“Contrary to popular belief, manufactured homes aren’t less expensive than site-built homes because they are “lower-quality” homes, they are just built in a more cost-efficient and innovative way.”

Who says?

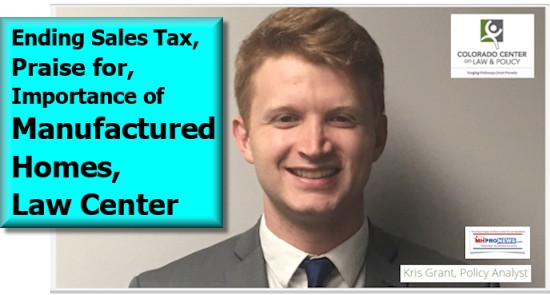

Kristopher Grant is a policy analyst at the Colorado Center on Law and Policy.

“Land costs notwithstanding, producers of manufactured homes make a quality, affordable option, at less than half of the price per square foot than conventional homebuilders,” says Grant.

Grant, in an Op-Ed to the Denver Post, makes the case for repealing state sales tax on manufactured homes.

“Unfortunately, a significant financial barrier can make the acquisition of new manufactured homes more difficult to obtain: the state sales tax,” the policy analyst said.

Grant notes in part that sales tax is indirectly packaged wrapped into the price of conventional housing too.

Importance for Affordable Housing Buyers

“Under Colorado state law, new manufactured homes are considered personal property (think cars and television sets) and thus subject to the state sales tax at the time of purchase. Granted, only a portion of the value of the home is taxed, but for an average priced home that still amounts to roughly $1,000. In addition to the state sales tax, manufactured homeowners also pay their annual property taxes and are thus double-taxed in practice,” Grant said.

He compares that to site builders, who “On the flip side, those who build conventional, site-built homes pay sales tax on the building materials and ultimately build those costs into the final price of the home, increasing the overall value of the home to the eventual owner.”

Colorado’s jostling over sales taxes is nothing new for the industry, which sees periodic moves in various states to raise or lower them. But does eliminating them entirely signal a possible new for states who want to encourage affordable home ownership?

Grant says that “Fortunately, a bill being considered by state legislators seeks to remove this financial barrier…[Colorado] House bill 1315 would exempt the purchase of a new manufactured home from the state sales tax.”

“While HB 1315 would result in a modest revenue reduction over time, this exemption is directly targeted at those Colorado families already struggling to stay ahead. This is money they will be able to spend on child care, groceries, a college savings account and their new home loan,” said the analyst.

“In 2017, 937 Coloradan families purchased a new manufactured home. These families saved up their earnings, got their credit scores in order and made the financially responsible decision to purchase a home and an asset. Let’s encourage more Coloradans to do the same by passing HB 1315 and bring manufactured housing into the larger affordable housing discussion in this state,” concluded Grant.

With most states concerned about their budgets, it would be an uphill fight. Colorado will be an interesting test case, as the influx of revenue from legalized pot-sales might, might make it easier to accomplish there. If one state relents on sales tax on manufactured housing, others could follow suit.

Time will tell… but one thing is certain. It is one more indicator that manufactured housing, properly understood, is a non-partisan issue. ## (News, analysis, and commentary.)

(Third party images provided under fair use guidelines.)

Related Report:

“Move, Open, Live” De Rose Industries & Senator Thom Tillis’ Mobile Home Comments

Consulting, Marketing, Video, Recruiting, and Training Resources

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.