Almost a decade after the enactment of the Housing and Economic Recovery Act (HERA 2008) that birthed the Duty to Serve and the SAFE Act, the Federal Housing Finance Agency (FHFA) has published “its final Evaluation Guidance for the Duty to Serve Program.”

In a release to MHProNews, the FHFA said, “FHFA’s Evaluation Guidance communicates FHFA’s expectations regarding the process for developing Fannie Mae and Freddie Mac’s (the Enterprises) Underserved Markets Plans, the standard for FHFA to issue a “Non-Objection” to the Plans, and the process by which FHFA will evaluate the Plans and report to Congress the Enterprises’ achievements under their Plans each year.”

“The Underserved Markets Plans, that propose the activities the Enterprises will undertake over a three year period to support housing finance in the manufactured housing, affordable housing preservation, and rural housing markets, are scheduled to be finalized before the end of the year,” said the FHFA’s release.

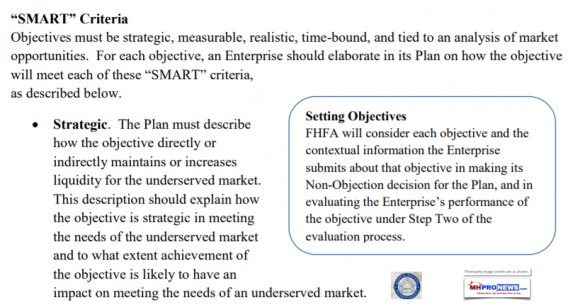

Some top-line screen captures from the attachment, linked below include these.

The entire final guidance document provided by the FHFA is linked here.

The Daily Business News has noted that ROCs already have some chattel lending secured under a pilot program.

New Long-Term, Market Rate Loans in Manufactured Home Communities, Report, Reactions

Previous links on this topic are linked below.

“An Elephant Ass,” Understanding GSEs, Duty to Serve, Manufactured Home Lending

Duty to Serve (DTS) Manufactured Housing “Confidential Documents,” Draft and Downloads, FHFA, GSEs

Industry Voices

I appreciate the way that MHAAR respectfully criticized my commentary on the Federal Housing Finance Agency’s (FHFA’s) final rule to implement the “Duty to Serve” (DTS) requirements as being “far too charitable,” but the criticism was misdirected. My comments neither praised nor denigrated the FHFA for the DTS final rule.

Industry Voices

We at MHARR have the greatest respect for Jim Ayotte, but his recent commentary on the final Duty to Serve (DTS) rule issued by the Federal Housing Finance Agency (FHFA) is far too charitable. It’s one thing to see the proverbial glass as half full versus half empty.

“More of the Same,” Leader Says About Fannie Mae Duty to Serve Meeting

MHProNews will see industry input on this topic. But the initial read is this is a “slow crawl, then walk” course – before there is hope of this becoming a ‘run’ in the finance sector of manufactured home chattel (personal property, home only) lending. © ## (News, analysis, and commentary.)

Note 1: For those who want to sign up to our industry leading headline news updates – typically sent twice weekly – please click here to sign up in just seconds.

Note 2: For news tips, and commentary, email with a BOLD subject line (MH Tip, MH Commentary, etc.) to: iReportMHNewsTips@mhmsm.com.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.