Facts, insights directly from Cavco Industries (CVCO), publicly undisputed evidence, troubling episodes, and various trends are going to be examined herein to shed light on the headline question. During a well-documented affordable housing crisis – when millions of housing units are needed, and conventional builders are surging but struggling to keep up – how is it possible that well capitalized manufactured and modular home builder Cavco Industries is underperforming?

A few factoids and evidence-based statements will help to clearly frame the issue.

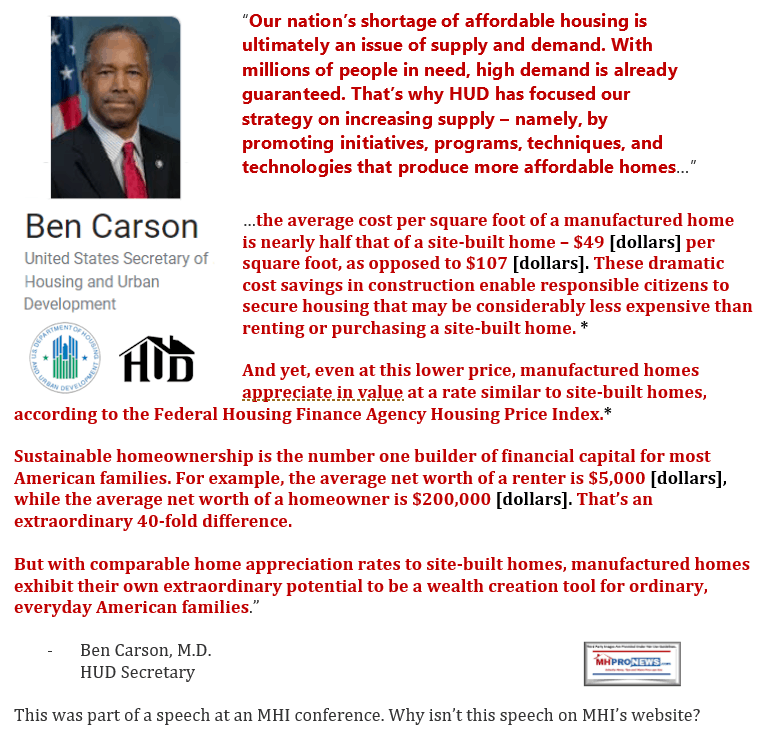

- “In fact, the United States needs a minimum of 7.2 million more affordable housing units,” said Forbes on 2.14.2020. The left-of-center National Low Income Housing Coalition (NLIHC) similarly said that there is a need for some 7 million more units.

- “New [conventional or ‘site built’] construction on single-family homes could exceed 1 million (in 2021),” said Forbes on Jan 4, 2021.

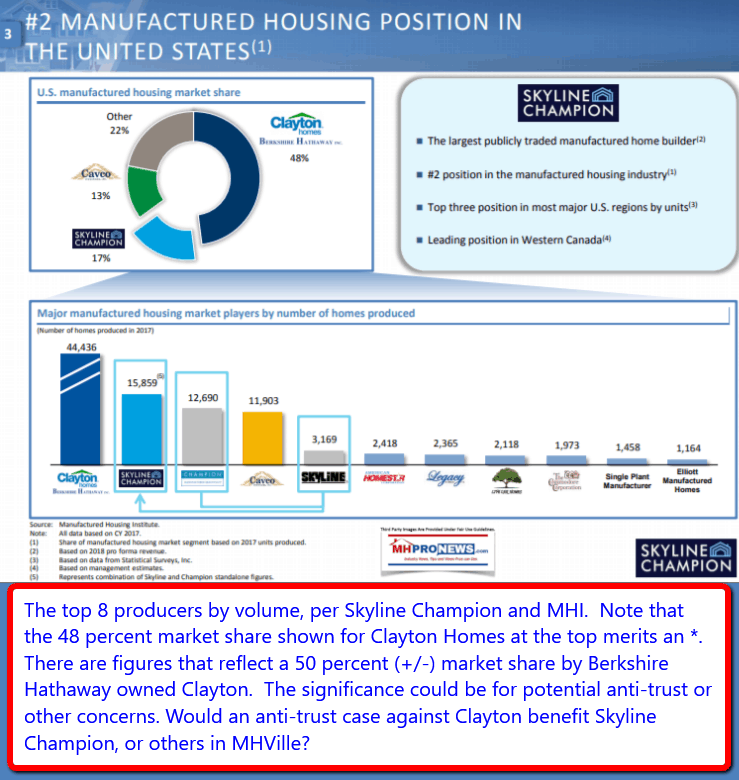

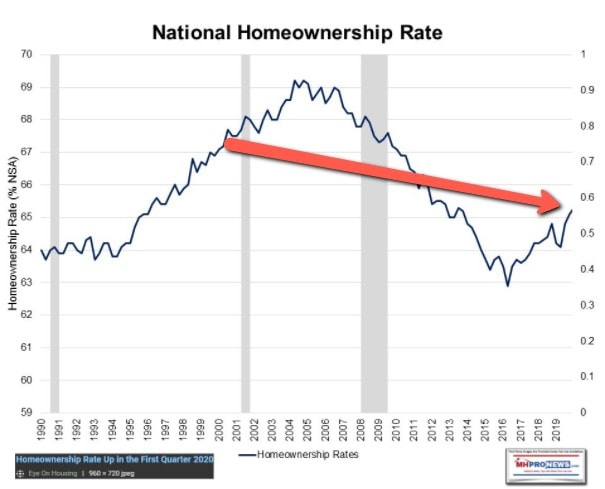

Then why has HUD Code manufactured homes struggled for years to even attain 100,000 new units in a year? Indeed, years after then Manufactured Housing Institute (MHI) president Richard “Dick” Jennison publicly said in Louisville, KY on a video recorded address that the manufactured home industry could attain 500,000 new units annually. Cavco admits that the prior high was some 373,000 units in 1998. Then why did the manufactured home industry experience its second year-over-year decline in 2020?

- Who benefits and who is harmed in this scenario?

- Is it mere happenstance or something else?

- Are objective, thinking observers to believe that seasoned professionals at Cavco – or other MHI member brands – are unable to grow their company – and the industry – during an affordable housing crisis?

That is what those jarring facts should cause objective-minded professionals and advocates to probe. Because more modest investors, industry professionals, affordable housing advocates, public officials, and taxpayers who foot the bill for billions annually in affordable housing programs are all in the mix of those who ought to be pressing for answers and then appropriate legal action.

But there are more points worthy of consideration.

The need for affordable housing is arguably poised to grow. Consider these items.

- One way or another, the eviction moratoriums are likely to end at some point in time, as the judge’s ruling reported last night signals. There are potentially millions of people who could be displaced, if what could be described as an artificially created crisis is not managed properly.

Or ponder the insights and questions sparked by the recent NBC News report at this link here.

Those items above and that follow help frame the importance of the insights from the seminal third-party research by Samuel “Sam” Strommen at Knudson Law. Strommen’s legal research report argues that there is a case for “felony” market manipulation and possible RICO concerns involving MHI and some key member companies. Cavco is one of those brands Strommen’s research named/linked.

When asked to dispute those published concerns, neither Berkshire Hathaway, Cavco, Skyline Champion, MHI, or their outside attorney/surrogates named in the Knudson research report dared deny the well-documented and reasoned points Strommen raised.

That is more then sufficient a predicate to make this point. There are tremendous opportunities for producing more HUD Code manufactured homes. The infographic below serves to illustrate that contention.

The laws needed to make easier placement or more financing at competitive rates already exist. Then how can someone rationally explain why educated and seasoned professionals at Cavco – or other MHI connected brands – seem to be unable to produce the types of results that the marketplace clearly indicate are possible?

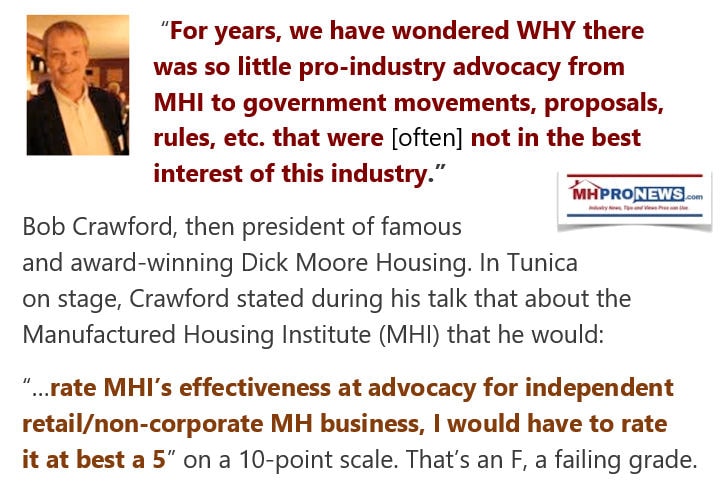

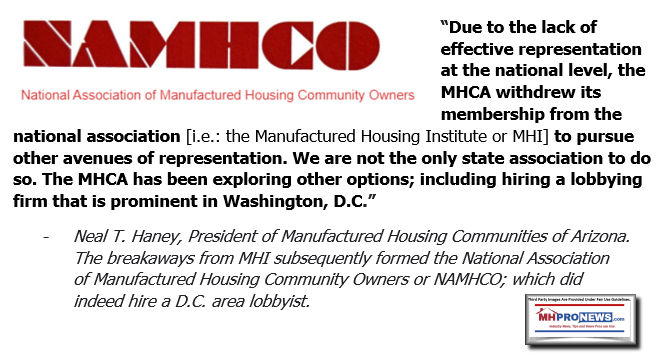

In contrast to the quote above, there is the darker assessment by those who left MHI precisely because the association postured for years without delivering the results they claimed to be working toward.

In the midst of an affordable housing crisis where millions of affordable homes are needed, publicly traded companies such as Cavco Industries (CVCO) are producing arguably tepid results. Why? That is what this report will explore through the lens of the linked reports and CVCO’s own updated investor pitch deck.

Examining, Fact-Checking, and Questioning Cavco Industries November 2020 Investor Relations Presentation Slides

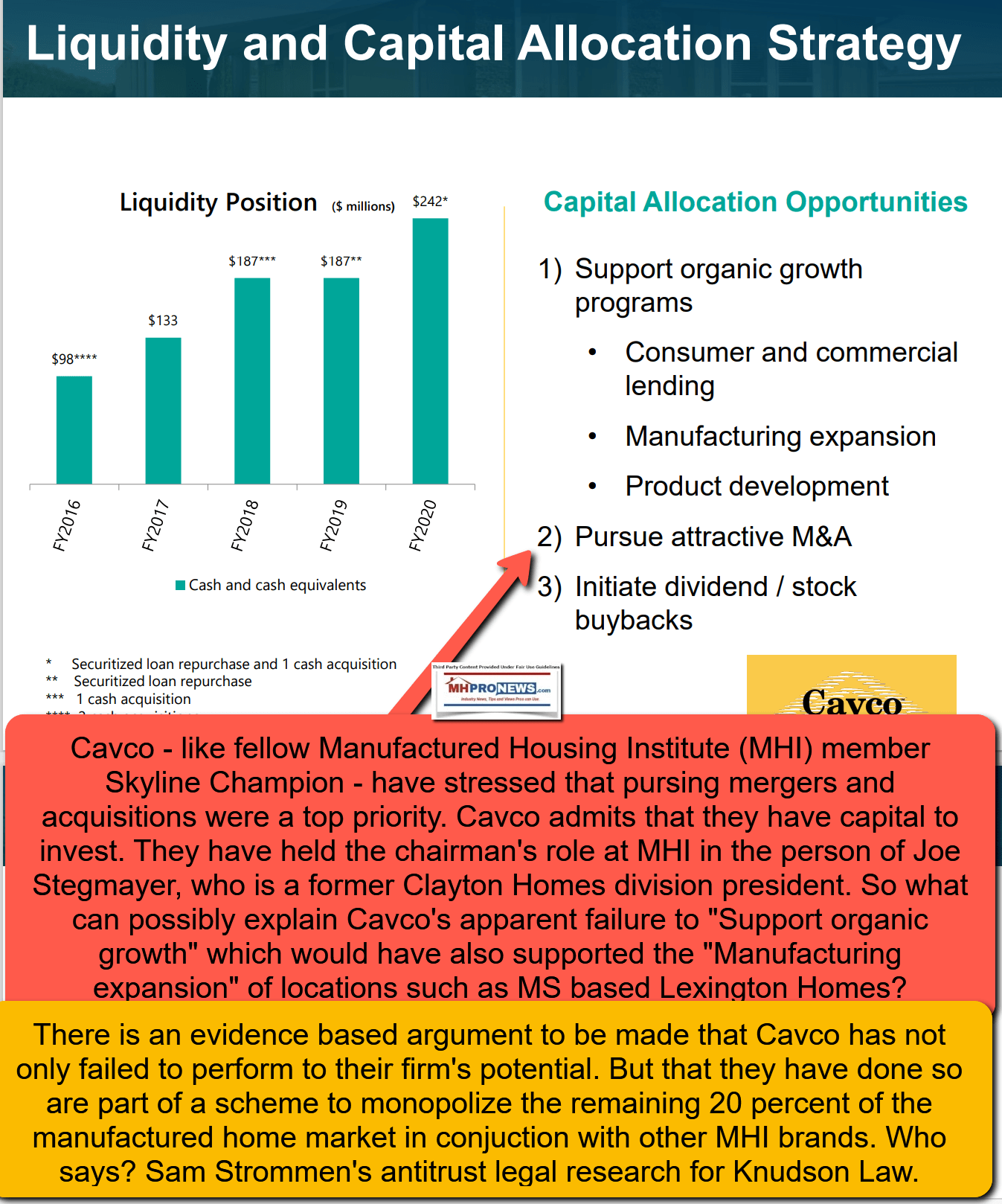

The fact that Cavco Industries (CVCO) produces a range of factory-built housing, including HUD Code manufactured homes, modular code units, commercial construction, vacation cabins, et al should point to more topside potential. They admit that they are well capitalized and are considering stock buybacks so that capital is not sitting idle.

So why is Cavco underperforming? Why is the SEC still investigating that arguably scandal plagued firm? Why has the SEC not settled with Cavco, which made it clear that they were willing to negotiate with federal officials? Why have two top officials stepped down or aside under the cloud of SEC actions? See the recent report linked above for more on those topics.

Cavco – like fellow Manufactured Housing Institute (MHI) member Skyline Champion – have stressed that pursing mergers and acquisitions were a top priority. Isn’t that odd, when already some 80 percent of the industry is consolidated by MHI’s ‘big three?’

Cavco admits that:

- they have capital to invest.

- Cavco held the chairman’s role at MHI in the person of Joe Stegmayer.

- Stegmayer was a former Clayton Homes division president.

- Kevin Clayton preached the “castle and moat” strategy preached by Warren Buffett, which some insider and outside of manufactured housing have described as a slow motion method for monopolization. Clayton said in a video interview that “the moat” was being taught to their team members. Furthermore, Warren Buffett’s ‘teaching’ of this method is quite public, so even apart from the Clayton- or MHI-connections, Stegmayer may well have adopted it on his own.

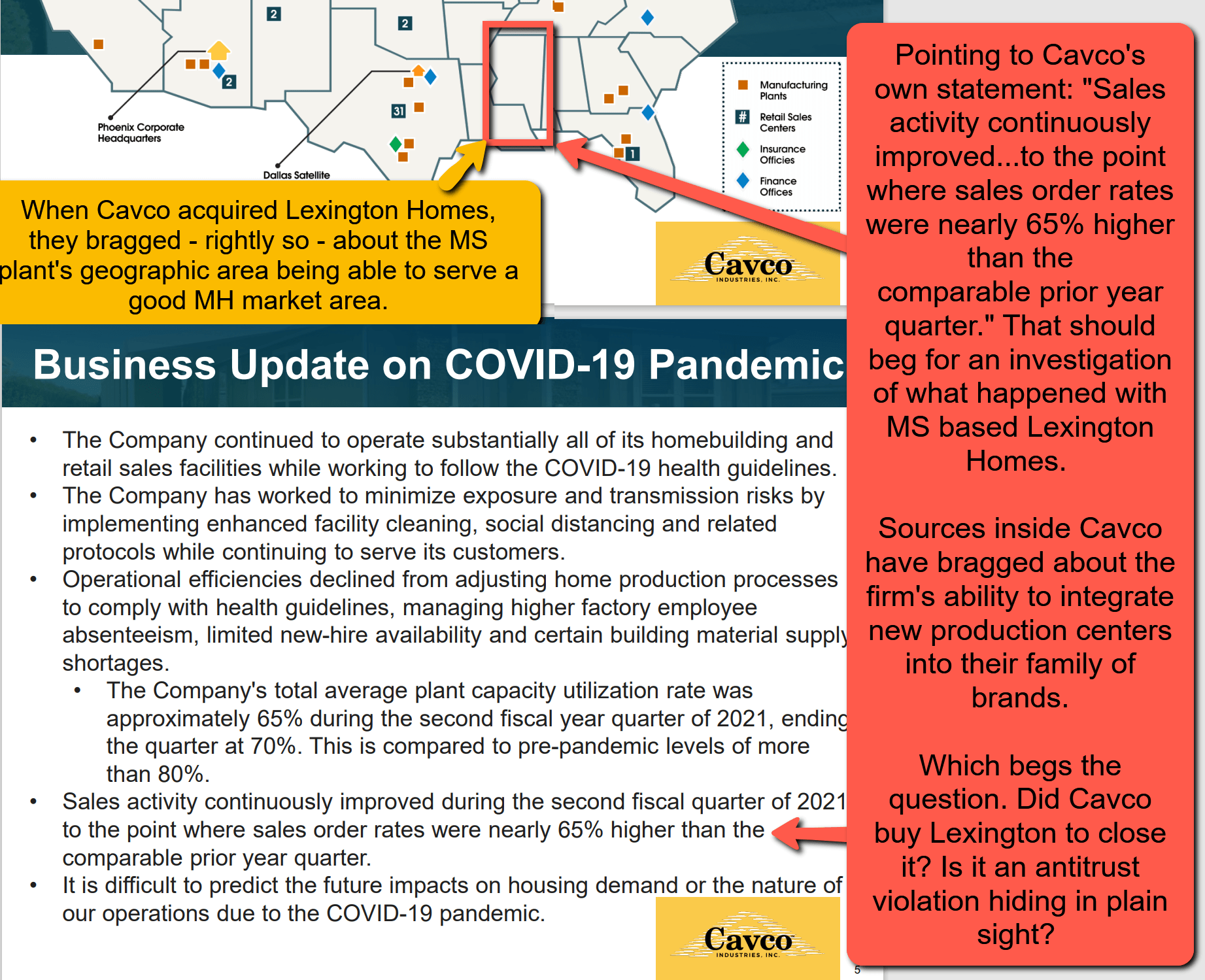

With such questions hanging, what can possibly explain Cavco’s apparent failure to – quoting Cavco’s IR pitch-deck – “Support organic growth” which would have also supported the “Manufacturing expansion” of locations such as MS based Lexington Homes?

Sources inside Cavco have bragged about the firm’s ability to integrate new production centers into their family of brands. There is evidence to back that claim up in other acquisitions.

Which begs the question. Did Cavco buy Lexington Homes to close it? Was Lexington a “killer acquisition” – an antitrust violation – hiding in plain sight?

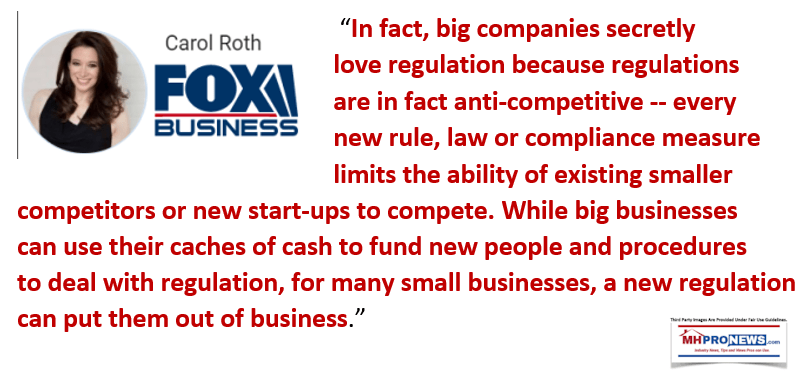

The Federal Trade Commission website says: “But there are antitrust risks when competitors interact to such a degree that they are no longer acting independently, or when collaborating gives competitors the ability to wield market power together.”

The Yale University website notes “if the incumbent already faced a lot of competition from other companies or if future competition was likely to increase, killer acquisitions were less likely to take place.”

“Killer acquisitions” is the term used to describe the method of eliminating a competitor through buying it with the intention to close a business or location. An evidence-based case can be made could have occurred when Cavco bought and later closed Lexington Homes. While that and other concerns merits a formal legal investigation, and the accused are innocent until proven guilty by legal process or through a plea deal, the fact that Cavco is mute on such concerns may be an increased reason for considering such concerns.

There is an additional reason why Lexington may have been bought by Cavco.

Lexington Homes was reportedly a member of the Manufactured Housing Association for Regulatory Reform (MHARR). Washington, D.C. based MHARR is the primary nonprofit trade group which is ‘fighting’ the Arlington, VA based MHI over their decades of failures to properly represent the interests of manufactured home independents and consumers.

That noted, the question arises that by purchasing Lexington, and removing it from MHARR membership, was Cavco aiming to undermine one of the chief voices of dissent from the increasingly consolidated manufactured housing market?

MHProNews is hereby raising evidence based questions that Cavco officials – who once routinely responded promptly to MHProNews – now declines to answer.

Pointing to Cavco’s own statement: “Sales activity continuously improved…to the point where sales order rates were nearly 65% higher than the comparable prior year quarter.” That is yet another factoid that should beg for an investigation of what happened with MS based Lexington Homes. For those truly familiar with market potential and the existing legal advantages possible for HUD Code manufactured homes, most any argument that Cavco might advance is likely to fall apart under scrutiny. That may explain their silence when they previously used to respond to MHProNews inquiries.

Despite their corporate leadership’s claims that they were striving to create what amounted to a new culture post-Joe Stegmayer’s departure, Cavco had yet another ranking official – Dan Urness – step down from his role at the firm following a Wells notice from the SEC. Further, by suggesting that they were trying to create a new culture, what does that say about the prior culture at Cavco?

As Strommen’s independent research report for Knudson Law suggests, is Cavco part of a ploy by the Big Three MHI members to consolidate – through arguably illegal means – to manipulate the manufactured housing market?

Given that numerous law firms publicly announced their pursuit of Cavco following the initial announcement in November 2018 of an SEC investigation, are there reasons to think that the millions that Cavco has admitted to paying in legal costs yet another reason to think that the firm is being mismanaged in a fashion that benefits a few at a cost to the many?

A Broader Context and Postscript

If multi-billion dollar billionaires and brands are working to manipulate manufactured housing, is that part of a larger national problem?

Whatever one thinks of the warnings by prominent figures like Robert F. Kennedy Jr., there are a range of voices akin to his, Edward Curtin’s, Naomi Wolf, Glenn Greenwald, and others that are warning against a ‘totalitarian’ minded set of government operated by billionaires who aim to dominate if not de facto rule American society. While the report below is NOT directly related to manufactured housing, it does raise related questions. Is it a surprise that some of them are directly and/or indirectly involved in the American manufactured home market?

It must be noted that there are and have been voices from among both Democrats and Republicans for years that have said that they favor antitrust action. That being so, why has serious antitrust action been so slow to actually develop in an impactful way?

As Axios and others are making the claim that big corporations are the de facto ‘fourth branch’ of government that is capable of moving more nimbly. That is why this merits a truly bipartisan and serious investigation, not mere video and photo ops and posturing designed to get more donations for the next election cycle.

Additionally, during the Trump Administration, there was the start of antitrust action and that:

1. certain public officials said that sufficient legal power existed under current laws.

2. Others claim that ‘new powers’ are needed.

3. Then there are those voices who propose more regulations of the now- dominating firms, as opposed to breaking them up.

The reason those options matter is that options 2 and 3 de facto benefit monopolists.

The thrust of action should therefor be toward the breakup of monopolies, both inside and outside of manufactured housing, as opposed to mere fines or regulations that de facto reward those who are the purported wrongdoers. Because consolidation routinely costs jobs and has other adverse impacts, and because the low volume of shipments is a de facto barrier of entry, maintenance, and exit the proper remedy is to pursue every legal avenue at punishing the wrongdoers.

Conclusion

Few issues are as important as affordable housing. Virtually every aspect of American life is touched directly or indirectly through the vexing issue of there being less affordable housing today than there was 20 years ago.

At the root of numerous issues that face Americans, monopolization and manipulation of information, capital, and markets are routinely nearby. Is that mere coincidence?

Every serious investigator asks, cui bono? Who benefits? The reverse of that question is also valid. Who is not benefiting in a given scenario? Is it not the millions who seek affordable housing? Is it not minorities and lower income whites that are being harmed by the tens of millions in this current scenario?

After decades of talk about creating more affordable housing, the troubling takeaway from a sober look at the manufactured home industry is this.

No trade media in our industry has even come close to pulling back the veil on these issues. Perhaps that is why ours is the runaway most read?

See the linked and related reports above and below to learn more.

##

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.