“NAHB represents more than 140,000 members who are involved in building single-family and multifamily housing, remodeling and other aspects of residential and light commercial construction,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB). “NAHB’s members, most of whom build 10 or fewer homes per year, construct approximately 80% of all new housing in the United States each year,” Huey told members of the House Financial Services Committee Subcommittee on Housing and Insurance on 7.14.2023. It was the same hearing the Cavco Industries (CVCO) CEO William “Bill” Boor testified to the same Congressional subcommittee on behalf of the Manufactured Housing Institute (MHI). Note that NAHB has more members than the entire manufactured housing industry built nationally in 2022. As the Manufactured Housing Association for Regulatory Reform (MHARR) reported in “2022…cumulative production of 112,882 homes, a 6.7% increase over the 105,772 homes produced during 2021.” An examination of the testimony of NAHB’s Chair Huey will shed light on the housing market in general and several issues facing manufactured housing too.

Part I of today’s report will be NAHB Chair Alicia Huey’s testimony. The highlighting is added by MHProNews, but should not keep readers from looking at everything Huey said. Her testimony is packed with insights, some of which are arguably more relevant to understanding housing market dynamics better, some of which are more impactful to manufactured housing.

Part II will link Cavco Industries (CVCO) Bill Boor’s testimony on behalf of the Manufactured Housing Institute (MHI) to the same House subcommittee Huey addressed last Friday.

Part III will be additional information with more MHProNews analysis and commentary. (Note: the 5Ls, shown in the graphic from Freddie Mac below, are referenced by Huey in her testimony.)

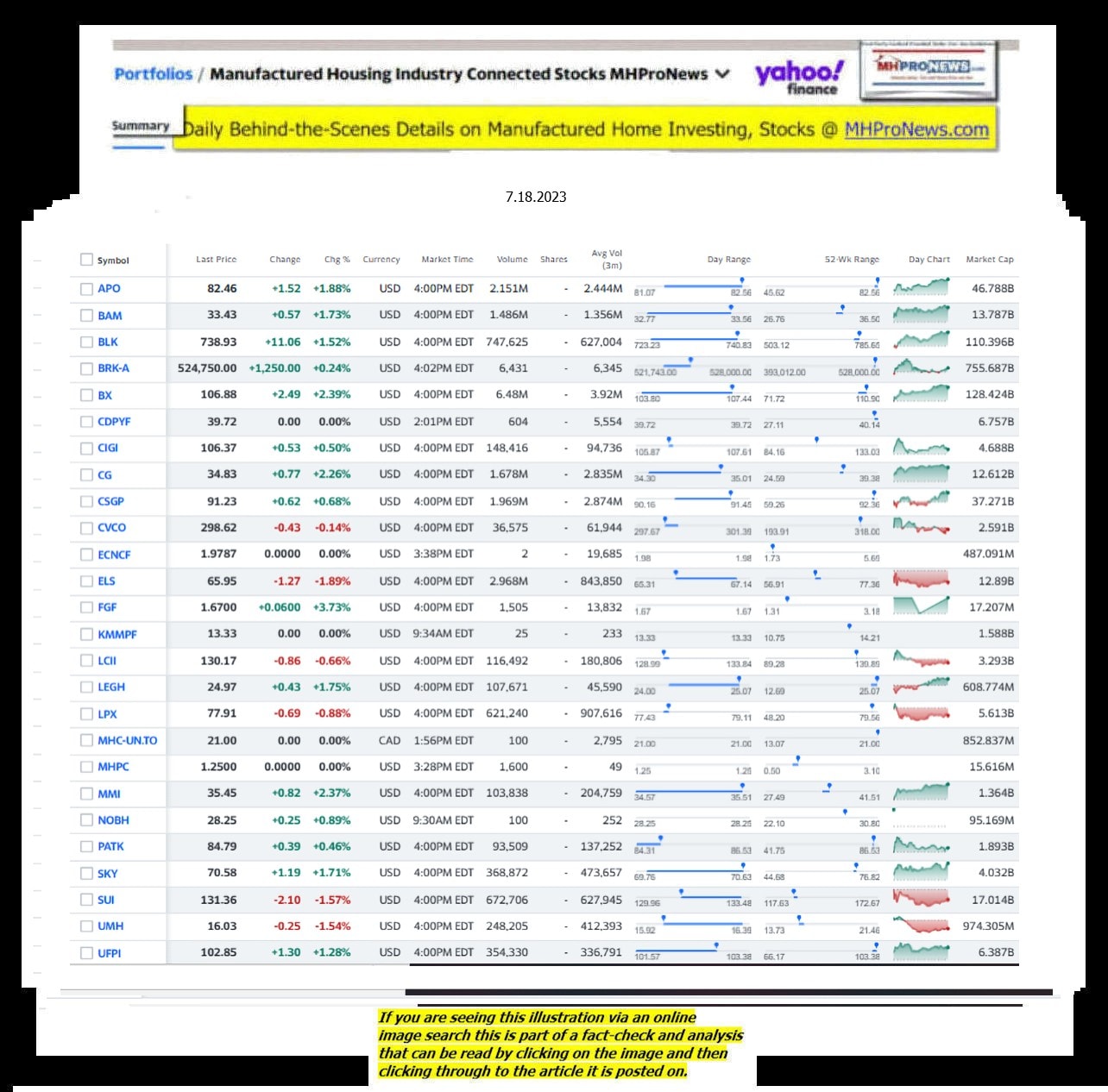

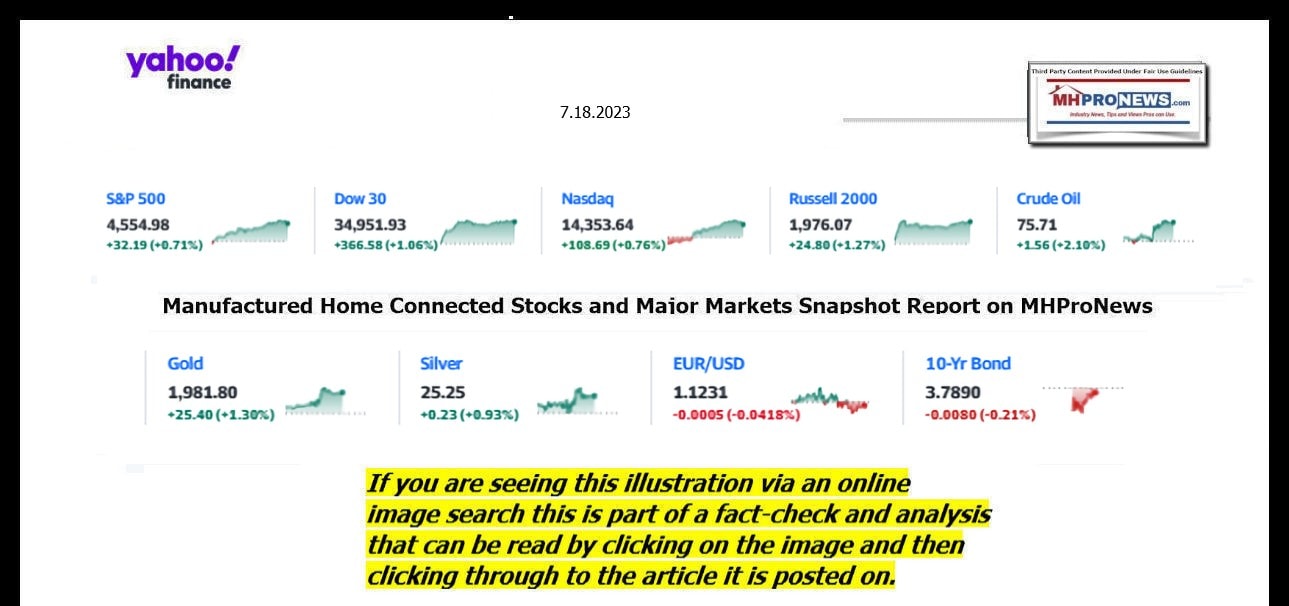

Part IV will be our Daily Business News on MHProNews’ manufactured housing industry connected stocks in a snapshot at the closing bell form, along with our signature left (CNN) right (Newsmax) headlines at a glance.

Part I – Testimony of Alicia Huey on Behalf of the National Association of Home Builders Before the House Financial Services Committee Subcommittee on Housing and Insurance Hearing on “How Mandates Like ESG Distort Markets and Drive Up Costs for Insurance and Housing” July 14, 2023.

Introduction

Chairman Davidson, Ranking Member Cleaver and members of the subcommittee, I am pleased to appear before you today on behalf of the National Association of Home Builders (NAHB) to share our views on how burdensome government regulations and mandates, promoted by government support for Environmental, Social and Corporate Governance (ESG) policies, impact our industry’s ability to increase the production of quality, affordable housing. My name is Alicia Huey, and I am NAHB’s 2023 Chairman of the Board of Directors and a custom home builder and developer from Birmingham, Ala.

NAHB represents more than 140,000 members who are involved in building single-family and multifamily housing, remodeling and other aspects of residential and light commercial construction. NAHB’s members, most of whom build 10 or fewer homes per year, construct approximately 80% of all new housing in the United States each year.

Considerations of ESG have become more mainstream over the past few years as a way to assess the environmental and social risks faced by companies and direct investment strategies for major corporations, fiduciaries, and financiers. There currently is no federal framework for regulating ESG, yet a growing number of policies have been emerging over the past several years at the federal, state and local levels to do just that. Most of these policies focus on disclosure of ESG risks and risk mitigation, and most limit the requirements to the largest companies. The U.S. Securities and Exchange Commission, for example, requires public companies to disclose “material” financial risks and in March 2022, proposed amendments to the Securities Act of 1933 and the Securities and Exchange Act of 1934 that would require registrants to provide certain climate-related information in their registration statements and annual reports. In addition, many organizations voluntarily disclose their ESG risks to foster public trust and transparency and/or establish themselves as sustainable and/or socially responsible in the marketplace.

NAHB’s typical members build 10 or fewer homes a year and operate as traditional small businesses, so most currently are not directly impacted by ESG investing decisions. However, as ESG considerations are given more credence in the various “whole of government” approaches to address climate change and other social issues, they are becoming increasingly relied upon to justify regulatory actions. As a result, government support of, and encouragement for, ESG policies are more and more likely to have a direct impact on housing production and affordability.

As ESG policies are implemented and mature over time, the nation’s home builders are concerned about the far-reaching impacts and how we will be challenged to comply. ESG policies already have caused insurance companies to drop out of some areas and raise rates in others. Lenders are being urged to minimize the risks associated with their portfolios, causing concern they may cease lending in certain locations or increase their borrowing rates. Likewise, small businesses doing business with publicly traded companies may eventually be required to provide their ESG risk data to those larger companies. As supply chain woes continue to stifle residential construction projects across the nation, we worry that ESG disclosure requirements could further impede or prevent availability of needed building supplies and/or transportation to their required destinations.

Most of NAHB’s small business members live in the communities in which they build. They are stewards of the environment, hire local workers, provide housing at a diversity of price points, run their businesses in responsible ways and make positive contributions to the social and economic fabric of their towns. But government regulations continue to make it more and more difficult for them to meet their goals and any ESG-related mandates will make providing affordable housing and running profitable businesses even more difficult. Small businesses are not equipped to deal with ESG paperwork and reporting obligations or further delays to their projects. They are family-operated businesses that generally lack in-house counsel or compliance experts. Given the uncertainties surrounding risk disclosures, recordkeeping protocols and even the lack of standards measurement metrics, our members are concerned about future compliance requirements. Placing additional reporting obligations on an already tight regulatory regime and/or further limiting the availability of property insurance will add costs and inefficiencies to the home building process, delay closings and increase home prices and rents to home buyers, homeowners, and renters.

The nation is experiencing a housing affordability crisis and there already are significant challenges to addressing that concern. Now is not the time to create or support additional regulations that add more uncertainty, delays and costs to the home building process.

Housing Affordability and the Need for Additional Supply

Safe, decent and affordable housing provides fundamental benefits that are essential to the well-being of families, communities and the nation. For these reasons, housing affordability is NAHB’s top advocacy issue. NAHB’s research shows that housing affordability in the single-family market is at its lowest level since NAHB began tracking it on a consistent basis in 2012. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), just 45.6% of new and existing homes sold between the beginning of January and end of March 2023 were affordable to families earning the U.S. median income of $96,300[1]. Clearly, owning or renting a suitable home is increasingly out of financial reach for many households. According to Harvard’s Joint Center for Housing Studies, in 2020, the nationwide share of cost-burdened households paying more than 30% of their incomes for housing stood at 30%. Moreover, 14% of all households were severely burdened and were spending more than one-half of their incomes for shelter[2].

As a nation, we can and must do better. All home buyers and renters in America should have a choice in securing safe, decent and affordable housing where they want to live. America’s workforce families, including members of the armed forces, teachers and first responders, should be able to afford to live in homes or apartments in the communities they serve. NAHB strongly believes that increasing the inventory of new single-family and multifamily housing is key to improving housing affordability. However, the lack of housing supply is not the only factor impacting housing affordability. Government policies and regulations, including those put in place to support and promote ESG, are making it harder and harder for home builders and multifamily developers to build housing that is affordable.

Impact of Regulation on the Cost of Housing

Home building is subject to a wide array of regulatory costs that may be imposed by any combination of federal, state and local governments. These costs include those associated with complying with federal labor and environmental regulations, building codes and standards, local zoning ordinances, as well as fees imposed at different stages of the development and construction process. And these costs are not insignificant. An NAHB study on regulatory burdens shows that approximately 24% of the price of a typical newly–built single–family home is due to the broad set of regulatory burdens imposed by state, local and federal governments[3]. Moreover, between 2011 and 2016, such costs increased by 29%, faster than inflation and economic growth. Such burdens are high for apartment construction as well, as an updated joint study by NAHB and the National Multifamily Housing Council conducted in June 2022 found that up to 41% of apartment development costs are due to regulations [4].

Regulatory costs have a direct and negative effect on housing affordability. NAHB’s “Priced Out” Estimates for 2022 show that 117,932 households would be priced out of the housing market if the median U.S. new home price rises by $1,000.[5] As a benchmark, 87.5 million households (roughly 69% of all U.S. households) are not able to afford a median-priced new home. Similarly, an analysis using 2018 data found that a $1,000 increase in the cost of building a new rental unit will price out almost 20,000 renters for that apartment.[6]

NAHB Urges Action

Increased regulations, building code requirements, mortgage interest rates, and insurance premiums for homeowners’ coverage, among other things, add significant costs to homes and further harm housing affordability. To mitigate this housing affordability crisis, NAHB continues to urge both Congress and the Administration to address the primary factors limiting builders’ ability to increase the supply and affordability of new housing. These factors can be summarized as the five L’s: lack of labor, lack of lots and land, lumber and materials shortages, lending challenges, and finally laws and regulatory burdens. While there is no silver bullet, rather than further incentivizing and supporting ESG policies that unnecessarily add to the regulatory burdens home builders already face and further impede the ability of our industry to increase the supply of affordable housing nationwide, NAHB urges Congress to pass legislation to alleviate these regulatory burdens and let the market forces determine how best to incorporate ESG considerations into the residential sector.

Government Mandates and Regulations Impacting the Home Building Industry

Residential construction is one of the most heavily regulated industries in the country. The time and cost invested in complying with regulations impacts a business’s ability to thrive and grow; they also can negatively affect housing affordability and stifle economic development. As noted above, in these challenging economic times, the decrease in housing production and increase in price clearly indicate the need to reduce the regulatory burden on the housing industry.

Residential construction is one of the few industries in which a government-issued permit typically is required for each unit of production. Additional rules create a constricting web of regulatory requirements that affect every aspect of the land development and home building process and add substantially to the cost of construction. The breadth of these regulations is largely invisible to the home buyer, the public, and even the regulators themselves. Nevertheless, they have a profound impact on housing affordability and prevent many families from becoming homeowners.

While onerous building regulations historically have stemmed from legislation such as the Clean Water Act, the Endangered Species Act, the Energy Policy Act, the Occupational Safety and Health Act, the Fair Housing Act, and the Safe Drinking Water Act, government regulators are increasingly citing the need for new or revised regulations to address ESG considerations. Indeed, this Administration’s focus on climate change, social justice, energy efficiency and labor unions all fit within the broader parameters of ESG. Overreliance on ESG factors often ignores the central tenets of consumer choice, market needs and project feasibility, key considerations that are central to small home building businesses.

While many actions have been taken over the past few years to insert ESG considerations into federal policies and regulation, the following are particularly concerning to home builders:

- Building Energy Codes

Recent legislation uses the lure of federal dollars to pressure state and local governments into implementing unnecessary ESG policies and regulations, which will drive up housing prices across the country. The Inflation Reduction Act provides $1 billion in grants for state and local governments to adopt costly and restrictive energy codes, such as the 2021 International Energy Conservation Code (IECC). While NAHB supports the adoption of cost-effective, modern energy codes, we oppose any federal funding that prohibits jurisdictions from adopting amendments to the energy code to accommodate local conditions and address cost-effectiveness concerns.

Forcing the adoption of costly and restrictive energy codes to qualify for these grants will exacerbate the current housing affordability crisis and limit energy choice for consumers. Adoption of the 2021 IECC can add as much as $31,000 to the price of a new home yet can take as long as 90 years for the homeowners to see a payback from this investment. Implementation of these grants will result in fewer families being able to achieve the American dream of homeownership.

It is not just the lure of federal funding that is being used to force the implementation of costly and unnecessary energy codes, as the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) are considering requiring the 2021 IECC for virtually all new construction supported by HUD and USDA. Such mandates will have an especially negative impact on historically underserved communities and first-time homebuyers, two of the very groups these agencies seek to support and who are highly sensitive to price fluctuations at the low- to midprice range of the housing market. Builders also face major hurdles under this proposal, including finding qualified inspectors and complying with a patchwork of building standards.

- Electrification and Gas Stoves

Concerns about the impacts of climate change have compelled policymakers at all levels to look for ways to cut greenhouse gas emissions (GHG) across all sectors of the U.S. economy. While there are many ways to achieve GHG reductions, many communities have pointed to ESG policies to gain support to pass laws or ordinances that effectively ban the use of natural gas and propane within new construction and existing homes. These efforts are concerning for several reasons. First, because new construction is already significantly more energy efficient than the existing housing stock, any GHG emissions reductions gained through electrifying new construction would be far less than reductions gained by improving the energy efficiency of existing homes.

Second, although electrification may provide benefits in certain applications, electrification mandates can be costly and infeasible in some areas of the country and create challenges for builders, homeowners and consumers. For example, due to performance limitations of electric heat pumps in colder climates, the continued use of fossil fuel may be the only feasible option in certain circumstances and locations. Likewise, because electrification can result in both increased first costs and higher utility bills, electrification may place additional burdens on the consumer. A study conducted by the Home Innovation Research Labs in 2021 found that the additional up-front cost to build an all-electric house (as compared to a house with natural gas equipment and appliances) ranged from $3,832-$15,100 depending on climate zone.[7] Importantly, these estimates do not include fees for upgrading electric service or providing community electric infrastructure, which can be substantial.

Finally, electrification policies can adversely impact consumer choice. The recent efforts by federal agencies to consider limiting access to gas stoves ignore consumer preferences and pocketbooks. As home builders, we believe our customers have a right to choose the appliances and energy sources used in their homes. Over 187 million Americans currently use natural gas appliances, saving them an average of $1,068 each year. Gas stoves are used in nearly 40 million homes nationwide and have proven to be a safe, efficient and affordable appliance choice for families for well over a century. The current push to regulate gas stoves will result in negligible health, safety and energy outcomes, but will drastically limit the ability of homeowners to install and use gas stoves in their homes and enjoy the cost savings that come with their use in some areas of the country.

- Transformer Standards

The Department of Energy (DOE) has proposed a new rule to increase energy efficiency standards for distribution transformers. The timing of this proposed rule could not be worse and is certain to make an already bad situation worse. If finalized as proposed, manufacturers will be forced to retool production lines to produce new transformers instead of addressing the historic backlog that is hampering development across the country.

Transformers are an essential part of the electrical grid bringing power to homes and businesses. Homes cannot be sold unless a transformer is installed and working, and power is being sent to the home. For the past few years, lead times to obtain transformers have remained stubbornly long, ranging anywhere from 18 to 24 months as global supply chains continue to heal in the wake of the COVID-19 pandemic. Delays in transformer availability and installation are completely halting home building projects in many areas and frustrating recovery efforts in those affected by natural disasters. In addition, for the home building business, delays result in additional costs.

DOE’s proposed rule is particularly troubling because it would dictate that manufacturers increase the efficiency of distribution transformers by a mere one-tenth of a percentage point even though the agency already mandates distribution transformers be manufactured to incredibly high efficiency standards. Importantly, due to the intricate ways transformers are designed and assembled, increasing their efficiency even by a fraction of a percentage point could add months to an already lengthy order-cycle. Additionally, the proposed rule would require manufacturers to transition to a different type of steel, which is largely untested, less flexible and more expensive. The existing supply of this alternative steel is very limited and mostly foreign-sourced.

Energy efficiency standards play an important role in reaching decarbonization benchmarks while transitioning our nation to a clean and increasingly electrified economy. However, as proposed, the rule would delay the realization of these benefits while at the same time exacerbating the current distribution transformer shortage crisis at the expense of housing affordability.

- Waters of the U.S.

Home builders and developers remain in a state of regulatory uncertainty regarding the scope of federal jurisdiction over waters of the United States (WOTUS) under the Clean Water Act (CWA). On May 25, 2023, the Supreme Court ruled in Sackett v. Environmental Protection Agency (EPA) that the test the agencies were using to define federal authority was too broad and therefore was impermissible. Since then, the U.S. Army Corps of Engineers (Corps) has simply stopped processing requests for approved jurisdictional determinations (AJDs) while the districts await guidance from Corps’ headquarters on how to proceed. Halting AJDs leads to permitting delays and places another barrier on the nation’s home builders’ ability to provide safe, decent and affordable housing.

The agencies have stated they will provide a new regulatory definition of WOTUS by September 1, 2023, but until then, do not intend to lift the nationwide suspension of AJDs or provide any interim guidance. Land acquisition, permit processing and home building cannot be paused until September 1; landowners desperately need the agencies to issue interim guidance.

A healthy housing market is critical to a strong and vibrant U.S. economy, and it is contingent upon EPA and the Corps moving forward quickly and affirmatively to clarify the scope of federal CWA jurisdiction and restart the Section 404 approval processes. Sackett established clear, bright lines concerning which aquatic features are not jurisdictional under the CWA. Home builders and the construction industry desperately need clear rules to protect our nation’s waterways and environment while allowing the economy to move forward.

- Intersection of the National Flood Insurance Program and the Endangered Species Act

Home builders and developers in California recently learned that the Federal Emergency Management Agency (FEMA) would suspend its issuance of letters of floodplain map revision based on fill under the National Flood Insurance Program (NFIP) across 38 counties in California on July 1, 2023. This suspension impacts countless residential construction, transportation infrastructure, and other planned activities occurring within areas mapped by FEMA as being within the 100-year floodplain and potentially puts at risk tens of thousands of new housing units. For example, NAHB members from the greater San Francisco Bay area reported over 6,400 planned single-family homes, as well as nearly 800 affordable housing units, that would be impacted. While suspending aspects of the floodplain mapping program does not prohibit NAHB members from building new residential units, even a temporary suspension of FEMA’s floodplain mapping can have significant economic impacts upon home builders, prospective homebuyers and renters alike.

FEMA’s decision to suspend processing certain map change requests is the result of a confidential legal settlement between FEMA and environmental advocates who claimed that the simple act of revising floodplain maps negatively impacts federally protected species or their designated critical habitat under the Endangered Species Act (ESA). NAHB disagrees. FEMA has nationwide policy that requires individuals seeking these revisions to first provide FEMA with documentation that their planned activity either has no impact upon endangered species or they have already met the necessary ESA requirements. That should be sufficient to satisfy any landowners’ ESA obligations.

What makes this issue even more troubling is that FEMA has publicly acknowledged this will be a multiyear suspension while FEMA “consults” with the U.S. Fish and Wildlife Service (USFWS) and the National Marine Fisheries Services (NFMS). A similar process in Washington State took over six years to complete, while in neighboring Oregon, over a decade has passed since FEMA initiated ESA consultation. Importantly, unlike what is occurring in California, FEMA did not suspend the processing of requests in Oregon or Washington or make any changes to the NFIP while it was engaged in the ESA consultation process.

Requiring home buyers to purchase flood insurance for a home purposefully built out of the flood zone will have significant economic impacts. Requiring these home buyers to buy insurance when they do not need it only puts the American Dream of owning a home further out of touch.

- Rent Control

NAHB multifamily members are apartment builders, owners and managers who generally operate small businesses. They strive to provide quality, well-maintained and well-managed apartment communities, but doing so is becoming more difficult due to the growing number of ESG-related federal proposals and mandates, such as those included in the White House Blueprint for a Renters Bill of Rights,[8] which are directed at the rental and management policies of privately-owned conventional apartments.

Many of these proposals, particularly with respect to eviction diversion programs, are intended to extend temporary measures implemented during the COVID-19 pandemic. While many of the initiatives proposed in the blueprint are still under consideration and have not been implemented at this time, nevertheless, NAHB is gravely concerned that federal intervention — either directly by statute/regulation or indirectly through pressure on the Government Sponsored Enterprises to adopt specific lease terms or impose various controls on rents and/or fees, eviction proceedings and tenant screening or federal “source of income protection” laws — will have negative unintended consequences that discourage private sector participation in the conventional rental market.

Apartment owners and managers already are subject to a myriad of tenant protection and fair housing statutes, regulations, administrative policies and case law from all levels of government; additional federal rent and management policy restrictions on private, conventional apartment operations are unnecessary, unwise, and may also jeopardize the financial safety and soundness of the properties.

For example, multifamily properties are underwritten to operate off of the rents. Rent control policies, including those that would cap the percentage of annual rent increases, create disincentives to new supply and insurmountable hurdles to keep pace with operating and maintenance costs. Because such government policies are so disruptive, builders avoid working in jurisdictions with rent control policies in place.[9]

- Property/Casualty Insurance

Due to increasing perceived risks and pressure to address ESG, among other reasons, many private insurance companies are denying the sale of new property and casualty insurance policies, declining to renew existing coverages, and/or drastically raising policy rates in certain states. To make matters worse, reinsurance companies are rapidly increasing the costs of insurance for insurance companies on all lines of coverage due to recent national and global disasters, burgeoning bureaucratic expenses and to make up for reduced participation. Taken together, it is becoming increasingly more difficult for both existing and potential new homeowners to secure available and affordable insurance, which is impacting the ability of our members to sell their homes.

Certain borrowers are required to obtain and maintain homeowners’ insurance as a condition of their mortgages. The inability to purchase or maintain policies because of unaffordable rate hikes or insurance companies declining to renew policies is becoming a growing issue that is impacting housing affordability and the ability of many to become homeowners. Although insurance is regulated at the state level, NAHB believes the federal government has an obligation to ensure insurance is available and affordable in all areas of the country. Indeed, the Federal Insurance Office (FIO) within the U.S. Department of the Treasury is charged with monitoring all aspects of the insurance sector, including the extent to which underserved communities have access to affordable insurance products. Clearly, solving the insurance issue is an important and key aspect of addressing the housing affordability challenge.

Conclusion

Thank you, Chairman Davidson and Ranking Member Cleaver for convening this important hearing and allowing NAHB to share our views on how burdensome government regulations and mandates, promoted by . NAHB stands ready to work with you and members of the subcommittee to achieve thoughtful, effective policies to address these concerns and expand the availability of affordable housing for all Americans.

Footnotes;

[1] https://www.nahb.org/news-and-economics/press-releases/2022/11/housing-affordability-falls-to-more-than10-year-low-as-rising-interest-rates-take-a-toll

[2] https://www.jchs.harvard.edu/sites/default/files/reports/files/Harvard_JCHS_State_Nations_Housing_2022.pdf

[3] https://eyeonhousing.org/2021/05/regulation–now–accounts–for–93870–of–the–average–new–home–price/

[4] https://www.nahb.org/news–and–economics/press–releases/2022/06/new–research–shows–regulations–accountfor–40–point–6–percent–of–apartment–development–costs

[5] https://www.nahb.org/–/media/05E9E223D0514B56B56F798CAA9EBB34.ashx .

[6] Based on the 2018 median rent of $2,189, a $1000 increase in the cost of building a new apartment unit would price out 19,617 renters.

[7] Home Innovation Research Labs, Cost and Other Implications of Electrification Policies on Residential Construction, February 2021. https://www.nahb.org/-/media/NAHB/nahb-community/docs/committees/construction-codes-and-standards-committee/home-innovation-electrificationreport-2021.pdf

[8] White House Domestic Policy Council and National Economic Council, Blueprint for a Renters Bill of Rights, January 2023. https://www.whitehouse.gov/wp-content/uploads/2023/01/White-House-Blueprint-for-a-RentersBill-of-Rights.pdf

[9] Paul Emrath, National Association of Home Builders (NAHB) Caitlin Sugrue Walter, National Multifamily Housing Council (NMHC), Regulation: 40.6 Percent of the Cost of a Multifamily Development, June 9, 2022, page 4. (Accessed at special–study–regulation–40–percent–of–the–cost–of–multifamily–development–june–2022.pdf (nahb.org) 7/10/23).

Part II – Written Testimony of William “Bill” Boor Chief Executive Officer Cavco Industries, Inc. Vice-Chairman Manufactured Housing Institute Before the: U.S. House of Representatives Committee on Financial Services Subcommittee on Housing and Insurance Hearing Entitled: “How Mandates Like ESG Distort Markets and Drive Up Costs for Insurance and Housing”

See that in full detail plus expert analysis at this link below.

Part III – Additional Information with More MHProNews Analysis and Commentary

What NAHB has said publicly are consistent with what MHARR has said publicly and privately about the NAHB’s willingness to fight to stop the “adopt[ion of] costly and restrictive energy codes, such as the 2021 International Energy Conservation Code (IECC).” What MHI has started, but which MHARR, MHI affiliate TMHA, and some others have indicated that MHI is signaling that they are waffling on continuing to press their litigation against the DOE. This despite the fact that MHI’s own attorneys have argued that the DOE rule could cause “irreparable harm” to manufactured housing. Yet that 2021 IECC standards is what the NAHB is strongly opposed to for their far costlier site-built housing.

NAHB may have done manufactured housing independents and affordable housing advocates several possible favors through these remarks. That said, there are also points of concern, as some of NAHB Chairman Huey’s comments are (from their perspective) understandably focused on their own members. Note that while MHI likes to talk about their ‘coalition partners’ in conventional housing, there is no such similar nod by the NAHB toward MHI. This despite the fact that NAHB and MHI were addressing similar issues.

Huey pointed out the link between ESG on Democratic policies that are driving up costs on insurance, appliances, rental costs, and more. While Huey doesn’t say “Democratic” she did point to the years that the Obama-Biden Administration was in office, and she also pointed to the ‘current’ administration, which are Democrats. Facts are what they are, and it makes the point that MHProNews raises in a related report by MHProNews at this link here.

Elections have consequences.

Policies have consequences.

Huey pointed to a legal action that MHProNews may probe in a possible upcoming report.

In summary, Huey underscored points MHLivingNews and MHProNews have made several times, including in reports like the one linked below.

Without claiming expertise in NAHB association politics, Huey’s point that 80 percent of their builders are ‘small’ builders that build 10 or fewer homes a year ought to cause manufactured housing professionals to lean in to learn more. How so? Because currently, MHI’s ‘big three’ are about 80 percent of the U.S. manufactured housing market, the inverted ratio that Huey says is true of NAHB membership production. To grasp the issues related to that more deeply, see report linked below.

Part IV. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 7.18.2023

- Thread’s newest features

- Meta’s Twitter rival app rolls out its first batch of updates since its launch. Here’s what’s what we know

- The battle for the ‘Taco Tuesday’ trademark is over

- Babies R Us was gone for good. Now it’s back with a new US flagship store

- Americans aren’t rebuilding their savings fast enough

- BlackRock made a climate pledge. Then it appointed a Saudi oil executive to its board

- Target workers can now wear shorts

- Microsoft unveils more secure AI-powered Bing Chat for businesses to ensure ‘data doesn’t leak’

- UN Secretary General embraces calls for a new UN agency on AI in the face of ‘potentially catastrophic and existential risks’

- Amazon and Apple fined $218 million by Spain antitrust watchdog

- AI is a concern for writers. But actors could have even more to fear

- In-N-Out bans mask wearing for employees in some states

- Retail sales rose in June for third straight month

- Peacock is getting its first-ever price hike

- Top economists urge bolder action on ‘crisis of extreme inequality’

- ‘Elusive’ Apple iPhone from 2007 sells for $190,000

- US startups are having a bad year. Relief isn’t coming

- Tesla directors will return $735 million to company to settle shareholder suit

- Biden administration announces new labels for gadgets that are less vulnerable to cyberattacks

- Indian tech giant Wipro will invest $1 billion in AI, including training all staff

- Higher food prices and more hunger: Collapse of Black Sea grain deal poses a massive threat

- Evergrande posts losses of $81 billion over two years as it reports long-delayed results

- Fox News’ new prime time lineup shows Rupert Murdoch can’t quit Trump

- The Fed is debating getting rate hikes out of the way sooner

Headlines from right-of-center Newsmax 7.18.2023

- Trump Says He Expects to Be Indicted in 1/6 Attack Probe

- Former President Donald Trump’s legal complications continue to mount. Strikingly, his lead over rivals for the Republican presidential nomination continues to grow despite those other troubles. (AP)

- Trump said he received a letter from Special Counsel Jack Smith on Sunday stating that he’s a target of the probe into Jan. 6, when protesters stormed Congress, many of them intent on preventing certification of Democrat Joe Biden’s 2020 election victory. “Deranged Jack Smith, the prosecutor with Joe Biden’s DOJ, sent a letter … stating that I am a TARGET of the January 6 Grand Jury investigation,” Trump said in a post on his Truth Social platform. [Full Story]

- Alford: New $1.3B Ukraine Package ‘Goes Against Congress’

- Goya CEO: ‘Hand of God’ All Over ‘Sound of Freedom’ Film | video

- Nikki Haley: Country Must Move Past Trump’s Legal Woes | video

- Lawyer in N.Y. Serial Killings: Families Got Taunting Calls | video

- Kustoff: Jayapal Can’t Take Back ‘Racist’ Israel Comment | video

- Comer: Media Attacking Biden Probe Despite ‘Hard Evidence’ | video

- Boebert: Name-Calling Dems Should Call GOP ‘The Majority’ | video

- Dean Cain: Actors Fight for Better Residuals, Against AI | video

- Lara Trump: Left Flops in Labeling MAGA ‘Extremist’ | video

- Phoenix Hits at Least 110 for 19th Straight Day

- The extreme heat scorching Phoenix set a new record Tuesday, the 19th consecutive day temperatures hit at least 110 degrees Fahrenheit (43 Celsius) in a summer of suffering echoing around much of the globe.As human-caused climate change and a newly formed El Nino are…… [Full Story]

- Pentagon Leak Suspect Teixeira Seeks Pretrial Release

- The Massachusetts Air National Guard member accused of leaking secret [Full Story]

- Liberal Christian Denomination Slams Dobbs Ruling

- The United Church of Christ, a liberal mainline Christian [Full Story]

- Trump Mocks Fox News, Hails Newsmax

- Piggybacking on boos for Fox News at the Turning Point Action [Full Story]

- Comer: Fmr FBI Agent Confirms IRS Whistleblower Claims

- Despite attempts to deflect whistleblower claims by House Oversight [Full Story]

- White House Cocaine Latest in String of DC Unsolved Mysteries

- The Secret Service’s seeming inability to determine who left a bag of [Full Story] | Platinum Article

- Eastman Attny: Contesting Election Not Illegal Now, or Ever

- Although there are reports claiming special counsel Jack Smith is [Full Story] | video

- Russia Targets Ukraine Ports in ‘Mass Revenge Strike’

- Russia’s Defense Ministry said on Tuesday it had hit military targets [Full Story]

- Related

- US to Announce $1.3B in Ukraine Military Aid

- US Authorizes European F-16 Training for Ukraine

- Yellen Meets With EU Commish on Ukrainian Support

- Tenney to Newsmax: Biden Admin Has No Exit Strategy for Ukraine |video

- House GOP Sets Vote on Pro-Israel Resolution

- House Republicans have scheduled a vote for later Tuesday to state [Full Story] | video

- Could Roadblocks ‘Derail’ Schumer’s ‘UFO’ Transparency Push?

- As U.S. lawmakers and national security analysts work to destigmatize [Full Story] | Platinum Article

- Colorado Teen Accused of Trying to Go to Iraq to Fight for the Islamic State Group

- An 18-year-old from suburban Denver who allegedly planned to go to [Full Story]

- Spartz Threatens to Stall Work to Get Spending Cuts

- Ahead of the House scheduled to begin voting on appropriations bills [Full Story]

- US Soldier Flees to North Korea While Touring Border Village

- An American soldier facing military disciplinary actions fled across [Full Story]

- Serbia’s Vucic: NATO Has to Help End Kosovo Attacks

- Accusing Kosovo of carrying out “silent ethnic cleansing,” Serbian [Full Story]

- Oversight Committee Reveals Biden Timeline

- Republicans on the House Oversight Committee released a timeline of [Full Story]

- In-N-Out Burger Bans Employees From Wearing Masks

- The California-based fast food chain In-N-Out Burger announced this [Full Story]

- I&I/TIPP Poll: Trump Leads DeSantis by 39 Points

- Fifty-three percent of likely Republican primary voters say they [Full Story]

- Momentum for Federal Wildland Firefighters Wage Hike

- There is increased momentum to pass legislation boosting the wages of [Full Story]

- Trump: DOJ Says I’m Target in 2020 Election Case

- Former President Donald Trump said Tuesday he received a letter from [Full Story]

- Biden Taking Student Debt Relief Into 2024 Election

- The Washington Examiner reports that President Joe Biden is trying [Full Story]

- Powerball Jackpot Hits $1 Billion

- The U.S. Powerball jackpot has reached a whopping $1 billion for only [Full Story]

- Trump’s Agenda47: Take Back Our Colleges From ‘Maniacs’

- In his second policy agenda item on education, former President [Full Story] | video

- Premise Poll: Trump Would Beat Biden, DeSantis Would Not

- Former President Donald Trump would beat President Joe Biden in the [Full Story]

- House GOP Debating Garland Impeachment

- Republican lawmakers in the House are debating whether to move ahead [Full Story]

- Louisiana Prehistoric Artifacts Saved From Disasters, Looters

- Long buried under the woods of west central Louisiana, stone tools, [Full Story]

- Kerry Says US, China Could ‘Significantly’ Impact World

- U.S. climate envoy John Kerry told China’s top diplomat on Tuesday [Full Story]

- Study: Israel Most Targeted Country on Twitter

- The Jewish state has been accused of human rights violations on the [Full Story]

- DeSantis Is First Major Party Candidate in S.C. Primary

- Florida Gov. Ron DeSantis filed paperwork Tuesday for South [Full Story]

- Suspected Serial Killer’s Arrest Brings New Evidence

- A “flood” of evidence and information regarding Rex Heuermann, the [Full Story]

- Israeli President Visits US Amid Tensions, Meets Biden

- Israeli President Isaac Herzog departed Israel late Monday night for [Full Story]

- Egypt Union Bans Rapper Travis Scott’s Pyramid Concert

- The Egyptian musicians’ syndicate announced Tuesday it would not [Full Story]

- Finance

- FTC Cracks Down on Illegal Robocalls, Telemarketing

- U.S. regulators Tuesday announced a nationwide crackdown to stop companies from inundating people with billions of unwanted and illegal robocalls and telemarketing calls… [Full Story]

- Powell Could Go Down as Most Successful Fed Chief Ever

- J&J Sues US to Halt Medicare Drug Price Negotiations

- At 110, Phoenix Smashes Heat Record for US Cities

- Sean Combs Aspires to Create New Black Wall Street

- More Finance

- Health

- Lilly Drug Slows Alzheimer’s Progression by 60 Percent

- Eli Lilly’s experimental drug donanemab slowed the progression of Alzheimer’s by 60% for patients in the earliest stages of the brain-wasting disease, according to trial data presented at a medical meeting on Monday. For those patients, the drug slowed cognitive decline by…… [Full Story]

- J&J Sues US to Halt Medicare Drug Price Negotiations

- As Planet Warms, Infectious Diseases On the Rise

- Weekend Warriors Get All the Heart Benefits

- Hearing Aids May Cut Dementia Risk