Industry in Focus Report

by Eric Miller, MHMSM.com journalist

Yet representatives from Fannie and Freddie were not present at a recent Housing Finance Summit on June 2 in Elkhart, Indiana, sponsored by Congressman Joe Donnelly. Moreover, many industry members were disappointed that the proposed rule to implement the DTS provision of the Housing and Economic Recovery Act of 2008 by the Federal Housing Finance Agency (FHFA) does not include either chattel transactions or land-home packages where the land and the home are subject to separate liens.

Few industry observers minimize the potential positive impact from Title I program improvements or including chattel loans in DTS; Congressman Donnelly calls it an essential component of ensuring that the manufactured housing industry remains competitive. Meanwhile, there’s a quiet move forward for community operators to self-finance manufactured home purchases. Meeting success, major industry players are gathering data that will later be presented as evidence of positive performance to banks hoping to lure the banks into the chattel loan market.

For the time-being, availability of financing remains tight, and industry consultant George Allen says the alternative has been for manufactured home communities to take equity from their properties and function as banks. It’s an alternative a growing number of community operators are embracing. Allen points out that this market grew from a couple million dollars in loans in the late 1990s to somewhere between $3.5 billion and $5 billion in 2009.

“It’s the future, at least for the time being,” Allen says.

While owner-originated financing still represents a small portion of the over-all manufactured home market and is largely used to finance existing homes, the evidence of profitability is mounting. Currently Allen notes positive performance statistics on housing loans originated on site in manufactured housing communities are being melded together by a major but unidentified loan servicer assisted by three or four of the largest land-lease community portfolio owners in the world.

“The goal is to offset and negate lingering bad taste from the Green Tree catastrophe,” Allen says. Once a major player in the chattel loan market, Green Tree’s parent company Conseco experienced huge losses on its portfolio and filed for bankruptcy in 2002.

Allen explains how banks could be approached. “Positive performance will be made public to the right banks at the time. Then we’ll say, “Here’s what we’ve learned and here are the results. This is why you should come back into the chattel loan business.”

Some in the industry see the absence of representatives from the GSEs at the financial meeting in Elkhart as further evidence these organizations are not interested in providing chattel loans. To consultant Kenneth Rishel, this is, on the surface at least, understandable.

“Every time the government has tried to do personal-property manufactured home loans, they have lost money,” Rishel says, explaining that in his view, the reason is a failure on the part of GSEs to acknowledge that manufactured housing loans are a specialized product.

Rishel says his own company, Precision Capital Funding, hasn’t had a loss in 35 years of lending on personal property. Rishel explains that in order to make manufactured home loans and not lose money, that top performers apply a lot of things to underwriting and servicing that the government has never applied.

“They (the FHA) don’t understand it and don’t have the knowledge to make those loans,” Rishel says. To him, as important as it is to show banks and the government that the loans can be profitable, it is equally important to help them acquire the specific knowledge how to do so.

“It’s going to require a willingness on the part of the people in the industry to spend time and money to sit down with the GSEs and teach them what they don’t know,” Rishel says, adding that the plan also would require their willingness to learn.

To industry advocates in Washington, none of that negates the importance and immediacy of implementing regulations already on the books.

“Initially, it could mean more than 20,000 homes,” says Danny D. Ghorbani, President, Manufactured Housing Association for Regulatory Reform (MHARR). “Some say up to 25,000 homes. FHA Title I implementation would help the industry and consumers tremendously.”

MHARR Senior Vice President Mark Weiss adds to that, explaining that FHA loans currently account for approximately 35 percent of total housing finance market, which to the manufactured housing industry would mean some 17,500 homes. “If we could get proper participation even up to that average level, it would make a tremendous difference,” Weiss says.

Thayer Long, Executive Vice President, Manufactured Housing Institute (MHI) also stressed the importance of implementing Title I. He pointed to a recent Harvard study that showed people are looking for less expensive, smaller homes. That describes manufactured housing, which is well-suited to fill the needs of larges numbers of consumers, so long as they can find financing.

“Title 1 could bring more lenders into marketplace,” Long says. “Even just a three or four percent increase in the number of buyers is significant when you’re talking about 50,000 or 60,000 homes.” Long emphasizes that FHA loans are 90 percent insured, making them particularly attractive to lenders.

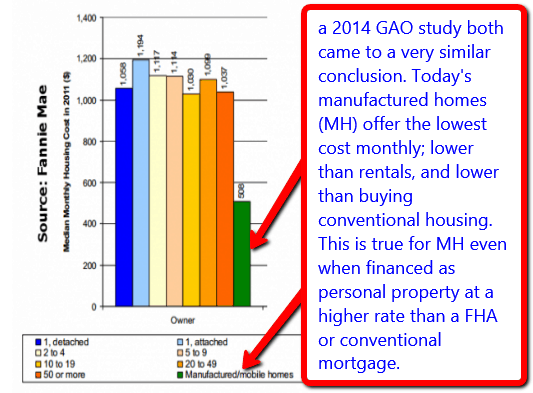

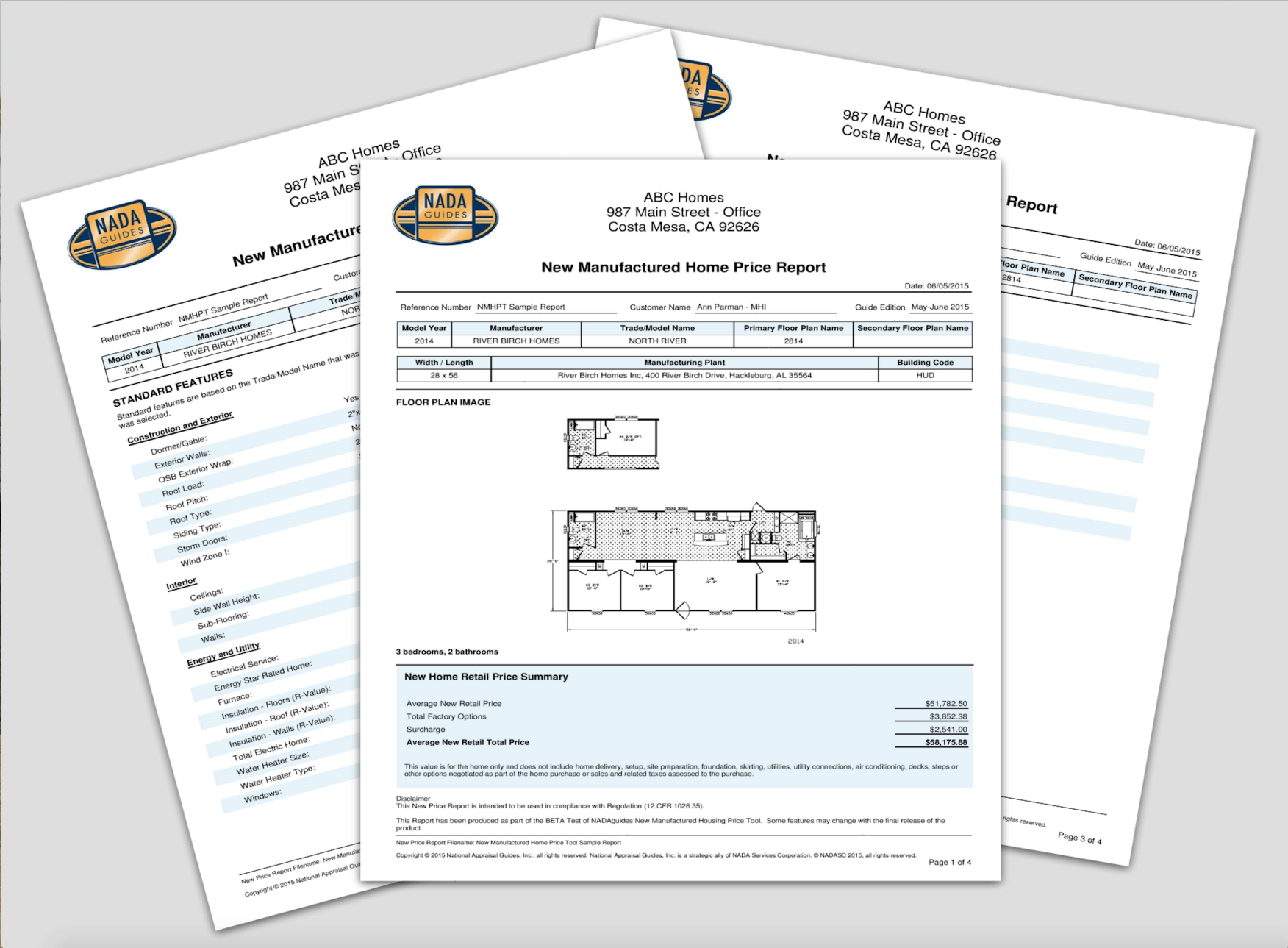

Tim Williams, President of 21st Mortgage, says his company is already providing financing for manufactured housing. It’s just that the cost of money is greater and because the rates are higher. As he explains it, this is because it costs the same to originate and service a loan of $50,000 as it does a loan of $250,000.

Williams says access to the GSEs’ low-cost funds could help, but so far the GSEs have ignored Congress’s DTS mandate.

Williams expects some boost when Ginnie Mae approves lenders as issuers of Title 1 loans – he expects 21st Mortgage will be one of the first – but the market impact may be modest.

“It affects only borrowers who qualify under FHA,” Williams explains. “We’re already making those loans using money that costs a little more than six percent. It will give us lower-cost money and open up the market to more customers, but it’s not going to add five percent to industry shipments.” Ken Rishel estimates that current about six percent of loans that ought to be financed are being financed. While in terms of the entire market, those numbers are significant, Rishel notes that even a doubling would leave that number at just 12 percent.

“That still leaves a substantial percentage of potential sales that are not being financed,” Rishel says. “We still need another way to do it, and the only way I believe is owner-assisted financing.”

“We’re going to see a much greater percentage of community owners getting into community-assisted financing the right way, learning how to finance brand-new houses.” Rishel explained that while this channel is becoming more prevalent, a small but growing percentage goes to finance newly-constructed manufactured houses.

“The customer base is there,” he says; “the only thing standing in the way of industry is lack of financing.”

##