While the Manufactured Housing Institute is apparently taking contributions from the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac for doing toe-in-the water lending on manufactured homes, the Manufactured Housing Association for Regulatory Reform (MHARR) has been pushing numerous buttons and doors in Washington, D.C.

Their goal?

To get more lending on manufactured homes. That would thereby reduce the industry’s dependence on Berkshire Hathaway brand financing.

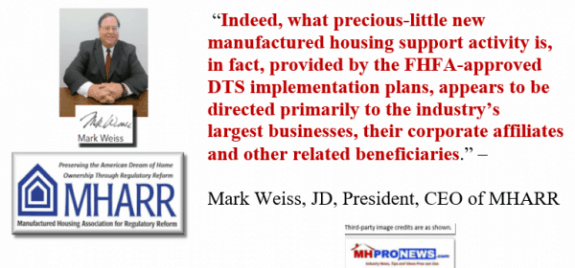

In a statement to the Daily Business News on MHProNews, the D.C. based trade group for independent producers of HUD Code manufactured homes said as follows. “As industry members are aware, MHARR has been pressing FHFA, Fannie Mae, Freddie Mac, Congress and the Administration to provide for market-significant levels of secondary market and securitization support, by the Government Sponsored Enterprises (GSEs) under DTS, for the personal property or “chattel” loans which comprise 80% or more of the purchase-money consumer financing for HUD Code manufactured homes.”

The nation’s credit unions have also blasted at the GSEs implementation of the Duty to Serve, or DTS. ICYMI, or for a refresher, see the linked report below.

MHARR plans to carefully analyze these proposed DTS plan modifications, and will submit appropriate comments to FHFA. They encourage industry members to do likewise.

Comments on the proposed modifications must be submitted to FHFA no later than November 2, 2018.

MHARR, FHFA and another tip-source all provided the following to MHProNews.

Duty to Serve Update: FHFA Requests Public Input on Fannie Mae and Freddie Mac’s Proposed Duty to Serve Plan Modifications

Greetings:

Today the Federal Housing Finance Agency is requesting public input as part of the Agency’s consideration of proposed modifications to Fannie Mae and Freddie Mac’s (the Enterprises) 2018-2020 Underserved Markets Plans (Plans) under the Duty to Serve program. FHFA has determined that public input would be helpful in considering four of Fannie Mae’s twenty-two proposed modifications that would each make a substantial change to the content of its Plan. Freddie Mac has submitted one modification that FHFA considers to be a modest correction and, as a result, FHFA is not seeking public input on this proposal.

FHFA intends to issue Non-Objections to the Enterprises, where appropriate, for proposed modifications by December 2018. Upon the issuance of a Non-Objection, FHFA intends to publish the following documents on FHFA’s public website:

- The modified Plan(s) the Enterprises submitted that received a Non-Objection from FHFA;

- Redlined versions of the portions of the modified Plans containing all modifications, including technical edits;

- All of the Enterprises’ completed “Plan Modification Request” templates (twenty-two from Fannie Mae and one from Freddie Mac). These documents will be published to provide the public with insight into the reasons the Enterprises’ changed their Plans.

FHFA is issuing this Request for Input on its dedicated webpage, FHFA.gov/DTS through November 2, 2018.

For more information and program updates, visit FHFA.gov/DTS.

###

MHARR Exposes GSES’ Failure On Chattel Financing Before Congress | Manufactured Housing Association Regulatory Reform

FOR IMMEDIATE RELEASE (202) 783-4087 Contact: MHARR Washington, D.C., September 27, 2018 – The Manufactured Housing Association for Regulatory Reform (MHARR), in a submission (copy attached) to the House of Representatives’ Financial Services Committee in conjunction with a September 27, 2018 oversight hearing on regulation of the two “Government Sponsored Enterprises” (GSEs) – Fannie Mae and Freddie Mac – strongly criticized the Federal Housing Finance Agency (FHFA), for failing to implement federal law and, instead, sanctioning the GSEs’ continuing discrimination against lower and moderate-income American consumers seeking to purchase manufactured homes through personal property, or chattel loans.

As recently as last week, MHARR provided the report linked above, which contains their testimony to Congress protesting the FHFA’s handling of the GSEs and DTS.

It is one of a series of moves with Congress and others, designed to bring about more lending for manufactured home retailers, and communities, and thus supporting their member-manufacturers.

Readers are reminded of the drama last week with the FHFA’s own sexual improprieties fracas. See that under the related reports, linked further below. ## (News, analysis, and commentary.)

NOTICE: You can join the scores who follow us on Twitter at this link. You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

Mel Watt – FHFA and MH Connected Hearing Today to Feature Sexual Misconduct Allegations

FHFA Hearing Before Congress Raises GSEs’ Failure on Manufactured Home Chattel Financing

“Waste, Fraud, and Abuse” – FHFA, GSE Federal Oversight Announcement