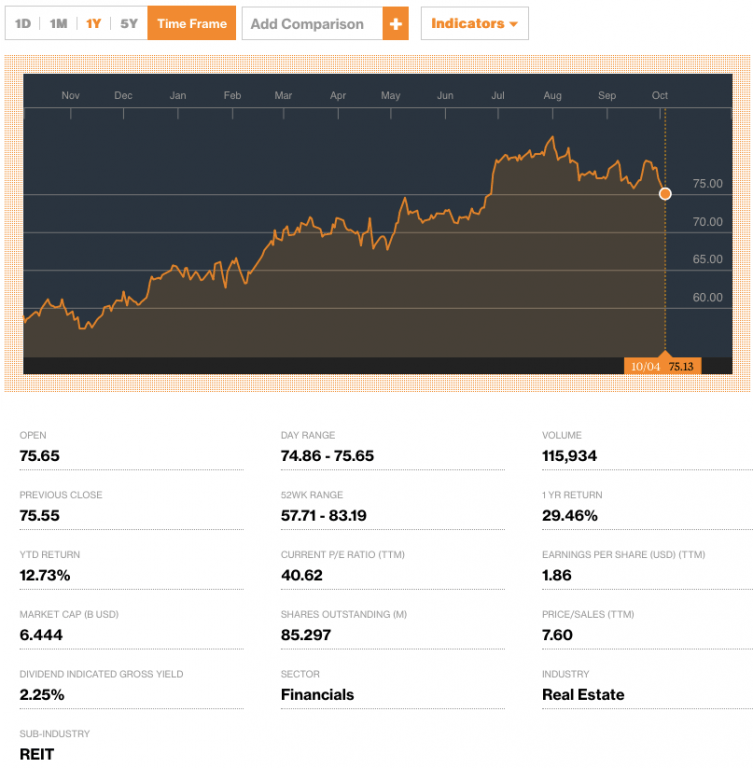

Equity Lifestyle Properties, Inc. (NYSE:ELS) stock was down 1.74% on September 30th, hitting a price of $77.18, which has raised concerns for some traders who wonder – is part of a new pattern?

According to the Press Telegraph, analysts expect earnings of $0.83 per share, which would be an increase of 7.79% from last year’s earnings of $0.77 per share. The next ELS earnings call is scheduled for October 17th.

Information from The Market Digest indicates that traders have been “relatively bearish” on ELS over the last 4 weeks. But the stock went down only 1.6%. Compared to the S&P 500 over the same period and the stock price has fallen 3.46% over the past week.

ELS stock is expected to deviate a maximum of $7.57 from the average target price of $78.33 for the short-term period. Experts have initiated coverage on the stock with the high target of $87.00 according to The Market Digest.

As Daily Business News readers are aware, we recently covered ELS, their dividend updates and their September 8th acquisition in Ellenton, FL. The company has a market cap of $6.83 billion, and is one of the manufactured home industry connected stocks tracked every business day by the Daily Business News, with the most recent report, linked here.

Bank of Montreal Acquires New Stake

According to Baseball News Source, the Bank of Montreal Can acquired 162,197 shares of ELS, valued at $12,984,000 according to its most recent 13F filing with the SEC.

After the SEC filing, Montreal Can owned about 0.19% of ELS. A number of other investors adjusted their stakes in the company:

- Norges Bank acquired a new stake during the fourth quarter valued at approximately $43,997,000.

- NN Investment Partners Holdings N.V. acquired a new stake during the first quarter valued at approximately $33,005,000.

- Goldman Sachs Group Inc. boosted its stake by 25.0% in the first quarter. Goldman Sachs Group Inc. now owns 1,556,487 shares of the company’s stock valued at $113,204,000 after buying an additional 311,786 shares during the period.

- Renaissance Technologies LLC boosted its stake by 18.7% in the first quarter and now owns 1,026,300 shares of the company’s stock valued at $74,643,000 after buying an additional 161,600 shares during the period.

- State Street Corp boosted its stake by 3.0% in the first quarter. State Street Corp now owns 2,457,328 shares of the company’s stock valued at $178,722,000 after buying an additional 72,727 shares during the period.

Institutional investors currently own some 94.83% of ELS stock.

A number of research firms have weighed in on ELS.

BMO Capital Markets reissued a “hold” rating and issued a $77.00 target price on shares in a report on Thursday, July 28th.

Citigroup Inc. increased their target price on ELS from $70.00 to $80.00 and gave the company a “neutral” rating in a report on Thursday, July 7th.

Cantor Fitzgerald reissued a “hold” rating on shares of Equity Lifestyle Properties in a report on Saturday, June 4th.

As manufactured housing professionals, investors and enthusiasts know, ELS is a REIT – a Real Estate Investment Trust – and is one of the largest owner/operators of manufactured home communities and RV parks in the nation. The Daily Business News will continue to follow ELS closely. ##

(Image credits are as shown.)

Submitted by RC Williams to the Daily Business News for MHProNews.