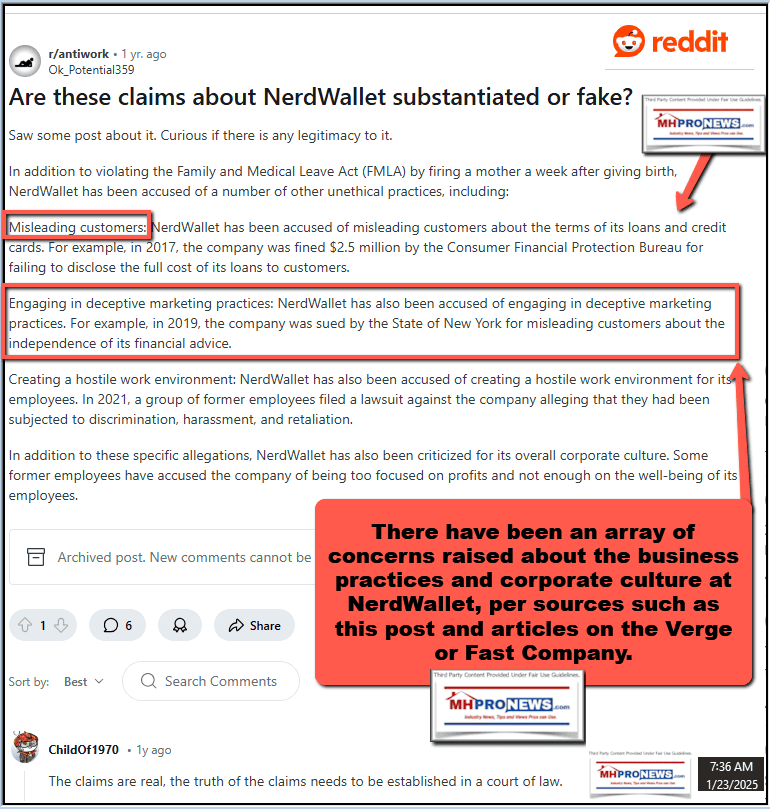

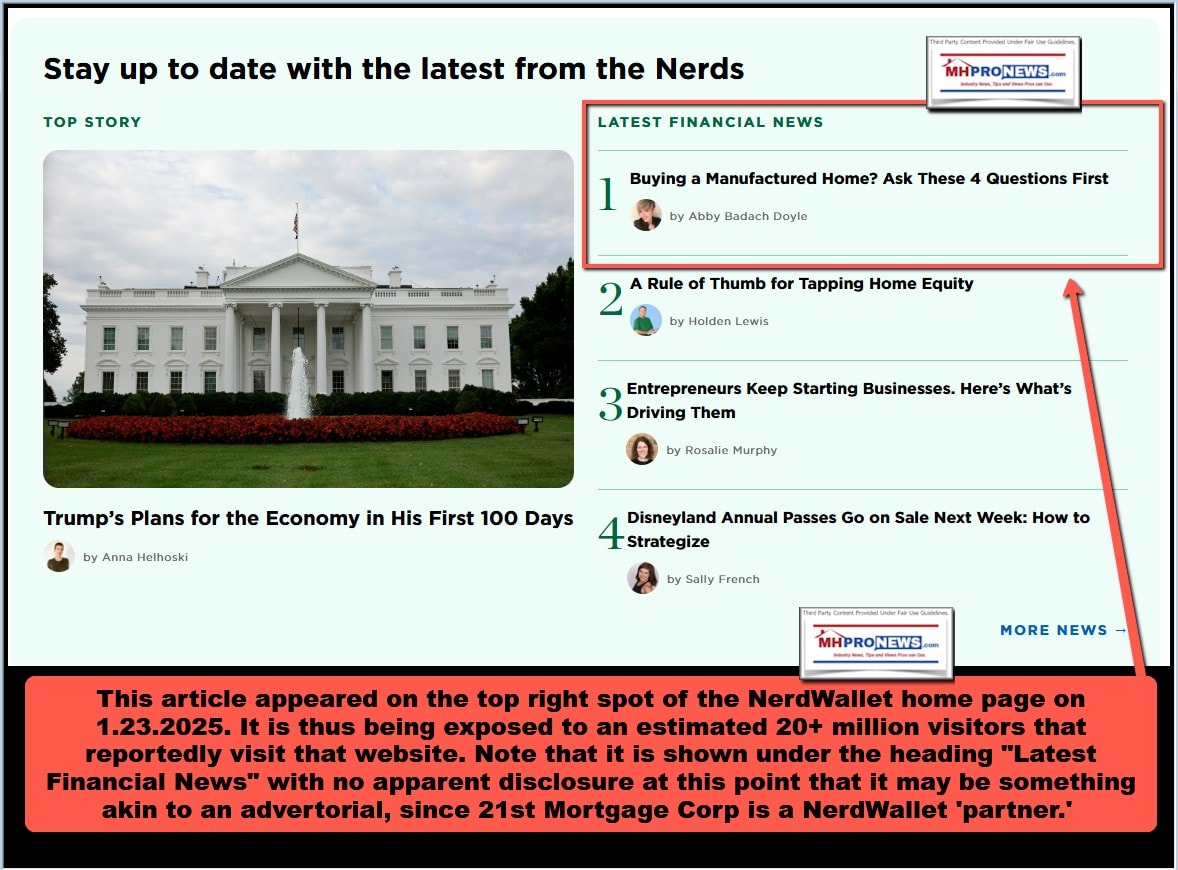

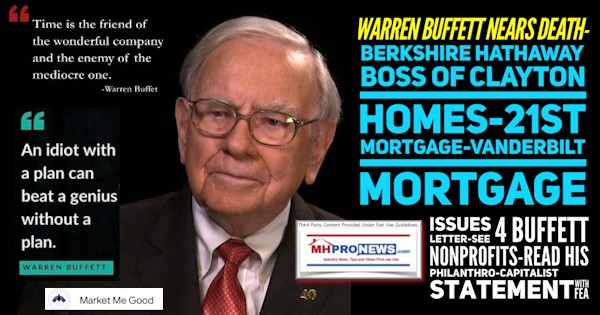

According to left-leaning Wikipedia: “NerdWallet has an average of 23 million monthly users1.” According to Craft.co: “NerdWallet has 5 employees across 3 locations and $599.4 m in annual revenue in FY 2023.” That’s $599.4 million U.S. dollars. According to the Verge: “Plaid, the financial service” used by various financial service providers “will pay $58 million to affected users” of a class action lawsuit reported by Fast Company. Verge said: “In addition to the aforementioned apps, some other popular apps that Plaid powers include Chime, Mint, Betterment, and NerdWallet.” A post on Reddit says: “Misleading customers: NerdWallet has been accused of misleading customers about the terms of its loans and credit cards.” Furthermore, that Reddit post said: “Engaging in deceptive marketing practices: NerdWallet has also been accused of engaging in deceptive marketing practices. For example, in 2019, the company was sued by the State of New York for misleading customers about the independence of its financial advice…” (emphasis added). That company, NerdWallet, published on 1.21.2025 an article about manufactured housing and manufactured home loans. That article, as the headline declared, was entitled “Buying a Manufactured Home? Ask These 4 Questions First.” Among the firms that are listed on the NerdWallet website as a “partner” is 21st Mortgage Corporation (21st). 21st is a prominent member of the Manufactured Housing Institute, is a sister brand to Clayton Homes and Vanderbilt Mortgage and Finance (Vanderbilt or VMF), each of which are among the biggest or are among the largest companies in their niches in the manufactured home industry on this date. Clayton, 21st, and Vanderbilt (VMF) are all owned by Warren Buffett led Berkshire Hathaway (BRK). Berkshire owned VMF was recently hit by a suit from the Consumer Financial Protection Bureau (CFPB), which a Clayton press release found here and Vanderbilt (per NerdWallet) have denied is valid. What this exposé will explore in a systematic fashion are concerns raised by their article: “Buying a Manufactured Home? Ask These 4 Questions First” which per their website was written by Abby Badach Doyle and was “Edited by Jeanette Margle.” The article on the NerdWallet website claims to have been “Fact Checked.” More on that further below. While the article on NerdWallet has certain disclosures, those same disclosures appear to be lacking on two other websites that MHProNews spot checked in the course of preparing this report, analysis, and expert commentary. MHProNews reached out to NerdWallet prior to publishing this article, and some emails back and forth did not result in clarity on the origins of this article. Did 21st, the Manufactured Housing Institute (MHI), or others in that orbit suggest or spark their article being written? Either way, what are some of the concerns and apparent problems with that article? How does may articles like this one potentially impact smaller businesses, consumers, investors, and others?

1) Those are among the items that will be explored in this fact-backed and artificial intelligence (AI) bolstered look into the array of vexing issues involved.

2) One of hundreds to perhaps thousands of ‘news’ sites online that the same article from Nerd Wallet above appeared is shown in the screen capture below. A discerning reader MIGHT notice the statement “content exchange” but that follows the word “news.” Thus, the impression that many who read this could easily be that this is legitimate news rather than something that is in some ways arguably similar to an advertorial. Longtime and detail-minded readers of MHProNews may recall that during the Richard “Dick” Jennison era, that former MHI president and CEO was part of a relatively short-lived campaign of advertorials critiqued at the time by MHProNews. After exposés by MHProNews, MHI apparently suspended that advertorial practice.

3) Until now, that is, if NerdWallet is comparable to an advertorial. It may in some ways be more sophisticated than an advertorial as will be explored herein.

According to Oxford Languages, an advertorial is defined as follows: “a newspaper or magazine advertisement giving information about a product in the style of an editorial or objective journalistic article.” But part of the potential problem for trusting content generated by NerdWallet is illustrated in the screen capture below. The disclosures found on the NerdWallet site are NOT apparent in the top part of the content posted below.

4) MHI leaders and their outside attorney David Goch have been asked to respond to concerns raised by MHProNews regarding this report with analysis and commentary. MHProNews will provide the following outline for this fact-backed probe. They include the following elements.

a) Part I. An extensive Q&A thread with left-leaning Bing’s artificial intelligence powered Copilot. For detail minded readers, it will tee up the concerns that should become more evident in Part II.

b) Part II. The content produced by NerdWallet, with some specific analysis and commentary on elements of their article shown in Part III.

c) Part III additional information plus more analysis and commentary.

Part I – Q&A (Chat thread) by MHProNews with AI Powered Copilot

This article appeared on the top right spot of the NerdWallet home page on 1.23.2025. It is thus being exposed to an estimated 20+ million visitors that reportedly visit that website. Note that it is shown under the heading “Latest Financial News” with no apparent disclosure at this point that it may be something akin to an advertorial, since 21st Mortgage Corp is a NerdWallet ‘partner.’

1)

At least some (perhaps many) Articles on NerdWallet have an advertising disclosure on the top left corner of the article before it begins that has the hot linked words “Advertising Disclosure.” Is NerdWallet a kind of advertorials that other news sites are allowed to pick up that may or may not have that same disclosure on the top left?

Other news sites may also feature advertorials or sponsored content, but it’s important for them to include similar disclosures to maintain transparency and trust with their readers. If you’re concerned about the presence of such disclosures, it’s always a good idea to check for them before trusting the content.

Does this help clarify things for you?

2)

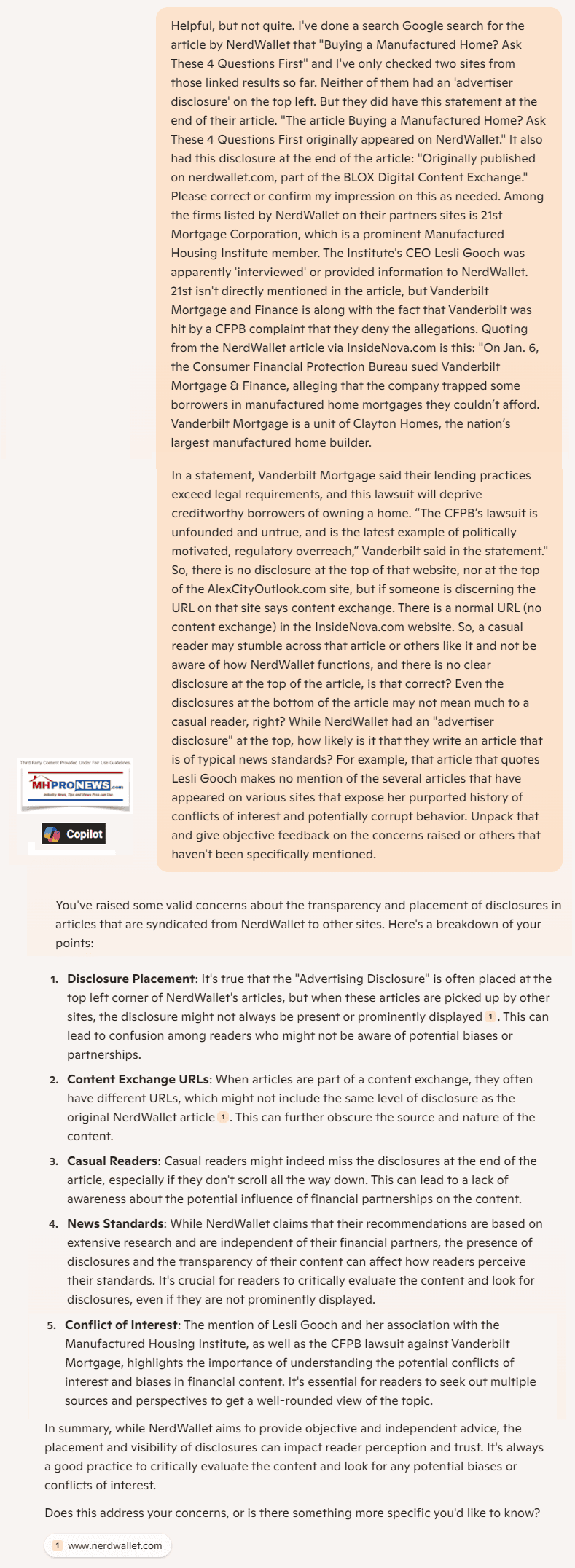

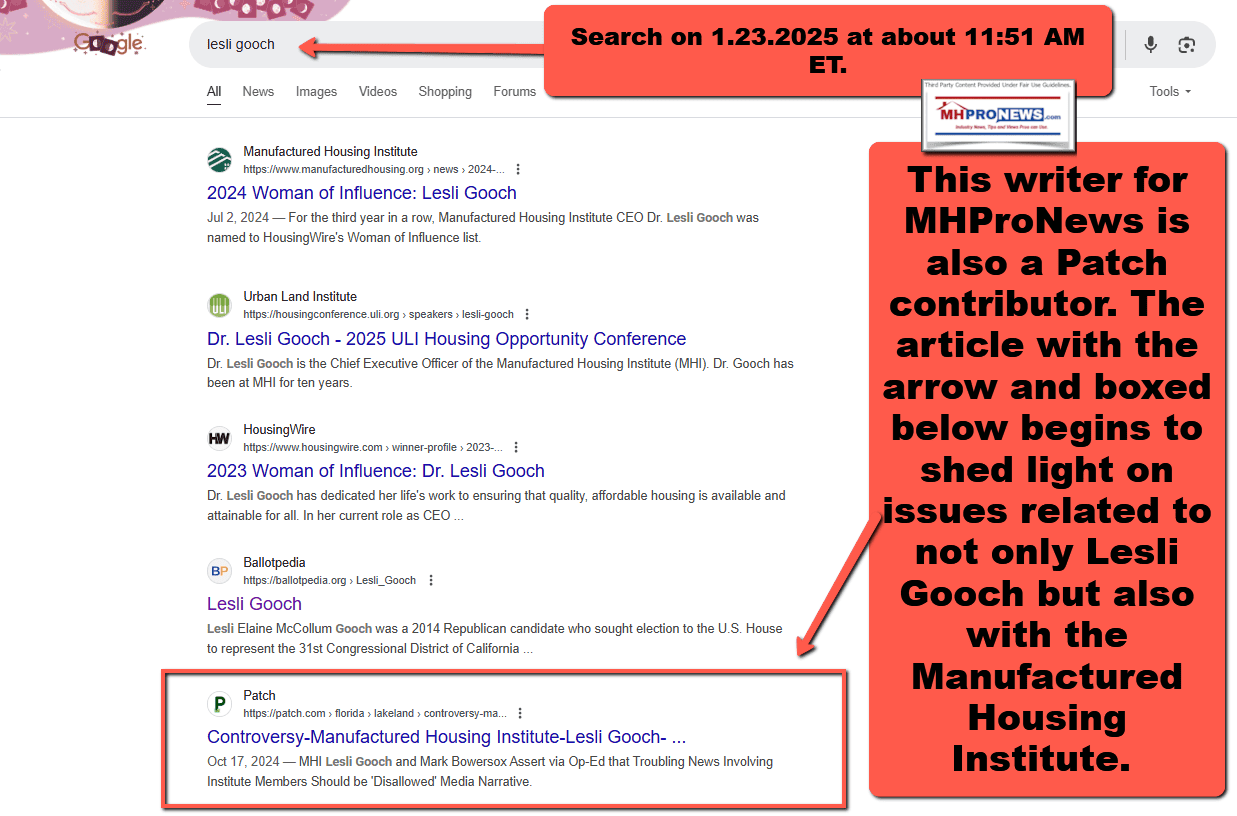

Helpful, but not quite. I’ve done a search Google search for the article by NerdWallet that “Buying a Manufactured Home? Ask These 4 Questions First” and I’ve only checked two sites from those linked results so far. Neither of them had an ‘advertiser disclosure’ on the top left. But they did have this statement at the end of their article. “The article Buying a Manufactured Home? Ask These 4 Questions First originally appeared on NerdWallet.” It also had this disclosure at the end of the article: “Originally published on nerdwallet.com, part of the BLOX Digital Content Exchange.” Please correct or confirm my impression on this as needed. Among the firms listed by NerdWallet on their partners sites is 21st Mortgage Corporation, which is a prominent Manufactured Housing Institute member. The Institute’s CEO Lesli Gooch was apparently ‘interviewed’ or provided information to NerdWallet. 21st isn’t directly mentioned in the article, but Vanderbilt Mortgage and Finance is along with the fact that Vanderbilt was hit by a CFPB complaint that they deny the allegations. Quoting from the NerdWallet article via InsideNova.com is this: “On Jan. 6, the Consumer Financial Protection Bureau sued Vanderbilt Mortgage & Finance, alleging that the company trapped some borrowers in manufactured home mortgages they couldn’t afford. Vanderbilt Mortgage is a unit of Clayton Homes, the nation’s largest manufactured home builder. In a statement, Vanderbilt Mortgage said their lending practices exceed legal requirements, and this lawsuit will deprive creditworthy borrowers of owning a home. “The CFPB’s lawsuit is unfounded and untrue, and is the latest example of politically motivated, regulatory overreach,” Vanderbilt said in the statement.” So, there is no disclosure at the top of that website, nor at the top of the AlexCityOutlook.com site, but if someone is discerning the URL on that site says content exchange. There is a normal URL (no content exchange) in the InsideNova.com website. So, a casual reader may stumble across that article or others like it and not be aware of how NerdWallet functions, and there is no clear disclosure at the top of the article, is that correct? Even the disclosures at the bottom of the article may not mean much to a casual reader, right? While NerdWallet had an “advertiser disclosure” at the top, how likely is it that they write an article that is of typical news standards? For example, that article that quotes Lesli Gooch makes no mention of the several articles that have appeared on various sites that expose her purported history of conflicts of interest and potentially corrupt behavior. Unpack that and give objective feedback on the concerns raised or others that haven’t been specifically mentioned.

- Disclosure Placement: It’s true that the “Advertising Disclosure” is often placed at the top left corner of NerdWallet’s articles, but when these articles are picked up by other sites, the disclosure might not always be present or prominently displayed. This can lead to confusion among readers who might not be aware of potential biases or partnerships.

- Content Exchange URLs: When articles are part of a content exchange, they often have different URLs, which might not include the same level of disclosure as the original NerdWallet article. This can further obscure the source and nature of the content.

- Casual Readers: Casual readers might indeed miss the disclosures at the end of the article, especially if they don’t scroll all the way down. This can lead to a lack of awareness about the potential influence of financial partnerships on the content.

- News Standards: While NerdWallet claims that their recommendations are based on extensive research and are independent of their financial partners, the presence of disclosures and the transparency of their content can affect how readers perceive their standards. It’s crucial for readers to critically evaluate the content and look for disclosures, even if they are not prominently displayed.

- Conflict of Interest: The mention of Lesli Gooch and her association with the Manufactured Housing Institute, as well as the CFPB lawsuit against Vanderbilt Mortgage, highlights the importance of understanding the potential conflicts of interest and biases in financial content. It’s essential for readers to seek out multiple sources and perspectives to get a well-rounded view of the topic.

In summary, while NerdWallet aims to provide objective and independent advice, the placement and visibility of disclosures can impact reader perception and trust. It’s always a good practice to critically evaluate the content and look for any potential biases or conflicts of interest.

Does this address your concerns, or is there something more specific you’d like to know?

3) Note a few typos in the Q&As have been corrected herein, but the originals are as shown in the screen captures placed below each Q&A.

Helpful, but not quite complete, IMHO. Berkshire Hathaway is the parent company of 21st Mortgage Corporation, which was not mentioned in the NerdWallet article. Someone would have to go to the appropriate page on the NerdWallet site to find 21st buried in a list of hundreds of their partners. Clayton Homes and Vanderbilt mortgage are mentioned by NerdWallet and thus the other articles being carried by other sites. Last I checked, 21st is actually larger than Vanderbilt in loan volume and is used by non-Clayton Homes sellers in manufactured housing. There are no apparent disclosures by some, perhaps many or all of those sites with that article about the web of relationships that exist. Samuel Strommen with Knudson Law did an antitrust and consumer interest focused thesis that mentioned apparent antitrust violations that included 21st Mortgage Corporation, Clayton Homes, and the Manufactured Housing Institute among others. There is no mention in that article about the Institute’s failure to press “enhanced preemption” under the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, 2000 Reform Law, 2000 Reform Act). There is no mention of the Manufactured Housing Association for Regulatory Reform (MHARR). There is no mention of concerns raised about Lesli Gooch or the evidence of manipulation of the Institute by consolidators in the industry. A casual consumer who may or may not have been actively interested in a shopping for a manufactured home before reading that article could stumble across it, read it, find its message appealing and not realize that it is similar to an advertorial and lacks any apparent critical evaluation of the claims made by Gooch or the apparent lack of objectivity by the Institute which keeps someone like Gooch as their CEO when she has been dogged with evidence of conflict of interest for years and the board of directors has obviously done nothing about them. The Institute has been compared by one of its members in a remark to MHProNews as akin to a secret society that has insiders and outsiders and the insiders are those who are consolidation focused, so they have a different agenda that that of sincere consumers of affordable housing or sincere companies that may ‘trust’ the Institute or Gooch despite obvious concerns. Unpack that from various angles.

Would you like to dive deeper into any specific aspect of this topic, such as the role of the Manufactured Housing Institute, the concerns about Lesli Gooch, or the impact of antitrust issues on consumers? I’m here to help with any angle you’d like to explore further.

4)

Yes, I’d like you to critically view the remarks in my inquiry, confirm or clarify them as needed, and then see if this may be the kind of issue that state or federal regulators need to be investigating and under what legal basis or bases.

- 21st Mortgage Corporation: You’re correct that Berkshire Hathaway is the parent company of 21st Mortgage Corporation, which was not mentioned in the NerdWallet article. This omission could mislead consumers who are not aware of the full scope of relationships within the industry.

- Clayton Homes and Vanderbilt Mortgage: These companies are mentioned by NerdWallet, which might give the impression that they are the primary players, while other significant entities like 21st Mortgage Corporation are overlooked.

- Loan Volume and Usage: Your point about 21st Mortgage Corporation being larger in loan volume and used by non-Clayton Homes sellers is important. This highlights the need for transparency and comprehensive information for consumers.

- Antitrust and Consumer Interest Concerns: Samuel Strommen’s thesis on antitrust violations involving 21st Mortgage Corporation, Clayton Homes, and the Manufactured Housing Institute (MHI) raises serious concerns. The lack of mention of the Manufactured Housing Association for Regulatory Reform (MHARR) and the failure to press “enhanced preemption” under the Manufactured Housing Improvement Act of 2000 (MHIA) are significant omissions.

- Lesli Gooch and Conflict of Interest: The allegations against Lesli Gooch, including her past campaign controversies and potential conflicts of interest, are troubling. The fact that she continues to hold her position despite these concerns suggests a lack of accountability within the MHI.

- Manipulation of the Institute: The claim that the MHI may be manipulated by consolidators in the industry, with insiders having a different agenda from sincere consumers and companies, is a serious accusation. This could indicate a need for regulatory scrutiny to ensure fair practices and transparency.

Given these points, it seems there are several angles that state or federal regulators might need to investigate:

- Antitrust Violations: The potential antitrust issues involving major players in the manufactured housing industry could warrant investigation under federal antitrust laws.

- Consumer Protection: Ensuring that consumers have access to unbiased and comprehensive information about their housing options is crucial. Regulators might need to look into whether there are deceptive practices or conflicts of interest that harm consumers.

- Transparency and Disclosure: The lack of transparency and disclosure about relationships and potential conflicts of interest within the industry could be a focus for regulatory action.

Would you like to explore any of these angles further, or is there another aspect you’d like to delve into?

Note that the two linked articles by Copilot above are as shown below.

- https://patch.com/florida/lakeland/lesli-gooch-ph-d-award-coverup-headfake-scandal-rest-story?form=MG0AV3

- https://www.manufacturedhomepronews.com/two-more-class-action-antitrust-suits-hit-high-profile-manufactured-housing-institute-members-and-mhi-state-affiliate-members-towsend-in-case-no-123-cv-16462-and-muns-pleadings-and-analysis/?form=MG0AV3

5)

Helpful, but let’s dig deeper. The production of manufactured housing has plunged some 70 percent since its last high of 1998, right? The key factors mentioned by MHARR on that are zoning barriers and a lack of competitive financing access. The article mentions FHA Title I lending, which has fallen so far that it may be in the single digits per year, despite the fact that it was a program created to make more affordable manufactured home sales possible. There is no mention in the NerdWallet article about the FHFA’s failure to press the Duty to Serve Manufactured Housing under the Housing and Economic Recovery Act (HERA) of 2008. Last I checked, 21st and Vanderbilt (VMF) are among the few lenders set up for that program and they have reported near zero originations, correct? So, despite the rosy promises of NerdWallet, it seems that there are many obviously missed items in that article that are raised by more objective and critical sources, such as MHProNews, MHLivingNews, MHARR, the Patch that you cited, or the Private Equity Stakeholder Project (PESP) which has done some deeper dives into problems with the community sector of the Manufactured Home Industry. If someone merely ‘trusts’ NerdWallet because it has become a fairly commonplace name for consumers, they could be led into any number of problematic areas with little or no guidance, contrary to their claims, right? In terms of 21st Mortgage, Clayton Homes sells under more brand names than just that – retailers or others that may even be owned by Clayton but aren’t labeled as Clayton Homes on their road sign. So, someone who is a consumer can end up going to a non-Clayton retailer and still end up looking at Clayton built product, right? As to potential legal concerns, it seems to me that RICO might be among them because ‘the wires’ and internet is being used in a potentially misleading or deceptive fashion, right? Unpack that and cite sources as warranted.

- Decline in Manufactured Housing Production

Indeed, the production of manufactured homes has significantly declined since its peak in 1998. According to MHProNews, production has fallen by nearly 90% since then1. This decline is attributed to several factors, including zoning barriers and lack of competitive financing access.

- Zoning Barriers and Financing Access

MHARR has consistently highlighted zoning and financing barriers as major obstacles. Local zoning laws often restrict where manufactured homes can be placed, and financing options for these homes are limited2. The FHA Title I lending program, which was designed to make manufactured homes more affordable, has seen a significant decline in usage.

- FHA Title I Lending

FHA Title I lending has indeed fallen to very low levels, with some reports suggesting it may be in the single digits per year. This decline has made it difficult for many potential buyers to finance their manufactured homes1.

- FHFA’s Duty to Serve Manufactured Housing

The FHFA’s Duty to Serve Manufactured Housing, as mandated by the Housing and Economic Recovery Act (HERA) of 2008, has not been effectively implemented. Only a few lenders, such as 21st Mortgage and Vanderbilt VMF, have participated in the program, and their originations have been minimal3.

- Criticism of NerdWallet Article

You’re correct that the NerdWallet article may have missed some critical issues raised by more objective sources like MHProNews, MHLivingNews, MHARR, and the Private Equity Stakeholder Project (PESP). These sources have provided deeper insights into the problems within the manufactured housing industry, particularly in the community sector1.

- Clayton Homes and Retailers

Clayton Homes sells manufactured homes under various brand names, and consumers may end up purchasing Clayton-built homes from retailers that aren’t explicitly labeled as Clayton Homes. This can lead to confusion and potential legal concerns.

- Potential Legal Concerns

The use of the internet and other communication channels to potentially mislead consumers could raise legal issues under the RICO Act, which addresses organized crime and racketeering.

Sources

- MHProNews: Provides detailed reports on manufactured housing production and industry challenges.

- MHARR: Advocates for regulatory reform and highlights barriers to affordable manufactured housing.

- NerdWallet: Offers consumer advice but may lack depth in addressing industry-specific issues.

- PESP: Conducts in-depth analyses of the manufactured housing industry and its challenges.

It’s clear that there are significant issues that need to be addressed to improve the affordability and accessibility of manufactured homes. Do you have any specific questions or areas you’d like to explore further?

6)

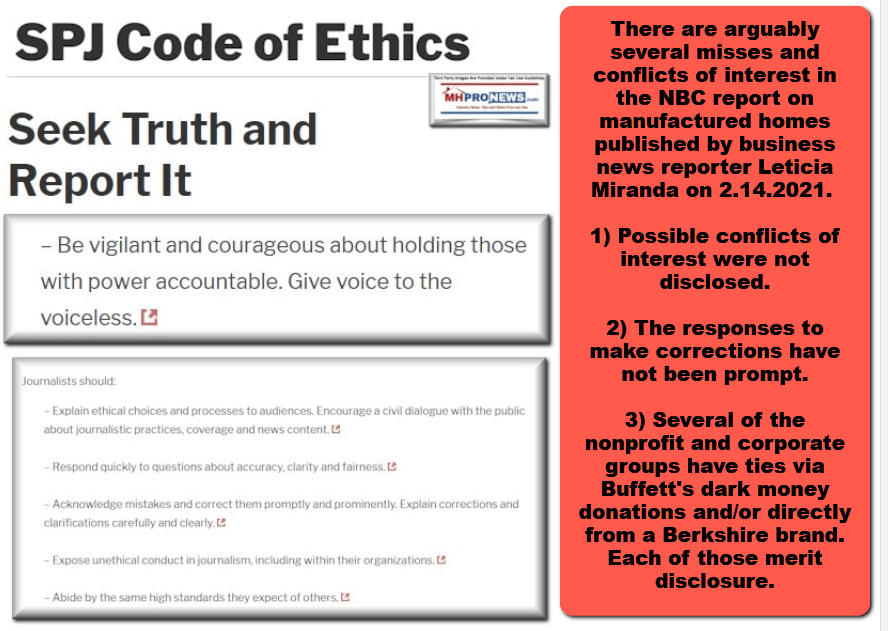

Useful, but let’s dig deeper. I’d like to point out that in 2009 manufactured home production feel nearly 90 percent from its 1998 high, that was more like an 87 percent decline, but it has recovered since then. Production in 2024 is estimated to finish the year at around 100,000 new manufactured homes, instead of the 373,143 that were produced in 1998. So that would be roughly a 73 percent fall since its last high in 1998, correct? Next, given that several of the companies involved in the Manufactured Housing Institute are publicly traded, there are also questions that ought to be asked as far as the SEC disclosures of materiality to their shareholders, right? If companies such as Cavco (CVCO) or Champion (SKY-formerly called Skyline Champion) are making statements to shareholders that suggest that they are looking to grow their sales but they are in fact colluding with Clayton Homes and often private equity or institutional equity backed firms operating in the land lease community sector such as those which have been named in antitrust litigation, that too is a problem that has unmentioned by NerdWallet, right? If someone who is a writer for NerdWallet does even a reasonable Google search, they should find articles that link them to sites such as those you previously mentioned that will present them with a different take than the rosy one raised by apparently conflicted Lesli Gooch, right? It is hard to imagine how someone could have written an article that produced an article like the one being explored originally written by NerdWallet’s Abby Badach Doyle that misses all those rather prominent issues raised by more objective and analytical sources, right? Yet, if NerdWallet wants to be treated like serious media then they should be applying standards similar to what the American Press Institute of the Society of Professional Journalists Code of Ethical Conduct established, right? Unpack those because if this is happening in manufactured housing using NerdWallet what other similar problems might be occurring in other products being promoted by them and their affiliates?

Decline in Manufactured Home Production

You’re correct that manufactured home production has seen a significant decline since its peak in 1998. The drop from 373,143 homes in 1998 to an estimated 100,000 homes in 2024 represents a substantial decrease2. This decline highlights the challenges faced by the industry over the years.

SEC Disclosures and Materiality

Publicly traded companies like Cavco and Champion are required to disclose material information to their shareholders. This includes any information that could influence an investor’s decision to buy, sell, or hold securities3. If these companies are making statements about growth while potentially engaging in practices that could be seen as anti-competitive, this could be a significant issue that needs to be disclosed.

Antitrust Concerns

The mention of potential collusion with Clayton Homes and private equity firms in the land lease community sector raises serious antitrust concerns. Antitrust laws are designed to promote competition and prevent monopolies. If companies are engaging in practices that stifle competition, this could lead to legal and regulatory scrutiny.

NerdWallet’s Coverage

It’s concerning if NerdWallet’s coverage of the manufactured housing industry is not addressing these critical issues. As a media outlet, NerdWallet should adhere to high journalistic standards, including thorough research and balanced reporting4. If they are missing out on important aspects of the industry, this could undermine their credibility.

Ethical Standards

The American Press Institute and the Society of Professional Journalists have established codes of ethical conduct that emphasize accuracy, fairness, and transparency. Media outlets should strive to meet these standards to maintain trust with their audience.

Broader Implications

If these issues are present in the manufactured housing industry, it raises questions about whether similar problems might exist in other sectors covered by NerdWallet and their affiliates. It’s crucial for media outlets to conduct thorough and unbiased reporting to ensure that their audience receives accurate and comprehensive information.

Would you like to explore any specific aspect further or discuss potential solutions to these issues?

Provide a summary of the items we covered from various vantage points that include consumers, smaller businesses, regulators that are trying to honestly instead of corruptly enforcing various laws and regulators, and what potential liability or legal exposure exists on the part of NerdWallet and their content partners?

Sure, let’s summarize the key points from various perspectives:

Consumers

- Affordability and Accessibility: Consumers face challenges in accessing affordable manufactured homes due to declining production and limited financing options.

- Misleading Information: There is concern that media coverage, such as NerdWallet’s, may not fully address the issues consumers face, potentially leading to misinformation3.

Smaller Businesses

- Market Competition: Smaller businesses in the manufactured housing industry may struggle to compete with larger firms, especially if there are antitrust violations or collusion among major players.

- Regulatory Compliance: Smaller businesses must navigate complex zoning laws and regulatory requirements, which can be more burdensome for them compared to larger companies.

Honest Regulators

- Enforcement of Laws: Honest regulators aim to enforce zoning laws and antitrust regulations to ensure fair competition and protect consumers.

- Challenges: Regulators face challenges in effectively enforcing these laws, especially when dealing with powerful industry players and complex legal landscapes.

Potential Liability and Legal Exposure

- NerdWallet and Content Partners: NerdWallet and its content partners could face legal exposure if they fail to meet journalistic standards, such as those set by the American Press Institute and the Society of Professional Journalists3.

- Antitrust Violations: Companies involved in the manufactured housing industry, including publicly traded firms like Cavco and Champion, could face legal action if found guilty of antitrust violations or collusion.

- Disclosure Requirements: Publicly traded companies must disclose material information to their shareholders, including any potential legal risks or antitrust issues.

Broader Implications

- Media Standards: If NerdWallet’s coverage is lacking in certain areas, it raises questions about the standards applied by other media outlets as well3.

- Industry Practices: The issues in the manufactured housing industry may reflect broader problems in other sectors, highlighting the need for thorough and unbiased reporting.

Would you like to delve deeper into any specific area or explore potential solutions to these challenges?

MHProNews Note: the 4 links from Copilot are those provided below.

- https://www.fanniemae.com/media/18721/display?form=MG0AV3

- https://manufacturedhousingassociationregulatoryreform.org/mharr-calls-on-hud-to-remove-zoning-placement-and-consumer-financing-barriers-to-manufactured-homes/?form=MG0AV3

- https://manufacturedhousingassociationregulatoryreform.org/hud-undertakes-study-proposed-by-mharr/?form=MG0AV3

- https://www.manufacturedhomepronews.com/the-rise-and-fall-of-hud-code-manufactured-housing-a-history-of-u-s-manufactured-home-production-by-year-1995-2022-and-2023-year-to-date-data-plus-mhville-markets-update/?form=MG0AV3

7)

Useful, but let’s dig deeper. I’d like to point out that in 2009 manufactured home production feel nearly 90 percent from its 1998 high, that was more like an 87 percent decline, but it has recovered since then. Production in 2024 is estimated to finish the year at around 100,000 new manufactured homes, instead of the 373,143 that were produced in 1998. So that would be roughly a 73 percent fall since its last high in 1998, correct? Next, given that several of the companies involved in the Manufactured Housing Institute are publicly traded, there are also questions that ought to be asked as far as the SEC disclosures of materiality to their shareholders, right? If companies such as Cavco (CVCO) or Champion (SKY-formerly called Skyline Champion) are making statements to shareholders that suggest that they are looking to grow their sales but they are in fact colluding with Clayton Homes and often private equity or institutional equity backed firms operating in the land lease community sector such as those which have been named in antitrust litigation, that too is a problem that has unmentioned by NerdWallet, right? If someone who is a writer for NerdWallet does even a reasonable Google search, they should find articles that link them to sites such as those you previously mentioned that will present them with a different take than the rosy one raised by apparently conflicted Lesli Gooch, right? It is hard to imagine how someone could have written an article that produced an article like the one being explored originally written by NerdWallet’s Abby Badach Doyle that misses all those rather prominent issues raised by more objective and analytical sources, right? Yet, if NerdWallet wants to be treated like serious media then they should be applying standards similar to what the American Press Institute of the Society of Professional Journalists Code of Ethical Conduct established, right? Unpack those because if this is happening in manufactured housing using NerdWallet what other similar problems might be occurring in other products being promoted by them and their affiliates?

Decline in Manufactured Home Production

You’re correct that manufactured home production has seen a significant decline since its peak in 1998. The drop from 373,143 homes in 1998 to an estimated 100,000 homes in 2024 represents a substantial decrease. This decline highlights the challenges faced by the industry over the years.

SEC Disclosures and Materiality

Publicly traded companies like Cavco and Champion are required to disclose material information to their shareholders. This includes any information that could influence an investor’s decision to buy, sell, or hold securities. If these companies are making statements about growth while potentially engaging in practices that could be seen as anti-competitive, this could be a significant issue that needs to be disclosed.

Antitrust Concerns

The mention of potential collusion with Clayton Homes and private equity firms in the land lease community sector raises serious antitrust concerns. Antitrust laws are designed to promote competition and prevent monopolies. If companies are engaging in practices that stifle competition, this could lead to legal and regulatory scrutiny.

NerdWallet’s Coverage

It’s concerning if NerdWallet’s coverage of the manufactured housing industry is not addressing these critical issues. As a media outlet, NerdWallet should adhere to high journalistic standards, including thorough research and balanced reporting. If they are missing out on important aspects of the industry, this could undermine their credibility.

Ethical Standards

The American Press Institute and the Society of Professional Journalists have established codes of ethical conduct that emphasize accuracy, fairness, and transparency. Media outlets should strive to meet these standards to maintain trust with their audience.

Broader Implications

If these issues are present in the manufactured housing industry, it raises questions about whether similar problems might exist in other sectors covered by NerdWallet and their affiliates. It’s crucial for media outlets to conduct thorough and unbiased reporting to ensure that their audience receives accurate and comprehensive information.

Would you like to explore any specific aspect further or discuss potential solutions to these issues?

8)

Provide a summary of the items we covered from various vantage points that include consumers, smaller businesses, regulators that are trying to honestly instead of corruptly enforcing various laws and regulators, and what potential liability or legal exposure exists on the part of NerdWallet and their content partners?

Consumers

- Affordability and Accessibility: Consumers face challenges in accessing affordable manufactured homes due to declining production and limited financing options.

- Misleading Information: There is concern that media coverage, such as NerdWallet’s, may not fully address the issues consumers face, potentially leading to misinformation.

Smaller Businesses

- Market Competition: Smaller businesses in the manufactured housing industry may struggle to compete with larger firms, especially if there are antitrust violations or collusion among major players.

- Regulatory Compliance: Smaller businesses must navigate complex zoning laws and regulatory requirements, which can be more burdensome for them compared to larger companies.

Honest Regulators

- Enforcement of Laws: Honest regulators aim to enforce zoning laws and antitrust regulations to ensure fair competition and protect consumers.

- Challenges: Regulators face challenges in effectively enforcing these laws, especially when dealing with powerful industry players and complex legal landscapes.

Potential Liability and Legal Exposure

- NerdWallet and Content Partners: NerdWallet and its content partners could face legal exposure if they fail to meet journalistic standards, such as those set by the American Press Institute and the Society of Professional Journalists.

- Antitrust Violations: Companies involved in the manufactured housing industry, including publicly traded firms like Cavco and Champion, could face legal action if found guilty of antitrust violations or collusion.

- Disclosure Requirements: Publicly traded companies must disclose material information to their shareholders, including any potential legal risks or antitrust issues.

Broader Implications

- Media Standards: If NerdWallet’s coverage is lacking in certain areas, it raises questions about the standards applied by other media outlets as well.

- Industry Practices: The issues in the manufactured housing industry may reflect broader problems in other sectors, highlighting the need for thorough and unbiased reporting.

Would you like to delve deeper into any specific area or explore potential solutions to these challenges?

- https://www.hud.gov/program_offices/housing/mhs/faqs?form=MG0AV3

- https://www.nerdwallet.com/article/small-business/limited-liability-partnership?form=MG0AV3

- https://www.nerdwallet.com/article/small-business/general-partnerships?form=MG0AV3

- https://www.justice.gov/atr?form=MG0AV3

Part II – Text from original article on NerdWallet (Note: Show this text SHOULD NOT be construed as an endorsement of NerdWallet, nor any person or organization they mention in their article).

Buying a Manufactured Home? Ask These 4 Questions First – NerdWallet

Buying a Manufactured Home? Ask These 4 Questions First

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Lead Writer

Lead Assigning Editor

With stylish features and floor plans, many of today’s manufactured homes break the old “mobile home” stereotype — without breaking the bank.

On average, new manufactured homes cost about a third of the price of site-built homes, reports the Manufactured Housing Institute, a trade group. Factory construction lowers material and labor costs, and a federal building code makes inspections more efficient.

Lesli Gooch, CEO of the MHI, says manufactured homes are an attractive choice for many buyers, from entry-level buyers to retirees.

“It’s affordable, but it’s also turnkey,” she says.

However, obstacles remain. In some cities, zoning restrictions limit or ban where manufactured homes can be placed. And it’s harder to find a mortgage for amounts below $150,000, so buyers have fewer lender choices for traditional financing.

On Jan. 6, the Consumer Financial Protection Bureau sued Vanderbilt Mortgage & Finance, alleging that the company trapped some borrowers in manufactured home mortgages they couldn’t afford. Vanderbilt Mortgage is a unit of Clayton Homes, the nation’s largest manufactured home builder.

In a statement, Vanderbilt Mortgage said their lending practices exceed legal requirements, and this lawsuit will deprive creditworthy borrowers of owning a home. “The CFPB’s lawsuit is unfounded and untrue, and is the latest example of politically motivated, regulatory overreach,” Vanderbilt said in the statement.

If you’re shopping for a manufactured home this year, ask these questions to shop smart and stay informed.

How much can I afford?

Manufactured homes are one of the lowest-priced home types on the market. In December 2024, the median listing price for a manufactured home was $159,500, compared to $420,000 for an existing single-family home, reports Realtor.com.

When it’s time to set your budget, no one knows your cash flow better than you do. It’s your responsibility — not a lender’s — to determine a monthly payment that works for you. Start with an online calculator to estimate how much house you can afford. For free or low-cost advice, find a housing counselor sponsored by the U.S. Department of Housing and Urban Development (HUD).

Pro tip: The onsite lender at the manufactured home dealer isn’t your only option to finance your home. It’s OK to shop around, and when you talk to a loan officer, you shouldn’t feel rushed or pressured to buy. Alys Cohen, senior attorney with the National Consumer Law Center, says to trust your gut.

“If you feel like you’re being talked into a mortgage you can’t afford, then you’re being talked into a mortgage you can’t afford,” she says.

Which type of loan is best for me?

Compare at least three lenders to understand your options and get the best interest rate. Want to delegate? Have a mortgage broker shop around on your behalf. (Brokers charge a fee, but can often negotiate a lower interest rate than you can find on your own.)

To finance a manufactured home, the two most common options are traditional mortgages (like conventional loans or FHA loans) and personal property loans. A traditional mortgage has stricter qualifications: Usually, the home must be titled as “real property,” which means you need to own the land underneath and attach the home to a permanent foundation. But average interest rates are lower with a mortgage, and you’ll have more options if you struggle to make payments.

Personal property loans, sometimes called chattel loans, aren’t secured by the land. Since most manufactured homes come titled as “personal property,” chattel loans can be more convenient to get. But with higher interest rates, the cost of borrowing is generally more expensive. FHA Title I loans, backed by the Federal Housing Administration, are a type of personal property loan to finance a manufactured home, lot or both.

With a traditional mortgage, a lender must send you a copy of your Closing Disclosure at least three days before your closing date. If numbers on the final paperwork look different than what you agreed to, that’s a red flag, says Cohen.

“It should be worrisome if they say, ‘Oh well, we’ll just fix that later,’ or, ‘We didn’t really mean that,’ or, ‘We can just get you a new loan later to fix that problem — just sign here today,’” she says.

Will I own or lease the land underneath?

You may have heard that all manufactured homes lose value over time, like a car. But today, that’s not always the case. When you keep up with maintenance and repairs, a manufactured home can grow in value similar to a site-built home. In 2024, the national median price per square foot for a manufactured home climbed 1.2%, while the median price per square foot of a single-family home climbed 2.5%, reports Realtor.com.

However, a manufactured home can lose value when you don’t (or can’t afford to) keep up with maintenance — especially if you don’t own the land underneath. While land ownership is a strong predictor of appreciation, there’s less upfront cost to buy a unit in a land-lease community, says Dave Anderson, executive director of the National Manufactured Home Owners Association.

“Leasing land instead of buying it can hugely increase the affordability,” he says.

Affordable housing can be hard to find in rural areas or small towns, so a land lease might be the best option. For low-income families, owning a home on a leased lot can offer more stability than renting an apartment.

If that’s the best fit for your financial situation, do your research to make sure the community is well-managed. Are the roads and public utilities in good shape? Is there a history of tenant complaints or lawsuits? Your state attorney general’s office should have a consumer guide on your rights as a tenant of a manufactured home park, Anderson notes.

Am I ready for the responsibility of homeownership?

The cost of homeownership doesn’t end with the mortgage. Leave some wiggle room in your budget for ongoing expenses like taxes, insurance and maintenance.

One plus, Gooch notes: With their excellent energy efficiency, manufactured homes tend to have a shorter to-do list when you move in.

“People today don’t have time to go buy the fixer upper that’s old and drafty and really expensive,” she says. “And in the end, they don’t have the money to fix it up.”

If you do your research and stick to your budget, a manufactured home can be a smart way to get well-crafted construction at a lower cost.

“It’s not Grandma’s trailer, right?” Gooch says. “These are quality, resilient homes.”

There is more but that sets the stage. Note the difference between that and the Society for Professional Journalism (SPJ) Code of Ethical Conduct standards or those of the American Press Institute (API). Note the illustration below was a fact check of an NBC News report.

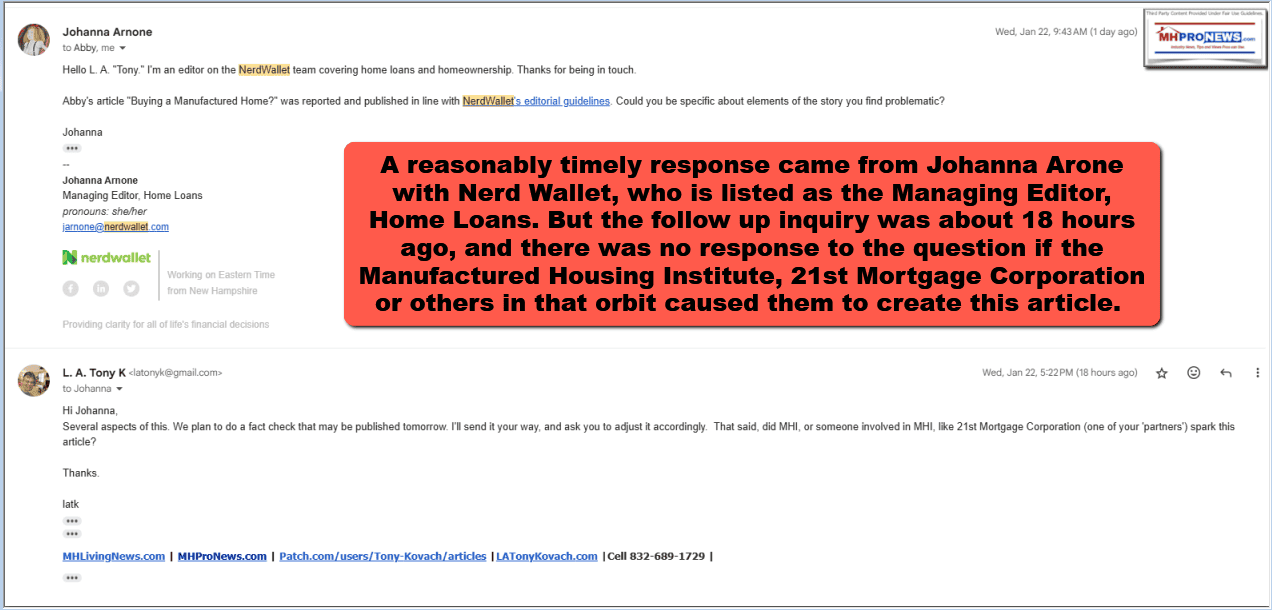

f) As of 11:32 AM ET there was no further follow up from NerdWallet’s editor.

A reasonably timely response came from Johanna Arone with Nerd Wallet, who is listed as the Managing Editor, Home Loans. But the follow up inquiry was about 18 hours ago, and there was no response to the question if the Manufactured Housing Institute, 21st Mortgage Corporation or others in that orbit caused them to create this article.

| from: | L. A. Tony Kovach (for MHProNews.com) | ||

| to: | Johanna Arnone @nerdwallet.com> |

||

| date: | Jan 22, 2025, 5:22 PM | ||

| subject: | Re: Johanna Arnone, per Abby’s auto reply Fwd: Abby, media outreach about your NerdWallet article on manufactured housing. |

Hi Johanna,

g) With no email follow up to the above the following email was sent to specific Manufactured Housing Institute (MHI) linked leaders, their outside attorney David Goch, Tim Williams with the 21st Mortgage Corporation, and others as shown.

| from: | L. A. Tony Kovach for MHProNews. | ||

| to: | William “Bill” Boor @cavco.com |

||

| cc: | Tim Williams @21stmortgage.com Lesli Gooch @mfghome.org David Goch @wc-b.com |

||

| Various industry attorneys, some MHI members, and people on the PESP staff were BCC’d. | |||

| date: | Jan 23, 2025, 9:18 AM | ||

| subject: | Bill, Tim, Lesli, and David, media outreach on NerdWallet issue |

—

L. A. “Tony” Kovach

Managing Member

LifeStyle Factory Homes, LLC

DBAs:

MHLivingNews.com| MHProNews.

Connect on LinkedIn:

h) If NerdWallet even did a basic Google or other web search this is what they would likely see. Yet, none of the many controversies that Lesli Gooch, the Manufactured Housing Institute (MHI), and their members are a part of exposed in that Patch item linked here are found in their article. If they read that it would, or should, have led to a vastly different style of article than what they posted. Meaning, it calls into question their self-promotional claims.

3) MHProNews plans to do a follow up on this issue, perhaps including on the Patch. MHProNews will reach out to the same parties as before, to give them a chance to weigh in, or in the case of NerdWallet, a chance to remove or revise their content. Stay tuned.

MHProNews Notice. At least one update to this article is planned, hopefully before close of day. Check back for the latest.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’