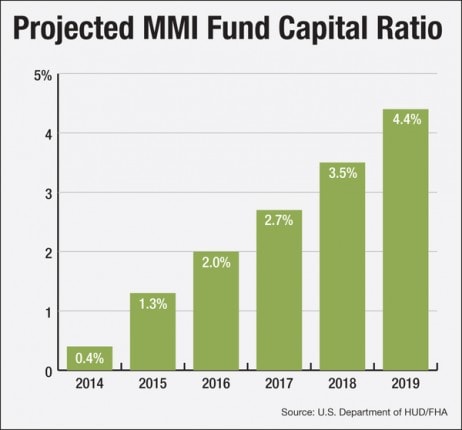

NationalMortgageNews informs MHProNews that “the FHA’s Mortgage Insurance Fund reached a 0.41% capital ratio in fiscal year 2014, which ended Sept. 30, up from a negative 0.11% in the year prior. While the improvement was good news, the fund’s ratio was well below its statutory minimum of 2%.”

This report was part of Julian Castro’s recent interview with BloombergTV – which also covered the Obama Adminstrations goals for GSE reform – see the interview, linked here.

House Republicans are skeptical about the overall positive report.

“We’ve heard similar rosy predictions about FHA finances for years,” House Financial Services Committee Chairman Jeb Hensarling said in a press statement. “Some in Washington are now clamoring for the FHA to lower its annual mortgage insurance premiums. But until the FHA fulfills its statutory requirement, that should be a non-starter.”

Chairman Hensarling is correct in saying there are calls for premium reductions, including from the National Association of Realtors (NAR), which said that 400,000 potential buyers were knocked out of the market in 2013 by the higher FHA premiums. Depending on loan size, analysts say the higher FHA risk premiums can cost a borrower $200-400 more monthly.

With the FHA’s MMI fund “on the path to recovery, NAR urges FHA to lower its annual mortgage insurance premiums and eliminate the requirement that mortgage insurance be held for the life of the loan,” said NAR President Chris Polychron.

Mortgage Bankers Association (MBA) President David Stevens – a professional who seems warm to manufactured housing – agreed.

“FHA premiums are currently at an all-time high,” said Stevens, who was also a former FHA commissioner. “FHA needs to find the right balance so it can meet its mission and further grow its reserves by sustaining increasing volumes without being adversely selected.”

NMN’s Brian Collins, stated that “FHA endorsed nearly 566,500 forward loans in fiscal 2014, compared to 892,400 ten years ago. FHA also endorsed 40,500 reverse mortgage loans in fiscal 2014, compared to 37,800 in FY 2004.”

Ironic Oversight in Facts?

What is lost these flying facts is that the CFPB in its recent report on manufactured housing lending comes off as seemingly crying foul for MH lenders charging to cover their risks and costs, while the FHA is praised by some for hiking premiums to cover risks in order for it to remain financially sound. Is that a double standard?

The Government Sponsored Enterprises (GSEs) have suggested they will lower down payments and essentially compete with FHA for the business it has traditional done. This comes at a time when FHA endorsed only some 566,500 forward loans in fiscal 2014, compared to 892,400 ten years ago.

As lending is a life-blood for all big ticket and home sales – including manufactured housing – MHProNews will continue to track such developments. ##

(Image credit: National Mortgage News)