We are now past ‘back to school’ season and formally entered fall on Sunday, 9.22.2024 at 12:45 PM. Days to Election says it is 43 days plus so many hours to November 5, 2024. Early voting began in Virginia, where WMAL (105.9 FM) indicated from an early voting location that there was a line of voters. WMAL’s staff said that while most Republicans traditionally vote on Election Day (i.e.: this year, 11.5.2024), based on their engagement with those in line, a possible shift in voting patterns may be underway as sizable numbers of those early voters were apparently Trump supporters. Elections in the U.S. for centuries come and go. But in the late 20th century into the 21st century, elections influence housing, the economy, and markets. Per a recent Fannie Mae Economic and Strategic Research Group (ESR) report to MHProNews, housing sales has hit a multi-decade low, despite interest rates falling even before the Federal Reserve announced their 50-basis point (1/2 percent) rate cut.

An analysis in brief of the following will be included in Part II.

Part I – According to Fannie Mae Economic and Strategic Research is the following.

Existing Home Sales on Pace to Hit Nearly 30-Year Low, Despite Recently Lower Rates

Mortgage Rates Now Forecast to Average 5.7% by End of 2025

WASHINGTON, DC – September 18, 2024 – Despite a significant decline in mortgage rates and improved supply in some parts of the country, existing home sales are not expected to pick up meaningfully through the remainder of 2024, with the annual pace now forecast to be the slowest since 1995, according to the September 2024 commentary from the Fannie Mae (FNMA/OTCQB) Economic and Strategic Research (ESR) Group. Recent data, including softness in pending home sales and purchase mortgage applications, continue to suggest limited home-purchase demand at current affordability levels. According to the ESR Group, existing home sales have not grown despite a nearly 20-percent increase in homes available for sale from year-ago levels, in part due to geographic variations. Much of the increase in for-sale inventories has occurred in the Sun Belt and Mountain West regions, areas that also experienced some of the strongest home price growth in recent years, as well as robust new home construction. This creates both a large relative affordability shock in these states and greater competition for existing home sales stemming from the new construction. The ESR Group believes some combination of easing mortgage rates and soft home price growth relative to income growth in these regions will be needed before existing home sales begin to meaningfully rise.

The ESR Group’s economic growth outlook was mostly unchanged this month, as incoming data has been largely consistent with expectations. The ESR Group notes that the economy is likely shifting into a slower growth path, and as inflation moves closer to the 2-percent target, the Federal Reserve is poised to move monetary policy toward a more neutral stance. Still, the ESR Group believes the lagged effect of monetary policy is likely to keep real gross domestic product growth subdued in coming quarters before returning to the long-term trend by the end of 2025.

“Increasingly, regional variations in housing supply are creating divergent affordability conditions and experiences for consumers on both sides of the home sales transaction; however, taken as a whole, home sales activity, particularly on the existing side, remains near what we consider to be the floor of basic demographic and household mortgage demand,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Supply has risen significantly in many Sun Belt states, where such factors as ease of new home development and increasing insurance costs are having an impact, but at the national level the supply shortage still very much applies. Although mortgage rates have fallen considerably in recent weeks, we’ve not seen evidence of a corresponding increase in loan application activity, nor has there been an improvement in consumer homebuying sentiment. We think it’s likely that many would-be borrowers are waiting for affordability to improve even further, and that some may be anticipating additional declines in mortgage rates given expectations that the Fed will lower the federal funds target rate. Others may be waiting for household incomes to improve further to offset some of the recent home price growth, or they may be thinking that future supply growth will ease affordability. Regardless of the lever, we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995.”

Visit the Economic & Strategic Research site at fanniemae.com to read the full September 2024 Economic Outlook, including the Economic Developments Commentary, Economic Forecast, Housing Forecast, and Multifamily Market Commentary.

About the ESR Group

Fannie Mae’s Economic and Strategic Research Group, led by Chief Economist Doug Duncan, studies current data, analyzes historical and emerging trends, and conducts surveys of consumer and mortgage lender groups to provide forecasts and analyses on the economy, housing, and mortgage markets. The ESR Group was awarded the prestigious 2022 Lawrence R. Klein Award for Blue Chip Forecast Accuracy based on the accuracy of its macroeconomic forecasts published over the 4-year period from 2018 to 2021. ##

Part II – Additional Information with MHProNews Analysis in Brief plus the Sunday Weekly MHVille Headlines in Review

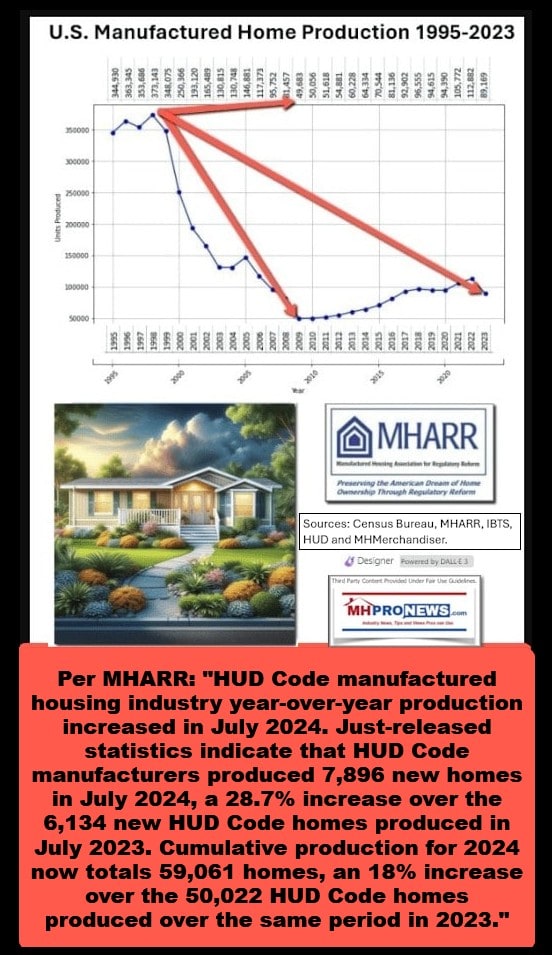

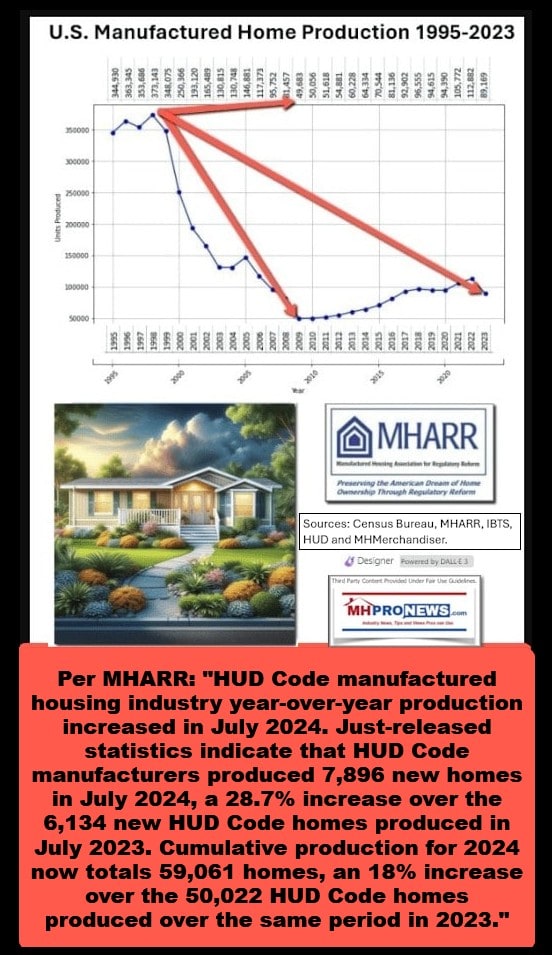

1) “Regardless of the lever, we expect affordability to remain the primary constraint on housing activity for the foreseeable future, and we now think full-year 2024 will produce the fewest existing home sales since 1995” (emphasis added) said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. Perhaps that key italicized phrase by Duncan could be good for MHVille. For emphasis, that would arguably be: “we expect affordability to remain the primary constraint on housing activity for the foreseeable future.” At the Manufactured Housing Association for Regulatory Reform (MHARR), for example, they often use a phrase like ‘inherently affordable mainstream manufactured housing.’

2) For example, per an after-midnight Google search for “inherently affordable mainstream manufactured housing” on this date: “At a time when housing affordability in the United States has reached an all-time low according to press reports, the production of inherently affordable, mainstream manufactured housing, costing, on average, less than 25% of the price of an average site-built home, according to the most recent available annual U.S.” That statement found on Google was posted MHARR’s website at the linked article below, but is also found on MHLivingNews, MHProNews, and several other mainstream news sites that picked up that phrasing from MHARR’s press release at that time.

3) It seems that the Manufactured Housing Institute (MHI) website, and often those non-MHProNews/MHLivingNews publishers who operate in the MHI orbit, are often averse to publishing news that may run counter to the desired MHI narrative. Curiously, that apparently includes these monthly reports from Fannie Mae’s ESR Group. From a pre-dawn search is the following result. Only MHProNews has periodically published articles from Fannie’s ESR Group since 2019, per the search linked here.

MHI, or any news source, could freely distribute content like that offered from Fannie Mae ESR Group. It offers routinely useful insights into general housing market conditions from an operation, i.e.: Fannie Mae, that MHI claims to be engaged with. Fannie Mae has even co-sponsored MHI events. Finance is a post-production issue, not a production issue (which is MHARR’s focus and is the sector where they collect members’ dues).

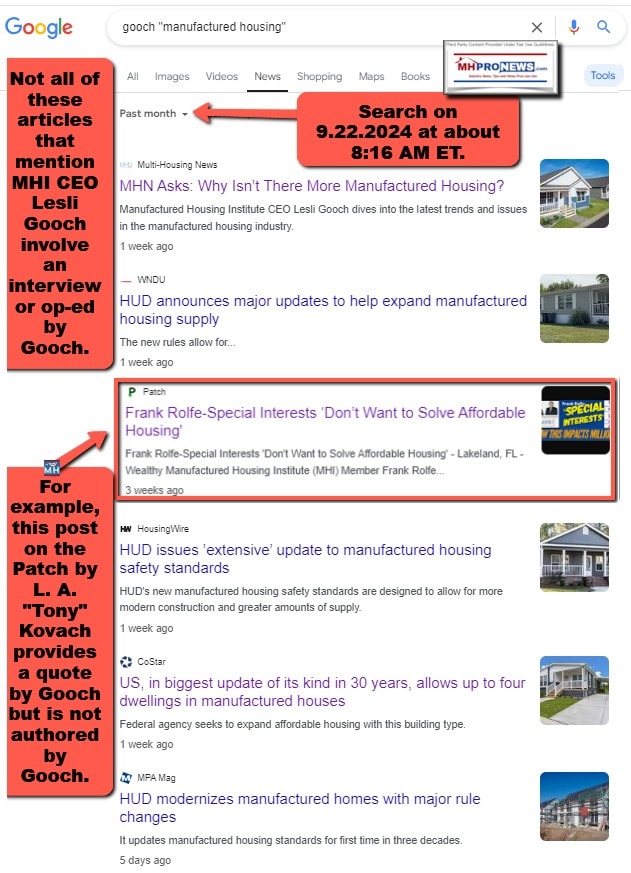

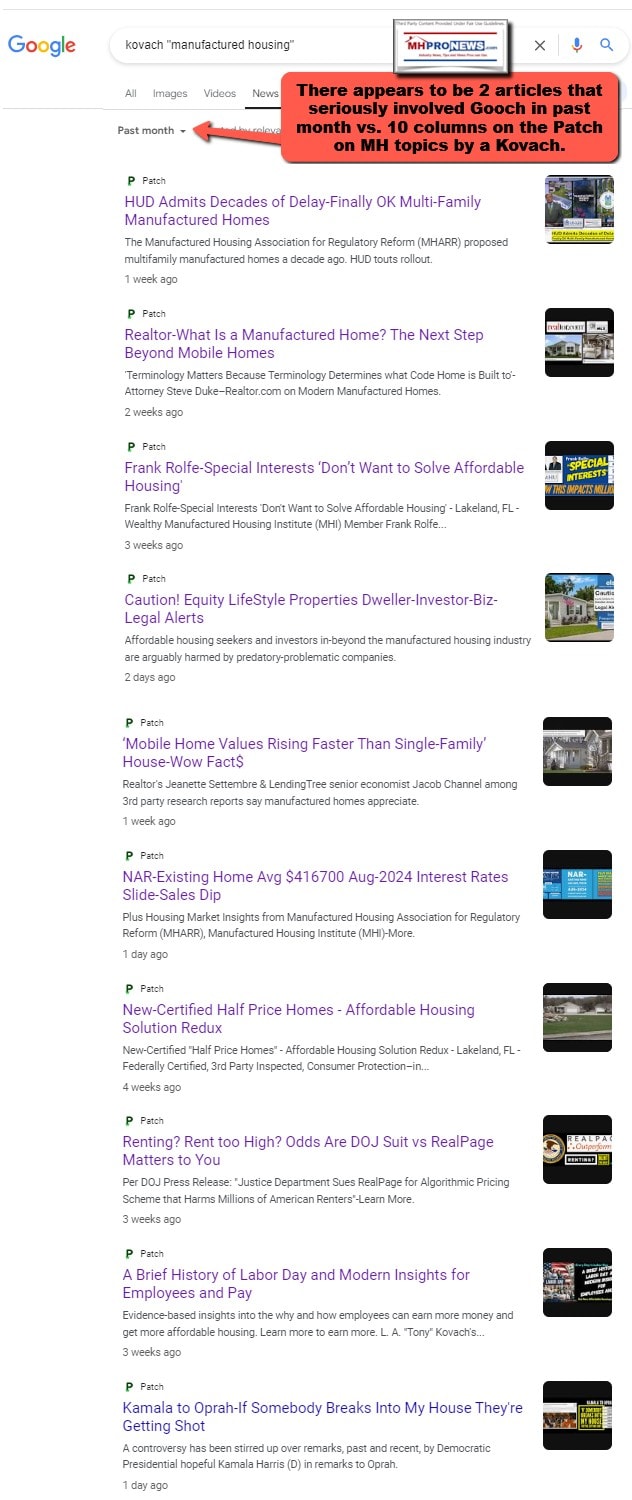

4) Among the headlines for the week in review are the latest in our posts on the Patch. Those posts cover affordable housing along with other topics too. It is now approaching one month since we began those posts. There is an evidence-based case to be made that those news posts indexed by Google or other search engines on the Patch represent more content on third-party sites than MHI CEO Lesli Gooch has produced. The ratio appears to be about 5 posts by a Kovach to 1 involving Gooch, based on the following Google news searches.

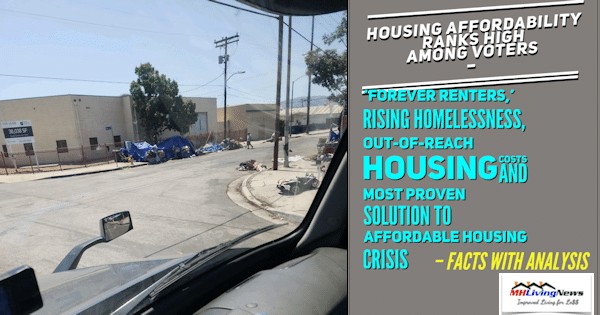

5) Note that while each produces unique data sets and remarks, the Fannie Mae ESRG report is broadly consistent with what the National Association of Realtors (NAR) recently reported to MHProNews about the existing sales housing market (see headlines below). Since there is a widespread thirst for affordable housing, and record homelessness in the U.S. despite record ‘peacetime’ spending by the federal government, why is manufactured housing underperforming during an affordable housing crisis? Answers to that question are explored, directly and obliquely, in many of the headline reports that follow.

Don’t miss Part III (traditional postscript).

With no further adieu, here are the headlines for the week that was from 9.15 to 9.22.2024.

What’s News on MHLivingNews

What’s New from Washington, D.C. based MHARR

What’s New from Tim Connor, CSP, on the Words of Wisdom

What’s New on the Masthead

27 Articles Posted in the past Month on the Patch by TARK or L. A. “Tony” Kovach

- TARK Drill-Down on Tyranny vs. Faith; Freedom and Upcoming Election| Article posted Sep 22, 2024 at 6:26am

Right to Free Speech is Under Attack, per TARK = Tamas A.R. Kovach, a Teenager who has Traveled the U.S. Extensively and is a Good Student.

-

Kamala to Oprah-If Somebody Breaks Into My House They’re Getting Shot | Article posted Sep 20, 2024 at 5:00pm

A controversy has been stirred up over remarks, past and recent, by Democratic Presidential hopeful Kamala Harris (D) in remarks to Oprah.

-

NAR-Existing Home Avg $416700 Aug-2024 Interest Rates Slide-Sales Dip| Article posted Sep 20, 2024 at 11:21am Plus Housing Market Insights from Manufactured Housing Association for Regulatory Reform (MHARR), Manufactured Housing Institute (MHI)-More

| -

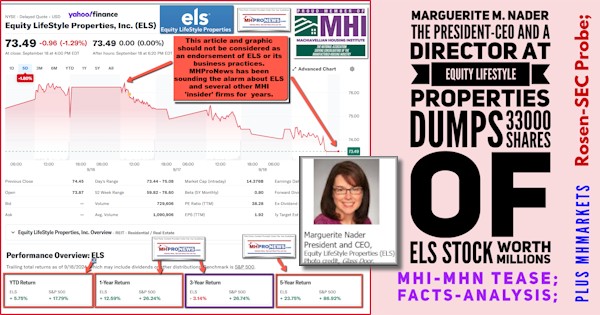

Caution! Equity LifeStyle Properties Dweller-Investor-Biz-Legal Alerts | Article posted Sep 19, 2024 at 4:46pm Affordable housing seekers and investors in-beyond the manufactured housing industry are arguably harmed by predatory-problematic companies.

-

Herland: ‘Aldous Huxley Interview-Tech, Big Gov, Big Biz=Grave Danger’| Article posted Sep 18, 2024 at 3:43pm From across the political spectrum, a growing number of thoughtful voices are warning against the nexus of Big Tech, Big Biz and Big Gov

-

U.S. Health-Dr. Marty Makary–‘Broke Medicine’ Blind Spots-Price We Pay| Article posted Sep 18, 2024 at 10:33am Johns Hopkins medical expert Dr. Marty Makary, M.D., authored New York Times bestselling book “The Price We Pay” and new book “Blind Spots”

-

12 Examples of Public Calls for Violence Against Trump-More Ryan Routh| Article posted Sep 17, 2024 at 5:07pm Robert De Niro, ‘Morning Joe’ Scarborough-10 more examples of higher-profile figures making statements about risk of Trump as a ‘dictator.’

-

Deception & Misdirection-3 Tricks-Paltering, Posturing and Projecting| Article posted Sep 17, 2024 at 12:50pm Steven J. Allen, J.D., Ph.D., Distinguished Senior Fellow @ Capital Research Center among those reporting how sly info can mislead public

-

Gunman Ryan Wesley Routh Insights from CNN-Daily Signal-Patch and X| Article posted Sep 16, 2024 at 3:37pm This post will provide insights from Democrats, Republicans, and media sources that span the left-right spectrum on accused gunman Routh.

-

Lessons of Bernie Madoff-Enron-WorldCom-2008 Housing-Financial Crisis| Article posted Sep 15, 2024 at 1:02pm Be it inflation, affordable housing, massive financial scams, or many issues, federal, state, and local officials often fail “We the People”

| -

What Pastors, Priests, Religious Leaders and People Must Do – or Else| Article posted Sep 14, 2024 at 3:05pm We’d still have slavery, be a colony of England, or be stuck with tea from British monopolists if pastors hadn’t spoken truth from pulpits.

-

“TANSTAAFL”–What Does It Mean and Why Does It Matter to You and Yours?| Article posted Sep 13, 2024 at 4:51pm EconLib, Investopedia, Technovelgy, Edge, Wikipedia, and Cato are among scores hailing the importance and practical value of TAANSTAFL.

-

HUD Admits Decades of Delay-Finally OK Multi-Family Manufactured Homes| Article posted Sep 12, 2024 at 3:37pm

The Manufactured Housing Association for Regulatory Reform (MHARR) proposed multifamily manufactured homes a decade ago. HUD touts rollout.

-

‘Mobile Home Values Rising Faster Than Single-Family’ House-Wow Fact$| Article posted Sep 11, 2024 at 1:48pm Realtor’s Jeanette Settembre & LendingTree senior economist Jacob Channel among 3rd party research reports say manufactured homes appreciate

-

Realtor-What Is a Manufactured Home? The Next Step Beyond Mobile Homes| Article posted Sep 9, 2024 at 1:41pm ‘Terminology Matters Because Terminology Determines what Code Home is Built to’-Attorney Steve Duke–Realtor.com on Modern Manufactured Homes

-

The Two Groups that Should See New Movie Reagan (2024) with Trailer| Article posted Sep 8, 2024 at 4:17am Over half of the population was born since Ronald Reagan was president. Then and now, it was a complex era. Uplifting and informative |

-

Magyar Szabadság Kör – Cultural-Culinary Experience in Plant City, FL| Article posted Sep 6, 2024 at 1:39am The Hungarian Liberty Club is a celebration of the cultural, culinary, spiritual, and political values that make the Magyars unique.

-

Realtor? Journalist? Affordable Manufactured Home Production Jumps| Article posted Sep 5, 2024 at 1:40pm Follow the facts. Follow the money trail. Those are useful mantras for journalists, researchers, and investigators. There is a lot to know.

-

Orlando RE Agent Smith-Younger Adults Will Need $8500 Monthly for Rent| Article posted Sep 4, 2024 at 1:37pm ‘Forever Renters’ Rising as is Homelessness, Out-of-Reach Housing Costs, and Housing Affordability Ranks High Among Voters. Want Solutions?

-

Blankley-Goodbye American Dream? Only 10% Polled Can Buy a House; But|Article posted Sep 3, 2024 at 6:46pm Troubling Update on U.S. Housing Market; But Timely Solutions That are Already Federal Law Await. Facts-Insights with Analysis Provided.

-

A Brief History of Labor Day and Modern Insights for Employees and Pay| Article posted Sep 2, 2024 at 6:09am Evidence-based insights into the why and how employees can earn more money and get more affordable housing. Learn more to earn more.

-

Waiting for Fed Rate Cut Before Buying a Home? Experts Say Think Twice| Article posted Sep 1, 2024 at 12:32am Rate cuts and other incentives could spike demand, send housing costs higher creating a similar or even a higher payment. But options exist.

-

Frank Rolfe-Special Interests ‘Don’t Want to Solve Affordable Housing’| Article posted Aug 29, 2024 at 12:31am Wealthy Manufactured Housing Institute (MHI) Member Frank Rolfe said: “the Correct Statement is “We Don’t Want to Solve Affordable Housing”

-

TARK-‘I’m a Teen and Know the Solution to Affordable Housing Crisis’ |Article posted Aug 28, 2024 at 12:31am Reading, go to Washington D.C., meet with public officials, attend events, go to your local district Congressional office, you learn stuff.

-

Renting? Rent too High? Odds Are DOJ Suit vs RealPage Matters to You| Article posted Aug 27, 2024 at 8:31am Per DOJ Press Release: “Justice Department Sues RealPage for Algorithmic Pricing Scheme that Harms Millions of American Renters”-Learn More.

-

New-Certified “Half Price Homes” – Affordable Housing Solution Redux| Article posted Aug 26, 2024 at 12:26pm

Federally Certified, 3rd Party Inspected, Consumer Protection–in Affordable Housing Crisis, How Can This Miss? Probing Eye-Opening Research -

Solution: “Would-Be Homebuyers Need 80% More Income Than 4 Years Ago”|Article posted Aug 25, 2024 at 5:13pm A fact check and analysis of a report by Bethany Blakely with AI confirmed her troubling points. A closer look reveals solutions.

What’s New on the Daily Business News on MHProNews

Saturday 9.21.2024

Friday 9.20.2024

Thursday 9.19.2024

Wednesday 9.18.2024

Tuesday 9.17.2024

Monday 9.16.2024

Sunday 9.15.2024

Part III (Traditional Postscript)

Manufactured housing ought to be soaring. But instead, it is snoring. Many professions have key performance indicators (KPIs). In a profession such as manufactured housing, monthly and annual production ought to be an obvious KPI. By that metric, MHI – as currently the sole national post-production trade group in manufactured housing – ought to be held accountable for the apparently poor performance of the industry in the 21st century. But that isn’t just Lesli Gooch, Mark Bowersox, or other staffers. That responsibility arguably falls on the MHI board of directors too.

Changing events and dynamics can change the timing of any report on MHProNews or MHLivingNews. That noted, there is a special report tentatively planned for tomorrow (Monday) morning. Don’t miss it. ##

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’