Also, the Federal Reserve has released its September meeting minutes. Hang on to your wallet, that report is also found below in the Daily Business News market spotlight section.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Harvey Weinstein sexual assault scandal grows

- How NBC gave up Ronan Farrow’s Weinstein scoop

- Bull market is 103 months old. Trump owns 11 of them

- Some favorite tax breaks could be on the chopping block

- Wall Street’s $6 trillion man is bullish, but…

- Trump threatens NBC over critical coverage

- California property damage could reach billions

- Google admits new smart speaker was eavesdropping

- Facebook debuts standalone VR headset

- NFL: We’re not making players stand for anthem

- Amazon’s new plan aims to get teens hooked

Selected headlines and bullets from Fox Business:

- NAFTA benefits Canada more than the US, Agriculture Secretary says

- Wall Street ends at record highs; eyes on Fed, earnings

- Oil prices steady as Saudis pump more; OPEC sees strong demand

- Trump expected to nominate Nielsen as Homeland Security secretary: Official

- Fed divide on inflation intensified at September policy meeting

- Former ESPN reporter says she was told not to like conservative-leaning tweets

- Winter heating costs going up this year

- NFL legend Mike Ditka apologizes for comments on racial oppression

- How Trump tax plan would alter mortgage interest deduction

- Harvey Weinstein’s $5M donation to USC forfeited amid sexual harassment allegations: Report

- NBC killing Ronan Farrow’s Weinstein exposé is a major embarrassment: Howard Kurtz

- Fish magnate The Codfather must forfeit 4 boats, 34 permits

- Oklahoma crude oil line ruptured by construction crew

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

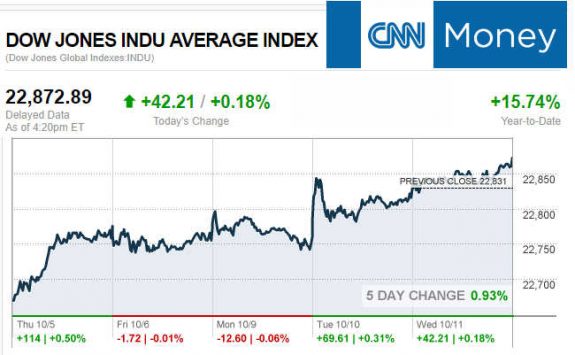

Today’s markets and stocks, at the closing bell…

S&P 500 2,555.24 +4.60(+0.18%)

Dow 30 22,872.89 +42.21(+0.18%)

Nasdaq 6,603.55 +16.30(+0.25%)

Crude Oil 51.33 +0.41(+0.81%)

Gold 1,295.40 +1.60(+0.12%)

Silver 17.24 +0.03(+0.16%)

EUR/USD 1.1867 +0.0057(+0.48%)

10-Yr Bond 2.35 0.00(0.00%)

Russell 2000 1,506.90 -1.08(-0.07%)

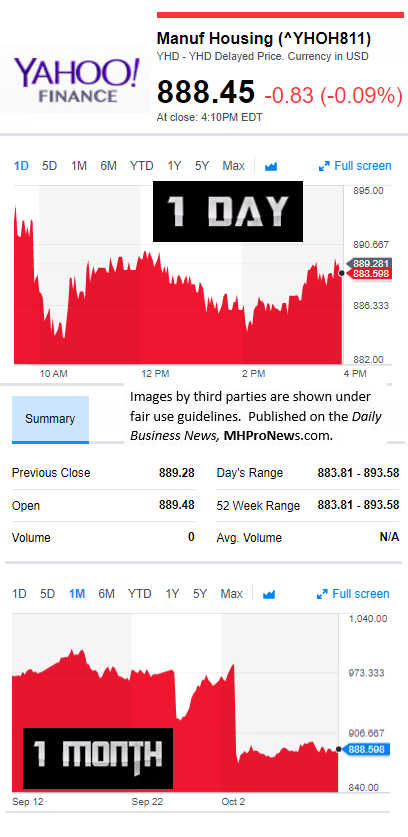

Manufactured Housing Composite Value

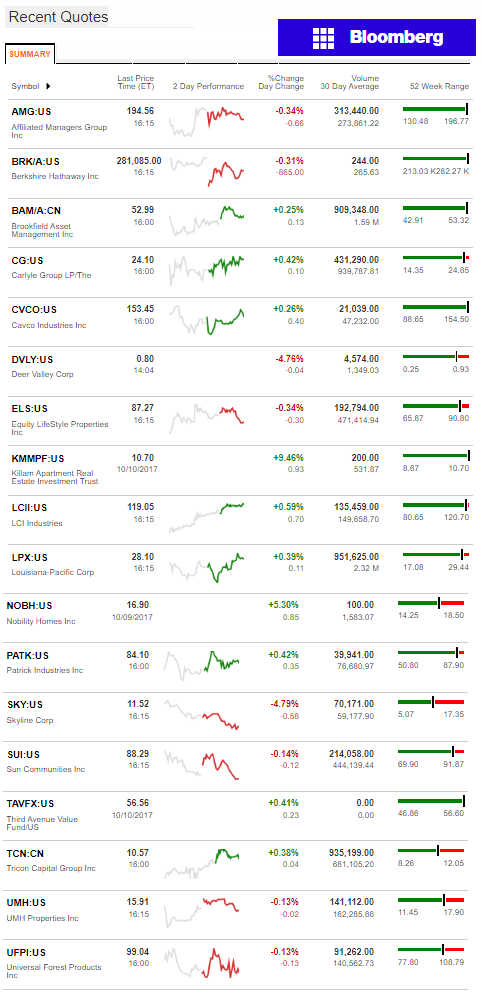

Today’s Big Movers

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Fed Plans on Rates

“The majority of Fed officials are worried that core inflation might not rebound quickly, but that isn’t going to stop them from continuing to normalize interest rates, particularly not when the unemployment rate is getting so low,” said Paul Ashworth, an economist at Capital Economics, per Fox Business.

Policymakers felt that another rate increase this year “was likely to be warranted,” the Fed said.

“Fed Chair Janet Yellen has repeatedly acknowledged since the meeting that there is rising uncertainty on the path of inflation, which has been retreating from the Fed’s 2 percent target rate over the past few months,” said the Fox report.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)