The word “historic” or “epic” can often mean “inspiring” in specific contexts. The historically tough resolve of those who died defending a monastery against Mexican invaders became the battle cry “Remember the Alamo” that led to Sam Houston’s upset victory against Santa Anna’s force that had double the numbers of the Texan soldiers. The historic resolve of Winston Churchill resisting the Nazi onslaught in World War II is celebrated and remembered by millions in England and around the world.

“Never yield to force; never yield to the apparently overwhelming might of the enemy.”

“…never give in, never, never, never, never—in nothing, great or small, large or petty—never give in except to convictions of honour and good sense.”

Manufactured housing needs such epic examples of fighters too.

A message to MHProNews from a high-level executive of a Manufactured Housing Institute (MHI) member company says thirty HUD Code manufactured home plants are idled and the industry’s top lender is preparing for a wave of repossessions. Without naming names, that off-the-record insider’s message to this publication came from an operator that has spoken of “moat” building. Time will tell how accurate the emailed claims will prove to be.

But what those examples reflect are the stark differences between fighting for freedom and fighting for feudalistic power.

Industry professionals who are independent-minded should never forget that Santa Anna and Adolf Hitler each justified their choices and behaviors. On the other side of that, the battles for Texas freedom and the British resistance to the Nazi blitzkrieg and aerial bombardment still inspire people generations later.

There was a point in time when Santa Anna or Hitler’s forces seemed unstoppable. But the courage of fighters with a more noble cause resulted in upset victories that are worthy of remembrance, precisely because they were real and demonstrated that David vs. Goliath victories can still happen in our own day.

What Goes Around, Comes Around?

Quoting Jim Clyburn on the value of history isn’t necessarily equated with endorsement of his political beliefs. That disclaimer noted, Clyburn is right about the value of history.

MHProNews launched a series of periodic interviews with Danny Ghorbani for several specific reasons. As a lover of history and a believer in the inspirational power of fighting for just causes, this writer watched as certain voices inside MHVille twisted reality to try to make themselves and/or certain organizations look better. Mark Twain in his newspaper was a bold and colorful liar, by some accounts. It was Twain who said it is easier to fool people than to convince them that the deceived that they had been fooled.

To counter debilitating obstructionism and manipulation of the market in manufactured housing as well as within key elements of the federal government, we looked in part to a fellow who was part of the ‘in’ crowd before leaving it to eventually forge a new entity in tandem with a relatively few but visionary industry businesses. Those businesses hired a fighter to lead what was originally called the Association for Regulatory Reform (ARR) and what later became the Manufactured Housing Association for Regulatory Reform (MHARR).

What many don’t know is that while working for MHI, Danny Ghorbani reportedly developed some 200,000 new MH home sites in just four years. How many could say something similar? That 200,000 home site development mark is itself worthy of study, because it matters to consumers and manufactured housing independents alike. But that will be set aside for another time.

The biographical outline below is based upon what was published by the RV/MH Hall of Fame. Then after a period MHARR press release, the latest insights and allegations by the mercurial Ghorbani in our latest exclusive Q&A will follow. After the Ghorbani Q&A will be an MHProNews analysis and commentary.

The following is based on what is found on the RV/MH Hall of Fame website.

He is recognized as a long time champion of manufactured housing causes on both technical and policy issues. As the CEO of MHARR for the past 20 years, he has been instrumental in leading the way for improvement to the National Manufactured Housing Construction and Safety Act, (known as the HUD code) and was instrumental in the development and passage of the Manufactured Housing Improvement Act of 2000.”

As additional context to establish the caliber and capabilities of Ghorbani was this from his retirement announcement by MHARR, which was previously published by MHProNews.

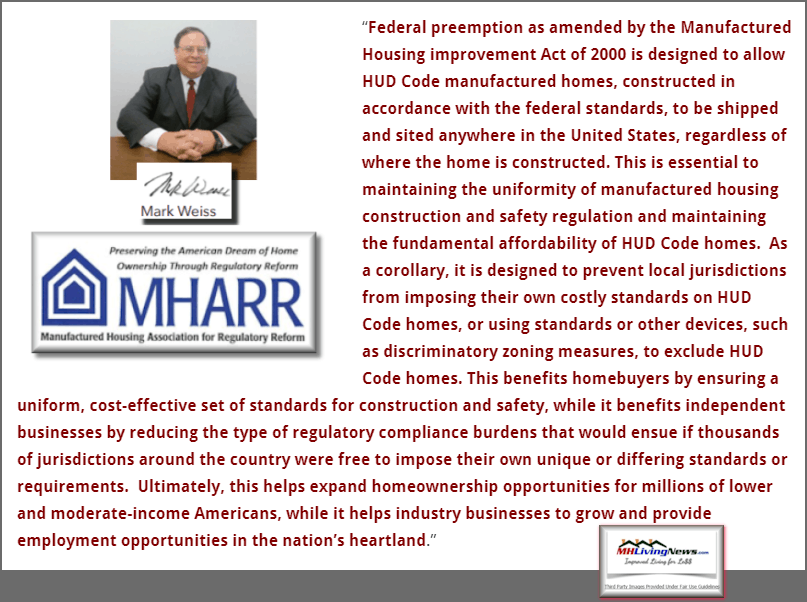

A 46-year veteran of the manufactured housing industry who has served since 1985 as the first and only President & CEO of MHARR, Ghorbani was asked by the MHARR Board of Directors — and has agreed — to continue as the Association’s Senior Advisor on national policies. Further, to ensure a totally seamless transition and uninterrupted continuation of the Association’s national policies and activities, the Board has selected the Association’s current Senior Vice President, Mark Weiss, to be MHARR’s new President and CEO effective January 1, 2015.

Making this announcement in Washington D.C., MHARR Chairman John Bostick stated that “In his 46 years of service to and representation of the manufactured housing industry, Danny Ghorbani has contributed tremendously to the advancement and evolution of all aspects of our industry. We wish him and his family a well-deserved and enjoyable retirement, knowing that he will continue assisting MHARR and the industry going forward.”

A Structural and Civil Engineering graduate from the University of Illinois, Ghorbani was first recruited as a member of the professional team assembled by the City of Chicago’s legendry Mayor, Richard J. Daley, to re-design the city’s aging trunnion bascule bridges. A year later in 1968, Ghorbani was recruited by the Mobile Home Manufacturers Association (since re-named the Manufactured Housing Institute) to work with a team of planners, landscape architects and engineers as the Project Engineer and Chief of Design Services for a new program to plan, design and engineer modern manufactured home residential developments and communities throughout the United States in order to meet increasing consumer demand and the rapid growth of the industry.

Four years, and some 200,000+ engineered manufactured housing sites later, on his way to Georgia Tech University to take a teaching position and complete his post-graduate studies, Ghorbani was asked by MHMA leaders to remain with the Association, take charge of its transition from Chicago, Illinois to Washington, D.C., and be part of the industry’s entry into the federal arena. Ghorbani accepted this challenge and stayed with the Association, where he began twelve years of wide-ranging activities and responsibilities on behalf of the manufactured housing industry, including, among other things, managing the industry’s 600+ company-strong suppliers group, the industry’s two national shows and expositions (with the then-national manufactured housing show in Louisville, Kentucky being the 5th largest indoor trade show and exposition in the United States for four consecutive years), and serving as the industry’s representative and liaison to various international housing forums and negotiations.

Then, in 1985, when a group of industry visionaries and pioneers concluded that the fledging federal manufactured housing program was rapidly veering off-course, they selected Ghorbani as the President and CEO of their newly formed association (MHARR) to chart a bold, new and different direction for the industry in Washington, D.C. Fully aware that the initial federal law — patterned after the automobile industry — and its corresponding regulatory excesses coupled with discrimination against the industry and its consumers had drastically hampered industry growth, MHARR began devising and aggressively advancing national policies that gradually gained ground and credibility for the industry with officials, lawmakers and consumers in the Nation’s Capital. This effort culminated with the passage of the landmark Manufactured Housing Improvement Act of 2000, signed into law by President Clinton on December 27, 2000, recognizing manufactured homes, for the first time, as affordable, legitimate “housing.”

A staunch advocate for fair treatment of manufactured housing and its consumers, with a watchful eye to protect the delicate balance between consumer protection and affordability, Ghorbani has, for nearly five decades, been a leader, fighting for fair and reasonable industry regulation and elimination of all discrimination against the industry and its consumers.

In Washington, D.C., Ghorbani said: ”It has been a privilege and honor to work for, represent and advance an industry that I love and a product that I truly believe in.” He continued, “but the real reward for me personally has been and will continue to be the literally thousands of friends and supporters that I have been fortunate enough to know and work closely with in advancing this great industry.”

###

With that backdrop, MHProNews now presents the latest Q&A with Danny Ghorbani.

“In our Q&A of March 9, 2020, you indicated that Fannie Mae and Freddie Mac are using various schemes to cover-up and get away with their ongoing evasion of the Duty to Serve (DTS) mandate established by the Housing and Economic Recovery Act of 2008 (HERA) which instructed them in specified ways to serve the HUD Code manufactured housing industry and its consumers. Can you elaborate on the “how and why” of what Fannie and Freddie are doing with respect to DTS?”

Danny Ghorbani Answer:

“Addressing your question from a Fannie Mae and Freddie Mac decision-making and policy perspective, and without going too deeply into the weeds, the two Enterprises, quite simply, have been able to evade the full and proper implementation of the manufactured housing segment of the Duty to Serve the Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA). They have done this — and continue to do so — by employing a series of creative schemes, excuses, delays, dodges and unholy alliances, resulting in ongoing defiance of the DTS law and its clear mandate. And while this is a sad commentary on the effectiveness of the manufactured housing industry’s post-production sector in the Nation’s Capital, as well as a dark chapter in the short history of their federal regulator, the Federal Housing Finance Agency (FHFA), one has to grudgingly admire the devious way in which Fannie and Freddie have gotten away with their ongoing charade. More on this later.

With this background, the basic question you now are asking is: “how and why Fannie and Freddie continue to get away with skirting this federal law and its clear mandate?” The “why” part of your question was mostly answered in our Q& A of March 9, 2020, although there are additional relevant observations later in this Q & A response. But the “how” part of your question is something different and new, which warrants further explanation and elaboration.

Having watched, studied and analyzed the Enterprises’ actions for nearly four decades, and having been involved, engaged-in and instrumental in the drafting and passage of the DTS law, it is my personal opinion that Fannie and Freddie, whether by chance or by design, or a combination of both, have initiated, perfected and ultimately exploited a three-pronged approach to their interpretation, implementation and handling of the DTS law. And when these three approaches overlap, as they have since 2008, they create a platform-of-operation and a comfort zone which allows them to defy the law and its mandate to satisfy their own view of manufactured housing (see, Q & A of March 9, 2020) while, at the same time, richly benefiting their favored clients at the expense of the industry’s small businesses and the moderate and lower income American consumers that they are supposed to serve.

And what are the three prongs of this approach? They are:

1-The Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac continuing home-financing (particularly chattel financing) discrimination against a class of American consumers who depend on today’s federally regulated manufactured housing (MH) as their principal and, in some cases, only source of homeownership;

2-Fannie’s and Freddie’s utter disregard for the well-established parity between the construction/manufacturing of today’s MH and all other types of single- family dwellings; and

3-The GSEs unholy alliance with — and green lights given to them by — unexpected quarters, which provide them with just enough cover to continue the unacceptable status quo.

Now, let’s delve a bit more into each of these three factors.

1- It is a well-known and long-established fact that the large majority of manufactured home (MH) purchasers are young couples, moderate and lower income consumers and elderly Americans. Fannie and Freddie have and continue to routinely question the credit-worthiness of these groups as an excuse for not securitizing MH loans. And their biggest excuse, of course, is that they do not have any relevant data available to justify their risk-taking in securitizing such loans – and particularly chattel loans. But this is nothing more than a bogus excuse, because they have had twelve years with the best available tools and an army of home-financing experts at their disposal to actually develop such data themselves. For them, this should be an easy task and something that would not take twelve years, with no end in sight. For example, in one of its countless number of comments on the implementation of DTS, the Manufactured Housing Association for Regulatory Reform (MHARR) provided Fannie, Freddie and FHFA with a suggested program that would start with a small but market-significant number of chattel loans which would vigorously be reviewed and evaluated periodically. If the results were satisfactory, they would then gradually increase the number of loans and continue with their close monitoring. Now, if MHARR could formulate a workable approach like this, why can’t Fannie Mae and Freddie Mac? Instead, Fannie and Freddie have wasted twelve years and all they have to show for it are meaningless, miniscule, dead-end “pilot programs” that have discouraged and driven away industry participation, and forced the consumers into very high-rate private chattel loans … something that DTS was supposed to change for the better, but has instead become worse. And if these private companies can earn profits on such high-rate loans, why can’t Fannie and Freddie, at the very least, start one lower-rate loan program, while still earning a profit? For the Enterprises, whose careless and unimaginative programs (remember sub-prime loan programs?) cost American taxpayers trillions of dollars and brought the world economy to near-collapse to worry about high risks and potential defaults on a miniscule number of manufactured housing loans is hypocrisy at best and pure discrimination against some 80% of manufactured home consumers at worst. Given Fannie and Freddie’s checkered history with the manufactured housing industry, one would have to conclude that it is the latter.

2- The DTS law and its mandate are clear, unambiguous and unwavering. Simply stated, with the DTS law Congress told Fannie and Freddie that they have miserably failed to serve the federally-regulated manufactured housing industry and consumers of affordable housing since they were created, and with the DTS mandate, they now have to start serving both — i.e., not site-built, or modular, or sectional, or any other type of single-family dwelling built in compliance with other types of building codes, but today’s quality, well-built and affordable manufactured homes constructed in full compliance with the HUD Code and regulated by the federal government. They must provide securitization programs that would enable finance companies to offer lower-rate loans for manufactured housing AS IS WHEN IT LEAVES THE FACTORY AND IS PURCHASED BY A HOME BUYER…as simple as that. But that is not good enough for Fannie and Freddie as they have decided to re-invent the wheel by demanding that the code and materials be substantially upgraded to the point that the bottom-line price of the home would make it prohibitively costly to the average consumer who would otherwise depend on a manufactured home for his or her homeownership. A very clever way of avoiding the securitization of mainstream manufactured housing loans, right? And to make matters worse, as if they are ashamed of the name “manufactured home,” or in an effort to look down at the product, or in an attempt to confuse homebuyers (or, possibly, a combination of all the above) they, with the help from some within the industry, have invented meaningless and unrelated names such as “High-End Initiative,” “MH Select,” “New Type” of home, “New Generation” of home, “New Class” of home, “Advantage Home,” “Choice Home” and the worst name of all, “Cross-ModTM home!!” (As an aside, the CrossModTM name appears to have been invented by a wannabe individual totally devoid of any and all knowledge, and without the slightest understanding of the rich heritage and history of this great industry…not to mention the difficult and cumbersome evolution that it has endured to get where it is today.) So, Fannie and Freddie must be educated to understand that when a manufactured home leaves the factory with that federal-seal-of-approval affixed to it, it is on par and in full parity with — and, in many cases superior to — any and all other single-family dwellings built to any other building code in the United States of America.

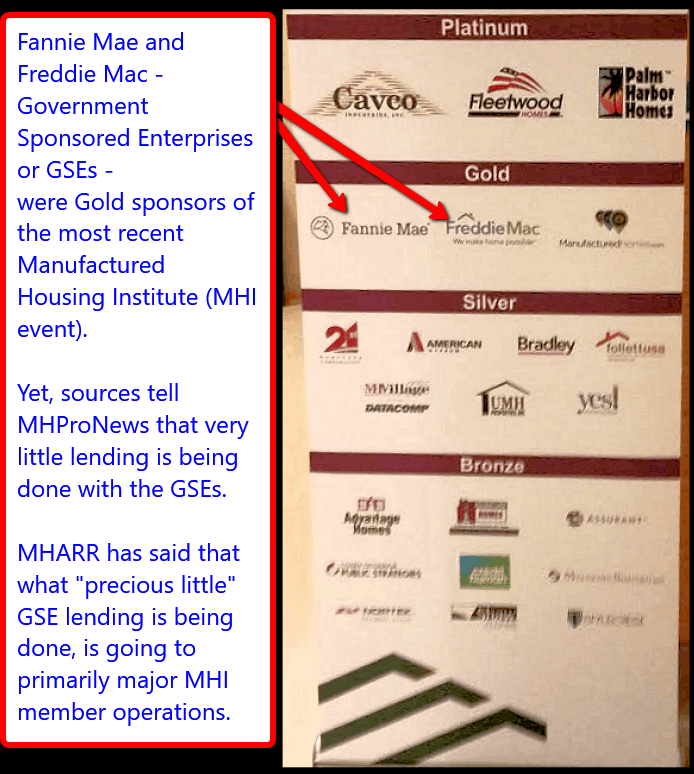

3- One of the main reasons that Fannie and Freddie have been able to yank-around the manufactured housing industry and consumers with a perceived legitimacy for their dodging and evading all these years, is due to their alliance with — and a green light given to them by — a segment of the industry and their regulators (i.e., the Manufactured Housing Institute (MHI) and FHFA).While MHI was a loyal and integral partner with MHARR and the rest of the industry and consumer coalition during the drafting and passage of the DTS law, it went off the reservation (as it did with the landmark Manufactured Housing Improvement Act of 2000 reform law) when it came to the full and proper implementation of the DTS law. I have been around this industry and Washington, DC long enough to know for a fact that Fannie and Freddie would have not been able to do what they have done with this industry and its consumers all these years had it not been for the wink and nod given to Fannie Mae and Freddie Mac by MHI, and their half-hearted support for DTS.

To be sure, and according to the available information, MHI has had its limitations and shortcomings in pulling their punches, often saying one thing publicly, but doing something different privately, going along to get along, as one, or two, or possibly three of their largest conglomerate members are the only companies utilizing Fannie and Freddie’s wild-goose-chase securitization programs — or should I say “pilot programs” or whatever is the name of the latest program that they offer these days.

I am not aware of any small businesses in this industry using a Fannie or Freddie program. Furthermore, MHI’s membership includes two of the largest finance conglomerates that provide higher-rate chattel loans and have no incentive at all to support the full and proper implementation of DTS that would attract competition from smaller companies which would utilize DTS to support lower-rate chattel loans. (Incidentally, here is another major set-back for the post-production sector of the industry when there is no independent, national collective association to represent their views and interests on critical matters such as this.)

As for the green light that FHFA has given to Fannie and Freddie to continue their evasion of and failure to fully and properly implement the DTS law, there are several words that would perfectly describe FHFA’s action or lack thereof prior to the arrival of its current Director, Mark Calabria and his team. Unfortunately, none of those words are pleasant enough to be listed here, thus we’ll spare them. Since Director Calabria’s arrival at FHFA, though, and given the fact that I personally have known and worked with this gentleman for nearly three decades with positive results, I use the word “disappointing” to describe FHFA’s efforts to regulate and fully and properly implement the DTS law. I say this because Director Calabria is a trusted and serious federal government regulator. He and his team have a large reservoir of credibility with our industry, and with me, personally. They were quite helpful and indeed instrumental in the passage of the landmark 2000 reform law. They respect and admire this industry for the quality homes that it builds and the affordable homeownership opportunities it offers to moderate and lower-income consumers. They, along with other relevant agencies, have an aggressive mandate and the full protection of President Trump and Congress to increase and expand the supply of affordable housing for American consumers — a huge undertaking that rightfully must start with affordable HUD Code manufactured housing. Why is it, then, that after nearly two years in charge of FHFA he has not been able to reign-in the renegade Fannie Mae and Freddie Mac, and fully and properly implement the DTS law for the benefit of consumers and the industry’s small businesses? Thus, my disappointment at the continuing green light that FHFA is seemingly providing to these Enterprises along with the perceived legitimacy that allows them to continue with their evasion. Although I don’t hold my breath, it is obvious that drastic decisions must be made by FHFA to end the unacceptable status quo and put the vital DTS mandate back on track.

The proverbial ball is clearly in FHFA’s court, to use its full power and authority to put an end to the nonsense and evasion that Fannie and Freddie have gotten away with for 12-plus years (and counting) regarding DTS.”

##

Supporting Evidence?

The reply to the question posed by MHProNews is that of Danny Ghorbani. Objective thinkers should ask themselves, is there evidence for Ghorbani’s assertions?

The short answer is yes. Just a few examples will serve to prove that point.

- Fannie, Freddie, MHI and a others involved have refused to release the minutes of closed door discussions that resulted in the “new class of homes” that was dubbed in 2019 as “CrossModTM homes” by MHI.

- David Dworkin, President and CEO of the National Housing Conference said in formal comments to the federal government the following, which is quite in keeping with Ghorbani’s assertion. It should be noted that Dworkin served as a vice president for a GSE, so one might presume that he knew what he was talking about. Furthermore, Dworkin arguably did a better job of arguing for more from the GSEs than Lesli Gooch did, see that comparison of their respective remarks at the link here.

- MHI has had as event sponsors Fannie Mae and Freddie Mac. That smacks of collusion that points to the very concerns raised by Ghorbani in his response. After all, why would Fannie and Freddie need to sponsor MHI to curry favor, if the GSEs were sincere in their intention of robustly supporting all HUD Code manufactured homes?

- MHProNews and MHLivingNews has done several reports that all tend to support the concerns raised by Ghorbani. One of several is linked below.

- Donna Feir, Ph.D., and research economist studied this issue and was troubled by what she found, citing the Seattle Times expose that pointed a finger at Clayton Homes and their associated Berkshire Hathaway lenders of Vanderbilt Mortgage and Finance (VMF) and 21st Mortgage Corporation.

- There is a prima facie case to be made that since Triad Financial Services, Credit Human and other lower rate manufactured housing “home only,” personal property or chattel loan lenders is successfully making such loans at lower rates that 21st or VMF. Years of sustained lending by Triad and Credit Human – who have reportedly provided the GSEs with their data – is sufficient evidence for Fannie and Freddie to issue and securitize the loans that DTS mandates.

Those are sufficient examples to make Ghorbani’s statements come to life. It should be noted that Ghorbani – as is true of others quoted, interviewed or otherwise cited here on MHProNews – had no idea of what our analysis of his comments would be. He’ll be reading these words for the first time along with thousands of other industry professionals.

Fighting Back Can Pay Historic Dividends

Every war has casualties. Casualties of war may be tragic but they can also potentially inspiring as the Battle of the Alamo or the resistance to the Nazi blitz of England reflect.

For every causality of war, many more stand in the shadows of fighters and their leaders with increased freedom.

There is a war on in America and the world. Chinese communists are among those arguably involved in that battle, but so are a relatively few Moat-builders in America that has impacted our industry and others.

Among the whistleblowers in MHVille who have stepped up in recent days is a mid-level manager that claims that he watched an MHI member producer receiving a container from China. After the outbreak of COVID19, that tipster claims that producer was having that container unloaded by workers without any personal protective gear. “Social distancing” and other norms supposedly went out the window.

Sales and management staff of a vertically integrated captive MHI retailer contacted MHProNews recently with allegations that they have been shorted commissions, bonuses, and earned income. MHProNews has been told that documents will be compiled and organized along with written statements to substantiate those claims.

What does that have to do with the Danny Ghorbani interview? To some there will seem to be no connection. For others, they will ‘get it’ – that the only way to stop corruption is to expose it and then fight back against it.

If MHI, Clayton Homes (BRK), Skyline Champion (SKY), and Cavco Industries (CVCO) leadership are so smart, then why is it that after roughly a dozen years, DTS is still languishing? Isn’t the logical explanation that they like the status quo, and for their own reasons abet Fannie, Freddie and the FHFA because it allows them to build their respective moats?

“Occam’s razor (or Ockham’s razor) is a principle from philosophy. Suppose there exist two explanations for an occurrence. In this case the one that requires the smallest number of assumptions is usually correct. Another way of saying it is that the more assumptions you have to make, the more unlikely an explanation,” says Wikipedia.

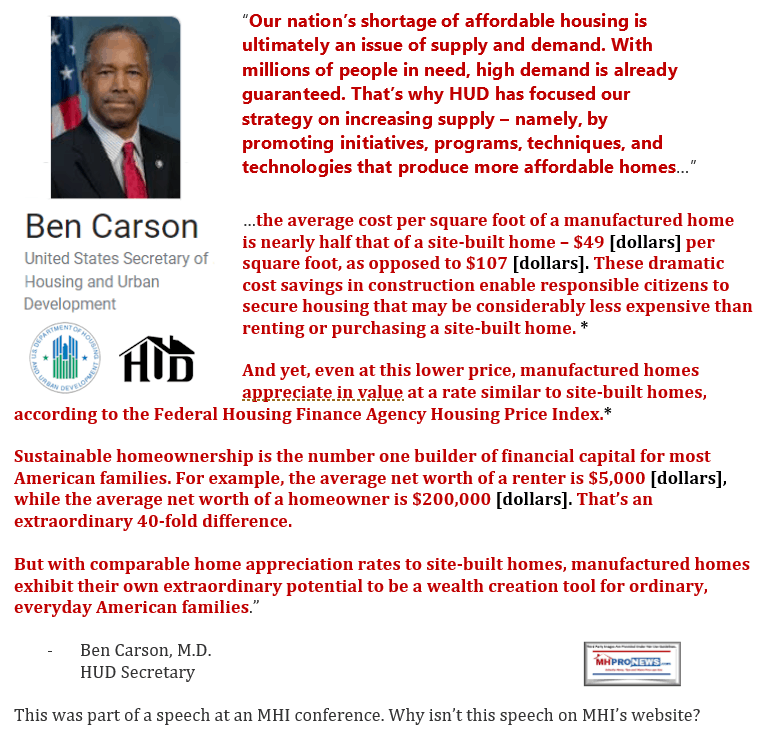

Beyond the evidence revealed in the recent online debate with MHI defender Andy Gedo, there is a simple principle that should be considered when viewing the relatively poor state of manufactured housing. How is it possible that an industry with such a robust and colorful history could be underperforming so badly since 2003? Are clear-eyed thinkers to believe that Berkshire Hathaway, MHI or the largest brands in manufactured housing could be so inept as to be unable to grow the industry during an affordable housing crisis?

That’s simply beyond belief. That matters in this COVID19 era because the industry is poised to have tremendous demand for affordable housing.

But that won’t occur without addressing the core issues that have faced manufactured housing for some 2 decades. One of those is financing, which today’s new Q&A with Danny Ghorbani addresses.

Another is the “place to put” issue, which MHARR has been on the correct side of for years too. That 200,000 home sites in 4 years that Ghorbani achieved is an example of what is possible when someone puts their mind to a problem. That 200,000 was achieved before the “enhanced preemption” was made law as part of the MHIA of 2000.

Then there is the image/educational/promotional issue. That will be examined another time, but it must be stressed that it is likewise a key need. Because people don’t buy a product in huge volumes that they don’t understand or misunderstand. The good news is that the misunderstandings can be cleared up with the proper effort.

There is an epic battle underway that involves all of America. Manufactured housing is a subset of that struggle. But it is an important subset, because affordable housing is the most proven pathway to wealth building for the average man, woman or family.

MHProNews plans more in this periodic series with Ghorbani in the weeks ahead. Stay tuned.

That’s a wrap on this evergreen report. But stay tuned for more from your #1 source for the most-read manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Former Manufactured Housing Institute Vice President Sounds Off on Manufactured Home Financing

February 2020, Latest National Manufactured Housing Production Data, MHI and MHARR Comparisons

Are Manufactured Housing Supply Chains in China Threatened by Coronavirus?