A tip was provided to several days ago to MHProNews regarding claims that Manufactured Housing Institute (MHI) CEO Lesli Gooch, Ph.D., had “backstabbed” the interests of literarily millions of owners of HUD Code manufactured homes. The claim sounded so bold and brazen, MHProNews asked for documentation to support the allegations. In the follow up, the tipster linked to the Federal Housing Finance Agency (FHFA) gave extensive evidence supporting the contentions.

Once that evidence was provided, MHProNews contacted:

- Gooch,

- MHI,

- Ron Olson, an named-partner attorney at Munger Tolles Olson (MTO) law firm and a Berkshire Hathaway board member,

- Tom Hodges – currently MHI Chairman and General Counsel for Clayton Homes, a Berkshire Hathaway owned brand (BRK),

- Tim Williams – President and CEO of 21st Mortgage (BRK),

- Eric Hamilton – President and CEO of Vanderbilt Mortgage and Finance (VMF) – also a Berkshire brand,

- Matt Webb, attorney for 21st,

- John Greiner, attorney with Graydon Law, who said in a written statement to MHProNews that he represents MHI’s interests.

They were among those contacted for comments and reaction to the potentially explosive claim. That email follows further below. The original of the actual document from FHFA is in hand. A copy of its full content with respect to Gooch will be found attached herein.

Following the emailed request for reaction to those listed above is additional information, analysis, and MHProNews Commentary that includes a call for fresh independent post-production leadership.

Subject: Bill Merrill FHFA connected tip RE: MHI CEO Lesli Gooch

Lesli, Tom, et al,

According to a source at the FHFA that documented their assertion, Lesli said on 2/11/2021 the following with officials from Fannie Mae, Freddie Mac, FHFA, and others listening.

“We are the only national trade association that represents all segments of the factory-built housing industry.”

After acknowledging that FHFA data reflects manufactured home value appreciation, and you paid “lip service” to MHI acknowledging the need to provide support for chattel and other lending by the GSEs, our source tells us and documented the claim that that the thrust of your comments were focused on CrossModTM homes, and not on mainstream manufactured homes.

“My comments today are focused on changes that both Fannie Mae and Freddie Mac have made to their loan programs for a new category of manufactured homes called CrossModTM homes.”

“We need the GSEs to ensure appraisers follow the new appraisal guidelines for homes that qualify for MH Advantage and Choice homes,” which FHFA claims that Gooch said align with MHI’s CrossModTM branding.

Per our source, which provided us the details, Gooch said: “Our fundamental concern is that in spite of the new programs appraisal guidelines, appraisers are just not aware of CrossMod and that it is a distinct type of HUD code manufactured home. We are concerned that by default, they are using manufactured homes as comps when appraising a CrossMod home.”

- Given that retailers and lenders have told us that appraisals for HUD Code homes has been an ongoing challenge for years, why did Gooch and MHI not argue for a full and proper defense of a good appraisal for all HUD Code manufactured homes?

- Given that the word that only low double digits of CrossModTM homes exist, and that there are millions of HUD Code manufactured homes, why has MHI given such a full throated defense of CrossModTM in a fashion that will serve to undermine a healthy and proper view of millions of existing HUD Code manufactured homes?

- Why does Ms. Gooch even have a job after pitching on behalf of MHI such a betrayal of the valuations of millions of mainstream manufactured homes?

We plan to do a report, of course. Beyond the questions above, which we would value an emailed response to for our mutual accuracy in communications, we are also hereby asking for the following.

What steps if any has MHI leadership taken to discipline or remove Gooch and to contact FHFA and the GSEs to fully and properly appraise all manufactured homes?

Why is Clayton Homes, Skyline Champion, and Cavco Industries leadership still pushing a product – i.e. CrossModTM – that has clearly failed in the marketplace, while it simultaneously undermines millions of existing and most future HUD Code manufactured homes?

What steps – if any – has MHI leadership, Clayton Homes, Skyline Champion, and Cavco Industries taken to get a full and proper implementation of the all of the Manufactured Housing Improvement Act of 2000 – notably the enhanced federal preemption provision to help overcome zoning and placement barriers – and the full support for chattel financing as well as land-home lending under the Duty to Serve Manufactured Housing provision mandated for Fannie Mae and Freddie Mac passed in the Housing and Economic Recovery Act of 2008?

- We are once more hereby asking for the minutes to the closed-door meetings between Fannie Mae, Freddie Mac, and key people involved in MHI that resulted in the “new class of manufactured homes” later rebranded as CrossModTM

- We are also asking that MHI publish how much money Fannie Mae and Freddie Mac have paid to “sponsor” or otherwise support MHI, while simultaneously working to avoid full and proper implementation of the DTS for all HUD Code manufactured homes.

Please email your responses to my attention. As we are working on a deadline, so we value a prompt response.

Note we have BCC’d various industry members and other interested parties to document this request.

Thank you.

Tony

PS: We are still waiting on MHI, Berkshire, Clayton, et al’s response to the allegations of “Felony” market rigging by key members of MHI. See the reports linked below. For our mutual clarity, kindly respond separately to those concerns from this request. Thank you.

…[Name, contact, and email signature line information followed].

###

New Independent Leadership Wanted! Additional Information, MHProNews Analysis and Commentary

It is not American jurisprudence, but there is an old English saying that “silence betokens consent.” The deafening silence of MHI leaders on the latest allegation, after over a year of other revelations about conflicts of interest by Gooch speaks volumes.

Indeed, there is evidence that Gooch has a history of close ties to several scandals. The one below is just one.

Apparently, MHI’s leadership is okay with her statement to FHFA, Fannie Mae, Freddie Mac and the evidence of conflicts of interest. How so? Because they are silent about it and have taken no steps to stop it.

This is why new post-production leadership among industry independents is wanted and needed. The Omaha-Knoxville-Arlington axis and their allies have become bolder in how brazenly the undermine manufactured housing independents. ICYMI, see the report based on an MHI tipster in the report linked below.

In fairness to Gooch, her predecessor – Richard “Dick” Jennison – also apparently acted for years in conflict with the interests of manufactured home consumers, owners, certain investors, and independents. A prima facie case of statements made under oath by Jennison is found below.

To provide the entire statement made by Gooch on 2.11.2021, see the document linked here. For those with any knowledge of the importance of financing in the purchase, refinance, or resale of HUD Code manufactured homes, that must be kept in mind.

To make it clear, Kevin Clayton – who was among the BCC’d in the email show further above – is the source of this quote. See the report linked below for context.

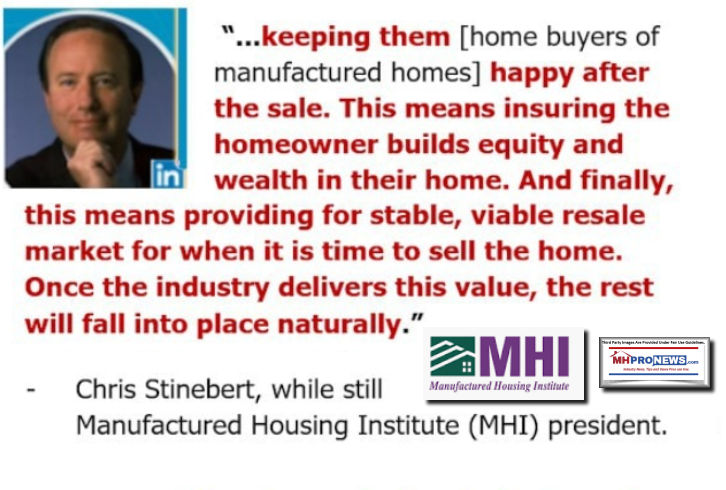

Chris Stinebert was a prior MHI President and CEO who worked with the Manufactured Housing Association for Regulatory Reform (MHARR) backed bill to enact the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform Law). Stinebert said the following as part of his exit message to the manufactured home industry. Stinebert’s assertion supports the notion of how important protecting manufactured homeowners interests were and obviously still are.

Keep in mind that when financing dried up for conventional housing during the 2008 housing/financial crisis, housing values plummeted. As financing returned and buyers re-entered the market, that same principle – the need for good financing to support housing purchases and valuations – logically applies to manufactured homes too.

The Urban Institute, which has listed Warren Buffett as a lifetime trustee, also made it plain that access to financing with favorable terms are important in protecting and supporting the appreciation potential for manufactured housing.

Summing those points up.

These interrelated factors arguably underscore just how vital the Duty to Serve (DTS) could be to supporting more sales, higher resale values, and more. But the reverse is also true. When DTS financing is curtailed or limited on what MHARR refers to as “mainstream” manufactured homes, that undermines the valuations of manufactured homeowners.

As Buffett and others have noted, and Kevin Clayton affirmed, financing and resalability has a ripple effect on the entire manufactured home market. Clayton said it, so, it must be true – right?

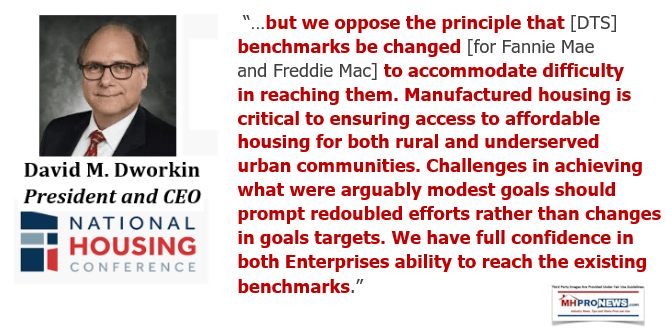

MHARR has, for over a decade, argued for full and proper implementation of DTS, while MHI – by contrast – has paid lip service to it, while occasionally revealing in formal statements some that quite at odds with their own claims of supporting “all segments” of the manufactured home industry.

In short, those factors support the contention that Gooch – apparently with the active or tacit support of Clayton, 21st, VMF (BRK), Skyline-Champion (SKY), and Cavco Industries (CVCO) – ‘backstabbed‘ millions of manufactured homeownership.

That in turn is a part of a purported and apparent pattern of deterrence that all dissuade more sales and newcomers into the manufactured housing profession. It is part of what MHI member Andy Gedo called Clayton’s moat.

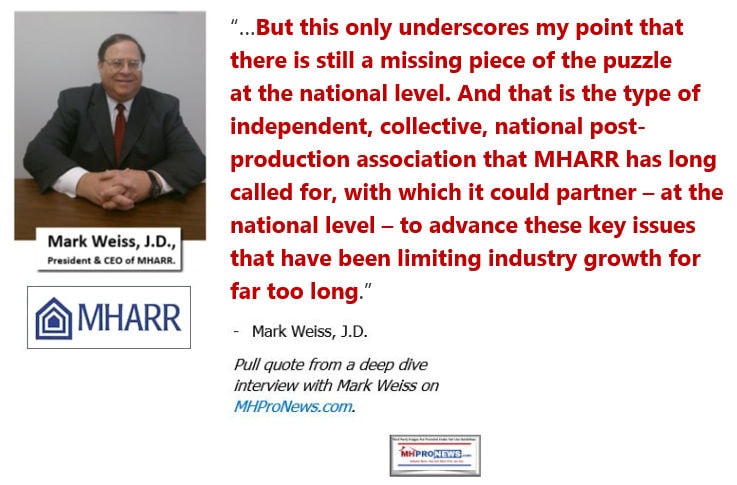

Kevin Clayton and other MHI ‘leaders’ can say what they want. But it is deeds more than words that matter, when deeds and words do not match up. There is a need for a post-production trade group that can work hand-in-glove with MHARR.

It must be noted that in the absence of MHARR’s leadership and willingness to fight and expose MHI on issue after issue that harms independents, consumers, and taxpayers. Backstabbed by Gooch? The case can be made that this is just the latest in a string of such betrayals.

As Warren Buffett said, you can’t make a good deal with a bad person – or an organization run by bad people.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.