The Small Business Administration (SBA) was created to help independent business level the playing field in their access to capital markets.

While a relatively small number of businesses tend to dominate various sectors of the manufactured housing industry, the vast majority of operations in retail, communities, production, installations, service, and transportation are small businesses.

Nationally, congressional data provided to the Daily Business News says: “Small businesses continue to face significant hurdles when it comes to accessing capital. With large companies frequently raising capital through debt and equity markets, small businesses regularly finance their ventures with commercial bank borrowing. However, despite improving economic conditions in recent years, levels of bank lending to small businesses remain stationary. With the approximately 29 million small businesses in the nation accounting for two out of every three new private sector jobs, the inability to access capital is preventing the engines of the economy from expanding. Communities across the country rely heavily on the products, services, and jobs created by main street businesses. Capital is critical to growing jobs, communities, and the economy.”

“With capital options limited, small businesses, startups, and entrepreneurs are turning toward the United States Small Business Administration (SBA) to finance their dreams,” the House Small Business Committee tells the Daily Business News. “The SBA offers a number of financing programs designed to offer creditworthy businesses the ability to obtain capital.”

Among the information that the House Small Business Committee shared about SBA lending programs, are the following.

7(a) Loan Program

SBA’s flagship program is the 7(a) Loan Program, which provides creditworthy small firms that cannot obtain credit elsewhere the opportunity to access capital from private lenders. SBA does not offer direct lending to small businesses; rather, SBA guarantees the repayment of loans issued by lenders for general business purposes.

CDC/504 Loan Program

SBA’s second largest loan program is the CDC/504 Loan Program, which provides long-term and fixed-rate financing provided by a combination of private and government guarantee support to assist with the acquisition of major fixed assets, such as real estate or machinery or equipment purchases that expand or update small businesses. To be eligible for the loan program, the project must meet a job creation or job retention requirement or meet specific community development or public policy goals.

Microloan Program

To bridge the gap for small dollar borrowers, the SBA offers the Microloan Program, which works with nonprofit lending intermediaries to make small dollar loans of $50,000 or less.

Small Business Investment Company (SBIC) Program

To increase the amount of private equity flowing to small businesses, the SBA offers the SBIC program, where private equity capital is utilized to invest in small businesses.

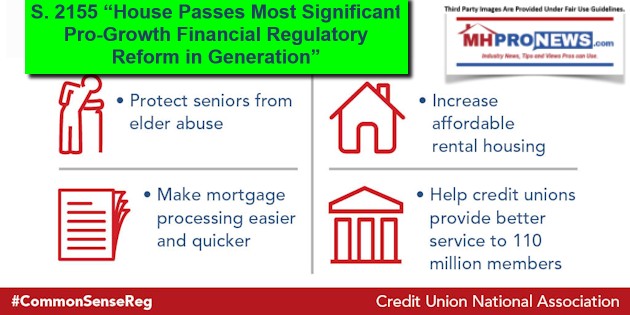

So, in addition to the reforms pending the signature of President Trump on the now passed “Economic Growth, Regulatory Relief and Consumer Protection Act” (S. 2155), there are other options that industry professionals who may have trouble accessing through normal banking channels could consider tapping. The SBA is one of those options. ## (News, analysis, and commentary.)

(Third party images, content are provided under fair use guidelines.)

Related Reports:

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.