An authentic way to track the trends in manufactured housing is by using factual measurements based upon new U.S. manufactured home production and trends. This report is being posted in part to counter apparent paltering and posturing of data, statistics, graphics and trends by others in MHVille rather than clearly reflect the reality of manufactured housing production and shipments that are known in October 2023 based on official federal information sources. The facts herein will reveal that manufactured housing is broadly down at this time. Manufactured home production is lower both as measured by year-over-year changes in production and shipments (2023 vs. 2022), but also as measured by production in the 21st century vs. the last decade of 20th century. But according to the Census Bureau: “In 2000, the U.S. Census Bureau counted 281.4 million people in the United States,” while WorldOMeter said that the: “United States 2023 population is estimated at 339,996,563 people at mid-year” 2023.

Meaning, even though the population of the U.S. has grown by nearly 121 percent, manufactured housing production is down sharply since 2000.

According to the most recent data from the Manufactured Housing Association for Regulatory Reform (MHARR), which cites official information compiled on behalf of the U.S. Department of Housing and Urban Development (HUD): “HUD Code manufacturers produced 8,670 new homes in August 2023, a 19.1% decrease from the 10,722 new HUD Code homes produced in August 2022. Cumulative production for 2023 is now 58,692 homes, a 27% decrease from the 80,431 homes produced over the same period during 2022.” That would be an average of 7336.5 new HUD Code manufactured homes produced monthly through August 2023. Annualizing that monthly rate of 7,336.5 homes produced for the entire year could yield some 88,038 homes for 2023. That would be the lowest total production since 2016 (see that further below in Part II of this report and analysis).

In 2000, total manufactured housing industry production was 250,366 single and multi-section homes. If the industry had merely kept pace with population growth, that should mean that manufactured housing in 2023 should have produced 302,500 homes. So, at the current pace, doing the math tells thinkers and observer that there is a deficit of some 214,462 new manufactured homes in this year alone.

Millions Missing

The implications of the facts are stunning. Because doing that math for each year in the 21st century vs. production in 2000 implies that all told, literally millions of manufactured homes that could have been built had the industry merely kept pace weren’t as a result of the industry’s 21st century slide.

Yet federal legislation was enacted in 2000 and 2008, each of which was supposed to boost manufactured housing to higher levels than occurred in 2000. It is entirely conceivable that there would be no U.S. housing shortage had federal legislation merely been properly enforced. If Cavco Industries is correct when they said earlier this year that the U.S. needs 6 million housing units, that shortage could well have been met by manufactured housing production alone. More on that other topics will be examined in Part II of this evidence-based report and analysis below.

Against that stunning backdrop, Part I of this report will provide information from official sources as shown. As noted, October 2023 reporting of federal data in manufactured housing reflects August 2023 results. Other than the Manufactured Housing Association for Regulatory Reform (MHARR), no other known manufactured housing trade association routinely and accurately provide such information, per Bing’s Artificial Intelligence (AI) tool. See that further below.

Part II of this report will provide additional information with more MHProNews analysis and commentary. Facts and implications like the example above will be reviewed and analyzed.

With that preface in mind, here are the cold, hard facts.

Part I

#1 HUD Code manufactured home data from IBTS

| Institute for Building Technology & Safety | ||||||||||

| Shipments and Production Summary Report 08/01/2023 – 08/31/2023 | ||||||||||

| Shipments | ||||

| State | SW | MW | Total | Floors |

| Dest. Pending | 6 | 5 | 11 | 16 |

| Alabama | 669 | 211 | 880 | 1,090 |

| Alaska | 0 | 0 | 0 | 0 |

| Arizona | 50 | 129 | 179 | 308 |

| Arkansas | 67 | 78 | 145 | 223 |

| California | 38 | 206 | 244 | 461 |

| Colorado | 31 | 17 | 48 | 66 |

| Connecticut | 7 | 8 | 15 | 23 |

| Delaware | 9 | 22 | 31 | 53 |

| District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 158 | 456 | 614 | 1,074 |

| Georgia | 134 | 204 | 338 | 542 |

| Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 11 | 27 | 38 | 68 |

| Illinois | 92 | 40 | 132 | 172 |

| Indiana | 154 | 57 | 211 | 269 |

| Iowa | 22 | 11 | 33 | 44 |

| Kansas | 41 | 20 | 61 | 81 |

| Kentucky | 107 | 179 | 286 | 465 |

| Louisiana | 242 | 114 | 356 | 471 |

| Maine | 35 | 66 | 101 | 167 |

| Maryland | 4 | 2 | 6 | 8 |

| Massachusetts | 1 | 8 | 9 | 17 |

| Michigan | 183 | 141 | 324 | 465 |

| Minnesota | 26 | 33 | 59 | 92 |

| Mississippi | 139 | 133 | 272 | 405 |

| Missouri | 60 | 64 | 124 | 188 |

| Montana | 13 | 21 | 34 | 56 |

| Nebraska | 27 | 3 | 30 | 33 |

| Nevada | 20 | 25 | 45 | 72 |

| New Hampshire | 17 | 27 | 44 | 71 |

| New Jersey | 22 | 6 | 28 | 34 |

| New Mexico | 49 | 77 | 126 | 205 |

| New York | 46 | 93 | 139 | 232 |

| North Carolina | 208 | 316 | 524 | 840 |

| North Dakota | 13 | 8 | 21 | 29 |

| Ohio | 103 | 57 | 160 | 217 |

| Oklahoma | 70 | 105 | 175 | 281 |

| Oregon | 23 | 73 | 96 | 174 |

| Pennsylvania | 84 | 79 | 163 | 240 |

| Rhode Island | 6 | 0 | 6 | 6 |

| South Carolina | 125 | 243 | 368 | 611 |

| South Dakota | 15 | 14 | 29 | 43 |

| Tennessee | 81 | 197 | 278 | 475 |

| Texas | 691 | 706 | 1,397 | 2,111 |

| Utah | 9 | 16 | 25 | 41 |

| Vermont | 11 | 11 | 22 | 33 |

| Virginia | 51 | 56 | 107 | 164 |

| Washington | 17 | 101 | 118 | 225 |

| West Virginia | 37 | 46 | 83 | 129 |

| Wisconsin | 77 | 37 | 114 | 151 |

| Wyoming | 14 | 7 | 21 | 28 |

| Canada | 0 | 0 | 0 | 0 |

| Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 4,115 | 4,555 | 8,670 | 13,269 |

| THE ABOVE STATISTICS ARE PROVIDED AS A MONTHLY | ||||

| SUBSCRIPTION SERVICE. REPRODUCTION IN PART OR | ||||

| IN TOTAL MUST CARRY AN ATTRIBUTION TO IBTS, INC. | ||||

| Production | ||||

| State | SW | MW | Total | Floors |

| States Shown(*) | 243 | 307 | 550 | 861 |

| Alabama | 843 | 679 | 1,522 | 2,201 |

| *Alaska | 0 | 0 | 0 | 0 |

| Arizona | 66 | 144 | 210 | 356 |

| *Arkansas | 0 | 0 | 0 | 0 |

| California | 36 | 174 | 210 | 390 |

| *Colorado | 0 | 0 | 0 | 0 |

| *Connecticut | 0 | 0 | 0 | 0 |

| *Delaware | 0 | 0 | 0 | 0 |

| *District of Columbia | 0 | 0 | 0 | 0 |

| Florida | 69 | 238 | 307 | 548 |

| Georgia | 121 | 335 | 456 | 792 |

| *Hawaii | 0 | 0 | 0 | 0 |

| Idaho | 36 | 73 | 109 | 191 |

| *Illinois | 0 | 0 | 0 | 0 |

| Indiana | 545 | 227 | 772 | 999 |

| *Iowa | 0 | 0 | 0 | 0 |

| *Kansas | 0 | 0 | 0 | 0 |

| *Kentucky | 0 | 0 | 0 | 0 |

| *Louisiana | 0 | 0 | 0 | 0 |

| *Maine | 0 | 0 | 0 | 0 |

| *Maryland | 0 | 0 | 0 | 0 |

| *Massachusetts | 0 | 0 | 0 | 0 |

| *Michigan | 0 | 0 | 0 | 0 |

| Minnesota | 84 | 61 | 145 | 206 |

| *Mississippi | 0 | 0 | 0 | 0 |

| *Missouri | 0 | 0 | 0 | 0 |

| *Montana | 0 | 0 | 0 | 0 |

| *Nebraska | 0 | 0 | 0 | 0 |

| *Nevada | 0 | 0 | 0 | 0 |

| *New Hampshire | 0 | 0 | 0 | 0 |

| *New Jersey | 0 | 0 | 0 | 0 |

| *New Mexico | 0 | 0 | 0 | 0 |

| *New York | 0 | 0 | 0 | 0 |

| North Carolina | 183 | 287 | 470 | 757 |

| *North Dakota | 0 | 0 | 0 | 0 |

| *Ohio | 0 | 0 | 0 | 0 |

| *Oklahoma | 0 | 0 | 0 | 0 |

| Oregon | 35 | 180 | 215 | 405 |

| Pennsylvania | 215 | 303 | 518 | 821 |

| *Rhode Island | 0 | 0 | 0 | 0 |

| *South Carolina | 0 | 0 | 0 | 0 |

| *South Dakota | 0 | 0 | 0 | 0 |

| Tennessee | 553 | 747 | 1,300 | 2,047 |

| Texas | 1,086 | 800 | 1,886 | 2,695 |

| *Utah | 0 | 0 | 0 | 0 |

| *Vermont | 0 | 0 | 0 | 0 |

| *Virginia | 0 | 0 | 0 | 0 |

| *Washington | 0 | 0 | 0 | 0 |

| *West Virginia | 0 | 0 | 0 | 0 |

| *Wisconsin | 0 | 0 | 0 | 0 |

| *Wyoming | 0 | 0 | 0 | 0 |

| *Canada | 0 | 0 | 0 | 0 |

| *Puerto Rico | 0 | 0 | 0 | 0 |

| Total | 4,115 | 4,555 | 8,670 | 13,269 |

| (*) THESE STATES HAVE FEWER THAN THREE PLANTS. | ||||

| FIGURES ARE AGGREGATED ON FIRST LINE ABOVE | ||||

| TOTALS TO PROTECT PROPRIETARY INFORMATION. | ||||

Ashok K Goswami, PE, COO, 45207 Research Place, Ashburn, VA

Part I #2. HUD and Census Bureau Conventional Residential Housing Data

U.S. Dept. of Housing and Urban Development

Office of Public Affairs

(202) 708-0685

hudpublicaffairs@hud.gov

October 25, 2023

HUD AND CENSUS BUREAU REPORT NEW RESIDENTIAL SALES IN SEPTEMBER 2023

WASHINGTON – The U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau jointly announced the following new residential sales statistics for September 2023:

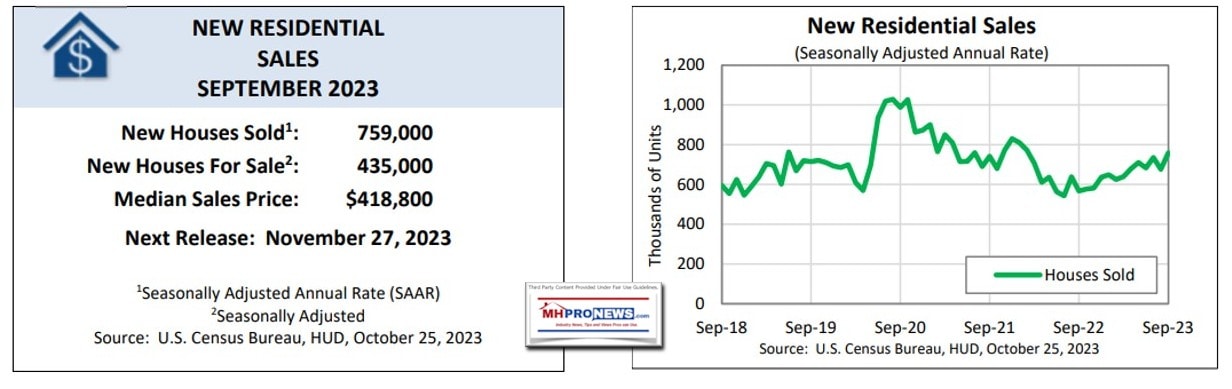

New Home Sales

Sales of new single‐family houses in September 2023 were at a seasonally adjusted annual rate of 795,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.3 percent (±16.6 percent)* above the revised August rate of 676,000, and is 33.9 percent (±22.9 percent)* above the September 2022 estimate of 567,000.

Sales Price

The median sales price of new houses sold in September 2023 was $418,800. The average sales price was $503,900.

For Sale Inventory and Months’ Supply

The seasonally‐adjusted estimate of new houses for sale at the end of September was 435,000. This represents a supply of 6.9 months at the current sales rate.

The October report is scheduled for release on November 27, 2023. View the full schedule in the Economic Briefing Room:

www.census.gov/economic-indicators/. The full text and tables for this release can be found at www.census.gov/construction/nrs/.

EXPLANATORY NOTES

These statistics are estimated from sample surveys. They are subject to sampling variability as well as nonsampling error including bias and variance from response, nonreporting, and undercoverage. Estimated average relative standard errors of the preliminary data are shown in the tables. Whenever a statement such as “2.5 percent (±3.2%) above” appears in the text, this indicates the range (‐0.7 to +5.7 percent) in which the actual percent change is likely to have occurred. All ranges given for percent changes are 90‐percent confidence intervals and account only for sampling variability. If a range does not contain zero, the change is statistically significant. If it does contain zero, the change is not statistically significant; that is, it is uncertain whether there was an increase or decrease. The same policies apply to the confidence intervals for percent changes shown in the tables. Changes in seasonally adjusted statistics often show irregular movement. It takes 3 months to establish a trend for new houses sold. Preliminary new home sales figures are subject to revision due to the survey methodology and definitions used. The survey is primarily based on a sample of houses selected from building permits. Since a “sale” is defined as a deposit taken or sales agreement signed, this can occur prior to a permit being issued. An estimate of these prior sales is included in the sales figure. On average, the preliminary seasonally adjusted estimate of total sales is revised about 3 percent. Changes in sales price data reflect changes in the distribution of houses by region, size, etc., as well as changes in the prices of houses with identical characteristics. Explanations of confidence intervals and sampling variability can be found at the Census Bureau’s website.

Notice of Revision: With this release, seasonally adjusted estimates of housing units sold, housing units for sale, and the months’ supply of new housing have been revised back to January 2018. All revised estimates are available on the Census Bureau website.

“HUD’s mission is to create strong, sustainable, inclusive communities and quality affordable homes for all.” … ##

Part I #3 – U.S. Census Bureau Manufactured Housing Survey Report for October 2023

The most recent national report from the U.S. Census Bureau and HUD are as follows. Note that the years 2018 to 2023 are covered in this report. Compare this to the total above from IBTS to see that this report rounds the data up or down to the nearest hundred. Example 8.7 is about 8,700 units when the actual IBTS count for August 2023 was 8,670 new single and multi-section manufactured homes.

Shipments of New Manufactured Homes, 2018 – 2023 |

|||||||||

|

(Thousands of Units) |

|||||||||

| Period | Not Seasonally Adjusted | Seasonal Index | Seasonally Adjusted Annual Rate | Period | Not Seasonally Adjusted | Seasonal Index | Seasonally Adjusted Annual Rate | ||

| 2023 | 2022 | ||||||||

| January | 7.0 | 95.4 | 87 | January | 9.1 | 92.3 | 118 | ||

| February | 6.6 | 93.0 | 85 | February | 9.3 | 93.6 | 119 | ||

| March | 7.6 | 110.3 | 83 | March | 11.3 | 111.1 | 122 | ||

| April | 6.7 | 95.2 | 84 | April | 10.2 | 100.9 | 121 | ||

| May | 7.9 | 109.4 | 86 | May | 10.5 | 103.7 | 121 | ||

| Juner | 8.2 | 112.7 | 87 | June | 11.4 | 113.0 | 121 | ||

| Julyr | 6.1 | 83.7 | 88 | July | 8.1 | 83.8 | 115 | ||

| Augustp | 8.7 | 116.9 | 89 | August | 10.7 | 112.3 | 115 | ||

| September | September | 9.4 | 103.3 | 109 | |||||

| October | October | 8.7 | 101.9 | 102 | |||||

| November | November | 8.0 | 99.0 | 97 | |||||

| December | December | 6.4 | 82.9 | 93 | |||||

| Total: | 58.7 | Total: | 112.9 | ||||||

| 2021 | 2020 | ||||||||

| January | 8.5 | 93.2 | 109 | January | 8.7 | 104.2 | 101 | ||

| February | 8.0 | 94.4 | 102 | February | 8.2 | 94.9 | 104 | ||

| March | 10.0 | 108.7 | 110 | March | 8.3 | 103.5 | 97 | ||

| April | 9.2 | 107.3 | 103 | April | 6.6 | 108.7 | 73 | ||

| May | 8.6 | 99.6 | 104 | May | 6.6 | 100.0 | 80 | ||

| June | 9.4 | 109.7 | 103 | June | 7.6 | 106.4 | 85 | ||

| July | 7.6 | 87.9 | 103 | July | 7.5 | 93.1 | 97 | ||

| August | 9.1 | 106.0 | 103 | August | 7.9 | 101.5 | 94 | ||

| September | 9.0 | 104.3 | 104 | September | 8.1 | 102.1 | 96 | ||

| October | 9.3 | 102.9 | 108 | October | 9.0 | 108.5 | 100 | ||

| November | 9.1 | 97.2 | 112 | November | 8.0 | 95.1 | 101 | ||

| December | 8.0 | 88.3 | 109 | December | 7.6 | 87.8 | 104 | ||

| Total: | 105.8 | Total: | 94.4 | ||||||

| 2019 | 2018 | ||||||||

| January | 7.6 | 102.9 | 88 | January | 8.6 | 100.1 | 104 | ||

| February | 7.2 | 95.5 | 91 |

|

8.1 | 95.0 | 102 | ||

| March | 7.6 | 100.1 | 91 | March | 8.8 | 104.7 | 101 | ||

| April | 8.0 | 103.6 | 93 | April | 8.3 | 100.8 | 98 | ||

| May | 8.6 | 110.9 | 93 | May | 8.8 | 109.4 | 97 | ||

| June | 7.8 | 99.2 | 94 | June | 8.3 | 102.6 | 97 | ||

| July | 7.1 | 89.9 | 95 | July | 6.8 | 85.8 | 95 | ||

| August | 8.6 | 107.3 | 97 | August | 9.2 | 113.8 | 97 | ||

| September | 8.0 | 97.9 | 99 | September | 7.5 | 95.0 | 95 | ||

| October | 9.4 | 114.6 | 99 | October | 8.6 | 112.1 | 92 | ||

| November | 8.0 | 95.5 | 100 | November | 7.7 | 102.0 | 90 | ||

| December | 6.7 | 81.9 | 99 | December | 5.9 | 79.4 | 90 | ||

| Total: | 94.6 | Total: | 96.6 | ||||||

| p Preliminary | |||||||||

| r Revised – refers to seasonal index and seasonally adjusted annual rate figures | |||||||||

| Note: Components may not add to totals due to rounding. | |||||||||

| Note: The Census Bureau has reviewed this data product for unauthorized disclosure of confidential information and has approved | |||||||||

| the disclosure avoidance practices applied. (Approval ID: CBDRB-FY23-0317) | |||||||||

| Source: Not seasonally adjusted statistics on shipments are compiled from manufacturer’s reports to | |||||||||

| the Institute for Building Technology and Safety (IBTS). | |||||||||

* The 90 percent confidence interval includes zero. In such cases, there is insufficient statistical evidence to conclude that the actual change is different from zero.

###

Part II. Additional Information with More MHProNews Analysis and Commentary

The Census Bureau data for 2018 through year-to-date information in 2023 above is rounded off but is largely accurate as a comparison to the facts from official sources for the year-by-year totals from 1995 to 2021 shown below through a Bing AI search.

Barring a sharp increase, at the current levels of production, the national total of new HUD Code manufactured homes in 2023 is likely to finish lower than any year since 2016.

Recall that MHProNews cautioned in 2022 despite the happy talk of some in the industry, that the last time that the Manufactured Housing Institute (MHI) said that the industry had ‘momentum‘ when they launched their apparently failed CrossModsTM initiative, that year and now again the industry’s production dipped instead of grew.

MHProNews asked Bing AI chat the following on 10.29.2023 at about 3:53 PM ET.

> “Can you provide me a listing of total U.S. manufactured housing production by year starting with 1995 through year-to-date August 2023?”

Per Bing AI was the following response, using their ‘balanced’ (blue) response setting.

The U.S. Census Bureau also collects data on shipments, prices, and characteristics of new manufactured housing through the Manufactured Housing Survey (MHS) 2. The MHS produces monthly regional estimates of the average sales price for new manufactured homes and more detailed annual estimates including selected characteristics of new manufactured homes. In addition, MHS produces monthly estimates of homes shipped by status 23.

According to Manufactured Home Pro News (MHProNews), the total annual new U.S. manufactured home production data by year starting in 1995 is as follows 1:

| Year | Total Production |

| 1995 | 344,930 |

| 1996 | 363,345 |

| 1997 | 353,686 |

| 1998 | 373,143 |

| 1999 | 348,075 |

| 2000 | 250,366 |

| 2001 | 193,120 |

| 2002 | 165,489 |

| 2003 | 130,815 |

| 2004 | 130,748 |

| 2005 | 146,881 |

| 2006 | 117,373 |

| 2007 | 95,752 |

| 2008 | 81,457 |

| 2009 | 49,683 |

| 2010 | 50,056 |

| 2011 | 51,618 |

| 2012 | 54,881 |

| 2013 | 60,228 |

| 2014 | 64,334 |

| 2015 | 70,544 |

| 2016 | 81,136 |

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

I hope this helps!

Learn more:

That first link is to this report actually has the 2022 and year-to-date through August 2023 data at the link below. Graphics and other illustrations are included.

Note that fact checks of MHI’s website on this date revealed that some information previously provided by MHI to the public now appears to be either removed, and/or it is available now to members only. Note that fact checks of MHI’s website should not be construed as an endorsement by MHProNews of that organization.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Then note this from Bing AI in response to a predawn MHProNews inquiry.

The Texas Real Estate Research Center (TRERC), which that university appears to have financial ties to at least one prominent manufactured home producer that happens to be a Manufactured Housing Institute (MHI) member, was proclaiming in 2022 about how CrossMods: “its real.” But neither that TRERC report on CrossMods nor others have the total number of such costlier HUD code manufactured homes built and sold. That total count on CrossMods built and sold are oddly unknown.

Isn’t it common sense that if the CrossMods program was succeeding, that MHI, Clayton Homes and others would be shouting those results from the rooftops?

But instead, that program which despite years of hype didn’t catch fire with street retailers, also failed to catch fire with developers. MHI admitted as much in a document that is also not found on the public side of their website. What happened to all of the years of research, focus groups, and other happy talk about how CrossMods were going to grow the manufactured home industry’s production?

Recall that MHARR consistently and persistently cautioned against CrossMods. So too did MHProNews and MHLivingNews from early on, including in reports like those linked below. Those reports, and others since, have been validated by the apparent lack of success from the overhyped, but underperforming CrossMods scheme.

“What Are We, Chopped Liver?” MHI Member December 2018 Reactions

MHI vs. MHARR on Transparent Information, or the Lack Thereof

Note that missing from the above publicly available information about manufactured housing are Manufactured Housing Institute (MHI) linked sources. Per Bing AI the following.

Something similar can be said about MHI ‘endorsed’ or “awarded” sources. They may be ‘free’ but they routinely fail to provide such hard-fact analysis or data that reflects the reality that manufactured housing been in retreat for over 2 decades.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

While a European factory-home builder is investing hundreds of millions of dollars in a new U.S. production center, HUD Code manufactured housing is in decline? Does the stark nature of such comparisons not cause thoughtful professionals, affordable housing advocates, investors and others to question the efficacy and motivations of the self-proclaimed representatives of “all segments” of manufactured housing? Meaning, the Manufactured Housing Institute?

Can Avoidable Tragedies Proceed Triumph in the 21st Century for Contemporary Manufactured Housing?

To recap and then build upon an earlier factoid, once more consider the following. In 2000, total manufactured housing industry production was 250,366 single and multi-section homes. If the industry had merely kept pace with population growth, that should mean that manufactured housing in 2023 should have produced 302,500 homes. So, at the current pace, doing the math tells thinkers and observer that there is a deficit of some 214,462 new manufactured homes in this year alone.

This is proverbial back of the napkin math (that merits refining) but take that 214,462 deficit of new manufactured homes in 2023 and do the following calculations. 214,462 x 22.66 years = 4,859,708.92. Nearly 5 million more new HUD Code manufactured homes could have been built, per those rough numbers, had manufactured housing merely kept pace with the proportional production levels experienced in the year 2000. Again, compare that to what prominent MHI member Cavco Industries (CVCO) said to investors in the screen capture below was the number of housing units needed in the years.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

that the industry ought to expect this current downturn because more expensive site-built housing is also in a downturn? MHI’s research and reasoning are arguably a classic example of PALTERING and the use of a RED HERRING logical fallacy. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

MHI leaders, including, but not limited to Cavco’s CEO William “Bill” Boor can’t have it both ways. They consistently appear to use gaslighting or razzle dazzle style claims and remarks.

Boor told Congress on July 14, 2023 that the industry is at a “critical crossroads.” If the goal is robust potential growth vs. actual production declines, Boor is right.

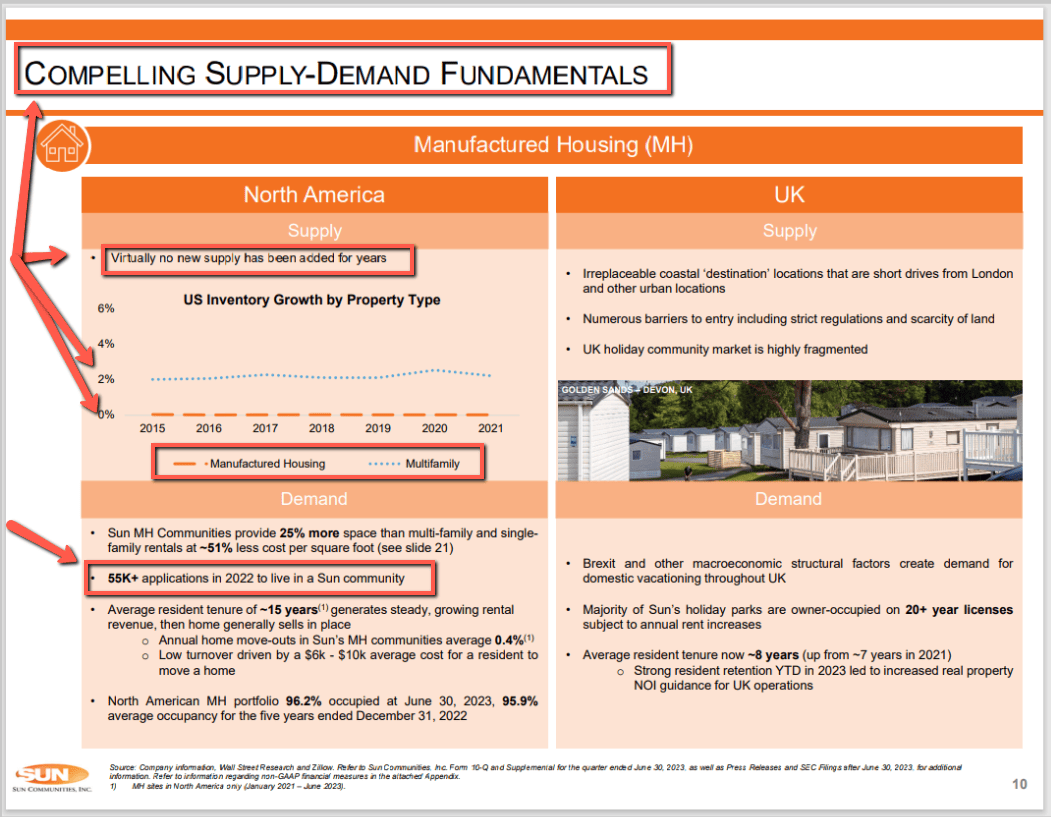

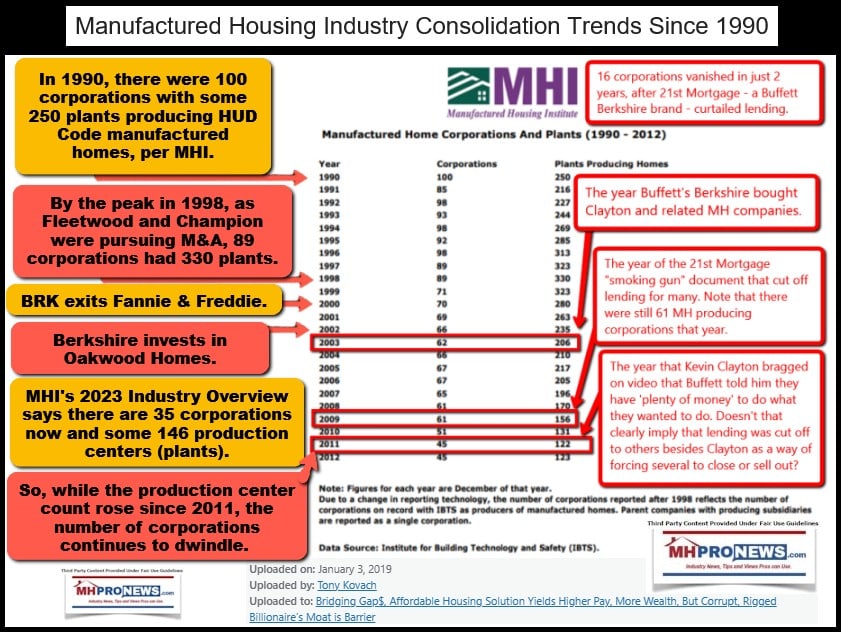

But several prominent members of MHI, including Boor’s firm, Sun Communities, and others are telling investors that consolidation is the goal. A lack of new development, which would logically result in more sales during an affordable housing crisis, means existing communities are ‘worth more.’ But applying that sort of business model to the multi-family housing business would mean you’d have to shut down the building of hundreds of thousands of new units annually. Housing would become even less affordable than it already is.

Among manufactured housing industry trade media, only MHProNews and MHLivingNews have consistently and persistently spotlighted the harmful ripple effects of the various inept and/or corrupt scams that are at work in manufactured housing. While MHInsider, ManufacturedHomes.com carry water for the MHI party line paltering and propaganda, the industry’s growth minded independents and consumers seeking affordable home ownership have apparently been cheated out of millions of ‘new homes sold’ opportunities?!

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

This document shown below, once publicly available on MHI’s website, also appears to be missing or hidden behind a “member only” paywall now. As a planned follow up report by MHProNews will reveal, there is strong evidence that MHI is removing/hiding information that was once publicly available. Why? And if they suddenly start to repost this missing information, will that be because MHProNews is exposing it?

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Missing the production of some 5 million (+/-) new HUD Code manufactured homes in the 21st century ought to be an earthquake level revelation for both supporters and critics of MHI. The lack of affordable housing, per Oregon Public Broadcasting (OPB) and others cited in the report linked below, is the top cause of homelessness in America.

Those nearly 5 million missing HUD Code manufactured homes – had the industry merely held its share of proportionate growth from 2000 to today as the U.S. population increased – could mean millions would be building equity instead of renting.

The Topsy Turvey, upside down behavior of MHI claiming one thing but producing results that are often in stark contradiction to their posturing simply can’t be allowed to stand without serious federal, state, and other investigations.

Indeed, the evidence-based argument can be made the recently announced ANTITRUST claims in class action lawsuits launched against several prominent MHI members may be the leading edge of what is to come. At least one announced probe is pending, and two national cases have been launched.

Against this backdrop, how could MHI leaders tolerate the apparently gross conflicts of interest exhibited by MHI CEO Lesli Gooch, Ph.D.? Note that each of the linked reports will go into specifics on topics that shed light on how this tragic scenario has come to pass.

In conclusion, when the facts are carefully examined and are properly understood, they paint a picture of either mind bogglingly inept and or grossly corrupt behavior.

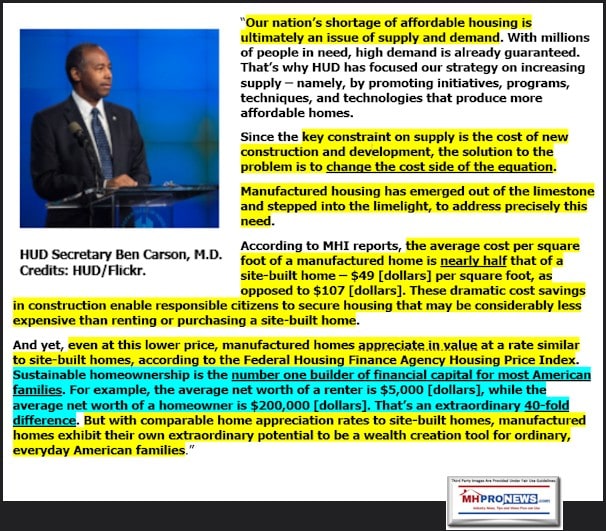

That is very much in keeping with the research by James A. “Jim” Schmitz Jr., his Minneapolis Federal Reserve research colleagues, and Samuel “Sam” Strommen while he was still at Knudson Law. Schmitz said that it is necessary to fight monopolistic forces for manufactured housing to succeed. Strommen blew the whistle in a heavily footnoted legal thesis that accused several prominent industry insiders of “felony” antitrust violations in manufactured housing. Oddly, others in the MHI orbit, and MHI itself failed to give any or the proper attention to either of those researchers work, why not?

Perhaps 5 million (or more) American households could be living in a HUD Code manufactured home today instead of living in a basement with parents or stuck in a costly rental where they can’t build equity. MHProNews will continue to shine a bright light on the facts and then do the math and expert analysis that explains just what this ongoing scheme has done to the American Dream. ###

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Programming notice. New fact-packed special reports are pending. Watch for them.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’