Depending on whom your source(s) happen to be for news, the ‘credit’ for the rally could be going to the president’s good fortune that global markets are also rising, or credit going to the prior president, Barack H. Obama. By contrast, President Donald J. Trump and his supporters point to factors they’ve directly addressed. Some facts and a graph will help tell the tale, that’s our market spotlight for today.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- The story behind Apple & Amazon’s expansion

- Trump consumer protection chief requests $0 in funding

- GE’s $31 billion pension nightmare

- Apple & Google charter buses vandalized on highway

- Big companies used to pay the best wages

- Amazon picks 20 finalists for its second HQ Trending

- Wells Fargo billing glitch infuriates customers

- Have you heard of the 4% rule?

- IRS collects billions in pot taxes, much of it in cash

- Most Americans can’t cover a $1,000 emergency

- Keeping hackers out of your driverless car

Selected headlines and bullets from Fox Business:

- GE’s demise ‘heartbreaking,’ fast action needed: Fmr. GE executive Bob Nardelli

- GE faces big charge: Is a break-up next?

- US jobless claims fall to 45-year low

- Oil slips towards $69 ahead of U.S. supply report

- Stocks retreat from record highs

- Amazon announces its list of 20 candidates for second headquarters

- Mulvaney’s budget request for the CFPB: $0

- BNY Mellon to raise wages for 1,000 employees following tax overhaul

- GoDaddy, NASCAR’s Danica Patrick reunite for farewell races

- How bitcoin really operates

- Capitalism is on trial and passing the test: Varney

- Millennials underestimating retirement costs

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,798.03 -4.53(-0.16%)

Dow 30 26,017.81 -97.84(-0.37%)

Nasdaq 7,296.05 -2.23(-0.03%)

Russell 2000 1,576.70 -9.96(-0.63%)

Crude Oil 63.78 -0.19(-0.30%)

Gold 1,326.70 -12.50(-0.93%)

Silver 16.95 -0.21(-1.23%)

EUR/USD 1.2242 +0.0073(+0.58%)

10-Yr Bond 2.611 +0.033 (+1.28%)

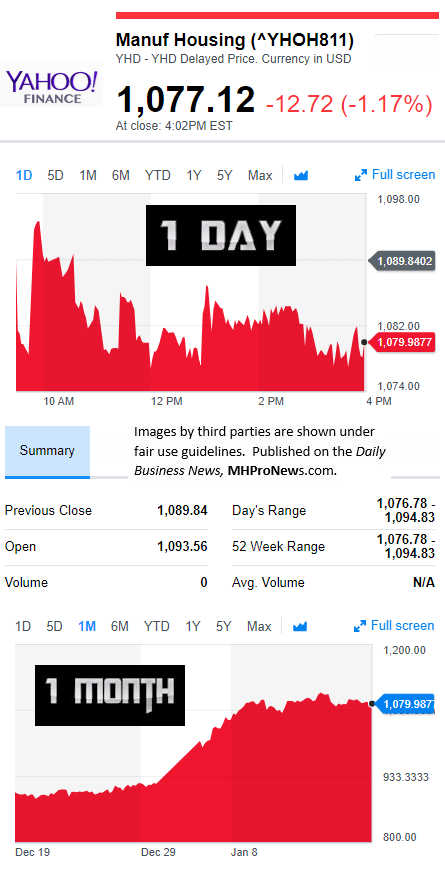

Manufactured Housing Composite Value

Today’s Big Movers

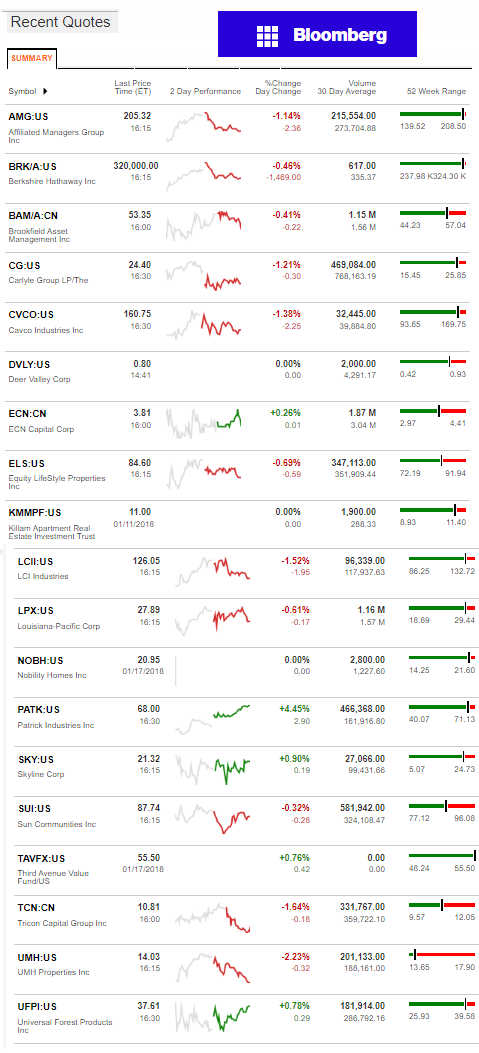

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

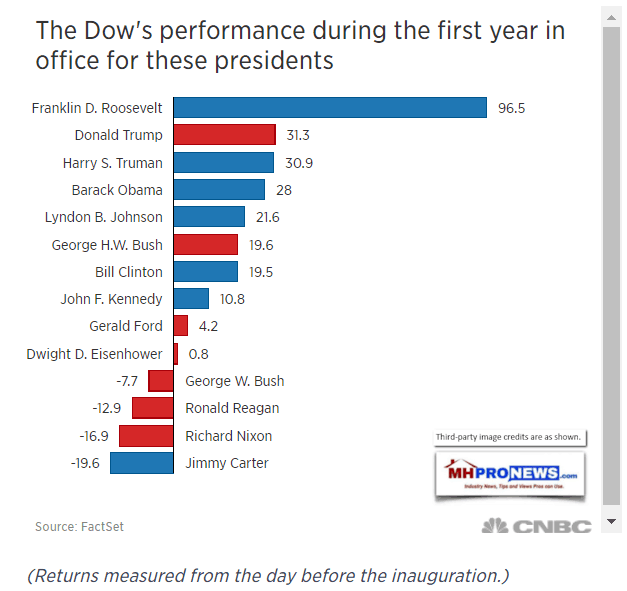

While both Presidents Barack H. Obama and Donald J. Trump enjoyed a similar boost in the Dow and markets the causes are quite different.

POTUS Obama relied on huge deficits and soaring debts, the opposite of what he campaigned upon, when he said that George W. Bush’s debts and deficits was unpatriotic. The Obama years also benefited from a second artificial stimulus, caused by the Federal Reserves purchases in the markets.

By contrast, POTUS Trump has relied upon proven economic principles that worked for both President John F. Kennedy (D), and President Ronald Reagan (R). Reducing regulations, cutting taxes has historically spurred economic growth.

It should also be noted that the Trump bump is occurring at a pace that is allowing the FED to “unwind” those QE purchases, which is a arguably drag on the economy.

Some facts, per left-of-center CNBC.

- The 30-stock index has surged more than 31 percent since Trump’s inauguration.

- That marks the index’s best performance under the first year of a president since Roosevelt.

- “You’ve got lower taxes, less regulation and confidence in the economy is high,” said one investor.

- The S&P 500 surged 23 percent during Trump’s first year in office.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

Profitable Insight$ – POTU$ Trump Effect on MH Stock$ at 1 Year, Part 4

Trump Effect – 1 Year Election Impact on Manufactured Housing Connected Stocks, Part 2

Just the Facts – Trump Effect on Manufactured Home Connected Stocks, Part 1

NOTE: the chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)