding – |

195,117 | 193,183 | 195,069 | 192,656 | ||||

| Fully Diluted …………………………………………………………………………… | 195,281 | 193,412 | 195,255 | 192,883 |

______________________

- Reflects a $1.7 million reduction to the carrying value of certain assets as a result of Hurricane Ian and insurance recovery revenue of $5.4 million for the quarter ended December 31, 2022. Reflects a $5.4 million reduction to the carrying value of certain assets and insurance recovery revenue of $5.4 million as a result of Hurricane Ian for the year ended December 31, 2022.

- Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6.

- Represents non-operating expenses associated with the Westwinds ground leases that terminated on August 31, 2022. As such, the expenses are not comparable from period to period and have been added back to Normalized FFO.

- Net income per fully diluted Common Share is calculated before Income allocated to non-controlling interest – Common OP Units.

Consolidated Income from Property Operations (1)

(In millions, except home site and occupancy figures, unaudited)

Quarters Ended

December 31, Years Ended December 31,

2021

| $

|

634.0

15.2 409.6 63.2 34.7 120.8 |

|

|

1,277.5

522.1 23.5 |

| 545.6 | |

| $ | 731.9 |

|

|

73,265

69,509 94.9 % |

| $ | 760 |

| $

|

266.1

58.9 84.6 |

| $ | 409.6 |

| $

|

158.9

3.7 92.6 16.2 6.9 28.1 |

|

|

306.4

120.8 5.0 |

| 125.8 | |

| $ | 180.6 |

|

|

72,715

68,968 94.8 % |

| $ | 768 |

| $

|

67.1 13.3

12.2 |

| $ | 92.6 |

MH base rental income (2) ………………………………………………………………$ 152.8 $ 603.1 Rental home income (2) …………………………………………………………………. 4.0 16.7

RV and marina base rental income (2) ……………………………………………… 89.6 362.8 Annual membership subscriptions ………………………………………………….. 15.2 58.3

Membership upgrade sales current period, gross ………………………………. 6.9 36.3

Utility and other income (2) ……………………………………………………………. 28.1 108.4

Property operating revenues ……………………………………………………… 296.6 1,185.6

Property operating, maintenance and real estate taxes (2) …………………… 119.4 479.9

Sales and marketing, gross …………………………………………………………….. 4.8 23.7

Property operating expenses ……………………………………………………… 124.2 503.6

Income from property operations, excluding deferrals and

property management (1) ……………………………………………………………..

Manufactured home site figures and occupancy averages:

Total sites ……………………………………………………………………………………. 73,457 73,232 Occupied sites ……………………………………………………………………………… 69,672 69,463 Occupancy % ………………………………………………………………………………. 94.8 % 94.9 % Monthly base rent per site ………………………………………………………………$ 731 $ 723

RV and marina base rental income:

Annual …………………………………………………………………………………………$ 63.5 $ 237.2 Seasonal ……………………………………………………………………………………… 11.6 41.7

Transient …………………………………………………………………………………….. 14.5 83.9

Total RV and marina base rental income …………………………………….$ 89.6 $ 362.8

______________________

- Excludes property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net.

- MH base rental income, Rental home income, RV and marina base rental income and Utility income, net of bad debt expense, are presented in Rental income in the Consolidated Statements of Income on page 6. Bad debt expense is presented in Property operating, maintenance and real estate taxes in this table.

Core Income from Property Operations (1)

(In millions, except home site and occupancy figures, unaudited)

| Quarters Ended December 31, | Years Ended December 31, | |||||||

| MH base rental income …………………………………………………… Rental home income ………………………………………………………. RV and marina base rental income …………………………………… Annual membership subscriptions …………………………………….

Membership upgrade sales current period, gross ……………….. Utility and other income …………………………………………………. Property operating revenues ……………………………………….. Utility expense ………………………………………………………………. Payroll ………………………………………………………………………….. Repair & Maintenance ……………………………………………………. Insurance and other (3) …………………………………………………….. Real estate taxes …………………………………………………………….. Sales and marketing, gross ……………………………………………… |

2022

$ 158.8 |

2021

$ 149.8 |

Change (2)

6.0 % (6.7) % 5.7 % 5.8 % 0.3 % 1.3 % 5.1 % 6.0 % 6.8 % (4.7) % (5.0) % 3.3 % 6.9 % |

2022

$ 626.0 15.2 352.7 62.5 33.4 105.3 1,195.1 138.7 108.4 81.0 86.4 67.1 22.9 |

2021

$ 591.7 16.7 323.4 58.1 36.2 100.4 1,126.5 125.4 100.6 75.2 83.3 64.6 23.8 |

Change (2)

5.8 % (8.8) % 9.1 % 7.5 % (7.8) % 4.9 % 6.1 % 10.6 % 7.7 % 7.7 % 3.7 % 4.0 % (3.4) % |

||

|

|

3.7

81.7 16.0 6.9 25.1 292.2 33.3 25.5 16.7 20.1 16.8 5.0 |

|

4.0

77.3 15.2 6.9 24.8 278.0 31.4 23.9 17.5 21.2 16.3 4.8 |

|||||

Property operating expenses ………………………………………. 117.4 115.1 2.1 % 504.5 472.9 6.7 %

Income from property operations, excluding deferrals

and property management (1) ………………………………………… $ 174.8

| Occupied sites (4)……………………………………………………………

|

68,880 | 68,895 |

_____________________

- Excludes property management and the GAAP deferral of membership upgrades sales upfront payments and membership sales commissions, net. Core properties exclude Fort Myers Beach, Gulf Air, Pine Island and Ramblers Rest.

- Calculations prepared using actual results without rounding.

- Includes bad debt expense for the periods presented.

- Occupied sites are presented as of the end of the period. Occupied sites have decreased by 15 from 68,895 at December 31, 2021.

Core Income from Property Operations (continued)

(In millions, except home site and occupancy figures, unaudited)

Quarters Ended December 31, Years Ended December 31,

averages:

| Total sites | 72,454 | 72,348 | 72,455 | 72,208 | ||

| Occupied sites | 68,913 | 68,802 | 68,913 | 68,675 | ||

| Occupancy % | 95.1 % | 95.1 % | 95.1 % | 95.1 % | ||

| Monthly base rent per site

Core RV and marina base rental income: |

$ 768 | $ 726 | $ 757 | $ 718 | ||

| Annual (2) | $ 58.2 | $ 53.4 | 9.0% | $ 224.6 | $ 206.4 | 8.8% |

| Seasonal | 12.2 | 10.4 | 17.4% | 52.1 | 37.6 | 38.6% |

| Transient | 11.3 | 13.6 | (16.5)% | 76.0 | 79.4 | (4.3)% |

Total Seasonal and Transient $ 23.5 $ 24.0 (1.8)% $ 128.1 $ 117.0 9.5%

| Core utility information: | ||||||||

| Income | $ 15.0 | $ 13.6 | 10.3% | $ | 61.1 | $ | 55.0 | 11.1% |

| Expense | 33.3 | 31.4 | 6.0% | 138.7 | 125.4 | 10.6% | ||

| Expense, net | $ 18.3 | $ 17.8 | 2.8% | $ | 77.6 | $ | 70.4 | 10.2% |

| Utility Recovery Rate (3) | 45.0 % | 43.3 % | 44.1 % | 43.9 % |

Total RV and marina base rental income $ 81.7 $ 77.4 5.7% $ 352.7 $ 323.4 9.1%

_____________________

- Calculations prepared using actual results without rounding.

- Core Annual marina base rental income represents approximately 99% of the total Core marina base rental income for all periods presented.

- Calculated by dividing the utility income by utility expense.

Non-Core Income from Property Operations (1)

(In millions, unaudited)

Quarter Ended Year Ended

| MH base rental income …………………………………………………………………………………………….. | $ | 0.1 | $ | 8.0 |

| RV and marina base rental income …………………………………………………………………………….. | 10.9 | 56.9 | ||

| Annual membership subscriptions ……………………………………………………………………………… | 0.2 | 0.7 | ||

| Utility and other income ……………………………………………………………………………………………. | 3.0 | 15.5 | ||

| Membership upgrade sales current period, gross ………………………………………………………….. | — | 1.3 | ||

| Property operating revenues ……………………………………………………………………………………. | 14.2 | 82.4 |

December 31, 2022 December 31, 2022

Property operating expenses (2) ………………………………………………………………………………… Income from property operations, excluding deferrals and property management (1)

______________________

- Excludes property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net.

- Includes bad debt expense for the periods presented.

Income from Rental Home Operations

(In millions, except occupied rentals, unaudited)

Quarters Ended December 31, Years Ended December 31,

|

|

Manufactured homes:

Rental operations revenues (1) …………………………………………………………. Rental home operations expense (2) …………………………………………………. Income from rental home operations …………………………………………….. Depreciation on rental homes (3) ……………………………………………………… Income from rental operations, net of depreciation …………………….

Occupied rentals: (4)

New …………………………………………………………………………………………….

Used …………………………………………………………………………………………….

Total occupied rental sites …………………………………………………………

As of December 31, 2022 As of December 31, 2021

Net of Net of

Cost basis in rental homes: (5) Gross Depreciation Gross Depreciation

| $

|

226.8 16.1 |

| $ | 242.9 |

| $

|

237.8 14.7 |

| $ | 252.5 |

New …………………………………………………………………………………………….$ 196.1 $ 184.5

Used …………………………………………………………………………………………… 8.2 8.7

Total rental homes ………………………………………………………………………$ 204.3 $ 193.2

______________________

- For the quarters ended December 31, 2022 and 2021, approximately $6.5 million and $7.5 million, respectively, of the rental operations revenue is included in the MH base rental income in the Core Income from Property Operations on pages 11-12. The remainder of the rental operations revenue is included in Rental home income for the quarters ended December 31, 2022 and 2021 in the Core Income from Property Operations on pages 11-12.

- Rental home operations expense is included in Property operating, maintenance and real estate taxes in the Consolidated Income from Property Operations on page 10. Rental home operations expense is included in Insurance and other in the Core Income from Property Operations on pages 11-12.

- Depreciation on rental homes in our Core portfolio is presented in Depreciation and amortization in the Consolidated Statements of Income on page 6.

- Occupied rentals as of the end of the period in our Core portfolio. Included in occupied rentals as of December 31, 2021 were 236 homes rented through ECHO Financing LLC (“ECHO joint venture”). On December 22, 2022, we completed the purchase of all homes held by the ECHO joint venture.

- Includes both occupied and unoccupied rental homes in our Core portfolio. New home cost basis does not include the costs associated with our ECHO joint venture for 2021.

Total Sites and Home Sales

(In thousands, except sites and home sale volumes, unaudited)

Summary of Total Sites as of December 31, 2022

Sites (1)

| MH sites ………………………………………………………………………………………………………………………………………………………………….

RV sites: |

72,700 | |

| Annual ………………………………………………………………………………………………………………………………………………………………. | 34,200 | |

| Seasonal …………………………………………………………………………………………………………………………………………………………….. | 12,700 | |

| Transient ……………………………………………………………………………………………………………………………………………………………. | 15,300 | |

| Marina slips …………………………………………………………………………………………………………………………………………………………….. | 6,900 | |

| Membership (2)………………………………………………………………………………………………………………………………………………………….

|

25,800 | |

| Joint Ventures (3) ………………………………………………………………………………………………………………………………………………………

|

3,300 | |

| Total ……………………………………………………………………………………………………………………………………………………………………… | 170,900 |

Home Sales – Select Data

Quarters Ended December 31, Years Ended December 31,

| Total New Home Sales Volume (4) ………………………………………………….

|

219 | 338 | 1,176 | 1,163 | ||||

| New Home Sales Volume – ECHO joint venture ………………………….. | 6 | 26 | 78 | 82 | ||||

| New Home Sales Gross Revenues (4)……………………………………………….

|

$ | 24,562 | $ | 30,089 | $ | 116,790 | $ | 94,160 |

| Total Used Home Sales Volume ……………………………………………………. | 87 | 118 | 337 | 432 | ||||

| Used Home Sales Gross Revenues …………………………………………………. | $ | 1,064 | $ | 1,445 | $ | 4,401 | $ | 4,297 |

| Brokered Home Resales Volume ……………………………………………………. | 134 | 192 | 808 | 735 | ||||

| Brokered Home Resales Gross Revenues ………………………………………… | $ | 604 | $ | 589 | $ | 3,195 | $ | 2,144 |

______________________

- MH sites are generally leased on an annual basis to residents who own or lease factory-built homes, including manufactured homes. Annual RV and marina sites are leased on an annual basis to customers who generally have an RV, factory-built cottage, boat or other unit placed on the site, including those Northern properties that are open for the summer season. Seasonal RV and marina sites are leased to customers generally for one to six months. Transient RV and marina sites are leased to customers on a short-term basis.

- Sites primarily utilized by approximately 128,400 members. Includes approximately 6,400 sites rented on an annual basis.

- Joint ventures have approximately 2,000 annual sites and 1,300 transient sites.

- Total new home sales volume includes home sales from our ECHO joint venture through December 22, 2022. New home sales gross revenues does not include the revenues associated with the ECHO joint venture.

Memberships – Select Data

(Unaudited)

| Years Ended December 31, | |||||

| Member Count (1) …………………………………………………………………………………

Thousand Trails Camping Pass (TTC) Origination ………………………………….. TTC Sales ………………………………………………………………………………………… RV Dealer TTC Activations ……………………………………………………………….. Number of annuals (2)……………………………………………………………………………

Number of upgrade sales (3) …………………………………………………………………..

(In thousands, unaudited) Annual membership subscriptions ………………………………………………………… RV base rental income from annuals ……………………………………………………… RV base rental income from seasonals/transients …………………………………….. Membership upgrade sales current period, gross ……………………………………… Utility and other income ………………………………………………………………………. |

2018

111,094 37,528 17,194 20,334 5,888 2,500 $ 47,778 $ 18,363 $ 19,840 $ 15,191 $ 2,410 |

2019

115,680 41,484 19,267 22,217 5,938 2,919 $ 51,015 $ 19,634 $ 20,181 $ 19,111 $ 2,422 |

2020

116,169 44,129 20,587 23,542 5,986 3,373 $ 53,085 $ 20,761 $ 18,126 $ 21,739 $ 2,426 |

2021

125,149 50,523 23,923 26,600 6,320 4,863 $ 58,251 $ 23,127 $ 25,562 $ 36,270 $ 2,735 |

2022

128,439 51,415 23,237 28,178 6,390 4,068 $ 63,215 $ 25,945 $ 24,316 $ 34,661 $ 2,626 |

______________________

- Members have entered into annual subscriptions with us that entitle them to use certain properties on a continuous basis for up to 21 days.

- Members who rent a specific site for an entire year in connection with their membership subscriptions.

- Existing members who have upgraded memberships are eligible for enhanced benefits, including but not limited to longer stays, the ability to make earlier reservations, potential discounts on rental units, and potential access to additional properties. Upgrades require a non-refundable upfront payment.

Market Capitalization

(In millions, except share and OP Unit data, unaudited) Capital Structure as of December 31, 2022

Total % of Total % of Total

Common Common Market

Shares/Units Shares/Units Total % of Total Capitalization

| $

|

2,718 698 |

| $ | 3,416 |

| $ | 12,622 |

Secured Debt …………………………………………. 79.6 %

Unsecured Debt ……………………………………… 20.4 %

Total Debt (1) ………………………………………… 100.0 % 21.3 %

Common Shares …………………………………….. 186,120,298 95.3 % OP Units ……………………………………………….. 9,265,565 4.7 %

Total Common Shares and OP Units ………… 195,385,863 100.0 %

Common Stock price at December 31, 2022 . $ 64.60

Fair Value of Common Shares and OP

Units …………………………………………………….. 100.0 %

Total Equity …………………………………………. $ 12,622 100.0 % 78.7 %

Total Market Capitalization …………………..

______________________

- Excludes deferred financing costs of approximately $28.1 million.

$ 16,038 100.0 %

Debt Maturity Schedule

Debt Maturity Schedule as of December 31, 2022

(In thousands, unaudited)

| Year | Secured Debt | Weighted

Average Interest Rate |

Unsecured

Debt (1) |

Weighted

Average Interest Rate |

Total Debt | % of Total Debt | Weighted

Average Interest Rate |

| $

|

—

— — 300,000 200,000 — — — — — |

| $

|

500,000

198,000 |

| — | |

|

|

698,000

(3,183) |

| $ | 694,817 |

| 3.3 |

2023 $ 92,512 4.91 % — % $ 92,512 2.87 % 4.91 % 2024 10,003 5.49 % — % 10,003 0.31 % 5.49 %

2025 93,206 3.45 % — % 93,206 2.90 % 3.45 % 2026 — — % 1.79 % 300,000 9.32 % 1.79 %

2027 — — % 4.94 % 200,000 6.22 % 4.94 % 2028 207,117 4.19 % — % 207,117 6.44 % 4.19 % 2029 39,320 4.10 % — % 39,320 1.22 % 4.10 % 2030 275,385 2.69 % — % 275,385 8.56 % 2.69 %

2031 259,461 2.46 % — % 259,461 8.06 % 2.46 %

Thereafter 1,740,974 3.76 % — % 1,740,974 54.10 % 3.76 %

Total $ 2,717,978 3.60 % 3.05 % $ 3,217,978 100.0 % 3.52 %

Unsecured Line of Credit 198,000

Note Premiums 136

Total Debt 2,718,114 3,416,114

Deferred Financing Costs (24,948) (28,131)

Total Debt, net $ 2,693,166 $ 3,387,983 3.72 % (1)

Average Years to Maturity 11.29.6

______________________

- Reflects effective interest rate for the year ended December 31, 2022, including interest associated with the line of credit and amortization of note premiums and deferred financing costs.

Non-GAAP Financial Measures Definitions and Reconciliations

FUNDS FROM OPERATIONS (FFO). We define FFO as net income, computed in accordance with GAAP, excluding gains or losses from sales of properties, depreciation and amortization related to real estate, impairment charges and adjustments to reflect our share of FFO of unconsolidated joint ventures. Adjustments for unconsolidated joint ventures are calculated to reflect FFO on the same basis. We compute FFO in accordance with our interpretation of standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. We receive non-refundable upfront payments from membership upgrade contracts. In accordance with GAAP, the non-refundable upfront payments and related commissions are deferred and amortized over the estimated membership upgrade contract term. Although the NAREIT definition of FFO does not address the treatment of non-refundable upfront payments, we believe that it is appropriate to adjust for the impact of the deferral activity in our calculation of FFO.

We believe FFO, as defined by the Board of Governors of NAREIT, is generally a measure of performance for an equity REIT. While FFO is a relevant and widely used measure of operating performance for equity REITs, it does not represent cash flow from operations or net income as defined by GAAP, and it should not be considered as an alternative to these indicators in evaluating liquidity or operating performance.

NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO). We define Normalized FFO as FFO excluding non-operating income and expense items, such as gains and losses from early debt extinguishment, including prepayment penalties and defeasance costs, transaction/pursuit costs, and other miscellaneous non-comparable items. Normalized FFO presented herein is not necessarily comparable to Normalized FFO presented by other real estate companies due to the fact that not all real estate companies use the same methodology for computing this amount.

FUNDS AVAILABLE FOR DISTRIBUTION (FAD). We define FAD as Normalized FFO less non-revenue producing capital expenditures.

We believe that FFO, Normalized FFO and FAD are helpful to investors as supplemental measures of the performance of an equity REIT. We believe that by excluding the effect of gains or losses from sales of properties, depreciation and amortization related to real estate and impairment charges, which are based on historical costs and may be of limited relevance in evaluating current performance, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. We further believe that Normalized FFO provides useful information to investors, analysts and our management because it allows them to compare our operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences not related to our operations. For example, we believe that excluding the early extinguishment of debt and other miscellaneous non-comparable items from FFO allows investors, analysts and our management to assess the sustainability of operating performance in future periods because these costs do not affect the future operations of the properties. In some cases, we provide information about identified non-cash components of FFO and Normalized FFO because it allows investors, analysts and our management to assess the impact of those items.

INCOME FROM PROPERTY OPERATIONS, EXCLUDING DEFERRALS AND PROPERTY MANAGEMENT. We define Income from property operations, excluding deferrals and property management as rental income, membership subscriptions and upgrade sales, utility and other income less property and rental home operating and maintenance expenses, real estate taxes, sales and marketing expenses, excluding property management and the GAAP deferral of membership upgrade sales upfront payments and membership sales commissions, net. For comparative purposes, we present bad debt expense within Property operating, maintenance and real estate taxes in the current and prior periods. We believe that this Non-GAAP financial measure is helpful to investors and analysts as a measure of the operating results of our properties.

The following table reconciles Net income available for Common Stockholders to Income from property operations:

Quarters Ended December 31, Years Ended December 31,

(amounts in thousands)

| $

|

284,611

16 14,198 (3,363) |

|

|

295,462

— 21,703 (180,179) (7,430) (8,553) (3,196) 74,083 202,362 139,012 27,321 44,857 — 8,646 1,156 116,562 |

|

|

731,806

(18,507) (74,083) |

| $ | 639,216 |

| $

|

73,031

8 3,635 (474) |

|

|

76,200

(3,747) 3,475 (35,242) (2,084) (1,633) (450) 18,110 49,625 27,118 6,175 10,022 — 1,769 — 31,286 |

|

|

180,624

(3,025) (18,110) |

| $ | 159,489 |

Net income available for Common Stockholders …………………………….$ 65,546 $ 262,462 Redeemable perpetual preferred stock dividends ………………………….. 8 16 Income allocated to non-controlling interests – Common OP Units .. 3,286 13,522

Equity in income of unconsolidated joint ventures ……………………….. (1,095) (3,881)

Income before equity in income of unconsolidated joint ventures …….. 67,745 272,119 (Gain)/loss on sale of real estate and impairment, net (1) ……………….. — 59

Membership upgrade sales upfront payments, deferred, net …………… 3,945 25,079

Gross revenues from home sales, brokered resales and ancillary

services (2) ……………………………………………………………………………….. (42,467) (152,517) Interest income ………………………………………………………………………… (1,702) (7,016) Income from other investments, net ……………………………………………. (1,159) (4,555) Membership sales commissions, deferred, net ……………………………… (670) (5,075)

Property management ……………………………………………………………….. 17,024 65,979

Depreciation and amortization …………………………………………………… 50,317 188,444

Cost of home sales, brokered resales and ancillary services (2) ……….. 35,081 120,623 Home selling expenses and ancillary operating expenses (2) …………… 5,949 23,538 General and administrative (2) …………………………………………………….. 8,983 39,576

Casualty-related charges/(recoveries), net (3) ……………………………….. — — Other expenses (2) …………………………………………………………………….. 1,398 4,241 Early debt retirement ………………………………………………………………… — 2,784

Interest and related amortization ………………………………………………… 27,951 108,718

Income from property operations, excluding deferrals and property

management ………………………………………………………………………………. 172,395 681,997 Membership upgrade sales upfront payments, and membership sales commissions, deferred, net ………………………………………………………… (3,275) (20,004)

Property management ……………………………………………………………….. (17,024) (65,979)

Income from property operations …………………………………………………..$ 152,096 $ 596,014

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE

(EBITDAre) AND ADJUSTED EBITDAre. We define EBITDAre as net income or loss excluding interest income and expense, income taxes, depreciation and amortization, gains or losses from sales of properties, impairments charges, and adjustments to reflect our share of EBITDAre of unconsolidated joint ventures. We compute EBITDAre in accordance with our interpretation of the standards established by NAREIT, which may not be comparable to EBITDAre reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. We receive non-refundable upfront payments from membership upgrade contracts. In accordance with GAAP, the non-refundable upfront payments and related commissions are deferred and amortized over the estimated customer life. Although the NAREIT definition of EBITDAre does not address the treatment of non-refundable upfront payments, we believe that it is appropriate to adjust for the impact of the deferral activity in our calculation of EBITDAre.

We define Adjusted EBITDAre as EBITDAre excluding non-operating income and expense items, such as gains and losses from early debt extinguishment, including prepayment penalties and defeasance costs, transaction/pursuit costs and other miscellaneous non-comparable items.

We believe that EBITDAre and Adjusted EBITDAre may be useful to an investor in evaluating our operating performance and liquidity because the measures are widely used to measure the operating performance of an equity REIT.

_____________________

- Reflects a $1.7 million reduction to the carrying value of certain assets as a result of Hurricane Ian and insurance recovery revenue of $5.4 million for the quarter ended December 31, 2022. Reflects a $5.4 million reduction to the carrying value of certain assets and insurance recovery revenue of $5.4 million as a result of Hurricane Ian for the year ended December 31, 2022.

- Prior period amounts have been reclassified to conform to the current period presentation.

- Casualty-related charges/(recoveries), net includes debris removal and cleanup costs related to Hurricane Ian of $40.6 million and insurance recovery revenue of $40.6 million for the quarter and year ended December 31, 2022.

The following table reconciles Consolidated net income to EBITDAre and Adjusted EBITDAre:

Quarters Ended December 31, Years Ended December 31,

(amounts in thousands)

| $

|

298,825

(7,430) 21,703 (3,196) 202,362 4,619 116,562 — 5,484 |

|

|

638,929 1,156

3,807 3,119 |

| $ | 647,011 |

| $

|

76,674

(2,084) 3,475 (450) 49,625 1,346 31,286 (3,747) 1,637 |

|

|

157,762

— 423 1,046 |

| $ | 159,231 |

Consolidated net income ………………………………………………………………$ 68,840 $ 276,000

Interest income ………………………………………………………………………… (1,702) (7,016) Membership upgrade sales upfront payments, deferred, net ………….. 3,945 25,079

Membership sales commissions, deferred, net ……………………………… (670) (5,075)

Real estate depreciation and amortization ……………………………………. 50,317 188,444 Other depreciation and amortization …………………………………………… 765 2,927 Interest and related amortization ……………………………………………….. 27,951 108,718 (Gain)/loss on sale of real estate and impairment, net (1) ……………….. — 59

Adjustments to our share of EBITDAre of unconsolidated joint

ventures ………………………………………………………………………………….. 612 1,390

EBITDAre …………………………………………………………………………………. 150,058 590,526 Early debt retirement ………………………………………………………………… — 2,784

Transaction/pursuit costs (2) ……………………………………………………….. 598 598

Lease termination expenses (3) ……………………………………………………. — —

Adjusted EBITDAre …………………………………………………………………….$ 150,656 $ 593,908

CORE. The Core properties include properties we owned and operated during all of 2021 and 2022. We believe Core is a measure that is useful to investors for annual comparison as it removes the fluctuations associated with acquisitions, dispositions and significant transactions or unique situations.

NON-CORE. The Non-Core properties include properties that were not owned and operated during all of 2021 and 2022. This includes, but is not limited to, six RV communities and eleven marinas acquired during 2021, one membership RV community and three RV communities acquired during 2022 and our Westwinds MH community and an adjacent shopping center. The ground leases with respect to Westwinds and the adjacent shopping center terminated on August 31, 2022. The Non-Core properties also include Fort Myers Beach, Gulf Air, Pine Island, and Ramblers Rest.

INCOME FROM RENTAL OPERATIONS, NET OF DEPRECIATION. We use Income from rental operations, net of depreciation as an alternative measure to evaluate the operating results of our home rental program. Income from rental operations, net of depreciation, represents income from rental operations less depreciation expense on rental homes. We believe this measure is meaningful for investors as it provides a complete picture of the home rental program operating results, including the impact of depreciation, which affects our home rental program investment decisions.

NON-REVENUE PRODUCING IMPROVEMENTS. Represents capital expenditures that do not directly result in increased revenue or expense savings and are primarily comprised of common area improvements, furniture and mechanical improvements.

FIXED CHARGES. Fixed charges consist of interest expense, amortization of note premiums and debt issuance costs.

______________________

- Reflects a $1.7 million reduction to the carrying value of certain assets as a result of Hurricane Ian and insurance recovery revenue of $5.4 million for the quarter ended December 31, 2022. Reflects a $5.4 million reduction to the carrying value of certain assets and insurance recovery revenue of $5.4 million as a result of Hurricane Ian for the year ended December 31, 2022.

- Represents transaction/pursuit costs related to unconsummated acquisitions included in Other expenses in the Consolidated Statements of Income on page 6.

- Represents non-operating expenses associated with the Westwinds ground leases that terminated on August 31, 2022.

Part I B.

Equity LifeStyle Properties Inc. (ELS) Q4 2022 Earnings Call Transcript

Jan. 31, 2023 3:06 PM ET

Equity LifeStyle Properties Inc. (NYSE:ELS) Q4 2022 Results Conference Call January 31, 2023 11:00 AM ET

Company Participants

Marguerite Nader – President & Chief Executive Officer

Paul Seavey – Executive Vice President & Chief Financial Officer

Patrick Waite – Executive Vice President & Chief Operating Officer

Conference Call Participants

Nick Joseph – Citi

Anthony Powell – Barclays

Brad Heffern – RBC

Samir Khanal – Evercore ISI

Keegan Carl – Wolfe Research, LLC

Wesley Golladay – Robert W. Baird & Co.

Anthony Hau – Truist Securities

Joshua Dennerlein – Bank of America

John Pawlowski – Green Street Advisors

Michael Goldsmith – UBS

Operator

Good day, everyone, and thank you all for joining us to discuss Equity LifeStyle Properties Fourth Quarter 2022 results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO.

In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. [Operator Instructions]. As a reminder, this call is being recorded.